Professional Documents

Culture Documents

CIR Vs Bank of Commerce

Uploaded by

Aster Beane Araneta0 ratings0% found this document useful (0 votes)

325 views2 pagesCIR vs Bank of Commerce

Original Title

CIR vs Bank of Commerce

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCIR vs Bank of Commerce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

325 views2 pagesCIR Vs Bank of Commerce

Uploaded by

Aster Beane AranetaCIR vs Bank of Commerce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

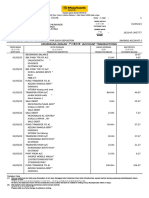

Case 4: COMMISSIONER OF INTERNAL REVENUE, petitioner, imposed.

The CA declared that the final withholding

vs. BANK OF COMMERCE, respondent. tax in the amount of P17,768,509.00 was a trust fund

for the government; hence, does not form part of the

1. In 1994 and 1995, the respondent Bank of Commerce respondents gross receipts. The legal ownership of

derived passive income in the form of interests or discounts the amount had already been vested in the

from its investments in government securities and private government. (kumbaga, bakit pa isa-subject sa

commercial papers. 5% tax of gross receipts yung final withholding

a. On several occasions during the said period, it paid tax, eh hindi naman na-receive yun ng Bank.

5% gross receipts tax on its income, as reflected in kumbaga, sa government na yun)

its quarterly percentage tax returns. Included therein

were the respondent banks passive income from the Hence, the present action by the petitioner arguing that the

said investments amounting to P85,384,254.51, definition of gross receipts, income received may be actual or

which had already been subjected to a final tax of constructive. in computing the 5% gross receipts tax, the income

20%. (basta nangyari, sinama niya sa gross need not be actually received. For income to form part of the

receipts, which was subjected to the 5% tax, taxable gross receipts, constructive receipt is enough. Hence, the

yung passive income niya na na-tax na rin ng CIR maintains that the withholding tax form the respondent Banks

20% sa withholding) income should be included in the gross receipts that are subject to

2. Relying on a 1996 decision of the CTA1 which held that the the 5% tax.

20% final withholding tax on interest income from banks Argument of respondent: that it should not be included in the gross

does not form part of taxable gross receipts for Gross receipts because it merely held the amount for the government. It

Receipts Tax (GRT) purposes, Bank of Commerce then filed neither benefited nor owned the said withheld money.

an administrative claim for refund for alleged overpayment

of taxes in the mentioned years of 1994 and 1995. Before it Issue: Should the withholding tax from the passive income of the

could be barred from the mandatory two-year prescriptive respondent Bank of Commerce be included in its gross receipts?

period for refund claims, Bank of Commerce also filed

judicially before the CTA.

3. Answer of CIR: Bank of Commerce was not able to prove Ruling: Yes.

that it is entitled for the said refund.

4. The CTA rendered a decision in favor of the respondent Bank 1. by the definition of gross receipts, it shall be

of Commerce ordering the CIR to give the refund. The CTA included.

relied on the ruling in the case of the Manila Jockey Club, a. The word gross must be used in its plain and

and held that the term gross receipts excluded those which ordinary meaning. It is defined as whole, entire, total,

had been especially earmarked by law or regulation for the without deduction. A common definition is without

government or persons other than the taxpayer. deduction. Gross is also defined as taking in the

5. The CIR elevated the case to the CA. The CA affirmed the whole; having no deduction or abatement; whole,

decision of the CTA. total as opposed to a sum consisting of separate or

a. It held that the P17,076,850.90 representing the final specified parts. Gross is the antithesis of net.

withholding tax derived from passive investments b.

subjected to final tax should not be construed as 2. If there is no specific provision excluding or allowing

forming part of the gross receipts of the respondent the deduction of final withholding tax from the tax

bank upon which the 5% gross receipts tax should be base (gross receipts), then it should be included.

a. Indeed, there is a presumption that receipts of a

1 Asia Bank Corporation v. Commissioner of Internal Revenue, CTA person engaging in business are subject to the gross

Case No. 472, citing Section 4(e) of Revenue Regulations (Rev. receipts tax.

