Professional Documents

Culture Documents

Unit - Introduction To Derivatives

Uploaded by

Sudheer KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit - Introduction To Derivatives

Uploaded by

Sudheer KumarCopyright:

Available Formats

FINANCIAL DERIVATIVES

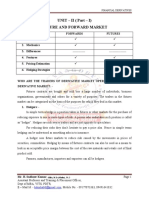

FINANCIAL DERIVATIVES SYLLABUS AT A GLANCE: -

Financial Derivatives

Derivatives & Its Features, Types of Unit - I Role of derivative

Derivatives, Development & Growth Introduction to Derivatives market, Uses & Misuses

Of derivative market, Linkages b/n of derivatives

Spot & Derivative Markets

Mechanics of future market, structure Determination of

Of future & forward markets, forward & future prices

Unit - II

Hedging Strategies, Interest rate futures

Future and Forward

Currency futures &

Market

Forwards

D/b/n Options & Futures, Structure Option pricing models

Of Options, principles of option 1 Binomial model,

Unit - III

Pricing, 2 Black ScholesMerton

Options

Model

Advanced option strategies, Unit - IV hedging with options,

Trading with options, Basic Option Strategies Currency options

Concept & Nature of Swaps, features Unit - V Major types of swaps

Of swaps, evolution of swaps Swaps 1 Interest rate swaps,

2 Currency swaps,

3 Commodity swaps,

4 Equity index swaps,

5 Credit risk in swaps,

Using swaps to manage risk, pricing & valuing swaps

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 1

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

UNIT I

INTRODUCTION TO DERIVATIVES

The past decades has witnessed the multiple growths in the volume of international trade

and business due to the wave of globalization and liberalization all over the world. As a result,

the demand for the international money and financial instruments increased significantly at the

global level. Due to unexpected changes in foreign exchange rates, interest rates and commodity

prices, stock market prices at the different financial markets, corporate world exposed to

financial markets. Price fluctuations make it hard for business to estimate their future production

costs and revenues. Adverse changes have even threatened the very survival of the business

world. It is therefore to manage such risks, the new financial instruments have been developed n

the financial markets which are also popularly known as financial derivatives.

As instruments of risk management these generally do not influence the fluctuations in

the underlying asset prices. However, by the locking in asset prices, derivative products

minimize the impact of fluctuations in asset prices on the profitability and cash flow situation of

risk averse investors.

Today the financial derivatives have become increasingly popular and most commonly

used in the world of finance. This has grown with so phenomenal speed all over the world that

now it is called as the derivatives revolution. In an estimate, the present annual trading volume of

derivative markets has crossed US $ 30,000 billion representing more than 100 tones gross

domestic product of India.

WHAT ARE DERIVATIVES? OR DEFINITION OF FINANCIAL DERIVATIVE: -

The word derivative originated in mathematics and refers to a variable that has been from

another variable. In financial sense, a derivative is financial product which had been derived

from a market for another product.

For example, you have purchased a gold future on May 2003 for delivery in August

2003. The price of gold May 2003 in the spot market is 4,500 per 10 grams and for future

delivery in August 2003 is 4,800 per 10 grams. Suppose in July 2003 the spot price of gold

changes and increased to 4,800 per 10 grams. In the same line value of financial derivatives or

gold futures will also change.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 2

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

DEFINITION OF DERIVATIVES: -

A derivative is financial instrument or financial contract whose value is derived from the

value of an underlying asset. Hence, the name derivatives come into existence. The price of

derivatives in dependent on the behavior of the price of one or more basic underlying assets,

these contracts are legally binding agreements made on the trading on the screen of stock

exchanges to buy or sell an asset in future. The asset can be a share index, interest rate, equity

shares, treasury bills, bond, rupee, dollar exchange rate, sugar, crude oil, soya bean, cotton,

coffee and what you have.

Derivative can be also defined as a financial instrument or contract between two parties

that derived its value from other underlying asset or underlying reference price, interest rate or

index. A derivative by itself does not constitute ownership; instead it is a promise to convey

ownership.

In the Indian context the Securities Contract (Regulation) Act, 1956 (SCR or SCA)

defines derivative includes,

1. A security derived from a debt instrument, share, loan whether secured or unsecured, risk

instrument or contract for differences or any other form of security.

2. A contract which derives its value from the prices or index of prices of underlying

securities.

DIFFERENCE BETWEEN SHARES AND DERIVATIVES: -

PARAMETER SHARES DERIVATIVES

Nature Assets(Except warrants & Contracts

Convertible bond)

Standardization Standardized with securities Not standardized

law

Risk High Low

Return High Moderate return

Initial Investment Minimum Measurable Minimum or Zero

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 3

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

The above definition conveys that,

1. The derivatives are financial products,

2. Derivatives is derived from another instrument / contract called the underlying,

A very simple example of derivatives is curd, which is derivative of milk. The price of curd

depends upon the price of milk which in turn depends upon the demand and supply of milk.

General Characteristics of Derivatives: -

Derivative defined as per Accounting Standard SFAS 133 is a financial derivative or

other contract with the following features,

1. It has one or more Underlying asset,

2. It requires negligible initial investment or no initial net investment compared to other

types of financial contracts,

3. Should provide for net settlement i.e., offsetting of initial contract position,

4. The value of derivative depends on their underlying asset price movements,

5. The instrument relates to the future contracts and settlement of terms between the parties

involved, normally called maturity in case of forwards contract,

6. The parties involved may be obliged to exercise their contracts or offset then(Forwards,

futures) or may have rights(Like options buyers),

7. The contracts are fulfilled or transacted through a recognized exchange(Futures

contracts), through the clearing house or they may be private bio lateral

contracts(Forwards, Swaps) or other counter contracts(Options),

8. These are contingent asset or liabilities i.e., off balance sheet to instruments,

9. Derivatives are also known as delivery or deferred payment instrument. It means that it

is easier to take short or long position in derivatives in comparison to other assets or

securities. They are more easily amenable to financial engineering,

10. Derivatives have little usefulness in mobilizing fresh capital or corporate world except

warrants and convertibles.

TYPES OF DERIVATIVES: -

Common derivatives include options, forward contracts, futures contract and swaps

common underling assets include interest rates, exchange rates, commodities, stocks, stock

indices, bonds and bond indices, treasury bills (Short term debt securities).

