Professional Documents

Culture Documents

INVESTMENTS: KEY FINANCIAL CONCEPTS

Uploaded by

Julrick Cubio Egbus0 ratings0% found this document useful (0 votes)

15 views3 pageshere

Original Title

3a Questions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthere

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesINVESTMENTS: KEY FINANCIAL CONCEPTS

Uploaded by

Julrick Cubio Egbushere

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

INVESTMENTS:

THEORY

Financial Instrument

1. Which of the following is not a financial asset?

a. Cash

b. An equity instrument of another equity

c. A contract that may or will be settled in the entitys own instrument and is

not classified as an equity instrument of the entity

d. Prepaid expenses

ANSWER: D

2. The components of market risk are

a. Credit risk and liquidity risk

b. Currency risk and credit risk

c. Interest rate risk and currency risk

d. Liquidity risk and currency risk

ANSWER: C

Financial Assets @ FV

3. Which of the following is not a category of financial assets?

a. Financial assets at fair value through profit and loss

b. Financial assets at fair value through other comprehensive income

c. Financial assets at amortized cost

d. Financial assets held for sale

ANSWER: D

Investment in Equity Security

4. It is the date on which the stock and transfer book of the entity is closed for

registration. Only those shareholders registered as this date are entitled to

receive dividends.

a. Date of declaration

b. Date of record

c. Date of payment

d. Date of mailing the dividend check

ANSWER: B

PROBLEMS

Financial Assets @ FV

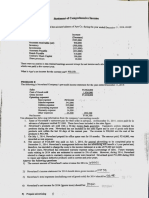

1. HALA Company acquired a financial instrument for P 4000000 on March 31,

2014. The financial instrument is classified as financial asset at fair value

through other comprehensive income. The direct acquisition costs incurred

amounted to P 700000. On December 31, 2014, the fair value of the

instrument was P 5500000 and the transaction costs that would be incurred

on the sale of the investment are estimated at P 600000. What gain should

be recognized in other comprehensive income for the year ended December

31, 2014?

a. 200000

b. 900000

c. 0

d. 800000

ANSWER: D

2. During 2014, NAHULOG Company purchased marketable equity securities as

a trading investment. For the year ended December 31, 2014, the entity

recognized an unrealized loss of P 230000.

There were no security transactions during 2015. Pertinent information on

December 31, 2015 is as follows:

Security Cost Market Value

A 2450000 2300000

B 1800000 1820000

4250000 4120000

In the 2015 income statement, what should be the reported as unrealized

gain or loss?

a. Unrealized gain of P 130000

b. Unrealized loss of P 100000

c. Unrealized loss of P 130000

d. Unrealized gain of P 100000

ANSWER: D

Investment in Equity Security

3. On January 1, 2014, ONLY BINAY Company purchased 40000 shares of RST at

P 100 per share. The investment is measured at fair value through other

comprehensive income. Brokerage fees amounted to P 120000. A P 5

dividend per share RST had been declared on December 1, 2013, to be paid

on March 31, 2014 to shareholders of record on January 31, 2014. No other

transactions occurred in 2014 affecting the investment in RST shares. What is

the initial measurement of the investment?

a. 4000000

b. 4120000

c. 3800000

d. 3920000

ANSWER: D

4. On March 1, 2014, MAR Company purchased 10000 ordinary shares of

DUTERTE at P 80 per share. On September 30, 2014, MAR received 110000

stock rights to purchase an additional 10000 shares at P 90 per share. The

stock rights had an expiration date on February 1, 2015. On September 30,

2014, DUTERTEs share had a market value P 95 and the stock right had a

market value of P 5. What amount should right had a market value of P 5.

What amount should be reported on September30, 2014 for investment in

stock rights?

a. 150000

b. 100000

c. 60000

d. 50000

ANSWER: D

You might also like

- Cpa Review School - Prac 1Document12 pagesCpa Review School - Prac 1jikee1150% (2)

- Substantive Audit of Investments CHAPTER 15 16Document8 pagesSubstantive Audit of Investments CHAPTER 15 16Nexxus BaladadNo ratings yet

- Substantive Audit of Investments 2 CHAPTER 17Document4 pagesSubstantive Audit of Investments 2 CHAPTER 17Nexxus BaladadNo ratings yet

- Financial Accounting and ReportingDocument5 pagesFinancial Accounting and ReportingJustine JaymaNo ratings yet

- Theory - Ias32Document2 pagesTheory - Ias32Dj RedNo ratings yet

- ACC-108-Prov-conting-prem-warrantDocument4 pagesACC-108-Prov-conting-prem-warrantGhie RodriguezNo ratings yet

