Professional Documents

Culture Documents

BPCL

Uploaded by

Mahendra Singh TaragiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BPCL

Uploaded by

Mahendra Singh TaragiCopyright:

Available Formats

A Progressive Digital Media business

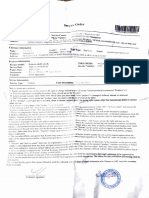

COMPANY PROFILE

Bharat Petroleum

Corporation Limited

REFERENCE CODE: 7723BFE4-BE04-4129-A4B7-08D5CFCBA466

PUBLICATION DATE: 12 Feb 2016

www.marketline.com

COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED

Bharat Petroleum Corporation Limited

TABLE OF CONTENTS

TABLE OF CONTENTS

Company Overview ........................................................................................................3

Key Facts ......................................................................................................................... 3

Business Description .....................................................................................................4

History ............................................................................................................................. 6

Key Employees .............................................................................................................10

Key Employee Biographies .........................................................................................12

Major Products & Services ..........................................................................................15

Revenue Analysis .........................................................................................................16

SWOT Analysis .............................................................................................................17

Top Competitors ...........................................................................................................23

Company View ..............................................................................................................24

Locations And Subsidaries .........................................................................................26

Financial Overview .......................................................................................................27

Bharat Petroleum Corporation Limited

MarketLine

Page 2

Bharat Petroleum Corporation Limited

Company Overview

Company Overview

COMPANY OVERVIEW

Bharat Petroleum Corporation Limited (BPCL or 'the company') is engaged in refining, processing, and

distributing petroleum products, and exploration and production of hydrocarbons. It offers petrol, diesel,

kerosene, aviation fuel, liquefied petroleum gas (LPG), compressed natural gas (CNG), and lubricants.

The company primarily operates in India, where it is headquartered in Mumbai, and employed 12,750

people as on March 31, 2015.

The company reported revenues of (Rupee) INR1,886,513.6 million for the fiscal year ended March 2016

(FY2016), a decrease of 22.2% over FY2015. In FY2016, the companys operating margin was 6.7%,

compared to an operating margin of 2.8% in FY2015. In FY2016, the company recorded a net margin of

4.2%, compared to a net margin of 2% in FY2015.

Key Facts

KEY FACTS

Head Office

Bharat Petroleum Corporation Limited

Bharat Bhavan

4 and 6 Currimbhoy Road

Ballard Estate

IND

Phone

Fax

Web Address

Revenue / turnover (INR Mn)

1,886,513.6

Revenue (USD Mn)

29,459.0

Financial Year End

March

Employees

12,623

Bombay Stock Exchange Ticker

500547

Bharat Petroleum Corporation Limited

MarketLine

Page 3

Bharat Petroleum Corporation Limited

Business Description

Business Description

BUSINESS DESCRIPTION

Bharat Petroleum Corporation Limited (BPCL or 'the company') is an India-based oil marketing company

that focuses on refining, processing, and distributing petroleum products. It primarily offers petrol, diesel,

kerosene, aviation fuel, liquefied petroleum gas (LPG), compressed natural gas (CNG), and lubricants. In

FY2015, the aggregate refinery throughput at BPCL's refineries at Mumbai and Kochi, along with its

subsidiary company, Numaligarh Refinery (NRL) and 50% throughput of joint venture company, Bharat

Oman Refineries (BORL) was 29.3 million metric tons (MMT). The company generated market sales of

34.95 MMT during FY2015 and exports of petroleum products stood at 2.2 MMT. The company primarily

operates in India.

BPCL operates through two business segments: downstream petroleum (refinery and marketing of

petroleum products); and exploration and production (E&P) of hydrocarbons.

The company's petroleum products include fuels, gases, lubricants, solvents, and special products. The

company also produces bitumen and sulfur. BPCL produces three categories of industrial fuels, including

marine fuels, black oils, and white oils. The company's marine fuels include the following: high flash high

speed diesel (HFHSD) and furnace oil; black oil which include light diesel oil (LDO); and white oils which

comprise motor spirit (petrol), high speed diesel (HSD), kerosene (SKO), and naphtha. BPCL also offers

various gases, including poly propelene feed stock, natural gas, LPG, and Bharat metal cutting gas.

Under the lubricants division, BPCL offers various kinds of lubricants including automotive engine oils,

agricultural equipment engine oils, earthmoving equipment engine oils, gear oils, transmission oils,

specialty oils, and greases. In the automotive category, the company supplies lubricants with the MAK

brand. BPCL is marketing MAK lubricants across India through its network of 13,000 fuel stations and 591

lubricants distributors spread across the country. During FY2015, the company produced a total of

287,649 million tons (MT) of lubricants and sold 311,000 MT.

BPCL produces bitumen which is used for road construction, surfacing airfield runways and taxi tracks,

hydraulic applications such as canal lining, river bank protection, dam construction, and sea defenses.

The company also manufactures sulfur as a by-product which finds its applications in the manufacturing

of sulfuric acid and in the manufacture of fertilizers.

The company's products under solvent and special products category include mineral turpentine, special

boiling point (SBP) spirits, hexane, benzene, and toluene. The mineral turpentine is used in the

manufacture of surface coatings, like paints, varnished, and lacquers; and in dry cleaning.

BPCL supplies aviation fuel through its network of aviation fueling stations spread across the India. The

company operated 35 aviation service stations in FY2015. The company is also engaged in the LPG

market for homes which involve home delivery of gas cylinders and LPG supplies through pipeline to

mega residential complexes. The company supplies its LPG under the brand Bharatgas. In FY2015, the

company operated 12,809 retail outlets, 50 LPG bottling plants and 4,044 distributors. For the same

period, BPCL had a LPG customer base of 45.8 million. In addition, the company filled a total of 4.3 MMT

of gas in cylinders during FY2015. In addition, BPCL handled approximately 1,205 megatons (TMT) of

gas. Out of this, 314 TMT of gas was supplied to Mumbai Refinery, 76 TMT was supplied to Kochi

Bharat Petroleum Corporation Limited

MarketLine

Page 4

Bharat Petroleum Corporation Limited

Business Description

Refinery for own use requirements and the balance of approximately 815 TMT of gas was sold to various

customers across different sectors like fertilizer, power, and steel, among others. Moreover,

approximately 15 TMT LNG was supplied through tank trucks to customers who are located away from

the pipeline grids.

The company markets its products through its network of retail outlets, gas stations, kerosene dealers,

LPG distributors, and lubricant shops, as well as supplying fuels directly to international and domestic

airlines.

The company's industrial and commercial business unit (I&C SBU) caters to over 8,000 industrial

customers across India which include industries from the public and private sectors, of the core and noncore segments, and various government establishments such as defense, railways, state transport

undertakings, and state electricity boards. During FY2015, the industrial and commercial business

recorded a total sales volume of 3.4 MMT.

BPCL's E&P segment operates through Bharat Petro Resources (BPRL), a wholly-owned subsidiary of

the company. BPRL is engaged in the exploration and production activities of oil and gas. BPRL has

participating interests in 17 exploration blocks, in consortium with other partners. Out of these blocks,

seven blocks are in India and six in Brazil, and one each in Mozambique, Indonesia, Australia and East

Timor. The total area of these 17 blocks (where BPRL/its subsidiaries have PI) is around 24,375 square

kilometers (sq.km), of which approximately 88% is offshore acreage.

Apart from the refining, marketing, exploration, and production activities, the company is also involved in

crude imports. The total crude requirement for BPCL and its companies is over 22 million metric tons per

annum (MMTPA). Of this, approximately 40% is met out of indigenous crude production by Oil and

Natural Gas Corporation (ONGC). The balance requirement is met through imports. The quantum of

crude oil imported during FY2015 stood at 18.1 MMT.

Bharat Petroleum Corporation Limited

MarketLine

Page 5

Bharat Petroleum Corporation Limited

History

History

HISTORY

Bharat Petroleum Corporation Limited (BPCL or 'the company') history dates back to 1952 when Burmah

Shell Refineries (BSR) was incorporated as a company and also established a refinery in Mahul.

The Government of India acquired 100% equity share holding of BSR in 1976. Later the name of BSR

was changed to Bharat Refineries (BRL) and subsequently to BPCL in 1977.

