Professional Documents

Culture Documents

Nationwide Health of Housing Markets Report

Uploaded by

Tad SooterCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nationwide Health of Housing Markets Report

Uploaded by

Tad SooterCopyright:

Available Formats

Nationwides Health of Housing

Markets (HoHM) Report

Nationwide Economics

2016 Q4

Data as of 2016 Q3

HoHM Report Executive Summary:

The national LIHHM* suggests that the overall U.S. housing market

continues to be healthy with a positive outlook over the next year, as

solid job growth and a pick-up in household formations mostly

offset rising home prices and interest rates.

Regionally, the LIHHM rankings show positive housing trends in the

majority of metropolitan statistical areas (MSAs). This suggests that

most local housing markets should see sustainable expansion over

the next year.

Energy sector slowdowns continue to depress the housing outlooks

in several MSAs in energy-intensive areas, especially in North

Dakota, Wyoming, Texas, and Louisiana. Stabilizing oil prices and

employment readings, however, should soon improve the housing

metrics in these regions.

More than a quarter of MSAs are rated as healthy and most

sustainable indicating a positive outlook for 2017 and a very small

likelihood of a downturn in housing activity.

* Leading Index of Healthy Housing Markets (LIHHM): A data-driven view of the near-term

performance of housing markets based upon current health indicators for the national housing

market and 400 metropolitan statistical areas (MSAs) and divisions across the country.

See more at www.InTheNation.com/housing

HoHM Report 2016 Q4

The national LIHHM continues to reflect a sustainable U.S. housing market

The current value for the national LIHHM* is 107.4, little changed from the second quarter and slightly lower

than the reading from a year ago. Improved growth in household formations and continued declines in

serious delinquencies are boosting the LIHHM score, while solid job growth also remains supportive of

housing demand. On the downside, home price appreciation continues to run above the long-term average,

although still-low (albeit rising) mortgage rates are helping to keep housing affordable.

Regionally, the LIHHM performance rankings indicate that the vast majority of metro areas across the

country are healthy, suggesting that few regional housing markets are vulnerable to a housing downturn in

the near term. The energy sector continues to depress scores for a few local markets, but with oil prices and

energy sector employment stabilizing, the outlook should improve in coming quarters.

National LIHHM

LIHHM Scores*

125

125

120

120

115

115

110

110

105

105

100

100

95

95

90

90

85

85

80

80

75

75

125

POSITIVE

100

NEUTRAL

75

NEGATIVE

MSA LIHHM Performance Rankings

Performance

Rankings*

400

350

NumberofMSAs

300

+4

POSITIVE

NEUTRAL

250

200

150

100

50

0

* See appendix for full descriptions

-4

NEGATIVE

See more at www.InTheNation.com/housing

Nationwide Economics

Page 2

HoHM Report 2016 Q4

The regional LIHHM rankings show continued sustainability in the majority of housing markets

Five MSAs have a ranking of +3 and an additional 114 have a ranking of +2, indicating that more than a

quarter of MSAs show very healthy housing fundamentals (see page 5 for more).

The majority of the bottom 10 MSAs are located in energy-intensive states (North Dakota, Wyoming,

Texas, and Louisiana) and all have negative rankings suggesting a modest risk of a housing slowdown

in the next year. Another 56 MSAs are ranked neutral, one step away from a less-than-optimistic outlook.

Unsustainable house price growth is lowering affordability and making the outlook less positive for a few

larger cities in the western half of the country, including Dallas, Denver, Portland, and San Francisco.

