Professional Documents

Culture Documents

Section 16A &16B of The ITO, 1984

Uploaded by

masudsweb0 ratings0% found this document useful (0 votes)

22 views1 pageSection 16A &16B of the ITO, 1984

Charge of surcharge

Charge of additional tax

Original Title

Section 16A &16B of the ITO, 1984

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSection 16A &16B of the ITO, 1984

Charge of surcharge

Charge of additional tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pageSection 16A &16B of The ITO, 1984

Uploaded by

masudswebSection 16A &16B of the ITO, 1984

Charge of surcharge

Charge of additional tax

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Charge of surcharge

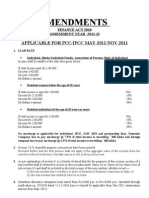

16A. (1) Where any Act of Parliament enacts that a surcharge on income shall be charged for any

assessment year at any rate or rates, such surcharge at that rate or those rates shall be charged

for that year in respect of the total income of the income year or the income years, as the case

may be, of every person.

(2) All the provisions of this Ordinance relating to charge, assessment, deduction at source,

payment in advance, collection, recovery and refund of income tax shall, so far as may be, apply

to the charge, assessment, deduction at source, payment in advance, collection, recovery and

refund of the surcharge.

Charge of additional tax

16B. Charge of additional tax.-Notwithstanding anything contained in any other provision of this

Ordinance, where any person employs or allows, without prior approval of the Board of Investment

or any competent authority of the Government, as the case may be, any individual not being a

Bangladeshi citizen to work at his business or profession at any time during the income year, such

person shall be charged additional tax at the rate of fifty percent (50%) of the tax payable on his

income or taka five lakh, whichever is higher in addition to tax payable under this Ordinance.

You might also like

- The Companies (Profits) Surtax Act, 1964Document16 pagesThe Companies (Profits) Surtax Act, 1964Mrigendra MishraNo ratings yet

- Finance Act 2010 Amendments for Assessment Year 2011-12Document28 pagesFinance Act 2010 Amendments for Assessment Year 2011-12kavs234No ratings yet

- Administration 3-19Document2 pagesAdministration 3-19AtiaTahiraNo ratings yet

- Tax Planning For SalaryDocument31 pagesTax Planning For SalaryAjit SwainNo ratings yet

- Presentation On Payment of Bonus Act, 1965Document20 pagesPresentation On Payment of Bonus Act, 1965Anurag Mahor100% (2)

- Commonwealth Act No. 465Document3 pagesCommonwealth Act No. 465Carlos RabagoNo ratings yet

- The Income Tax ActDocument8 pagesThe Income Tax ActChakshuBehlNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesfatmaaleahNo ratings yet

- Ra 10708Document6 pagesRa 10708Miguel CardenasNo ratings yet

- Liability, penalties for tax noncomplianceDocument4 pagesLiability, penalties for tax noncomplianceedwardmlim0% (1)

- Section 1. Section 27 of The National Internal Revenue Code of 1997, AsDocument55 pagesSection 1. Section 27 of The National Internal Revenue Code of 1997, AsVladimir Reyes100% (1)

- STATUTORY PENALTIESDocument11 pagesSTATUTORY PENALTIESDianna MontefalcoNo ratings yet

- BIR Revenue Regulations No. 2-98Document93 pagesBIR Revenue Regulations No. 2-98Maan EspinosaNo ratings yet

- Revenue Regulations No 2-1998Document72 pagesRevenue Regulations No 2-1998RELLYNo ratings yet

- RA 9335 Attrition Act of 2005Document5 pagesRA 9335 Attrition Act of 2005Sj EclipseNo ratings yet

- 2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveDocument24 pages2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveAlezNo ratings yet

- RA 9337 Amends Tax Code SectionsDocument26 pagesRA 9337 Amends Tax Code SectionsDeeteroseNo ratings yet

- Republic Act NoDocument28 pagesRepublic Act NoAyen GarciaNo ratings yet

- Revenue Etc For Income TaxationDocument286 pagesRevenue Etc For Income TaxationpurplebasketNo ratings yet

