Professional Documents

Culture Documents

New York Commercial Criminal Insurance Regulation

Uploaded by

Matthew Hamilton0 ratings0% found this document useful (0 votes)

3K views3 pagesNew York Commercial Criminal Insurance Regulation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNew York Commercial Criminal Insurance Regulation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3K views3 pagesNew York Commercial Criminal Insurance Regulation

Uploaded by

Matthew HamiltonNew York Commercial Criminal Insurance Regulation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

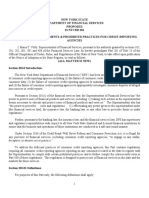

NEW YORK STATE

DEPARTMENT OF FINANCIAL SERVICES

11 NYCRR 76

(INSURANCE REGULATION 209)

COMMERICAL CRIME COVERAGE EXCLUSIONS

I, Maria T. Vullo, Superintendent of Financial Services, pursuant to the authority granted by Sections 202

and 302 of the Financial Services Law and Sections 301 and 2307 and Articles 23, 24 and 34 of the Insurance

Law, do hereby promulgate Part 76 of Title 11 of the Official Compilation of Codes, Rules and Regulations of

the State of New York (Insurance Regulation 209), to take effect on July 1, 2017, with respect to all policies

issued, renewed or delivered in this State on or after that date, to read as follows:

(ALL MATERIAL IS NEW)

Section 76.0 Preamble and purpose.

(a) Correction Law section 753 states that the public policy of New York, as expressed in Correction Law

Article 23-A, is to encourage the licensure and employment of persons previously convicted of one or more

criminal offenses. Correction Law section 752 forbids discrimination based upon a conviction for a previous

criminal offense unless there is a direct relationship between one or more of the previous offenses and the specific

employment sought or held by the individual; or the granting or continuation of employment would involve an

unreasonable risk to property or to the safety or welfare of specific individuals or the general public. Correction

Law section 753 specifies eight factors, including the public policy of the state, to be considered in making a

determination pursuant to section 752.

(b) However, commercial crime insurance policies often have provisions that will exclude coverage for loss

or damage caused by an employee who has been convicted of a criminal offense, where the employer knew about

the conviction prior to the loss or damage. This puts employers in the untenable position of either not being able

to obtain insurance or violating the Correction Law by not hiring the individual, even though a review of the

Correction Law factors would weigh in favor of employment. Given the strong public policy of the State, the

Superintendent has determined that it would be an unfair method of competition or an unfair or deceptive act and

practice in the conduct of the business of insurance in this state for an insurer that writes commercial crime

insurance policies in this state to exclude coverage where the employer has weighed the factors set out in

Correction Law Article 23-A and made a determination favorable to the employee.

Section 76.1 Definitions.

For purposes of this Part:

(a) Commercial crime coverage means coverage under a policy of commercial risk insurance that provides

burglary and theft insurance or fidelity insurance; and

(b) Commercial risk insurance has the meaning ascribed by Insurance Law section 107(a)(47).

Section 76.2 Prior convictions.

No policy issued, renewed or delivered in this state that provides commercial crime coverage may exclude

or limit coverage for loss or damage caused by an employee on the basis that the employee was convicted of one

or more criminal offenses in this state or any other jurisdiction prior to being employed by the employer, if, after

learning about an employees past criminal conviction or convictions, the employer made a determination to hire

or retain the employee utilizing the factors set out in Correction Law Article 23-A.

Section 76.3 Determined violation.

A contravention of this Part shall be deemed to be an unfair method of competition or an unfair or deceptive

act and practice in the conduct of the business of insurance in this state, and shall be deemed to be a trade practice

constituting a determined violation, as defined in section 2402(c) of the Insurance Law, in violation of section

2403 of such law.