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 4

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Derivatives

Financials Commodities

Basic Complex Futures Forwards

Forwards Futures Options Warrants & Convertibles

Swaps Exotics

Stock Futures Stock Index

Classification by Nature of the Underlying Asset: -

Another important way of classifying derivatives is according to the underlying from

which the derivatives derives its value as shown in table below,

STOCKS FOREIGN INTEREST COMMODITIES NATURAL

EXCHANGE RATE BONDS PHENOMENA

/ CREDIT

Single Stock Foreign Bond Futures Futures and Weather

Futures exchange, and options options on derivatives

forward contacts agricultural related to rainfall

commodities like and temperature

wheat, soya bean

and milk

Single Stock Currency futures Forward rate Energy derivatives Derivatives

Options agreements and like Crude oil, related to natural

interest rate natural gas and calamities like

futures electricity Earth Quakes

and Hurricanes

Stock Index Currency options Caps, floors, Futures and

Futures swaps and Options on

Swaptions precious metals ----

like Gold and

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 5

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Silver

Stock Index Currency Swaps Credit default Futures and

Options swaps and other options on

credit derivatives industrial metals ----

like Copper and

Aluminum

Another classification based on nature of the market in which the derivative is traded,

S. No Parameter Exchange Traded Over the counter (OTC)

Derivatives Derivatives

1. Type of products Futures contracts on Forward contracts on

stocks, Currencies and stocks, currencies and

commodities commodities OTC options

on stocks currencies and

commodities

2. Options Exchange traded OTC options on stocks,

options on stocks, currencies and commodities

currencies and

commodities

3. Nature of Derivative Swap note futures and Interest rate swaps, caps,

interest rate futures floors, and forward rate

agreements

4. Place of agreement & Recognized exchange Negotiated deals between

Parties the buyer and sellers, no

definite place where this

market exist

5. Customized contract Terms and conditions All contracts are customized

are not customized, contract that exactly

they are standardized requirements of counter

parties in the best possible

way little or less liquidity

6. Liquidity More liquidity Little or Less liquidity

7. Money Exchange Small amount has to No exchange of money at

be remitted as margin the time of entering contract

money

8. Counter party risk Counter party risk is Counter party risk

absent associated

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 6

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

1. FORWARDS: -

A forward contract is among the oldest and simplest of derivative contracts. It is a

simple customized contract between two parties to buy or sell an asset at a certain time in the

future for a certain time in the future for a certain price.

It is simply a purchase or sale transaction in which the price and other terms have

been agreed upon, but the delivery and payment are postponed to a later date.

A stock market transaction in which delivery takes place after two or four weeks

would normally be regarded as a forward transaction because the norm there is to settle within a

couple of days.

DIFFERENCE BETWEEN FORWARD AND SPOT MARKET: -

PARAMETER FORWARD MARKET SPOT MARKET

1. Payment Deferred till the expiry of the Immediately

contract

2. Delivery Deferred till the expiry of the Immediately

contract

3. Completion of Successful completion of Delivery and payment take

transaction transaction on maturity place simultaneously

depends upon two parties

FEATURES OF A FORWARD CONTRACT: -

The basic features of a forward contract are given below,

1. Forward contracts are bilateral contracts and they are exposed to counter party risk,

2. Each contract is custom designed and hence is unique in terms of contract size, expiration

date, the asset type, quality etc,

3. In forward contract, one of the parties takes a long position by agreeing to buy the asset at

a certain specified future date. The other party assumes a short position by agreeing to

sell the same asset at the same date for the same specified price,

4. The specific price in a forward contract is referred to as the delivery price. The forward

price for a particular forward contract a particular time is the delivery price that would

apply if the contact were entered into at that time both are equal at the time the contract is

entered into. However, as time passes, the forward price is likely to change whereas the

delivery price remains the same,

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 7

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

5. In the forward contract, derivative assets can often be contracted from the combination of

underlying assets, such assets are often known as synthetic assets in the forward market,

6. In the forward market, the contract has to be settled by delivery of the asset on expiration

date. In case the party wishes to reverse the contract, it has to compulsory go to the same

party, which may dominated and command the price it wants as being in a monopoly

situation,

7. Forward contracts are very popular in foreign exchange market as well as interest rate

bearing instruments. Most of the large and international banks quoted the forward rate

through their Forward Desk lying within their foreign exchange trading room,

8. As per the Indian forward contract act 1952 forward contracts are (i). Hedge contracts,

(ii). Transferable specific delivery (TSD) contracts and (iii). Non transferable specify

delivery (N - TSD),

9. A forward contract has to be settled in delivery or cash on expiry date,

Example: - An Indian company buys automobile parts from USA with payment of one million

dollar due in 90 day. The importer thus is short of dollar that is it owes dollars for future

delivery. Suppose present price of dollar is 48. Over the next 90 days, however dollar rise

against 48. The importer can hedge thus exchange risk by negotiating a 90 days forward

contract with a bank at a price of 50. According to forward contract in 90 days the bank will

give importer one dollar and importer will give to the bank 50 million rupees on due date

irrespective rate of dollar at that time. This is a typical of forward contact currency.

2. FUTURE CONTRACTS: -

Like a forward contract, a futures contract is an agreement between two parties to buy or

sell a specified quality of an asset at a specified price and at a specific time and place. Future

contracts are normally traded on an exchange which sets the certain standardized norms for

trading in the futures contracts. Futures often are settled in cash or cash equivalence, rather than

requiring physical delivery of the underlying asset. Parties to a futures contract may buy or write

options on futures.

As forward contracts entail credit risk, these are mainly suitable for large companies and

institutions that are well known to each other or to their banks. They are less suited to individuals

and other small entities. The Nobel Prize winning economist Milton Friedman anticipated a

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 8

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

devaluation of the British pound and wanted to sell the pound forward. He found that banks that

were not willing to transact with him were willing to oblige companies that wanted to undertake

similar transactions.

The most effective way to provide open and equal access to all is to organize the activity

of trading in an exchange.

Exchange traded contracts for delivery at a future date are known as future contracts to

distinguish them from forward contracts.