Reg.) No. 1280. b. In this case, there is no law which allows the

deduction of 20% final tax from the respondent

banks interest income for the computation of the 5% constitutes income earned by the taxpayer, then that

gross receipts tax. On the other hand, Section 8(a) amount manifestly forms part of the taxpayers gross

(c), Rev. Reg. No. 1784 provides that interest earned receipts. Because the amount withheld belongs to

on Philippine bank deposits and yield from deposit the taxpayer, he can transfer its ownership to the

substitutes are included as part of the tax base upon government in payment of his tax liability. The

which the gross receipts tax is imposed. amount withheld indubitably comes from income of

3. Although it is withheld for the government, the same the taxpayer, and thus forms part of his gross

is still income of the bank. The bare fact that the final receipts.

withholding tax is a special trust fund belonging to the

government and that the respondent bank did not benefit Second issue: is there double taxation?

from it while in custody of the borrower does not justify its

exclusion from the computation of interest income. Such Ruling: None. There is no double taxation, because there is

final withholding tax covers for the respondent banks no taxing twice, by the same taxing authority, within the

income and is the amount to be used to pay its tax liability same jurisdiction, for the same purpose, in different taxing

to the government. This tax, along with the creditable periods, some of the property in the territory. Subjecting

withholding tax, constitutes payment which would interest income to a 20% FWT and including it in the

extinguish the respondent banks obligation to the computation of the 5% GRT is clearly not double taxation.

government. The bank can only pay the money it owns, or

the money it is authorized to pay. First, the taxes herein are imposed on two different subject

a. Actual receipt of interest income is not limited to matters. The subject matter of the FWT is the passive income

physical receipt. Actual receipt may either be generated in the form of interest on deposits and yield on deposit

physical receipt or constructive receipt. When the substitutes, while the subject matter of the GRT is the privilege of

depository bank withholds the final tax to pay the tax engaging in the business of banking.

liability of the lending bank, there is prior to the

withholding a constructive receipt by the lending Second, although both taxes are national in scope because they

bank of the amount withheld. From the amount are imposed by the same taxing authority the national government

constructively received by the lending bank, the under the Tax Code and operate within the same Philippine

depository bank deducts the final withholding tax jurisdiction for the same purpose of raising revenues, the taxing

and remits it to the government for the account of periods they affect are different. The FWT is deducted and withheld

the lending bank. Thus, the interest income actually as soon as the income is earned, and is paid after every calendar

received by the lending bank, both physically and quarter in which it is earned. On the other hand, the GRT is neither

constructively, is the net interest plus the amount deducted nor withheld, but is paid only after every taxable quarter

withheld as final tax. in which it is earned.

b. The concept of a withholding tax on income

obviously and necessarily implies that the amount of Third, these two taxes are of different kinds or characters. The

the tax withheld comes from the income earned by FWT is an income tax subject to withholding, while the GRT is a

the taxpayer. Since the amount of the tax withheld percentage tax not subject to withholding.

You might also like

- CIR V Solidbank CorporationDocument1 pageCIR V Solidbank CorporationFrancis Ray Arbon FilipinasNo ratings yet

- CIR v. Bank of CommerceDocument6 pagesCIR v. Bank of Commerceamareia yapNo ratings yet

- Cir Vs Bank of Commerce DigestDocument1 pageCir Vs Bank of Commerce DigestMimmi ShaneNo ratings yet

- ING Banking vs. CIR (Digest)Document2 pagesING Banking vs. CIR (Digest)Theodore Dolar100% (1)

- CIR V Pilipinas ShellDocument4 pagesCIR V Pilipinas ShellCedric Enriquez100% (2)

- Silkair vs. CirDocument2 pagesSilkair vs. CirKath Leen100% (1)

- Commissioner of Internal Revenue vs. Avon Products Manufacturing, IncDocument3 pagesCommissioner of Internal Revenue vs. Avon Products Manufacturing, IncFrancis PunoNo ratings yet

