Professional Documents

Culture Documents

MIS Project

Uploaded by

umar ajmalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MIS Project

Uploaded by

umar ajmalCopyright:

Available Formats

MIS of NBP

ACKNOWLEDGEMENT

I have taken effort in this project however; it would not have been

possible without the kind of support and help of many individuals and

organization. I would like to extend my sincere thanks to all of them.

I am highly indebted to the NATIONAL BANK OF PAKISTAN for their

guides and constant supervision as well as providing necessary

information regarding project and also for their support in completing the

project.

I would like to express my gratitude towards my parents and members of

NATIONAL BANK OF PAKISTAN for their kind co-operation and

encouragement which help me in the completion of this project.

I would like to express my special gratitude and thanks to bank persons

for giving me such attention and time.

My thanks and appreciations also go to my colleague in developing the

project and people who have willingly helped me out with their abilities.

TABLE OF CONTENTS

Introduction03

Back ground of organization.05

History of NBP05

Current status of NBP..06

Organization structure...07

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

1

MIS of NBP

Main business activities.08

Information system..08

Current structure of IS.08

IS of Business..09

Business IS strategies.09

Challenges.09

New techniques.09

Number of employees.09

Number of branches..09

Supply of products.09

Security machines..09

Number of accounts and procedure.10

Interest rate system10

Number of departments.10

Competitors.10

Help line facilities10

Employees benefits.10

Joint venture.10

Promotion procedure10

Manager scale....10

Conclusion..10

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

2

MIS of NBP

Introduction

In this project we discuss about the management information system of NATIONAL BANK OF

PAKISTAN. Our objective in this project how NATIONAL BANK OF PAKISTAN maintain

records and how they made their transactions with the help of IS and NATIOAL BANK OF

PAKISTAN information technology achievement .NBP is a multinational organization which is

spread in all over the world. In this project we try to best to find the relevant and proper

information from the organization employee about management information system.

Objectives of Studying the Organization

The study is proposed to be carried out to achieve the following objectives:

A Primary objective

To meet the requirements of the MBA (Finance) degree (internship).

This study is our academic interest and will be helpful in our future life.

will become the foundation of future studies.

B Secondary objective

To analyze the present system of NBP to find out the effectiveness of the current

system.

to identify the problems/weaknesses of any kind.

operates its financial functions.

Types of services for its customers.

Finding out the appropriate solutions and give my suggestions to eliminate the

dilemma.

To apply theoretical concepts in practical aspects.

how they manage their working capital and credit policies.

To get awareness about the business development & financial techniques.

To analyze the proper management system of the organization.

To analyze the financial review of the bank as well as critical analysis of financial

statements.

To analyze the use of technology to ensure the cost effective operations. Efficient

management information system and service standard of the organization. As an

internee main focus of my study research was on procedures which are used in

NBP.

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

3

MIS of NBP

Project Title: Management Information System of NBP

Group Leader: Umar Ajmal

Project Members:

Name Registration Email Address Signature

Umar Ajmal MBAF13M048 Umarajmal03@gmail.com

Muhammad Kamran MBAF13M003 Kamrankamii6@gmail.com

Faisal Latif MBAF13M042 -----------------------------

Project Goal: Our project goal to known about the service, structure and information system

of National Bank Of Pakistan.

Organization Address: Zia-Ul-Haq Road, Main office, Gujranwala.

Date: 28-5-2014

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

4

MIS of NBP

History of NBP

1949 National Bank of Pakistan (NBP) was established under the National Bank

of Pakistan Ordinance of 1949 and was government-owned. NBP acted as an

agent of the central bank wherever the State Bank did not have its own branch. It

also undertook government treasury operations. Its first branches were

in jute growing areas in East Pakistan. Offices in Karachi and Lahore followed.

1950 NBP established a branch in Jeddah, Saudi Arabia.

1955 By this time NBP had branches in London and Calcutta.

1957 NBP established a branch in Baghdad, Iraq.

1962 NBP established a branch in Dar es Salaam, Tanganyika.

1964 The Iraqi government nationalized NBP's Baghdad branch.

1965 The Indian government seized the Calcutta branch on the outbreak of

hostilities between India and Pakistan.

