Professional Documents

Culture Documents

HSL PCG "Currency Daily": 28 February, 2017

Uploaded by

Dinesh ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSL PCG "Currency Daily": 28 February, 2017

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

HSL PCG CURRENCY DAILY

28 February, 2017

PRIVATE CLIENT GROUP [PCG]

STRATEGY FOR THE DAY

EURINR MAR FUT. SELL BELOW 70.75 SL 71.00 TGT 70.40

MAJOR CURRENCY CURRENCY VIEW POINT

Rupee at Pre-Demonetisation Level of 66.71

Prev.

Close Chg. % Chg.

Close

USDINR 66.71 66.83 -0.118 -0.18% Rupee closes at a fresh 15-week high against the US dollar,

DXY INDX 101.15 101.13 0.020 0.02% ahead of the key gross domestic product and fiscal deficit data

EURUSD 1.058 1.059 0.000 -0.03% today. The home currency closed at 66.71--a level last seen

GBPUSD 1.243 1.244 -0.001 -0.10% on 10 November 2016, up 0.14% from its previous close of

USDJPY 112.690 112.700 -0.010 -0.01% 66.83. The local currency opened at 66.72 and touched a high

DG USDINR 66.961 66.939 0.022 0.03% of 66.65, a level last seen on 10 November.

GDP data will provide clues on how the economy has

GLOBAL INDICES responded to the government decision to scrap Rs500 and

Rs1,000 bank notes in November. Gross domestic product will

Prev. expand 6.8% in the year through March - the slowest pace

Close Chg. % Chg.

Close since 2014 but still among the fastest in the world- according

SGX NIFTY 8926.5 8919.0 8 0.08% to the median estimates. GDP slowed to 6% in October-

NIFTY 8896.7 8939.5 -43 -0.48% December from a year earlier, the survey predicts, from 7.3%

SENSEX 28812.9 28893.0 -80 -0.28% the previous quarter. The gross value added - a key input of

HANG-SENG 23895.7 23925.1 -29 -0.12% GDP - is seen at 6% versus 7.1%. The full-year estimate of

NIKKEI 19238.7 19107.5 131 0.69%

6.8% marks a slump from 7.9%.

SHANGHAI 3231.5 3228.7 3 0.09%

The one month non-deliverable forward USDINR quoting at

S&P INDEX 2369.8 2367.3 2 0.10%

67.01 from yesterdays 66.95 indicating flat to positive start

DOW JONES 20837.4 20821.8 16 0.08%

NASDAQ

at domestic bourses.

5861.9 5845.3 17 0.28%

FTSE 7253.0 7243.7 9 0.13% Technically, the pair has been consolidating in the range of

CAC 4845.2 4845.2 0 0.00% 66.76 to 67.15. Overall bias for the pair remains bearish until

DAX 11822.7 11804.0 19 0.16% it close above 67.27, the long term moving average resistance

of 200 SMA.

PRIVATE CLIENT GROUP [PCG]

Dollar Bracing Up Ahead of Trump Speech

The dollar tread water enjoying support after U.S. President Donald Trump flagged a big boost in government

stimulus, and sought a "historic" increase in military spending. Trump will ask the U.S. Congress to boost Pentagon

spending in the next fiscal year by $54 billion in his first budget proposal, a White House budget official said. However,

the lift for the dollar is limited as the military spending increase would be accompanied by a cut in the same amount

from non-defense spending, including a large reduction in foreign aid.

ICE dollar index extended the previous day's modest gains and last up 0.02% at 101.15 after initially trading as low

as 100.69 overnight.

The pound fetched 1.2442 against after sliding to a 12-day low of 1.2384 the previous day as talk of another possible

Scottish independence vote added to fears about Britain's future as it prepares to leave the European Union.

Technically, ICE dollar index is broadly consolidate in the small range of 100.40 to 101.90.

SPOT USDINR DAILY CHART

TECHNICAL OUTLOOK

Technical Observations

USDINR forming lower top lower

bottom on daily scale indicating

continuation of bearish trend.

The formation of doji candlestick

after two bearish candle indicating

indecisiveness among traders.

Momentum oscillators given positive

cross over and about to exit

oversold zone suggesting short term

bounce.