- #33 CIR Vs British Overseas Airways CorporationDocument2 pages#33 CIR Vs British Overseas Airways CorporationTeacherEliNo ratings yet

- Used Actually, Directly and Exclusively For Educational Purposes Shall Be Exempt From Taxes and DutiesDocument2 pagesUsed Actually, Directly and Exclusively For Educational Purposes Shall Be Exempt From Taxes and DutiesJasper Alon100% (2)

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- Contex Corp vs. CirDocument3 pagesContex Corp vs. CirKath Leen100% (1)

- Lopez vs. City of ManilaDocument2 pagesLopez vs. City of ManilaDeniel Salvador B. MorilloNo ratings yet

- Aguinaldo Vs CIR #Tax-1Document2 pagesAguinaldo Vs CIR #Tax-1Earl TagraNo ratings yet

- Case #38 - CIR vs. United Cadiz SugarDocument2 pagesCase #38 - CIR vs. United Cadiz SugarJeffrey Magada100% (2)

- Courage VS Commissoner of Internal Revenue DigestDocument3 pagesCourage VS Commissoner of Internal Revenue DigestCharles Roger Raya100% (1)

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz Tuppal75% (4)

- Petron V TiangcoDocument1 pagePetron V TiangcoAleli Joyce Bucu100% (1)

- PLDT vs. City of Davao DigestDocument2 pagesPLDT vs. City of Davao DigestMa Gabriellen Quijada-TabuñagNo ratings yet

- Taxation Review - Soriano vs. Secretary of FinanceDocument2 pagesTaxation Review - Soriano vs. Secretary of FinanceMaestro Lazaro100% (2)

- Angeles Univ Foundation vs. City of AngelesDocument2 pagesAngeles Univ Foundation vs. City of AngelesDave Jonathan Morente100% (2)

- Cir vs. Air India DigestDocument3 pagesCir vs. Air India Digestkarlonov100% (2)

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- CIR vs. Filinvest Development Corp.Document2 pagesCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEDocument2 pagesDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusNo ratings yet

- CIR vs. Hambrecht & Quist PHDocument1 pageCIR vs. Hambrecht & Quist PHmaica_prudente50% (2)

- Commissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncDocument1 pageCommissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncMary AnneNo ratings yet

- Western Minolco v. CommissionerDocument2 pagesWestern Minolco v. CommissionerEva TrinidadNo ratings yet

- Smart Communications, Inc. vs. Municipality of Malvar, BatangasDocument3 pagesSmart Communications, Inc. vs. Municipality of Malvar, BatangasRaquel Doquenia100% (2)

- Fishwealth Canning v. CIRDocument1 pageFishwealth Canning v. CIRRia Kriselle Francia PabaleNo ratings yet

- Ing vs. Cir DigestDocument4 pagesIng vs. Cir DigestDonna DumaliangNo ratings yet

- ANPC v. BIR and CIR v. PAGCORDocument2 pagesANPC v. BIR and CIR v. PAGCORDerek C. Egalla100% (2)

- CIR Vs Sony DigestDocument2 pagesCIR Vs Sony DigestPre Avanz83% (6)

- Commissioner of Internal Revenue vs. Azucena T. Reyes The FactsDocument2 pagesCommissioner of Internal Revenue vs. Azucena T. Reyes The FactsHartel Buyuccan100% (1)

- Camp John Hay vs. CbaaDocument4 pagesCamp John Hay vs. CbaaAnonymous 5MiN6I78I0No ratings yet

- Borja Vs GellaDocument4 pagesBorja Vs Gelladwight yuNo ratings yet

- Cir V AcostaDocument2 pagesCir V AcostaJennilyn TugelidaNo ratings yet

- 10 OCEANIC WIRELESS NETWORK Vs CIRDocument3 pages10 OCEANIC WIRELESS NETWORK Vs CIRIsh100% (1)

- Kuenzle v. CIRDocument2 pagesKuenzle v. CIRTippy Dos Santos100% (2)