1967 The Tanzanian government nationalized the Dares Salaam branch.

1971 NBP acquired Bank of China's two branches, one in Karachi and one

at Chittagong. At separation of East Pakistan NBP lost its branches there. NBP

merged with Eastern Mercantile Bank and with Eastern Bank Corporation.

1974 The government of Pakistan nationalized NBP. As part of the concomitant

consolidation of the banking sector, NBP acquired Bank of Bahawalpur.

1977 NBP opened an offshore brain Cairo.

1994 NBP amalgamated Mehran Bank.

1997 NBP branch in Ashgabat, Turkmenistan commenced operations.

2000 NBP opened a representative office in Almaty, Kazakhstan.

2001 State Bank of Pakistan and Bank of England agree to allow only 2 Pakistani

banks to operate in the UK. NBP and United Bank agreed to merge their operations

to form Pakistan International Bank, of which NBP would own 45% and United

Bank 55%.

2002 Pakistan International Bank renamed itself United National Bank Limited

(UNB). The ownership structure of the UNB remained as before. The only change to

the shareholding structure is that UNB had recently been privatized in Pakistan and

was now owned 49% by the Government of Pakistan and 51% by a joint foreign

consortium of Abu Dhabi.

2003 NBP opened its branch in Kabul, and the first ATM in Afghanistan was

installed there.

2005 NBP closed its offshore branch in Cairo.

2010 NBP opened its branch in Karaganda (Kazakhstan.

2011 NBP opened its representative office in Toronto (Canada).

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

5

MIS of NBP

Current status

The National Bank of Pakistan (NBP) is one of the largest commercial bank operating

in Pakistan. It has redefined its role and has moved from a public sector organization into

a modern commercial bank. While it continues to act as trustee of public funds and as

the agent to the State Bank of Pakistan (in places where SBP does not have a presence)

it has diversified its business portfolio and is today a major lead player in the debt equity

market, corporate investment banking, retail and consumer banking, agricultural

financing, treasury services and is showing growing interest in promoting and developing

the country's small and medium enterprises and at the same time fulfilling its social

responsibilities, NBP headquarters in Karachi, Pakistan with over 1,280 branches

country wide (in December 2012). The bank provides both commercial and public sector

banking services. It has assets worth USD 12.293 billion in 2007. It has offloaded 23.2

percent share in the stock market, and while it has not been completely privatized like

the other three public sector banks, partial privatization has taken place. It is now listed

on the Karachi Stock Exchange. The national bank of Pakistan rank number one in ASIA

and number 10 in the world according to 2010.

Organization structure:

Chairman

Board of directors

Main Head office

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

6

MIS of NBP

Provincial head quarters

Regional head

Branches

Main business activities

Pay Order

NBP provides another reason to transfer your money using our facilities. Our pay orders are a secure and easy

way to move your money from one place to another. And, as usual, our charges for this service are extremely

competitive.

Traveler's Cheques

Negotiability:

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

7

MIS of NBP

Letter of Credit

NBP is committed to offering its business customers the widest range of options in the area of

money transfer. If you are a commercial enterprise then our Letter of Credit service is just what

you are looking for. With competitive rates, security, and ease of transaction, NBP Letters of

Credit are the best way to do your business transactions

Demand drafts

You are looking for a safe, speedy and reliable way to transfer money, you

can now purchase NBP's Demand Drafts at very reasonable rates. Any person

whether an account holder of the bank or not, can purchase a Demand Draft

from a bank branch.

Mail Transfer

Move your money safely and quickly using NBP Mail Transfer service. And we

also offer the most competitive rates in the market .

IS structure of NBP

With its 1341 online branches, NBP has become the largest bank with

100% online branch network.

NBP has increased its number of ATMs to 375 in 2013 that was 254 in

2011.

