Professional Documents

Culture Documents

Retail Research Sector Analysis

Uploaded by

shobhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail Research Sector Analysis

Uploaded by

shobhaCopyright:

Available Formats

RETAIL RESEARCH 18 Feb 2017

HSL Looking Glass

Periodical technical report on Banking & IT sectors

Nagaraj Shetti

nagarajs.shetti@hdfcsec.com

Tel-022-30750021

RETAIL RESEARCH P age |1

RETAIL RESEARCH

Sectors CMP Trend Support Resistance Trading Strategy Components expected to perform in line

NSE Banking (Bank Nifty) 20551 Up 20300 20900 Buy cmp/sell on rise Axis Bank, ICICI, Kotak and Yes Bank

CNX IT 10527 Up 10450 10650 Sell cmp/sell on rise Infosys, TCS, Wipro and HCL Tech

NSE BANKING (BANK NIFTY)

NSE Bank daily timeframe NSE Bank weekly timeframe

Observation:

Daily Timeframe: After showing sideways consolidation in the last couple of weeks, the banking sector opened with sharp

positive note yesterday, but was not able to sustain the highs and slipped into intraday decline.

A long range bear candle has been formed as per daily timeframe chart on Friday at the new swing high of around 21042

levels (all time high), which is suggesting a strong supply zone at the higher levels.

The sector participants like Axis Bank, ICICI Bank, Indus Ind bank, Yes Bank and Kotak are all showing resistance at highs and

other PSU banks like SBIN, BOB, BOI, Fed Bank, Can Bank and PNB are all showing sideways consolidation with weak bias.

Weekly timeframe: The banking sector showed sharp upmove during last week, but also lost some of intra-week gains and

closed the week with the net gains of around 338 points, as per w-o-w basis.

We observe a formation of bull candle with long upper shadow, which is suggesting a strong resistance at the higher levels.

This weeks high of around 21042 is also an all-time high for the sector.

The banking sector is now facing strong overhead resistance of down sloping trend line (blue line, connecting the two

important tops) around 20500 levels. Hence, this is going to be a crucial for this sector to maintain positive bias.

Summing Up:

The underlying trend of Banking sector is still positive and there is no formation of any reversal pattern at the higher levels.

The overall chart pattern of smaller/larger timeframe are suggesting a presence of strong resistance at 20900-21000 levels.

Hence, the maximum upside could be limited up to 21K and there is a likelihood of reversal forming at the higher levels.

RETAIL RESEARCH P age |2

RETAIL RESEARCH

CNX IT:

CNX IT daily timeframe CNX IT weekly timeframe

Observation:

Daily timeframe: The IT sector showed decent upmove during this week and closed the week with minor negative note on

Friday at the higher levels.

We observe a formation of negative candlestick pattern of dark cloud cover, which is considered to be a top reversal

pattern. The key immediate support of 200day EMA (green curvy line) is now placed at the danger of breaking below it

around 10450 levels.

The key sector participants like Infosys, TCS, Wipro and HCL Tech are all showing negative patterns near the overhead

hurdles. Other participants like Just Dial, Tech Mahindra and Mind Tree are still showing positive trend.

Weekly Timeframe: The IT sector has showed a fine upmove in the last couple of weeks and closed this week higher by

around 140 points, as per w-o-w basis.

We observe a formation of bullish candle with long upper shadow, which is suggesting a supply zone at the high of around

10650 levels. This could also mean that a sharp upside move of IT sector of the last couple of weeks seems to be halting

now.

Presently, the IT sector is facing resistance at the strong valuation resistance of around 10650 leves (green dashed horizontal

line, as per the concept of change in polarity). This area has been a significant reversal zone over the last two years and has

led to a significant reversals in the IT sector in past.

Summing Up:

A fine upside bounce back of IT sector seems to be completing here and the sector is now set to show some decent

correction from the higher levels.

The maximum upside could be limited up to 10650 levels and the confirmation of reversal pattern/correction from the highs

could lead IT sector could open up the potential downside levels of around 10150-100 in the next couple of weeks.

RETAIL RESEARCH P age |3

RETAIL RESEARCH

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

HDFC Securities Ltd is a SEBI Registered Research Analyst having registration no. INH000002475.

Disclosure:

I, Nagaraj S. Shetti, Graduate, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views

about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities

Ltd. or its Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the

Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest. Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have

been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no

guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be

complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or

located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what

would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This

document may not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the

income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or

other services for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the

company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the

financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests

with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments

made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the

NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in

the report, or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this

report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject

company for any other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date

of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other

advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of

the research report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of

our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that

are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the

subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the

Subject Company or third party in connection with the Research Report.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters

mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.

RETAIL RESEARCH P age |4

You might also like

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- Banking & IT Sector WatchDocument4 pagesBanking & IT Sector WatchAnonymous y3hYf50mTNo ratings yet

- Banking & IT Sector WatchDocument6 pagesBanking & IT Sector WatchGauriGanNo ratings yet

- Mentum Stocks: Sector Technical WatchDocument5 pagesMentum Stocks: Sector Technical WatchGauriGanNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument4 pagesHSL Techno-Sector Buzzer: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchjaimaaganNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument5 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchDinesh ChoudharyNo ratings yet

- Nifty Weekly Insight Week Ahead TechnicalsDocument4 pagesNifty Weekly Insight Week Ahead TechnicalsjaimaaganNo ratings yet

- Report PDFDocument4 pagesReport PDFshobhaNo ratings yet

- Sector Technical Watch: A Periodical Technical Report On Banking & IT SectorsDocument6 pagesSector Technical Watch: A Periodical Technical Report On Banking & IT SectorsGauriGanNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument6 pagesHSL Techno-Sector Buzzer: Retail ResearchumaganNo ratings yet

- Nifty Weekly Insight 8520 ResistanceDocument4 pagesNifty Weekly Insight 8520 ResistanceumaganNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- Domestic Indices Snapshots and Market OutlookDocument5 pagesDomestic Indices Snapshots and Market OutlookBharatNo ratings yet

- 9th Nov, 2023Document11 pages9th Nov, 2023Pushpendra KushwahaNo ratings yet

- Nifty: Technical OutlookDocument2 pagesNifty: Technical OutlookAmit kumarNo ratings yet

- MOStMarketOutlook27thMarch2024Document10 pagesMOStMarketOutlook27thMarch2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 Th February 24Document12 pagesMost Market Out Look 27 Th February 24Realm PhangchoNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument4 pagesHSL Techno-Sector Buzzer: Retail Researcharun_algoNo ratings yet

- Mentum Stocks: Sector Technical WatchDocument5 pagesMentum Stocks: Sector Technical WatchGauriGanNo ratings yet

- Daily Derivatives: December 1, 2016Document3 pagesDaily Derivatives: December 1, 2016Rajasekhar Reddy AnekalluNo ratings yet

- Daily Derivatives: December 23, 2016Document3 pagesDaily Derivatives: December 23, 2016choni singhNo ratings yet

- MOStMarketOutlook13thApril2023 PDFDocument10 pagesMOStMarketOutlook13thApril2023 PDFLakhan SharmaNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchjaimaaganNo ratings yet

- Technical Report 25th October 2011Document5 pagesTechnical Report 25th October 2011Angel BrokingNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchshobhaNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- Nifty sideways as ascending triangle hints at upside breakoutDocument3 pagesNifty sideways as ascending triangle hints at upside breakoutumaganNo ratings yet

- Technical Report 28th March 2012Document5 pagesTechnical Report 28th March 2012Angel BrokingNo ratings yet

- MOStMarketOutlook26thMarch2024Document10 pagesMOStMarketOutlook26thMarch2024Sandeep JaiswalNo ratings yet

- Morning Market Outlook and Investment IdeasDocument10 pagesMorning Market Outlook and Investment IdeasLakhan SharmaNo ratings yet

- Daily Derivatives: January 25, 2017Document3 pagesDaily Derivatives: January 25, 2017choni singhNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 14 TH February 2024Document10 pagesMOSt Market Outlook 14 TH February 2024Sandeep JaiswalNo ratings yet

- MOStMarketOutlook20thMarch2024Document10 pagesMOStMarketOutlook20thMarch2024Sandeep JaiswalNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchDinesh ChoudharyNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- Technical Report 24th April 2012Document5 pagesTechnical Report 24th April 2012Angel BrokingNo ratings yet

- Technical Report 2nd March 2012Document5 pagesTechnical Report 2nd March 2012Angel BrokingNo ratings yet

- Technical Report 28th February 2012Document5 pagesTechnical Report 28th February 2012Angel BrokingNo ratings yet

- Technical Report 24th February 2012Document5 pagesTechnical Report 24th February 2012Angel BrokingNo ratings yet

- Technical Report 27th January 2012Document5 pagesTechnical Report 27th January 2012Angel BrokingNo ratings yet

- MOSt Market Outlook 24 TH March 2023Document10 pagesMOSt Market Outlook 24 TH March 2023Hola GamerNo ratings yet

- Daily Technical Report - 02 May 2022 - 02-05-2022 - 08Document5 pagesDaily Technical Report - 02 May 2022 - 02-05-2022 - 08vikalp123123No ratings yet

- Daily Derivatives: November 19, 2015Document3 pagesDaily Derivatives: November 19, 2015choni singhNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail Researcharun_algoNo ratings yet

- Technical Report 3rd February 2012Document5 pagesTechnical Report 3rd February 2012Angel BrokingNo ratings yet

- Sectoral Index Report Banking 07042020 202004070809432449396 PDFDocument4 pagesSectoral Index Report Banking 07042020 202004070809432449396 PDFflying400No ratings yet

- Technical Report 19th October 2011Document5 pagesTechnical Report 19th October 2011Angel BrokingNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- Daily DerivativesDocument3 pagesDaily Derivativeschoni singhNo ratings yet

- MOStMarketOutlook3rdApril2024Document10 pagesMOStMarketOutlook3rdApril2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOStMarketOutlook28thMarch2024Document10 pagesMOStMarketOutlook28thMarch2024Sandeep JaiswalNo ratings yet

- Simple Mouse ClickDocument1 pageSimple Mouse ClickshobhaNo ratings yet

- Report PDFDocument16 pagesReport PDFshobhaNo ratings yet

- Simple RectangleDocument1 pageSimple RectangleshobhaNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- Report PDFDocument16 pagesReport PDFshobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 27 December, 2016Document6 pagesHSL PCG "Currency Daily": 27 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchshobhaNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchshobhaNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

- ReportDocument16 pagesReportshobhaNo ratings yet

- ReportDocument5 pagesReportshobhaNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchshobhaNo ratings yet

- Currency Daily: Rupee Depreciation on Card After Fed's Rate HikeDocument6 pagesCurrency Daily: Rupee Depreciation on Card After Fed's Rate HikeshobhaNo ratings yet

- Report PDFDocument4 pagesReport PDFshobhaNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- ReportDocument16 pagesReportshobhaNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchshobhaNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- Rupee Cheers as Carry Intact with RBI’s Status QuoDocument6 pagesRupee Cheers as Carry Intact with RBI’s Status QuoshobhaNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- Corporate Event Tracker January 2017Document1 pageCorporate Event Tracker January 2017shobhaNo ratings yet

- ReportDocument6 pagesReportshobhaNo ratings yet

- Nocil LTD: Retail ResearchDocument14 pagesNocil LTD: Retail ResearchDinesh ChoudharyNo ratings yet

- Advanced Accounting Test Bank Questions Chapter 8Document19 pagesAdvanced Accounting Test Bank Questions Chapter 8Ahmed Al EkamNo ratings yet

- Fdocuments - in A Project Report On The Analysis and Comparative Study of Sbi and HDFC MutualDocument88 pagesFdocuments - in A Project Report On The Analysis and Comparative Study of Sbi and HDFC Mutualparmeen singhNo ratings yet

