Professional Documents

Culture Documents

Kislan PDF

Uploaded by

Sankalan GhoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kislan PDF

Uploaded by

Sankalan GhoshCopyright:

Available Formats

NRODN BANKA SLOVENSKA

USING OF THE ECONOMIC VALUE ADDED MODEL

FOR VALUATION OF A COMPANY

Doc. Ing. Eva Kislingerov, CSc.

Prague University of Economics

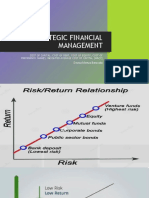

Introduction A basic construction of EVA measure is clear from the fol-

lowing formula:

There is possibility to use, with respect to the object of valu-

ation, several methods for valuation of a company in practice. EVAt = NOPATt Ct x WACCt

One of the most important and highly used group of methods

are yield methods. They are usually called Discounted Cash where NOPATt is Net Operating Profit After Tax,

Flows (DCF) methods. Value of a company is derived from Ct is long term capital,

present value of future incomes connected with the ownership WACC is Weighted Average Cost of Capital.

of a company. The core of these models is working with time

value of future incomes investor gets in case of realization of If EVA > 0 than we can say a company is successful. This

an investment. There are several possibilities to work with fu- is the only case wealth of shareholders increases because they

ture incomes in DCF models, like using cash flow, free cash gain more than what their original investment was. The ser-

flow or in some cases dividends. These are models with con- vice to creditors is included there, too. In case EVA = 0

struction and way of using well known to professional public, a company produced just as much as it was invested and

therefore the aim of this article is to focus on model called EVA < 0 leads to destroying of whealth of shareholders.

EVA Economic Value Added, which is recently highly used From above mentioned construction it is clear that EVA

by investors coming from developed market economies. concentrates all important aspects of business, like:

the amount of capital involved to business and its internal

EVA measure structure (talking about proportion od D/C and E/C),

cost of capital (shareholders and creditorscapital), which

The basic idea of this criteria is possible to find in microe- is price a company must pay for using resources (WACC),

conomics where it is said that the main goal of a comapny is effective employment of invested resources NOPAT.

maximalisation of profit. However it does not mean book Companies which can gain the highest level of profit

profit (the difference between revenues and costs) but econo- (NOPAT) while using minimum of cheap capital will ex-

mical profit. The difference between economical and book perience positive results. It is possible in case investments are

profit is that economical profit is the difference between re- consistently driven by criteria of net present value.

venues and economical costs, which are book costs and op- Therefore EVA represents an interesting measure of jud-

portunity costs. Opportunity costs are presented by the ging the performance of companies. It can be also used for

amount of money lost by not investing sources (like capital, measuring the value of a company. However now we have to

labour, etc.) to the best alternative use. Opportunity costs are rise a guestion of filling the parameters of the EVA model.

in reality represented mainly by interests from equity capital

including risk reward and sometimes lost wage, too. This re- NOPAT can be defined as a result of the following formula:

lation is possible to describe in following way: NOPAT = EBIT (1 t),

where EBIT is Earnings Before Interest and t is tax rate.

Book profit = Revenues Costs

Economical profit = Total revenues from capital Costs NOPAT derived this way includes both effect reached by

of capital using assets of a company (its technical-production base for

owners) and interest paid to creditors.

This leads to the conclusion that economical profit appears Parameter Ct represents long term invested capital. It is

when its amount is higher than normal profit derived from sum of equity and invested capital. The other way of defining

average cost of capital invested both by creditors (cost inter- Ct is to summarize fixed assets and net working capital (net

ests) and owners shareholders (opportunity costs). This is working captal = current assets short term liabilities). Both

a basic idea of new measure EVA. It was first published by approaches offer the same results.

Shawn Tully in the Fortune magazine in an article The Real In EVA model Weighted Average Cost of Capital (WACC)

Key to Creating Wealth. The broad publicity and success of is used for calculation of economic value added and as a dis-

EVA is result of work of a consulting company Stern Stewart count rate transferring future values of EVA to present value

management Services. to the date of valuation.

38 BIATEC, ronk 8, 11/2000

NRODN BANKA SLOVENSKA

Figure 1 Definition of Weighted Average Cost of Capital vide value of equity by number of shares we get value of

(WACC) a share, too.

