Professional Documents

Culture Documents

HSL PCG "Currency Daily": 27 December, 2016

Uploaded by

shobhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSL PCG "Currency Daily": 27 December, 2016

Uploaded by

shobhaCopyright:

Available Formats

HSL PCG CURRENCY DAILY

27 December, 2016

PRIVATE CLIENT GROUP [PCG]

VIEW POINT

STRATEGY FOR THE DAY Rupee Rallies for Second Day with Low Volume

Rupee closed nearly two week high in low volume trade on back of

SELL JPYINR AT CMP 57.89 SL 58.10 TGT 57.61/57.45 Christmas holiday in major developed market. The rupee closed at

67.74 per US dollara level last seen on 14 December, up 0.11%

from its previous close of 67.83. The benchmark 10-year

MAJOR CURRENCY government bond yield closed at 6.574% compared to Fridays close

of 6.544%. Yields rise across the curve ahead of $2.6b state bond

sale today. Thirteen states to sell 179.5b of bonds today.

Prev.

Close Chg. % Chg. The one month forward USDINR NDF quoted at 68.06, higher by 4

Close

paise suggesting flat to positive opening. However, technically the

USDINR 67.736 67.825 -0.089 -0.13% pair is in profit booking mode on hourly chart with down side

DXY INDX 103.130 102.92 0.210 0.20% support in the range of 67.70 to 67.58 while continue to face

EURUSD 1.044 1.045 -0.002 -0.16% resistance around 67.95.

GBPUSD 1.227 1.228 -0.001 -0.09%

USDJPY 117.350 117.10 0.250 0.21% Dollar Edge up after Holidays

DG USDINR 67.774 67.732 0.042 0.06%

The dollar edge up against the yen and euro early today as investors

emerged out of the holiday lull to hunt for bargains as the market

GLOBAL INDICES

entered the last trading stretch of the year. For now the dollar index

added 0.2% to 103.13, clawing back towards a 14-year high of

Prev. 103.650 marked a week ago. US Yields on Treasury bonds rise

Close Chg. % Chg.

Close across the curve, with 10-year yield up 2bps at 2.56%. U.S. bond

SGX NIFTY 7923.0 7911.0 12 0.15% market has completely priced in optimism for Trumps policies

NIFTY 7908.3 7985.8 -78 -0.97% pushing up near-term economic growth.

SENSEX 25807.1 26040.7 -234 -0.90% USD/JPY set for first advance in five days as the pair remains

vulnerable to downside risks amid lack of fresh catalysts and low

HANG-SENG 21574.8 21636.2 -61 -0.28%

liquidity as dollar rally takes breather.

NIKKEI 19451.9 19396.6 55 0.28% The yen did not show any action to Japan's inflation data, which saw

SHANGHAI 3116.0 3122.6 -7 -0.21% core consumer prices mark the ninth straight month of annual

S&P INDEX 2263.8 Close -- -- declines in November. Consumer prices excluding fresh food fell

DOW JONES 19933.8 Close -- -- 0.4% y/y in November, vs. est. -0.3%.

NASDAQ 5462.7 Close -- -- The financial markets in Sydney, Hong Kong and London still closed

today for the Christmas holidays.

FTSE 7068.2 Close -- --

The dollar likely to continues good show in todays session with low

CAC 4839.7 Close -- -- volume and volatility.

DAX 11449.9 Close -- --

PRIVATE CLIENT GROUP [PCG]

TECHNICAL OUTLOOK

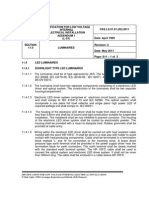

SPOT USDINR DAILY CHART

Technical Observations

Spot USDINR weakens for the second sessions to settle at 67.74 fell by 9 paise or 0.13%.

The pair is having Gap Up support in the range of 67.70 to 67.58.

Momentum oscillators exited from oversold conditions, but RSI and RSI Average is flatten giving no clues for the day.

In near term, Spot USDINR will get resistance at 67.94 and 68.07, the middle band of the Bollinger band and recent top

respectively, while on down side 67.58 and 67.325 remain support. .

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

Near Month Fut. Last Pivot S3 S2 S1 R1 R2 R3 View For The Day

USDINR 67.71 67.76 67.53 67.62 67.67 67.80 67.89 67.94 Bullish

EURINR 70.88 70.91 70.40 70.58 70.73 71.06 71.24 71.39 Bearish

GBPINR 83.25 83.28 82.98 83.09 83.17 83.36 83.48 83.55 Consolidation

JPYINR 57.89 57.93 57.63 57.74 57.82 58.01 58.12 58.20 Bearish

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 68.07 67.71 68.86 67.33 68.86 66.07 67.90 67.94 67.50 67.16 67.09

