Professional Documents

Culture Documents

Equity Report Outlook 6 Feb To 10 Feb

Uploaded by

zoidresearchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Report Outlook 6 Feb To 10 Feb

Uploaded by

zoidresearchCopyright:

Available Formats

EQUITY TECHNICAL REPORT

WEEKLY

[6 FEB to 10 FEB 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

6 FEB TO 10 FEB 17

NIFTY 50 8740.95 (99.70) (1.15%)

The benchmark Index Nifty opened flat from Fridays

close of 8641. Nifty traded in a narrow range of 45

points throughout the day. However, Nifty closed at

8633 on Monday. On Tuesday, The benchmark Index

Nifty in closing hours is struggling to touch 8600

levels on the higher side, Nifty fell 80 points from the

day high of 8632 and making a low of 8552, before

closing at 8561. On Wednesday, the Indian

benchmark index Nifty opened flat from yesterdays

close of 8561, After the Finance Minister Mr. Arun

Jaitley announced the Union Budget, in which he left

the Long Term Capital Gains and Short Term Capital

Gains Tax rates unchanged. Nifty surged by 155

points from its previous days close, Nifty made a high

of 8722 and closed at 8716. On Thursday, Indian

benchmark index Nifty opened flat from yesterdays

close of 8716. There was some consolidation In

trading session; Nifty traded in a range of 71 points

between its Intraday high and low of 8758 and 8686

and finally closed at 8734, 18 points above its

previous days close. We had recommended in last

week research report (see our weekly report 30 Jan

3 Feb 17) Nifty future buy on deep around 8600

targets will be 8750-8900. our level executed on

31 Jan 17. OUR TARGET ACHIEVED ON

THURSDAY 2 FEB 2017 NIFTY MADE HIGH AT

8606.40]. On Friday, The benchmark Index Nifty

opened flat from Thursday's close of 8734 and take a

resistance level of 8748; however ended with 6 point

gain at 8740. The benchmark Index Nifty50 (spot)

opened the week at 8635.55, made a high of 8757.60

low of 8537.50 and closed the week at 8740.95. Thus

the Nifty closed the week with a gained of 99.70

points or 1.15%.

Formations Future Outlook:

The 20 days EMA are placed at The Nifty daily chart is continuing a

8497.87 bullish trend. we advised to Nifty future

buy on deep around 8650 targets will

The 5 days EMA are placed at

be 8750-8900. The nifty future selling

8683.63

pressure below 8525. Nifty upside

weekly Resistance is 8900-8825 level.