The recent price action suggesting

consolidation with the broad range

of 67.15 to 66.32.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

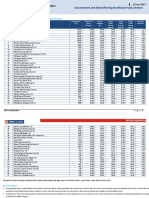

Contracts Last Pivot S3 S2 S1 R1 R2 R3 View For The Day

USDINR MAR17 66.94 66.95 66.76 66.82 66.88 67.01 67.07 67.13 Short Buildup

EURINR MAR17 70.96 70.92 70.54 70.66 70.81 71.08 71.19 71.34 Short Covering

GBPINR MAR17 83.20 83.20 82.71 82.87 83.03 83.36 83.52 83.69 Short Buildup

JPYINR MAR17 59.70 59.71 59.47 59.55 59.63 59.79 59.87 59.95 Long Buildup

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 67.10 66.79 68.27 66.65 68.86 66.07 66.89 67.20 67.71 67.51 67.28

EURINR 71.19 70.28 73.35 70.28 77.01 70.28 70.79 71.62 71.68 72.45 73.77

GBPINR 84.00 83.04 86.27 82.13 100.49 80.89 83.26 83.73 83.78 83.74 86.91

JPYINR 59.50 58.83 60.49 58.40 68.11 57.25 59.22 59.33 59.00 60.52 62.65

CURRENCY MOVEMENT

Abs Open Chg. in Chg. in

Currency Open High Low Close Volume

Chg. Interest OI Volume

SPOT USDINR 66.72 66.77 66.65 66.71 -0.12 -- -- -- --

USDINR MAR. FUT. 67.00 67.01 66.89 66.94 -0.15 1640322 17438 768813 -428820

SPOT EURINR 70.56 70.69 70.40 70.61 0.11 -- -- -- --

EURINR MAR. FUT. 70.98 71.04 70.77 70.96 0.10 74383 -477 39100 -25772

SPOT GBPINR 83.02 83.02 82.64 82.81 -0.99 -- -- -- --

GBPINR MAR. FUT. 83.20 83.36 83.03 83.20 -0.47 43610 5667 59550 4605

SPOT JPYINR 59.57 59.57 59.38 59.43 -0.05 -- -- -- --

JPYINR MAR. FUT. 59.65 59.80 59.64 59.70 0.34 14172 1248 22746 3865

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

02/27/2017 15:30 EC Economic Confidence Feb -- 108.0 107.9

02/27/2017 19:00 US Durable Goods Orders Jan P 1.80% 1.80% -0.50%

02/27/2017 20:30 US Pending Home Sales MoM Jan 0.90% -2.80% 1.60%

02/27/2017 21:00 US Dallas Fed Manf. Activity Feb 20 24.5 22.1

ECONOMIC EVENTS TODAY

Date Time Country Event Period Survey Prior

02/28/2017 16:30 IN Fiscal Deficit INR Crore Jan 43254

02/28/2017 17:30 IN GVA YoY 4Q 6.0% 7.10%

02/28/2017 17:30 IN GDP YoY 4Q 6.1% 7.30%

02/28/2017 17:30 IN GDP Annual Estimate YoY 2017 6.8% 7.90%

02/28/2017 19:00 US GDP Annualized QoQ 4Q S 2.1% 1.90%

02/28/2017 19:00 US Core PCE QoQ 4Q S 1.3% 1.30%

02/28/2017 20:15 US Chicago Purchasing Manager Feb 53.0 50.3

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

You might also like

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 22 February, 2017Document6 pagesHSL PCG "Currency Daily": 22 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 March, 2017Document6 pagesHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 February, 2017Document6 pagesHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 18 October, 2016Document6 pagesHSL PCG "Currency Daily": 18 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 23 November, 2016Document6 pagesHSL PCG "Currency Daily": 23 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 December, 2016Document6 pagesHSL PCG "Currency Daily": 08 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 16 February, 2017Document6 pagesHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 14 February, 2017Document6 pagesHSL PCG "Currency Daily": 14 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 19 October, 2016Document6 pagesHSL PCG "Currency Daily": 19 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 27 December, 2016Document6 pagesHSL PCG "Currency Daily": 27 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 17 January, 2017Document6 pagesHSL PCG "Currency Daily": 17 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 21 October, 2016Document6 pagesHSL PCG "Currency Daily": 21 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 26 October, 2016Document6 pagesHSL PCG "Currency Daily": 26 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 03 November, 2016Document6 pagesHSL PCG "Currency Daily": 03 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 15 December, 2016Document6 pagesHSL PCG "Currency Daily": 15 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- Stock Market Reports For The Week (21st - 25th March - 2011)Document6 pagesStock Market Reports For The Week (21st - 25th March - 2011)Dasher_No_1No ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- Market Snapshot ADocument5 pagesMarket Snapshot Abi11yNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- DailyNewsLetter - 20 Oct 10Document3 pagesDailyNewsLetter - 20 Oct 10checrucifixNo ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyNo ratings yet

