Professional Documents

Culture Documents

Recent Developments of Corporate Insolvency Law in Malaysia

Uploaded by

inventionjournalsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recent Developments of Corporate Insolvency Law in Malaysia

Uploaded by

inventionjournalsCopyright:

Available Formats

International Journal of Humanities and Social Science Invention

ISSN (Online): 2319 7722, ISSN (Print): 2319 7714

www.ijhssi.org ||Volume 5 Issue 12||December. 2016 || PP.33-37

Recent Developments of Corporate Insolvency Law in Malaysia

Azrol Abdullah1, Gan Chee Keong2, Tee Yee Khuan @ Joshua3

(Chief Justices Office & Research Division of the Federal Court of Malaysia)

ABSTRACT: This article aims to analyse the current corporate insolvency framework in Malaysia and the

problem faced in the corporate insolvency law. Under the current corporate insolvency law in Malaysia, there

are numerous approaches in dealing with corporate insolvency, but it appears that the current framework is

found to be inadequate due to lack of focus accorded on the rescue mechanisms or attempts to rehabilitate

companies. Conversely, the current corporate insolvency framework is very much focused on liquidation or

winding up of a company. This article also highlights some of the proactive reform efforts undertaken by the

Malaysian government to keep in tandem with the latest development that had taken place in the corporate

sector. Accordingly, this article will propose some future reforms to the relevant department in order to

reinvigorate the existing insolvency regulatory framework to be more dynamic and in line with international

standards adopted by other countries within the region.

Keywords: corporate insolvency, corporate rescue mechanisms, corporate voluntary arrangement, crossborder insolvency, judicial management

I.

INTRODUCTION

The law relating to corporate insolvency in Malaysia is governed by the Companies Act 1965 and the

Companies Winding-up Rules 1972. While the laws relating to personal insolvency in Malaysia are contained in

the Bankruptcy Act 1967 and the Bankruptcy Rules 1969. Malaysia maintains a separate insolvency regulatory

frameworks for personal and corporate insolvency. There is no single insolvency regulatory framework which

consolidates both the corporate and personal insolvency unlike the Insolvency Act 1986 in the United Kingdom.

II.

THE CURRENT CORPORATE INSOLVENCY FRAMEWORK IN MALAYSIA

Under the current corporate insolvency law in Malaysia, there are numerous approaches adopted in

dealing with corporate insolvency. Firstly, regarding the receivership process where creditors may appoint a

receiver and manager. More often than not, the company intended to be wound up and its assets are hived off

and sold separately. The receivership procedures are widely practised in all jurisdictions. However, the primary

purpose of a receivership is not to act in the collective interest of all creditors of the company but to liquidate the

companys assets under a debenture for the interest of the debenture holders and not primarily to rescue or

rehabilitate the company. Second, a winding up process which is intended to enable proper closure of a

company that intends to cease operation or unable to continue with its business. The winding up process may be

made voluntarily (through a members or creditors resolution) or by way of an application filed to the court for

winding up order. Third, a scheme of arrangement under Section 176 of the Companies Act 1965. Whilst the

section is not intended to serve specifically as a corporate rescue mechanism, it has somehow proven to be

useful for companies facing financial difficulty. Where Section 176 of the Companies Act 1965 is concerned,

although the procedures under Section 176 of the Companies Act 1965 have been amended in 1988 following

constant criticisms from the market players, the scheme offered by Section 176 is still seen as costly,

cumbersome and slow in its procedures and implementation particularly if it is to be used for corporate

rehabilitation or rescue.

In responding to the problems faced by the banking sector in Malaysia in the wake of the 1997

financial crisis, a new formal insolvency process that is the special administration under the Pengurusan

Danaharta Nasional Berhad Act 1998 (the Danaharta Act) was introduced to complement the older insolvency

law and the restructuring process. The Danaharta Act proffers a non-court based procedure that operates along

the commercial principles by adopting the market driven approach despite the fact that it is a government entity.