Automation and centralization of EOBI pension payments to facilitate

EOBI pensioners to withdraw pension from any NBP branch.

Centralization of local remittances like DD, MT, PO for every branch that

enhanced security and reliability of system and improved efficiency by

eliminating the manual processes.

Enhancement in EBS to automatically incorporate IBAN in statement of

Accounts.

Data Capture module for Govt. Pension System is live in 151 branches.

SMS alerts services project implemented and made live at pilot.

IS of NBP

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

8

MIS of NBP

All types of accounts are maintained on the spread sheet and they use SPSS software. All

branches are connected through intranet, extranet, and intranet. NBP use protects account

software which protects the all accounts of the customer. The customer can received her foreign

remittance with the help of western union. Each customer has unique pin code. The customer can

draw her amount from bank within 2or3 minutes.

Central information function (CFI) for the internal control system. All customer accounts

information creates a backup. All employees have unique email account. All relevant information

about employee sends on its ID. Balance inquiry through online is available. The NBP used wide

area network.

Challenges of IS

NBP face big challenges in IT now days. Due to old employee they fail to introduce the

information system. Heavy amount are required to introduce the information system. And there is

big reason that there is no permanent employees.

IS techniques

NBP now days are going to introduce core banking system. This is totally paper less working.

And NBP are going to introduce a website which iswww.nbpwelfisher.com. Which provide online

help to customer?

Number of Employee

The number of employee of NBP is more than 15000. And nearby 1200 employee are working in

the Gujranwala region. And average number of employees in one branch is 7.

Number of Branches

NBP matins its position as Pakistan premier bank with a network of over 1310 branches in

Pakistan, 23 overseas, 9 National and inter National subsidiaries and 10 Regional representative

office all over the world. 59 branches are working in Gujranwala region.

Supply of Products

These are following major products of NBP. Premium Aamdani, Premium Saver, Saiban, Advance

salary, cash card, Investor advantage, cash in gold, kisan Taqat , kisan dost and Pak Renit etc

Security Machines

Checking made of those people who enter in the bank with the help detector or walk through gate.

And pin code security system on the cash lock. And security cameras are also used for checking.

No. of Accounts and procedure

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

9

MIS of NBP

These are generally three main types of accounts are opened which are profit & loss, fixed saving

account and current account. These accounts are opened within 10 or 15 days.

Interest Rate System

These are following type of interest. 15.5% interest is charged on the gold and 9.5% interest

charged on advance salary. 10% interest provide on the fixed account. Interest on profit and loss

account provide if amount continuously 6 days in account.

No. of Departments

These are following departments which are corporation of finance, consumer banking,

Transactional banking, operations department, software development and automation, Financial

control, Internal Audit, Risk Management and credit, Economic & Business research, Training

and Development, strategic planning and HR department.

Competitor

All commercial banks are competitor of the NATIONAL BANK OF PAKISTAN. But UBL,

HBL, MCB are big competitor of NBP.

Help line facility

NBP provide help line facility which is (111-627-627) in this help line 1200 call received by bank.

Bank also provides help on website which is www.nbp.com.

Employee benefit

Different type of loan facilities are provided to employees and bonces and promotion are also

made to employees. Insurance is also made for employee who is valid at the age of 65. Pension is

also providing to employee after retirement. Free medical facilities are providing on job and after

retirement.

Joint venture

NBP also have a joint venture with UBL in U.K, with name of Pakistan International Bank (U.K)

LTD., with seven branches main branch at London, Glasgow branch, Bradford branch, Sheffield

branch, Birmingham branch and Knights Bridge branch (London).

Promotion Procedure

The promotion depend on qualification and employee appraisal report.

Manger scale

The manger is divided in to two categories. In some branches the scale of manger are OG 1 and

OG 2 but in main branch manager are AVP. These manger scales are equal to (17, 18, and 19)

scale respectively.

Conclusion

In the end of our project we conclude that management information system is so effective rather

than other banks. In this project we try to discuss all function of NBP. In the end we thanks to

those entire employee who provide information about our project.