Pricing can be based on an open cry system or bids and offers can be matched

electronically. The future contract will state the price that will be paid and the date of delivery.

Example: -

A Silver manufacturer is concerned about the price of silver he will not able to plan for

profitability. Given the current level of production he expects to have about 20,000 ounces of

silver ready in next two months. The current price of silver on May 10 is 1052.5 per ounce and

July futures price at FMC is 1068 per ounce which he believes to be satisfied price. But he

fears, that price in future may go down. So, he will enter into a future contract.

The features of future contracts: -

1. Exchange traded: -

Futures contracts are traded in an exchange. In India, the futures and options trading

system of NSE called NEAT F and O trading system which is a great deal of transparency

about past trades, prices and volumes.

2. Standardization: -

One of the most important features of future contract is that the contract has certain

standardized specification i.e., quality of the asset, the date and month of delivery, the units

of price quotation, location of settlement etc. For,

Example: - The largest exchanges on which futures contracts are traded are the Chicago

board of trade (CBOT) and the Chicago mercantile exchange (CME).

3. Daily Settlement or Market to Market: -

Since the futures contracts are performed through a standard exchange, so at the close

of the day of trading, each contract is marked to market. The system of daily mark to market

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 9

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

is that the gains and losses are paid out daily; instead of waiting for maturity accordingly the

members accounts are credited.

4. Initial Margins: -

The daily mark to market reduces credit risk dramatically, but does not eliminate it

completely. The remaining credit risk is that the buyer or seller may default in making the

mark to market payment. The exchange deals with this risk by collected an initial margin

from both buyer and seller. The margin has to be collected from both because the exchange

does not know beforehand whether the price will move up or down and therefore, whether

the market to market payment will have to come from buyer or seller.

5. Novation: -

Yet another feature of most futures exchanges is the concept of Novation. This means

that the exchange becomes a counter party for all trades. Thus if A buys a futures contract

from B, the exchange replaces this transaction with two transactions. In one transaction, the

exchange buys from B and in another transaction the exchange sells to A. Even if A defaults

the exchange has to fulfill its obligation to B and try and sell the asset in the market at risk is

thus intermediated by the exchange just as in may forward markets the credit risk is

intermediated by banks. As the exchange relies on sophicated margining system to manage

the credit risk, it does not have to charge a large fee to cover the risk, it does not have to

charge fee to cover the risk.

6. Anonymous Trading: -

One advantage of Novation is that it allows anonymous trading. A person buying a

futures contract in an exchange does not care who is selling the contract. The exchange needs

to know the identity of the traders to implement the margining system while the regulator

needs this information to investigate market irregularities that may occur.

7. Easy close out: -

Another advantage of Novation is that it makes it very easy to unwind a futures

transaction. If an investor has bought a future contract, he can go back to the market

whenever he wishes and sell the future.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 10

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

8. Delivery rare or Expire date: -

The future contracts are executed on the expiry date. The period which the delivery

will be made is set by the exchange which varies from contract to contract. Typically 95 98

% of futures trades are closed out before maturity. Only the remaining 2 5% of all

transactions actually results in payment and delivery.

9. Basis & Tick Size: -

The future prices are expressed in currency units with a minimum price movement

called a tick size. This means that the futures prices must be rounded to the nearest tick. The

difference between a future price and cash prize of the asset is known as the Basis.

DIFFERENCE BETWEEN FORWARDS AND FUTURES: -

S. NO PARAMETER FORWARDS FUTURES

1. Trading Traded by telephones or telex Traded in an competitive

(OTC) bilateral contracts OTC area (Recognized Exchange)

2. Size of Contract Customized depend upon Standardized in each future

buyer and seller market

3. Price of contract Remains fixed till maturity Changes every day

4. Delivery date Normally one specified Range of delivery dates

delivery date

5. Mark to Market Not done Mark to Market every day

6. Margin No margin required Margins are to be paid by

both buyers and sellers

7. Counter party risk Present Not present

8. Settlement Settled at end of contract Settled daily

9. Credit risk Some credit risk Virtually no credit

10. Terms Decided by both parties Standardized with respect to

mutually & tailor or the quality of the asset

individually made future period and future

place

11. Marginal Payment No marginal money required Margin payments are

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 11

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

required

12. Cash Settlement Delivery or final cash Contract is usually closed

settlement usually takes place out prior to maturity

13. Payment Cost of forward contract based They entails brokerage fee

on bid ask spread for purchase and sales

orders

14. No. of contracts in a There can be any number of Number of contracts in a

year contracts year are fixed

15. Frequency of 90% of all forward contracts Very few futures (<5%)

Delivery are settled by actual delivery contracts are settled by

actually delivery

16. Hedging These are tailor made for Hedging is by nearest month

specific date and quantity so it and quality contracts so it is

is perfect not perfect

17. Liquidity No liquidity Highly liquidity

18. Mode of delivery Specifically decided most of Standardized, most of the

the contracts result in delivery contracts are cash settled

19. Transaction cost Costs are based on bid ask Include brokerage fees for

spread buy and sell orders

20. Regulation Self regulatory and no need Respective changes where

registration they are registered

3. OPTIONS: -

The derivative security is a security or contract or instrument designed in such way that

its price is derived from the price of underlying asset. Hence, the price of a derivative security is

not arbitrary; rather it is linked to the price of the underlying asset.

A price of a derivative security is affected by its features, rights and obligations arisen out

against the underlying parties. That is way the price of security would different as per related

derivatives features. For,

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 12

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Example: - The primary difference between an option and a future or forward contract is that

options confer a right rather than obligation to buy or sell the underlying asset. As a result pay

off under options will be different to futures or forwards.

Concept of options: -

Option is a specific derivative instrument under which one party gets the right, but no

obligation, to buy or sell a specific quantity of an asset at an agreed price on or before a

particular date. For,

Example: - One person buys an option contract to purchase 100 shares of SBI at 300 per share

for a period of 3 months. It means that said person has the right to purchase the share of SBI at

300 per share within 3 months from the date of the contract. If the price of SBI increases, he

will exercise the option and if the price below 300 then he will not exercise the optionally when

he is in profit. In case of loss he will not exercise the option. The specified price at which the

option holder has the right to trade is known as the strike price or the exercise price. All options

have a maturity or expiry data after which the option to trade cannot be exercised.