You might also like

- EDU - Project Management Assistant Basic Education FSN-8Document4 pagesEDU - Project Management Assistant Basic Education FSN-8Yustinus EndratnoNo ratings yet

- QBE ME Project Specific WordingDocument18 pagesQBE ME Project Specific WordingpranavyesNo ratings yet

- Insurance Basics and Key ConceptsDocument91 pagesInsurance Basics and Key ConceptsMarichu Castillo HernandezNo ratings yet

- TOPIC SIX - WORK INJURY BENEFITS ACT 2007Document8 pagesTOPIC SIX - WORK INJURY BENEFITS ACT 2007Scolanne WagicheruNo ratings yet

- 02 Department of Professional and Financial Regulation 029 Bureau of Financial Institutions Loans To One Borrower Limitations (Reg. 28)Document13 pages02 Department of Professional and Financial Regulation 029 Bureau of Financial Institutions Loans To One Borrower Limitations (Reg. 28)Robin Van SoCheatNo ratings yet

- New Insurance Code of The PhilippinesDocument10 pagesNew Insurance Code of The PhilippinesSherlyn Paran Paquit-SeldaNo ratings yet

- Insurance Contract DefinitionsDocument20 pagesInsurance Contract Definitionsraechelle bulosNo ratings yet

- Chapter 25Document18 pagesChapter 25Sherif AzizNo ratings yet

- Insurance CodeDocument15 pagesInsurance CodeOw WawieNo ratings yet

- Insurance Code Secs. 2(1), 3, 77 OutlineDocument30 pagesInsurance Code Secs. 2(1), 3, 77 OutlineAliyah SandersNo ratings yet

- North Carolina Employment Securities Commission Regulations Issued July 27, 2010Document98 pagesNorth Carolina Employment Securities Commission Regulations Issued July 27, 2010Anthony Flanagan100% (1)

- Advanced No Fault Issues Under Arkansas LawDocument38 pagesAdvanced No Fault Issues Under Arkansas LawGerry SchulzeNo ratings yet

- Insurance Part VI ProvisionsDocument1 pageInsurance Part VI ProvisionsJCapskyNo ratings yet

- MercRev Insurance Syllabus (My Part)Document8 pagesMercRev Insurance Syllabus (My Part)p95No ratings yet

- Claims Settlement: Title 11Document33 pagesClaims Settlement: Title 11Eunice SerneoNo ratings yet

- Contractors All Risks - Policy WordingsDocument8 pagesContractors All Risks - Policy WordingskrishbistNo ratings yet

- Labor PrinciplesDocument5 pagesLabor PrinciplesRose de DiosNo ratings yet

- Texas Steering and Insurance DirectionDocument2 pagesTexas Steering and Insurance DirectionDonnie WeltyNo ratings yet

- Insurance Chapter II Case DigestsDocument15 pagesInsurance Chapter II Case DigestsVictoria ChavezNo ratings yet

- Insurance Chapter II Case DigestsDocument14 pagesInsurance Chapter II Case DigestsmawinellNo ratings yet

- Hizon Notes - FormattedDocument31 pagesHizon Notes - Formattednicole5anne5ddddddNo ratings yet

- Upload 1.4Document5 pagesUpload 1.4DAVID JEROMENo ratings yet

- National Insurance Company Limited: Regd. & Head Office. 3, Middleton Street, Kolkata-700071Document19 pagesNational Insurance Company Limited: Regd. & Head Office. 3, Middleton Street, Kolkata-700071Ankur PatilNo ratings yet

- S12 PDFDocument2 pagesS12 PDFEric PaitNo ratings yet

- Ic 27Document8 pagesIc 27ShooshooNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument9 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledAnonymous lvUVwZMNo ratings yet

- Verbal WarningDocument6 pagesVerbal WarningWZZM NewsNo ratings yet

- Claims Settlement and SubrogationDocument16 pagesClaims Settlement and SubrogationRaymund ArcosNo ratings yet

- Senate Bill 753: King, Madaleno, Manno, Mcfadden, Montgomery, Muse, Peters, Pinsky, Ramirez, Raskin, Rosapepe, and StoneDocument19 pagesSenate Bill 753: King, Madaleno, Manno, Mcfadden, Montgomery, Muse, Peters, Pinsky, Ramirez, Raskin, Rosapepe, and Stoneabc2newsNo ratings yet

- Senate Bill 61Document18 pagesSenate Bill 61LansingStateJournalNo ratings yet

- Insurance policy cancellation and warranty rulesDocument2 pagesInsurance policy cancellation and warranty rulessakuraNo ratings yet

- Insurance LawDocument3 pagesInsurance LawJoe BuenoNo ratings yet

- Insurance Reform Bill Limits Damages RecoveryDocument3 pagesInsurance Reform Bill Limits Damages RecoveryvalentinejnNo ratings yet

- Newind 1 PDF 1622284615Document9 pagesNewind 1 PDF 1622284615Harish RamanathanNo ratings yet