EURINR 71.22 70.42 73.35 70.42 77.49 70.42 70.83 71.84 72.63 73.74 74.43

GBPINR 84.70 83.07 86.88 83.07 100.49 80.89 83.64 85.00 83.90 85.28 89.58

JPYINR 57.90 57.45 62.80 57.25 68.11 54.82 57.79 58.74 61.39 63.47 63.00

CURRENCY MOVEMENT

Open Chg. in Chg. in

Currency Open High Low Close Chg. Volume

Interest OI Volume

SPOT USDINR 67.81 67.86 67.72 67.74 -0.09 -- -- -- --

USDINR DEC. FUT. 67.82 67.85 67.71 67.71 -0.09 1897664 -36149 438343 -350700

SPOT EURINR 70.93 71.01 70.76 70.84 -0.03 -- -- -- --

EURINR DEC. FUT. 71.09 71.09 70.76 70.88 -0.01 23570 -2511 15232 -10948

SPOT GBPINR 83.34 83.38 83.14 83.16 -0.02 -- -- -- --

GBPINR DEC. FUT. 83.29 83.40 83.21 83.25 0.08 22373 -3775 14697 -31004

SPOT JPYINR 57.94 57.97 57.84 57.85 0.07 -- -- -- --

JPYINR DEC. FUT. 57.95 58.05 57.86 57.89 0.06 33931 -2251 7669 -1875

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

None

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Prior

None

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

You might also like

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG “CURRENCY DAILY” Focuses on Rupee StrengthDocument6 pagesHSL PCG “CURRENCY DAILY” Focuses on Rupee StrengthDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG “CURRENCY DAILY” SummaryDocument6 pagesHSL PCG “CURRENCY DAILY” SummarykhaniyalalNo ratings yet

- HSL PCG Currency Daily OutlookDocument6 pagesHSL PCG Currency Daily Outlookarun_algoNo ratings yet

- HSL PCG "Currency Daily": 03 March, 2017Document6 pagesHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyNo ratings yet

- Rupee Cheers as Carry Intact with RBI’s Status QuoDocument6 pagesRupee Cheers as Carry Intact with RBI’s Status QuoshobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- Currency Daily: Rupee Depreciation on Card After Fed's Rate HikeDocument6 pagesCurrency Daily: Rupee Depreciation on Card After Fed's Rate HikeshobhaNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- Currency Daily: Lower Inflation Supports Stronger RupeeDocument6 pagesCurrency Daily: Lower Inflation Supports Stronger RupeeDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 16 February, 2017Document6 pagesHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 18 October, 2016Document6 pagesHSL PCG "Currency Daily": 18 October, 2016khaniyalalNo ratings yet

- HSL PCG CURRENCY DAILY MARKET REVIEWDocument6 pagesHSL PCG CURRENCY DAILY MARKET REVIEWkhaniyalalNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 03 November, 2016Document6 pagesHSL PCG "Currency Daily": 03 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 26 October, 2016Document6 pagesHSL PCG "Currency Daily": 26 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 17 January, 2017Document6 pagesHSL PCG "Currency Daily": 17 January, 2017arun_algoNo ratings yet

- Currency Daily WrapDocument6 pagesCurrency Daily WrapkhaniyalalNo ratings yet

- HSL PCG Currency Daily ReportDocument6 pagesHSL PCG Currency Daily ReportDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 23 February, 2017Document6 pagesHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalNo ratings yet

- HSL PCG Currency Daily BriefingDocument6 pagesHSL PCG Currency Daily Briefingarun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalNo ratings yet

- HSL PCG “CURRENCY DAILYDocument6 pagesHSL PCG “CURRENCY DAILYarun_algoNo ratings yet

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyNo ratings yet

- Commodities Market: Technical Outlook: BearishDocument4 pagesCommodities Market: Technical Outlook: BearishhasxxbNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- HSL PCG "Currency Daily": Private Client Group (PCG)Document6 pagesHSL PCG "Currency Daily": Private Client Group (PCG)umaganNo ratings yet

- Market Outlook For 09 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 09 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- Your Next Great Stock: How to Screen the Market for Tomorrow's Top PerformersFrom EverandYour Next Great Stock: How to Screen the Market for Tomorrow's Top PerformersRating: 3 out of 5 stars3/5 (1)

- Report PDFDocument16 pagesReport PDFshobhaNo ratings yet

- Simple RectangleDocument1 pageSimple RectangleshobhaNo ratings yet

- Simple Mouse ClickDocument1 pageSimple Mouse ClickshobhaNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- Report PDFDocument16 pagesReport PDFshobhaNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchshobhaNo ratings yet

- ReportDocument16 pagesReportshobhaNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchshobhaNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchshobhaNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- Currency Daily: Rupee Depreciation on Card After Fed's Rate HikeDocument6 pagesCurrency Daily: Rupee Depreciation on Card After Fed's Rate HikeshobhaNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- ReportDocument6 pagesReportshobhaNo ratings yet

- ReportDocument16 pagesReportshobhaNo ratings yet

- Rupee Cheers as Carry Intact with RBI’s Status QuoDocument6 pagesRupee Cheers as Carry Intact with RBI’s Status QuoshobhaNo ratings yet