Department of Management Sciences, University Of Sargodha, Gujranwala Campus.

10

You might also like

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Internship Report National Bank of Pakistan and Its Nearest GuidelinesDocument67 pagesInternship Report National Bank of Pakistan and Its Nearest GuidelinesAbaid SandhuNo ratings yet

- Internship Report On National Bank of Pakistan C Branch MansehraDocument67 pagesInternship Report On National Bank of Pakistan C Branch MansehraFaisal AwanNo ratings yet

- Internship Report: On National Bank of PakistanDocument71 pagesInternship Report: On National Bank of PakistanChaudaxy XUmarNo ratings yet

- Internship Report MCB Bank LTDDocument100 pagesInternship Report MCB Bank LTDSajidp78663% (16)

- Internship Report On MCB Bank LimitedDocument41 pagesInternship Report On MCB Bank LimitedAmanullah KhanNo ratings yet

- INTERNSHIP REPORT ON MCB BANK LIMITED,,lastDocument84 pagesINTERNSHIP REPORT ON MCB BANK LIMITED,,lastHaris KhakwaniNo ratings yet

- Bank Al-Habib Limited Deciding Which Way To Go MovDocument14 pagesBank Al-Habib Limited Deciding Which Way To Go MovSayed Atif HussainNo ratings yet

- MCB ReportDocument40 pagesMCB ReportMuzammil Iqbal Qaim KhaniNo ratings yet

- Bank AlhabibDocument16 pagesBank Alhabibamtulbaseer0% (1)

- MCB Presentation For SubmissionDocument79 pagesMCB Presentation For SubmissionAfshan HabibNo ratings yet

- MCB Final ReportDocument17 pagesMCB Final ReportkamranNo ratings yet

- Internship Report of Js BankDocument67 pagesInternship Report of Js BankSalahaudin67% (3)

- MCB Internship ReportDocument31 pagesMCB Internship ReportShakeel QureshiNo ratings yet

- Bank Alfalah Internship ReportDocument35 pagesBank Alfalah Internship ReportTAS_ALPHA100% (1)

- Internship ReportDocument17 pagesInternship ReportAsad AliNo ratings yet

- Internship Report NBPDocument55 pagesInternship Report NBPSidra NaeemNo ratings yet

- HBL FinalDocument74 pagesHBL Finalasif_ufd100% (1)

- Internship Report SilkbankDocument80 pagesInternship Report SilkbankKomal Shujaat67% (6)

- Mission of IBBLDocument19 pagesMission of IBBLTayyaba AkramNo ratings yet

- Maekreting and Management of Bank Al Habib (Khawar19 - S@Document59 pagesMaekreting and Management of Bank Al Habib (Khawar19 - S@khawar nadeem100% (3)

- Internship Report EBLDocument144 pagesInternship Report EBLaareef37No ratings yet

- Report On Information System of Muslim Commercial BankDocument20 pagesReport On Information System of Muslim Commercial Bankannieriaz63% (8)

- Ration Analysis of 3 Commercial Banks in PakistanDocument30 pagesRation Analysis of 3 Commercial Banks in PakistanMubarak HussainNo ratings yet

- Seemab Alam Haider Internship Report 2020 at HBL Revised20200714-107175-7911tpDocument26 pagesSeemab Alam Haider Internship Report 2020 at HBL Revised20200714-107175-7911tpjaved khokhar123No ratings yet

- The Bank of KhyberDocument76 pagesThe Bank of KhyberWaqas KhanNo ratings yet

- The City Bank Ltd.Document34 pagesThe City Bank Ltd.Shamsuddin AhmedNo ratings yet

- HDFC Bank CAMELS AnalysisDocument15 pagesHDFC Bank CAMELS Analysisprasanthgeni22No ratings yet

- Financial Ratio Analysis of Standard Chartered Bank, JS Bank and Bank Alfalah in Pakistan For The Year Ended September 2009Document7 pagesFinancial Ratio Analysis of Standard Chartered Bank, JS Bank and Bank Alfalah in Pakistan For The Year Ended September 2009ReaderNo ratings yet

- MCB Bank Internship Report 2012Document58 pagesMCB Bank Internship Report 2012Vegabond Nwaar100% (1)

- Internship Report On Askari BankDocument124 pagesInternship Report On Askari Banksajidobry_8476018440% (1)

- Askari Bank Report OriginalDocument66 pagesAskari Bank Report OriginalDanish Hafeez67% (3)

- Introduction of HBLDocument16 pagesIntroduction of HBLFatima AliNo ratings yet

- Internship ReportDocument66 pagesInternship ReportUmer JafarNo ratings yet

- Allied Bank LimitedDocument88 pagesAllied Bank Limitedshani27No ratings yet

- Emerging Trends in Banking Financial Services of Banking Sector in India With Respect To State Bank of IndiaDocument16 pagesEmerging Trends in Banking Financial Services of Banking Sector in India With Respect To State Bank of IndiaarcherselevatorsNo ratings yet

- NRBC-Internship Report - ShafayetDocument54 pagesNRBC-Internship Report - ShafayetShafayet JamilNo ratings yet

- Internship Report On Bank AlfalahDocument38 pagesInternship Report On Bank Alfalahaamir mumtazNo ratings yet

- United Bank Limited Layyah Branch, Layyah: Bzu Bahadur Sub Campus LayyahDocument22 pagesUnited Bank Limited Layyah Branch, Layyah: Bzu Bahadur Sub Campus LayyahZIA UL REHMANNo ratings yet

- JS Bank Final Report Business CommunicationDocument10 pagesJS Bank Final Report Business CommunicationSyed Abdullah RazaNo ratings yet

- Credit Risk Management of NBL1Document119 pagesCredit Risk Management of NBL1Mir FaiazNo ratings yet

- Internship Report: Submitted byDocument20 pagesInternship Report: Submitted byAnnum LaeeqNo ratings yet

- Internship Report - Allied BankDocument102 pagesInternship Report - Allied BankMuazzam MughalNo ratings yet

- Credit Risk Management of National Bank Ltd.Document51 pagesCredit Risk Management of National Bank Ltd.Mou Tushi100% (1)

- Introduction-to-Financial-Systems-and-Banking-Regulations Stage-1 SYLLABUSDocument31 pagesIntroduction-to-Financial-Systems-and-Banking-Regulations Stage-1 SYLLABUSAHSANNo ratings yet

- An Internship Report OnDocument62 pagesAn Internship Report OnJahangir AlamNo ratings yet

- Chap-2 Introduction of NBPDocument7 pagesChap-2 Introduction of NBP✬ SHANZA MALIK ✬No ratings yet

- Bank Alfalah Limited Internship ReportDocument67 pagesBank Alfalah Limited Internship Reportbbaahmad89No ratings yet

- Askari BankDocument116 pagesAskari BankHassan100% (2)

- Exim BankDocument48 pagesExim BankAnonymous w7zJFTwqiQNo ratings yet

- Internship Report of EBLDocument54 pagesInternship Report of EBLHossan SabbirNo ratings yet

- Marketing Management ProjectDocument7 pagesMarketing Management ProjectSabaNo ratings yet

- Complete Report of NBP by RameezDocument112 pagesComplete Report of NBP by RameezRameez Shahid100% (2)

- Assessment of Government Influence On Exchange RatesDocument1 pageAssessment of Government Influence On Exchange Ratestrilocksp SinghNo ratings yet

- Internship Report 2Document20 pagesInternship Report 2Ahmad AliNo ratings yet

- 1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Document56 pages1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Tareq AlamNo ratings yet

- Intership ReportDocument44 pagesIntership ReportALI SHER HaidriNo ratings yet

- Saad Man AgmenDocument7 pagesSaad Man Agmensaadhaxor33No ratings yet

- Dbms NBP Project ReportDocument49 pagesDbms NBP Project ReporttalhaNo ratings yet

- Bank of MaharashtraDocument91 pagesBank of MaharashtraArun Savukar67% (3)