The company incorporated a joint venture company, Bharat Oman Refineries, in 1994. In the following

year, BPCL signed a memorandum of understanding (MOU) with Bank of Baroda in 1995, to launch the

first co-branded credit card in the country.

Three years later, the company along with Gas Authority of India (GAIL) established a joint venture

company, Indraprastha Gas, for implementing the project for supply of CNG to the household and

automobile sectors in Delhi, India.

McDonald's made an agreement with BPCL to open and run restaurants at selected petrol pumps across

India, in 2000. BPCL launched "Speed 93", its own brand of petrol, in 2003. In the same year, BPCL

entered the LNG market by signing a gas sales purchase agreement with Petronet LNG.

During 2004, BPCL entered into a business to business e-commerce arrangement with IDBI Bank, to

provide an automated payment and purchase process to BPCL's corporate and industrial clients. In the

same year, the company tied up with Tata Consultancy Services to provide medical advisory and

counseling services at Ghar, the highway retailing initiative of BPCL. In the following year, BPCL and

GAIL formed another joint venture company, Central UP Gas, for implementation of City Gas projects in

Delhi and Kanpur.

In 2006, the Government of Oman signed an exploration and production sharing agreement (EPSA) for

the on land exploration block 56 with the consortium comprising BPCL, Oilex (operator), Hindustan

Petroleum, GAIL, and Videocon Industries. In the same year, BPCL acquired a 20% interest in an

exploration block in Australia. Subsequently, the company incorporated its wholly-owned subsidiary,

Bharat Petro Resources (BPRL) to focus on exploration and production activities.

Further in 2006, Sabaramati Gas, a joint venture company promoted by BPCL and Gujarat State

Petroleum, was incorporated for implementing the City Gas distribution project for supply of CNG to the

household and automobile sectors in the city of Gandhinagar, Mehsana, and Sabarkantha Districts of

Gujarat, India. Additionally, the company also incorporated Maharashtra Natural Gas as a joint venture

company with GAIL as the other partner, for implementing the project for supply of CNG to the household,

industrial, and automobile sectors in Pune and its nearby areas.

During 2007, Bharat Stars Services, a joint venture company promoted by BPCL and ST Airport,

Singapore was incorporated for providing plane fuelling services at the new Bengaluru International

Airport. Additionally, BPCL sold its 49% shareholdings in Bharat Shell to Shell Overseas. In the same

year, BPCL and Videocon Industries acquired 50% stake in Brazil's EnCana Brasil Petroleo.

Bharat Petroleum Corporation Limited

MarketLine

Page 6

Bharat Petroleum Corporation Limited

History

In 2008, BPCL established a new joint venture company for the production, procurement, cultivation, and

plantation of horticulture crops such as Jatropha and Pongamia. The new joint venture company was

involved in trading, research and development, and management of all crops and plantation including

biofuels in the state of Uttar Pradesh, India. The joint venture company was promoted by BPCL with

Nandan Biomatrix and Shapoorji Pallonji through an affiliate.

Also in 2008, BPCL established a Singapore subsidiary, Matrix Bharat Marine Services, as a joint venture

company with Matrix Marine Fuels, an affiliate of the Mabanaft group of companies of Hamburg, Germany

to carry on the bunkering business and the supply of marine lubricants in the Singapore market, as well

as international bunkering including expansion in the Asian and Middle East markets. In the same year,

Punjab Energy Development Agency (PEDA) signed a MOU with BPCL to set up solar photovoltaic

power plants at Lalru in Punjab, India.

In 2009, Oman Oil Company (OOC) and Bharat Oman Refinery (BORL), a subsidiary of BPCL, signed an

agreement in Oman related to an additional investment of over INR12,200 million ($256.2 million) by

OOC in BORL. As a result of this investment, OOC acquired 26% of the equity share capital of BORL.

During 2010, BPCL's Mumbai refinery commissioned green fuel production facilities. Later in 2010, the

company started operations at its Bina refinery in the central Indian state of Madhya Pradesh by

launching its crude distillation unit. In the same year, BPCL and Hindustan Petroleum entered into a MOU

with Gujarat State Petroleum to form a joint venture for trunk gas pipelines. As part of the transaction, the

joint venture decided to bid for pipeline projects of Petroleum and Natural Gas Regulatory Board.

Further in 2010, a consortium of Gujarat State Petronet, Indian Oil, Hindustan Petroleum, and BPCL was

set to be awarded a more than INR60 billion ($1.35 billion) contract from the Petroleum and Natural Gas

Regulatory Board to lay 1,600 kilometers of gas pipeline from Mallavaram in Andhra Pradesh to Bhilwara

in Rajasthan.

BPCL signed an initial agreement in 2011 with the provincial government of Rajasthan to sell fuel

products from the state's proposed refinery. The company will sell at least 75% of the volume of the

products from the proposed Rajasthan refinery under the agreement. In the same year, BPLC planned to

build an LNG import facility and pipeline infrastructure in India to transport gas from a Mozambique block

in which it holds stake with Videocon Industries.

Later in 2011, the board at BPCL approved the expansion of the Kochi Refinery by six million tons per

year. The expansion project will also examine the feasibility of building up gradation facilities to reduce

residual fuel generation and enhance distillates. The company will invest INR3,000 million ($65.8 million)

for its pre-project activities. Thereafter in 2011, Goodyear India partnered with BPCL to open wheel care

outlets at select petrol pumps of the public sector undertaking across the country.

Also in 2011, Bharat Oman Refineries, a joint venture between BPCL and Oman Oil Co, planned a

capacity expansion at the Bina refinery in Madhya Pradesh from six million tons a year to 15 million tons

a year in two phases expected to be completed by 2015 or 2016, costing the company INR113,970

million ($2,499.4 million). In addition, BPCL planned to expand its refineries in Kochi from 190,000 barrels

per day to 300,000 barrels per day and at its Bina refinery from 120,000 barrels per day to 180,000

barrels per day. It also planned to build a fluid catalytic cracking unit at the Kochi plant. These expansions

Bharat Petroleum Corporation Limited

MarketLine

Page 7

Bharat Petroleum Corporation Limited

History

are expected to be operational by 2015.

Thereafter in 2011, BPCL signed an MOU with HMT to enhance its export business. In the same year,

BPCL planned to set up a land-based LNG terminal at Maharashtra and Karnataka which will have a

capacity of five to six MT with an investment of INR45,000 million ($986.9 million). Towards the end of

2011, BPCL planned to diversify into petrochemicals and build a niche petrochemical project at a cost of

INR50-60 billion ($1.1-1.3 billion). Subsequently, BPCL planned to sign an agreement to form a joint

venture (JV) with UK's LP Chemicals for setting up a petrochemical plant at its Kochi refinery in Kerala.

In 2012, BPCL planned to acquire 11% share in Kannur International Airport (KIAL) and to invest around

INR550-600 million ($12.1-13.2 million) in the project. In the same year, BPCL planned to acquire 21%

stake in the proposed airport in Kannur in north Kerala. Also, BPCL and HPCL planned to purchase a

strategic stake in a subsidiary of Mumbai-based Swan Energy. Subsequently, Engineers India (EIL)

secured an INR7,200 million ($150.19 million) consultancy services contract from BPCL for the integrated

refinery expansion project (IREP) at Kochi.

Moreover in 2012, BPCL signed an MOU with Kannur International Airport (KIAL) for an equity investment

of INR170 million ($35.46 million) in KIAL. Additionally, BPCL inked a MOU with LG Chemicals (of South

Korea) for creating a joint venture to set up a petrochemical plant next to its Kochi refinery complex.

Subsequently, BPCL entered into licensing agreements with four technology providers for its IREP in

Kochi, involving an investment of INR142,250 million ($2,967.3 million). In the same year, BPCL planned

to offer 51% stake in its INR60,000 million ($1,251.6 million) project to its South Korean joint venture

partner LG Chemicals.

Further in 2012, BPCL and Videocon Industries announced an oil discovery in the BM-SEA-11 block in

ultra-deep waters of the Sergipe-Alago as Basin off Brazil. In the same year, BPCL signed an agreement

with Honda Motorcycle and Scooters India for preparation of engine oil. As per the contract, Honda

genuine engine oil will be prepared especially for two wheelers which will be available at all the retail

outlets of BPCL. Later, BPCL planned to complete expansion projects worth more than $3 billion at two

refineries by 2015, to increase output and to upgrade fuel quality.

