Professional Documents

Culture Documents

Oceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008

Uploaded by

Oceanic Bank International PLCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008

Uploaded by

Oceanic Bank International PLCCopyright:

Available Formats

REVISED CONSOLIDATED BALANCE SHEET REPORT OF THE INDEPENDENT AUDITOR

AS AT 31 DECEMBER 2008 TO THE MEMBERS OF OCEANIC BANK INTERNATIONAL PLC

Group Group Bank Bank Report on the revised consolidated financial statements

2008 2007 2008 2007 We have audited the accompanying revised consolidated financial statements of Oceanic Bank Interna-

N'000 N'000 N'000 N'000 tional Plc (“the Bank”) and its subsidiaries (together,” the Group”) which comprise the consolidated balance

Assets

sheets as of 31 December 2008, the consolidated profit and loss accounts and consolidated statements of

Cash and balances with central banks 219,603,069 191,872,199 209,928,721 186,871,542

Treasury bills 51,599,267 287,879,611 51,143,306 287,879,611

cash flow for the period then ended and a summary of significant accounting policies and other explana-

Due from other banks 188,624,756 122,163,536 186,354,159 121,287,431 tory notes. These revised consolidated financial statements have been prepared under the accounting

Loans and advances to customers 503,693,644 339,498,600 490,075,624 338,338,721 policies set out therein and replace the original consolidated financial statements approved by the

Advances under finance lease 4,833,839 2,528,240 4,832,376 2,528,240 directors on 28 May 2009.

Insurance receivables 223,437 140,714 - -

Investment securities 104,906,107 32,724,951 80,545,839 31,876,387 Directors’ responsibility for the revised financial statements

Investment in subsidiaries - 67,698 33,068,771 6,013,528

The directors are responsible for the preparation and fair presentation of these revised consolidated finan-

Deferred tax asset 102,098,798 - 101,606,826 -

Other assets 37,885,550 31,464,450 36,529,451 26,083,115 cial statements in accordance with Nigerian Statements of Accounting Standards and with the require-

Investment property 11,865,798 369,623 4,300,000 - ments of the Companies and Allied Matters Act and the Banks and Other Financial Institutions Act. This

Property and equipment 62,969,353 29,726,956 60,959,754 29,562,312 responsibility includes: designing, implementing and maintaining internal control relevant to the prepara-

Total assets 1,288,303,618 1,038,436,578 1,259,344,827 1,030,440,887 tion and fair presentation of financial statements that are free from material misstatement, whether due to

Liabilities

fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates

Customer deposits 1,088,881,437 693,924,840 1,090,506,806 690,394,946 that are reasonable in the circumstances.

Due to other banks 81,133,911 12,621,065 79,144,343 11,251,881

Liability on investment contracts 463,664 61,441 - - Auditor’s responsibility

Borrowed funds 85,504,350 21,460,070 77,920,850 21,460,070 Our responsibility is to express an opinion on these revised consolidated financial statements based on our

Current income tax 2,461,024 4,184,958 886,969 3,952,555 audit. We conducted our audit in accordance with International Standards on Auditing. Those standards

Other liabilities 52,867,108 78,583,220 42,478,234 77,155,872

require that we comply with ethical requirements and plan and perform our audit to obtain reasonable

Provision on insurance contracts 1,033,847 477,364 - -

Deferred income tax liabilities - 3,112,360 - 3,077,686 assurance that the financial statements are free from material misstatement.

Retirement benefit obligations 3,764,955 880,882 3,352,809 672,491

1,316,110,296 815,306,200 1,294,290,011 807,965,501 An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the revised financial statements. The procedures selected depend on the auditor’s judgement, including

Equity the assessment of the risks of material misstatement of the revised financial statements, whether due to

Share capital 11,110,685 5,821,003 11,110,685 5,821,003

fraud or error. In making those risk assessments, the auditor considers internal control relevant to the

Share premium 176,748,589 14,677,493 176,748,589 14,677,493

Retained earnings (230,375,878) 16,284,975 (237,185,268) 16,013,220

entity’s preparation and fair presentation of the revised financial statements in order to design audit proce-

Other reserves 14,816,834 14,409,901 14,380,810 14,380,810 dures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the

Deposit for shares - 171,582,860 - 171,582,860 effectiveness of the company’s internal control. An audit also includes evaluating the appropriateness of

Equity holders of parent (27,699,770) 222,776,232 (34,945,184) 222,475,386 accounting policies used and the reasonableness of accounting estimates made by the directors, as well as

Non-controlling interest (106,908) 354,146 - - evaluating the overall presentation of the revised financial statements.

