Professional Documents

Culture Documents

ACCT 2105 Tutorial Exercises - Topic 4 - Income Statement

Uploaded by

Hoàng Trọng HiếuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 2105 Tutorial Exercises - Topic 4 - Income Statement

Uploaded by

Hoàng Trọng HiếuCopyright:

Available Formats

Chapter 6 INCOME STATEMENT

QUESTION 1

Prepare an income statement for the year ended 30 June 2006 given the

following balances.

$

Cash 3,000

Sales 280,000

Salary and wages 37,000

Accounts receivable 15,000

Loan interest 4,000

Insurance 2,000

Loan 40,000

Telephone and postage 1,500

Rent and rates 12,400

Cost of sales 160,000

Inventory 11,000

Accounts payable 9,100

Heat and light 3,700

Motor vehicles 32,000

Equipment repairs 1,600

Depreciation motor vehicles 4,500

Motor vehicle running costs 1,700

Depreciation equipment 3,200

Royalties received 1,700

Accounting and audit 3,400

Bad and doubtful debts 800

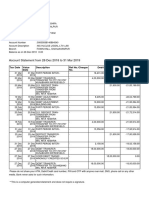

QUESTION 2

Below is the financial information of SSS Mart Pty Ltd for the year ended 31

December 2008:

$

Income tax 20,000

Sales revenue 1,000,000

Selling expenses 80,000

Opening/Beginning inventory 150,000

Administrative expenses 100,000

Closing/Ending inventory 150,000

Financial expenses 20,000

Net purchases 610,000

Required:

Prepare an income statement for the year ended 31 December 2008 for SSS

Mart Pty Ltd.

RMIT International University | ACCT2105 Accounting for Organisations and Society 1

Tutorial Exercise

QUESTION 3

Three years ago, T. Roderick organized Harbor Realty. At December 31,

2008, at the end of the current fiscal year, the following financial information

was provided:

$

Cash 3,425

Accounts receivable 7,000

Supplies 1,270

Prepaid insurance 620

Office equipment 51,650

Accumulated depreciation 9,700

Accounts payable 925

Unearned fees 1,250

Capital 29,000

Drawing 5,200

Fees earned 59,125

Wages expense 22,415

Rent expense 4,200

Utilities expense 2,715

Miscellaneous expense 1,505

Additional Information:

Depreciation of Equipment during the year is $4,950

Required:

Prepare the income statement for the year ended 31 December 2008 and

balance sheet as at 31 December 2008.

RMIT International University | ACCT2105 Accounting for Organisations and Society 2

Tutorial Exercise/Topic 4

QUESTION 4

The following are the financial data of Parachute Repair at the end of the

period 31 December 2008. Make the necessary adjustments.

$

Cash 12,950

Supplies 4,295

Prepaid insurance 2,735

Equipment 40,650

Accumulated depreciation Equipment 9,209

Motor vehicles 36,300

Accumulated depreciation Motor vehicles 6,400

Accounts payable 2,015

Bank loan 10,000

Jessie Toh, Capital 26,426

Jessie Toh, Drawing 5,000

Service revenue 91,950

Salaries expense 23,925

Rent expense 10,600

Motor vehicle expense 7,350

Miscellaneous expense 2,195

Adjustments:

a. Depreciation of equipment during the year is $ 3,380

b. Depreciation of trucks during the year is $4,400

c. The bank loan will be repaid over five years time at equal yearly

instalment. The first instalment will commence on 30 September 2009.

Required:

Prepare the income statement for the year ended 31 December 2008 and

balance sheet as at 31 December 2008.

RMIT International University | ACCT2105 Accounting for Organisations and Society 3

Tutorial Exercise/Topic 4

QUESTION 5

Tan Kia See started a management consultancy business, Apex Consultancy.

The following financial data is for the year ended 30 June 2009:

$

Cash 18,680

Accounts receivable 2,000

Supplies 3,720

Prepaid insurance 4,400

Equipment 26,000

Accumulated depreciation-Equipment 2,600

Account payable 1,100

Tan Kia See, Capital 35,100

Service fee 48,800

Unearned rental revenue 5,300

Salaries expense 27,400

Utilities expense 5,400

Miscellaneous expense 5,300

Additional information:

Depreciation for the equipment is $2,600.

Required: -

(a) Prepare the income statement for the year ended 30 June 2009.

(b) Prepare the balance sheet as at 30 June 2009.

RMIT International University | ACCT2105 Accounting for Organisations and Society 4

Tutorial Exercise/Topic 4

QUESTION 6

Devis Laundry presents the following financial data for the period ended 30

June 2009 which is the end of the current year.