This is one of the remarkable features of the special administration under the Danaharta Act as compared to the

process under the scheme of arrangement. Time is very crucial in the formulation of a workable restructuring

plan. The appointed special administrator must devise a workable restructuring plan in ensuring that the

implementation of the plan be carried out within the period of three to six months after the appointment. This

process proves to be faster than the procedures made available under Section 176 of the Companies Act 1965

because the normal court process would usually involve longer time to complete. The workable restructuring

plan initiated by the special administrator requires only the approval of the secured creditors and not the

shareholders of the company or its unsecured creditors. Once it is approved, the workout proposal binds the

www.ijhssi.org

33 | Page

Recent Developments of Corporate Insolvency in Malaysia

company, its shareholders and all creditors. This process is very distinct from the procedure under the scheme of

arrangement which requires approval of 75 percent in value and a simple majority in number of each class of

creditors and members present and voting. The creditors under the scheme of arrangement are divided into

classes according to their communality of interests.

Another informal corporate rescue work out that had been introduced following the 1997 financial

crisis was the Corporate Debt Restructuring Committee (CDRC) under the auspices of the Central Bank of

Malaysia. The CDRC sets specific criteria to be met by applicant such as, the company must have a potentially

viable business and have more than RM50 million worth of debts attached to more than one financial institution.

The CDRC acts as a secretariat which supervises and facilitates negotiations between the creditors, banks and

debtors (Aishah Bidin, 2012). The above mentioned frameworks outline the current insolvency measures

available in dealing with corporate insolvency in Malaysia. However, it would not be too farfetched to suggest

that the current framework is found to be inadequate because lack of focus on the rescue mechanisms or

attempts to rehabilitate companies.

III.

THE PROBLEM FACED

Careful perusal of the earlier mentioned framework positively indicates that the current corporate

insolvency framework emphasized more on the liquidation process or winding up of a company. That could be

the probable reason as to why liquidation often been seen as the only viable option for insolvent companies.

However, the present framework is insufficient because the framework lacks of focus on the rescue mechanisms

or efforts to rehabilitate companies. It is observed that the corporate insolvency framework in other jurisdictions

govern matters pertaining to pre-insolvency procedures, liquidation process, consolidation of corporate and

personal laws and corporate rescue mechanisms. In most jurisdictions, effective corporate insolvency regime

means a process that is able to provide a system that enables the winding up of companies that has no future

prospect of the business in becoming profitable and viable with the least possible cost and delay. At the same

time, an effective corporate insolvency regime should be able to provide mechanisms to rehabilitate companies

and rescue companies from being wound up. For instance, the Harmer Report of Australia, whilst

acknowledging the general principles of corporate insolvency law, stated that there should be an effective

release of the insolvent company from financial obligations and liabilities (The Secretariat to the Corporate Law

Reform Committee (CLRC) Companies Commission of Malaysia, 2014). The so called corporate rescue

mechanisms is also present in the United Kingdom, where two further measures exist, to wit, administration,

which aims to afford a company in a potentially insolvent position an alternative to automatic liquidation,

including the possible outcome of assuring that company's survival; and company voluntary arrangements,

conceived as a pre-insolvency measure leading to creditors being consulted in order to facilitate the

reconstruction of a company (Paul J. Omar, 1998).

By improving the capability of the corporate insolvency law to be able in dealing with liquidation as

well as corporate rescue mechanism, more commercially realistic measures could be devised in addressing the

needs of companies and investors. It is pertinent to note that companies are mostly used as mode of conducting

business. Indeed, some businesses flourish but some bound to fail. Therefore, a company that is used as a

vehicle to conduct business should be permitted to wind up its business whenever it feels that there is no viable

prospect of the business becoming profitable. As such, the corporate insolvency law should provide or facilitate

the winding up process of that company efficiently. However, if a companys failure is due to temporary

financial problems or external economic factors, then a rescue mechanism may enable the company to be

rehabilitated and to preserve its business as a going concern. A corporate rescue mechanism may also enable

better returns for creditors and shareholders as fragmented sale of a companys business in most cases may not

be in the best interest of the companys creditors and shareholders. At this point, the lack of focus on the rescue

mechanisms or attempts to rehabilitate companies in the current corporate insolvency law is the main problem

that requires attention.

