Professional Documents

Culture Documents

Alvin Lee's Resume Highlighting Investment Banking and Consulting Experience

Uploaded by

Kelvin Lim Wei Liang0 ratings0% found this document useful (0 votes)

219 views1 pageSample Resume

Original Title

Sample Resume

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSample Resume

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

219 views1 pageAlvin Lee's Resume Highlighting Investment Banking and Consulting Experience

Uploaded by

Kelvin Lim Wei LiangSample Resume

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Alvin Lee

24 W. 37th St, New York, NY 10036

917-5555555 | al.tang.31@gmail.com

EDUCATION

New York University

Bachelor of Commerce with Distinction, Marketing

Grades: All subjects scored Distinction or High Distinction

Honors: Top 10% of students for Semester 1, 2011 and Semester 2, 2011

International University

Sarjana Ekonomi in Marketing

GPA: 3.61 / 4.0; GPS for past two semesters: 4.00, 3.90

Honors: Deans List 2008, Deans List 2009, Deans List 2010

New York, NY

January 2011- Graduated December 2011

Jakarta, Indonesia

Attended Sep 2008-December 2010

WORK & LEADERSHIP EXPERIENCE

Boutique Investment Firm

New York, New York

Investment Banking Analyst, M&A Advisory Services

Jan 2012 Present

Currently working on transactions in the specialty chemicals, metal fabrication, telecom and oil and gas industries

Preparing detailed financial models including merger and acquisition models (M&A) and leveraged buyout (LBO)

models

Valuing companies using multiples, comparable company analyses and discounted cash flow analyses

Selected Transaction Experience:

o $3.3Bn M&A buy-side acquisition for multinational specialty chemicals company

Built financial projection models projecting companys income statement, cash flow statement and balance

sheet as well as depreciation and working capital schedules

Conducted valuation analysis, including analyzing comparable companies, precedent transactions and building

discounted cash flow models: analysis resulted in valuation between $3.6Bn-$3.9Bnm based on 7x-8x EBITDA

multiples

Identifying potential bolt-on acquisitions based on client strategy as well as financial, geographic and product

line criteria across various industry sectors

o $36MM LBO of aluminum processing company

Constructed full-scale LBO model including 3 statements, valuation, supporting schedules and scenario

analysis: analysis yielded valuation between $13.6MM and $19.1MM based on 5x-6x EBITDA multiple

Base case returns analysis yielded 26.73% IRR based on an 8.0x EBITDA purchase multiple

Authored 2 page selling memorandum presenting potential opportunity to investment firms

o $19MM LBO of oil and gas services company

Built complete model with three statement projection, supporting debt, mezzanine, depreciation schedules

and integrated with IRR analysis: DCF analysis yielded intrinsic value between $16.6MM and $17.5MM

LBO analysis yielded 28.18% IRR based on 4x EBITDA purchase multiple

JW Consulting

Springfield, IL

Junior Management Consultant

January 2008 October 2008

Created, edited and updated proprietary management technology solutions for use by project teams

Selected Project Experience:

o Banpu

Created new methods of teaching leadership and teamwork skills within the Banpu Manager-Leader program;

methods were then permanently integrated into the larger Manager-Leader program for use with other

companies

SKILLS, ACTIVITIES & INTERESTS

Languages: Fluent in English and Indonesian; Conversational Proficiency in German and Hebrew

Certifications & Training: BIWS Financial Modeling Courses

Activities: PCYC Boxing Gym (assistant coach); Economics Tutor; coach at Muay Thai Training Camp

Interests: Martial Arts; Adventure Travel; Mountain Climbing; Military Science; History

You might also like

- George Robinson CVDocument4 pagesGeorge Robinson CVGeorge RobinsonNo ratings yet

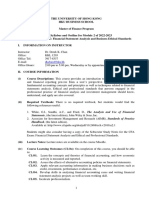

- MBA 1 Course Outline October 2010Document67 pagesMBA 1 Course Outline October 2010Vu Hoang ThanhNo ratings yet

- Jerry Hartanto Resume 150805Document3 pagesJerry Hartanto Resume 150805api-292262154No ratings yet

- FIN 400 Course SylDocument4 pagesFIN 400 Course SylShebelle ColoradoNo ratings yet