- Audit of Liabilities (Diagnostic Exam)Document4 pagesAudit of Liabilities (Diagnostic Exam)Lyca MaeNo ratings yet

- BS & Is (Questions)Document7 pagesBS & Is (Questions)Dale JimenoNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- 7th Pylon Cup Final Round SGVDocument11 pages7th Pylon Cup Final Round SGVrcaa04No ratings yet

- 8th PICPA National Accounting Quiz ShowdownDocument28 pages8th PICPA National Accounting Quiz Showdownrcaa04No ratings yet

- HGdghdhaghgadDocument9 pagesHGdghdhaghgadJohn Brian D. SorianoNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- Paper F7. Financial ReportingDocument5 pagesPaper F7. Financial ReportingNub ChetNo ratings yet

- Paper F7. Financial ReportingDocument6 pagesPaper F7. Financial ReportingNub ChetNo ratings yet

- Midterm SheDocument5 pagesMidterm SheKaye Delos SantosNo ratings yet

- Financial Accounting Vol.3 ADocument10 pagesFinancial Accounting Vol.3 ALovely Lorelie Del Mundo Planos29% (14)

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocument13 pagesAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNo ratings yet

- Auditing Cup FINALS Nfjpia Bsa CpaDocument13 pagesAuditing Cup FINALS Nfjpia Bsa CpaJohn LuNo ratings yet

- P1 AnswerKeyDocument8 pagesP1 AnswerKeyscrapped prince100% (2)

- Financial Accounting Final Term AssignmentDocument6 pagesFinancial Accounting Final Term AssignmentMaketh.Man33% (3)

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocument10 pagesResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Prequalifying Exam Level 1 Set B AK FSUU AccountingDocument9 pagesPrequalifying Exam Level 1 Set B AK FSUU AccountingRobert CastilloNo ratings yet

- Far JpiaDocument14 pagesFar JpiaJNo ratings yet

- Review Accounting Cash Accrual ConceptsDocument4 pagesReview Accounting Cash Accrual ConceptsForkenstein0% (1)

- Afar JpiaDocument18 pagesAfar JpiaRaraColladoNo ratings yet

- ACC 107 Practice ExamDocument29 pagesACC 107 Practice ExamAJ Jahara GapateNo ratings yet

- Quizzer With Answer PDFDocument6 pagesQuizzer With Answer PDFGamers HubNo ratings yet

- Noncurrent Asset Held For Sale Multiple Choice: A. B. C. DDocument5 pagesNoncurrent Asset Held For Sale Multiple Choice: A. B. C. Dlinkin soyNo ratings yet

- Calculating Carrying Value of InvestmentsDocument3 pagesCalculating Carrying Value of InvestmentsJeric IsraelNo ratings yet

- Accounting For Investments: TheoriesDocument20 pagesAccounting For Investments: TheoriesJohn AlbateraNo ratings yet

- Afar JpiaDocument18 pagesAfar JpiaAken Lieram Ats AnaNo ratings yet

- 004 Investments 2018Document13 pages004 Investments 2018Anonymous 2Qp0oYN0% (1)

- Audit of Liabilities QuizDocument2 pagesAudit of Liabilities QuizCattleyaNo ratings yet

- This Study Resource Was: Audit of Liabilities Case 1Document9 pagesThis Study Resource Was: Audit of Liabilities Case 1Alexandra Nicole IsaacNo ratings yet

- pg.565-593 of Financial Accounting Book 2014 ValixDocument29 pagespg.565-593 of Financial Accounting Book 2014 ValixPeter Paul Enero Perez50% (2)

- AFAR - Forex 2019Document3 pagesAFAR - Forex 2019Joanna Rose DeciarNo ratings yet

- Consolidation Case SolutionsDocument3 pagesConsolidation Case SolutionsMarcus ReyesNo ratings yet

- The Review Schooj. of AccountancyDocument17 pagesThe Review Schooj. of AccountancyYukiNo ratings yet

- Book Value Per Share TQDocument6 pagesBook Value Per Share TQIvy SaliseNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasLayNo ratings yet

- 1st Long Quiz With AnswersDocument9 pages1st Long Quiz With Answersrochielanciola50% (4)

- Financial Accounting III Midterm ExaminationDocument9 pagesFinancial Accounting III Midterm ExaminationKriz-leen TiuNo ratings yet

- Level 1 Questions FinalDocument10 pagesLevel 1 Questions FinalExequielCamisaCrusperoNo ratings yet

- QUIZ - Financial Instruments: Key TermsDocument6 pagesQUIZ - Financial Instruments: Key TermsJessaNo ratings yet