Total equity (27,806,678) 223,130,378 (34,945,184) 222,475,386

The audit of revised financial statements includes the performance of procedures to assess whether the

Total equity and liabilities 1,288,303,618 1,038,436,578 1,259,344,827 1,030,440,887

revisions made by the directors are appropriate and have been properly made.

Acceptances and guarantees 171,929,386 219,535,338 170,812,831 224,135,338 We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our

opinion.

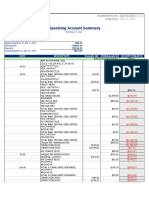

REVISED CONSOLIDATED PROFIT & LOSS ACCOUNT

FOR PERIOD ENDED 31 DECEMBER 2008 Opinion

In our opinion the revised consolidated financial statements give a true and fair view of the state of the

Group Group Bank Bank financial affairs of the Bank and the Group as of 31 December 2008 and of their losses and cash flows for

15 months to 12 months to 15 months to 12 months to

the period then ended in accordance with Nigerian Statements of Accounting Standards, the Companies

December September December September

2008 2007 2008 2007 and Allied Matters Act and the Banks and Other Financial Institutions Act.

N'000 N'000 N'000 N'000

Matter of Emphasis

Gross earnings 118,298,499 74,936,710 106,038,572 73,746,812 Without qualifying our opinion, we draw attention to the following matters.As described in note 2 in the

financial statements, the current management team of the bank which resumed in August 2009 identified

(Loss)/Profit before taxation (338,233,659) 23,007,153 (345,724,748) 22,341,307 significant errors and irregularities in the accounting records of the Bank and some of its subsidiaries, which

Taxation 103,557,554 (5,469,912) 104,401,107 (5,207,222)

were indicative of management override of processes and controls. In response, the current management

(Loss)/Profit after taxation (234,676,105) 17,537,241 (241,323,641) 17,134,085

Non-controlling interest 96,387 (4,764) - -

team carried out a comprehensive exercise designed to identify and correct all material errors in the

(Loss)/Profit attributable to the group (234,579,718) 17,532,477 (241,323,641) 17,134,085 accounting records. This exercise resulted in the recognition of loans amounting to N231 billion that were

previously not recognised, additions to provisions for loans and interest-in-suspense amounting to N238

Appropriated as follows: billion and N78 billion respectively, and other adjustments set out in note 2.As described in note 43 in the

Transfer to statutory reserve 29,557 2,570,113 - 2,570,113 financial statements the Bank and the Group incurred losses before tax amounting to N346 billion and

Transfer to SMEIS reserve - 856,704 - 856,704 N338 billion respectively for the period ended 31 December 2008 and had negative shareholders funds of

Transfer to contingency reserve 176,733 26,591 - - N35 billion and N28 billion respectively as of that date. These conditions, along with other matters as set

Transfer to retained earnings reserve (234,786,008) 14,079,069 (241,323,641) 13,707,268

(234,579,718) 17,532,477 (241,323,641) 17,134,085

forth in note 43 indicate the existence of a material uncertainty which may cast significant doubt about the

bank’s ability to continue as a going concern. However, as indicated in note 43 the bank has received finan-

cial support from the Central Bank of Nigeria and has also received a confirmation of continued financial

Earnings per share (basic) (N10.56) N1.51 (N10.86) N1.47 support for a period of at least 12 months from the date of these financial statements."

Dividend per share (proposed) - 102k - 102k

Report on Other Legal Requirements

The Companies and Allied Matters Act and the Banks and Other Financial Institutions Act require that in

carrying out our audit we consider and report to you on the following matters. We confirm that:i) we

obtained all the information and explanations which to the best of our knowledge and belief were neces-

sary for the purposes of our audit;ii) in our opinion proper books of account were kept by the Bank;iii) the

Bank’s balance sheet and profit and loss account are in agreement with the books of account;iv) our exami-

Apostle Hayford I. Alile Mr John Aboh nation of loans and advances was carried out in accordance with the Prudential Guidelines for licensed

Chairman Managing Director banks issued by the Central Bank of Nigeria; v) related party transactions and balances are disclosed in Note

35 to the consolidated financial statements in accordance with the Central Bank of Nigeria Circular

BSD/1/2004.