- Financial Management - Capital BudgetingDocument34 pagesFinancial Management - Capital BudgetingPravallika ValivetiNo ratings yet

- Chapter 2Document9 pagesChapter 2api-25939187No ratings yet

- Advanced Business Calculations Level 3/series 4-2009Document11 pagesAdvanced Business Calculations Level 3/series 4-2009Hein Linn Kyaw75% (4)

- Sarana Meditama Metropolitan (Q4 - 2017)Document93 pagesSarana Meditama Metropolitan (Q4 - 2017)Wihelmina DeaNo ratings yet

- Intraday IndicatorDocument7 pagesIntraday IndicatoremailtodeepNo ratings yet

- Fin 365 Individual Assignment Muhd Sharizan (2020453984)Document3 pagesFin 365 Individual Assignment Muhd Sharizan (2020453984)mohd ChanNo ratings yet

- Forex Calendar at Forex FactoryDocument2 pagesForex Calendar at Forex FactoryMuhamad SochabasNo ratings yet

- Understanding India VIX: Implications of Rising and Falling VolatilityDocument6 pagesUnderstanding India VIX: Implications of Rising and Falling VolatilitysuryaNo ratings yet

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraNo ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisRAKESH SINGHNo ratings yet

- The 5 Most Powerful Candlestick PatternsDocument12 pagesThe 5 Most Powerful Candlestick PatternsfikeiNo ratings yet

- Equity AnalysisDocument90 pagesEquity AnalysisAbhishek SaxenaNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Cfin 6th Edition Besley Test BankDocument15 pagesCfin 6th Edition Besley Test Bankdrkevinlee03071984jki100% (26)

- Case 11 Financial ForecastingDocument9 pagesCase 11 Financial ForecastingFD ReynosoNo ratings yet

- Stress Testing at Major Financial Institutions:: Survey Results and PracticeDocument46 pagesStress Testing at Major Financial Institutions:: Survey Results and Practicebing mirandaNo ratings yet

- Far Compiled Reviewer PDF FreeDocument33 pagesFar Compiled Reviewer PDF FreeRhyna Vergara SumaoyNo ratings yet

- Ira Sohn Presentation 2014.05.05Document111 pagesIra Sohn Presentation 2014.05.05Zerohedge50% (2)

- Salomon Brothers Understanding Yield Curve Part 2 Market's Rate Expectatios and Forward RatesDocument23 pagesSalomon Brothers Understanding Yield Curve Part 2 Market's Rate Expectatios and Forward Ratesfengw89No ratings yet

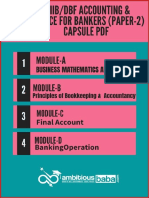

- JAIJAIIB Paper 2 CAPSULE PDF 2.O Accounting Finance For Bankers by Ambitious BabaDocument159 pagesJAIJAIIB Paper 2 CAPSULE PDF 2.O Accounting Finance For Bankers by Ambitious BabaSaurabhNo ratings yet

- Analyze Capital Structure With Ratios And RiskDocument35 pagesAnalyze Capital Structure With Ratios And RiskArly Kurt TorresNo ratings yet

- FRTB Ey ReviewDocument8 pagesFRTB Ey Review4GetM100% (1)

- Practice Questions: Problem 1.1Document6 pagesPractice Questions: Problem 1.1Micah Ng100% (1)

- Abbvie Inc. earnings and valuationDocument1 pageAbbvie Inc. earnings and valuationderek_2010No ratings yet

- Business FinanceDocument5 pagesBusiness FinanceJojie Mae GabunilasNo ratings yet

- Factors Behind The Rapid Growth in Financial EngineeringDocument3 pagesFactors Behind The Rapid Growth in Financial EngineeringCT SunilkumarNo ratings yet

- Financial Ratios FormulaDocument2 pagesFinancial Ratios FormulaAlthea AcidreNo ratings yet

- Selling Nifty Weekly Options Intraday Using Point &Document84 pagesSelling Nifty Weekly Options Intraday Using Point &Sachin Screener100% (1)