Option is itself an asset that can be bought and sold. Just as one can be buyer or a seller

of gold, one can be a buyer or a seller of gold call option. It is the holder (buyer) of the option

who decides whether to exercise it or not. The seller simply has to accept whatever decision the

buyer takes and perform his side of contract. Thus the seller of an option has an obligation to

trade when the buyer himself has no right to trade.

Today options are traded on a Varity of instruments like commodities, financial assets as

diverse as foreign exchange, bank time deposits, treasury securities, stocks, stock indexes,

petroleum products, food grains, metals etc.

Options are the most flexible of all types of derivatives because they give an option

holder a multiple choice at various moments during the life time of the option contract. However,

an option seller does not have such flexibility and always has to fulfill the option holders

requests. For this reason, the option buyer has to pay a premium to the option seller.

PARAMETER BUYER SELLER

1. Call Option Right to buy at the exercise Obligation to sell at the

price exercise price

2. Put option Right to sell at the exercise Obligation to buy at the

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 13

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

price exercise price

3. Risk Limited because he cannot The maximum loss for the

lose more than premium paid writer of a put option is equal

as he can abandon the option to the strike price. In general,

the risk for writer of a call

option is unlimited

4. Profit His potential gain is the The maximum profit for the

erotically unlimited writer of a put option is equal

to premium of options

Difference between OPTIONS VS FORWARDS contract: -

PARAMETER OPTIONS FORWARD CONTRACT

1. Right & Obligation Buyer (Option holder) has Buyer has right and obligation

right to sell or buy at the to buy at the forward price.

exercise price or strike price. Seller has right and obligation

Seller has obligation to buy or to sell at the forward price.

sell at the exercise price. A Both buyer as well as the

right is a privilege or a claim seller is under compulsion.

conferred upon the buyer

where as an obligation is a

compulsion.

Buyer gets this right at price a

price known as the options

price or premium.

2. Risk Little or more risk, because he Every transaction has a risk

can go for sell / buy / drop the which is equal to delivery cost

option depend upon the at the maximum.

exercise price before the

expiry date.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 14

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Difference between OPTIONS VS FUTURES contract: -

PARAMETER OPTIONS FORWARD CONTRACT

1. Premium In case of one party (Option No cash is transferred to either

Buyer) has to pay in cash the party at the time of the

option price (Premium) to the formation of the contract.

other party (Seller) this is not

returned to the buyer whether

he invests for actual

performance of the contract or

not.

2. Risk Reward Systematic risk or reward The buyer of the contract

relationship does not arise. realizes the gain in cash when

price of the future contract

increases and incurs losses in

case of fall in the prices. The

position is opposite in case of

the seller of the futures

contract.

3. Number of Contracts There is no limit to the There is process of closing out

number of option contracts position which causes

that can be in existence at any contracts to cease to exist,

time. hence diminishing the total

number in comparison to

potions.

4. SWAPS: -

Swap means Barter, Swaps are private agreements between two parties to exchange

cash flows in the future according to a prearranged formula. Swaps are used by different

companies / institutions / governments. Some institutions / organizations have access to some

form of financial instruments but they need different financial instruments.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 15

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

They can be regarded as portfolios of forward contracts. The two commonly used

Swaps are:

1. Interest rate swaps: These entail swapping only the interest related cash flows between

the parties in the same currency.

2. Currency Swaps: These entail swapping both principal and interest on different currency

than those in the opposite direction.

Swaptions: Swaptions are options to buy or sell a swap that will become operative at the expiry

of the options. Thus a Swaptions is an option on a forward swap. Rather than have calls and puts,

the Swaptions market has receiver Swaptions and payer Swaptions. A receiver Swaptions is an

option to receive fixed and pay floating. A payer Swaptions is an option to pay fixed and receive

floating.

EVOLUTION OF DERIVATIVES: -

Derivatives are definitely not a modern invention. Derivatives have probably been around

for as long as people have been trading with one another. Forward contracting dates back at least

to the 12th century and may well have been around before then. Merchants entered into contracts

with one another for future delivery of specified amount of commodities at specific prices. A

primary motivation for pre arraigning a buyer or seller for a stock of commodities in early

contracts was to lessen the possibility that large swings would inhibit marketing the commodity

after a harvest.

It has been claimed that the worlds first organized futures exchange was the Dojima rice

futures market officially set up in 1730 in Osaka Japan when the fendal land lords in Japan

needed money for their annual tribute to Tokyo, they said rice tickets representing rice in the

warehouse or in the fields. These tickets were bought and sold in the Dojima market and could

be regarded as the forerunners of modern exchange traded in future contracts.

In 1848, the future contracts came into existence with establishment Chicago board of

trade in 1848. In the year 1898, the butter and egg dealers of Chicago produce exchange joined

hands to form Chicago mercantile exchange for trading futures to hedge their risks of price

volatility. Gradually the exchange also provided the future markets for other commodities like

pork bellies (1961), little cattle (1964), live hogs (1966) and feeder cattle (1971). This success in

trading of foreign currencies (1972), T bond futures (1975) and equity index futures (1982),

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 16

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Futures contracts were initially traded on agricultural commodities in 1864, Chicago board of

trade (CBOT) begins trading on these products involving gold, silver and food items.

Trading in financial futures like stock futures originated with international monetary

markets (IMM) in 1972 followed by the interest rate futures being introduced in CBOT in 1975.