- Employee Engagement Presentation-UCSB Townhall January 12 2016 PDFDocument36 pagesEmployee Engagement Presentation-UCSB Townhall January 12 2016 PDFumar ajmalNo ratings yet

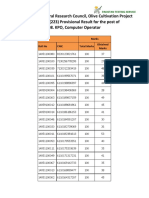

- KPO, Computer OperatorDocument7 pagesKPO, Computer Operatorumar ajmalNo ratings yet

- Print Tutor ListDocument1 pagePrint Tutor Listumar ajmalNo ratings yet

- Safety Climate in Organizations: April 2016Document25 pagesSafety Climate in Organizations: April 2016umar ajmalNo ratings yet

- ZTBLDeposit Slip InstructionsDocument1 pageZTBLDeposit Slip Instructionsumar ajmalNo ratings yet

- Master of Business Administration (MBA) Department of Business Administration University of Sargodha, Gujranwala CampusDocument1 pageMaster of Business Administration (MBA) Department of Business Administration University of Sargodha, Gujranwala Campusumar ajmalNo ratings yet

- The Organizational and Safety Climate Inventory (OSCI) : Reliability and ValidityDocument18 pagesThe Organizational and Safety Climate Inventory (OSCI) : Reliability and Validityumar ajmalNo ratings yet

- Leaderships Styles PowerpointDocument13 pagesLeaderships Styles Powerpointumar ajmalNo ratings yet

- Due Process Handbook Resupply 28 Feb 2013 WEBSITEDocument49 pagesDue Process Handbook Resupply 28 Feb 2013 WEBSITEumar ajmalNo ratings yet

- Learning and Studying Questionnaire: Enhancing Teaching-Learning Environments in Undergraduate CoursesDocument4 pagesLearning and Studying Questionnaire: Enhancing Teaching-Learning Environments in Undergraduate Coursesumar ajmalNo ratings yet

- Reseach PapaerDocument58 pagesReseach Papaerumar ajmalNo ratings yet

- Journal Title & Year of Inception Total # of Downloads (A) Total # of Articles Published (B) Average Downloads Per Article (C)Document1 pageJournal Title & Year of Inception Total # of Downloads (A) Total # of Articles Published (B) Average Downloads Per Article (C)umar ajmalNo ratings yet

- Non Mark-up/Interest IncomeDocument1 pageNon Mark-up/Interest Incomeumar ajmalNo ratings yet

- Review Of: Financial Position 2016Document3 pagesReview Of: Financial Position 2016umar ajmalNo ratings yet

- Cost Accounting Planning and Control 9e 9th Edition by Matz Hammer Usry Solutions ManualDocument1 pageCost Accounting Planning and Control 9e 9th Edition by Matz Hammer Usry Solutions Manualumar ajmalNo ratings yet

- English L 18 - With AnswersDocument9 pagesEnglish L 18 - With AnswersErin MalfoyNo ratings yet

- Clark Water Corporation vs. BIR First DivisionDocument19 pagesClark Water Corporation vs. BIR First DivisionMarishiNo ratings yet

- Lease FinancingDocument17 pagesLease FinancingPoonam Sharma100% (2)

- Declarations On Higher Education and Sustainable DevelopmentDocument2 pagesDeclarations On Higher Education and Sustainable DevelopmentNidia CaetanoNo ratings yet

- From "Politics, Governance and The Philippine Constitution" of Rivas and NaelDocument2 pagesFrom "Politics, Governance and The Philippine Constitution" of Rivas and NaelKESHNo ratings yet

- Modules 1-8 Answer To Guides QuestionsDocument15 pagesModules 1-8 Answer To Guides QuestionsBlackblight •No ratings yet

- Fare Matrix: "No Face Mask, No Ride" "Two Passengers Only"Document4 pagesFare Matrix: "No Face Mask, No Ride" "Two Passengers Only"Joshua G NacarioNo ratings yet

- IJHSS - A Penetrating Evaluation of Jibanananda Das' Sensibilities A Calm Anguished Vision - 3Document10 pagesIJHSS - A Penetrating Evaluation of Jibanananda Das' Sensibilities A Calm Anguished Vision - 3iaset123No ratings yet

- Aims of The Big Three'Document10 pagesAims of The Big Three'SafaNo ratings yet

- Implications - CSR Practices in Food and Beverage Companies During PandemicDocument9 pagesImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranNo ratings yet

- S No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCADocument10 pagesS No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCAarorathevipulNo ratings yet

- Priyanshu Mts Answer KeyDocument34 pagesPriyanshu Mts Answer KeyAnima BalNo ratings yet

- John 5:31-47Document5 pagesJohn 5:31-47John ShearhartNo ratings yet

- 3 Longman Academic Writing Series 4th Edition Answer KeyDocument21 pages3 Longman Academic Writing Series 4th Edition Answer KeyZheer KurdishNo ratings yet

- Essay R JDocument5 pagesEssay R Japi-574033038No ratings yet

- Grile EnglezaDocument3 pagesGrile Englezakis10No ratings yet

- BiratchowkDocument2 pagesBiratchowkdarshanNo ratings yet

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Notice: Native American Human Remains, Funerary Objects Inventory, Repatriation, Etc.: Cosumnes River College, Sacramento, CADocument2 pagesNotice: Native American Human Remains, Funerary Objects Inventory, Repatriation, Etc.: Cosumnes River College, Sacramento, CAJustia.comNo ratings yet

- ARTA Art of Emerging Europe2Document2 pagesARTA Art of Emerging Europe2DanSanity TVNo ratings yet

- Assessment Task-2Document7 pagesAssessment Task-2Parash RijalNo ratings yet

- Sample OTsDocument5 pagesSample OTsVishnu ArvindNo ratings yet

- The Importance of Connecting The First/Last Mile To Public TransporDocument14 pagesThe Importance of Connecting The First/Last Mile To Public TransporLouise Anthony AlparaqueNo ratings yet

- National Budget Memorandum No. 129 Reaction PaperDocument2 pagesNational Budget Memorandum No. 129 Reaction PaperVhia ParajasNo ratings yet

- Securities and Exchange Board of India Vs Kishore SC20162402161639501COM692642Document14 pagesSecurities and Exchange Board of India Vs Kishore SC20162402161639501COM692642Prabhat SinghNo ratings yet

- CRPC MCQ StartDocument24 pagesCRPC MCQ StartkashishNo ratings yet

- Sharmila Ghuge V StateDocument20 pagesSharmila Ghuge V StateBar & BenchNo ratings yet

- Group 5Document38 pagesGroup 5krizel rebualosNo ratings yet

- Environment Impact Assessment Notification, 1994Document26 pagesEnvironment Impact Assessment Notification, 1994Sarang BondeNo ratings yet

- Mini Manual CompiereDocument20 pagesMini Manual Compiereapi-3778979100% (1)

- The 30 Day MBA: Your Fast Track Guide to Business SuccessFrom EverandThe 30 Day MBA: Your Fast Track Guide to Business SuccessRating: 4.5 out of 5 stars4.5/5 (19)

- Roadmap: Second Edition: The Get-It-Together Guide for Figuring Out What To Do with Your Life (Career Change Advice Book, Self Help Job Workbook)From EverandRoadmap: Second Edition: The Get-It-Together Guide for Figuring Out What To Do with Your Life (Career Change Advice Book, Self Help Job Workbook)Rating: 5 out of 5 stars5/5 (8)

- Steal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeFrom EverandSteal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeRating: 4.5 out of 5 stars4.5/5 (39)

- Summary: Designing Your Life: How to Build a Well-Lived, Joyful Life By Bill Burnett and Dave Evans: Key Takeaways, Summary and AnalysisFrom EverandSummary: Designing Your Life: How to Build a Well-Lived, Joyful Life By Bill Burnett and Dave Evans: Key Takeaways, Summary and AnalysisRating: 3 out of 5 stars3/5 (1)