IV.

LAW REFORM EFFORT

In overcoming the experiencing problem, the government had taken up proactive steps to keep in

tandem with the latest development in the corporate sector. Earlier this year, the Companies Bill 2015 was

passed on 4 April 2016 by the Dewan Rakyat (House of Representatives). The Bill would replace the existing

Companies Act 1965 and expected to bring major reforms largely in the corporate landscape and harmonise the

Malaysia's insolvency laws and bridging it closer to the modern international standards. One of the key features

of the Bill is the introduction of two new corporate rescue mechanisms in attempting to assist financially

distressed companies from being wound-up. The Bill obtained its royal assent on 31 August 2016, but yet to be

in force.

In short, the two new corporate rescue mechanisms introduced by the Bill are the Judicial Management

and the Corporate Voluntary Arrangement (Shereen Khan, Olivia Tan, Aishah Bidin, 2014). These two new

www.ijhssi.org

34 | Page

Recent Developments of Corporate Insolvency in Malaysia

corporate rescue mechanisms have been succinctly explained by Jason Opperman and Nick Williams in their

article Malaysias New Insolvency Regime which can be briefly described below:

4.1 The Judicial Management (section 403-430 Companies Bill 2015)

The Judicial Management process allows the directors, shareholders or creditors of a company, where

there is a reasonable probability of rehabilitating the company, to apply to the Court to appoint an independent

and qualified Judicial Manager to take charge of the management of the company. The Judicial Management

process under the Bill is modelled based on the existing Singaporean Judicial Management regime. Pursuant to

the new law, the Court may grant a Judicial Management order if: (1) it is satisfied that the company is or will

be unable to pay its debts; (2) it considers that the making of the order would be likely to achieve one or more of

the following purposes: (i) the survival of the company, or the whole or part of its undertaking as a going

concern; (ii) the approval of a compromise or arrangement between the company and its creditors; (iii) a more

advantageous realisation of the company's assets would be effected than on a winding up.

Once Judicial Management order is issued by the Court, a statutory moratorium of 180 days would

commence during which the company cannot be wound-up. Further, during the moratorium period, no receiver

can be appointed, no security can be enforced, no shares can be transferred and no proceedings can be

commenced against the company without leave from the Court. The effect on counterparties of a company

under the Judicial Management will vary. For example, other than with leave from the Court, no landlord or

other person to whom rent is payable may exercise any right of forfeiture in relation to premises let to the

company. On the other hand, if (as expected) the Malaysian Courts follow the application of the Singaporean

Judicial Management laws, then ipso facto clauses which entitle an innocent contracting party to terminate the

agreement and/or exercise certain remedies upon the commencement of Judicial Management will be effective.

During the 180 days moratorium, the Judicial Manager is charged with preparing a restructuring plan for the

company for approval by the creditors of the company. The moratorium may be extended on the application of

the Judicial Manager for another 180 days. In order for the Judicial Managers restructuring plan to be approved

by the creditors, at least 75% in value of the creditors must approve the plan. If the restructuring plan is

approved by the creditors, the Judicial Manager then applies to Court to sanction the plan following which the

plan will be implemented.

4.2 Corporate Voluntary Arrangement (section 395-402 Companies Bill 2015)

The new second mechanism is the Corporate Voluntary Arrangement process, which is based on

similar legislation available in the UK. Under the Corporate Voluntary Arrangement, the directors of a private

company could propose a debt restructuring proposal to revive the fortunes of the company. Unlike the existing

Scheme of Arrangement process, the Bill requires a qualified insolvency practitioner, known as the nominee

to conduct an initial assessment of the viability of the proposed Corporate Voluntary Arrangement. Once the

nominee has considered the proposed Corporate Voluntary Arrangement, he would then submit to the directors

a statement indicating whether or not in his opinion: (1) the proposed Corporate Voluntary Arrangement has a

reasonable prospect of being approved and implemented; (2) the company is likely to have sufficient funds

available for it during the proposed moratorium to enable the company to carry on its business; (3) that meetings

of the company and creditors should be summoned to consider the proposed Corporate Voluntary Arrangement.