Interest for external Risk-free

capital provided re rate rf

Sample

Entering data: set the value of ALFA, Ltd. to the Dec. 31,

1998 if you know following data:

Stock beta

a) Information from the balance sheet:

Debt (D) 55 mil. K D/C = 0.29

re = rf + (rm rf) (rm rf) Equity (E) 134 mil. K E/C = 0.71

Risk market

premium RMP Long Term Invested Capital (C) 189 mil. K = 1.00

b) After Tax Debt Cost

Income Tax Cost of External Capital rd 15 %

D = Debt

Rate t (E = Equity) Income Tax Rate (t)x100 35 %

Effective Cost of Debt rd 15(1 0.35) = 9.75 %

c) Cost of Internal Capital

Weighted Cost of Internal Capital re (CAPM2 model)

Average Cost D + r

WACC = rd(1 t) E

e 18.,42% = 10.5 + (1.1 x 7.2)

of Capital C C

Risk-free rate rf (by CNB to Dec.31. 98) 10.5 %

Stock beta () (by Brokers company) 1.1

Equity risk premium in CR (rm rf) 5.5%3 + 1.7%4

The Cost C = Value of balance

sum (E+D) d) Information from financial strategy of ALFA, Ltd.

of Debt

made for the period of 1999 2001:

EVA model for assessment of value of a company YEAR NOPAT Capital Invested (C)

1999 41 205

In previous paragraph there were defined all entries which 2000 44 222

would be used in a model for assessment of value of a com- 2001 48 241

pany. First lets state general formula. What is the form of 2002 50 260

a model mostly used in Czech companies? With respect to

transformation of economy and consequent necessity of reor- Work schedule

ganization and rebuilding of most of the companies it seems 1. Calculation of Weighted Average Cost of Capital (WACC)

to be most appropriate to use so called two-phase model. We implement entering data introduced in above to the

At first we introduce general formula: equation:

WACC = 9.75 x 0.29 + 18.42 x 0.71 = 2.83 + 13.08 = 15.91%

Value of a company = Capital Invested + PV1(EVA) WACC is 15.91%.

2. Calculation of EVA for the period of 1999 to 2001 and

If we implement above described entering parameters, then

after

n ALFA, Ltd. presumes that the structure of the capital will

EVAt EVAn/WACCn

Value of a company = Ct + + remain stable (it corresponds with the planes of a company),

t n

t=1 (1 + WACCt) (1 + WACCn) it does not expect any change in risk and therefore in cost of

where n is a length of forecasted period. capital, too. WACC can be therefore used for the second pha-

se of the calculation, too.

From above mentioned relationships it is clear that total va- YEAR EVA = NOPAT WACC x C

}

lue of a company consists of book value of invested capital 1999 8.38 = 41 0.1591 x 205

and present value of future EVA. Calculation in two phases 2000 8.68 = 44 0.1591 x 222 the first phase

means that in the first phase presents a planning horizon de- 2001 9.66 = 48 0.1591 x 241

rived from period like strategic financial plan. For example 2002 8.63 = 50 0.1591 x 260 the second phase

entering data are derived from Pro Forma sheets. The second

phase is represented by period where each entering parame- 1PV is a shortcut for Present Value

ter is not specified for each period but it is presumed that ex- 2CAPM means Capital Assets Pricing Model, the author of this mo-

pected yield lasts forewer. It is possible to meet several forms del is Sharp.

3Equity risk premium (r r ) in the most developed economy in the

m f

of calculation used for the second phase which usually takes USA is 5.5%. It represents the difference between total market rate and

into account the growth rate of a company. For our purposes risk free rate.

4Rating agencies set long term rating of each country for investors. It

we use form of perpetual bond.

represents the portion of a risk connected to the investment in given

As a result of the application of this model we get the va- area. The Czech republic was given rating A to the end of 1998 by the

lue of a company as a whole. We have to subtract value of rating agency Standard & Poors. It represents the extra premium for the

debt from this value and then we get value of equity. If we di- risk of the area of 1.7%, in total 7.2%.

BIATEC, ronk 8, 11/2000 39

You might also like

- Diesel Engines For Vehicles D2066 D2676Document6 pagesDiesel Engines For Vehicles D2066 D2676Branislava Savic63% (16)

- Study Notes - Google Project Management Professional CertificateDocument4 pagesStudy Notes - Google Project Management Professional CertificateSWAPNIL100% (1)

- Law of Torts - LLB - Notes PDFDocument53 pagesLaw of Torts - LLB - Notes PDFSimran94% (18)

- NPVDocument6 pagesNPVSankalan GhoshNo ratings yet

- Reaction PaperDocument3 pagesReaction PaperLois DolorNo ratings yet

- Bill of Quantities 16FI0009Document1 pageBill of Quantities 16FI0009AJothamChristianNo ratings yet

- API RP 7C-11F Installation, Maintenance and Operation of Internal Combustion Engines.Document3 pagesAPI RP 7C-11F Installation, Maintenance and Operation of Internal Combustion Engines.Rashid Ghani100% (1)

- Required Returns and The Cost of CapitalDocument51 pagesRequired Returns and The Cost of CapitalSajjad khanNo ratings yet

- EFN406 Module 09 Notes 2022Document6 pagesEFN406 Module 09 Notes 2022zx zNo ratings yet

- SS - 7-8 - Mindmaps - Corporate FinanceDocument38 pagesSS - 7-8 - Mindmaps - Corporate Financehaoyuting426No ratings yet

- Cost of CapitalDocument114 pagesCost of CapitalNamra ImranNo ratings yet

- W8 PresentationDocument13 pagesW8 Presentationtfqg6yn6gjNo ratings yet

- Capital StructureDocument22 pagesCapital StructureBhanu sharmaNo ratings yet

- 3 Value Based ManagementDocument11 pages3 Value Based ManagementMaximilian ÜbelsbacherNo ratings yet

- Session 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceDocument25 pagesSession 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceSaurabh GuptaNo ratings yet

- Chapt ER: Valuation and FinancingDocument35 pagesChapt ER: Valuation and FinancingArka Prava ChaudhuriNo ratings yet

- Valuation Lecture I: WACC vs. APV and Capital Structure DecisionsDocument14 pagesValuation Lecture I: WACC vs. APV and Capital Structure DecisionsJuan Manuel VeronNo ratings yet

- P4 Chapter 03 WACCDocument38 pagesP4 Chapter 03 WACCasim tariqNo ratings yet

- Topic 8 Cost of Capital-StudentDocument28 pagesTopic 8 Cost of Capital-StudentlinhttisvnuNo ratings yet

- Case Study in Finance NotesDocument27 pagesCase Study in Finance Noteskarthik sNo ratings yet

- Required Returns and The Cost of Capital Required Returns and The Cost of CapitalDocument41 pagesRequired Returns and The Cost of Capital Required Returns and The Cost of CapitalsarvinpsgNo ratings yet

- Financial Management: Jia, Ning (贾宁) School of Economics and Management Tsinghua UniversityDocument53 pagesFinancial Management: Jia, Ning (贾宁) School of Economics and Management Tsinghua University王振權No ratings yet

- Manajemen Keuangan RangkumanDocument6 pagesManajemen Keuangan RangkumanDanty Christina SitalaksmiNo ratings yet

- Definition of WACCDocument6 pagesDefinition of WACCMMNo ratings yet

- Cost of Equity and Capital Pricing Model: Presented By: Akhilesh Dalal Preeti Yadav Bhushan Pednekar Anuja NaikDocument25 pagesCost of Equity and Capital Pricing Model: Presented By: Akhilesh Dalal Preeti Yadav Bhushan Pednekar Anuja Naikbhushanmba09No ratings yet

- Seminar 5Document6 pagesSeminar 5vofmichiganrulesNo ratings yet

- Corporate FinanceDocument21 pagesCorporate FinanceJust for Silly UseNo ratings yet

- AFM - Cost of Capital - AE - Week 1Document41 pagesAFM - Cost of Capital - AE - Week 1AwaiZ zahidNo ratings yet

- CH 09 RevisedDocument36 pagesCH 09 RevisedNiharikaChouhanNo ratings yet

- Risk and The Cost of Capital: Principles of Corporate FinanceDocument34 pagesRisk and The Cost of Capital: Principles of Corporate FinanceMarcos José JúniorNo ratings yet

- Week 14 Risk and The Cost of Capital II: Financial Management Spring 2012Document28 pagesWeek 14 Risk and The Cost of Capital II: Financial Management Spring 2012ssunday giftNo ratings yet

- WACCDocument2 pagesWACCTomlucaNo ratings yet

- Chapter 11 - Cost of CapitalDocument21 pagesChapter 11 - Cost of Capitalhaymanotandualem2015No ratings yet

- 133 Chapter 112002Document20 pages133 Chapter 112002RonNo ratings yet

- Interviews Financial ModelingDocument7 pagesInterviews Financial ModelingsavuthuNo ratings yet

- Cost of CapitalDocument36 pagesCost of CapitalPrashant Kapoor0% (1)

- Chapter 11 - Cost of CapitalDocument20 pagesChapter 11 - Cost of Capitalreza786No ratings yet

- ValuationDocument3 pagesValuationRendry Da Silva SantosNo ratings yet

- Acf2 2024Document30 pagesAcf2 2024rodrigo.felix17012002No ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalnigemahamatiNo ratings yet

- Module 4 - 7 - Different Ways of Calculating WACCDocument10 pagesModule 4 - 7 - Different Ways of Calculating WACCBaher WilliamNo ratings yet

- Cost of CapitalDocument21 pagesCost of CapitalSukmawatiiNo ratings yet

- Sampa Video - Case 5Document10 pagesSampa Video - Case 5Morten LassenNo ratings yet

- Capital Structure Lecture 9Document45 pagesCapital Structure Lecture 9koketsoNo ratings yet

- Crash Course Company ValuationDocument35 pagesCrash Course Company ValuationfarukhgulzarNo ratings yet

- Northwestern University J.L. Kellogg Graduate School of ManagementDocument52 pagesNorthwestern University J.L. Kellogg Graduate School of ManagementlatecircleNo ratings yet

- CH 6 - Cost of Capital PDFDocument49 pagesCH 6 - Cost of Capital PDFJanta RajaNo ratings yet

- Capital Budgeting Under UncertaintyDocument30 pagesCapital Budgeting Under UncertaintyJyoti YadavNo ratings yet

- Risk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionDocument27 pagesRisk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionZee ZioaNo ratings yet

- Chapter 8 - Cost of CapitalDocument32 pagesChapter 8 - Cost of Capitalnurfatimah473No ratings yet

- The Complete Investment Banker ExtractDocument19 pagesThe Complete Investment Banker ExtractipsitaNo ratings yet

- Chapter 13: Risk, Cost of Capital, and Capital Budgeting: Corporate Finance Ross, Westerfield, and JaffeDocument15 pagesChapter 13: Risk, Cost of Capital, and Capital Budgeting: Corporate Finance Ross, Westerfield, and JaffePháp NguyễnNo ratings yet

- Strategic Financial ManagementDocument28 pagesStrategic Financial ManagementDayana MasturaNo ratings yet

- Valuation of Firms in Mergers and Acquisitions: Okan BayrakDocument27 pagesValuation of Firms in Mergers and Acquisitions: Okan Bayrakneha1001No ratings yet

- Weighted Average Cost of CapitalDocument6 pagesWeighted Average Cost of CapitalSMBNo ratings yet

- Cost of Capital and DCFDocument8 pagesCost of Capital and DCFRamneek SinghNo ratings yet

- FM414 LN 6 Master Copy Presentation Solutions - Valuation - 2024 ColorDocument16 pagesFM414 LN 6 Master Copy Presentation Solutions - Valuation - 2024 ColorAntonio AguiarNo ratings yet

- FM Handout 4Document33 pagesFM Handout 4Rofiq VedcNo ratings yet

- Discounted Cash Flow Valuation MethodsDocument20 pagesDiscounted Cash Flow Valuation Methodsmeditationinstitute.netNo ratings yet

- PAK CFE Supplemental Formula Sheet (Spring 2023)Document49 pagesPAK CFE Supplemental Formula Sheet (Spring 2023)CalvinNo ratings yet

- Topic04 WACCDocument28 pagesTopic04 WACCGaukhar RyskulovaNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsDocument18 pagesSuggested Answer - Syl12 - Dec13 - Paper 14 Final Examination: Suggested Answers To QuestionsMudit AgarwalNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Cost of Capital: Applications and ExamplesFrom EverandCost of Capital: Applications and ExamplesRating: 4.5 out of 5 stars4.5/5 (2)

- 1511 05728Document22 pages1511 05728Mark VargasNo ratings yet

- Kaleidoscope Career The Sofa: Lisa A. Mainiero, Ph.D. and Sherry E. Sullivan, PH.DDocument20 pagesKaleidoscope Career The Sofa: Lisa A. Mainiero, Ph.D. and Sherry E. Sullivan, PH.DSankalan GhoshNo ratings yet

- Torrent Power Annual Report 2010-11Document181 pagesTorrent Power Annual Report 2010-11sannuk725810% (1)

- 5th SemesterDocument1 page5th SemesterSankalan GhoshNo ratings yet

- 14 Power PointDocument31 pages14 Power PointRana WaziNo ratings yet

- Course Outline - Cost and Management AccountingDocument3 pagesCourse Outline - Cost and Management AccountingSankalan GhoshNo ratings yet

- MBA Competency Exam 3 Spring 2011 PDFDocument7 pagesMBA Competency Exam 3 Spring 2011 PDFSankalan GhoshNo ratings yet

- 4368 Note10Document2 pages4368 Note10Sankalan GhoshNo ratings yet

- Chapter 08Document6 pagesChapter 08Sankalan GhoshNo ratings yet

- HuDocument13 pagesHujt626No ratings yet

- Chapter2 PDFDocument48 pagesChapter2 PDFSankalan GhoshNo ratings yet

- HuDocument13 pagesHujt626No ratings yet

- Fib2717436957 PDFDocument1 pageFib2717436957 PDFSankalan GhoshNo ratings yet

- NDE Tourist Check List 2016 010516 PDFDocument2 pagesNDE Tourist Check List 2016 010516 PDFSankalan GhoshNo ratings yet

- RoDocument7 pagesRopersonaliserNo ratings yet

- Check List PDFDocument2 pagesCheck List PDFSankalan GhoshNo ratings yet

- Cat 2015 Score Card: Common Admission Test (Cat) - 2015 Indian Institutes of ManagementDocument1 pageCat 2015 Score Card: Common Admission Test (Cat) - 2015 Indian Institutes of ManagementSankalan GhoshNo ratings yet

- Normal Probabilites PracticeDocument2 pagesNormal Probabilites PracticeGagan TiwaiNo ratings yet

- NPVDocument28 pagesNPVdshilkarNo ratings yet

- Acute Suppurative Otitis MediaDocument41 pagesAcute Suppurative Otitis Mediarani suwadjiNo ratings yet

- French Cuisine RecipeDocument6 pagesFrench Cuisine RecipeJimmy AchasNo ratings yet

- Pediatric Fever of Unknown Origin: Educational GapDocument14 pagesPediatric Fever of Unknown Origin: Educational GapPiegl-Gulácsy VeraNo ratings yet

- Tata NanoDocument25 pagesTata Nanop01p100% (1)

- Level of Organisation of Protein StructureDocument18 pagesLevel of Organisation of Protein Structureyinghui94No ratings yet

- QAU TTS Form Annual AssessmentDocument6 pagesQAU TTS Form Annual AssessmentsohaibtarikNo ratings yet

- 5045.CHUYÊN ĐỀDocument8 pages5045.CHUYÊN ĐỀThanh HuyềnNo ratings yet

- ID25bc8b496-2013 Dse English PaperDocument2 pagesID25bc8b496-2013 Dse English PaperSimpson WainuiNo ratings yet

- Payment of Wages 1936Document4 pagesPayment of Wages 1936Anand ReddyNo ratings yet

- Legrand Price List-01 ST April-2014Document144 pagesLegrand Price List-01 ST April-2014Umesh SutharNo ratings yet

- Extraction of Mangiferin From Mangifera Indica L. LeavesDocument7 pagesExtraction of Mangiferin From Mangifera Indica L. LeavesDaniel BartoloNo ratings yet

- Final - Anarchy One-Sheet Sell SheetDocument2 pagesFinal - Anarchy One-Sheet Sell SheetMaddanie WijayaNo ratings yet

- Chapter 30 - HypertensionDocument70 pagesChapter 30 - HypertensionSakaC.TanayaNo ratings yet

- Learning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)Document6 pagesLearning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)NurulNo ratings yet

- Energy Production From Speed BreakerDocument44 pagesEnergy Production From Speed BreakerMuhammad Bilal67% (3)

- Art Integrated ProjectDocument14 pagesArt Integrated ProjectSreeti GangulyNo ratings yet

- Present Tenses ExercisesDocument4 pagesPresent Tenses Exercisesmonkeynotes100% (1)

- Stratum CorneumDocument4 pagesStratum CorneumMuh Firdaus Ar-RappanyNo ratings yet

- The Phases of The Moon Station Activity Worksheet Pa2Document3 pagesThe Phases of The Moon Station Activity Worksheet Pa2api-284353863100% (1)

- Pyromet Examples Self StudyDocument2 pagesPyromet Examples Self StudyTessa BeeNo ratings yet

- Flight Data Recorder Rule ChangeDocument7 pagesFlight Data Recorder Rule ChangeIgnacio ZupaNo ratings yet

- Prediction of CBR From Index Properties of Cohesive Soils: Magdi ZumrawiDocument1 pagePrediction of CBR From Index Properties of Cohesive Soils: Magdi Zumrawidruwid6No ratings yet

- CandyDocument24 pagesCandySjdb FjfbNo ratings yet

- 1572 - Anantha Narayanan FFS CalculationDocument1 page1572 - Anantha Narayanan FFS CalculationAnantha NarayananNo ratings yet

- Standard BMW PDFDocument19 pagesStandard BMW PDFIna IoanaNo ratings yet