- Ultralearning: Master Hard Skills, Outsmart the Competition, and Accelerate Your CareerFrom EverandUltralearning: Master Hard Skills, Outsmart the Competition, and Accelerate Your CareerRating: 4.5 out of 5 stars4.5/5 (361)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (62)

- From Paycheck to Purpose: The Clear Path to Doing Work You LoveFrom EverandFrom Paycheck to Purpose: The Clear Path to Doing Work You LoveRating: 4.5 out of 5 stars4.5/5 (39)

- Summary: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Daniel Moran: Key Takeaways, Summary & AnalysisFrom EverandSummary: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Daniel Moran: Key Takeaways, Summary & AnalysisRating: 5 out of 5 stars5/5 (2)

- The 2-Hour Job Search: Using Technology to Get the Right Job FasterFrom EverandThe 2-Hour Job Search: Using Technology to Get the Right Job FasterRating: 4 out of 5 stars4/5 (23)

- The First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterFrom EverandThe First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterRating: 4.5 out of 5 stars4.5/5 (122)

- The Staff Engineer's Path: A Guide for Individual Contributors Navigating Growth and ChangeFrom EverandThe Staff Engineer's Path: A Guide for Individual Contributors Navigating Growth and ChangeRating: 4.5 out of 5 stars4.5/5 (6)

- Start.: Punch Fear in the Face, Escape Average, and Do Work That MattersFrom EverandStart.: Punch Fear in the Face, Escape Average, and Do Work That MattersRating: 4.5 out of 5 stars4.5/5 (57)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkFrom EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkRating: 4.5 out of 5 stars4.5/5 (12)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (91)

- The Proximity Principle: The Proven Strategy That Will Lead to the Career You LoveFrom EverandThe Proximity Principle: The Proven Strategy That Will Lead to the Career You LoveRating: 4.5 out of 5 stars4.5/5 (93)

- Start a Business for Less Than $2,000: From Airbrush Artist to Wellness Instructor, 75+ Profitable Business Startups for Under $2,000From EverandStart a Business for Less Than $2,000: From Airbrush Artist to Wellness Instructor, 75+ Profitable Business Startups for Under $2,000Rating: 5 out of 5 stars5/5 (1)

- HBR Guide to Office Politics (HBR Guide Series)From EverandHBR Guide to Office Politics (HBR Guide Series)Rating: 4.5 out of 5 stars4.5/5 (13)

- Company Of One: Why Staying Small Is the Next Big Thing for BusinessFrom EverandCompany Of One: Why Staying Small Is the Next Big Thing for BusinessRating: 3.5 out of 5 stars3.5/5 (14)

- The Search for Self-Respect: Psycho-CyberneticsFrom EverandThe Search for Self-Respect: Psycho-CyberneticsRating: 4.5 out of 5 stars4.5/5 (10)

- 12 Habits Of Valuable Employees: Your Roadmap to an Amazing CareerFrom Everand12 Habits Of Valuable Employees: Your Roadmap to an Amazing CareerNo ratings yet

- Career Rehab: Rebuild Your Personal Brand and Rethink the Way You WorkFrom EverandCareer Rehab: Rebuild Your Personal Brand and Rethink the Way You WorkRating: 4.5 out of 5 stars4.5/5 (5)

- The Visual Mba: Two Years of Business School Packed into One Priceless Book of Pure AwesomenessFrom EverandThe Visual Mba: Two Years of Business School Packed into One Priceless Book of Pure AwesomenessRating: 4 out of 5 stars4/5 (6)

- What Every BODY is Saying: An Ex-FBI Agent’s Guide to Speed-Reading PeopleFrom EverandWhat Every BODY is Saying: An Ex-FBI Agent’s Guide to Speed-Reading PeopleRating: 4.5 out of 5 stars4.5/5 (354)

- Mean Girls at Work: How to Stay Professional When Things Get PersonalFrom EverandMean Girls at Work: How to Stay Professional When Things Get PersonalRating: 3 out of 5 stars3/5 (6)