- OutsourcingDocument24 pagesOutsourcingihabkarinaNo ratings yet

- Sourcing Procurement Category Manager in USA Resume Evgeny (Eugene) RomakinDocument1 pageSourcing Procurement Category Manager in USA Resume Evgeny (Eugene) RomakinEvgenyEugeneRomakinNo ratings yet

- Managing Director Product Management in New York City Resume Anthony ThalmanDocument2 pagesManaging Director Product Management in New York City Resume Anthony ThalmanAnthony ThalmanNo ratings yet

- Master Degree in Real Estate Business (MRE) : Course NameDocument7 pagesMaster Degree in Real Estate Business (MRE) : Course Namestephane_lolo3No ratings yet

- Resume - Nikhil SachanDocument2 pagesResume - Nikhil SachanAshish AggarwalNo ratings yet

- Minkyung Lowe ResumeDocument3 pagesMinkyung Lowe ResumeMinkyung Lowe100% (1)

- VijayMogha - Cv.cranfield MBADocument4 pagesVijayMogha - Cv.cranfield MBAshrutthii4561No ratings yet

- Chapter2 AligningSelectionProjectsDocument36 pagesChapter2 AligningSelectionProjectsZeynep SenerNo ratings yet

- Rohit Menon Iitr IbmDocument2 pagesRohit Menon Iitr IbmRohit MenonNo ratings yet

- Abhishek Valsangkar ResumeDocument2 pagesAbhishek Valsangkar Resumeabhishek_v_sNo ratings yet

- CV - 2023-01-31T105245.508Document1 pageCV - 2023-01-31T105245.508Ayush MagowNo ratings yet

- National Account Manager in ST Louis MO Resume Michael PlummerDocument2 pagesNational Account Manager in ST Louis MO Resume Michael PlummerMichaelPlummerNo ratings yet

- Format Synopsis ProjectDocument6 pagesFormat Synopsis ProjectRavi DhandhariaNo ratings yet

- VP Director Strategy Commercial Development in London UK Resume Sharon LeeDocument2 pagesVP Director Strategy Commercial Development in London UK Resume Sharon LeeSharonLee2No ratings yet

- CV Saurabh Kainth PDFDocument2 pagesCV Saurabh Kainth PDFShankar SanyalNo ratings yet

- Resume Eve YangDocument2 pagesResume Eve Yangjohn willeyNo ratings yet

- Allyson Joy Heumann ResumeDocument2 pagesAllyson Joy Heumann ResumeallysonjoyheumannNo ratings yet

- CIO Information Technology VP in Orlando FL Resume Jerry DiNataleDocument2 pagesCIO Information Technology VP in Orlando FL Resume Jerry DiNataleJerryDiNataleNo ratings yet

- ATHE - Qual Delivery PDBM - Pdf-Level 7Document38 pagesATHE - Qual Delivery PDBM - Pdf-Level 7Kailash VermaNo ratings yet

- Robinson, H. S Et Al (2005), Business Performance Measurement Practices in Construction Engineering OrganisationsDocument28 pagesRobinson, H. S Et Al (2005), Business Performance Measurement Practices in Construction Engineering OrganisationsDavid SabaflyNo ratings yet

- Unit Number and Title: Unit 7, Business Strategy Module TutorDocument9 pagesUnit Number and Title: Unit 7, Business Strategy Module Tutorannie64xNo ratings yet

- Sam Rao ResumeDocument1 pageSam Rao ResumeAmitabh RaoNo ratings yet

- General Manager SVP Technology in Dallas Fort Worth TX Resume Scott LedbetterDocument2 pagesGeneral Manager SVP Technology in Dallas Fort Worth TX Resume Scott LedbetterScott LedbetterNo ratings yet

- Profit Management StrategyDocument6 pagesProfit Management StrategyNithia MathivananNo ratings yet

- Sustainable Business ConsultantDocument14 pagesSustainable Business Consultantamitjain310No ratings yet

- CEO President Strategic Initiatives in Knoxville TN Resume Robert StribleyDocument2 pagesCEO President Strategic Initiatives in Knoxville TN Resume Robert StribleyRobertStribleyNo ratings yet

- Main Strategies For Control in An OrganizationDocument6 pagesMain Strategies For Control in An OrganizationtallalbasahelNo ratings yet

- UK Soft Drink AnalysisDocument11 pagesUK Soft Drink AnalysisThara DasanayakaNo ratings yet