Performance

Rankings

+4

POSITIVE

NEUTRAL

-4

NEGATIVE

Top 10 MSAs

Data as of 2016 Q3

Bottom 10 MSAs

Rank

Metropolitan Statistical Area

Rank

Metropolitan Statistical Area

New Bern NC

400

Bismarck ND

Cleveland TN

399

Victoria TX

Syracuse NY

398

Casper WY

Goldsboro NC

397

Houma-Thibodaux LA

Baltimore-Columbia MD

396

Lafayette LA

Fayetteville NC

395

San Angelo TX

Valdosta GA

394

Dallas-Plano-Irving TX

Cumberland MD-WV

393

Anchorage AK

Columbia SC

392

Missoula MT

10

Augusta-Richmond GA-SC

391

Hammond LA

See more at www.InTheNation.com/housing

Nationwide Economics

Page 3

HoHM Report 2016 Q4

Only one of the top 40* largest MSAs has a LIHHM performance ranking that is negative (mainly due to

worsening affordability), while five more of these MSAs are neutral. This suggests that most of the major

U.S. housing markets are sustainable with little chance of a downturn in the near future.

MSAs by size

(Top 40), with

corresponding

performance

rankings

Performance Rankings:

+4

-4

POSITIVE

NEUTRAL

NEGATIVE

Performance Rankings

Current

Prior Qtr

Prior Year

1

1

2

Metropolitan Statistical Area

New York-Jersey City-White Plains NY-NJ

Los Angeles-Long Beach-Glendale CA

Chicago-Naperville-Arlington Heights IL

Houston-The Woodlands-Sugar Land TX

Atlanta-Sandy Springs-Roswell GA

Washington-Arlington-Alexandria DC-VA

Phoenix-Mesa-Scottsdale AZ

Dallas-Plano-Irving TX

Minneapolis-St. Paul-Bloomington MN-WI

10

Riverside-San Bernardino-Ontario CA

11

Tampa-St. Petersburg-Clearwater FL

12

San Diego-Carlsbad CA

13

Seattle-Bellevue-Everett WA

14

St Louis MO-IL

15

Denver-Aurora-Lakewood CO

16

Baltimore-Columbia-Towson MD

17

Anaheim-Santa Ana-Irvine CA

18

Warren-Troy-Farmington Hills MI

19

Pittsburgh PA

20

Oakland-Hayward-Berkeley CA

21

Portland-Vancouver-Hillsboro OR-WA

22

Nassau County-Suffolk County NY

23

Charlotte-Concord-Gastonia NC-SC

24

Miami-Miami Beach-Kendall FL

25

Orlando-Kissimmee-Sanford FL

26

Cambridge-Newton-Framingham MA

27

Newark NJ-PA

28

Fort Worth-Arlington TX

29

Cleveland-Elyria OH

30

Cincinnati OH-KY-IN

31

San Antonio-New Braunfels TX

32

Sacramento-Roseville-Arden-Arcade CA

33

Philadelphia PA

34

Kansas City MO-KS

35

Columbus OH

36

Las Vegas-Henderson-Paradise NV

37

Indianapolis-Carmel-Anderson IN

38

Boston MA

39

Fort Lauderdale-Pompano Beach-FL

40

Austin-Round Rock TX

Data as of 2016 Q3

* Largest 40 determined by number of households

See more at www.InTheNation.com/housing

Nationwide Economics

Page 4

HoHM Report 2016 Q4

The most sustainable housing markets have the most optimistic outlook for 2017

In this quarters release, there are 119 metropolitan statistical areas (MSAs) with a LIHHM ranking of +2 or

+3 a reading indicating markets with the most sustainable trends in housing fundamentals. The strong

readings suggest that these local markets are most likely to see continued sustainable growth in home

sales activity and house price appreciation in 2017. Moreover, there is little chance of a downturn in the

housing sector in these markets over the next year or so.

Regionally, the majority of the most sustainable housing markets are located east of the Mississippi River.

A few of the largest metro areas of the country, including New York City, Boston, Chicago, and

Philadelphia, are within this group. Note that the ratings including the broader suburban areas of New

York City and Philadelphia are more positive than those in the central cores of those MSAs.

There are a few common characteristics among the most sustainable housing markets:

Sustainable house price growth: House price appreciation over the past year in these MSAs is close

to their long-term average indicative of sustainable growth in home values. Conversely, house price

growth in many of the neutral or negatively rated MSAs is too hot or too cold compared to average.