- 2.2.1 Notes To Financial StatementsDocument2 pages2.2.1 Notes To Financial Statementsjoint accountNo ratings yet

- Lecture15 - Error CorrectionDocument2 pagesLecture15 - Error Correctionjsus22No ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- Guided Exercises Current Liabilities.pdfDocument4 pagesGuided Exercises Current Liabilities.pdflexfred55No ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- 009 Cash Basis Accrual BasisDocument4 pages009 Cash Basis Accrual BasisRosanna Romanca50% (2)

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Investment Property and Other InvestmentsDocument4 pagesInvestment Property and Other InvestmentsMiguel MartinezNo ratings yet

- Bfjpia Cup 2 - Practical Accounting 1 Easy: Page 1 of 10Document10 pagesBfjpia Cup 2 - Practical Accounting 1 Easy: Page 1 of 10kristelle0marisseNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Feasibility Study: Misamis UniversityDocument5 pagesFeasibility Study: Misamis UniversityJulrick Cubio EgbusNo ratings yet

- ApplicantDocument1 pageApplicantJulrick Cubio EgbusNo ratings yet

- Bsa BoothDocument1 pageBsa BoothJulrick Cubio EgbusNo ratings yet

- A Home Office InventoryDocument1 pageA Home Office InventoryJulrick Cubio EgbusNo ratings yet

- HouseOfFrey (BucketListMAINPLAN3)Document2 pagesHouseOfFrey (BucketListMAINPLAN3)Julrick Cubio EgbusNo ratings yet

- Comprehensive P1 HandoutsDocument16 pagesComprehensive P1 HandoutsBea Baclig100% (4)

- Worldcom Accounting Scandal: SynopsisDocument16 pagesWorldcom Accounting Scandal: SynopsisJulrick Cubio EgbusNo ratings yet

- Issues: Fs - ActualizationDocument2 pagesIssues: Fs - ActualizationJulrick Cubio EgbusNo ratings yet

- La Salle University Property and Purchasing Systems AuditDocument3 pagesLa Salle University Property and Purchasing Systems AuditJulrick Cubio EgbusNo ratings yet

- Bsa BoothDocument1 pageBsa BoothJulrick Cubio EgbusNo ratings yet

- Guide To Qualifying ExamsDocument4 pagesGuide To Qualifying ExamsGSUPolSciNo ratings yet

- La Salle University Property and Purchasing Systems AuditDocument3 pagesLa Salle University Property and Purchasing Systems AuditJulrick Cubio EgbusNo ratings yet

- Bsa BoothDocument1 pageBsa BoothJulrick Cubio EgbusNo ratings yet

- Auditing ProblemsDocument53 pagesAuditing ProblemsZerjo Cantalejo0% (1)

- God's Plan For Marriage Is To Reflect His Image: Genesis 1:26-28Document2 pagesGod's Plan For Marriage Is To Reflect His Image: Genesis 1:26-28Julrick Cubio EgbusNo ratings yet

- Supervision, Blind Fields, 3-Way MatchDocument3 pagesSupervision, Blind Fields, 3-Way MatchJulrick Cubio EgbusNo ratings yet

- QuantiDocument2 pagesQuantiJulrick Cubio EgbusNo ratings yet

- Chapter3 (MAS2)Document2 pagesChapter3 (MAS2)Julrick Cubio EgbusNo ratings yet

- Bsa BoothDocument6 pagesBsa BoothJulrick Cubio EgbusNo ratings yet

- HOUSEof FREYDocument1 pageHOUSEof FREYJulrick Cubio EgbusNo ratings yet

- Lycee AdScriptDocument1 pageLycee AdScriptRhett SageNo ratings yet

- House of FreyDocument4 pagesHouse of FreyJulrick Cubio EgbusNo ratings yet

- WHIZ KiDZ Activity April 2018 ReportDocument1 pageWHIZ KiDZ Activity April 2018 ReportJulrick Cubio EgbusNo ratings yet

- Part 4Document1 pagePart 4Julrick Cubio EgbusNo ratings yet

- Effect of Enron Scandal on Filipino CPAsDocument2 pagesEffect of Enron Scandal on Filipino CPAsJulrick Cubio EgbusNo ratings yet

- House of Frey Activities GuideDocument1 pageHouse of Frey Activities GuideJulrick Cubio EgbusNo ratings yet

- Written Reprimand for Attendance and PerformanceDocument4 pagesWritten Reprimand for Attendance and PerformanceJulrick Cubio EgbusNo ratings yet