- Chapter 2Document31 pagesChapter 2Maryam AlaleeliNo ratings yet

- Mba - R - Sem 3 - Strategic ManagementDocument3 pagesMba - R - Sem 3 - Strategic Managementamit shresthaNo ratings yet

- IT VP Director CIO in New York NY Resume James BrownDocument3 pagesIT VP Director CIO in New York NY Resume James BrownJamesBroownNo ratings yet

- CIO CTO Director Information Technology in Chicago IL Resume Mohit SenDocument2 pagesCIO CTO Director Information Technology in Chicago IL Resume Mohit SenMohitSen100% (1)

- 01 Hndts b2b Intro Oliva8 22 08for8 25 08Document48 pages01 Hndts b2b Intro Oliva8 22 08for8 25 08m_938155602No ratings yet

- Obu ExamplerDocument11 pagesObu Examplerahsan1379No ratings yet

- Business Development Client Relationship Manager in NYC Resume Byron CartozianDocument2 pagesBusiness Development Client Relationship Manager in NYC Resume Byron CartozianByronCartozianNo ratings yet

- IB Scotia477BR CoverletterDocument3 pagesIB Scotia477BR Coverletterphuongdpl2s4518No ratings yet

- Course OutlineDocument6 pagesCourse OutlineNancyNo ratings yet

- Guidelines On Process and Evaluation of Corporate Internship-2011-Suggestions IncorporatedDocument5 pagesGuidelines On Process and Evaluation of Corporate Internship-2011-Suggestions IncorporatedSaurabh BansalNo ratings yet

- Phuong (Lily) Tran Package 3Document7 pagesPhuong (Lily) Tran Package 3phtran123No ratings yet

- Senior Program Manager in Minneapolis ST Paul MN Resume Leslie WrightDocument2 pagesSenior Program Manager in Minneapolis ST Paul MN Resume Leslie WrightLeslie WrightNo ratings yet

- Abhijith Deshakulkarni1Document4 pagesAbhijith Deshakulkarni1Shiva SwaroopNo ratings yet

- H.No. 91B, Ward No. 20, Moh. Chaddian, Hadiabad, Phagwara, Punjab - 144401Document2 pagesH.No. 91B, Ward No. 20, Moh. Chaddian, Hadiabad, Phagwara, Punjab - 144401Sanya RajNo ratings yet

- Resume - Nidhi AggarwalDocument3 pagesResume - Nidhi Aggarwalthatsnidhi_aggNo ratings yet

- Director Sourcing Finance Vendor Management in Philadelphia PA Resume Jason GiglioDocument2 pagesDirector Sourcing Finance Vendor Management in Philadelphia PA Resume Jason GiglioJasonGiglioNo ratings yet

- Guidelines For Marketing Project & Report Writing (Steps Involved)Document42 pagesGuidelines For Marketing Project & Report Writing (Steps Involved)Sambeet Barman LangthasaNo ratings yet

- Lecture 19 MST Revision Project Risk 2 PDFDocument27 pagesLecture 19 MST Revision Project Risk 2 PDFLili TeunrokoNo ratings yet

- PAPER Financial Statement Analysis Using Common Size On Mahindra Sindol MotorsDocument10 pagesPAPER Financial Statement Analysis Using Common Size On Mahindra Sindol MotorsDr Bhadrappa HaralayyaNo ratings yet

- GSB Sample Investment Banking Private EquityDocument2 pagesGSB Sample Investment Banking Private EquityAshish SalunkheNo ratings yet

- Jiayi Jenny Wang ResumeDocument1 pageJiayi Jenny Wang ResumeJenny DorseyNo ratings yet

- Strategy, Structure, and Performance in Automotive Product DevelopmentDocument49 pagesStrategy, Structure, and Performance in Automotive Product DevelopmentSumeet LadsaongikarNo ratings yet

- CEO COO Manufacturing Executive in USA Resume Eric BauerDocument3 pagesCEO COO Manufacturing Executive in USA Resume Eric BauerEricBauerNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- Proposals & Competitive Tendering Part 2: Managing Winning Proposals (Second Edition)From EverandProposals & Competitive Tendering Part 2: Managing Winning Proposals (Second Edition)No ratings yet

- 2020 Mock Exam A - Afternoon Session (With Solutions)Document47 pages2020 Mock Exam A - Afternoon Session (With Solutions)Kelvin Lim Wei Liang100% (11)