Affordable housing: Relative to income gains, housing remains affordable in the majority of the most

sustainable markets. This suggests that house prices are in line with a homebuyers ability to pay and

are not pushing potential homebuyers out of the market by being too expensive.

Solid job growth: Job and income gains in these markets continue to drive demand for housing by

promoting household formations, especially by the millennial generation. In several of the lowest-rated

MSAs, unemployment is rising as job growth wanes, reducing the underlying demand for housing.

Falling delinquency rates: Default and delinquency rates are declining in nearly all of the most

sustainable markets, indicating that homebuyers have the income to meet their mortgage obligations.

Weaker job and income readings in some of the neutral or negatively rated MSAs can act as an early

signal of rising delinquency rates in coming quarters.

Most Sustainable MSAs: LIHHM Rankings +2 or +3

+4

POSITIVE

NEUTRAL

-4

NEGATIVE

See more at www.InTheNation.com/housing

Nationwide Economics

Page 5

HoHM Report 2016 Q4

Just as the national LIHHM reading has slipped a bit this year, the LIHHM rankings in an

increasing number of MSAs have edged down over the past four quarters

The near-term sustainability of housing markets is best measured by the current LIHHM (page 3), but

looking at shifts in the LIHHM over the course of a year can provide additional insights.

While more than a third of all MSAs saw their rankings drop in recent quarters, the majority of these

pulled back by only one ranking. There were only 19 MSAs that declined more sharply (down by 2+

rankings), including several MSAs in areas dependent upon oil production and distribution.

Since the LIHHM scores in many MSAs remained positive over the past year, about half of the LIHHM

rankings have not changed indicative of ongoing health in local housing markets.

Current

LIHHM

4Q change

+3

INCREASED

UNCHANGED

-3

DECREASED

Largest Increase

Largest Decrease

Rank

Metropolitan Statistical Area

Rank

Metropolitan Statistical Area

Watertown-Fort Drum NY

400

Bismarck ND

New Bern NC

399

Lubbock TX

Jacksonville NC

398

Anchorage AK

Grand Island NE

397

Iowa City IA

Fayetteville NC

396

Texarkana TX-AR

Dutchess County NY

395

Owensboro KY

Charleston WV

394

Casper WY

Pittsfield MA

393

Manhattan KS

Cleveland TN

392

Bremerton-Silverdale WA

10

Elmira NY

391

Carbondale-Marion IL

Change in performance ranking; Data as of 2016 Q3

See more at www.InTheNation.com/housing

Nationwide Economics

Page 6

Appendix

Leading Index of Healthy Housing Markets (LIHHM)

Nationwides LIHHM is a data-driven view of the near-term performance of housing

markets based upon current health indicators for the national housing market and

400 metropolitan statistical areas (MSAs*) and divisions across the country. For

each MSA, the LIHHM uses local-level data to incorporate the idiosyncratic

characteristics of regional housing markets. The focus of the LIHHM is on the entire

housing markets health, rather than a projection of house prices or home sales.

Nationwide Economics LIHHM methodology

The LIHHM is calculated using a number of variables that describe many of the

drivers of the housing market for each MSA. In order to provide the best indicator of

housing health, the included variables and corresponding weights for each provide

the optimal leading perspective on future housing markets for each MSA. The drivers

can be grouped into the following categories:

1.

2.

3.

4.

Employment

Demographics

Mortgage Market

House Prices

As an illustration, if job growth increases in an MSA, then the resulting rise in incomes

creates additional housing demand. Consumers have a greater ability to earn and

save for home purchases, increasing sales and pushing up house prices. The LIHHM

measures the movements in the included employment, demographic, mortgage

market, and house price variables versus the long-term trends within each MSA.