If the nominee provides a positive statement regarding the proposed Corporate Voluntary Arrangement,

the directors could file with the Court a document setting out the terms of the proposed Corporate Voluntary

Arrangement and other necessary documents. In order for the proposed Corporate Voluntary Agreement to be

approved at a specially convened meeting of creditors: (1) a simple majority of creditors present and voting

must approve the scheme; (2) at least 75% in value of the creditors present and voting must approve the scheme.

If a Corporate Voluntary Arrangement is approved, the company may apply for a moratorium of

between 28 and 60 days during which the company cannot be wound-up, no Judicial Manager can be appointed

and no shares can be transferred etc. It is important to note that under the Corporate Voluntary Arrangement, a

secured creditor is not prevented from appointing a receiver over its secured property during the moratorium.

Although the Corporate Voluntary Arrangement proposal is initially proposed by the directors of a company, it

is the nominee insolvency practitioner who is responsible for supervising and implementing the proposal. The

nominee can apply to Court for directions in relation to any particular matter arising under the Corporate

Voluntary Arrangement.

The aforementioned are the ongoing efforts undertaken to recalibrate the corporate insolvency law in

Malaysia to be in line with the international standards adopted by other countries in the region. Most

importantly, the current reform has introduced new corporate rescue mechanisms into the corporate insolvency

law in availing directors more flexibility to deal with a company facing distress so that the company may remain

in business and to avoid being trapped in a winding-up scenario. Although the current reform has substantially

www.ijhssi.org

35 | Page

Recent Developments of Corporate Insolvency in Malaysia

resolved the problem concerned, but there is still room for improvement (Jason Opperman and Nick Williams,

2016).

V. REFORMS FOR THE FUTURE

According to the World Bank based on data provided in the Doing Business Report 2016, Malaysia

ranked 45th out of 189 economies globally in 2015 relating to efficient insolvency. Meanwhile, Malaysia is

ranked second after Singapore among the ASEAN countries. Singapore ranked as the most efficient in resolving

insolvency issue amongst the ASEAN countries. Singapore took the 27th position in 2015 (The World Bank,

2015). The ranking of resolving insolvency among ASEAN countries are listed in the following schedule:

Table 1.

Ranking of Efficient Insolvency 2016 Among ASEAN Countries

Countries

Singapore

Malaysia

Thailand

Philippines

Indonesia

Cambodia

Brunei

Vietnam

Ranking of Efficient Insolvency 2016 (ASEAN)

27

45

49

53

77

82

98

123

(Source: Doing Business Report 2016)

This indicates that that more efforts must be given to improve Malaysias ranking at the global arena

and between the ASEAN countries. Therefore, to provide an efficient process in insolvency proceeding, the

need is pressing to streamline the insolvency laws in Malaysia.

As earlier mentioned, Malaysia is currently maintaining a separate insolvency regulatory frameworks

for personal and corporate insolvency. There is no single insolvency regulatory framework which consolidates

both the corporate and personal insolvency. Henceforth, it would be cogent to propose for a single Insolvency

Act for Malaysia to consolidate both existing legislations into a single legislation. Reason being, the current

corporate insolvency law framework is confusing due to the fact that extensive cross-references to various

bankruptcy principles and rules provided in the Bankruptcy Act 1967 have to be made. For instance, the

application of Section 53 of the Bankruptcy Act 1967 under Section 293 of the Companies Act 1965 for undue

preference transactions. This situation had caused confusion and in some occasions, failed to facilitate easy

understanding of the corporate insolvency regulatory framework. That is the reason why there is a need to

streamline the insolvency laws to a single piece of insolvency regulatory framework similar to the Insolvency

Act 1986 in the United Kingdom. This could be the reform that could be undertaken.