- Rates of Tax:-: Individual/HUF/AOP/Artificial Juridical PersonDocument8 pagesRates of Tax:-: Individual/HUF/AOP/Artificial Juridical PersonKiran KumarNo ratings yet

- Bonus Act 1965Document19 pagesBonus Act 1965api-27133856100% (3)

- Finance Act 2013Document63 pagesFinance Act 2013sdaac1No ratings yet

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Document2 pagesGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichNo ratings yet

- Bonus Act SummaryDocument6 pagesBonus Act SummaryRamniwash SinghNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesAnonymous 1tTxK4No ratings yet

- Payment of Bonus Act ExplainedDocument9 pagesPayment of Bonus Act ExplainedAkhil NautiyalNo ratings yet

- THE PAYMENT OF BONUS ACT, 1965 (Compatibility Mode)Document17 pagesTHE PAYMENT OF BONUS ACT, 1965 (Compatibility Mode)ronakNo ratings yet

- 1601 CDocument2 pages1601 CChedrick Fabros SalguetNo ratings yet

- Taxation Reviewer 1Document110 pagesTaxation Reviewer 1bigbully23No ratings yet

- Section 194Document10 pagesSection 194Hitesh NarwaniNo ratings yet

- Taxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesDocument8 pagesTaxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesIon FashNo ratings yet

- Deduction of Tax at Source - BComDocument8 pagesDeduction of Tax at Source - BComAniket AgrawalNo ratings yet

- Scope of TaxDocument3 pagesScope of TaxSheikh WickyNo ratings yet

- Income Tax NotesDocument59 pagesIncome Tax NotessheikhshaimNo ratings yet

- Tax Rates ZJCDocument9 pagesTax Rates ZJCArslan AhmadNo ratings yet

- Presentation On Income Exempted From Income TaxDocument20 pagesPresentation On Income Exempted From Income Taxyatin rajputNo ratings yet

- Incom TaxDocument54 pagesIncom TaxRamesh AlathurNo ratings yet

- IncomeTax Law and Practice-SBAX1022Document124 pagesIncomeTax Law and Practice-SBAX1022Kaushal DidwaniaNo ratings yet

- Iranian Income Tax For Natural PersonsDocument4 pagesIranian Income Tax For Natural PersonsHossein DavaniNo ratings yet

- NPS Bulletin Highlights Tax RulesDocument31 pagesNPS Bulletin Highlights Tax RulesSushobhan DasNo ratings yet

- Using Relevant Examples Discuss The Importance of Board of Governors in An Institution of LearningDocument10 pagesUsing Relevant Examples Discuss The Importance of Board of Governors in An Institution of Learningivanongia2000No ratings yet

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument35 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledKevin MatibagNo ratings yet

- Income Tax - Chap 01Document8 pagesIncome Tax - Chap 01ZainioNo ratings yet

- Explanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentDocument9 pagesExplanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentAl Amin SarkarNo ratings yet

- Ra 9337Document39 pagesRa 9337KcompacionNo ratings yet

- 81.tax Treatment On Compulsory Acquisition of LandDocument6 pages81.tax Treatment On Compulsory Acquisition of Landchandra sekhara reddy AlluNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledBlue GreenNo ratings yet

- Section - 35ACDocument2 pagesSection - 35ACwaqtkeebaatein12No ratings yet

- CPC Rule 48 Order 21Document8 pagesCPC Rule 48 Order 21kaartheekvyyahruti4291No ratings yet

- Eligibility For Bonus: Thirty Working DaysDocument17 pagesEligibility For Bonus: Thirty Working DaysAli AsgarNo ratings yet

- Tax Deficiency and Tax DeliquencyDocument4 pagesTax Deficiency and Tax DeliquencyJanelleNo ratings yet

- G.R. No. 172087Document12 pagesG.R. No. 172087monica may ramosNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document1 pageGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNo ratings yet