- Also A MD Once SaidDocument9 pagesAlso A MD Once SaidKelvin Lim Wei LiangNo ratings yet

- CFA LII Study Plan 2020Document5 pagesCFA LII Study Plan 2020Kelvin Lim Wei LiangNo ratings yet

- TradeZero GuideDocument2 pagesTradeZero GuideKelvin Lim Wei LiangNo ratings yet

- Banks ApplicationDocument1 pageBanks ApplicationKelvin Lim Wei LiangNo ratings yet

- EduNote 2013 02 Interest Rate Fixed Income PricesDocument5 pagesEduNote 2013 02 Interest Rate Fixed Income PricesKelvin Lim Wei LiangNo ratings yet

- Basic Market Analysis PDFDocument7 pagesBasic Market Analysis PDFKelvin Lim Wei Liang100% (1)

- UG: Multi-Strategy Intern Fall 2017 (Part-time/Full-time-LOA Required)Document3 pagesUG: Multi-Strategy Intern Fall 2017 (Part-time/Full-time-LOA Required)Kelvin Lim Wei LiangNo ratings yet

- (NOTES) Part 2 Audit Seminar NotesDocument32 pages(NOTES) Part 2 Audit Seminar NotesKelvin Lim Wei LiangNo ratings yet

- (Overpayment) Overall PC Market ShareDocument4 pages(Overpayment) Overall PC Market ShareKelvin Lim Wei LiangNo ratings yet

- Agenda: Questions For Kazan 090917 (Saturday) SlidesDocument3 pagesAgenda: Questions For Kazan 090917 (Saturday) SlidesKelvin Lim Wei LiangNo ratings yet

- Valuation TemplateDocument53 pagesValuation TemplateKelvin Lim Wei LiangNo ratings yet

- 1-MA - 2014-15 - T2 - Test 1 - Questions OnlyDocument8 pages1-MA - 2014-15 - T2 - Test 1 - Questions OnlyKelvin Lim Wei LiangNo ratings yet

- Tax Project FINAL V3Document20 pagesTax Project FINAL V3Kelvin Lim Wei LiangNo ratings yet

- (Overpayment) Overall PC Market ShareDocument4 pages(Overpayment) Overall PC Market ShareKelvin Lim Wei LiangNo ratings yet

- Internship Firms To ApplyDocument1 pageInternship Firms To ApplyKelvin Lim Wei LiangNo ratings yet

- Tax Project FINAL V3Document20 pagesTax Project FINAL V3Kelvin Lim Wei LiangNo ratings yet

- Mgmt005 Whitney ZhangDocument5 pagesMgmt005 Whitney ZhangKelvin Lim Wei LiangNo ratings yet

- Audit CheatsheetDocument1 pageAudit CheatsheetKelvin Lim Wei Liang0% (1)

- Advanced Course BookDocument164 pagesAdvanced Course BookKelvin Lim Wei Liang100% (4)

- Avista AdvisoryDocument3 pagesAvista AdvisoryKelvin Lim Wei LiangNo ratings yet

- Studying RoutineDocument12 pagesStudying RoutineKelvin Lim Wei Liang100% (1)

- Acquisition Valuation: Aswath DamodaranDocument49 pagesAcquisition Valuation: Aswath DamodaranUdit AdhlakhaNo ratings yet

- BNPP EcmDocument2 pagesBNPP EcmKelvin Lim Wei LiangNo ratings yet

- Recomendation LetterDocument1 pageRecomendation LetterKelvin Lim Wei LiangNo ratings yet

- Lim Wei Kiat Resume - Culinary Chef 25 Yrs SingaporeDocument2 pagesLim Wei Kiat Resume - Culinary Chef 25 Yrs SingaporeKelvin Lim Wei LiangNo ratings yet

- Acquisition Valuation: Aswath DamodaranDocument49 pagesAcquisition Valuation: Aswath DamodaranUdit AdhlakhaNo ratings yet

- GrammarDocument3 pagesGrammarKelvin Lim Wei LiangNo ratings yet

- Week 10Document4 pagesWeek 10Kelvin Lim Wei LiangNo ratings yet

- Case: 1: 11-cv-00672 Assigned To: Huvelle, Ellen S. Assign. Date: Description: General CivilDocument16 pagesCase: 1: 11-cv-00672 Assigned To: Huvelle, Ellen S. Assign. Date: Description: General CivilKelvin Lim Wei LiangNo ratings yet