Stock index futures were introduced in the USA in 1982. In the global scenario, the five leading

futures markets and their underlying securities are given in below table,

MAJOR FUTURES MARKET GLOBALLY: -

Name of the Futures Market Major Contracts Traded

1. Chicago Board of Trade (CBOT) Commodities, metals

2. International Monetary Market (IMM) Currencies, Debt, Stock Index

Chicago

3. International Petroleum Exchange, Petroleum

London

4. New York mercantile exchange Commodities & Metals

(NYMEX)

5. Singapore International Monetary Commodities, Currency, Debt and Index

Exchange

Options trading occurred later than futures trading until, 1973, options on equity stock

were traded on the OTC (over the trade counter) market only. The major boost came in 1973

when Chicago board options exchange (CBOE) was established entirely dedicated for trading of

options contracts in standardized forms. The first trading in swaps occurred in 1981 between

World Bank and IBM (Currency swap). And the following table lists the major developments in

financial derivatives,

The global derivatives industry chronology of instruments: -

YEAR FINANCIAL INSTRUMENTS

1. 1972 Foreign Currency Futures

2. 1973 Equity futures: futures on mortgage backed

bonds

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 17

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

3. 1974 Equity futures, equity options

4. 1975 T bill futures on mortgage backed bonds

5. 1977 T bond futures

6. 1979 Over the counter currency options

7. 1980 Currency Swaps

8. 1981 Equity index futures: options on T bond

futures, Bank CD futures T note futures,

Euro dollar futures, Interest rate swaps

9. 1982 Exchange listed currency options

10. 1983 Interest rate caps and floor options on T note,

futures, currency futures, equity index futures

11. 1985 Euro dollar options, swap options, futures on

US dollar and Municipal bond indices

12. 1987 Average options, commodity swaps, bond

futures, compound options, OTC compound

options, OTC average options

13. 1989 Three month Euro DM futures, captions

14. 1990 Equity index swaps

15. 1991 Portfolio Swaps

16. 1992 Differential swaps

17. 1993 Captions Exchange listed flex options

18. 1994 Credit default options

19. 1995 Credit derivatives

20. 1996 98 Exotic derivates

21. 2003 04 Energy derivatives, weather derivatives

The first financial derivatives were created only in the 1972, but within a couple of

decades, they grew rapidly to dominate the global derivatives market. By around 1990, financial

derivatives accounted for three fifths of derivative trading and financial contracts for,

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 18

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Example: - US trading bond futures and Euro dollar futures.

These were the most actively traded futures in the world. Despite rapid growth in

absolute volume, agricultural commodities constituted only a fifth of the market with energy and

materials accounting for the remaining one fifth since, then financial futures have continued to

growth very rapidly and in 2005, they accounted for over 90% of the worlds futures markets and

all the 20 most actively traded futures contracts in the world.

The latest terminal bank for international settlement (BIS) survey published in 2005

reports that the outstanding amount of OTC derivatives in global financial markets reached $248

trillion as at the end of 2004. This represents a 26%. Increase for 2004 and follows a 39%

increase in 2003. Also the growth in global OTC derivatives markets has averaged 31.6% since

1990. The total amount of derivatives outstanding in global market at $295 trillion world gross

domestic product is $40.8878 trillion at the end of 2004. Hence world derivative market is seven

times world gross domestic product.

OVERVIEW OF THE INDIAN DERIVATIVES MARKET: -

(OR)

EVOLUTION OF DERIVATIVES IN INDIA: -

In India, derivatives markets started in the late 1890s and were futures based markets

with commodities, primarily, agricultural commodities as the underlying assets. The first

organized futures market came up in 1875 with the establishment of Bombay cotton trade

association ltd. Subsequently may future exchange predominantly commodity based futures

sprang up viz. Bombay cotton exchange ltd in 1893. Gujarati vyapari mandali in 1900, Calcutta

hessian exchange ltd in 1919 and most of them did not last till the second world war in 1939. In

1969 central government imposed the ban on trading in derivatives to prevent speculation on the

prices of agricultural commodities. The late 1990s shows this signs of opposite trends - a large

scale revival of futures markets in India and hence the central government revoked the ban on

futures trading in October 1995. The civil supplies ministry agreed in principle for starting of

futures trading in Basmati rice, further in 1996, the government granted permission to the Indian

pepper and spice trade Association to convert its pepper futures exchange into an international

pepper exchange. On November 17, 1997 Indias first international futures exchange at kochi

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 19

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

known as the India pepper and Spice trade association International Commodity Exchange

(IPSTA ICE) was established.

Similarly the Cochin oil millers association in June 1996 demands the introduction of

futures trading in coconut oils. In August 1997, the central government proposed that Indian

companies with commodity price exposures should be allowed to use foreign futures and option

market.

Securities and Exchange Board of India (SEBI) appointed a committee named the Dr. L.

C. Gupta committee (LCGC) in 1996 in order to develop appropriate regulatory frame work for

derivatives in India.

The board of SEBI on May 11, 1998 accepted the recommendations of the Dr. L. C.

Gupta committee and approved introduction of derivatives trading in India in the phased manner.

The recommendation sequence is stock index futures, index options and options on stocks.

Subsequently the SEBI appointed Professor J. R. Verma Committee (1998) to look into the

operational aspects of derivatives market especially to prescribe risk containment measures to

new derivative products.

To remove the road block of non recognition of derivatives as securities under

securities law (Amendment) Bill, 1999 was introduced to bring about the much needed changes.

Accordingly in December 1999, the new frame work has been approved and derivatives have

been accorded the status of securities.

The most notable of development in the history of secondary segment of the Indian stock

market is the commencement of derivatives trading in June 2000. The SEBI approved derivatives

trading based on futures contracts at National Stock Exchange (NSE) and Bombay Stock

Exchange (BSE) in accordance with the rules / bye laws and regulations of the stock

Exchanges. To begin with, the SEBI permitted equity derivatives named stock index futures. The

BSE introduced on June 9th 2000 stock index futures based on the sensitive index (also called

SENSEX comprising 30 Scripts) named BSX and NSE started on June 12 2000 stock index

future based on its index S&P CNX NIFTY (Comprised 50 Scripts) in the name of

NFUTIDXNI.