$

Cash 3,100

Laundry supplies 6,560

Prepaid insurance 4,490

Laundry equipment 105,100

Accumulated depreciation 40,200

Accounts payable 6,100

T. Smith, Capital 37,800

T. Smith, Drawings 2,000

Laundry revenue 150,900

Salaries expense 61,400

Rent expense 36,000

Utilities expense 13,650

Miscellaneous expense 2,700

Additional Information: (for adjustment)

Depreciation of equipment during the year is $7,000

Required: -

Prepare an income statement and a balance sheet.

More EXERCISES:

Textbook:

A. Attempt the Comprehension Questions 6.3,6.4, 6.8

B. Application and Analysis exercise: 6.16,6.17,6.20,6.21, 6.23,6.25, 6.26

C. Synthesis and Analysis Problem: 6.37

RMIT International University | ACCT2105 Accounting for Organisations and Society 5

Tutorial Exercise/Topic 4

Multiple Choice Questions

1. The income statement

a. presents the income and expenses of an entity for a specific period of

time.

b. reports the changes in assets, liabilities and equity over a period of time.

c. reports the assets, liabilities and equity at a specific point in time.

d. summarises the change in retained earnings over a specific period of time.

2. Equity is increased by

a. liabilities.

b. expenses.

c. income.

d. dividends

3. Which of these will be recorded as income?

a. A loan is received from a bank

b. Money is collected from a customer owing from goods sold last week

c. A sale is made on credit

d. Additional capital is contributed by the owner

4. If an expense is paid for in cash, then

a. liabilities will decrease.

b. assets will decrease.

c. assets will increase.

d. equity will increase.

Use the following information to answer questions about Binh Thuong, Co.:

RMIT International University | ACCT2105 Accounting for Organisations and Society 6

Tutorial Exercise/Topic 4

Sales $1000

Cost of Goods Sold $550

Interest Received $50

Royalty Received $25

Salary Expense $40

Rent Expense $60

Depreciation Expense $80

Cash $500

Accounts Payable $120

Revenue Received in Advance $200

1. What is the amount of Gross Profit?

a. $525

b. $450

c. $345

d. $950

2. What is the amount of Total Income?

a. $525

b. $450

c. $650

d. $950

3. What is the amount of Total Operating Expenses?

a. $300

b. $500

c. $380

d. $180

4. What is the amount of Net Income?

a. $545

b. $345

c. $845

d. $65

Account Names (non exhaustive list)

RMIT International University | ACCT2105 Accounting for Organisations and Society 7

Tutorial Exercise/Topic 4

Advertising expense

Accounting and audit expense

Bad and doubtful Debts Expense

Commission expense

Commission fees

Cost of goods sold/Cost of Sales

Depreciation expense

Fees (as Revenue)

Insurance expense

Interest expense

Interest received (income)

Miscellaneous Expense

Office supplies expense

Operating Expenses

Property taxes expense

Rent Expense

Royalties received (income)

Salary expense

Sales

Supplies expense

Tax expense

Telephone and postage expense

Utilities Expense

Wages expense

RMIT International University | ACCT2105 Accounting for Organisations and Society 8

Tutorial Exercise/Topic 4

You might also like

- Multinational Corporations in PKDocument40 pagesMultinational Corporations in PKNadeem75% (51)

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Banking Laws: A.The New Central Bank Act (Ra 7653)Document17 pagesBanking Laws: A.The New Central Bank Act (Ra 7653)Janice F. Cabalag-De VillaNo ratings yet

- Accounting Policies & Procedures ManualDocument335 pagesAccounting Policies & Procedures ManualPlatonic100% (23)

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Chapter 4 Governmental AccountingDocument5 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Financial Accounting Assignment 2Document6 pagesFinancial Accounting Assignment 2kirubelNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Directions: Write Your Answer On A Separate Paper. Problem 1Document1 pageDirections: Write Your Answer On A Separate Paper. Problem 1Gio SantosNo ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- Chapter 4 Governmental AccountingDocument8 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- 2020 1 Accounting in Organisations and Society Assignment-3Document7 pages2020 1 Accounting in Organisations and Society Assignment-3Abs PangaderNo ratings yet

- Chapter 3new BOOK QuestionsDocument5 pagesChapter 3new BOOK Questionsgameppass22No ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- ACC101 - Accounting CycleDocument3 pagesACC101 - Accounting CycleJade PielNo ratings yet

- Final Exams AccountingDocument6 pagesFinal Exams AccountingCzarina Joy PeñaNo ratings yet

- Financial Accounting-Assignment-4Document4 pagesFinancial Accounting-Assignment-4Margaux JohannaNo ratings yet

- Principles of Accounting (A B E)Document3 pagesPrinciples of Accounting (A B E)r kNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Exhibit 7. Revenue and Expense RecognitionDocument6 pagesExhibit 7. Revenue and Expense RecognitionЭниЭ.No ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- FINAMAA Topic 2 Additional ActivityDocument2 pagesFINAMAA Topic 2 Additional ActivityJeasmine Andrea Diane PayumoNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- Accountancy I 2016 PDFDocument4 pagesAccountancy I 2016 PDFShahid RazwanNo ratings yet