- Land Acquisition in IndiaDocument16 pagesLand Acquisition in IndiavikasNo ratings yet

- Acknowledgement: These Slides Have Been Adapted FromDocument56 pagesAcknowledgement: These Slides Have Been Adapted FromagnesNo ratings yet

- Knowledge Acquisition and Documentation StructuringDocument1 pageKnowledge Acquisition and Documentation StructuringRuben's OscarNo ratings yet

- Merges & Acquisitions (M&A) : Made by Julia UchaninaDocument8 pagesMerges & Acquisitions (M&A) : Made by Julia UchaninaJulia UchaninaNo ratings yet

- Chapter 19 Audit of Acquisition and Payment CycleDocument21 pagesChapter 19 Audit of Acquisition and Payment Cycle0601084730% (1)

- Problem Set 1 The Framework For Valuation: FNCE30011 Essentials of Corporate ValuationDocument2 pagesProblem Set 1 The Framework For Valuation: FNCE30011 Essentials of Corporate ValuationYuki TanNo ratings yet

- FM - Chapter 32Document5 pagesFM - Chapter 32Amit SukhaniNo ratings yet

- The Winner's CurseDocument2 pagesThe Winner's Curseharshull27100% (1)

- Acquisition and MergingDocument19 pagesAcquisition and MergingTeerraNo ratings yet

- 2.110 Cost or Price ReasonablenessDocument4 pages2.110 Cost or Price ReasonablenessferryNo ratings yet

- DoD Contracting Officer Warranting Program Model PDFDocument17 pagesDoD Contracting Officer Warranting Program Model PDFKimberly CherryNo ratings yet

- Chapter - 32: Corporate Restructuring, Mergers and AcquisitionsDocument26 pagesChapter - 32: Corporate Restructuring, Mergers and AcquisitionsHardeep sagarNo ratings yet

- Yap - ACP312 - ULOd - in A NutshellDocument1 pageYap - ACP312 - ULOd - in A NutshellJunzen Ralph YapNo ratings yet

- Funding of Mergers & TakeoversDocument31 pagesFunding of Mergers & TakeoversMohit MohanNo ratings yet

- MNC PPT On 2309Document20 pagesMNC PPT On 2309Priya Mishra100% (1)

- Private Equity Industry InsightsDocument51 pagesPrivate Equity Industry InsightsАнди А. СаэзNo ratings yet

- Tata CorusDocument11 pagesTata CorusRajesh MahajanNo ratings yet

- Juken Technology - Swiss Franc Acquisition of Stepper Motor Assets - 15mar2010Document3 pagesJuken Technology - Swiss Franc Acquisition of Stepper Motor Assets - 15mar2010WeR1 Consultants Pte LtdNo ratings yet

- Role of Ad AgenciesDocument16 pagesRole of Ad AgenciesraveendramanipalNo ratings yet

- Multinational RestructuringDocument30 pagesMultinational RestructuringUmair Khan NiaziNo ratings yet

- Ifrs 3 Business CombinationsDocument11 pagesIfrs 3 Business CombinationsEshetieNo ratings yet

- ElectroluxDocument3 pagesElectroluxRupeet Singh100% (1)

- Business Growth Strategy Growth Strategy AnalysisDocument2 pagesBusiness Growth Strategy Growth Strategy AnalysisBoy Bearish0% (2)

- ASSIGNMENT3Document2 pagesASSIGNMENT3SandeepNo ratings yet

- Corporate Strategy - 2Document51 pagesCorporate Strategy - 2anon_938204859No ratings yet

- AC305 SAP Key NotesDocument48 pagesAC305 SAP Key NotesJamesYacoNo ratings yet

- Tata Steel - Corus Case StudyDocument24 pagesTata Steel - Corus Case StudyMegha Munshi ShahNo ratings yet

- Leveraged Buyout (LBO) AnalysisDocument4 pagesLeveraged Buyout (LBO) AnalysisAtibAhmedNo ratings yet

- Director Manager Contracts Procurement in Washington DC Resume Thomas RingwoodDocument3 pagesDirector Manager Contracts Procurement in Washington DC Resume Thomas RingwoodThomasRingwoodNo ratings yet

- Server RISL RajsathanDocument4 pagesServer RISL RajsathanRahulanandsharmaNo ratings yet