- PAYMENT OF BONUSDocument19 pagesPAYMENT OF BONUSkhyati.212496No ratings yet

- Tax Collection at Source ProjectDocument15 pagesTax Collection at Source ProjectShivamPandeyNo ratings yet

- Section 194Q - TDS On Certain PurchasesDocument1 pageSection 194Q - TDS On Certain PurchasesNishanth JoseNo ratings yet

- Income Tax Set 01 2020Document6 pagesIncome Tax Set 01 2020Taaha JanNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssemblednetortizNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Section 4 ITO, 1984Document1 pageSection 4 ITO, 1984masudswebNo ratings yet

- Section 4A ITO, 1984Document1 pageSection 4A ITO, 1984masudswebNo ratings yet

- Section 5 ITO, 1984Document1 pageSection 5 ITO, 1984masudswebNo ratings yet

- Section 24 of The ITO, 1984Document1 pageSection 24 of The ITO, 1984masudswebNo ratings yet

- Section 36 of The ITO, 1984Document1 pageSection 36 of The ITO, 1984masudswebNo ratings yet

- Carry Forward of Business LossesDocument1 pageCarry Forward of Business LossesmasudswebNo ratings yet

- The Income-Tax Ordinance, 1984: (Ordinance No. Xxxvi of 1984)Document2 pagesThe Income-Tax Ordinance, 1984: (Ordinance No. Xxxvi of 1984)masudsweb100% (1)

- Section 26 of The ITO, 1984Document1 pageSection 26 of The ITO, 1984masudswebNo ratings yet

- Section 16 of The ITO, 1984 Charge of Income TaxDocument1 pageSection 16 of The ITO, 1984 Charge of Income TaxmasudswebNo ratings yet

- Section 17 of The ITO, 1984Document1 pageSection 17 of The ITO, 1984masudswebNo ratings yet

- Salary Income Tax RulesDocument1 pageSalary Income Tax RulesmasudswebNo ratings yet

- Section 17 of The ITO, 1984Document1 pageSection 17 of The ITO, 1984masudswebNo ratings yet

- Definition of Agricultural IncomeDocument1 pageDefinition of Agricultural IncomemasudswebNo ratings yet

- Section 22 & 23 of The ITO, 1984Document1 pageSection 22 & 23 of The ITO, 1984masudswebNo ratings yet

- Section 20 of The ITO, 1984Document1 pageSection 20 of The ITO, 1984masudswebNo ratings yet

- Digital BangladeshDocument1 pageDigital BangladeshmasudswebNo ratings yet

- Sec 2 (35) of ITO, 1984 As Amended FA 2015Document1 pageSec 2 (35) of ITO, 1984 As Amended FA 2015masudswebNo ratings yet

- Principal Findings of Female Participation in Professional AccountancyDocument3 pagesPrincipal Findings of Female Participation in Professional AccountancymasudswebNo ratings yet

- Charge of SurchargeDocument1 pageCharge of SurchargemasudswebNo ratings yet

- Income Year DefinitionDocument1 pageIncome Year DefinitionmasudswebNo ratings yet

- Special Monitoring at DSEDocument1 pageSpecial Monitoring at DSEmasudswebNo ratings yet

- Section 50Document1 pageSection 50masudswebNo ratings yet

- Define CreditDocument1 pageDefine CreditmasudswebNo ratings yet

- Charge of Income Sec-16 of ITO, 1984Document1 pageCharge of Income Sec-16 of ITO, 1984masudswebNo ratings yet

- 184B and 184CDocument1 page184B and 184CmasudswebNo ratings yet

- Capital BudgetingDocument1 pageCapital BudgetingmasudswebNo ratings yet

- SWOT Analysis of Female Participation in Professional AccountancyDocument2 pagesSWOT Analysis of Female Participation in Professional AccountancymasudswebNo ratings yet

- SWOT Analysis of Female Participation in Professional AccountancyDocument2 pagesSWOT Analysis of Female Participation in Professional AccountancymasudswebNo ratings yet

- Accounting Entity (AICPA Adapted)Document1 pageAccounting Entity (AICPA Adapted)masudswebNo ratings yet