- Accountancy and Auditing-2016 PDFDocument6 pagesAccountancy and Auditing-2016 PDFMian Abdullah YaseenNo ratings yet

- LatihanDocument7 pagesLatihanDeny WilyartaNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Financial Statements - BasicDocument5 pagesFinancial Statements - BasicMohamed MubarakNo ratings yet

- Banking Company Final Accounts QuestionsDocument8 pagesBanking Company Final Accounts QuestionsPradeepaa BalajiNo ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- MC 2 - A201 - QuestionDocument6 pagesMC 2 - A201 - Questionlim qsNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- PART B - SET A (Odd Groups - 1,3,5,7,9)Document4 pagesPART B - SET A (Odd Groups - 1,3,5,7,9)ngocanhhlee.11No ratings yet

- A222 SELF STUDY TOPIC 2 - QueDocument2 pagesA222 SELF STUDY TOPIC 2 - QueAdelene NengNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Section B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?Document11 pagesSection B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?18071369 Nguyễn ThànhNo ratings yet

- Partnership Formation - Activity PDFDocument2 pagesPartnership Formation - Activity PDFWilliam TabuenaNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Tutorial 5 QuestionsDocument4 pagesTutorial 5 QuestionsChigoziem OnyekawaNo ratings yet

- Compre Audit Cieloflawless Q PDFDocument3 pagesCompre Audit Cieloflawless Q PDFCarina Mae Valdez ValenciaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- SOF DL en Brand V15 - tcm41 180545 PDFDocument11 pagesSOF DL en Brand V15 - tcm41 180545 PDFAnkur GargNo ratings yet

- AnshulDocument9 pagesAnshulAnshul SharmaNo ratings yet

- Credit Lending ModelsDocument14 pagesCredit Lending Modelsashish21900No ratings yet

- Payment and Other TermsDocument11 pagesPayment and Other TermsNguyệtt HươnggNo ratings yet

- KHALID AHMED0 CV 2Document3 pagesKHALID AHMED0 CV 2raajivrao8363No ratings yet

- 1567408107395rej1z59pM0TrJ6Ni PDFDocument2 pages1567408107395rej1z59pM0TrJ6Ni PDFBrajesh PandayNo ratings yet

- Platon Notes - Credit Transactions (Bolivar) PDFDocument56 pagesPlaton Notes - Credit Transactions (Bolivar) PDFajapanganibanNo ratings yet

- All Enrolment Centres List11 12 2022 7 03 49 PMDocument6 pagesAll Enrolment Centres List11 12 2022 7 03 49 PMpuneetchadhokarNo ratings yet

- HDFC Life Sanchay Plus Retail Brochure Final CTCDocument16 pagesHDFC Life Sanchay Plus Retail Brochure Final CTCdhaval2011No ratings yet

- HDFC PayslipDocument2 pagesHDFC PayslipRohit KumarNo ratings yet

- Bank Alfalah Internship ReportDocument22 pagesBank Alfalah Internship Reportmemon_maryam786No ratings yet

- Appendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbDocument4 pagesAppendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbRalph AcobaNo ratings yet

- Life Insurer Improves Customer RetentionDocument5 pagesLife Insurer Improves Customer RetentionmanchorusNo ratings yet

- HR Payroll US PracticeDocument37 pagesHR Payroll US PracticeHau LeNo ratings yet

- Promotion Study Material Clerk To OfficerDocument315 pagesPromotion Study Material Clerk To OfficerAbhishek KumarNo ratings yet

- Bss Terms and ConditionsDocument14 pagesBss Terms and ConditionsramdarakNo ratings yet

- IntrerShip Report On SME Banking PDFDocument81 pagesIntrerShip Report On SME Banking PDFBhavika MadaanNo ratings yet

- DEEPARAM 19063192741 UnlockedDocument9 pagesDEEPARAM 19063192741 UnlockedúméshNo ratings yet

- CECR Pol PDFDocument5 pagesCECR Pol PDFbobyNo ratings yet

- Use The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsDocument4 pagesUse The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsRey Joyce Abuel0% (1)

- APB Live BanksDocument12 pagesAPB Live BanksSumit Kumar GuptaNo ratings yet

- CibDocument6 pagesCibAriful Haque SajibNo ratings yet

- Banking System in PakistanDocument4 pagesBanking System in PakistanIrfan RashidNo ratings yet

- Keri Selman Robo-Signer ExtraordinaireDocument3 pagesKeri Selman Robo-Signer ExtraordinaireForeclosure FraudNo ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet