Professional Documents

Culture Documents

Pivot Point Table: Retail Research

Uploaded by

Dinesh ChoudharyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pivot Point Table: Retail Research

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

RETAIL RESEARCH 02 Mar 2017

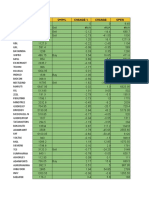

Pivot Point Table

Name Close % Change 20 SEMA Trend S1 S2 Pivot R1 R2

* CNX NIFTY 8945.8 0.7 8820.0 UP 8847 8909 8935 8972 9034

* CNX 100 9229.8 0.6 9105.3 UP 9142 9198 9223 9255 9311

* CNX 200 4821.2 0.6 4751.4 UP 4781 4807 4819 4833 4860

* CNX 500 7754.7 0.6 7638.7 UP 7692 7733 7751 7773 7814

* CNX AUTO 9670.6 0.2 9845.5 DN 9539 9624 9663 9710 9795

* CNX BANK INDEX 20783.8 0.9 20417.6 UP 20542 20697 20765 20852 21007

* CNX COMMODITIES 3420.6 0.1 3392.8 UP 3380 3407 3420 3434 3460

* CNX CONSUMPTION 3941.2 0.6 3902.9 UP 3897 3925 3937 3953 3981

* CNX ENERGY 11277.3 -0.7 10914.0 UP 11078 11223 11312 11367 11512

* CNX FINANCE 8377.3 1.1 8233.8 UP 8247 8329 8362 8410 8492

* CNX FMCG 22650.8 1.4 22593.8 UP 22090 22440 22578 22789 23139

* CNX INFRA 2994.8 -0.1 3011.2 DN 2955 2984 3001 3012 3041

* CNX IT INDEX 10748.0 0.6 10374.7 UP 10559 10678 10728 10798 10917

* CNX MEDIA 2995.1 0.0 2971.7 UP 2957 2983 2996 3009 3035

* CNX METAL 3184.6 1.8 3103.1 UP 3081 3145 3171 3210 3275

* CNX MNC 10640.0 0.3 10686.7 DN 10555 10613 10644 10671 10729

* CNX NIFTY JUNIOR 24456.7 0.1 24196.9 UP 24222 24384 24474 24547 24709

* CNX PHARMA 10700.8 1.1 10510.4 UP 10471 10621 10690 10770 10919

* CNX PSE 4015.3 -0.6 4083.0 DN 3942 3996 4030 4050 4103

* CNX PSU BANK 3310.7 0.7 3337.4 DN 3246 3291 3315 3335 3380

* CNX REALTY 204.9 3.9 193.0 UP 194 201 203 207 214

* CNX SERVICE 11529.3 0.7 11335.9 UP 11389 11479 11520 11570 11660

* NIFTY MIDCAP 50 4199.4 0.3 4099.5 UP 4160 4188 4203 4215 4242

* NSE INDIA VIX 13.6 -1.5 13.6 UP 13 13 14 14 14

ACC 1409.0 -0.2 1455.0 DN 1387 1403 1412 1418 1434

ADANI ENTERPRISE 98.0 -0.5 94.4 UP 95 97 98 99 102

ADANI PORT & SEZ 302.5 0.2 303.1 DN 297 301 303 305 308

ADANI POWER 38.6 0.0 36.7 UP 37 38 39 39 40

ADITYA BIRLA NUVO 1459.1 1.2 1459.1 DN 1401 1438 1454 1475 1512

AJANTA PHARMA 1716.7 0.0 1744.8 DN 1690 1709 1719 1727 1746

ALLAHABAD BANK 73.5 0.1 72.5 UP 71 73 74 75 76

AMARA RAJA BATTE 851.6 -0.8 869.7 DN 833 847 855 860 874

AMBUJA CEMENTS 228.9 -0.2 235.1 DN 225 228 229 231 233

AMTEK AUTO 38.7 1.8 36.1 UP 36 38 39 40 42

ANDHRA BANK 56.4 0.3 55.3 UP 55 56 57 57 58

APOLLO HOSPITALS 1325.9 1.9 1265.6 UP 1276 1308 1324 1341 1374

APOLLO TYRES 185.7 -1.0 182.1 UP 177 183 187 190 196

ARVIND 379.9 -0.1 377.4 UP 373 378 381 383 387

ASIAN PAINTS 1032.8 0.8 994.2 UP 1012 1026 1033 1040 1054

AUROBINDO PHARMA 678.3 0.2 677.3 UP 664 674 681 685 695

AXIS BANK 513.4 1.3 495.9 UP 497 508 515 520 532

BAJAJ AUTO 2769.0 0.5 2793.4 DN 2706 2749 2772 2792 2835

BANK OF BARODA 165.4 0.0 173.5 DN 161 164 166 168 171

BATA (I) 506.6 -0.4 500.2 UP 489 501 508 514 526

BHARAT FORGE 1052.0 -0.1 1027.9 UP 1020 1042 1053 1063 1085

BHARAT PETROLEUM 659.5 -1.6 699.1 DN 626 650 663 673 697

BHARTI AIRTEL 362.8 -0.7 360.1 UP 352 360 364 367 375

BHEL 160.3 -1.4 152.6 UP 154 158 161 163 168

BIOCON 1114.3 -0.7 1092.8 UP 1087 1107 1120 1127 1148

BOSCH 21514.6 -0.3 22257.9 DN 20972 21355 21577 21737 22120

BRITANNIA INDS 3181.0 -1.5 3235.5 DN 3066 3151 3205 3236 3321

RETAIL RESEARCH P age |1

RETAIL RESEARCH

CAIRN INDIA 291.6 2.6 282.2 UP 276 285 289 295 305

CEAT 1180.3 0.0 1149.9 UP 1138 1168 1187 1199 1229

CENTURY TEXTILES 949.1 -0.5 920.5 UP 927 942 952 958 974

CESC 827.6 -1.5 830.6 DN 787 815 832 844 872

CIPLA 586.3 0.4 588.4 DN 574 583 588 591 600

COAL INDIA 320.2 -0.5 321.6 DN 312 318 321 324 330

COLGATE PALMOLIV 897.3 -0.3 896.9 UP 878 890 896 903 915

DABUR (I) 276.2 -0.3 269.6 UP 270 274 276 278 283

DEWAN HOUSING 332.3 -0.3 310.6 UP 325 330 333 335 340

DISH TV (I) 97.1 0.6 89.8 UP 94 96 97 98 100

DIVIS LABS 764.9 0.8 744.9 UP 735 757 770 778 799

DR. REDDY'S LABS 2923.3 2.6 2964.4 DN 2767 2866 2907 2965 3063

EICHER MOTORS 23709.7 -1.7 24423.7 DN 22620 23410 23900 24200 24990

ENGINEERS (I) 149.6 -0.6 151.5 DN 146 149 150 151 154

GAIL (I) 506.4 -2.0 498.3 UP 483 500 510 516 533

GLENMARK PHARM 929.5 0.4 939.4 DN 912 924 930 936 948

GMR INFRASTRUCTURE 15.8 -0.6 14.4 UP 15 16 16 16 17

GODREJ INDS 498.7 -0.7 500.1 DN 486 495 500 504 513

GRASIM INDS 1005.7 1.6 999.5 UP 945 983 999 1021 1059

HAVELLS (I) 410.4 1.0 423.9 DN 399 406 410 414 421

HCL TECH 849.1 1.1 832.2 UP 831 842 847 854 865

HDFC 1400.6 2.2 1396.1 UP 1342 1378 1392 1414 1450

HDFC BANK 1391.7 0.1 1344.3 UP 1376 1387 1392 1397 1407

HERO MOTOCORP 3178.1 1.3 3188.9 DN 3105 3153 3175 3201 3249

HEXAWARE TECHNOL 226.6 1.0 208.7 UP 216 223 227 230 237

HIND PETROLEUM 518.6 -3.6 552.5 DN 492 510 518 527 544

HINDALCO 189.3 2.7 186.3 UP 178 185 189 193 200

HINDUSTAN UNILEVER 875.5 1.1 855.7 UP 847 865 873 883 901

HOUSING DEV & INFRA 69.8 1.3 67.2 UP 67 69 69 71 73

ICICI BANK 279.1 1.0 283.0 DN 274 277 279 281 285

IDBI 79.9 0.4 81.8 DN 78 79 80 81 82

IDEA CELLULAR 113.3 -2.2 110.2 UP 108 112 114 115 119

IDFC 53.5 0.5 54.5 DN 53 53 54 54 55

IFCI 29.0 -0.7 29.8 DN 28 29 29 29 30

INDIA CEMENTS 169.1 -0.6 163.5 UP 164 168 170 171 175

INDIABULLS HOUSING FINANCE 870.6 -0.1 832.9 UP 846 863 872 880 896

INDIABULLS REAL ESTATE 84.6 4.9 78.8 UP 77 82 83 86 91

INDIAN OVERSEAS BANK 27.7 3.4 27.1 UP 25 27 28 29 31

INDRAPRASTHA GAS 1050.2 0.7 1022.7 UP 1030 1043 1048 1056 1069

INDUSIND BANK 1326.2 1.0 1321.0 UP 1296 1316 1325 1336 1355

INFOSYS 1025.2 1.3 977.8 UP 998 1015 1021 1031 1048

IRB INFRASTRUCTURE DEVELOPERS 237.4 2.4 232.6 UP 226 233 236 240 247

ITC 268.5 2.4 270.0 DN 257 264 267 271 279

JAIN IRRIGATION 94.0 0.1 95.3 DN 92 93 94 95 96

JAIPRAKASH ASSOC 16.0 -2.7 14.0 UP 14 16 16 17 18

JAIPRAKASH POWER VENTURES 6.2 0.8 5.9 UP 6 6 6 6 7

JINDAL STEEL POW 126.3 0.6 99.0 UP 121 124 126 128 131

JSW ENERGY 64.8 -0.7 62.6 UP 63 64 65 66 67

JSW STEEL 189.8 1.5 188.7 UP 181 187 190 193 199

JUBILANT FOODWORKS 1002.4 -0.8 984.2 UP 970 994 1009 1017 1040

JUST DIAL 548.2 0.3 452.8 UP 529 542 550 556 569

KARNATAKA BANK 137.7 -0.1 122.2 UP 131 136 138 141 146

KAVERI SEED CO 496.6 0.0 469.2 UP 473 490 501 507 525

KOTAK MAHINDRA BANK 824.2 2.7 787.7 UP 783 808 818 834 859

RETAIL RESEARCH P age |2

RETAIL RESEARCH

L&T FINANCE HOLDINGS 116.1 -0.3 111.3 UP 113 115 117 117 119

LARSEN & TOUBRO 1476.2 0.5 1484.6 DN 1456 1470 1477 1484 1497

LIC HOUSING FIN 561.1 0.1 557.8 UP 551 558 563 565 572

LUPIN LABS 1469.8 -0.3 1465.6 UP 1451 1464 1472 1477 1490

MAHINDRA & MAHINDRA 1348.8 2.8 1296.8 UP 1251 1312 1335 1372 1433

MARUTI SUZUKI 5919.6 0.0 6058.3 DN 5757 5870 5935 5984 6098

MCLEOD RUSSEL 175.7 1.9 168.3 UP 168 173 175 178 183

MINDTREE 472.0 -0.5 465.0 UP 461 468 473 476 484

MOTHERSON SUMI 361.8 3.3 347.1 UP 340 353 358 367 380

NMDC 150.3 0.0 144.2 UP 146 149 150 152 155

NTPC 160.0 -1.8 169.5 DN 153 158 161 163 168

OIL (I) 333.2 1.8 334.9 DN 323 329 332 335 341

ONGC 193.9 0.2 195.6 DN 189 193 195 196 199

ORACLE FINANCIAL SERVICES SOFTWARE 3730.0 -0.3 3636.8 UP 3657 3705 3727 3753 3801

ORIENTAL BANK 126.9 -0.2 124.6 UP 123 126 127 129 131

PAGE INDS 14469.7 1.1 14311.0 UP 13773 14197 14349 14622 15046

POWER FINANCE CORP 137.2 0.9 134.3 UP 133 136 138 139 142

POWER GRID CORP OF INDIA 192.7 0.3 200.8 DN 189 191 193 194 197

PTC INDIA 87.8 -0.7 87.4 UP 85 87 88 89 91

PUNJAB NATIONAL BANK 142.7 0.9 143.7 DN 139 142 143 144 147

RELIANCE COMMUNICATIONS 38.8 -0.4 35.3 UP 36 38 39 40 42

RELIANCE INDS 1234.5 -0.3 1091.3 UP 1214 1228 1236 1243 1257

RURAL ELECTRIFICATION CORPORATION 153.4 0.5 148.2 UP 150 152 154 155 157

SHRIRAM TRANSPORT FINANCE 925.7 -0.4 949.5 DN 889 913 924 937 961

SIEMENS 1217.0 0.8 1207.5 UP 1181 1206 1221 1232 1257

SOUTH INDIA BANK 20.9 0.0 20.5 UP 20 21 21 21 22

SRF 1550.0 -0.4 1633.8 DN 1508 1538 1555 1567 1596

STATE BANK 271.8 0.9 272.4 DN 266 270 272 273 277

STEEL AUTHORITY 63.4 3.5 62.8 UP 60 62 63 64 66

STRIDES ARCOLAB 1168.7 0.5 1172.2 DN 1141 1160 1172 1180 1200

SUN PHARMACEUTICALS INDS 694.7 2.3 661.5 UP 665 683 690 702 720

SUN TV 724.0 1.5 693.9 UP 705 717 721 729 740

SYNDICATE BANK 70.0 0.7 70.1 DN 68 70 70 71 72

TATA COMMUNICATI 743.2 0.8 745.9 DN 724 736 742 749 761

TATA MOTORS 449.5 -1.6 484.4 DN 438 446 451 454 462

TATA POWER COMP 82.0 -0.8 82.5 DN 80 81 82 83 85

TATA STEEL 500.4 3.7 476.2 UP 469 488 495 507 527

TCS 2479.6 0.5 2373.3 UP 2434 2466 2484 2498 2530

TECH MAHINDRA 499.8 0.1 491.3 UP 477 491 497 505 520

TITAN COMPANY 438.2 0.2 420.4 UP 428 435 439 442 449

TVS MOTOR 425.3 -0.8 413.2 UP 415 422 426 429 436

UCO BANK 37.5 0.9 36.5 UP 36 37 37 38 39

ULTRATECH CEMENT 3731.1 -1.2 3741.9 DN 3646 3707 3744 3768 3829

UNITECH 6.4 5.8 5.9 UP 6 6 6 7 7

UNITED BREWERIES 782.5 0.6 797.6 DN 763 776 782 789 802

UPL 717.4 -0.1 721.9 DN 701 712 718 724 735

VEDANTA 265.5 2.5 257.4 UP 250 260 263 269 278

VOLTAS 378.1 1.2 347.1 UP 364 373 377 382 391

WIPRO 488.6 -0.1 472.3 UP 475 485 490 494 503

WOCKHARDT 750.0 -0.3 698.6 UP 716 740 755 765 789

YES BANK 1454.7 0.1 1427.3 UP 1420 1443 1455 1466 1490

ZEE ENTERTAINMENT ENTERPRISES 506.4 -0.6 513.5 DN 496 503 508 511 518

RETAIL RESEARCH P age |3

RETAIL RESEARCH

Table Explained:

20 SEMA 20 Day Simple Moving Average

Trend Prevailing Trend of the Index/Stock

UP - Uptrend. DN - Down Trend

S1, S2 & R1, R2 - Support 1, Support 2. & Resistance 1, Resistance 2

Pivot Median/Center level of the Price based on Previous Days Movement.

Intraday / Trading Tool:

Buy: First filter Trend should be UP i.e. price is above 20 SEMA (20 Day Simple Moving Average) as this set-up indicates that

the stock is in Near term Uptrend. In such a case initiate longs in such stocks above R1 with the Stoploss of S1/Low of the Day

whichever is less at the point of breakout.

Sell: First filter Trend Should be Down i.e. Closing price is below 20 SEMA (20 Day Simple Moving Average). as this set-up

indicates that the stock is in Near term Downtrend. In such a case Initiate shorts in such stocks below S1 with the Stoploss of

R1/High of the Day whichever is less at the point of breakdown.

For intraday traders looking for very small gains, R1 can be replaced by Pivot for buy and S1 can be replaced by Pivot for sell.

RETAIL RESEARCH P age |4

RETAIL RESEARCH

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475."

Disclosure:

We /I, (Gajendra Prabu), (MBA), authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our

views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities

Ltd. or its Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the

Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest. Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have

been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no

guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be

complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or

located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what

would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This

document may not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the

income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or

other services for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the

company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the

financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests

with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments

made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the

NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in

the report, or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this

report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject

company for any other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date

of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other

advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of

the research report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of

our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that

are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject

company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other

parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.

RETAIL RESEARCH P age |5

You might also like

- Top Indian stocks by daily percentage changeDocument15 pagesTop Indian stocks by daily percentage changeSantosh ThakurNo ratings yet

- Most Active by Contracts Futures Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document8 pagesMost Active by Contracts Futures Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- Run No DD (FT) DL (FT) Tli (FT) BLT (Degf)Document10 pagesRun No DD (FT) DL (FT) Tli (FT) BLT (Degf)eric edwinNo ratings yet

- 13th September DataDocument10 pages13th September DataAceNo ratings yet

- DojiDocument11 pagesDojiJaikumar KrishnaNo ratings yet

- TM-16 Well Test and Completion DetailsDocument32 pagesTM-16 Well Test and Completion DetailsKiki AmrullahNo ratings yet

- Ticker LTP O H L Change % Change OpenDocument22 pagesTicker LTP O H L Change % Change OpenPrasanna PharaohNo ratings yet

- India Export: Month Year Date Hs 4 Digit Hs CodeDocument7 pagesIndia Export: Month Year Date Hs 4 Digit Hs CodeCE CERTIFICATENo ratings yet

- Futures Trading Futures Trends - Most Active by ContractsDocument8 pagesFutures Trading Futures Trends - Most Active by ContractssudhakarrrrrrNo ratings yet

- F&OAnalysis 20 May 21Document8 pagesF&OAnalysis 20 May 21Siddharth TripathiNo ratings yet

- India ImportDocument8 pagesIndia ImportdheeruyadavNo ratings yet

- TABLE: Joint Reactions Story Joint Label Unique Name Load Case/Combo FX FY FZDocument3 pagesTABLE: Joint Reactions Story Joint Label Unique Name Load Case/Combo FX FY FZLinggaNo ratings yet

- Analisis Sismico DinamicoDocument28 pagesAnalisis Sismico DinamicoJhonatan Santa Cruz CamposNo ratings yet

- TABLE: Joint ReactionsDocument2 pagesTABLE: Joint ReactionsAtul ShrivastavaNo ratings yet

- Lista de preços leite e julho 2021Document15 pagesLista de preços leite e julho 2021Nitro FinanceiroNo ratings yet

- Kodad Municipality 1 ST Bill Detail'SDocument4 pagesKodad Municipality 1 ST Bill Detail'SSRIHARINo ratings yet

- Etabs To Safe ReactionsDocument160 pagesEtabs To Safe Reactionsnajam ansariNo ratings yet

- Problema PrognozaDocument4 pagesProblema PrognozaDănuţ D. MarianNo ratings yet

- FOUNDATION DESIGN CALCULATIONSDocument8 pagesFOUNDATION DESIGN CALCULATIONSAayush AdhikariNo ratings yet

- fe29093058fa481eb1ad846db49ed36e.xlsDocument2,416 pagesfe29093058fa481eb1ad846db49ed36e.xlsAnkit AggarwalNo ratings yet

- 2007SCI - Impact FactorDocument286 pages2007SCI - Impact FactorChiucheng Liu100% (11)

- MT871 26MM COMBINATION HAMMER PARTS LISTDocument4 pagesMT871 26MM COMBINATION HAMMER PARTS LISTAmar MalikiNo ratings yet

- TYREDocument89 pagesTYREkaswade BrianNo ratings yet

- STEEL BOM-20-03-2024Document41 pagesSTEEL BOM-20-03-2024RAJESHWARNo ratings yet

- Change in Stocks After Fall in Market Dec-2021Document2 pagesChange in Stocks After Fall in Market Dec-2021Devashish PisalNo ratings yet

- HSL Research NSE 200 Support & Resistance-26Document5 pagesHSL Research NSE 200 Support & Resistance-26riddhi SalviNo ratings yet

- Live Nse StocksDocument4 pagesLive Nse StocksP.r.sarmaNo ratings yet

- 2006 SCI Impact FactorDocument102 pages2006 SCI Impact FactorChiucheng Liu100% (6)

- Presupuesto SVIT FormatoDocument10 pagesPresupuesto SVIT FormatoJosé de Jesús Silva RamírezNo ratings yet

- Ngeres Versi 07Document4 pagesNgeres Versi 07m yudhi pramanaNo ratings yet

- TABLE: Column Forces Story Column Unique Name Load Case/Combo Station M3 M2 PDocument13 pagesTABLE: Column Forces Story Column Unique Name Load Case/Combo Station M3 M2 PCambodia Civil EngineeringNo ratings yet

- Annual Max FlowDocument8 pagesAnnual Max FlowArun ShalithaNo ratings yet

- 2005 SciDocument852 pages2005 SciBrian100% (5)

- Regional Top Formation BKBDocument3 pagesRegional Top Formation BKBizulNo ratings yet

- Print Dindigul Pre Med Ord Format Dindigul & Theni (2022-23)Document10 pagesPrint Dindigul Pre Med Ord Format Dindigul & Theni (2022-23)premkumar mayathevanNo ratings yet

- Sr. Symbol Price Triangle Breakout TMC PIN BPC BPCDocument6 pagesSr. Symbol Price Triangle Breakout TMC PIN BPC BPCAvinash GaikwadNo ratings yet

- Final Primera Vuelta AbastecimientoDocument4 pagesFinal Primera Vuelta AbastecimientoHarley AmbrocioNo ratings yet

- FUNGILAB Patrones de Viscosidad para Usos GeneralesDocument5 pagesFUNGILAB Patrones de Viscosidad para Usos GeneralesOscar Guzman CastroNo ratings yet

- BESCOM Transformer Repair Estimate Provides Cost BreakdownDocument715 pagesBESCOM Transformer Repair Estimate Provides Cost BreakdownRAMESHNo ratings yet

- Applied Compre S'22Document3 pagesApplied Compre S'22Hafiz Saddique MalikNo ratings yet

- Story Stiffness Table AnalysisDocument2 pagesStory Stiffness Table AnalysisAtul ShrivastavaNo ratings yet

- Sismos Escalados 01-05Document3,760 pagesSismos Escalados 01-05Pas Ag SNo ratings yet

- CotdataDocument3 pagesCotdatasanevah539No ratings yet

- Doji 6Document51 pagesDoji 6jayakumar krishnaNo ratings yet

- India Import: Month Year Date Indian Port Foreign Country Chapter Hs 4 Digit Hs CodeDocument6 pagesIndia Import: Month Year Date Indian Port Foreign Country Chapter Hs 4 Digit Hs CodeHarnil GondaliyaNo ratings yet

- Countryco Emp HC Rgdpna RknaDocument5 pagesCountryco Emp HC Rgdpna RknaMinza JahangirNo ratings yet

- Countryco Emp HC Rgdpna RknaDocument5 pagesCountryco Emp HC Rgdpna RknaMinza JahangirNo ratings yet

- AistargetDocument529 pagesAistargetGuillermo Plazas Amortegui40% (5)

- BTDocument6 pagesBTyudhaNo ratings yet

- Defective Summary Monthly 2017-2018Document37 pagesDefective Summary Monthly 2017-2018jim kangNo ratings yet

- IPC Cases 2008 - All StatesDocument1 pageIPC Cases 2008 - All StatessilkboardNo ratings yet

- Expansion RectagularDocument3 pagesExpansion RectagularJorge Luis GutierrezNo ratings yet

- TABLE: Joint ReactionsDocument3 pagesTABLE: Joint ReactionsshaimenneNo ratings yet

- Daily Stock Check ListDocument7 pagesDaily Stock Check ListvineetksrNo ratings yet

- Sin Rot-PQDocument58 pagesSin Rot-PQBodeguero QuímicosNo ratings yet

- Support Reactions DataDocument12 pagesSupport Reactions DataAbdulrahman AftabafzalNo ratings yet

- UntitledDocument6 pagesUntitledYadir Augusto Mayorga DiazNo ratings yet

- Sales Till 23rd August 2021Document96 pagesSales Till 23rd August 2021Jahanzeb ShameemNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document7 pagesApplicationForm (GH FLATS)gauravghaiNo ratings yet

- Methodology Document of NIFTY Sectoral Index Series: January 2020Document16 pagesMethodology Document of NIFTY Sectoral Index Series: January 2020Sumit KhatanaNo ratings yet

- Forensic Review Under IBC 1711 PDFDocument22 pagesForensic Review Under IBC 1711 PDFaaryan0001No ratings yet

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- 04peter Steidlmayer Kevin Koy-Markets and Market Logic-EnDocument171 pages04peter Steidlmayer Kevin Koy-Markets and Market Logic-EnDinesh Choudhary100% (1)

- WIPRO - Pick of The Week-280119Document15 pagesWIPRO - Pick of The Week-280119Dinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- AZB Capital Markets Update ICDR 2018 PDFDocument120 pagesAZB Capital Markets Update ICDR 2018 PDFpalo_909961085No ratings yet

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG Pick-Of-The-Week - Reliance Industries - 040219Document17 pagesHSL PCG Pick-Of-The-Week - Reliance Industries - 040219Dinesh ChoudharyNo ratings yet

- Triangle Trading MethodDocument14 pagesTriangle Trading Methodxagus100% (1)

- Safe Software FME Desktop/Server v2018 Data TransformationDocument1 pageSafe Software FME Desktop/Server v2018 Data TransformationDinesh ChoudharyNo ratings yet

- Membership FormDocument3 pagesMembership FormDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- ReportDocument8 pagesReportDinesh ChoudharyNo ratings yet

- ReportDocument9 pagesReportDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- ReportDocument3 pagesReportDinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- Report PDFDocument3 pagesReport PDFDinesh ChoudharyNo ratings yet

- ReportDocument8 pagesReportDinesh ChoudharyNo ratings yet

- ReportDocument15 pagesReportDinesh ChoudharyNo ratings yet