On the other hand, a model law on cross-border insolvency as propounded by the United Nation

Commission on International Trade Law (UNCITRAL) Model Law on Cross-Border Insolvency 1997 could

also be adopted. The purpose of the model law is to assist countries to equip their insolvency laws with a

modern legal framework to effectively address cross-border insolvency proceedings concerning debtors

experiencing severe financial distress or insolvency. The Model Law contains four key areas outlining the scope

of the Model Law itself and rules for access by representatives of foreign insolvency proceedings, including

those governing the treatment of foreign creditors. It also covers the effects of domestic recognition of foreign

procedures and, most importantly, rules for cooperation and for co-ordination of simultaneous proceedings in

several jurisdictions over the same debtor (Paul J. Omar, 2008).

In the Asia context, many countries currently do not have sufficient laws to deal with the issue of cooperation in insolvency cases that have cross-border or international elements. The principle of territoriality

often dominates and the insolvency of a group company which covers several countries in Asia, will be resolved

by reference to the specific law of the country that a particular entity is incorporated or where its assets are

located. On the cross-border insolvency front, the issues that face institutions is the differing levels of legal,

social and economic development amongst the various countries in Asia, coupled with the differences in legal

systems, language and culture. This adds a further dimension or obstacle to issues such as Court to Court

communication and judicial co-operation. As a result of that, it leads to differences in treatment of creditors and

differences in approaches towards debt restructuring, appointment of insolvency practitioners in multiple

jurisdictions, and no clear direction for the entire group company, unless all stakeholders co-operate and work

together for a common commercial benefit (Patrick Ang, 2015).

Based on the above reasons, it would be convincing to adopt the Model Law in our domestic

insolvency regulatory framework in order to address commercial and business concerns in international level.

The insolvency law in Malaysia, does not possess the necessary provisions to properly exercise control over

cross-border insolvency, notwithstanding the incremental growth of cross-border trade and transactions. In light

of the work that is being carried out in the region by international bodies operating in the financial sector, it is

www.ijhssi.org

36 | Page

Recent Developments of Corporate Insolvency in Malaysia

necessary to take the issue of cross-border insolvency as a priority in Malaysia. This would seem persuasive and

essential given that the framework for international insolvency has been considerable advanced by the adoption

of the UNCITRAL Model Law on Cross-Border Insolvency 1997.

VI. CONCLUSION

It is clear that current framework of insolvency measures dealing with corporate insolvency is

inadequate due to lack of focus on rescue mechanisms or attempts to rehabilitate companies. Nonetheless, the

Government had acted in tandem with the latest development in the corporate sector by introducing the

Companies Bill 2015 that will replace the existing Companies Act 1965, and bring major reforms to the

insolvency regulatory framework. Two new corporate rescue mechanisms have been introduced in the

Companies Bill 2015. However, there is still room for improvement particularly to provide an efficient process

in insolvency proceeding. Therefore, the government is urged to carry out a study on the proposed future reform

in order to take all necessary steps in making the existing insolvency regulatory framework relevant and in line

with the same international standards as many other countries in the region.

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

Aishah Bidin, Corporate Reform and Corporate Governance in Malaysia: Responses to Globalization, in P.M. Vasudev and Susan

Watson (Ed.), Corporate Governance after the Financial Crisis, (New York: Edward Elgar Publishing Ltd, 2012) 229-248.

The Companies Bill 2015.

Jason Opperman and Nick Williams, Malaysias New Insolvency Regime, Legal Insight, K & L Gates, 2016

http://www.klgates.com/malaysias-nes-insolvency-regime-07-05-2016/

Omar, P.J., Cross-Border Jurisdiction and Assistance in Insolvency: The Position in Malaysia and Singapore, PER/PELJ, 11(1),

2008, 158-211.

Paul J. Omar, Insolvency Law in Malaysia: A Case for Reform, Malayan Law Journal, 4, 1998, xix-xxiv.

Patrick Ang, Cross-Border Insolvency Issues in Asia, Legal Network Series (A), 1, 2015, xci.