- Nocil LTD: Retail ResearchDocument14 pagesNocil LTD: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- ReportDocument5 pagesReportshobhaNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- Corporate Event Tracker January 2017Document1 pageCorporate Event Tracker January 2017shobhaNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchshobhaNo ratings yet

- Report PDFDocument4 pagesReport PDFshobhaNo ratings yet

- Adapting Cognitive Behavioral Techniques To Address Anxiety and Depression in Cognitively Able Emerging Adults On The Autism SpectrumDocument3 pagesAdapting Cognitive Behavioral Techniques To Address Anxiety and Depression in Cognitively Able Emerging Adults On The Autism SpectrumVini PezzinNo ratings yet

- Internal auditing multiple choice questionsDocument4 pagesInternal auditing multiple choice questionsSantos Gigantoca Jr.No ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationAdaaan AfzalNo ratings yet

- Fancy YarnsDocument7 pagesFancy Yarnsiriarn100% (1)

- Prperman 2016 14 3 (Spec. 14Document8 pagesPrperman 2016 14 3 (Spec. 14celia rifaNo ratings yet

- English A June 2008 p2Document9 pagesEnglish A June 2008 p2LilyNo ratings yet

- Benedict - Ethnic Stereotypes and Colonized Peoples at World's Fairs - Fair RepresentationsDocument16 pagesBenedict - Ethnic Stereotypes and Colonized Peoples at World's Fairs - Fair RepresentationsVeronica UribeNo ratings yet

- We Generally View Objects As Either Moving or Not MovingDocument11 pagesWe Generally View Objects As Either Moving or Not MovingMarietoni D. QueseaNo ratings yet

- CPS Layoffs BreakdownDocument21 pagesCPS Layoffs BreakdownjroneillNo ratings yet

- Gabriel Nobre de Souza - Groningen Mini-MetropolisDocument9 pagesGabriel Nobre de Souza - Groningen Mini-MetropolisGabrielNobredeSouzaNo ratings yet

- British and American Culture Marking RubricDocument5 pagesBritish and American Culture Marking RubricAn Ho LongNo ratings yet

- Adjutant-Introuvable BASIC VERSIONDocument7 pagesAdjutant-Introuvable BASIC VERSIONfurrypdfNo ratings yet

- Anki Very Useful ManualDocument5 pagesAnki Very Useful ManualSoundaryaNo ratings yet

- JKR Specs L-S1 Addendum No 1 LED Luminaires - May 2011Document3 pagesJKR Specs L-S1 Addendum No 1 LED Luminaires - May 2011Leong KmNo ratings yet

- Padmavati Gora BadalDocument63 pagesPadmavati Gora BadalLalit MishraNo ratings yet

- 360 PathwaysDocument4 pages360 PathwaysAlberto StrusbergNo ratings yet

- English ProjectDocument10 pagesEnglish ProjectHarshman Singh HarshmanNo ratings yet

- Introduction To Managerial Accounting Canadian 5th Edition Brewer Solutions ManualDocument25 pagesIntroduction To Managerial Accounting Canadian 5th Edition Brewer Solutions ManualMaryJohnsonsmni100% (57)

- 42U System Cabinet GuideDocument68 pages42U System Cabinet GuideGerman AndersNo ratings yet

- Albert PikeDocument6 pagesAlbert Pikeapi-302575383No ratings yet

- Karan Chawla and Joshua Lee November 21, 2016 MEDS 3020 - Fall 2016 Dr. Rosevear, Dr. Cartwright, Dr. LiebermanDocument2 pagesKaran Chawla and Joshua Lee November 21, 2016 MEDS 3020 - Fall 2016 Dr. Rosevear, Dr. Cartwright, Dr. LiebermanJeremy DelaneyNo ratings yet

- RRR Media Kit April 2018Document12 pagesRRR Media Kit April 2018SilasNo ratings yet

- Carmina GadelicaDocument37 pagesCarmina GadelicaoniricsNo ratings yet

- Escalado / PLC - 1 (CPU 1214C AC/DC/Rly) / Program BlocksDocument2 pagesEscalado / PLC - 1 (CPU 1214C AC/DC/Rly) / Program BlocksSegundo Angel Vasquez HuamanNo ratings yet

- MATH Concepts PDFDocument2 pagesMATH Concepts PDFs bNo ratings yet

- My ResumeDocument4 pagesMy Resumeapi-216740002No ratings yet

- Money MBA 1Document4 pagesMoney MBA 1neaman_ahmed0% (1)

- Polymer Science: Thermal Transitions in PolymersDocument20 pagesPolymer Science: Thermal Transitions in Polymerstanveer054No ratings yet

- Pahang JUJ 2012 SPM ChemistryDocument285 pagesPahang JUJ 2012 SPM ChemistryJeyShida100% (1)

- Rumi and ReligionDocument2 pagesRumi and ReligionJustin LiewNo ratings yet