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- Report PDFDocument3 pagesReport PDFDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- Quality Reliability Eng - 2021 - Saha - Parametric Inference of The Loss Based Index CPM For Normal DistributionDocument27 pagesQuality Reliability Eng - 2021 - Saha - Parametric Inference of The Loss Based Index CPM For Normal DistributionShweta SinghNo ratings yet

- Continue: Struggle For Pakistan I H Qureshi PDFDocument3 pagesContinue: Struggle For Pakistan I H Qureshi PDFDESI Mp350% (2)

- Jones Rural School - 300555Document13 pagesJones Rural School - 300555Roland Acob Del Rosario Jr.100% (1)

- Bob Trish Duggan FoundationDocument19 pagesBob Trish Duggan FoundationWilfried HandlNo ratings yet

- Perceived Impact of Community Policing On Crime Prevention and Public Safety in Ozamiz CityDocument7 pagesPerceived Impact of Community Policing On Crime Prevention and Public Safety in Ozamiz Cityjabezgaming02No ratings yet

- Ieee - 2030 Smart GridDocument26 pagesIeee - 2030 Smart GridarturoelectricaNo ratings yet

- Interjections Worksheet PDFDocument1 pageInterjections Worksheet PDFLeonard Patrick Faunillan Bayno100% (1)

- ST Learning Task 10Document6 pagesST Learning Task 10Jermaine DoloritoNo ratings yet

- Application For Counter Claim of The Defendant Under Order 8 RuleDocument2 pagesApplication For Counter Claim of The Defendant Under Order 8 RuleP SHIVA KUMAR MUDALIARNo ratings yet

- Curriculum Implementation & EvaluationDocument121 pagesCurriculum Implementation & Evaluationwaseem555100% (2)

- Giving Counsel PDFDocument42 pagesGiving Counsel PDFPaul ChungNo ratings yet

- 125) League of Cities of The Philippines vs. COMELEC (G.R. No. 176951, April 12, 2011) 2Document35 pages125) League of Cities of The Philippines vs. COMELEC (G.R. No. 176951, April 12, 2011) 2Carmel Grace KiwasNo ratings yet

- Simple Past News Biography Regular and Irregular VerbsDocument15 pagesSimple Past News Biography Regular and Irregular VerbsDaniela MontemayorNo ratings yet

- Z Transform Part 1 PDFDocument16 pagesZ Transform Part 1 PDFAnanth SettyNo ratings yet

- Seng2011 - Assignment 5Document11 pagesSeng2011 - Assignment 5yajnas1996No ratings yet

- Sacred Books of The East Series, Volume 47: Pahlavi Texts, Part FiveDocument334 pagesSacred Books of The East Series, Volume 47: Pahlavi Texts, Part FiveJimmy T.100% (1)

- Chap 005Document13 pagesChap 005Mohammad ElabedNo ratings yet

- A Comprehensive Study of Types of Conditionals in LinguisticsDocument4 pagesA Comprehensive Study of Types of Conditionals in LinguisticsRyan CortezNo ratings yet

- Seven Years WarDocument55 pagesSeven Years WarKismat Dhaliwal100% (1)

- Engineering Code of EthicsDocument4 pagesEngineering Code of EthicsBeth Beth DiancoNo ratings yet

- Film Viewing RomeroDocument3 pagesFilm Viewing RomeroJenesis MuescoNo ratings yet

- Health COX's Monthly Dashboard - 2023 NovDocument4 pagesHealth COX's Monthly Dashboard - 2023 Novcox mamNo ratings yet

- Best Trusts and Estates OutlineDocument84 pagesBest Trusts and Estates OutlineJavi Luis100% (4)

- Compiler Design MCQ Question Bank Last Update 29-Dec-20202 Page 1 of 18Document18 pagesCompiler Design MCQ Question Bank Last Update 29-Dec-20202 Page 1 of 18SOMENATH ROY CHOUDHURYNo ratings yet

- News Lessons Cosplaying Hobbit Worksheet Intermediate 941615Document5 pagesNews Lessons Cosplaying Hobbit Worksheet Intermediate 941615Advennie Nuhujanan0% (1)

- Agatthiyar's Saumya Sagaram - A Quick Summary of The Ashta KarmaDocument5 pagesAgatthiyar's Saumya Sagaram - A Quick Summary of The Ashta KarmaBujji JohnNo ratings yet

- 07-30487 Notice of JoinderDocument20 pages07-30487 Notice of Joinderkykphilippe91% (11)

- How Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaDocument3 pagesHow Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 000 Digital Control LecturesDocument67 pages000 Digital Control LecturesPX PRNo ratings yet

- Commerce and Peace 11Document28 pagesCommerce and Peace 11FEDERICO ORSININo ratings yet