- Philippine Airlines vs. Commissioner of Internal RevenueDocument3 pagesPhilippine Airlines vs. Commissioner of Internal RevenueGenebva Mica NodaloNo ratings yet

- Adamson vs. Court of Appeals 2009Document3 pagesAdamson vs. Court of Appeals 2009joyceNo ratings yet

- Smart Vs City of DavaoDocument3 pagesSmart Vs City of DavaoGR100% (2)

- Tax DigestsDocument206 pagesTax DigestsPio Guieb AguilarNo ratings yet

- Kepco Vs Cir Case DigestDocument1 pageKepco Vs Cir Case DigestjovifactorNo ratings yet

- Petron v. TiangcoDocument1 pagePetron v. TiangcoArahbells100% (1)

- Progressive Development Corporation v. Quezon CityDocument1 pageProgressive Development Corporation v. Quezon Cityfranzadon100% (1)

- Steag State Power, Inc. v. Commissioner of Internal Revenue, G.R. No. 205282, January 14, 2019 (Third Division)Document1 pageSteag State Power, Inc. v. Commissioner of Internal Revenue, G.R. No. 205282, January 14, 2019 (Third Division)John Kenneth JacintoNo ratings yet

- 02 Soriano vs. Secretary of FinanceDocument1 page02 Soriano vs. Secretary of FinanceMark Anthony Javellana SicadNo ratings yet

- City of Iriga V CASURECO IIIDocument3 pagesCity of Iriga V CASURECO IIIJerico GodoyNo ratings yet

- CIR vs. CA - G.R. No. 125355 (Digest)Document7 pagesCIR vs. CA - G.R. No. 125355 (Digest)Karen Gina DupraNo ratings yet

- Cir v. Acesite DigestDocument3 pagesCir v. Acesite DigestkathrynmaydevezaNo ratings yet

- Digests 1Document5 pagesDigests 1Jopet EstolasNo ratings yet

- Air Canada v. CIR DigestDocument2 pagesAir Canada v. CIR Digestpinkblush717100% (3)

- Supreme Transliner v. BPIDocument1 pageSupreme Transliner v. BPIWhere Did Macky GallegoNo ratings yet

- Cir VS Cta and Petron Corp PDFDocument3 pagesCir VS Cta and Petron Corp PDFMark Joseph LupangoNo ratings yet

- Marcos II Vs CA Case DigestDocument2 pagesMarcos II Vs CA Case Digestlucky javellana100% (3)

- Cir V CA ComasercoDocument2 pagesCir V CA ComasercoJoel G. AyonNo ratings yet

- Tax Digest Cañero PDFDocument9 pagesTax Digest Cañero PDFGreghvon MatolNo ratings yet

- Commissioner of Internal Revenue V Solidbank CorporationDocument2 pagesCommissioner of Internal Revenue V Solidbank CorporationMarj CenNo ratings yet

- CIR v. Bank of Commerce (2005) Case DigestDocument2 pagesCIR v. Bank of Commerce (2005) Case DigestShandrei GuevarraNo ratings yet

- F. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Document3 pagesF. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Rhenee Rose Reas SugboNo ratings yet

- Torts Finals ReviewerDocument20 pagesTorts Finals ReviewerAster Beane AranetaNo ratings yet

- Labor Organization (LO) Legitimate Labor Organization (LLO)Document10 pagesLabor Organization (LO) Legitimate Labor Organization (LLO)Aster Beane AranetaNo ratings yet

- VII. Evidence. Araneta. 11384085. AY2015-16. Atty. Custodio 1Document34 pagesVII. Evidence. Araneta. 11384085. AY2015-16. Atty. Custodio 1Aster Beane AranetaNo ratings yet

- Sessions 5 and 6Document4 pagesSessions 5 and 6Aster Beane AranetaNo ratings yet

- Session 7 and 8Document10 pagesSession 7 and 8Aster Beane AranetaNo ratings yet