These drivers are used to derive an overall LIHHM score on a scale from 75 to 125

centered around a neutral value of 100. These values are placed into performance

rankings to allow for better comparisons across MSAs. These performance rankings

are the key metric in comparing the MSAs both to each other and across time. Raw

LIHHM values are used for calculation purposes only and will only be shown on the

national level as the national score is standalone and is not compared to other areas.

* MSA: Geographical region with high population density and close economic ties throughout the nearby area,

capturing 85-90% of the U.S. population

See more at www.InTheNation.com/housing

Nationwide Economics

Page 7

Authored by Nationwide Economics

DAVID BERSON, PhD

Senior Vice President, Chief Economist

David holds a doctorate in Economics and a masters degree in Public Policy

from the University of Michigan. Prior to Nationwide, David served as Chief

Economist, Strategist and Head of Risk Analytics for The PMI Group, Inc., and

Vice President and Chief Economist for Fannie Mae. David has also served as

Chief Financial Economist at Wharton Econometrics and visiting scholar at the

Federal Reserve Bank of Kansas City. His government experience has included

roles with the Presidents Council of Economic Advisors, U.S. Treasury

Department and the Office of Special Trade Representative. He is a past

President of the National Association for Business Economics.

BRYAN JORDAN, CFA

Deputy Chief Economist

Bryan is a frequent author and knowledgeable source on economic topics, and

has been featured in The Wall Street Journal and New York Times. Bryan holds

degrees in Economics and Political Science from Miami University and has

earned the Chartered Financial Analyst designation. He currently serves as

Chairman of the Ohio Council on Economic Education and is a member of the

Ohio Governors Council of Economic Advisors, the National Association for

Business Economics, and the Bloomberg monthly economic forecasting panel.

BEN AYERS, MS

Senior Economist

Ben authors periodic economic analyses from the Nationwide Economics team,

as well as commentary on key economic topics. Ben is also responsible for

understanding and analyzing the enterprise business drivers to assist the

strategic planning process. He holds a Master of Science in Economics from the

Ohio State University, specializing in applied economic analysis, and a BSBA

from the Fisher College of Business at the Ohio State University, with a focus

on economics and international business.

Additional contributors: Ankit Gupta, Steve Hall, Aaron Reincheld, and Emily Watson

The information in this report is provided by Nationwide Economics and is general in nature and not intended as investment or economic

advice, or a recommendation to buy or sell any security or adopt any investment strategy. Additionally, it does not take into account any

specific investment objectives, tax and financial condition or particular needs of any specific person.

The economic and market forecasts reflect our opinion as of the date of this report and are subject to change without notice. These

forecasts show a broad range of possible outcomes. Because they are subject to high levels of uncertainty, they will not reflect actual

performance. We obtained certain information from sources deemed reliable, but we do not guarantee its accuracy, completeness or

fairness.

Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company.

NFM-13575AO.2

See more at www.InTheNation.com/housing

Nationwide Economics

Page 8

You might also like

- Personal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyFrom EverandPersonal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyNo ratings yet

- House Poor: How to Buy and Sell Your Home Come Bubble or BustFrom EverandHouse Poor: How to Buy and Sell Your Home Come Bubble or BustNo ratings yet

- Housing Report David Berson NationwideDocument8 pagesHousing Report David Berson NationwideMike CroninNo ratings yet

- National Cap Rate SnapshotDocument7 pagesNational Cap Rate Snapshotapi-259396700No ratings yet

- Beverly-Hanks & Associates: Second Quarter Market Report 2011Document20 pagesBeverly-Hanks & Associates: Second Quarter Market Report 2011ashevillerealestateNo ratings yet

- Nest Report Charlottesville: Q4 2011Document9 pagesNest Report Charlottesville: Q4 2011Jonathan KauffmannNo ratings yet

- CRE Chartbook 4Q 2012Document11 pagesCRE Chartbook 4Q 2012subwayguyNo ratings yet

- Nest Realty Q2 2013 Charlottesville Real Estate Market ReportDocument9 pagesNest Realty Q2 2013 Charlottesville Real Estate Market ReportJonathan KauffmannNo ratings yet

- Weekly Economic Commentary 3-26-12Document11 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- Weekly Economic Commentary 3-26-12Document6 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- Nest Report: Charlottesville Area Real Estate Market Report Q3 2012Document9 pagesNest Report: Charlottesville Area Real Estate Market Report Q3 2012Jonathan KauffmannNo ratings yet

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoNo ratings yet

- Clear Capital Reports National Double DipDocument8 pagesClear Capital Reports National Double DipLori Horton LincolnNo ratings yet

- FreddieMac MF Outlook 2016Document15 pagesFreddieMac MF Outlook 2016macondo06No ratings yet

- Housing Affordability Study: How Even The Cheapest Metros Are More Unaffordable Than Big CitiesDocument6 pagesHousing Affordability Study: How Even The Cheapest Metros Are More Unaffordable Than Big CitiesJust Rent to OwnNo ratings yet

- Property Barometer - Area-Value-Bands August 2015Document2 pagesProperty Barometer - Area-Value-Bands August 2015Francois-No ratings yet

- Q2 2012 Charlottesville Nest ReportDocument9 pagesQ2 2012 Charlottesville Nest ReportJim DuncanNo ratings yet

- Quarterly Review NOV11Document22 pagesQuarterly Review NOV11ftforee2No ratings yet

- Colorado Association of Realtors Housing Market Report For April 2022Document15 pagesColorado Association of Realtors Housing Market Report For April 2022Michael_Roberts2019No ratings yet

- 2016 Commercial Lending Trends SurveyDocument31 pages2016 Commercial Lending Trends SurveyNational Association of REALTORS®No ratings yet

- TD BANK-JUL-28-TD Economic-Teranet-National Bank House Price IndexDocument1 pageTD BANK-JUL-28-TD Economic-Teranet-National Bank House Price IndexMiir ViirNo ratings yet

- May 2013 - On The MoveDocument4 pagesMay 2013 - On The MoveBryant StadlerNo ratings yet

- REMAX National Housing Report - July 2012 FinalDocument2 pagesREMAX National Housing Report - July 2012 FinalSheila Newton TeamNo ratings yet

- Housing Data Wrap-Up: December 2012: Economics GroupDocument7 pagesHousing Data Wrap-Up: December 2012: Economics GroupAaron MaslianskyNo ratings yet

- Midyear Report 2008Document5 pagesMidyear Report 2008Missouri Netizen NewsNo ratings yet

- San Antonio Area Market Report Winter 2015/spring 2016Document11 pagesSan Antonio Area Market Report Winter 2015/spring 2016api-312668189No ratings yet

- Executive Summary: Signs of Recovery in The For-Sale MarketDocument6 pagesExecutive Summary: Signs of Recovery in The For-Sale MarketBruce BartlettNo ratings yet

- Property Intelligence Report July 2013Document4 pagesProperty Intelligence Report July 2013thomascruseNo ratings yet

- 2016 NAR Research Resource GuideDocument9 pages2016 NAR Research Resource GuideNational Association of REALTORS®50% (2)

- Fiscal Policy, Politics and Weather Patterns... : Julie WillisDocument4 pagesFiscal Policy, Politics and Weather Patterns... : Julie WillisJulie Crismond WillisNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Final HousingInTheChampionCity August2019Document68 pagesFinal HousingInTheChampionCity August2019JHNo ratings yet

- Onsumer Atch Anada: Canadian Housing Prices - Beware of The AverageDocument4 pagesOnsumer Atch Anada: Canadian Housing Prices - Beware of The AverageSteve LadurantayeNo ratings yet

- Midyear Report 2007Document4 pagesMidyear Report 2007Missouri Netizen NewsNo ratings yet