In the year July 2001, index options, options on individual securities and futures on

individual securities on both the NSE and the BSE are introduced.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 20

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

Interest rate a future trading was introduced on the NSE in June 2003, the underlying

assets were taken to be notional treasury bills or notional 10 year bonds (both Zero coupon and

Coupon bearing)

The chronology of the events is presented below in the form of table

1. 1952 Enactment of the forward (Regulation) Act

2. 1953 Setting up of the forward markets commission

3. 1956 Enactment of SCRA

4. 1969 Prohibition of all forms of forward trading

under section 16 of SCRA

5. 1972 Informal carry forward trades between two

settlement cycles began on BSE

6. 1980 Khuso committee recommendation

reintroduction of futures in most commodities

7. 1983 Government amends bye laws of exchanges of

Bombay, Calcutta, Ahmadabad and introduced

carry forward trading in specified shares

8. 1992 Enactment of the SEBI act

9. 1993 SEBI prohibits carry forward transactions

10. 1994 Kabra committee recommends further trading

in nine commodities

11. 1995 G. S. Patel committee recommends revised

carry forward system

12. 1996 Revised system restarted on BSE

13. 18 November 1996 SEBI set up L. C. Gupta committee to draft a

policy frame work for index futures

14. 11 May 1998 L. C. Gupta committee submitted report

15. 1998 Varma committee to recommend risk

containment measures for derivatives trading

16. 1999 Securities law (Amendment) Act, 1999 permits

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 21

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

legal frame work for derivatives trading in

India

17. 7 July 1990 RBI gave permission for OTC forward rate

Agreement (FRAs) and interest rate swaps

18. 24 May 2000 Singapore international mercantile exchange

(SIMES) choose NIFTY for trading futures

and options on an Indian index

19. 25 May 2000 SEBI gave permission to NSE and BSE to do

index futures trading

20. 9 June 2000 Trading of BSE Sensex futures commended at

NSE

21. 12 June 2000 Trading of NIFTY futures commended at BSE

22. 31 August 2000 Trading of futures and options on NIFTY to

commence at SIMES

23. July 2001 Trading on equity futures at NSE on 31

Securities

24. June 2003 Trading on interest rate futures commenced at

NSE

25. July 2003 Trading on FC rupees options started

Derivative products in Indian financial markets: -

1. Index Index futures and index options

2. Stock Stock futures and stock options

3. Currency Currency futures and forwards 1980 (OTC)

4. Interest rate Interest rate futures

Calendar of introduction of derivatives products in Indian financial markets: -

OTC EXCHANGE TRADED

1980 Currency forwards June 2000 Equity index futures

1997 Long term foreign, Currency rupees June 2001 Equity index option

swaps

July 1999 Interest rate swaps and FRAs July 2001 Stock option

July 2003 FC rupee options June 2003 Interest rate futures

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 22

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

USES OF DERIVATIVES OR ECONOMIC BENEFITS OF DERIVATIVES OR

PRACTICAL SIGNIFICANCE OF DERIVATIVES: -

Derivative markets serve the society in two important ways provide risk management

and mitigation tools, there by contributing to the development of what economists call complete

markets. Complete market concept refers to that situation where no particular investors be better

off than others or patterns of returns of all additional securities are spanned by the already

existing securities in its or there is no further scope of additional security.

Secondly derivative assist in managerial decision making by providing some

information on future prices that will help in production decisions.

1. Risk Management,

2. Price Discovery,

3. Transfer of Risk,

4. Liquidity and Volume of trading,

5. Trading Catalysts,

6. Allocation of Resources,

7. Attractive large investors,

8. Better economic decisions,

9. Corporations use Derivatives,

10. Financial service firms, banks and other dealers use derivatives,

11. Mutual funds and investment institutions use Derivatives,

12. Mutual funds and investment institutions use derivatives,

13. Individual use derivatives.

1. Risk Management: -

One of the most important services provided by the derivatives is to control, avoid

shift and manage efficiently different types of risks through strategies like hedging,

arbitraging, spreading etc., Derivatives assist the holders to shift of modify suitably the risk

characteristics of their portfolios. These are specifically useful in highly volatile financial

conditions like erratic trading, highly flexible interest rates, volatile exchange rates or

monetary chaos. An oil refiner might find himself paying more for crude oil or a jewelry

manufacture for gold due to variation of prices beyond our control. Such movement may

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 23

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

adversely affect his or her business and even threaten its viability. Derivatives usually in the

form of options and futures are therefore used as means to protect against key business risks

which are beyond ones control.

2. Price Discovery: -

Another important function that is served by the derivative markets is price discovery,

which refers to the process of establishment of bench mark market prices that are used more

broadly in the economy.

Prices in an organized derivatives market reflection the perfection of market

participants about the future and lead the prices of underlying to the perceived future level.

The prices of derivatives converge with the prices of the underlying at the expiration of the

derivative contract. Thus, derivatives help of future as well as current prices.

3. Transfer of Risk: -

The derivative market helps to transfer risks from those who have them but may not

like them to those who have an appetite for then i.e. from hedges to speculators.

4. Liquidity and Volume of trading: -

Derivatives due to their inherent nature are linked to the underlying cash markets with

the introduction of derivatives, the underlying market witness higher trading volumes

because of participation by more players who would not otherwise participate for lack of an

arrangement to transfer risk.

5. Trading Catalysts: -

The derivatives trading encourage the competition trading in the markets, different

risk taking preference of the market operators like speculators, hedgers, arbitrageurs etc,

resulting in increase in trading volume in the country. They also attract young investors

bright, creative well educated people with an entrepreneurial attitude, professional and other

experts who will act as catalysts to the growth of financial markets.

They often energize others to create new business, new products and new

employment opportunities, the benefits of which are immense.

6. Allocation of Resources: -

Prices of goods in the future are very important for production decisions because

these will help the producers and supplier in supplier allocation of resources because

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 24

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

derivatives serve as barometers of the future trends in prices which result in the discovery of

new price both on the spot and futures markets. For,

Example: - A cotton farmer in Andhra Pradesh would like to know what he produces will be

attractive he may chose to go for cotton crop. Otherwise he might opt for some other cash

crop.

This information will be available to him if cotton is trading in a future / forward

market, then the farmer can get some idea about likely price realization.

7. Attractive large investors: -

In the derivative trading no immediate full amount of the transaction is required since

most of them are based on margin trading. As result, large numbers of traders, speculators

arbitrageurs operate in such markets. So, derivatives trading enhance liquidity and reduce

transaction costs in the markets for underlying assets.

8. Better economic decisions: -

Derivatives reduce transaction cost because it is often easier to buy and sell in the

forward market than in the cash market (Spot market). Traders dont give delivery of the

asset at all. Hence derivative markets are much cheaper and more convenient for assets that

are hard to store and transport.

Lower transaction cost often lead to higher liquidity in the derivative market.

By reducing transaction costs and increasing liquidity, derivative market improve

price discovery and lead to more accurate prices in the cash market. This leads to better

economic decisions.