- Araneta-Special Proceedings-AY1516-Atty. Gallo 1Document13 pagesAraneta-Special Proceedings-AY1516-Atty. Gallo 1Aster Beane AranetaNo ratings yet

- Torts Finals ReviewerDocument20 pagesTorts Finals ReviewerAster Beane AranetaNo ratings yet

- VII. Evidence. Araneta. 11384085. AY2015-16. Atty. Custodio 1Document20 pagesVII. Evidence. Araneta. 11384085. AY2015-16. Atty. Custodio 1Aster Beane AranetaNo ratings yet

- V. Araneta Notes. Evidence. Atty. Custodio. Term 2 Ay 2015-2016Document11 pagesV. Araneta Notes. Evidence. Atty. Custodio. Term 2 Ay 2015-2016Aster Beane AranetaNo ratings yet

- 1 Session. Araneta-Evidence - Custodio - AY 2015 - 2016 - Term 2 1Document145 pages1 Session. Araneta-Evidence - Custodio - AY 2015 - 2016 - Term 2 1Aster Beane AranetaNo ratings yet

- IV. Araneta. Evidence. Atty. Custodio. 2015-2016Document7 pagesIV. Araneta. Evidence. Atty. Custodio. 2015-2016Aster Beane AranetaNo ratings yet

- Session 3Document21 pagesSession 3Aster Beane AranetaNo ratings yet

- V. Araneta Notes. Evidence. Atty. Custodio. Term 2 Ay 2015-2016Document48 pagesV. Araneta Notes. Evidence. Atty. Custodio. Term 2 Ay 2015-2016Aster Beane AranetaNo ratings yet

- Poli CasesDocument26 pagesPoli CasesAster Beane AranetaNo ratings yet

- Labor - For MemorizationDocument7 pagesLabor - For MemorizationAster Beane AranetaNo ratings yet

- Modern Approaches Place of The Most Significant Relationship Case 1: Auten Vs AutenDocument8 pagesModern Approaches Place of The Most Significant Relationship Case 1: Auten Vs AutenAster Beane AranetaNo ratings yet

- Transfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedDocument16 pagesTransfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedAster Beane AranetaNo ratings yet

- People v. GuttierezDocument5 pagesPeople v. GuttierezAster Beane AranetaNo ratings yet

- Session 3Document21 pagesSession 3Aster Beane AranetaNo ratings yet

- Walter E OlsenDocument1 pageWalter E OlsenAster Beane AranetaNo ratings yet

- Rizal Banking Corporation VsDocument1 pageRizal Banking Corporation VsAster Beane AranetaNo ratings yet

- Strikes and Lockouts PDFDocument11 pagesStrikes and Lockouts PDFAster Beane AranetaNo ratings yet

- Salvacion Vs Central BankDocument1 pageSalvacion Vs Central BankAster Beane AranetaNo ratings yet

- Credit Transactions TablesDocument2 pagesCredit Transactions TablesAster Beane AranetaNo ratings yet

- Session 2Document12 pagesSession 2Aster Beane AranetaNo ratings yet

- Pledge Annotation and CasesDocument15 pagesPledge Annotation and CasesAster Beane AranetaNo ratings yet

- Session 3Document22 pagesSession 3Aster Beane AranetaNo ratings yet

- Conflicts of Law Reviewer - SESSION 1 SALODocument9 pagesConflicts of Law Reviewer - SESSION 1 SALOAster Beane AranetaNo ratings yet

- Session 1Document163 pagesSession 1Aster Beane AranetaNo ratings yet

- Session 1Document18 pagesSession 1Aster Beane AranetaNo ratings yet

- AramcoGoldCoins FOFOA032210Document15 pagesAramcoGoldCoins FOFOA032210Christien PetrieNo ratings yet

- Blackbook Topics TybbiDocument2 pagesBlackbook Topics Tybbiankit chauhan100% (1)

- Negotiable Instruments Act 1881Document47 pagesNegotiable Instruments Act 1881SupriyamathewNo ratings yet

- FM-06 Performance Task 1 Answer KeyDocument1 pageFM-06 Performance Task 1 Answer Keyyamamotoakemi24No ratings yet