Shereen Khan, Olivia Tan, Aishah Bidin, Recent Developments of Insolvency and Restructuring in Malaysia, Australian Journal of

Basic and Applied Sciences, 8(1), 2014, 508-512.

The Secretariat to the Corporate Law Reform Committee (CLRC) Companies Commission of Malaysia, Reforming the Corporate

Insolvency Regime http://www.ssm.com.my/files/clrc/articles/CLRCArt3.pdf

The World Bank, Doing Business 2016: Measuring Regulatory Quality and Efficiency, 13 th Edition, The World Bank Group,

Washington, 2015. 1-348.

UNCITRAL

Model

Law

on

Cross-Border

Insolvency.

(1997).

http://www.uncitral.org/uncitral/en/uncitral

texts/insolvency/1997model.html

www.ijhssi.org

37 | Page

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale IndonesiaDocument9 pagesThe Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale Indonesiainventionjournals100% (1)

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - NigeriaDocument12 pagesEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeriainventionjournals100% (1)

- Inter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiaDocument5 pagesInter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiainventionjournalsNo ratings yet

- The Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisDocument7 pagesThe Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisinventionjournalsNo ratings yet

- The Network Governance in Kasongan Industrial ClusterDocument7 pagesThe Network Governance in Kasongan Industrial ClusterinventionjournalsNo ratings yet

- The Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityDocument10 pagesThe Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityinventionjournalsNo ratings yet

- A Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiDocument6 pagesA Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiinventionjournalsNo ratings yet

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.Document12 pagesEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.inventionjournalsNo ratings yet

- Islamic Insurance in The Global EconomyDocument3 pagesIslamic Insurance in The Global EconomyinventionjournalsNo ratings yet

- Negotiated Masculinities in Contemporary American FictionDocument5 pagesNegotiated Masculinities in Contemporary American FictioninventionjournalsNo ratings yet

- The Impact of Leadership On Creativity and InnovationDocument8 pagesThe Impact of Leadership On Creativity and InnovationinventionjournalsNo ratings yet

- An Appraisal of The Current State of Affairs in Nigerian Party PoliticsDocument7 pagesAn Appraisal of The Current State of Affairs in Nigerian Party PoliticsinventionjournalsNo ratings yet

- Muslims On The Margin: A Study of Muslims OBCs in West BengalDocument6 pagesMuslims On The Margin: A Study of Muslims OBCs in West BengalinventionjournalsNo ratings yet

- Student Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and UniversitiesDocument12 pagesStudent Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and Universitiesinventionjournals100% (1)

- E0606012850 PDFDocument23 pagesE0606012850 PDFinventionjournalsNo ratings yet

- A Critical Survey of The MahabhartaDocument2 pagesA Critical Survey of The MahabhartainventionjournalsNo ratings yet

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDocument12 pagesNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNo ratings yet

- Literary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)Document5 pagesLiterary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)inventionjournalsNo ratings yet

- Effect of P-Delta Due To Different Eccentricities in Tall StructuresDocument8 pagesEffect of P-Delta Due To Different Eccentricities in Tall StructuresinventionjournalsNo ratings yet

- F0606015153 PDFDocument3 pagesF0606015153 PDFinventionjournalsNo ratings yet

- E0606012850 PDFDocument23 pagesE0606012850 PDFinventionjournalsNo ratings yet

- H0606016570 PDFDocument6 pagesH0606016570 PDFinventionjournalsNo ratings yet

- F0606015153 PDFDocument3 pagesF0606015153 PDFinventionjournalsNo ratings yet

- C0606011419 PDFDocument6 pagesC0606011419 PDFinventionjournalsNo ratings yet

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDocument12 pagesNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNo ratings yet

- Development of Nighttime Visibility Assessment System For Road Using A Low Light CameraDocument5 pagesDevelopment of Nighttime Visibility Assessment System For Road Using A Low Light CamerainventionjournalsNo ratings yet