On the downside strong support at

8600-8450

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

6 FEB TO 10 FEB 17

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 8899 8820 8679 8600 8459

AUTOMOBILE

BAJAJ-AUTO 2968.67 2888.33 2838.67 2758.33 2708.67

BOSCHLTD 24759.78 23589.57 22829.78 21659.57 20899.78

EICHERMOT 25458.43 24422.17 23413.73 22377.47 21369.03

HEROMOTOCO 3377.07 3295.53 3223.02 3141.48 3068.97

M&M 1345.03 1302.87 1265.43 1223.27 1185.83

MARUTI 6412.62 6264.03 6069.77 5921.18 5726.92

TATAMTRDVR 352.62 343.33 336.42 327.13 320.22

TATAMOTORS 554.87 538.73 528.37 512.23 501.87

CEMENT & CEMENT PRODUCTS

ACC 1505.33 1464.62 1435.43 1394.72 1365.53

AMBUJACEM 240.98 235.12 230.63 224.77 220.28

GRASIM 1051.00 997.65 952.20 898.85 853.40

ULTRACEMCO 3875.97 3806.73 3731.27 3662.03 3586.57

CONSTRUCTION

LT 1535.37 1508.03 1467.52 1440.18 1399.67

CONSUMER GOODS

ASIANPAINT 1021.37 1003.63 983.32 965.58 945.27

HINDUNILVR 880.92 865.33 851.97 836.38 823.02

ITC 294.48 283.77 269.18 258.47 243.88

ENERGY

BPCL 734.73 716.67 694.93 676.87 655.13

GAIL 501.17 489.93 476.77 465.53 452.37

NTPC 181.65 176.80 173.05 168.20 164.45

ONGC 216.38 208.67 204.08 196.37 191.78

POWERGRID 212.17 206.93 204.02 198.78 195.87

RELIANCE 1066.42 1050.03 1037.42 1021.03 1008.42

TATAPOWER 84.55 82.60 80.80 78.85 77.05

FINANCIAL SERVICES

AXISBANK 513.57 502.13 481.07 469.63 448.57

BANKBARODA 202.25 194.35 179.35 171.45 156.45

HDFCBANK 1340.35 1325.70 1301.35 1286.70 1262.35

HDFC 1453.75 1425.60 1389.30 1361.15 1324.85

ICICIBANK 301.98 291.77 277.28 267.07 252.58

INDUSINDBK 1366.37 1334.78 1283.92 1252.33 1201.47

KOTAKBANK 806.27 785.78 762.47 741.98 718.67

SBIN 290.82 284.18 271.92 265.28 253.02

YESBANK 1437.23 1417.52 1399.28 1379.57 1361.33

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

6 FEB TO 10 FEB 17

INDUSTRIAL MANUFACTURING

BHEL 147.70 145.20 140.45 137.95 133.20

IT

HCLTECH 881.02 855.88 817.27 792.13 753.52

INFY 977.80 956.95 930.65 909.80 883.50

TCS 2444.78 2338.67 2245.83 2139.72 2046.88

TECHM 522.75 501.60 463.55 442.40 404.35

WIPRO 479.68 468.72 457.03 446.07 434.38

MEDIA & ENTERTAINMENT

ZEEL 525.92 510.88 499.12 484.08 472.32

METALS

COALINDIA 342.58 334.37 318.68 310.47 294.78

HINDALCO 206.22 198.98 192.77 185.53 179.32

TATASTEEL 494.03 483.42 470.28 459.67 446.53

SERVICES

ADANIPORTS 321.18 312.37 302.43 293.62 283.68

PHARMA

AUROPHARMA 743.00 713.85 685.20 656.05 627.40

CIPLA 640.43 624.17 595.23 578.97 550.03

DRREDDY 3297.45 3221.00 3082.55 3006.10 2867.65

LUPIN 1553.60 1522.80 1479.25 1448.45 1404.90

SUNPHARMA 676.68 661.97 640.18 625.47 603.68

TELECOM

BHARTIARTL 396.47 375.13 348.62 327.28 300.77

INFRATEL 386.15 343.00 312.85 269.70 239.55

IDEA 142.15 125.80 102.65 86.30 63.15

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

IDEA 78.00 109.45 40.32% 31.45

BANKBARODA 167.70 186.45 11.18% 18.75

BHARTIARTL 323.75 353.80 9.28% 30.05

ITC 257.40 273.05 6.08% 15.05

DRREDDY 2994.55 3144.55 5.01% 150.00

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

INFRATEL 353.90 299.85 -15.27% -54.05

TCS 2357.80 2232.55 -5.31% -125.25

AUROPHARMA 713.60 684.70 -4.05% -28.90

TATAMOTORS 541.95 522.60 -3.57% -19.35

NTPC 177.50 171.95 -3.13% -5.55

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

6 FEB TO 10 FEB 17

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

03/FEB/2017 5123.63 4769.79 353.84

02/FEB/2017 5360.88 5252.29 108.59

01/FEB/2017 5530.41 5437.68 92.73

31/JAN/2017 4608.79 5141.67 -532.88

30/JAN/2017 3212.83 2605.47 607.36

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

03/FEB/2017 2354.95 2397.48 -42.53

02/FEB/2017 3083.74 3194.63 -110.89

01/FEB/2017 3460.36 2326.62 1133.74

31/JAN/2017 3726.34 3488.97 237.37

30/JAN/2017 2525.39 2485.35 40.04

MOST ACTIVE NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

23/FEB/2017 CE 8800 150522 4591875

23/FEB/2017 CE 8900 126397 4025775

23/FEB/2017 CE 9000 126065 6382875

23/FEB/2017 PE 8700 135031 3309600