- Home Sales Continue To Grow As Median Prices ModerateDocument8 pagesHome Sales Continue To Grow As Median Prices ModeratePaul KnoffNo ratings yet

- Union City Full Market Report (Week of Nov 4, 2013)Document6 pagesUnion City Full Market Report (Week of Nov 4, 2013)Harry KharaNo ratings yet

- Zillow Q3 Real Estate ReportDocument4 pagesZillow Q3 Real Estate ReportLani RosalesNo ratings yet

- Home Price Monitor January 2012Document13 pagesHome Price Monitor January 2012National Association of REALTORS®No ratings yet

- The Reader: Furman Center Releases 2008 "State of New York City's Housing and Neighborhoods" ReportDocument12 pagesThe Reader: Furman Center Releases 2008 "State of New York City's Housing and Neighborhoods" ReportanhdincNo ratings yet

- Quarterly Highlights Q3Document12 pagesQuarterly Highlights Q3tfong3477No ratings yet

- Economic Focus 8-29-11Document1 pageEconomic Focus 8-29-11Jessica Kister-LombardoNo ratings yet

- Jason Carrier Winter NewsletterDocument4 pagesJason Carrier Winter NewsletterjcarrierNo ratings yet

- 2019 MF and Office ReportDocument12 pages2019 MF and Office ReportAlex PopovicNo ratings yet

- A Rent To Own Real Estate Forecast in CaliforniaDocument5 pagesA Rent To Own Real Estate Forecast in CaliforniaJust Rent to OwnNo ratings yet

- New York State Consumer Real Estate Sentiment Scores: Siena Research InstituteDocument7 pagesNew York State Consumer Real Estate Sentiment Scores: Siena Research InstitutejspectorNo ratings yet

- Residential Mortgage Market Report 2007Document44 pagesResidential Mortgage Market Report 2007fbjunkieNo ratings yet

- Are Indias Cities in A Housing BubbleDocument9 pagesAre Indias Cities in A Housing BubbleAshwinBhandurgeNo ratings yet

- Union City Market ReportDocument6 pagesUnion City Market ReportHarry KharaNo ratings yet

- Monthly Indicators: October 2016 Quick FactsDocument12 pagesMonthly Indicators: October 2016 Quick FactsJoshua YehNo ratings yet

- Zillow 2014 Housing PredictionsDocument4 pagesZillow 2014 Housing Predictionsalbertoosorio2010No ratings yet

- Union City-Full ReportDocument6 pagesUnion City-Full ReportHarry KharaNo ratings yet

- Global Realestate TrendsDocument8 pagesGlobal Realestate TrendscutmytaxesNo ratings yet

- Hayward Full Market Report (Week of February 24, 2014)Document6 pagesHayward Full Market Report (Week of February 24, 2014)Harry KharaNo ratings yet

- Macroeconomic Background: IndiaDocument3 pagesMacroeconomic Background: IndiaParkins PatelNo ratings yet

- 4th Quarter 2013 Market Report: Houlihan LawrenceDocument36 pages4th Quarter 2013 Market Report: Houlihan LawrenceAnonymous Feglbx5No ratings yet

- CBRE North America CapRate 2014H2 MasterDocument51 pagesCBRE North America CapRate 2014H2 MasterAnonymous pWGhTF8eNo ratings yet

- Calgary Real Estate November 2011 Monthly Housing StatisticsDocument19 pagesCalgary Real Estate November 2011 Monthly Housing StatisticsCrystal TostNo ratings yet

- 04 30 12 Market Update (SF) Az Cave Creek-2Document6 pages04 30 12 Market Update (SF) Az Cave Creek-2Kelli J GrantNo ratings yet

- The Wright Report:: Sacramento's Residential Investment AnalysisDocument26 pagesThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstateNo ratings yet

- Susquehanna Township School District Superintendent ContractDocument12 pagesSusquehanna Township School District Superintendent ContractBarbara MillerNo ratings yet

- Millersburg Area School District Superintendent ContractDocument12 pagesMillersburg Area School District Superintendent ContractBarbara MillerNo ratings yet

- South Middleton School District Superintendent ContractDocument11 pagesSouth Middleton School District Superintendent ContractBarbara MillerNo ratings yet

- Middletown Area School District Superintendent ContractDocument9 pagesMiddletown Area School District Superintendent ContractBarbara MillerNo ratings yet

- Lower Dauphin School District Superintendent ContractDocument20 pagesLower Dauphin School District Superintendent ContractBarbara MillerNo ratings yet

- Derry Township School District Superintendent ContractDocument38 pagesDerry Township School District Superintendent ContractBarbara MillerNo ratings yet

- Harrisburg School District Superintendent's ContractDocument21 pagesHarrisburg School District Superintendent's ContractPennLiveNo ratings yet

- West Perry School District Superintendent ContractDocument12 pagesWest Perry School District Superintendent ContractBarbara MillerNo ratings yet

- Lawsuit Against Pennsylvania Turnpike Filed by Trucking AssociationsDocument43 pagesLawsuit Against Pennsylvania Turnpike Filed by Trucking AssociationsBarbara MillerNo ratings yet

- Derry Township School District Superintendent Contract AddendemDocument26 pagesDerry Township School District Superintendent Contract AddendemBarbara MillerNo ratings yet

- West Shore School District Superintendent ContractDocument7 pagesWest Shore School District Superintendent ContractBarbara MillerNo ratings yet

- Central Dauphin School District Superintendent ContractDocument16 pagesCentral Dauphin School District Superintendent ContractBarbara MillerNo ratings yet

- Mechanicsburg Area School District Superintendent ContractDocument25 pagesMechanicsburg Area School District Superintendent ContractBarbara MillerNo ratings yet

- Withum Contract Amendment 2016-2021 PDFDocument3 pagesWithum Contract Amendment 2016-2021 PDFBarbara MillerNo ratings yet

- Susquenita School District Superintendent ContractDocument14 pagesSusquenita School District Superintendent ContractBarbara MillerNo ratings yet

- Greenwood School District Superintendent ContractDocument2 pagesGreenwood School District Superintendent ContractBarbara MillerNo ratings yet

- Camp Hill School District Superintendent ContractDocument16 pagesCamp Hill School District Superintendent ContractBarbara MillerNo ratings yet

- Cumberland Valley School District Superintendent ContractDocument29 pagesCumberland Valley School District Superintendent ContractBarbara MillerNo ratings yet

- Cumberland Valley School District Superintendent ContractDocument29 pagesCumberland Valley School District Superintendent ContractBarbara MillerNo ratings yet

- Amendment To Acting Cuperintendent Contract, South Middleton School DistrictDocument1 pageAmendment To Acting Cuperintendent Contract, South Middleton School DistrictBarbara MillerNo ratings yet

- Big Spring School District Superintendent ContractDocument15 pagesBig Spring School District Superintendent ContractBarbara MillerNo ratings yet

- Capital Area Intermediate Unit Executive Director ContractDocument17 pagesCapital Area Intermediate Unit Executive Director ContractBarbara MillerNo ratings yet

- Carlisle Area School District Superintendent ContractDocument18 pagesCarlisle Area School District Superintendent ContractBarbara MillerNo ratings yet

- 2016 Annual Report-Lower Paxton Township Police DepartmentDocument29 pages2016 Annual Report-Lower Paxton Township Police DepartmentBarbara MillerNo ratings yet

- Capital Area Transit Route Changes March 5, 2018Document2 pagesCapital Area Transit Route Changes March 5, 2018Barbara MillerNo ratings yet

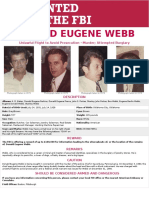

- FBI Wanted Poster For Donald Eugene WebbDocument1 pageFBI Wanted Poster For Donald Eugene WebbBarbara MillerNo ratings yet