Professional Documents

Culture Documents

Global Technology - Feb 3, 2017

Uploaded by

Breitbart NewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Technology - Feb 3, 2017

Uploaded by

Breitbart NewsCopyright:

Available Formats

February 3, 2017

The H-1B Visa Debate:

A Global FAQ for Investors

Equity Research

The H-1B Visa Debate: A Global FAQ for Investors

US election: Catalyzing renewed debate on role of H1B visas

The US election has catalyzed a renewed debate on potential changes to James Schneider, Ph.D.

(917) 343-3149 james.schneider@gs.com

the H-1B visa system. We provide a global FAQ for investors to frame the Goldman, Sachs & Co.

range of potential outcomes and the impact on the global tech industry.

Alec Phillips

What is an H-1B visa, and how does it work? (202) 637-3746 alec.phillips@gs.com

Goldman, Sachs & Co.

First instituted in 1991, the H-1B visa system was designed to provide US

companies with increased access to highly qualified talent overseas. Under

Heather Bellini, CFA

the current system, a maximum of 85k visas are granted annually for a (212) 357-7710 heather.bellini@gs.com

period of 3 years (with renewals for additional 3 year periods) and potential Goldman, Sachs & Co.

for a green card thereafter. The minimum H-1B salary is $60k (unchanged

Heath P. Terry, CFA

since 1991), and holders can apply for a qualified spouse to work in the US. (212) 357-1849 heath.terry@gs.com

We estimate that 900k - 1mn H-1B visa holders currently reside in the US. Goldman, Sachs & Co.

What potential changes to the system are on the table? Simona Jankowski, CFA

Newly introduced legislation in Congress, as well as other reported memos (415) 249-7437 simona.jankowski@gs.com

Goldman, Sachs & Co.

on the table from the Trump Administration, proposes several changes to

the existing H-1B program. These proposals could: (1) increase minimum Mohammed Moawalla

salary requirements for H-1B visa applicants; (2) impose a bidding +44(20)7774-1726 mohammed.moawalla@gs.com

Goldman Sachs International

system whereby employers sponsoring an H-1B at higher salary levels

would have preference over bidders at lower salaries; (3) place caps on the Lara Fourman

number of US workers employed by a company who are on an H-1B visa. (917) 343-7293 lara.fourman@gs.com

Goldman, Sachs & Co.

What can be done with executive orders vs. legislation?

The President is authorized to make limited administrative changes to the Julia McCrimlisk

(917) 343-2456 julia.mccrimlisk@gs.com

H-1B system via the Department of Homeland Security, including the Goldman, Sachs & Co.

application process and the ability of spouses to seek work in the US.

However, any increase in the number of visas offered or broad changes to Love Ghotra

(801) 741-5441 love.ghotra@gs.com

allocation policy must be made in Congress with the legislative process. Goldman, Sachs & Co.

What impact could potential changes have on the industry?

Potential changes to the H-1B system could have significant impact across

Tech including: (1) Lower margins for IT Services companies: We calculate

total costs for IT Services companies could rise by 3%-14% (with a larger

EPS drop), depending on the reforms. Among larger firms, we see the biggest

impact for Cognizant, TCS, Infosys and Wipro; (2) Higher wages for US

tech workers, and higher labor costs for employers: Companies may opt to

hire more American tech workers at higher salaries given the reduced wage

gap, with increased labor costs across Tech; (3) Increased talent availability

for Software and Internet: A salary-based allocation process could be

favorable for Software & Internet companies given higher average salaries.

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors

should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors

should consider this report as only a single factor in making their investment decision. For Reg AC certification and other

important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by

non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.

The Goldman Sachs Group, Inc. Global Investment Research

February 3, 2017 Global: Technology

THE H-1B VISA PROGRAM in numbers

SHARE OF WORKFORCE SUPPLY/DEMAND MISMATCH

The number of H-1B visa The maximum number of new H-

900,000+ holders working in the US

today, roughly 0.7% of the 85,000

1B visas the US can grant per year

(not including renewals). Congress

labor force. (p. 4) initially set this cap at 65k in 1991

and raised it as high as 195k in the

late 90s. (p. 4)

The share of US tech-

12%-13% related jobs filled by H-1B

visa holders. (p. 4) The percentage of H-1B visas

24% reserved for applicants with

advanced degrees from US

universities. (p. 4)

BIG TEN

The share of new H-1B visas held

by the top 10 awarded companies H-1B applications received in

34% in 2014, which included Tata

Consultancy, Infosys, Cognizant,

236,000 2016nearly three times the

annual quota. (p. 4)

IBM and Accenture. (p. 6)

LIONS SHARE

Prof. services

6% Other

14% Other

18%

Percentage of

Ed 6%

65%

H-1B issuance for China 70% 2015 H-1B visas

computer-related

jobs in 2015. (p. 7).

12% 70% issued to Indian

citizens. (p. 10).

Architecture &

engineering 9%

A HIGHER FLOOR

The minimum required salary

$60k $75k

The average salary for H-1B

for H-1B visa holders employees at IT service firms.

unchanged since 1991. (p. 4) (p. 12)

$100k/ Minimum H-1B salaries

Estimated increase (GSe) in

proposed by two different

3%-14% costs for IT service firms

assuming some change in the

$130k Congressional bills. (p. 7)

minimum salary rules. (p. 9)

Goldman Sachs Global Investment Research 2

February 3, 2017 Global: Technology

The H-1B Visa Debate: A Global FAQ for Investors

How the visa system works today

Question 1: What is the H-1B visa program? How does it compare to other visas?

For more on potential

policy actions under a

H-1B visas have been issued under the authority of the Immigration Act of 1990 since 1991.

Trump administration, According to the US Citizenship and Immigration Services (USCIS), You may be eligible

see our GS360 for an H-1B visa if you are planning to work...in the United States in an occupation that

webpage. Our normally requires a bachelors degree or higher in a related field of study (e.g., engineers,

economists and scientists or mathematicians), and you have at least a bachelors degree or equivalent in a

strategists explore the field related to the position. The visa was introduced to provide US companies with

implications of tax

increased access to highly qualified talent overseas.

reform, protectionist

trade policies, and H-1B visas grant an initial period of stay in the United States of up to three years.

more. Extensions are possible in up to three-year increments. The H-1B visa is considered a dual

intent visa, meaning an H-1B holder can have legal immigration intentand apply for and

obtain a green cardwhile still holding an H-1B visa.

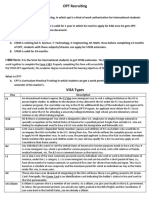

The H-1B visa is one of many types of work visas in the US. In Exhibit 1, we summarize the

different US work visas, the requirements, and the period of stay. While much of the recent

political news has been around H-1B visa reform, L-1 and EB-5 visas have also come under

scrutiny. L-1 visas are granted to foreign workers that have worked for the corporation for

at least one year prior to getting the visa. The EB-5 visa is for individuals that invest at least

$1mn to create ten new US jobs, commonly achieved through real estate development.

Exhibit 1: H-1B is the most commonly issued work visa in the US

Types of US work visas; duration considers maximum initial stay, not opportunity for renewals; visas issued includes new visas

and renewals issued in 2015

U.S. Work Visas

H-1B L-1A L-1B O-1A EB-2 EB-5 E-2 B-1

For those with

For those with

achievements Temporary

For those with extraordinary For foreign For treaty

For inter-office transfers in the arts, business

job offers ability or investors investors

sciences, or visa

achievement

business

Duration 3 years 1 year 3 years 3 years Permanent 2 years 1-6 months

Visas issued 172,748 78,537 23,680* n/a n/a 41,289 43,421

*Broader category than O-1A, which includes O-1, O-2, and O-3 visas

Source: US Citizenship and Immigration Services, Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research 3

February 3, 2017 Global: Technology

Question 2: How are H-1B visas allocated by the government?

In order to apply for an H-1B visa, employers must first submit a Labor Condition

Application (LCA) to the Department of Labor before the H-1B petition is submitted. The

LCA describes the position, rate of pay, proposed period of employment, and work location.

In addition, an employer must attest that: (1) it will provide the H-1B employee the same

benefits offered to US workers and pay the H-1B employee the higher of: the actual wage

paid others with similar experience and qualifications, or the prevailing wage for the

occupation; (2) it will provide the employee with working conditions that will not adversely

affect the working conditions of similar workers; (3) there is no strike or labor dispute at the

place of employment in the same occupation; (4) it has advertised the position for at least

10 business days. The Department of Labor certifies the validity of the LCA, and the H-1B

petition is then entered into a lottery system organized by the United States Citizenship and

Immigration Services (USCIS), which is part of the Department of Homeland Security.

H-1B visas are allocated by USCIS through random lottery based on the number of

applications. The USCIS employs a first-come, first-served, random computer lottery

system to select applicants up to the legal quota. USCIS first conducts a lottery for

advanced degree applications (20k quota). Any requests not selected are put back into the

general pool in a second lottery (65k quota). There is no limit on the number of applications

a company can submit. Once selected, based on DHS policy, the spouse of an H-1B visa

holder may also be eligible to seek work in the US.

The number of H-1B applications consistently outstrips the number of visas available.

USCIS received 236k H-1B visa applications in 2016, roughly three times the 85k annual

quota (Exhibits 2 and 3). Congress initially set the cap at 65k in 1990. After the visa cap was

first reached in 1997, Congress temporarily raised the cap to 115k in 1999 and 2000 and

195k from 2001-2003. The cap was lowered to 65k in 2004-2005 before settling at its current

level of 85k (with 20k allocated for applicants with graduate degrees from US universities).

The H-1B visa requires a minimum salary of $60k.

Exhibit 2: There have been no changes to the H-1B visa Exhibit 3: H-1B visa issuance has continued to increase

cap over the last decade New H-1B visa issuance and renewals, 1990-2015

Annual H-1B visa cap by year, 1991-present

250,000 200,000 172,748 H-1B visas

were issued in 2015

180,000

200,000 195k 160,000

140,000

150,000 120,000

115k 100,000

65k + 20k with graduate degrees

100,000 from U.S. universities 80,000 Visa caps were first

reached in 1997

65k 60,000

50,000 40,000

20,000 794 H-1B visas were

issued in 1990

0 0

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Source: US Department of State. Source: US Government Accountability Office, US Chamber of Commerce.

Question 3: How big an impact are H-1B visas in terms of the US labor force?

We estimate that 900k to 1mn individuals are working under H-1B visas in the US today,

based on the assumption that most existing visas are renewed for a second term, and that

about two-thirds of qualified H-1B visa holders eventually apply for a green card (based on

average wait times and green card quotas for countries affected). While H-1B visa holders

comprise only 0.6%-0.7% of total US jobs, we estimate they comprise about 12%-13%

Goldman Sachs Global Investment Research 4

February 3, 2017 Global: Technology

of tech-related jobs (Exhibit 4). Employment penetration figures would be slightly higher

when including spouses of H-1B visa holders (which could be as many as 500k people

based on prevailing marriage rates of roughly 50% across countries).

Exhibit 4: US H-1B visas at a glance

US jobs ('000s) Total jobs Tech-related jobs

US 144,314 4,988

H-1B 900-1,000 600-670

% H-1B 0.6%-0.7% 12.1%-13.4%

Source: USCIS, Bureau of Labor Statistics, Haver, Goldman Sachs Global Investment Research.

Framing the debate around H-1B visas

Question 4: What are the arguments in favor of the program as it stands today?

Many corporate tech industry leaders and politicians (including President Obama), have

been strongly in favor of the H-1B program and have even advocated for its expansion. We

highlight three arguments that are generally cited in favor of the H-1B visa program:

(1) H-1B workers help fill critical labor shortages. The National Association of

Software and Services Companies (NASSCOM), the Indian trade association,

estimates that the US will face a shortage of just over a million IT engineers by

2018. The association also argues that nearly half of the students enrolled in STEM

(Science, Technology, Engineering, and Mathematics) programs in US universities

are foreign nationals. Bureau of Labor Statistics data shows that unemployment

rates are lower for occupations that use a large number of H-1B visas than the

overall US (Exhibit 5), and a CIO Survey conducted by Harvey Nash/KPMG shows

that 65% of CIOs reported a technology skills shortage in 2016 (Exhibit 6).

(2) H-1B visas promote entrepreneurship and long-term job creation in the US.

Although there are no hard figures on the topic, proponents of H-1B visas argue

that foreign-born technologists who enter the US on educational or H-1B visas are

particularly entrepreneurial, and often go on to form their own ventures which

eventually add significantly to US job creation. A National Foundation for

American Policy study noted that 51% of startups with $1bn or greater market cap

in 2016 had at least one immigrant founder. In addition, technology startup

companies with limited startup funding can source talented individuals and

compete more easily for talent with larger firms (which is an explicit part of Rep.

Lofgrens proposed reforms; see below).

(3) H-1B workers are additive to US GDP and consumption. H-1B workers are well-

educated and command high wages, some of which would be reinvested back into

the US economy. In 2013, the Hoover Institution at Stanford University evaluated

the potential GDP benefit from a Senate bill to raise the cap on H-1B workers to a

minimum of 110k and a maximum of 180k (compared to 85k today). The

researchers found that these new H-1B workers would add an estimated $456bn to

GDP over the next ten years, over half of which would accrue to current US

citizens and residents.

Goldman Sachs Global Investment Research 5

February 3, 2017 Global: Technology

Exhibit 5: Unemployment rate for H-1B-related jobs is Exhibit 6: 65% of CIOs report a technology skills shortage

lower than that of the overall US today, a figure on the rise since the recession

US unemployment rate and professional and related % of CIOs reporting technology skills shortage, 2005-2016

occupations unemployment rate

12% 100%

85%

% of CIOs reporting tech skills shortage

90%

10% 78%

80% 73% 71%

Unemployment rate

8% 70% 65%

58% 60% 59%

60% 54%

6%

47% 45%

50% 42%

4%

40%

2% 30%

20%

0%

10%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

0%

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

National Professional and Related Occupations

Source: Bureau of Labor Statistics, Haver. Source: Harvey Nash/KPMG CIO Survey 2016.

Question 5: What is the motivation to change the current program?

Opponents of the H-1B program, as well as various members of Congress, have raised a

number of objections to the existing H-1B visa program, including:

(1) H-1B visa holders take jobs away from qualified Americans. Even though H-1B

visas are intended to fill labor shortages for skilled labor, there have been reported

incidents (and subsequent investigations) of companies such as Disney and

Southern California Edison that have allegedly laid off hundreds of employees and

replaced them with foreign workers brought to the US by outsourcing firms.

In a Senate Judiciary Committee hearing in 2015, Senator Grassley noted that

most employers are not required to prove to the Department of Labor that they

tried to find an American to fill the job first. And, if there is an equally or even

better qualified US worker available, the company does not have to offer him or

her the job. Some research has even questioned if there is a STEM shortage at all,

with a study by Georgetown University noting that only about half of those

graduating with undergraduate STEM degrees actually work in STEM-related fields

after college.

(2) H-1B visas depress wages for American technology workers. Some studies

have found that H-1B visa holders are often paid less than their US counterparts,

which runs counter to the requirements of the H-1B visa petition process (workers

are supposed to be paid the prevailing wage). According to analysis by Ron Hira, a

professor at Howard University who testified before Congress on high-skilled

immigration, foreign workers can be paid 20% to 40% less than the average wage

paid to Americans.

(3) The H-1B visa program favors certain industries over others. A

disproportionate share of H-1B visas are granted to IT outsourcing companies.

About two-thirds of H-1B petitions approved were for computer-related jobs, and

the ten employers that received the most H-1B visa approvals, which comprised

34% of total new visas issued, were all consulting and outsourcing companies

(Exhibits 7 and 8).

Goldman Sachs Global Investment Research 6

February 3, 2017 Global: Technology

Exhibit 7: Consulting and outsourcing companies are Exhibit 8: H-1B visas are concentrated among tech jobs

frequent users of H-1B visas H-1B visa issuance by occupation, 2015

Top 20 employers by H-1B visa approvals, 2014

Company H-1B visas % of total*

Tata Consultancy Services 7,149 8.4%

Cognizant Technology Solutions 5,228 6.2%

Infosys Limited 4,022 4.7% Other

Wipro Limited 3,246 3.8% 14%

Accenture 2,376 2.8%

Tech Mahindra 1,850 2.2%

IBM 1,513 1.8% Education

Capgemini** 1,422 1.7% 6%

L&T Infotech 1,298 1.5%

HCL Technologies 927 1.1% Professional

Amazon 877 1.0% services

Computer Sciences Corporation 873 1.0% 6%

Computer-related

Microsoft 850 1.0% 65%

Google 728 0.9% Architecture &

Intel 700 0.8% Engineering

Deloitte 559 0.7% 9%

Mindtree 487 0.6%

Apple 443 0.5%

UST Global 421 0.5%

Mphasis 405 0.5%

Top 20 35,374 41.6%

*Assumes 85k new visas issued.

**Capgemini includes iGate H-1B visa data.

Source: Computerworld. Source: US Citizenship and Immigration Services.

Question 6: What potential changes to the system are on the table?

Over the past five years, a number of bills have been proposed in Congress seeking to

change the existing H-1B system in one or more ways (Exhibit 9). In addition, recent press

reports (Bloomberg and Vox) suggest that President Trump may also introduce his own

proposal. Most existing policy proposals have taken one of the following dimensions:

(1) Increase in minimum salaries: Several bills propose raising the minimum salary

for H-1B visa workers from the current minimum of $60k (which has not changed

since 1991) to minimize wage arbitrage with local US workers. Reps. Issa and

Lofgren have proposed increasing salary minimums to $100k and $130k,

respectively.

(2) Salary bid vs. first-come, first-served lottery: Several proposals would change

the H-1B allocation process to a salary bidding system, where companies would

bid for the salary at which they are willing to sponsor someone. This compares to

the random lottery system today, where there is no limit on the number of

applications a company can submit. Trump policy advisors have reportedly

discussed a bid process (Bloomberg), although no formal proposal has surfaced.

(3) Capping the proportion of US workers on H-1Bs: Local employees (non-visa US

onsite workers) must comprise a minimum percentage of a companys US-based

headcount. Sens. Grassley and Durbin have proposed a bill with a 50% on-site cap.

We summarize the details of the most recent visa proposals in Exhibit 9.

Goldman Sachs Global Investment Research 7

February 3, 2017 Global: Technology

Exhibit 9: Summary of H-1B policy proposals

Sens. Grassley/Durbin Rep. Issa Rep. Lofgren President Trump

Current system H-1B and L-1 Visa Protect and Grow High-Skilled Integrity and

No formal proposal

Reform Act American Jobs Act Fairness Act of 2017

Minimum salary $60,000 $60,000 $100,000 $130,000

Allocation process Lottery Lottery Lottery Bid Bid

50% onsite cap for H-1B

Employee cap None None None

and L-1 visas

Source: Goldman Sachs Global Investment Research.

H-1B and L-1 Visa Reform Act (Sens. Grassley and Durbin): This bill prioritizes students

educated at US institutions and advanced degree holders when allocating visas, and

prevents companies with over 50 employees from hiring additional H-1B employees if H-1B

and L-1 workers represent over 50% of the companys US workforce. It also introduces

reforms to the L-1 visa program including a wage floor for L-1 workers. The bill was first

introduced in 2007, and was reintroduced in January 2017.

Protect and Grow American Jobs Act (Rep. Issa): This bill raises the minimum salary to

$100k (from $60k) and removes the exemption for workers with masters degrees. The bill

was first introduced in July 2016 and was reintroduced in January 2017.

High-Skilled Integrity and Fairness Act of 2017 (Rep. Lofgren): Eliminates the lowest

wage category, increases the prevailing wage requirements, and raises the minimum

salary at which employers are exempt from recruiting in the US to over $130k. The bill also

prioritizes employers willing to pay a higher wage (200% of the prevailing wage at the

given level), and sets aside 20% of annual H-1B visas for start-ups (50 or fewer workers).

This bill was first introduced in January 2017.

Question 7: What can be done with executive orders outside legislation?

Substantial changes to the H-1B visa program would very likely require Congressional

action to change the existing statute, as the existing law is specific about:

- The maximum number of H-1B visas that may be allocated;

- The principle of a first come, first served process for allocating H-1B visas.

However, executive action could conceivably be used to:

- Increase rigidity of enforcement for the existing certification process at an agency

level;

- Reduce H-1B visa quotas (existing law is specific about the maximum, but does

not set minimums);

- Potentially modify the LCA process (used to certify employer petitions for specific

open positions) to require employers to provide proof that they have tried to fill a

position with an American first;

- Potentially modify the LCA process to restrict lower-wage applicants (this point is

unclear given the level of specificity of the LCA process as codified in law).

We will continue to monitor the ongoing legislative process on immigration policy, as well

as forthcoming policy pronouncements from the Trump administration.

Goldman Sachs Global Investment Research 8

February 3, 2017 Global: Technology

Potential implications of H-1B visa reform

Question 8: What industries and companies would be most impacted by

changes?

We believe that IT Consulting and Outsourcing companies, which tend to pay H-1B

employees lower salaries relative to other industries, are at greatest risk given the

proposed reforms. Our analysis suggests that total costs could increase by 3% - 14%

for a range of IT Consulting and Outsourcing companies (with a correspondingly

larger drop in earnings), depending on what reforms might be enacted. More broadly, we

believe technology companies (which employ roughly two-thirds of H-1B visa holders)

could see a modest negative impact although we believe some changes (for example, a

bidding system) could also bring increased talent availability to certain industries such as

Software and Internet given the higher average salaries in these sectors.

Exhibit 10 illustrates that a higher minimum salary could increase operating costs across

the tech industry either minimally or significantly, depending on a companys H-1B

exposure and prevailing salary rates. The available data suggests that public IT Services

companies currently run at an average salary of $75k for H-1B employees, which is below

the minimum salaries in Rep. Issas proposal ($100k) and Rep. Lofgrens proposal ($130k).

Alternatively, if the allocation process switched from a first-come, first-served lottery

system to a salary bidding system, we would expect Consulting and Outsourcing

companies to be regularly outbid by Software, Internet, and Hardware companies, unless

they raise their salaries substantially.

Exhibit 10: Public consulting and outsourcing companies would be most at risk if higher minimum salaries are enacted

Incremental operating costs assuming higher minimum salary for H-1B employees

$80,000 salary minimum $100,000 salary minimum $130,000 salary minimum

Avg. salary

Company Industry H-1B visas* Salary chg. Incremental % Cost Salary chg. Incremental % Cost Salary chg. Incremental % Cost

($)

($) Cost ($mn) Increase ($) Cost ($mn) Increase ($) Cost ($mn) Increase

Public companies - meaningful impact

Mindtree IT Services 1,461 72,822 7,178 10 1.7% 27,178 40 6.5% 57,178 84 13.7%

Cognizant IT Services 23,790 72,559 7,441 177 1.7% 27,441 653 6.2% 57,441 1,367 12.9%

Mphasis IT Services 1,591 74,947 5,053 8 NM 25,053 40 5.0% 55,053 88 10.9%

TCS IT Services 20,973 69,648 10,352 217 1.9% 30,352 637 5.4% 60,352 1,266 10.8%

Infosys IT Services 14,659 79,201 799 12 NM 20,799 305 4.3% 50,799 745 10.4%

HCL Technologies IT Services 5,828 82,132 -- -- -- 17,868 104 2.8% 47,868 279 7.4%

Wipro IT Services 7,500 70,306 9,694 73 1.1% 29,694 223 3.5% 59,694 448 7.0%

Tech Mahindra IT Services 4,200 75,044 4,956 21 NM 24,956 105 3.0% 54,956 231 6.6%

Accenture IT Services 21,352 77,953 2,047 44 NM 22,047 471 1.7% 52,047 1,111 4.0%

Capgemini** IT Services 9,834 90,756 -- -- -- 9,244 91 NM 39,244 386 3.1%

L&T Infotech IT Services 6,897 74,064 5,936 41 NM 25,936 179 1.3% 55,936 386 2.8%

Public companies - no meaningful impact

CSC IT Services 500 60,736 19,264 10 NM 39,264 20 NM 69,264 35 NM

IBM IT Services 9,934 83,248 -- -- -- 16,752 166 NM 46,752 464 NM

Microsoft Software 5,694 122,641 -- -- -- -- -- -- 7,359 42 NM

Oracle Software 2,520 118,624 -- -- -- -- -- -- 11,376 29 NM

Amazon Internet 5,274 117,351 -- -- -- -- -- -- 12,649 67 NM

Google Internet 4,443 127,898 -- -- -- -- -- -- 2,102 9 NM

Intel Hardware 4,416 105,105 -- -- -- -- -- -- 24,895 110 NM

Qualcomm Hardware 3,381 116,343 -- -- -- -- -- -- 13,657 46 NM

Cisco Hardware 1,875 123,059 -- -- -- -- -- -- 6,941 13 NM

Apple Hardware 1,329 136,876 -- -- -- -- -- -- -- -- --

Private companies

Deloitte IT Services 6,150 95,371

UST Global IT Services 2,688 68,158

PwC IT Services 1,761 95,707

EY IT Services 1,119 92,297

*H-1B visa assumptions: for US-heritage IT Services companies, TCS, Infosys, Wipro, HCL Technologies, and Tech Mahindra, estimate based on company data, management

conversations, and GS analyst estimates; for Mphasis, assume two-thirds of US headcount is on H-1B visas; for other companies, estimate based on Computerworld's citing of

Freedom of Information Act data from 2013 and 2014 and assumes employees on H-1B visas remain with the company for six years.

**Capgemini visa estimates incorporate iGate H-1B visa data.

Source: Computerworld, myvisajobs.com, company data, Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research 9

February 3, 2017 Global: Technology

Question 9: What countries are most likely to be affected?

We believe India is most likely to be affected in the event of any changes to H-1B visa

policy. About 70% of H-1B visas were issued to people of Indian origin in 2015 (Exhibit 11).

This implies that about 60k of the new H-1B visas (70% of the 85k quota) are issued to

Indian citizens. To put this into context, about 1.3mn people graduate with a Bachelors in

Science or Bachelors in Technology from Indian universities each year. If H-1B visas were

only sourced from this cohort, this implies that about 4.6% of technical undergraduates

are employed through H-1B visas.

Exhibit 11: About 70% of H-1B visas are issued to Indian citizens

H-1B visa issuance by country, 2015

South Philippines,

Germany, 1,432

Korea,

1,091

2,526

Brazil, 1,258 Other, 18,781

France, 1,594

Japan, 1,146

Mexico, 2,894

UK, 2,111

China, 19,963

India, 119,952

Source: US Department of State, Bureau of Consular Affairs.

We believe the impact to Indian H-1B applicants depends greatly on whether the number of

H-1B applications continues to exceed the 85k cap.

(+) Applications still exceed the cap: Indian H-1B visa holders would likely work at higher-

paying companies (more concentrated in Software, Internet, and Hardware positions vs.

Consulting positions under a bid system) or have higher salaries (given higher minimum

salary requirements). Given higher salaries on average, this would increase remittance

volumes from the US to India.

(-) Applications do not exceed the cap: More stringent requirements could significantly

limit demand for workers on H-1B visas. Foreign workers might be deemed less attractive

to US employers as a result of a narrower wage gap between them and their US

counterparts. This could lead to oversupply of technically skilled labor in India, which could

negatively impact both the domestic job market and current account balances. We believe

this could have a significant negative impact for Indian-heritage IT Services companies, as

their cost competitiveness vs. more US-focused peers could be diminished.

Goldman Sachs Global Investment Research 10

February 3, 2017 Global: Technology

Question 10: What are the longer-term implications of H-1B visa reform?

We highlight three major longer-term implications of H-1B visa reform:

(1) Lower margins for IT consulting and outsourcing companies: We calculate that

total costs could increase by 3% - 14% for public IT Consulting and Outsourcing

companies (with a correspondingly larger drop in earnings), depending on what

reforms might be enacted under a range of scenarios resulting from higher salary

minimums. We believe that such changes could potentially result in the hiring of more

American workers, especially considering the increased administrative and overhead

costs associated with the H-1B visa process. In some cases, we believe Indian-heritage

firms have already begun to adjust their hiring practices and anecdotal statistics from

some companies suggest that they have already started to submit fewer H-1B

applications over the past year vs. prior years (although little data is available).

However, we acknowledge that talent supply disruptions in the domestic labor force

are likely to persist for a period of years after the enactment of any such change given

the educational and career tracks of new university students and graduates.

(2) Salaries move higher with increased jobs for American tech workers, but

higher labor costs for tech employers: Companies may opt to hire more American

tech workers at higher salaries given the reduced wage gap, with increases in labor

costs across Tech. We would expect the biggest uplift to come at the low end of the

H-1B wage spectrum (especially for the IT Consulting and Outsourcing companies),

with a modest impact in Software, Internet, and Hardware, as these prevailing salary

levels are already close to the highest caps proposed in the legislation surveyed

(Exhibit 12). Importantly, we believe the direct impact to larger US tech companies

may be somewhat mitigated by the use of L-1 (intra-company transfer) visas used by

many, which may or may not be included in any potential rule changes. We would

expect overall labor costs to increase across the tech universe, with the potential

structural change in how the IT Consulting and Outsourcing industry approaches its

labor pyramid in terms of both seniority and onshore/offshore mix.

(3) Increased talent availability for Software and Internet: The technology industry,

particularly companies based in Silicon Valley, has consistently provided

anecdotal evidence of labor shortages to fill qualifying high-skilled positions. We

believe this may be due in part to a limited allocation of H-1B visas under the

current volume-based lottery process. We believe a salary-based bidding process

could be favorable for Software and Internet companies, potentially alleviating

some wage pressure at the higher end of the spectrum.

Goldman Sachs Global Investment Research 11

February 3, 2017 Global: Technology

Exhibit 12: Companies with lower H-1B salary rates are at greatest risk under proposed

changes, particularly IT Services companies

Average H-1B visa salary by type of tech company

140,000

122,625 120,633 120,346

120,000

100,000

Average salary

80,000 75,172

60,000

40,000

20,000

-

Internet Software Hardware IT Services

Note: Services includes Accenture, Capgemini, Cognizant, IBM, HCL, Infosys, L&T Infotech,

Mindtree, Mphasis, Syntel, TCS, Tech Mahindra, Wipro; Hardware includes Apple, Cisco, Intel,

Qualcomm; Software includes Microsoft, Oracle; and Internet includes Amazon, Google.

Source: myvisajobs.com, Goldman Sachs Global Investment Research.

Goldman Sachs Global Investment Research 12

February 3, 2017 Global: Technology

Disclosure Appendix

Reg AC

We, James Schneider, Ph.D., Heather Bellini, CFA, Heath P. Terry, CFA, Simona Jankowski, CFA, Mohammed Moawalla, Lara Fourman, Julia

McCrimlisk and Love Ghotra, hereby certify that all of the views expressed in this report accurately reflect our personal views about the subject

company or companies and its or their securities. We also certify that no part of our compensation was, is or will be, directly or indirectly, related to

the specific recommendations or views expressed in this report.

I, Alec Phillips, hereby certify that all of the views expressed in this report accurately reflect my personal views, which have not been influenced by

considerations of the firm's business or client relationships.

Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs' Global Investment Research division.

Investment Profile

The Goldman Sachs Investment Profile provides investment context for a security by comparing key attributes of that security to its peer group and

market. The four key attributes depicted are: growth, returns, multiple and volatility. Growth, returns and multiple are indexed based on composites

of several methodologies to determine the stocks percentile ranking within the region's coverage universe.

The precise calculation of each metric may vary depending on the fiscal year, industry and region but the standard approach is as follows:

Growth is a composite of next year's estimate over current year's estimate, e.g. EPS, EBITDA, Revenue. Return is a year one prospective aggregate

of various return on capital measures, e.g. CROCI, ROACE, and ROE. Multiple is a composite of one-year forward valuation ratios, e.g. P/E, dividend

yield, EV/FCF, EV/EBITDA, EV/DACF, Price/Book. Volatility is measured as trailing twelve-month volatility adjusted for dividends.

Quantum

Quantum is Goldman Sachs' proprietary database providing access to detailed financial statement histories, forecasts and ratios. It can be used for

in-depth analysis of a single company, or to make comparisons between companies in different sectors and markets.

GS SUSTAIN

GS SUSTAIN is a global investment strategy aimed at long-term, long-only performance with a low turnover of ideas. The GS SUSTAIN focus list

includes leaders our analysis shows to be well positioned to deliver long term outperformance through sustained competitive advantage and

superior returns on capital relative to their global industry peers. Leaders are identified based on quantifiable analysis of three aspects of corporate

performance: cash return on cash invested, industry positioning and management quality (the effectiveness of companies' management of the

environmental, social and governance issues facing their industry).

Disclosures

Coverage group(s) of stocks by primary analyst(s)

James Schneider, Ph.D.: America-ATM/POS and Self-Service, America-IT Consulting and Outsourcing, America-Transaction Processors. Heather

Bellini, CFA: America-Software. Heath P. Terry, CFA: America-Internet. Simona Jankowski, CFA: America-Consumer Hardware & Mobility, America-IT

Hardware, America-Telecom Equipment. Mohammed Moawalla: Europe-IT Services, Europe-Software.

America-ATM/POS and Self-Service: CPI Card Group, CPI Card Group, VeriFone Systems Inc..

America-Consumer Hardware & Mobility: Apple Inc., BlackBerry Ltd., BlackBerry Ltd., Corning Inc., Garmin Ltd., GoPro Inc., Qualcomm Inc..

America-IT Consulting and Outsourcing: Accenture Plc, Black Knight Financial Services Inc., CGI Group, CGI Group, Cognizant Technology Solutions,

Computer Sciences Corp., Fidelity National Information Services, Fiserv Inc., International Business Machines, Sabre Corp., West Corp..

America-IT Hardware: 3D Systems Corp., Aerohive Networks Inc., Arista Networks Inc., Brocade Communications Systems, CDW Corp., Cisco

Systems Inc., F5 Networks Inc., Hewlett Packard Enterprise Co., HP Inc., Motorola Solutions Inc., NetApp Inc., Nimble Storage Inc., Nutanix Inc., Pure

Storage Inc., Stratasys Ltd., Xerox Corp., Zebra Technologies Corp.

America-Internet: Amazon.com Inc., Bankrate Inc., Criteo SA, eBay Inc., Endurance International Group, Etsy Inc., Expedia Inc., Groupon Inc.,

GrubHub Inc., IAC/InterActiveCorp, LendingClub Corp., Match Group, Netflix Inc., Pandora Media Inc., PayPal Holdings, Priceline.com Inc., Shutterfly

Inc., TripAdvisor Inc., Trivago N.V., TrueCar, Twitter Inc., WebMD Health Corp., Yahoo! Inc., Yelp Inc., Zillow Group, Zynga Inc..

America-Software: Adobe Systems Inc., Akamai Technologies Inc., Alphabet Inc., ANSYS Inc., Atlassian Corp., Autodesk Inc., Citrix Systems Inc.,

Facebook Inc., Microsoft Corp., MobileIron Inc., Oracle Corp., PTC Inc., Red Hat Inc., RingCentral, Salesforce.com Inc., Twilio, VMware Inc., Workday

Inc..

America-Telecom Equipment: Acacia Communications Inc., ADTRAN Inc., ARRIS International Plc, Ciena Corp., Finisar Corp., Infinera Corp., Juniper

Networks Inc., Lumentum Holdings.

America-Transaction Processors: Automatic Data Processing Inc., Blackhawk Network Holdings, Evertec Inc., First Data Corp., FleetCor Technologies

Inc., Global Payments Inc., MasterCard Inc., MoneyGram International Inc., Paychex Inc., Square Inc., Total System Services Inc., Vantiv Inc., Visa Inc.,

Western Union Co., WEX Inc..

Europe-IT Services: Atos, Capgemini, Indra, Wirecard, Worldline, Worldpay Group.

Europe-Software: Aveva, Dassault Systemes, Hexagon AB, Sage Group, SAP, SAP, Software AG, Temenos.

Company-specific regulatory disclosures

Compendium report: please see disclosures at http://www.gs.com/research/hedge.html. Disclosures applicable to the companies included in this

compendium can be found in the latest relevant published research

Distribution of ratings/investment banking relationships

Goldman Sachs Investment Research global Equity coverage universe

Rating Distribution Investment Banking Relationships

Goldman Sachs Global Investment Research 13

February 3, 2017 Global: Technology

Buy Hold Sell Buy Hold Sell

Global 32% 54% 14% 64% 60% 51%

As of January 1, 2017, Goldman Sachs Global Investment Research had investment ratings on 2,902 equity securities. Goldman Sachs assigns stocks

as Buys and Sells on various regional Investment Lists; stocks not so assigned are deemed Neutral. Such assignments equate to Buy, Hold and Sell

for the purposes of the above disclosure required by the FINRA Rules. See 'Ratings, Coverage groups and views and related definitions' below. The

Investment Banking Relationships chart reflects the percentage of subject companies within each rating category for whom Goldman Sachs has

provided investment banking services within the previous twelve months.

Price target and rating history chart(s)

Compendium report: please see disclosures at http://www.gs.com/research/hedge.html. Disclosures applicable to the companies included in this

compendium can be found in the latest relevant published research

Regulatory disclosures

Disclosures required by United States laws and regulations

See company-specific regulatory disclosures above for any of the following disclosures required as to companies referred to in this report: manager

or co-manager in a pending transaction; 1% or other ownership; compensation for certain services; types of client relationships; managed/co-

managed public offerings in prior periods; directorships; for equity securities, market making and/or specialist role. Goldman Sachs trades or may

trade as a principal in debt securities (or in related derivatives) of issuers discussed in this report.

The following are additional required disclosures: Ownership and material conflicts of interest: Goldman Sachs policy prohibits its analysts,

professionals reporting to analysts and members of their households from owning securities of any company in the analyst's area of

coverage. Analyst compensation: Analysts are paid in part based on the profitability of Goldman Sachs, which includes investment banking

revenues. Analyst as officer or director: Goldman Sachs policy prohibits its analysts, persons reporting to analysts or members of their

households from serving as an officer, director, advisory board member or employee of any company in the analyst's area of coverage. Non-U.S.

Analysts: Non-U.S. analysts may not be associated persons of Goldman, Sachs & Co. and therefore may not be subject to FINRA Rule 2241 or FINRA

Rule 2242 restrictions on communications with subject company, public appearances and trading securities held by the analysts.

Distribution of ratings: See the distribution of ratings disclosure above. Price chart: See the price chart, with changes of ratings and price targets in

prior periods, above, or, if electronic format or if with respect to multiple companies which are the subject of this report, on the Goldman Sachs

website at http://www.gs.com/research/hedge.html.

Additional disclosures required under the laws and regulations of jurisdictions other than the United States

The following disclosures are those required by the jurisdiction indicated, except to the extent already made above pursuant to United States laws

and regulations. Australia: Goldman Sachs Australia Pty Ltd and its affiliates are not authorised deposit-taking institutions (as that term is defined in

the Banking Act 1959 (Cth)) in Australia and do not provide banking services, nor carry on a banking business, in Australia. This research, and any

access to it, is intended only for "wholesale clients" within the meaning of the Australian Corporations Act, unless otherwise agreed by Goldman

Sachs. In producing research reports, members of the Global Investment Research Division of Goldman Sachs Australia may attend site visits and

other meetings hosted by the issuers the subject of its research reports. In some instances the costs of such site visits or meetings may be met in part

or in whole by the issuers concerned if Goldman Sachs Australia considers it is appropriate and reasonable in the specific circumstances relating to

the site visit or meeting. Brazil: Disclosure information in relation to CVM Instruction 483 is available at

http://www.gs.com/worldwide/brazil/area/gir/index.html. Where applicable, the Brazil-registered analyst primarily responsible for the content of this

research report, as defined in Article 16 of CVM Instruction 483, is the first author named at the beginning of this report, unless indicated otherwise at

the end of the text. Canada: Goldman Sachs Canada Inc. is an affiliate of The Goldman Sachs Group Inc. and therefore is included in the company

specific disclosures relating to Goldman Sachs (as defined above). Goldman Sachs Canada Inc. has approved of, and agreed to take responsibility for,

this research report in Canada if and to the extent that Goldman Sachs Canada Inc. disseminates this research report to its clients. Hong

Kong: Further information on the securities of covered companies referred to in this research may be obtained on request from Goldman Sachs

(Asia) L.L.C. India: Further information on the subject company or companies referred to in this research may be obtained from Goldman Sachs

(India) Securities Private Limited, Research Analyst - SEBI Registration Number INH000001493, 951-A, Rational House, Appasaheb Marathe Marg,

Prabhadevi, Mumbai 400 025, India, Corporate Identity Number U74140MH2006FTC160634, Phone +91 22 6616 9000, Fax +91 22 6616 9001. Goldman

Sachs may beneficially own 1% or more of the securities (as such term is defined in clause 2 (h) the Indian Securities Contracts (Regulation) Act,

1956) of the subject company or companies referred to in this research report. Japan: See below. Korea: Further information on the subject

company or companies referred to in this research may be obtained from Goldman Sachs (Asia) L.L.C., Seoul Branch. New Zealand: Goldman

Sachs New Zealand Limited and its affiliates are neither "registered banks" nor "deposit takers" (as defined in the Reserve Bank of New Zealand Act

1989) in New Zealand. This research, and any access to it, is intended for "wholesale clients" (as defined in the Financial Advisers Act 2008) unless

otherwise agreed by Goldman Sachs. Russia: Research reports distributed in the Russian Federation are not advertising as defined in the Russian

legislation, but are information and analysis not having product promotion as their main purpose and do not provide appraisal within the meaning of

the Russian legislation on appraisal activity. Singapore: Further information on the covered companies referred to in this research may be obtained

from Goldman Sachs (Singapore) Pte. (Company Number: 198602165W). Taiwan: This material is for reference only and must not be reprinted

without permission. Investors should carefully consider their own investment risk. Investment results are the responsibility of the individual

investor. United Kingdom: Persons who would be categorized as retail clients in the United Kingdom, as such term is defined in the rules of the

Financial Conduct Authority, should read this research in conjunction with prior Goldman Sachs research on the covered companies referred to

herein and should refer to the risk warnings that have been sent to them by Goldman Sachs International. A copy of these risks warnings, and a

glossary of certain financial terms used in this report, are available from Goldman Sachs International on request.

European Union: Disclosure information in relation to Article 4 (1) (d) and Article 6 (2) of the European Commission Directive 2003/125/EC is available

at http://www.gs.com/disclosures/europeanpolicy.html which states the European Policy for Managing Conflicts of Interest in Connection with

Investment Research.

Japan: Goldman Sachs Japan Co., Ltd. is a Financial Instrument Dealer registered with the Kanto Financial Bureau under registration number Kinsho

69, and a member of Japan Securities Dealers Association, Financial Futures Association of Japan and Type II Financial Instruments Firms

Association. Sales and purchase of equities are subject to commission pre-determined with clients plus consumption tax. See company-specific

disclosures as to any applicable disclosures required by Japanese stock exchanges, the Japanese Securities Dealers Association or the Japanese

Securities Finance Company.

Goldman Sachs Global Investment Research 14

February 3, 2017 Global: Technology

Ratings, coverage groups and views and related definitions

Buy (B), Neutral (N), Sell (S) -Analysts recommend stocks as Buys or Sells for inclusion on various regional Investment Lists. Being assigned a Buy

or Sell on an Investment List is determined by a stock's return potential relative to its coverage group as described below. Any stock not assigned as

a Buy or a Sell on an Investment List is deemed Neutral. Each regional Investment Review Committee manages various regional Investment Lists to a

global guideline of 25%-35% of stocks as Buy and 10%-15% of stocks as Sell; however, the distribution of Buys and Sells in any particular coverage

group may vary as determined by the regional Investment Review Committee. Regional Conviction Buy and Sell lists represent investment

recommendations focused on either the size of the potential return or the likelihood of the realization of the return.

Return potential represents the price differential between the current share price and the price target expected during the time horizon associated

with the price target. Price targets are required for all covered stocks. The return potential, price target and associated time horizon are stated in each

report adding or reiterating an Investment List membership.

Coverage groups and views: A list of all stocks in each coverage group is available by primary analyst, stock and coverage group at

http://www.gs.com/research/hedge.html. The analyst assigns one of the following coverage views which represents the analyst's investment outlook

on the coverage group relative to the group's historical fundamentals and/or valuation. Attractive (A). The investment outlook over the following 12

months is favorable relative to the coverage group's historical fundamentals and/or valuation. Neutral (N). The investment outlook over the

following 12 months is neutral relative to the coverage group's historical fundamentals and/or valuation. Cautious (C). The investment outlook over

the following 12 months is unfavorable relative to the coverage group's historical fundamentals and/or valuation.

Not Rated (NR). The investment rating and target price have been removed pursuant to Goldman Sachs policy when Goldman Sachs is acting in an

advisory capacity in a merger or strategic transaction involving this company and in certain other circumstances. Rating Suspended (RS). Goldman

Sachs Research has suspended the investment rating and price target for this stock, because there is not a sufficient fundamental basis for

determining, or there are legal, regulatory or policy constraints around publishing, an investment rating or target. The previous investment rating and

price target, if any, are no longer in effect for this stock and should not be relied upon. Coverage Suspended (CS). Goldman Sachs has suspended

coverage of this company. Not Covered (NC). Goldman Sachs does not cover this company. Not Available or Not Applicable (NA). The

information is not available for display or is not applicable. Not Meaningful (NM). The information is not meaningful and is therefore excluded.

Global product; distributing entities

The Global Investment Research Division of Goldman Sachs produces and distributes research products for clients of Goldman Sachs on a global

basis. Analysts based in Goldman Sachs offices around the world produce equity research on industries and companies, and research on

macroeconomics, currencies, commodities and portfolio strategy. This research is disseminated in Australia by Goldman Sachs Australia Pty Ltd

(ABN 21 006 797 897); in Brazil by Goldman Sachs do Brasil Corretora de Ttulos e Valores Mobilirios S.A.; in Canada by either Goldman Sachs

Canada Inc. or Goldman, Sachs & Co.; in Hong Kong by Goldman Sachs (Asia) L.L.C.; in India by Goldman Sachs (India) Securities Private Ltd.; in

Japan by Goldman Sachs Japan Co., Ltd.; in the Republic of Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in New Zealand by Goldman Sachs

New Zealand Limited; in Russia by OOO Goldman Sachs; in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 198602165W); and in

the United States of America by Goldman, Sachs & Co. Goldman Sachs International has approved this research in connection with its distribution in

the United Kingdom and European Union.

European Union: Goldman Sachs International authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority

and the Prudential Regulation Authority, has approved this research in connection with its distribution in the European Union and United Kingdom;

Goldman Sachs AG and Goldman Sachs International Zweigniederlassung Frankfurt, regulated by the Bundesanstalt fr

Finanzdienstleistungsaufsicht, may also distribute research in Germany.

General disclosures

This research is for our clients only. Other than disclosures relating to Goldman Sachs, this research is based on current public information that we

consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and

forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as

appropriate, but various regulations may prevent us from doing so. Other than certain industry reports published on a periodic basis, the large

majority of reports are published at irregular intervals as appropriate in the analyst's judgment.

Goldman Sachs conducts a global full-service, integrated investment banking, investment management, and brokerage business. We have

investment banking and other business relationships with a substantial percentage of the companies covered by our Global Investment Research

Division. Goldman, Sachs & Co., the United States broker dealer, is a member of SIPC (http://www.sipc.org).

Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal

trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks

and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

The analysts named in this report may have from time to time discussed with our clients, including Goldman Sachs salespersons and traders, or may

discuss in this report, trading strategies that reference catalysts or events that may have a near-term impact on the market price of the equity

securities discussed in this report, which impact may be directionally counter to the analyst's published price target expectations for such stocks. Any

such trading strategies are distinct from and do not affect the analyst's fundamental equity rating for such stocks, which rating reflects a stock's

return potential relative to its coverage group as described herein.

We and our affiliates, officers, directors, and employees, excluding equity and credit analysts, will from time to time have long or short positions in,

act as principal in, and buy or sell, the securities or derivatives, if any, referred to in this research.

The views attributed to third party presenters at Goldman Sachs arranged conferences, including individuals from other parts of Goldman Sachs, do

not necessarily reflect those of Global Investment Research and are not an official view of Goldman Sachs.

Any third party referenced herein, including any salespeople, traders and other professionals or members of their household, may have positions in

the products mentioned that are inconsistent with the views expressed by analysts named in this report.

This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be

illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of

individual clients. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if

appropriate, seek professional advice, including tax advice. The price and value of investments referred to in this research and the income from them

may fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur.

Fluctuations in exchange rates could have adverse effects on the value or price of, or income derived from, certain investments.

Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Investors should review current options disclosure documents which are available from Goldman Sachs sales representatives or at

Goldman Sachs Global Investment Research 15

February 3, 2017 Global: Technology

http://www.theocc.com/about/publications/character-risks.jsp. Transaction costs may be significant in option strategies calling for multiple purchase

and sales of options such as spreads. Supporting documentation will be supplied upon request.

All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client websites. Not all

research content is redistributed to our clients or available to third-party aggregators, nor is Goldman Sachs responsible for the redistribution of our

research by third party aggregators. For research, models or other data available on a particular security, please contact your sales representative or

go to http://360.gs.com.

Disclosure information is also available at http://www.gs.com/research/hedge.html or from Research Compliance, 200 West Street, New York, NY

10282.

2017 Goldman Sachs.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior

written consent of The Goldman Sachs Group, Inc.

Goldman Sachs Global Investment Research 16

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Sen. Eric Schmitt: Contractor Rule Letter to GSA, NASA, and DODDocument5 pagesSen. Eric Schmitt: Contractor Rule Letter to GSA, NASA, and DODBreitbart NewsNo ratings yet

- The Tarrance Group Nevada Senate Polling Memo AprilDocument3 pagesThe Tarrance Group Nevada Senate Polling Memo AprilBreitbart News100% (1)

- Bobulinski - Written StatementDocument11 pagesBobulinski - Written StatementBreitbart NewsNo ratings yet

- Vance Legislation On Chinese International Law Violation LegislationDocument5 pagesVance Legislation On Chinese International Law Violation LegislationBreitbart News100% (1)

- Tax Form 990Document10 pagesTax Form 990Breitbart NewsNo ratings yet

- ACP Board Book Feb 2024Document66 pagesACP Board Book Feb 2024Breitbart News100% (1)

- Bobulinski - Written StatementDocument11 pagesBobulinski - Written StatementBreitbart NewsNo ratings yet

- 2024-03-28 - CJC Letter To JRBDocument7 pages2024-03-28 - CJC Letter To JRBBreitbart NewsNo ratings yet

- U.S. Chamber of Commerce Foundation - Full Filing - Nonprofit Explorer - ProPublicaDocument43 pagesU.S. Chamber of Commerce Foundation - Full Filing - Nonprofit Explorer - ProPublicaBreitbart NewsNo ratings yet