- HouseOfFrey (BucketList)Document1 pageHouseOfFrey (BucketList)Julrick Cubio EgbusNo ratings yet

- Ang Appurtenant Kay Parehas Man Ata Na Sa Silingan NamoDocument3 pagesAng Appurtenant Kay Parehas Man Ata Na Sa Silingan NamoJulrick Cubio EgbusNo ratings yet

- Bsa BoothDocument6 pagesBsa BoothJulrick Cubio EgbusNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisJasper Briones IINo ratings yet

- Capital Budgeting MethodsDocument19 pagesCapital Budgeting MethodsAnonymous KYjEOO2nGNo ratings yet

- Format of GPF Calculation: Month Subscription Refund Arrears Total Deposit Withdrawal ProgressiveDocument1 pageFormat of GPF Calculation: Month Subscription Refund Arrears Total Deposit Withdrawal ProgressivebhajjiNo ratings yet

- HAL Presentation Jan 2017Document31 pagesHAL Presentation Jan 2017Sujatha LokeshNo ratings yet

- ReillyDocument20 pagesReillyLalitha Janaki Chamarty0% (1)

- Details of State Pension SchemesDocument30 pagesDetails of State Pension SchemesBoreda RahulNo ratings yet

- A Guide To Investing in Closed-End Funds: Key PointsDocument4 pagesA Guide To Investing in Closed-End Funds: Key Pointsemirav2No ratings yet

- Taxation NotesDocument27 pagesTaxation NotesRound RoundNo ratings yet

- 3.1.2 The Allocation of Resources in Competitive MarketsDocument5 pages3.1.2 The Allocation of Resources in Competitive MarketsFattyschippy1No ratings yet

- S. Peter Lebowitz and Theresa Lebowitz v. Commissioner of Internal Revenue, 917 F.2d 1314, 2d Cir. (1990)Document10 pagesS. Peter Lebowitz and Theresa Lebowitz v. Commissioner of Internal Revenue, 917 F.2d 1314, 2d Cir. (1990)Scribd Government DocsNo ratings yet

- Pricing of Holiday MarketDocument24 pagesPricing of Holiday MarketRabikumar HawaibamNo ratings yet

- Research Grant GuidelinesDocument12 pagesResearch Grant GuidelinessckamoteNo ratings yet

- Covivio Hotels Bond Investor PresentationDocument57 pagesCovivio Hotels Bond Investor PresentationTung NgoNo ratings yet

- Financial Management Practices of Small Firms in Ghana:-An Empirical Study. BY Ben K. Agyei-MensahDocument24 pagesFinancial Management Practices of Small Firms in Ghana:-An Empirical Study. BY Ben K. Agyei-MensahLaylyDwi_RNo ratings yet

- CA PE II SyllabusDocument9 pagesCA PE II SyllabusdeeptimanneyNo ratings yet

- Rbi 8 % Bond TdsDocument3 pagesRbi 8 % Bond TdssunnycccccNo ratings yet

- Aaya PrakaranaDocument10 pagesAaya Prakaranaking1q100% (1)

- Viva Africa Consulting ProfileDocument9 pagesViva Africa Consulting ProfileNyandia KamaweNo ratings yet

- CH 07Document99 pagesCH 07homeboimartinNo ratings yet

- Rocco S Gourmet Foods Inc Provides The Following Data From TheDocument2 pagesRocco S Gourmet Foods Inc Provides The Following Data From TheMuhammad ShahidNo ratings yet

- Statements of Cash FlowsDocument23 pagesStatements of Cash FlowslesterNo ratings yet

- Insurance Commission Ruling on Life Insurance ClaimsDocument8 pagesInsurance Commission Ruling on Life Insurance ClaimsMarioneMaeThiamNo ratings yet

- Earn $1,100 Per Week Through Risk Free Arbitrage BettingDocument19 pagesEarn $1,100 Per Week Through Risk Free Arbitrage Bettingsnpatel171100% (1)

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Document2 pagesJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- M&A Intro by Prof. Rahul KavishwarDocument51 pagesM&A Intro by Prof. Rahul Kavishwarsalman parvezNo ratings yet

- Fci 132 Accounts - Finance PaperDocument15 pagesFci 132 Accounts - Finance PapersukanyaNo ratings yet

- Chapter 17 Flashcards - QuizletDocument34 pagesChapter 17 Flashcards - QuizletAlucard77777No ratings yet

- Fabozzi Fofmi4 Ch28 ImDocument15 pagesFabozzi Fofmi4 Ch28 ImAndreea ConoroNo ratings yet

- Tata Vs HyundaiDocument49 pagesTata Vs HyundaiAnkit SethNo ratings yet