9. Corporations use Derivatives: -

Companies use currency forwards and other derivatives to hedge their exports,

imports and other foreign exchange exposures. They use commodity derivatives to hedge raw

material consumption and inventories as well as their output prices and inventories. For,

Example: - An electrical goods manufacturer might use copper futures to hedge the cost of

copper which is a major raw material for it. A gold mining company might use gold futures

to hedge the selling price of its output. Companies also use interest rate derivatives to hedge

their borrowing costs.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 25

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

An exporter of prawns to a foreign country may find that his supply may be

competitive if the rupee exchange is more than 44 per US dollar at the time of his foreign

currency receipts. If there is a forward market, he can gang the going forward exchange rate

3 months hence and if the forward market is over 44 per US dollar he may undertake the

contract. If the rate is less than 44, he may not enter into agreement with the foreign buyer to

supply.

10. Financial service firms, banks and other dealers use derivatives: -

Bank and securities firms use derivatives to hedge their inventories of securities for,

Example: - A stock broker might carry large inventories of shares as part of his trading

activities. He might use stock index futures to eliminate the market risk of these inventories.

Banks often act as dealers in derivative markets to earn dealer spreads by buying a

derivative from one customer and selling the same to another at a higher price. They may

also seek to make profits by carrying on arbitrage between different markets. Some firms

may also speculate on different prices and earn trading profits by taking positions.

11. Mutual funds and investment institutions use Derivatives: -

Bank and securities firms use derivatives to hedge their inventories of securities for,

Example: - A stock broker might carry large inventories of shares as part of his trading

activities. He might use stock index futures to eliminate the market risk of these inventories.

Banks often act as dealers in derivative markets to earn dealer spreads by buying a

derivative from one customer and selling the same to another at a higher price. They may

also seek to make profits by carrying on arbitrage between different markets. Some firms

may also speculate on different prices and earn trading profits by taking positions.

12. Mutual funds and investment institutions use derivatives: -

Investment institutions use currency forwards and other derivatives to hedge their

internal asset and liability portfolios. The use swaps and other interest rate derivatives to

protect their portfolios from the effects of from the effects of interest rate risk. They use

commodity futures to invest in asset classes in which they find it difficult to invest directly.

Investment institutions also sell options to earn premium income and enhance the returns on

the portfolio. Hedge funds and other aggressive investors use derivatives to speculate in

various financial markets or to arbitrage between different markets.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 26

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

13. Individual use derivatives: -

Many individuals do speculate on asset prices. A famous

Example: - The late Nobel Prize winning economist Milton Friedman who wanted to short

sell the British pound in 1969 when his economic analysis convinced him that a devaluation

of that currency was imminent. He was unable to do so in the OTC markets available at the

time and this experience made him a strong supporter of financial futures in Chicago.

Individuals who manage their own investment portfolios might also use derivatives

for the same reasons as investment institutions. In addition, they may use derivatives to

hedge their non tradable assets. For,

Example: - An individual who holds non transferable employee stock options granted by

his employer might use derivatives to hedge the risk of these options.

MISUSE OF DERIVATIVES OR CRITIQUES OF DERIVATIVES: -

Besides from the important services provides by the derivatives, some experts have

raised doubts and have become critique on the growth of derivatives. They have warned

against them and believe that the derivatives will cause to destabilization, volatility, financial

excesses and oscillations in the financial markets.

1. Speculative and Gambling Devices,

2. Increase in risk,

3. Instability of the financial system,

4. Price stability,

5. Displacement effect,

6. Increased regulatory burden.

1. Speculative and Gambling Devices: -

It is witnessed from the financial markets throughout the world that the trading

volume in derivatives have increased in multiples of the value of the underlying assets and

hardly one to two percent derivatives are settled by the actual delivery of the underlying

assets. Sometimes these speculative buying and selling by professionals and amateurs

adversely affect the genuine producers and distributors.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 27

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

2. Increase in risk: -

It has been observed that the derivatives market especially OTC markets, as

particularly customized privately managed and negotiated and thus they are highly risky.

Empirical studies in this respect have that derivatives used by the banks have not resulted in

the reduction in risk and rather these have risen of new types of risk. They are powerful

leveraged mechanism used to create risk.

3. Instability of the financial system: -

It is argued that derivatives have increased risk not only for their users but also for the

whole financial system. The malpractices, desperate behavior and fraud by the users of

derivatives have threatened the stability of the financial markets and the financial system.

4. Price stability: -

Some expert agrees that derivatives have caused wild fluctuations in the price. The

derivative may be helpful in price stabilization only if there exist a properly organized,

competitive and well regulated market. Further the traders behave and financial in

professional manner and follow standard code of conduct.

5. Displacement effect: -

Growth of the derivatives will reduce the volume of the business in the primary or

new issue market specifically for the new and small corporate units. It is apprehension that

most of investors will divert to the derivative markets, raising fresh capital by such units will

be difficult and hence, this will create displacement effect in the financial market.

6. Increased regulatory burden: -

The derivatives create instability in the financial system as a result; there will be more

burdens on the government or regulatory authorities to control the activities of the traders in

financial derivatives.

ROLE OF DERIVATIVE MARKET OR FUNCTIONS OF DERIVATIVE MARKET: -

Globally derivatives markets are huge and growing rapidly and expansion is probably

going at a scorching pace in the developing countries. Securities markets are dwarfed by the

derivatives markets.

The latest terminal bank for international settlement (BIS) survey published in 2005

reports that the outstanding amount (Notional principal) of OTC derivatives in global

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 28

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

financial market reached $248 trillion as at the end of 2004. This represents a 26% increase

for 2004 and follows a 39% increase in 2003.

The BIS also reports that the outstanding amount of exchange traded derivatives (i. e.

futures and options) reached $46.6 trillion at the years end. Together with the amount of

OTC derivatives, this put the total amount of derivatives outstanding in global market $295

trillion.

Ever since their introduction, derivatives market in India shown a phenomenal growth

in exchange traded and OTC segments. It can be noticed that market for interest rate

derivatives is now comparable with that for government securities in India while the equity

derivatives turnover is more than turnover in the spot market. National stock exchange

ranked as the 17th largest derivatives exchange in the world based on futures and options and

10th largest in the future segment. In the year 2005, the NSE traded 35 times the number of

equity futures contracts as were traded on one Chicago.