- Ra 10607Document15 pagesRa 10607mblopez1100% (1)

- Noel F. Manankil Et - Al. vs. COADocument3 pagesNoel F. Manankil Et - Al. vs. COAmajdsilvestreNo ratings yet

- United States Court of Appeals Fourth CircuitDocument5 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- Insurance Notes Claims SettlementDocument7 pagesInsurance Notes Claims SettlementJinuro SanNo ratings yet

- Notary E & O PolicyDocument4 pagesNotary E & O PolicyMARK MENO©™No ratings yet

- Corporate GuaranteeDocument14 pagesCorporate GuaranteeAkio ChingNo ratings yet

- Regulation and Supervision of Insurance IndustryDocument46 pagesRegulation and Supervision of Insurance IndustryYUSLINA BINTI ABDUL GHAN1No ratings yet

- American Mutual Insurance Company v. Charles A. Romero, Jr. and Cecil Corcoran, 428 F.2d 870, 10th Cir. (1970)Document6 pagesAmerican Mutual Insurance Company v. Charles A. Romero, Jr. and Cecil Corcoran, 428 F.2d 870, 10th Cir. (1970)Scribd Government DocsNo ratings yet

- Mba Iv, Ir-Gratuity ActDocument19 pagesMba Iv, Ir-Gratuity Actmanu KartikayNo ratings yet

- Insurance Final Exam NotesDocument5 pagesInsurance Final Exam NotesJaymee Andomang Os-agNo ratings yet

- New York Labor Law 201 D 9-6-23Document4 pagesNew York Labor Law 201 D 9-6-23norkaNo ratings yet

- PlayDocument6 pagesPlaylance zoletaNo ratings yet

- Lien On Assets of The Company Under Labour LawsDocument2 pagesLien On Assets of The Company Under Labour LawsSamaksh KhannaNo ratings yet

- Correction Law Article 23aDocument3 pagesCorrection Law Article 23aAkun 75051No ratings yet

- Philippines establishes Insurance CodeDocument3 pagesPhilippines establishes Insurance CodeShine BillonesNo ratings yet

- Guideline On Exercising Power ToDocument6 pagesGuideline On Exercising Power TochocolateNo ratings yet

- Employment Accidents Insurance Act (20.8.1948/608) Chapter 1. General ProvisionsDocument50 pagesEmployment Accidents Insurance Act (20.8.1948/608) Chapter 1. General ProvisionsJorge A. OnirevesNo ratings yet

- Insurance Reviewer (Fire Insurance and Casualty Insurance)Document13 pagesInsurance Reviewer (Fire Insurance and Casualty Insurance)Guiller C. Magsumbol100% (1)

- Pup College of Law Insurance: 2011 Bar ReviewerDocument45 pagesPup College of Law Insurance: 2011 Bar ReviewerHoney Crisril M. CalimotNo ratings yet

- HB342 Motor Vehicle Title Loan ActDocument46 pagesHB342 Motor Vehicle Title Loan ActLindsey BasyeNo ratings yet

- Default and Enforcement: NtroductionDocument20 pagesDefault and Enforcement: NtroductionSeniorNo ratings yet

- INSURANCE CODE OF THE PHILIPPINESDocument3 pagesINSURANCE CODE OF THE PHILIPPINESSon Gabriel UyNo ratings yet

- Insurance VI IXDocument16 pagesInsurance VI IXMa Jean Baluyo CastanedaNo ratings yet

- RTW Senate BillDocument8 pagesRTW Senate Billapackof2No ratings yet

- Contractor All Risk Insurance Policy for Road ProjectDocument21 pagesContractor All Risk Insurance Policy for Road ProjectRohitNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- 2018 State of The State BookDocument374 pages2018 State of The State BookMatthew HamiltonNo ratings yet

- 2018-19 Executive Budget Briefing BookDocument161 pages2018-19 Executive Budget Briefing BookMatthew Hamilton100% (1)

- Joint Budget Schedule 2018 Release FINALDocument1 pageJoint Budget Schedule 2018 Release FINALMatthew HamiltonNo ratings yet

- FY 18-19 Budget School Aid RunsDocument15 pagesFY 18-19 Budget School Aid RunsMatthew HamiltonNo ratings yet

- SNY0118 Crosstabs011618Document7 pagesSNY0118 Crosstabs011618Nick ReismanNo ratings yet