Towards the end of 2012, BPCL planned to lay two pipelines, one from Ingur (Tamil Nadu) to

Devangonthi (near Bangalore in Karnataka), and the other from Kochi (Kerala) to Coimbatore (Tamil

Nadu). Subsequently, BPCL and Videocon Industries planned to turn the natural gas discovery in a block

in Mozambique into LNG at a plant to be jointly built with neighboring gas field operator Eni of Italy.

In 2013, BPCL planned to invest INR200,000 million ($4,172 million) for integrated expansion of the Kochi

Refinery. In the same year, BPCL signed an agreement with Bengal Aerotropolis (BAPL) to establish a

fuel farm at upcoming Greenfield airport at Durgapur, West Bengal. Additionally, ONGC, BPCL, Mitsui of

Japan, and New Mangalore Port Trust signed a MOU to conduct feasibility of setting up $500-750 million

liquid gas import terminal at Mangalore.

At the end of 2013, NRL signed a MOU with BPCL for carrying out techno-commercial feasibility study for

putting up 6.0 MMTPA bulk crude oil import facilities by NRL as well as 1.0 MMTPA bulk LPG import

facilities by BPCL.

Bharat Petroleum Corporation Limited

MarketLine

Page 8

Bharat Petroleum Corporation Limited

History

During 2014, BPCL announced that it is planning to expand its Kochi refinery where it is also setting up a

petrochemicals unit. The expansion project envisages increasing the capacity of the Kochi refinery from

six million tons per annum (MTPA) to 15.5 MTPA. In the same year, BPCL announced to import more

than seven million tons of crude oil from the UAE and Kuwait from 2014 to 2015. Subsequently, BPCL

signed crude oil import deals with the UAE.

Thereafter in 2014, Rashtriya Chemicals & Fertilizers signed a MOU with BPCL for setting up of new

Sewage Treatment Plant (STP) at Trombay. This plant will be named as RCF-BPCL Sewage Treatment

Plant. Later, BPCL announced to diversify into petrochemicals at an estimated capital cost of INR45,880

million ($761.6 million). BPCL plans to produce niche petrochemicals such as acrylic acid, acrylates and

oxo alcohols.

In May 2015, Petronet CCK (PCCKL) became a subsidiary of BPCL with BPCL holding 68.97% of the

paid-up equity share capital of PCCKL.

In November 2015, BPCL and GAIL Gas was awarded the authorization for laying, building, operating,

and expanding of a City Gas Distribution Network (CGD Network) in the Haridwar District by the

Petroleum and Natural Gas Regulatory Board.

In December 2015, BPCL entered into a binding gas sale and purchase agreement (GSPA) with Petronet

LNG (PLL) for supply of an additional quantity of 0.1 MMTPA of RLNG with effect from January, 2016.

Bharat Petroleum Corporation Limited

MarketLine

Page 9

Bharat Petroleum Corporation Limited

Key Employees

Key Employees

KEY EMPLOYEES

Name

Job Title

Board

S. Varadarajan

Chairman and

Managing Director

Executive Board

6520266 INR

P. Balasubramanian

Director, Finance

Executive Board

4578572 INR

Deepak Bhojwani

Independent Director

Non Executive Board

Gopal Chandra Nanda

Independent Director

Non Executive Board

Rajesh Mangal

Independent Director

Non Executive Board

Anant Kumar Singh

Government Director

Non Executive Board

P.H. Kurian

Government Director

Non Executive Board

Manoj Pant

Chief Vigilance Officer Senior Management

Arjun Hira

Executive Director,

Marketing Corporate

Senior Management

Dipti Sanzgiri

Executive Director,

International Trade

Senior Management

George Paul

Executive Director,

Retail

Senior Management

I. Srinivas Rao

Executive Director, Gas Senior Management

J. Dinaker

Executive Director,

Audit

Senior Management

K. B. Narayanan

Executive Director,

Information Systems

Senior Management

K. P. Chandy

Executive Director,

Lubes

Senior Management

Manmohan Singh

Executive Director,

Senior Management

Engineering Services,

Marketing

M. M. Chawla

Executive Director,

Engineering and

Projects

Senior Management

M. M. Somaya

Executive Director,

Aviation

Senior Management

Monica Widhani

Executive Director,

Coordination

Senior Management

P. C. Srivastava

Executive Director,

HSSE

Senior Management

P. Kumaraswamy

Executive Director,

Projects, Kochi

Refinery

Senior Management

Prasad K. Panicker

Executive Director, I/C Senior Management

Bharat Petroleum Corporation Limited

MarketLine

Compensation

Page 10

Bharat Petroleum Corporation Limited

Key Employees

Kochi Refinery

Pramod Sharma

Executive Director,

New Business

Initiatives

Senior Management

R. K. Mehra

Executive Director,

Pipelines

Senior Management

R. P. Natekar

Executive Director, I&C Senior Management

S. K. Agrawal

Executive Director,

Corporate Affairs

Senior Management

Sharad K. Sharma

Executive Director,

Supply Chain

Optimization

Senior Management

K.K. Gupta

Director, Marketing

Executive Board

7291682 INR

B.K. Datta

Director, Refineries

Executive Board

5170465 INR

S. P. Gathoo

Director, Human

Resources

Executive Board

5701853 INR

Bharat Petroleum Corporation Limited

MarketLine

Page 11

Bharat Petroleum Corporation Limited

Key Employee Biographies

Key Employee Biographies

KEY EMPLOYEE BIOGRAPHIES

S. Varadarajan

Board:Executive Board

Job Title:Chairman and Managing Director

Since:2013

Mr. Varadarajan has been the Chairman and Managing Director at BPCL since 2013. Previously, he

served as the Director for the Finance Department he was also responsible for the overall treasury

management, risk management, corporate accounts, taxation, and budgeting. In addition to finance, he

has handled marketing as head of sales for the retail business in southern region and also led the

corporate strategy team. He is a Director at Petronet CCK (PCCKL) and is also a member of the Audit

Committee at PCCKL.

P. Balasubramanian

Board:Executive Board

Job Title:Director, Finance

Since:2014

Mr. Balasubramanian has been the Director of Finance at BPCL since 2014. He joined BPCL in 1985. Mr.

Balasubramanian has had stints in Internal Audit, Regional Finance, Corporate Treasury, Management

Accounts and Corporate Finance. Prior to his appointment as Director of Finance, he was heading

Corporate Finance. He is overall in charge of finance, accounts and fund management of the organization

and is responsible for evolving and formulating policies relating to finance and accounts as well as

implementation thereof.

Deepak Bhojwani

Board:Non Executive Board

Job Title:Independent Director

Since:2015

Mr. Bhojwani has been an Independent Director at BPCL since 2015.

Gopal Chandra Nanda

Board:Non Executive Board

Job Title:Independent Director

Since:2015

Mr. Nanda has been an Independent Director at BPCL since 2015.

Bharat Petroleum Corporation Limited

MarketLine

Page 12

Bharat Petroleum Corporation Limited

Key Employee Biographies

Rajesh Mangal

Board:Non Executive Board

Job Title:Independent Director

Since:2015

Mr. Mangal has been an Independent Director at BPCL since 2015.

Anant Kumar Singh

Board:Non Executive Board

Job Title:Government Director

Since:2016

Mr. Singh has been a Non-Executive Government Director at BPCL since 2016.

P.H. Kurian

Board:Non Executive Board

Job Title:Government Director

Since:2013

Mr. Kurian has been a Non-Executive Government Director at BPCL since 2013. He is Principal Secretary

(Industries and IT), Government of Kerala. Mr. Kurian served as Commissioner of Public Works

Department, Controller General of Patents, and Designs and Trademarks. He has wide experience in

public administration, infrastructure and industry.

K.K. Gupta

Board:Executive Board

Job Title:Director, Marketing

Since:2011

Age:60

Mr. Gupta has been the Director of Marketing at BPCL since 2011. He joined BPCL in 1979. During his

tenure at BPCL he headed major business units like lubes, LPG, retail, and logistics. Mr. Gupta is also a

Director at Indraprastha Gas, Numaligarh Refinery, and Sabarmati Gas.

B.K. Datta

Board:Executive Board

Job Title:Director, Refineries

Since:2011

Age:60

Bharat Petroleum Corporation Limited

MarketLine

Page 13

Bharat Petroleum Corporation Limited

Key Employee Biographies

Mr. Datta has been the Director of Refineries at BPCL since 2011. Prior to this he was the head of the

supply chain optimization function. He joined BPCL in 1979 and has held key positions in various

functions like the Mumbai Refinery, integrated information systems, and international trade and supplies,

among others.

S. P. Gathoo

Board:Executive Board

Job Title:Director, Human Resources

Since:2011

Mr. Gathoo has been the Director of Human Resources at BPCL since 2011. Prior to his appointment to

the board at BPCL, he was an Executive Director of Human Resources Services (HINR) and the Head of

Integrated Information Systems and Lubes Business at the company. He was also the Head of Human

Resources Development (HRD) at BPCL.

Bharat Petroleum Corporation Limited

MarketLine

Page 14

Bharat Petroleum Corporation Limited

Major Products & Services

Major Products & Services

MAJOR PRODUCTS & SERVICES

Bharat Petroleum Corporation Limited (BPCL or 'the company') is engaged in refining, processing, and

distributing petroleum products, and exploration and production of hydrocarbons. The company's key

products, services, and brands include the following:

Products:

Polypropylene feedstock

Liquefied petroleum gas (LPG)

Benzene

Toluene

Naphtha

Mineral turpentine

Aviation turbine fuel (ATF)

Superior kerosene

High speed diesel oil

Light diesel oil

Mineral Turpentine Oil

Low sulfur heavy stock (LSHS)

Bitumen

Lube oil base stock

Motor Spirit

Special Boiling Point Spirit/Hexane

Services:

Energy audits

Consultancy services

Technical services

Fuel management system

Online ordering

Bunkering

Brands:

Bharatgas

Speed

MAK

Bharat Petroleum Corporation Limited

MarketLine

Page 15

Bharat Petroleum Corporation Limited

Revenue Analysis

Revenue Analysis

REVENUE ANALYSIS

Bharat Petroleum Corporation Limited

The company recorded revenues of INR2,425,985 million ($39,786.2 million) during FY2015, a decrease

of 8.3% compared to FY2014. BPCL primarily operates in India.

For FY2015, BPCL generated most of the revenues from its downstream petroleum business with little

contribution from its exploration and production (E&P) business.

Revenue by segment*

In FY2015, the downstream petroleum segment recorded revenues of INR2,437,527.1 million ($39,975.4

million), a decrease of 8% compared to FY2014.

The E&P segment recorded revenues of INR15.9 million ($0.3 million) in FY2015, a decrease of 97%

compared to FY2014.

*as reported by the company in its annual filings.

Revenue by geography

BPCL primarily operates in India.

Bharat Petroleum Corporation Limited

MarketLine

Page 16

Bharat Petroleum Corporation Limited

SWOT Analysis

SWOT Analysis

SWOT ANALYSIS

Bharat Petroleum Corporation Limited (BPCL or 'the company') is engaged in refining, processing, and

distributing petroleum products, and exploration and production of hydrocarbons. It offers petrol, diesel,

kerosene, aviation fuel, LPG, CNG, and lubricants. BPCL has a strong market position domestically

across all businesses which provide significant competitive advantage over its peers. However,

increasing competition can create hindrances for the company in securing sites for its new fuel stations,

which could hurt the company's expansion plans.

Strength

Weakness

Market leading position

Non-conventional energy initiatives

Strong production capabilities

Robust research and development capabilities

Dependency on international market for supply of

crude oil

Concentration of operations

Opportunity

Threat

Strategic plan for the integrated refinery expansion

project

Expansion of the petrochemical business

Growing demand for oil and gas in India

Weakening of rupee over US dollar

Under-recovery of the prices of petroleum products

Intense competition

Strength

Market leading position

BPCL has market leading position across all its businesses. The company has recorded outstanding

results in all the facets of business for FY2014-15. Both in refining and marketing, excellent results have

been delivered which have contributed to the company achieving the highest ever net profit till date of

INR INR48,065.7 million ($788.3 million) million surpassing last year's record of INR39,106.8 million

($641.3 million). Amongst the public sector undertaking (PSU) oil companies, BPCL achieved the highest

average gross refining margin (GRM) of $3.97 per barrel during FY2014-15. BPCL's market sales volume

was 34.95 MMT as compared to 34.3 MMT achieved during FY2013-14.

BPCL's market share amongst the public sector oil companies stood at 23.29% in FY2015. Moreover,

BPCL recorded strong market shares in various products it sells. For instance, during FY2015, BPCL had

a market share of 6.8% in Naphtha sales with a total sales volume of 326,000 MT. Similarly, the company

recorded market share of 50.6%, 28.8% and 25.8% during FY2015 for special boiling point spirit, motor

spirit and LPG (bulk and packed), respectively. Further, BPCL also had a market share of 26.7%, 23.6%

and 22.1% for high speed diesel, aviation turbine fuel and light diesel, respectively. It also recorded 26%

market share in lubricants.

Bharat Petroleum Corporation Limited

MarketLine

Page 17

Bharat Petroleum Corporation Limited

SWOT Analysis

Therefore, the company's market leading position provides significant competitive advantage over its

peers. Moreover, market leading position enhances its brand image to attract more customers for its oil

and gas products.

Non-conventional energy initiatives

BPCL has placed strong emphasis on the development of non-conventional sources of energy. A number

of initiatives have been undertaken in tapping non-conventional energy sources like bio-diesel, wind

energy, solar energy, and fuel cells in order to develop alternate sources of energy. BPCL has promoted

Bharat Renewable Energy (BREL), a joint venture company with the objective of entering the bio-diesel

value chain in the state of Uttar Pradesh. "Project Triple One" has also been launched with the aim of

producing one million tons of bio-diesel from the plantation of Jatropha and Karanj, to replace diesel over

the next 10 years.

Moreover, BPCL has been one of the first energy companies to successfully generate power through

windmills in India. BPCL has installed 5 MW capacity windmills in the hilly range of Kappatguda in

Chitradurga district, Karnataka and a 0.5 MW wind farm in Tamil Nadu. The power produced from these

wind mills is sold to the State electricity grid. In addition, BPCL has commissioned smaller KW scale solar

plants for a total capacity of about 1500 KW for lighting and admin office building electrical loads at Kochi

and Mumbai Refineries, 205 retail outlets, along the Mumbai-Manmad pipeline, some LPG bottling plants

and Lube blending plants. Moreover, under the renewable energy policy, a 4 MW solar plant at Bina

Despatch Terminal and a 6 MW grid connected wind power project are being put up.

These initiatives will enable BPCL to strengthen its clean energy capabilities in the wake of changing

environment regulations.

Strong production capabilities

BPCL has strong production capabilities. The aggregate refinery throughput at BPCL's refineries at

Mumbai and Kochi and that of its subsidiary company NRL in FY2015 was 23.36 MMT. During FY2015,

Mumbai Refinery achieved throughput of 12.96 MMT of feedstock (crude oil and other feedstock).

Mumbai Refinery has achieved this level of throughput, despite having planned shutdown of one of the

crude processing units and associated secondary facility during FY2015. This represents a capacity

utilization of 108.0%.

Similarly, Kochi Refinery achieved the highest ever crude throughput of 10.40 MMT in FY2015, as

compared to 10.32 MMT in FY2014. This is the third year in succession that the throughput at the refinery

has crossed the 10 MMT mark. The capacity utilization of the refinery during FY2015 was 109.46%.

Strong production capabilities enable BPCL to continuously enhance its efficiency, to evaluate

opportunities to reduce costs, and to improve processes. In addition, it helps the company to increase the

reliability of order fulfillment and satisfaction of customer needs.

Robust research and development capabilities

Research and development (R&D) is an integral part of BPCL's strategy for achieving sustainable growth

Bharat Petroleum Corporation Limited

MarketLine

Page 18

Bharat Petroleum Corporation Limited

SWOT Analysis

and profitability. To enhance R&D capabilities, BPCL is continuously strengthening its infrastructure and

manpower resources. The core research areas are broadly divided into four categories namely refinery

processes upgradation and optimization, development of novel energy efficient technologies, product

development, and alternative fuels and energy. The new products developed include new neutralizing

amine, sorption enhanced steam reforming, de-aromatized specialty solvents having less than 0.5 weight

percent (wt%) aromatics content, and cost effective FCC gasoline sulphur reduction additive. Moreover,

the company also developed hydro treating catalyst for production of Euro-V diesel, catalyst for lube oil

base stock, new grades of bitumen, natural gas storage technology, novel reactor schemes for hydroprocessing, and FCC applications. Further, the R&D center at Sewree contributed to the lubes business

by developing new product formulations such as OE specific shock absorber fluid, limited slip gear oil,

high performance compressor oil, engine oil for 2 stroke stationary natural gas engines, and defense

specific hydraulic transmission oil.

The company has R&D capabilities at corporate R&D center, Greater Noida, Uttar Pradesh; product and

application development center, Sewree, Mumbai; and the R&D centre at Kochi refinery. The corporate

R&D Centre filed has filed four Indian patents and was granted six patents (two Indian, one US, and three

in other countries). Moreover, as part of its new initiatives, BPCL continued its research collaborations

with a number of leading research institutes. These include collaborations with EIL, IIP, IITs, ICT, Delhi

University, BITs Goa, as well as international partnerships with NTNU, Norway, CSIROClayton, RMIT and

University of Melbourne.

Robust research and development capabilities are helping the company in deploying new technology for

enhanced profitability and development of platform products by building new products around current

technological expertise.

Weakness

Dependency on international market for supply of crude oil

BPCL's dependence on imports for meeting the crude oil requirements of its refineries has been

increasing. BPCL's imports of crude oil rose from 16.9 million metric tons (MMT) in FY2014 to 18.1 MMT

in FY2015. Import of LPG increased from 1.5 MMT in FY2014 to 2.04 MMT in FY2015. The company did

not import any diesel, motor spirit, and reformate during FY2015.

The international crude oil markets remain extremely challenging since the crude oil prices are volatile.

On the other hand, supply of crude oil from domestic sources has been declining. All these factors

contribute in creating a demand supply gap for the company. This also hampers the face value of the

company as well as hits the revenues adversely.

Concentration of operations

BPCL primarily operates in India and generates major revenues from the country. Although the company

has presence in six countries across five continents, the company heavily depends on the Indian market

for its operating profits. As a result, this becomes a competitive disadvantage, as its competitors carry a

wider scale of operations. The prime concentration of company's operations in India not only increases its

Bharat Petroleum Corporation Limited

MarketLine

Page 19

Bharat Petroleum Corporation Limited

SWOT Analysis

exposure to local factors but also deprives BPCL of higher revenues from high growth markets in

countries outside India.

Opportunity

Strategic plan for the integrated refinery expansion project

In the recent years, BPCL has strategically planned for a major expansion program at its Kochi refinery.

BPCL, through integrated refinery expansion project (IREP), plans to increase the crude oil refining

capacity from 9.5 million metric tons per annum (MMTPA) to 15.5 MMTPA and modernize the processing

facilities to produce auto-fuels conforming to Euro-IV/ V specifications. It also envisages refinery residue

stream upgradation to value added products. The project involves a capital outlay of INR165,040 million

($2,706.6 million) with expected completion in May, 2016.

In accordance with this target, in April 2011, the Board of Directors at BPCL approved the expansion of

the Kochi refinery by six MMTPA. Further, in June 2011, BPCL planned to expand its refineries in Kochi

from 190,000 barrels per day to 300,000 barrels per day and also planned to build a fluid catalytic

cracking unit at the same plant. These expansions were operational by FY2015.

Further, in July 2012, BPCL gave an INR7,200 million ($150.19 million) consultancy services contract for

IREP to Engineers India Limited (EIL). EIL will offer consultancy services for project management,

detailed engineering, procurement, construction management, and supervision for the project. Further, in

September 2012, BPCL entered into license agreements with four technology providers for its IREP,

involving an investment of INR142,250 million ($2,967.3 million). Through the IREP project, about 1.3

MMTPA of pet-coke will also be produced besides conventional petroleum products. This along with

propylene and other petroleum products will provide a fillip to the industrial scene of Kerala. Later, in

December 2012, BPCL planned to lay a pipeline with a length of 221 kilometers and a capacity of one

MMTPA from Kochi (Kerala) to Coimbatore (Tamil Nadu).

Moreover, in April 2014, BPCL announced that it is planning to expand its Kochi refinery where it is also

setting up a petrochemicals unit. Investment in the IREP project would help BPCL to provide an

enhanced flexible energy mix, to increase its own generation capacity, and to improve its marketing

activities and to gain competitive advantage over its peers.

Expansion of the petrochemical business

BPCL is planning to diversify into the petrochemicals business. For instance, in December 2014, the

company planned to diversify into petrochemicals at an estimated capital cost of INR45,880 million

($761.6 million). BPCL plans to produce niche petrochemicals such as acrylic acid, acrylates and oxo

alcohols. Such niche products will be produced using Polymer Grade Propylene that will be available on

the completion of the IREP project. The major end uses of these chemicals are in paints and coatings,

adhesives, plasticizers, solvents and water treatment. The unit is expected to come on stream during

FY2018-19.

Further, in 2012, the company planned to offer 51% stake in the petrochemical project to its Korean joint

Bharat Petroleum Corporation Limited

MarketLine

Page 20

Bharat Petroleum Corporation Limited

SWOT Analysis

venture partner LG Chemicals. The plant will be commissioned by the end of FY2017. The propylene

plant is part of the company's proposed petrochemicals complex planned at Ambalamugal near Kochi,

where it also has a 9.5 MMT oil refinery. Later, in 2012, BPCL signed a MOU with LG Chemicals to set up

a petrochemical plant next to its Kochi refinery complex. The company would be installing a

petrochemical fluid catalytic cracker (PFCC) which would produce 500 thousand metric tons per annum

(TMTPA) of propylene. This project is scheduled for completion in the next four years dovetailed with the

refinery expansion project, with an expenditure of INR40-60 million ($0.83-$1.25 million). Moreover in

2011, BPCL planned to sign an agreement to form a joint venture with UK's LP Chemicals for setting up a

petrochemical plant at its Kochi refinery in Kerala.

With the expansion of petrochemical business, the company will add a new product line into its

downstream business and enhance its product portfolio as well as top line.

Growing demand for oil and gas in India

After the global economic meltdown, India's GDP (gross domestic product) grew at a healthy rate of 7.3%

in FY2014-15, accelerating from 6.9% in FY2013-14, aided by the good performance of the industries and

services sectors, and low inflation rate. It is expected to accelerate further to 7.5% in FY2015-16, as per

International Monetary Fund (IMF) projections. As energy demand grows, oil and gas companies will

have a major role to play in meeting the rising demand. Moreover, if India moves towards its targeted

GDP growth rate of around 9% per year, energy supplies must also grow between 6.5% to 7% each year,

and oil products demand must grow at around 4% to 5% per year. This creates significant potential for

India's energy sector with per capita consumption of petroleum products being very low, compared to

developed countries.

India recorded the highest growth of 7.1% in energy consumption in FY2014-15. It consumed 637.8

million tons of oil and oil equivalents. After a subdued performance in FY2013-14, the demand for refined

petroleum products grew by a significant 4.2% to 165 million tons (3.3 mbpd) in FY2014-15. Petrol and

LPG registered robust growths while diesel growth too turned positive from the previous year's negative

growth.

BPCL is one of the largest oil and gas marketing companies in India. The increasing demand for oil and

gas in India provides demand for the company's products. Moreover, the company is well positioned to

capitalize on the growing demand for oil and gas.

Threat

Weakening of rupee over US dollar

The Indian rupee has depreciated sharply against US dollar in the recent years. The Indian rupee

averaged slightly higher at INR61.2/US$ in FY2014-15 as compared to INR60.5/US$ in FY2013-14. The

Indian currency, which depreciated by over 5% in FY2015, could breach the INR70/US$ level against the

US dollar in 2016. The Indian rupee ended flat at INR66.1 against US dollar on first trading day of

FY2016. Moreover, since India depends on imports for a large part of crude oil it consumes, a weak

rupee will influence petrol and diesel prices. Therefore, the company will have to pay more for the

Bharat Petroleum Corporation Limited

MarketLine

Page 21

Bharat Petroleum Corporation Limited

SWOT Analysis

quantity of petrol and diesel it imports from oil exporting countries.

Weakening of rupee over US dollar will impact OMCs such as BPCL in increasing its fuel costs thus

hurting its margins.

Under-recovery of the prices of petroleum products

Although the Indian-state owned oil marketing companies (OMC) like BPCL are in theory free to raise the

prices of their petroleum products, but in practice they are rarely allowed to do so by the Indian

government, their majority shareholder.

Diesel price had been deregulated as of October 19, 2014 as a result of which OMCs losses have

reduced. Diesel prices re now market-linked which means if global crude prices rise, customers will have

to pay more for buying diesel and vice versa. Currently, OMC are suffering a loss of INR5.11 ($0.08) for

every liter of kerosene sold.

Although BPCL had absorbed such losses in the past whereby profits from its refining business had

compensated the losses suffered by its marketing operations allowing the company to record overall

profits, but declining refining margins are no longer enough to offset the marketing losses. Henceforth,

inability to raise prices of controlled petroleum products and delay in government compensation for the

losses suffered thereof, are pushing OMC like BPCL towards financial hardship.

Intense competition

The competition in the downstream segment in India has increased due to the entry of private sector

companies. Other state-owned oil companies in India have shed their co-existence policy in recent years

and have gained noticeable market share in the oil industry. BPCL faces intense competition from other

national and local companies such as Hindustan Petroleum, Indian Oil, Chennai Petroleum, Hindustan Oil

Exploration, and Mangalore Refinery and Petrochemicals.

In addition, deregulation of the downstream segment has led to the entry of private sector companies

such as Reliance Industries into this market segment. Increasing competition in the downstream segment

could force the company to offer additional subsidy and result in pricing pressures. This in turn would

increase costs and cause further decline in margins. Further, increasing competition can create

hindrances for the company in securing sites for its new stations, which could hurt the company's

expansion plans.

Bharat Petroleum Corporation Limited

MarketLine

Page 22

Bharat Petroleum Corporation Limited

Top Competitors

Top Competitors

TOP COMPETITORS

The following companies are the major competitors of Bharat Petroleum Corporation Limited

Essar Oil Limited

GP Petroleums Limited

Hindustan Oil Exploration Company Limited

Hindustan Petroleum Corporation Limited

Indian Oil Corporation Limited

Mangalore Refinery and Petrochemicals Limited

Bharat Petroleum Corporation Limited

MarketLine

Page 23

Bharat Petroleum Corporation Limited

Company View

Company View

COMPANY VIEW

A statement by S. Varadarajan, the Chairman and Managing Director at BPCL, is given below. The

statement has been taken from the company's FY2015 annual report.

Dear Shareowners,

It is with immense pride that I place before you the report of the performance of your Company in the

financial year 2014-15. Like in the preceding year, the Company has scaled a new peak in terms of

profitability. For the first time ever, the profit after tax for the year has crossed the INR5,000 crore profit

mark. The profit (after tax) of INR 5,084.51 crores represents a 25% leap over the previous year's then

record level of INR4,060.88 crores. The gross refining margins generated by the two refineries at Mumbai

and Kochi continue to be the highest amongst the PSU refineries.

The outstanding performance on all fronts has resulted in BPCL being bestowed with the 'Leading Oil &

Gas Corporate of the Year' and the 'Oil & Gas Marketing Company of the Year' Awards, two of the

topmost recognitions accorded by PetroFed in the Indian Oil & Gas Industry. This is the fourth time that

BPCL is winning the coveted award as the 'Oil & Gas Marketing Company of the Year.' BPCL has

attained the rank of 757 in the Forbes Global 2000 List in 2015, a significant leap from the 1045 rank of

2014. Your Company has thus been able to exceed the expectations of all the stakeholders and we would

strive to continue on this growth trajectory.

The capital market has also recognized the performance of the Company with the Company's market

capitalization growing at a steady pace over the past ten years. Your Company has recorded the highest

growth in market capitalization amongst all oil companies both in the public and private sectors and

provided the maximum return to stakeholders. While all these developments are indeed encouraging, it

also reinforces our commitment to continuously create value for all our stakeholders.

The sustained excellence in the performance across the Organization can be attributed to your

unwavering faith, the relentless dedication and determination of all our employees across the

Organization, the commendable co-operation of the dealer and distributor network, the continued support

of our customers, bankers, suppliers and contractors, and the steady guidance from Ministry of Petroleum

& Natural Gas. Our ability to think big has started yielding results. We have been generating good profits

on a consistent basis and this has enhanced our confidence to dream and expand our horizons.

Today, as we stand on the threshold of rapid growth of the economy, there are ample opportunities to

grow and spread our wings. The need of the hour is to let our agility propel us forward into the realms of a

limitless canvas. During 2013-14, we gained an insight into the thoughts of our employees across levels

and disciplines and gauged their aspirations for the future of this great Company through the "Let's Talk"

series. These ideas were further deliberated upon, validated by the Senior Management and converted

into actionable projects. In the light of the present day business environment, these projects have to be

churned to develop a comprehensive pathway that will help in achieving the next wave of growth. Being

carefully chosen to leverage people and technology, these themes will culminate into a well-integrated

Corporate Strategy Document. This has been designated as Project Sankalp - our resolve to take the

next giant leap. At the core of Sankalp will be our customers, whose patronage has brought us this far,

Bharat Petroleum Corporation Limited

MarketLine

Page 24

Bharat Petroleum Corporation Limited

Company View

our people whose deep sense of commitment and sincerity will continue to take this Company to greater

heights, path-breaking technology that will be leveraged to weave all the pieces together and the

abundant opportunities waiting to be exploited. I am confident that not only will we be able to undertake

the large capital expenditure program that will be needed, but also the projects will deliver immense value

to the shareholders.

The uniqueness of Project Sankalp is highlighted by the fact that this will be an in-house initiative planned

and driven by BPCians themselves. The abundant talent available in the Company has been leveraged,

thus sowing the seeds of ownership and accountability. This has been possible due to our tremendous

focus on learning and development in the past few years. Preparing the leadership pipeline and grooming

the future generations remains high on our priority list. Almost 200 candidates have been nominated for

Executive Management Programs in leading Management Institutes. Further, 135 candidates have also

been exposed to our intensive management program - Excelarator, specially designed in-house by the

Talent Development Team to help them meet future challenges and responsibilities.

A significant milestone achieved by the Oil Industry during 2014-15 was the successful implementation of

the Direct Benefit Transfer for LPG Scheme. Reintroduced in November 2014 as PAHAL (Pratyaksha

Hanstantarit Labh), the scheme has revolutionized the disbursement of LPG subsidy and has been

instrumental in reducing the LPG subsidy burden of the Government and ensuring that the same reaches

the targeted consumer. Even as the issues identified in the earlier DBTL scheme have been addressed,

the modified scheme has simplified the mechanism to provide a hassle free experience to the consumer.

More than 88% of our customers have been covered by the PAHAL Scheme. Further, the "GiveItUp"

campaign initiated by the Government of India, encouraging consumers to surrender their LPG subsidy

for Nation Building has been well received and in BPCL alone, more than 4 lakh consumers have given

up their subsidy.

I am thankful to each of you for your confidence in our capabilities. We will forever strive to take this great

Company to the ultimate pinnacle and create value, far exceeding your expectations. I assure you that

BPCL is and will always remain a performance driven institution, delivering on the commitments made to

each and every stakeholder.

Bharat Petroleum Corporation Limited

MarketLine

Page 25

Bharat Petroleum Corporation Limited

Locations And Subsidaries

Locations And Subsidaries

LOCATIONS AND SUBSIDARIES

Head Office

Bharat Petroleum Corporation Limited

Bharat Bhavan

4 and 6 Currimbhoy Road

Ballard Estate

IND

Phone:91 22 2271 3000

Fax:91 22 2271 3874

http://www.bharatpetroleum.com

Bharat Petroleum Corporation Limited

MarketLine

Page 26

Bharat Petroleum Corporation Limited

Financial Overview

Financial Overview

FINANCIAL OVERVIEW

Summarized Statement

*Note: Eliminations not included, all figures in Million except per share data.

Parameters

Income Statements

Currency

2012

2013

2014

2015

2016

Total Revenue

INR

Gross Profit

INR

180,134.00

309,589.10

251,801.60

257,636.60

319,526.40

Operating Income

INR

-11,577.70

-3,974.40

74,984.10

67,537.80

126,856.00

Net Income

INR

7,808.30

18,808.30

39,106.80

48,065.70

79,815.10

Diluted Normalized EPS

Balance Sheet

INR

5.27

13.16

28.88

33.25

55.54

Total Current Assets

INR

444,187.10

430,606.50

465,146.50

362,943.20

330,253.40

Total Assets

INR

778,135.90

795,497.90

888,791.70

869,725.30

937,885.20

Total Current Liabilities

INR

523,436.50

460,456.40

431,982.60

402,039.80

337,077.30

Total Liabilities

INR

619,336.80

627,742.50

694,394.50

644,105.80

657,549.40

Total Equity

INR

158,799.10

167,755.40

194,397.20

225,619.50

280,335.80

Total Common Shares

Outstanding

Cash Flow

INR

1,446.17

1,446.17

1,446.17

1,446.17

1,446.17

Cash from Operating

Activities

INR

19,066.90

59,263.30

95,880.80

207,423.20

135,711.70

Cash from Investing

Activities

INR

-22,758.50

-36,039.60

-68,806.40

-105,356.30

-96,458.00

Cash from Financing

Activities

INR

-43,787.10

-8,459.80

-37,360.50

-97,926.70

-28,650.10

Net Change in Cash

INR

-47,478.70

14,763.90

-10,286.10

4,140.20

10,603.60

2015

2016

2,071,515.50 2,367,679.90 2,644,210.60 2,425,985.00 1,886,513.60

Detailed Statement

*Note: Eliminations not included, all figures in Million except per share data.

Parameters

Income Statements

Currency

Revenue

INR

2,071,515.50 2,367,679.90 2,644,210.60 2,425,985.00 1,886,513.60

Total Revenue

INR

2,071,515.50 2,367,679.90 2,644,210.60 2,425,985.00 1,886,513.60

Cost of Revenue, Total

INR

1,891,381.50 2,058,090.80 2,392,409.00 2,168,348.40 1,566,987.20

Gross Profit

INR

180,134.00

309,589.10

251,801.60

257,636.60

319,526.40

Selling/ General/ Admin.

INR

76,070.10

89,152.00

136,637.30

147,870.50

154,790.30

Bharat Petroleum Corporation Limited

MarketLine

2012

2013

2014

Page 27

Bharat Petroleum Corporation Limited

Financial Overview

Expenses, Total

Depreciation/ Amortization INR

24,108.30

24,627.00

26,109.20

30,266.80

24,286.30

Unusual Expense

(Income)

INR

0.00

0.00

3,918.70

8.40

481.30

Other Operating

Expenses, Total

INR

25,170.80

32,283.70

10,152.30

11,953.10

13,112.50

Total Operating Expense INR

2,083,093.20 2,371,654.30 2,569,226.50 2,358,447.20 1,759,657.60

Operating Income

INR

-11,577.70

-3,974.40

74,984.10

67,537.80

126,856.00

Gain (Loss) on Sale of

Assets

INR

354.70

-368.80

-129.80

-28.90

-278.00

Other, Net

INR

6,102.10

5,480.60

57.60

4,778.90

1,591.90

Net Income Before Taxes INR

15,994.30

32,202.60

61,656.80

76,904.70

125,939.10

Provision for Income

Taxes

INR

7,481.50

12,841.10

21,127.00

26,084.60

41,299.30

Net Income After Taxes

INR

8,512.80

19,361.50

40,529.80

50,820.10

84,639.80

Minority Interest

INR

-704.50

-553.20

-1,423.00

-2,754.40

-4,849.60

Equity In Affiliates

INR

0.00

0.00

0.00

0.00

24.90

Net Income Before Extra. INR

Items

7,808.30

18,808.30

39,106.80

48,065.70

79,815.10

Net Income

INR

7,808.30

18,808.30

39,106.80

48,065.70

79,815.10

Income Available to Com INR

Excl ExtraOrd

7,808.30

18,808.30

39,106.80

48,065.70

79,815.10

Income Available to Com INR

Incl ExtraOrd

7,808.30

18,808.30

39,106.80

48,065.70

79,815.10

Diluted Net Income

INR

7,808.30

18,808.30

39,106.80

48,065.70

79,815.10

Diluted Weighted Average INR

Shares

1,446.00

1,446.20

1,446.20

1,446.20

1,446.20

Diluted EPS Excluding

ExtraOrd Items

INR

5.40

13.01

27.04

33.24

55.19

Diluted Normalized EPS

INR

5.27

13.16

28.88

33.25

55.54

DPS - Common Stock

Primary Issue

Balance Sheet

INR

2.75

5.50

8.50

11.25

15.50

Cash

INR

5,237.30

9,938.30

7,623.60

5,713.20

8,881.70

Cash & Equivalents

INR

8,001.90

18,536.20

9,650.00

21,300.00

33,193.50

Short Term Investments

INR

60,331.10

52,180.40

52,600.00

61,018.40

56,721.10

Cash and Short Term

Investments

INR

73,570.30

80,654.90

69,873.60

88,031.60

98,796.30

Accounts Receivable Trade, Net

INR

52,010.40

43,550.60

45,436.90

29,018.50

24,235.00

Total Receivables, Net

INR

58,714.60

143,816.30

160,107.30

97,980.80

71,575.50

Bharat Petroleum Corporation Limited

MarketLine

Page 28

Bharat Petroleum Corporation Limited

Financial Overview

Total Inventory

INR

210,970.90

199,566.90

231,694.70

174,000.20

154,968.50

Prepaid Expenses

INR

2,735.00

4,451.60

1,445.50

1,402.90

133.50

Other Current Assets,

Total

INR

98,196.30

2,116.80

2,025.40

1,527.70

4,779.60

Total Current Assets

INR

444,187.10

430,606.50

465,146.50

362,943.20

330,253.40

Property/ Plant/

INR

Equipment, Total - Gross

45,317.00

512,410.00

584,440.00

694,228.00

811,698.00

Accumulated

Depreciation, Total

INR

0.00

-198,173.20

-222,858.20

-251,398.80

-273,670.80

Property/ Plant/

Equipment, Total - Net

INR

287,643.10

314,236.80

361,581.80

442,829.20

538,027.20

Goodwill, Net

INR

4,334.30

0.00

0.00

144.50

610.00

Intangibles, Net

INR

3,246.50

7,609.30

7,934.90

5,993.70

7,788.90

Long Term Investments

INR

18,575.10

22,517.70

23,064.00

23,515.10

26,013.80

Note Receivable - Long

Term

INR

20,084.30

19,707.40

24,002.80

26,372.80

26,983.50

Other Long Term Assets, INR

Total

65.50

820.20

7,061.70

7,926.80

8,208.40

Total Assets

INR

778,135.90

795,497.90

888,791.70

869,725.30

937,885.20

Accounts Payable

INR

132,924.80

89,318.90

128,991.10

128,652.90

84,706.70

Accrued Expenses

INR

20,366.00

24,177.60

1,531.90

1,810.40

1,804.80

Notes Payable/ Short

Term Debt

INR

221,925.20

201,582.00

108,008.20

16,758.80

5,837.90

Current Port. of LT Debt/

Capital Leases

INR

17,714.80

2,964.80

3,537.30

44,745.10

22,661.10

Other Current liabilities,

Total

INR

130,505.70

142,413.10

189,914.10

210,072.60

222,066.80

Total Current Liabilities

INR

523,436.50

460,456.40

431,982.60

402,039.80

337,077.30

Long Term Debt

INR

61,890.60

127,021.80

219,977.20

193,418.20

260,430.50

Total Long Term Debt

INR

61,890.60

127,021.80

219,977.20

193,418.20

260,430.50

Total Debt

INR

301,530.60

331,568.60

331,522.70

254,922.10

288,929.50

Deferred Income Tax

INR

16,778.00

16,058.60

16,701.00

19,972.10

25,240.50

Minority Interest

INR

10,351.40

10,765.80

11,468.60

12,863.70

15,727.40

Other Liabilities, Total

INR

6,880.30

13,439.90

14,265.10

15,812.00

19,073.70

Total Liabilities

INR

619,336.80

627,742.50

694,394.50

644,105.80

657,549.40

Common Stock, Total

INR

3,615.40

7,230.80

7,230.80

7,230.80

7,230.80

Retained Earnings

(Accumulated Deficit)

INR

155,159.90

160,733.40

185,657.30

213,890.90

266,784.60

Other Equity, Total

INR

23.80

-208.80

1,509.10

4,497.80

6,320.40

Total Equity

INR

158,799.10

167,755.40

194,397.20

225,619.50

280,335.80

Total Liabilities &

INR

778,135.90

795,497.90

888,791.70

869,725.30

937,885.20

Bharat Petroleum Corporation Limited

MarketLine

Page 29

Bharat Petroleum Corporation Limited

Financial Overview

Shareholders' Equity

Total Common Shares

Outstanding

Cash Flow

INR

1,446.17

1,446.17

1,446.17

1,446.17

1,446.17

Net Income/ Starting Line INR

15,994.30

32,202.60

61,165.50

76,466.10

125,882.00

Depreciation/ Depletion

INR

24,108.30

24,627.00

26,109.20

30,266.80

24,286.30

Non-Cash Items

INR

26,225.90

22,836.00

24,391.10

-1,391.00

8,542.20

Changes in Working

Capital

INR

-47,261.60

-20,402.30

-15,785.00

102,081.30

-22,998.80

Cash from Operating

Activities

INR

19,066.90

59,263.30

95,880.80

207,423.20

135,711.70

Capital Expenditures

INR

-42,175.00

-55,246.00

-72,376.20

-108,990.40

-116,325.90

Other Investing Cash Flow INR

Items, Total

19,416.50

19,206.40

3,569.80

3,634.10

19,867.90

Cash from Investing

Activities

INR

-22,758.50

-36,039.60

-68,806.40

-105,356.30

-96,458.00

Financing Cash Flow

Items

INR

-23,351.70

-28,774.00

-20,972.80

-14,622.30

-20,718.20

Total Cash Dividends Paid INR

-5,583.50

-4,309.20

-8,316.80

-12,729.00

-29,962.80

Issuance (Retirement) of

Stock, Net

INR

0.00

-6,658.40

27.60

0.00

4.30

Issuance (Retirement) of

Debt, Net

INR

-14,851.90

31,281.80

-8,098.50

-70,575.40

22,026.60

Cash from Financing

Activities

INR

-43,787.10

-8,459.80

-37,360.50

-97,926.70

-28,650.10

Net Change in Cash

INR

-47,478.70

14,763.90

-10,286.10

4,140.20

10,603.60

Cash Interest Paid

INR

21,940.00

25,538.00

19,556.10

12,373.20

14,519.30

Cash Taxes Paid

INR

6,881.20

9,156.00

21,280.30

27,493.00

33,699.10

Capital Market Ratios

Key Ratios

P/E (Price/Earnings) Ratio

December 05,2016

10.95

EV/EBITDA (Enterprise Value/Earnings Before Interest, Taxes,

Depreciation and Amortization)

7.56

Enterprise Value/Sales

0.60

Enterprise Value/Operating Profit

8.96

Enterprise Value/Total Assets

1.21

Dividend Yield

0.03

Market Cap

Bharat Petroleum Corporation Limited

MarketLine

873,775.01

Page 30

Bharat Petroleum Corporation Limited

Financial Overview

Enterprise Value

1,136,356.71

Note: The above ratios are based on

the share price as of December

05,2016, they are absolute numbers

Annual Ratios

Key Ratios

Unit

Currency

2012

2013

2014

2015

2016

Sales Growth

37.28

14.30

11.68

-8.25

-22.24

Operating Income Growth

0.00

0.00

0.00

-9.93

87.83

EBITDA Growth

-15.05

41.71

54.44

22.11

40.17

Net Income Growth

-52.24

140.88

107.92

22.91

66.05

EPS Growth

-53.84

149.72

119.48

15.14

67.03

Working Capital Growth

Equity Ratios

38.79

-62.33

-211.10

-217.89

-82.55

EPS (Earnings per Share)

USD

5.40

13.01

27.04

33.24

55.19

Dividend per Share

USD

2.75

5.50

8.50

11.25

15.50

Dividend Cover

Absolute

1.96

2.36

3.18

2.95

3.56

Book Value per Share

USD

109.81

116.00

134.42

156.01

193.85

Cash Value per Share

Profitability Ratios

USD

5.53

12.82

6.67

14.73

22.95

Gross Margin

8.70

13.08

9.52

10.62

16.94

Operating Margin

-0.56

-0.17

2.84

2.78

6.72

Net Profit Margin

0.38

0.79

1.48

1.98

4.23

Profit Markup

9.52

15.04

10.53

11.88

20.39

PBT Margin (Profit Before Tax)

0.77

1.36

2.33

3.17

6.68

Return on Equity

4.92

11.21

20.12

21.30

28.47

Return on Capital Employed

-4.55

-1.19

16.41

14.44

21.11

Return on Assets

1.00

2.36

4.40

5.53

8.51

Return on Fixed Assets

-3.47

-1.09

17.70

13.33

20.88

Return on Working Capital

Cost Ratios

0.00

0.00

0.00

0.00

226.10

Growth Ratios

Bharat Petroleum Corporation Limited

MarketLine

Page 31

Bharat Petroleum Corporation Limited

Financial Overview

Operating Costs (% of Sales)

100.56

100.17

97.16

97.22

93.28

Administration Costs (% of Sales) %

Liquidity Ratios

3.67

3.77

5.17

6.10

8.21

Current Ratio

Absolute

0.85

0.94

1.08

0.90

0.98

Quick Ratio

Absolute

0.45

0.50

0.54

0.47

0.52

Cash Ratio

Leverage Ratios

Absolute

0.14

0.18

0.16

0.22

0.29

Debt to Equity Ratio

Absolute

1.90

1.98

1.71

1.13

1.03

Net Debt to Equity

Absolute

1.88

1.93

1.69

1.06

0.94

Debt to Capital Ratio

Efficiency Ratios

Absolute

1.18

0.99

0.73

0.55

0.48

Asset Turnover

Absolute

2.66

2.98

2.98

2.79

2.01

Fixed Asset Turnover

Absolute

7.20

7.53

7.31

5.48

3.51

Inventory Turnover

Absolute

8.97

10.31

10.33

12.46

10.11

Current Asset Turnover

Absolute

4.66

5.50

5.68

6.68

5.71

Capital Employed Turnover

Absolute

13.04

14.11

13.60

10.75

6.73

Working Capital Turnover

Absolute

0.00

0.00

0.00

0.00

79.73

Revenue per Employee

USD

0.00

0.00

0.00

0.00

149,450,495.13

Net Income per Employee

USD

0.00

0.00

0.00

0.00

6,322,989.78

Capex to Sales

2.04

2.33

2.74

4.49

6.17

R&D to Sales

0.00

0.00

0.00

0.00

0.00

Bharat Petroleum Corporation Limited

MarketLine

Page 32

A Progressive Digital Media business

John Carpenter House, John Carpenter Street, London, United Kingdom, EC4Y 0AN

T: +44 (0) 203 377 3042 | F: +44 (0) 870 134 4371 | E: reachus@marketline.com | W: www.marketline.com

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- India-Pakistan Relations: Challenges and Opportunities: DR.S.R.T.P Sugunakararaju, Shabnum AkhtarDocument7 pagesIndia-Pakistan Relations: Challenges and Opportunities: DR.S.R.T.P Sugunakararaju, Shabnum AkhtarMahendra Singh TaragiNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Comedy DialoguesDocument11 pagesComedy DialoguesMahendra Singh TaragiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Debate TopicsDocument5 pagesDebate TopicsMahendra Singh TaragiNo ratings yet

- Absence Record Term VIDocument51 pagesAbsence Record Term VIMahendra Singh TaragiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Coke Presentation IMC CampaignDocument13 pagesCoke Presentation IMC CampaignMahendra Singh TaragiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)