Functions or role of derivative market: -

1. Hedging,

2. Price stabilization function,

3. Liquidity Function,

4. Price discovery,

5. Financing Function,

6. Disseminating Information.

1. Hedging: - The primary function of the future market is the hedging function which is

also known as price insurance, risk shifting or risk transference function.

2. Price stabilization function: - Derivative market reduces both the heights of the peaks

and the depth of through the major causative factors responsible for such price stabilizing

influence are such as speculation, price discovery, tendency to panic etc.,

3. Liquidity Function: - Under derivative market the buyer and the seller have to deposit

only a fraction of the contract value say 5% or 10% known as margins. It means that the

traders in the futures market can do the business a much larger volume of contracts than

in a spot market and thus makes market are more liquid.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 29

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

FINANCIAL DERIVATIVES

4. Price discovery: - Another important use of derivatives market is the price discovery

which is revealing of information about futures cash market prices through the future

market. If these expectations are properly published then they also perform an

information or publicity function for the users and the society. In this way, a user of the

futures prices can make consumption or investment decisions more wisely.

5. Financing Function: - Another important function of a futures market is to raise finance

against the stock of assets or commodities lenders are often more interested to finance

hedged asset stock rather un hedged stock because the hedged asset stock are protected

against the risk of loss of value.

6. Disseminating Information: - Futures markets disseminate information quickly,

effectively and inexpensively and as a result, reducing the monopolistic tendency in the

market. Further such information disseminating service enables the society to discover or

form suitable true / correct / equilibrium prices. They serve as barometers of futures in

price resulting in the determination of correct prices on spot markets now and in futures.

They provide for centralized trading where information about fundamental supply and

demand conditions are efficiently assimilated and acted.

Mr. B. Sudheer Kumar, MBA, M.Sc (Maths), (Ph.D) Page 30

Assistant Professor and Training & Placement Officer,

Dept of MBA, VITS, PDTR,

E Mail Id: - bskmba06@gmail.com, Mobile No: - 09177873363, 09154779155.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Capital Markets View of Mortgage Servicing RightsDocument31 pagesA Capital Markets View of Mortgage Servicing RightsekcnhoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ASUG - SAP Commodity ManagementDocument41 pagesASUG - SAP Commodity Managementanon_68509251680% (5)

- Credit Risk Modelling - A PrimerDocument42 pagesCredit Risk Modelling - A PrimersatishdwnldNo ratings yet

- Fsc010 en Col52 ShowDocument463 pagesFsc010 en Col52 ShowGUSTAVOEENo ratings yet

- Auditing Problem From Audit of InvestmentDocument61 pagesAuditing Problem From Audit of InvestmentNicole Anne Santiago SibuloNo ratings yet

- Reviewer Intacc 1n2Document58 pagesReviewer Intacc 1n2John100% (1)

- Unit - II Future and Forward Market (Part - I)Document21 pagesUnit - II Future and Forward Market (Part - I)Sudheer KumarNo ratings yet

- A Study On Quality of Earnings in Petrochemical IndustryDocument9 pagesA Study On Quality of Earnings in Petrochemical IndustrySudheer KumarNo ratings yet

- A Study On Option StragiesDocument6 pagesA Study On Option StragiesSudheer KumarNo ratings yet

- 13 ThirteenDocument4 pages13 ThirteenSudheer KumarNo ratings yet

- ICICI Bank Performance ReviewDocument32 pagesICICI Bank Performance ReviewSandesh Kamble50% (2)

- Comparative Performance Evaluation of Selected Mutual Funds in IndiaDocument80 pagesComparative Performance Evaluation of Selected Mutual Funds in IndiaManish GargNo ratings yet

- SSR-2010 LRDocument24 pagesSSR-2010 LRdavidtollNo ratings yet

- Bos 54380 CP 6Document198 pagesBos 54380 CP 6Sourabh YadavNo ratings yet

- NEAT system questionsDocument7 pagesNEAT system questionsZainul Abedin100% (1)

- ACCT 302 Financial Reporting II Lecture 7Document63 pagesACCT 302 Financial Reporting II Lecture 7Jesse NelsonNo ratings yet

- Valuation: Accounting For Risk and The Expected ReturnDocument43 pagesValuation: Accounting For Risk and The Expected ReturnWoozy ZiNo ratings yet

- Oracle Financial Services Liquidity Risk Management Release 2.0 User GuideDocument133 pagesOracle Financial Services Liquidity Risk Management Release 2.0 User GuideAhmed_srour84No ratings yet

- Ac1101 Final Exam QuestionnaireDocument11 pagesAc1101 Final Exam QuestionnaireAngel ObligacionNo ratings yet

- Definations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007Document24 pagesDefinations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007rimolahaNo ratings yet

- Credit Default Swaps and Systemic RiskDocument25 pagesCredit Default Swaps and Systemic RiskMiguel Vega OtinianoNo ratings yet

- Research of The StudyDocument50 pagesResearch of The StudyRuchi KapoorNo ratings yet

- Assignment No 2Document6 pagesAssignment No 2Amazing worldNo ratings yet

- RBI - NPA CircularDocument96 pagesRBI - NPA CircularArundev SusarlaNo ratings yet

- Tax Issues in Purchase and Sale AgreementsDocument20 pagesTax Issues in Purchase and Sale AgreementsTaichi ChenNo ratings yet

- Margin FAQDocument39 pagesMargin FAQamitthemalNo ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Ceasa WP3822Document89 pagesCeasa WP3822Poe TryNo ratings yet

- Fin550 SipraDocument6 pagesFin550 Sipramadhu sudhanNo ratings yet

- Al KhadashDocument21 pagesAl Khadashmohammad aladwanNo ratings yet

- 11 Derivatives PDFDocument23 pages11 Derivatives PDFReshmi SinghaNo ratings yet

- Are Derivatives Financial "Weapons of Mass Destruction"?: by Helen Simon, CFP®Document3 pagesAre Derivatives Financial "Weapons of Mass Destruction"?: by Helen Simon, CFP®akshat241No ratings yet

- Synthetic ETFs Under The MicroscopeDocument63 pagesSynthetic ETFs Under The Microscopeed_nycNo ratings yet