- State of The State BingoDocument5 pagesState of The State BingoMatthew Hamilton100% (1)

- IDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.Document3 pagesIDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.liz_benjamin6490No ratings yet

- New York State Plastic Bag Task Force ReportDocument88 pagesNew York State Plastic Bag Task Force ReportMatthew Hamilton100% (1)

- SNY0118 Crosstabs011518Document3 pagesSNY0118 Crosstabs011518Matthew HamiltonNo ratings yet

- SNY1017 CrosstabsDocument6 pagesSNY1017 CrosstabsNick ReismanNo ratings yet

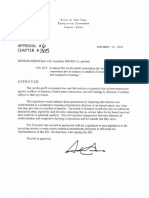

- Approval #64-66 of 2017Document3 pagesApproval #64-66 of 2017Matthew HamiltonNo ratings yet

- DiNapoli Debt Impact Study 2017Document30 pagesDiNapoli Debt Impact Study 2017Matthew HamiltonNo ratings yet

- 6-21-17 Ethics Committee Letter To Heastie Re: McLaughlin InvestigationDocument3 pages6-21-17 Ethics Committee Letter To Heastie Re: McLaughlin InvestigationMatthew HamiltonNo ratings yet

- 11-27-17 LetterDocument5 pages11-27-17 LetterNick ReismanNo ratings yet

- 6-22-17 Heastie Letter To Ethics Committee Re: McLaughlin InvestigationDocument1 page6-22-17 Heastie Letter To Ethics Committee Re: McLaughlin InvestigationMatthew HamiltonNo ratings yet

- 11-29-17 Heastie Letter To McLaughlin Re: McLaughlin InvestigationDocument2 pages11-29-17 Heastie Letter To McLaughlin Re: McLaughlin InvestigationMatthew HamiltonNo ratings yet

- 2016 Legislative Session CalendarDocument1 page2016 Legislative Session CalendarMatthew HamiltonNo ratings yet

- USA v. Skelos Appellate DecisionDocument12 pagesUSA v. Skelos Appellate DecisionMatthew HamiltonNo ratings yet

- Comptroller's Fiscal Update: State Fiscal Year 2017-18 Receipts and Disbursements Through The Mid-YearDocument10 pagesComptroller's Fiscal Update: State Fiscal Year 2017-18 Receipts and Disbursements Through The Mid-YearMatthew HamiltonNo ratings yet

- Andrew Cuomo Letter To Jeff Bezos Re HQ2Document2 pagesAndrew Cuomo Letter To Jeff Bezos Re HQ2Matthew HamiltonNo ratings yet

- OSC Municipal Water Systems ReportDocument14 pagesOSC Municipal Water Systems ReportMatthew HamiltonNo ratings yet

- DiNapoli Wall Street Profits Report 2017Document8 pagesDiNapoli Wall Street Profits Report 2017Matthew HamiltonNo ratings yet

- DiNapoli Federal Budget ReportDocument36 pagesDiNapoli Federal Budget ReportMatthew HamiltonNo ratings yet

- USA V Pigeon 100617Document29 pagesUSA V Pigeon 100617Matthew HamiltonNo ratings yet

- Rockefeller Instittue 106 Ideas For A Constitutional ConventionDocument17 pagesRockefeller Instittue 106 Ideas For A Constitutional ConventionMatthew HamiltonNo ratings yet

- Faso Scaffold Law BillDocument4 pagesFaso Scaffold Law BillMatthew HamiltonNo ratings yet

- Siena College October 2017 PollDocument8 pagesSiena College October 2017 PollMatthew HamiltonNo ratings yet

- NYS DFS Credit Reporting Agency RegulationsDocument6 pagesNYS DFS Credit Reporting Agency RegulationsMatthew HamiltonNo ratings yet

- Gov. Andrew Cuomo Law Approval Message #6 - 2017Document1 pageGov. Andrew Cuomo Law Approval Message #6 - 2017Matthew HamiltonNo ratings yet

- Gov. Andrew Immigration Status Executive OrderDocument2 pagesGov. Andrew Immigration Status Executive OrderMatthew HamiltonNo ratings yet

- Resume 1 18 17Document3 pagesResume 1 18 17api-313698032No ratings yet

- Medical Assistant Resume ObjectiveDocument5 pagesMedical Assistant Resume Objectiveafiwiaufk100% (2)

- Class 12 Sociology Notes Chapter 4 Studyguide360Document10 pagesClass 12 Sociology Notes Chapter 4 Studyguide360Gulam gausNo ratings yet

- Reply To Sona by President RamaphosaDocument18 pagesReply To Sona by President RamaphosaCityPressNo ratings yet

- Wcms 346714Document59 pagesWcms 346714Beste Ardıç ArslanNo ratings yet

- Materials Management Manual: A GuideDocument204 pagesMaterials Management Manual: A GuidesagarthegameNo ratings yet

- Chap 0023Document26 pagesChap 0023yousef olabiNo ratings yet

- Strategic Human Resource ManagementDocument17 pagesStrategic Human Resource ManagementGangadhar Mamadapur100% (1)

- Researching About Yourself: Lesson IiDocument8 pagesResearching About Yourself: Lesson IiKey Cylyn JalaNo ratings yet

- Research ReportDocument60 pagesResearch Reportnalindapriyanath9491No ratings yet

- Critical Review of Performance Management System at Telenor PakistanDocument7 pagesCritical Review of Performance Management System at Telenor PakistanFaisal Ahmad Jafri0% (1)

- Jia Li (2022) History of Feminism and Gender Equality in Modern PhilippinesDocument12 pagesJia Li (2022) History of Feminism and Gender Equality in Modern PhilippinesFRANCESCA LUISA GEMOTANo ratings yet

- Network of Asia-Pacific Schools and Institutes of Public Administration and Governance (NAPSIPAG) Annual Conference 2005Document4 pagesNetwork of Asia-Pacific Schools and Institutes of Public Administration and Governance (NAPSIPAG) Annual Conference 2005Avanish K SinghNo ratings yet

- Procedure System of Repair Procedure For Pile Concrete SurfaceDocument13 pagesProcedure System of Repair Procedure For Pile Concrete SurfaceImtiyaz AkhtarNo ratings yet

- Wal-Mart's Computerized Scheduling Raises Ethical DilemmasDocument8 pagesWal-Mart's Computerized Scheduling Raises Ethical DilemmasAnwar RabiaNo ratings yet

- Conflict ManagementDocument16 pagesConflict ManagementBisrat DaNo ratings yet

- Beginners Guide Psychometric Test JobtestprepDocument20 pagesBeginners Guide Psychometric Test JobtestprepOlivia Eka PrasetiawatiNo ratings yet

- Insurance Need AnalysisDocument8 pagesInsurance Need AnalysisRajesh Chowdary ChintamaneniNo ratings yet

- Manila Terminal Company v. The Court of Industrial Relations - GR No. L-1881.pdf - Case DigestDocument2 pagesManila Terminal Company v. The Court of Industrial Relations - GR No. L-1881.pdf - Case DigestAbigail Tolabing100% (1)

- 21st Century School Counselor Chap262008Document12 pages21st Century School Counselor Chap262008Wastiti AdiningrumNo ratings yet

- Organizational BehaviourDocument5 pagesOrganizational BehaviourLokam100% (1)

- "Improving Occupational Health and Workplace Safety in Saudi Arabia PDFDocument7 pages"Improving Occupational Health and Workplace Safety in Saudi Arabia PDFAnsarMahmoodNo ratings yet

- The Tradition of Spontaneous Order: Hayek's Insights Into Market CoordinationDocument12 pagesThe Tradition of Spontaneous Order: Hayek's Insights Into Market CoordinationAnonymous ORqO5yNo ratings yet

- Pakistan Council of Scientific & Industrial Research (Pcsir)Document3 pagesPakistan Council of Scientific & Industrial Research (Pcsir)paarassNo ratings yet

- Strategies for Growth and Managing ImplicationsDocument23 pagesStrategies for Growth and Managing ImplicationsLina Marcela AlzateNo ratings yet

- English TestDocument2 pagesEnglish TestDusan VulicevicNo ratings yet

- Mine Project Director Job PostingsDocument2 pagesMine Project Director Job PostingsScott O'BrienNo ratings yet

- B. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Document5 pagesB. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Anh NguyễnNo ratings yet

- Bcda V Coa - G.R. No. 178160, February 26, 2009Document10 pagesBcda V Coa - G.R. No. 178160, February 26, 2009Mak FranciscoNo ratings yet