- Bobulinski - Written StatementDocument11 pagesBobulinski - Written StatementBreitbart NewsNo ratings yet

- Amicus BriefDocument19 pagesAmicus BriefBreitbart News100% (1)

- Bobulinski - Written StatementDocument11 pagesBobulinski - Written StatementBreitbart NewsNo ratings yet

- ARCCI Report - Sexual Crimes in The October 7 #Hamas Terrorist AttackDocument39 pagesARCCI Report - Sexual Crimes in The October 7 #Hamas Terrorist AttackBreitbart News88% (8)

- Vance Legislation On Chinese International Law ViolationsDocument5 pagesVance Legislation On Chinese International Law ViolationsBreitbart News100% (2)

- Key Square January 2024 LetterDocument18 pagesKey Square January 2024 LetterBreitbart News100% (1)

- Davidson Feb Ukraine LetterDocument3 pagesDavidson Feb Ukraine LetterBreitbart NewsNo ratings yet

- Letter To Gensler Rumble InvestigationDocument2 pagesLetter To Gensler Rumble InvestigationBreitbart NewsNo ratings yet

- HHS DocumentDocument3 pagesHHS DocumentBreitbart News0% (1)

- Letter Final 1-26-24Document1 pageLetter Final 1-26-24Breitbart NewsNo ratings yet

- Sen. J.D. Vance's Letter To Treasury Secretary Janet YellenDocument2 pagesSen. J.D. Vance's Letter To Treasury Secretary Janet YellenBreitbart News100% (1)

- 2023-12-27 - Letter - SiskelDocument3 pages2023-12-27 - Letter - SiskelBreitbart NewsNo ratings yet

- Sambrano V United Airlines-238-Motion To Certify Class ActionDocument57 pagesSambrano V United Airlines-238-Motion To Certify Class ActionBreitbart News100% (2)

- Fourth Bank Records Memo (Source: House Oversight Committee)Document12 pagesFourth Bank Records Memo (Source: House Oversight Committee)Breitbart News100% (1)

- File 9506Document8 pagesFile 9506Breitbart NewsNo ratings yet

- 12.20.23 FINAL Letter To Secretary MayorkasDocument2 pages12.20.23 FINAL Letter To Secretary MayorkasBreitbart NewsNo ratings yet

- Jake Sullivan Removal LetterDocument2 pagesJake Sullivan Removal LetterBreitbart NewsNo ratings yet

- Vance Letter To Blinken On Poland Media FreedomDocument3 pagesVance Letter To Blinken On Poland Media FreedomBreitbart News100% (1)

- Rep. James Comer's Response Letter To Abbe LowellDocument3 pagesRep. James Comer's Response Letter To Abbe LowellBreitbart NewsNo ratings yet

- 2023.10.19 National Republican Amici Brief (To File)Document33 pages2023.10.19 National Republican Amici Brief (To File)Breitbart NewsNo ratings yet

- White House Classified Docs - Special Counsel HurDocument3 pagesWhite House Classified Docs - Special Counsel HurBreitbart NewsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- h1b Visa Application Proces1Document3 pagesh1b Visa Application Proces1anchal121No ratings yet

- 5th August Current Affairs by Kapil Kathpal (English) PDFDocument27 pages5th August Current Affairs by Kapil Kathpal (English) PDFAnkit AnandNo ratings yet

- All About RecruitmentDocument37 pagesAll About Recruitment1099 Devansh100% (4)

- Kranthi TrainingDocument265 pagesKranthi Trainingpadma princessNo ratings yet

- Amsterdam & Partners LLC Supplement To TEA Complaint Against Cosmos Foundation DBA Harmony Public SchoolsDocument12 pagesAmsterdam & Partners LLC Supplement To TEA Complaint Against Cosmos Foundation DBA Harmony Public SchoolsBreitbartTexasNo ratings yet

- Current Affairs December 2016 EbookDocument261 pagesCurrent Affairs December 2016 Ebooksaurabh887No ratings yet

- DS-160 Filing Prerequisites and ProcessDocument33 pagesDS-160 Filing Prerequisites and ProcessJanani ParameswaranNo ratings yet

- The Guide To Find A Job in The Financial SectorDocument88 pagesThe Guide To Find A Job in The Financial SectorCaroline BaillezNo ratings yet

- Shafrin's ResumeDocument2 pagesShafrin's ResumeGuar GumNo ratings yet

- US Immigration Law HandbookDocument36 pagesUS Immigration Law Handbookfaceoneoneoneone100% (1)

- US Staffing - RecruitmentDocument8 pagesUS Staffing - RecruitmentKj NaveenNo ratings yet

- Form I-765 (Permiso de Trabajo)Document27 pagesForm I-765 (Permiso de Trabajo)Anderson MoraNo ratings yet

- KPMG The Indian Services Sector Poised For Global AscendancyDocument282 pagesKPMG The Indian Services Sector Poised For Global Ascendancyrahulp9999No ratings yet

- High-Tech HousewivesDocument26 pagesHigh-Tech HousewivesUniversity of Washington PressNo ratings yet

- U.S. Department of LaborDocument16 pagesU.S. Department of LaborUSA_DepartmentOfLaborNo ratings yet

- H1 Visa Interview Sample Questions and AnswersDocument5 pagesH1 Visa Interview Sample Questions and AnswersNoore Alam SarkarNo ratings yet

- IT Staffing Training Manual: Your Step-by-Step Guide to SuccessDocument86 pagesIT Staffing Training Manual: Your Step-by-Step Guide to SuccessSrinivas Kantheti50% (2)

- Ead Expedite Cover LetterDocument5 pagesEad Expedite Cover Letterafiwgzsdf100% (2)

- Impact of IT on Living & Work ProductivityDocument4 pagesImpact of IT on Living & Work ProductivityJessaMaeDelosReyesNo ratings yet

- I-797c Receipt Notice Scribd - Google SearchDocument2 pagesI-797c Receipt Notice Scribd - Google SearchAshik Ishtiaque EmonNo ratings yet

- Recruiter TrainingDocument35 pagesRecruiter Trainingshree recruiter100% (1)

- Harshal PatilDocument72 pagesHarshal Patilsid visputeNo ratings yet

- Two Brothers Two MethodsDocument21 pagesTwo Brothers Two MethodsraghavNo ratings yet

- What Is OPT Recruting and OPT ScriptDocument6 pagesWhat Is OPT Recruting and OPT ScriptJaini Tharun GuptaNo ratings yet

- Envoy Filing H1B Onboarding GuideDocument11 pagesEnvoy Filing H1B Onboarding GuideRamesh Babu PindigantiNo ratings yet

- Chapter 10 Assessment and Key TermsDocument10 pagesChapter 10 Assessment and Key TermsArvee Mark Christian CunananNo ratings yet

- Godavari's Foundation: 406 C-International Human Resource ManagementDocument19 pagesGodavari's Foundation: 406 C-International Human Resource ManagementakashNo ratings yet

- Recruiter Resume TemplateDocument4 pagesRecruiter Resume TemplategajsureshNo ratings yet

- US - VISA GuidanceDocument23 pagesUS - VISA Guidancesathyavlr100% (3)

- Petition - US Visa Delays Due To 221g TAL Administrative ProcessingDocument6 pagesPetition - US Visa Delays Due To 221g TAL Administrative Processingwinsarkar100% (3)