- Financial Statements 2, ModuleDocument4 pagesFinancial Statements 2, ModuleSUHARTO USMANNo ratings yet

- CourseMarial - Ca11cinvestment Analysis and Portfolio ManagementDocument4 pagesCourseMarial - Ca11cinvestment Analysis and Portfolio Managementfash selectNo ratings yet

- D Mercer - Private Client Case Study-V1Document5 pagesD Mercer - Private Client Case Study-V1kapoor_mukesh4uNo ratings yet

- Damo CH 12Document65 pagesDamo CH 12HP KawaleNo ratings yet

- Chapter 10 - Financial Markets PDFDocument4 pagesChapter 10 - Financial Markets PDFKelrina D'silvaNo ratings yet

- Ibs TMN Sri Serdang, S'Gor 1 31/05/23Document8 pagesIbs TMN Sri Serdang, S'Gor 1 31/05/23jie skrttNo ratings yet

- Practice CH 3Document6 pagesPractice CH 3Aruzhan TanirbergenNo ratings yet

- Case Study 4.. Mariam Sharaf Al-Deen-MIS505Document3 pagesCase Study 4.. Mariam Sharaf Al-Deen-MIS505AbduNo ratings yet

- Discussion 4 FinanceDocument5 pagesDiscussion 4 Financepeter njovuNo ratings yet

- GBP Statement: Beatriz Manchado FloresDocument2 pagesGBP Statement: Beatriz Manchado Floresmr.laravelNo ratings yet

- Business Model FInancial Model SlidsDocument16 pagesBusiness Model FInancial Model SlidsChintan GosarNo ratings yet

- Bank Secrecy Act/Anti-Money Laundering Examination ManualDocument439 pagesBank Secrecy Act/Anti-Money Laundering Examination ManualMilton RechtNo ratings yet

- Countif Sumif ExercisesDocument18 pagesCountif Sumif Exerciseskemalll100% (1)

- Capsa UnitedDocument12 pagesCapsa Unitedvenkat rajNo ratings yet

- Cost of Capital and Capital Structure PlanningDocument32 pagesCost of Capital and Capital Structure PlanningAshiq NobitaNo ratings yet

- Business English Idioms & Idiomatic ExpressionsDocument2 pagesBusiness English Idioms & Idiomatic ExpressionsAnastasia AndreevnaNo ratings yet

- Islamic Banking Operation-DepositDocument24 pagesIslamic Banking Operation-DepositZul Aizat HamdanNo ratings yet

- Internship Report On UBLDocument62 pagesInternship Report On UBLbbaahmad89No ratings yet

- Q Mar22Document9 pagesQ Mar22user mrmysteryNo ratings yet

- Itmg 20230306Document5 pagesItmg 20230306Hanna WesleyNo ratings yet

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoDocument2 pagesThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NocykenNo ratings yet

- Andleeb Abbas - Declaration of Assets Liabilities - Dec 2013Document4 pagesAndleeb Abbas - Declaration of Assets Liabilities - Dec 2013PTI Official100% (1)

- Textbook of Financial Cost and Management Accounting (PDFDrive) - 642-664 PDFDocument23 pagesTextbook of Financial Cost and Management Accounting (PDFDrive) - 642-664 PDFKola SiriNo ratings yet

- Simple Interest Compounded Interest Population Growth Half LifeDocument32 pagesSimple Interest Compounded Interest Population Growth Half LifeCarmen GoguNo ratings yet

- KPMG Flash News Draft Guidelines For Core Investment CompaniesDocument5 pagesKPMG Flash News Draft Guidelines For Core Investment CompaniesmurthyeNo ratings yet

- Responsi Akkeu 2 EquityDocument36 pagesResponsi Akkeu 2 EquityAngel Valentine TirayoNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Taxes Have Consequences: An Income Tax History of the United StatesFrom EverandTaxes Have Consequences: An Income Tax History of the United StatesNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- Bookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesFrom EverandBookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesNo ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)