- D0606012027 PDFDocument8 pagesD0606012027 PDFinventionjournalsNo ratings yet

- H0606016570 PDFDocument6 pagesH0606016570 PDFinventionjournalsNo ratings yet

- C0606011419 PDFDocument6 pagesC0606011419 PDFinventionjournalsNo ratings yet

- D0606012027 PDFDocument8 pagesD0606012027 PDFinventionjournalsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bank of Maharastra Project ReportDocument33 pagesBank of Maharastra Project ReportBiswakesh Pati100% (1)

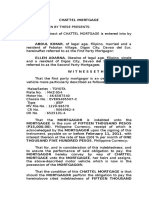

- Chattel MortgageDocument4 pagesChattel MortgageJames DecolongonNo ratings yet

- Edited 482599460 Citizens Bank Statements Format PDFDocument3 pagesEdited 482599460 Citizens Bank Statements Format PDFadetriawhitney428No ratings yet

- Module 4 ExcelDocument1 pageModule 4 ExcelHidayat TajuddinNo ratings yet

- Catur - Gaji Reflek RekeningDocument8 pagesCatur - Gaji Reflek RekeningAurora Marda BimantaraNo ratings yet

- How The Medici Family Continues To Influence The WorldDocument1 pageHow The Medici Family Continues To Influence The WorldEmily ProductionsNo ratings yet

- Sample Midterm QuestionDocument3 pagesSample Midterm QuestionAleema RokaiyaNo ratings yet

- e-StatementBRImo 107101000260307 Aug2023 20230905 004028Document12 pagese-StatementBRImo 107101000260307 Aug2023 20230905 004028Fedy HermawanNo ratings yet

- AbhinavDocument3 pagesAbhinavpraveen kumarNo ratings yet

- ANGOLA MergedDocument5 pagesANGOLA MergedRamiro MatiasNo ratings yet

- Reading 2 KeyDocument4 pagesReading 2 KeyNguyễn Văn NguyênNo ratings yet

- Louis InvoiceDocument1 pageLouis InvoiceArsalan HahaNo ratings yet

- Balloon Loan Payment Calculator1Document13 pagesBalloon Loan Payment Calculator1Rob SmithNo ratings yet

- ASENSO RURAL BANK OF BAUTISTA INC - HTMDocument2 pagesASENSO RURAL BANK OF BAUTISTA INC - HTMJim De VegaNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Financing Self Help Groups (SHGS) - Union Bank of IndiaDocument3 pagesFinancing Self Help Groups (SHGS) - Union Bank of IndiaSWAYAM PRAKASH PARIDANo ratings yet

- Business Finance LOANDocument7 pagesBusiness Finance LOAN매레이디No ratings yet

- Philippine Banking Corp vs Court of Appeals RulingDocument2 pagesPhilippine Banking Corp vs Court of Appeals RulingPACNo ratings yet

- Is Fednow Real - Google SearchDocument1 pageIs Fednow Real - Google SearchMiguel AttiehNo ratings yet

- Iwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00Document2 pagesIwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00iwan pratamaNo ratings yet

- PMB & Co-Op Accreditation Stufff 2018Document10 pagesPMB & Co-Op Accreditation Stufff 2018Boyi EnebinelsonNo ratings yet

- ARDCIBANK INC A RURAL BANK - HTMDocument2 pagesARDCIBANK INC A RURAL BANK - HTMJim De VegaNo ratings yet

- Credit and Collection Quiz 1 Reviewer.Document1 pageCredit and Collection Quiz 1 Reviewer.Subscribe to Kimmus pleaseNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- Debt Reduction Calculator - 20CRDocument7 pagesDebt Reduction Calculator - 20CRSuhailNo ratings yet

- Ug SCB Tariff Guide Booklet Nov LiteDocument30 pagesUg SCB Tariff Guide Booklet Nov Litemugabert2016No ratings yet

- Cooperative AssignmentDocument2 pagesCooperative AssignmentWhite WhiteyNo ratings yet

- Module 2 FM Pr8 Monetary Policy and Central BankingDocument20 pagesModule 2 FM Pr8 Monetary Policy and Central BankingFranzing LebsNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument10 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSubramanyam JonnaNo ratings yet