23/FEB/2017 PE 8600 106139 4469400

23/FEB/2017 PE 8500 95354 5320050

MOST ACTIVE BANK NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

09/FEB/2017 CE 20500 91504 362880

09/FEB/2017 CE 20300 78935 197960

09/FEB/2017 CE 20200 56284 217280

09/FEB/2017 PE 20000 67767 293200

09/FEB/2017 PE 19800 55559 169600

09/FEB/2017 PE 19500 54618 316360

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

6 FEB TO 10 FEB 17

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

4 FEB 17 LICHSGFIN BUY ON DEEP 550-555 577-605 OPEN

28 JAN 17 LUPIN BUY ON DEEP 1490-1500 1560-1620 OPEN

1ST TARGET

21 JAN 17 AMBUJACEM BUY ON DEEP 216-218 226-236

ACHIEVED

1ST TARGET

7 JAN 17 MOTHERSUMI BUY ON DEEP 332-330 345-360

ACHIEVED

ALL TARGET

31 DEC 16 VEDL BUY AROUND 216 225-235

ACHIEVED

1ST TARGET

24 DEC 16 SUNPHARMA BUY ABOVE 625 650-675

ACHIEVED

1ST TARGET

17 DEC 16 HDFCBANK BUY ABOVE 1200 1250-1300

ACHIEVED

10 DEC 16 HINDALCO BUY ON DEEP 182-180 189-200 EXIT AT 172

1ST TARGET

3 DEC 16 ONGC BUY ON DEEP 288-290 300-315

ACHIEVED

1ST TARGET

26 NOV 16 VEDL BUY ON DEEP 223-220 232-242

ACHIEVED

19 NOV 16 BANKBARODA BUY AROUND 177 184-192 EXIT AT 170

1ST TARGET

12 NOV 16 CANBK BUY ON DEEP 310-311 323-337

ACHIEVED

5 NOV 16 INFY BUY ABOVE 980 1020-1060 EXIT AT 940

ALL TARGET

28 OCT 16 VEDL BUY ON DEEP 202-201 210-220

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

Office 101, Shagun Tower

A.B. Commercial Road, Indore

452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Equity Report 16 - 20 OctDocument6 pagesEquity Report 16 - 20 OctzoidresearchNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Equity Weekly Report 19-23 NovDocument10 pagesEquity Weekly Report 19-23 NovzoidresearchNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Equity Report 21 Aug To 25 AugDocument6 pagesEquity Report 21 Aug To 25 AugzoidresearchNo ratings yet

- Equity Report 22 May To 26 MayDocument6 pagesEquity Report 22 May To 26 MayzoidresearchNo ratings yet

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Equity Weekly ReportDocument6 pagesEquity Weekly ReportzoidresearchNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Equity Weekly Report 8 May To 12 MayDocument6 pagesEquity Weekly Report 8 May To 12 MayzoidresearchNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Equity Report 19 June To 23 JuneDocument6 pagesEquity Report 19 June To 23 JunezoidresearchNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Equity Report 15 May To 19 MayDocument6 pagesEquity Report 15 May To 19 MayzoidresearchNo ratings yet

- Equity Technical Weekly ReportDocument6 pagesEquity Technical Weekly ReportzoidresearchNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Equity Technical Report 25 To 29 July - ZoidresearchDocument6 pagesEquity Technical Report 25 To 29 July - ZoidresearchzoidresearchNo ratings yet

- Equity Report 31 Oct To 4 NovDocument6 pagesEquity Report 31 Oct To 4 NovzoidresearchNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Equity Outlook 13 Feb To 17 FebDocument6 pagesEquity Outlook 13 Feb To 17 FebzoidresearchNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Equity Report 12 Dec To 16 DecDocument6 pagesEquity Report 12 Dec To 16 DeczoidresearchNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Equity Report 14 Nov To 18 NovDocument6 pagesEquity Report 14 Nov To 18 NovzoidresearchNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Equity Report 16 Aug To 19 AugDocument6 pagesEquity Report 16 Aug To 19 AugzoidresearchNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Equity Technical Report 10 - 14 OctDocument6 pagesEquity Technical Report 10 - 14 OctzoidresearchNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Equity Technical Report (08 - 12 Aug)Document6 pagesEquity Technical Report (08 - 12 Aug)zoidresearchNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Equity (Nifty50) Technical Report (11 - 15 July)Document6 pagesEquity (Nifty50) Technical Report (11 - 15 July)zoidresearchNo ratings yet

- Living Temple Class NotesDocument73 pagesLiving Temple Class NotesMichael Haskins100% (7)

- Tanaka 2Document15 pagesTanaka 2Firani Reza ByaNo ratings yet

- Fina1003abc - Hw#4Document4 pagesFina1003abc - Hw#4Peter JacksonNo ratings yet

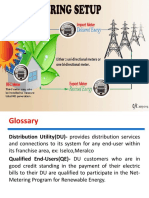

- Solar Net-Metering and Grid Tie SystemDocument30 pagesSolar Net-Metering and Grid Tie SystemBilly Twaine Palma Fuerte100% (1)

- Pre-Feasibility Study Prime Minister's Small Business Loan SchemeDocument18 pagesPre-Feasibility Study Prime Minister's Small Business Loan Schemeadnansensitive5057100% (1)

- Course OutlineDocument14 pagesCourse OutlineKris MercadoNo ratings yet

- Unpacking Sourcing Business ModelsDocument37 pagesUnpacking Sourcing Business ModelsAlan Veeck100% (3)

- Resort Operations Chapter 2Document20 pagesResort Operations Chapter 2Aaron Black100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Obstacle To Regulate HawalaDocument57 pagesObstacle To Regulate HawalaNitesh KumawatNo ratings yet

- Comparison Between Traditional Plan &ULIP's AT ICICIDocument70 pagesComparison Between Traditional Plan &ULIP's AT ICICIBabasab Patil (Karrisatte)100% (1)

- Laxman Intern ReportDocument52 pagesLaxman Intern ReportUtshav Poudel0% (1)

- SNCF 2009 Financial ReportDocument152 pagesSNCF 2009 Financial ReportWoosok YoonNo ratings yet

- Philippine Public Sector Accounting Standards 16 Investment PropertyDocument3 pagesPhilippine Public Sector Accounting Standards 16 Investment PropertyAr LineNo ratings yet

- Money Making StrategiesDocument57 pagesMoney Making StrategiesJanus100% (2)

- Dividend Policy: Corporate FinanceDocument11 pagesDividend Policy: Corporate FinanceLatikaGajaraniKarnaniNo ratings yet

- Financial MarketsDocument32 pagesFinancial MarketsArief Kurniawan100% (1)

- Louis Vitton Case Study Assignment2Document10 pagesLouis Vitton Case Study Assignment2Nesrine Youssef100% (1)

- Model BasedDocument50 pagesModel Basedgeorgez111No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackNo ratings yet

- Chapter 3 Corporate GovernanceDocument25 pagesChapter 3 Corporate GovernanceOmer UddinNo ratings yet

- Peer To Peer LendingDocument16 pagesPeer To Peer Lendingykbharti101100% (1)

- Rise and Fall of Global Trust BankDocument3 pagesRise and Fall of Global Trust BankmohitNo ratings yet

- FlashMemory SLNDocument6 pagesFlashMemory SLNShubham BhatiaNo ratings yet

- Value Investing: Guide ToDocument19 pagesValue Investing: Guide ToDomo TagubaNo ratings yet

- A Comparative Study On Customer Perception Towards LIC of India in View of Increased Competition by Private Companies A Research Done in 2009Document55 pagesA Comparative Study On Customer Perception Towards LIC of India in View of Increased Competition by Private Companies A Research Done in 2009pratiush0792% (13)

- Arpita MAJOR RESEARCH PROJECTDocument31 pagesArpita MAJOR RESEARCH PROJECTSukhvinder SinghNo ratings yet

- Incorporation or LLC Formation ChecklistDocument8 pagesIncorporation or LLC Formation Checklistnancyfallon100% (1)

- UltraTech Cement LTD Financial AnalysisDocument26 pagesUltraTech Cement LTD Financial AnalysisSayon DasNo ratings yet