The balance sheets, profit and loss accounts, report of the independent auditor and specific disclosures are

published in compliance with the requirements of S.27 of the Banks and Other Financial Institutions Act.The Contraventions

information disclosed have been extracted from the full financial statements of the bank and the group and During the period, the bank contravened certain provisions of the Banks and Other Financial Institutions

cannot be expected to provide as full an understanding of the financial performance, financial position and Act and the relevant circulars issued by the Central Bank of Nigeria. The details of these contraventions are

financing and investing activities of the bank and the group as the full financial statements. Copies of the full disclosed in Note 42 to the consolidated financial statements."

financial statements can be obtained from the Registrars of the Bank.

Chartered Accountants 11 June 2010

Lagos

www.oceanicbank.com experience peace...

You might also like

- Buccaneers ConfraternityDocument28 pagesBuccaneers Confraternitydice100% (9)

- Michael Partain Piermont Statement 2Document1 pageMichael Partain Piermont Statement 2Jonathan Seagull LivingstonNo ratings yet

- MBNA Statement StatementHistoryOpenSave PDFDocument4 pagesMBNA Statement StatementHistoryOpenSave PDFAlireza YamghaniNo ratings yet

- Bickslow Bank Statement Template - TemplateLabDocument1 pageBickslow Bank Statement Template - TemplateLabbaga ibakNo ratings yet

- 6 MonthDocument2 pages6 Monthharan5533No ratings yet

- Audited Consolidated Financial Statements For The Year Ended 31 October 2009Document32 pagesAudited Consolidated Financial Statements For The Year Ended 31 October 2009amitkanhere4397No ratings yet

- Governance, Risk and Compliance Charter PDFDocument17 pagesGovernance, Risk and Compliance Charter PDFMukendi Emmanuel100% (1)

- COA Resolution 2018-07Document2 pagesCOA Resolution 2018-07Gerard DGNo ratings yet

- QDB Annual Report 2014 enDocument62 pagesQDB Annual Report 2014 enMd Imran ImuNo ratings yet

- Knowledge Assurance QB (ICAEW) PDFDocument118 pagesKnowledge Assurance QB (ICAEW) PDFDipto Rzk88% (8)

- Internal Control AssessmentDocument8 pagesInternal Control AssessmentRomlan D.No ratings yet

- Windows Active Directory Audit Assurance Program - Icq - Eng - 0810Document35 pagesWindows Active Directory Audit Assurance Program - Icq - Eng - 0810Андрей МиксоновNo ratings yet

- Oceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Document1 pageOceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Oceanic Bank International PLC100% (1)

- 10 Bank Reconciliation Statement-1Document9 pages10 Bank Reconciliation Statement-1Abdul SamadNo ratings yet

- Oceanic Bank International PLC Unaudited Financial Statement For Period Ended March 31, 2010Document1 pageOceanic Bank International PLC Unaudited Financial Statement For Period Ended March 31, 2010Oceanic Bank International PLCNo ratings yet

- Fixed Deposit SampleDocument21 pagesFixed Deposit SampleSuriyachakArchwichaiNo ratings yet

- Format Debit Bal Bank StatementDocument1 pageFormat Debit Bal Bank StatementMzee KodiaNo ratings yet

- How To Read Your Account Analysis StatementDocument2 pagesHow To Read Your Account Analysis Statementmohamed elmakhzniNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementZuŋɘʀa AɓɗuɭɭʌhNo ratings yet

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNo ratings yet

- Please Take This To Your Local Bank: CIBC International Student PayDocument6 pagesPlease Take This To Your Local Bank: CIBC International Student PaypanikNo ratings yet

- Non Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeDocument1 pageNon Receipt / Delay: Funds LODR Code: Null: SN Document Type Document Name Date TimeVinod KumarNo ratings yet

- Creditcard StatementDocument3 pagesCreditcard Statementnaga100% (1)

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- Bank Reconciliation StatementDocument1 pageBank Reconciliation StatementAbdul RehmanNo ratings yet

- Worksheet For Bank Reconciliation - 8 PDFDocument2 pagesWorksheet For Bank Reconciliation - 8 PDFsanele dlaminiNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Bank Reconcilation Statement Example PDFDocument4 pagesBank Reconcilation Statement Example PDFZara ShoukatNo ratings yet

- Statement - 2Document4 pagesStatement - 2Gavin GoodNo ratings yet

- Microsoft Dynamics AX Bank Statement Import Setup For MT940Document6 pagesMicrosoft Dynamics AX Bank Statement Import Setup For MT940SharadNo ratings yet

- Utility Bill Template 30Document8 pagesUtility Bill Template 30衡治洲No ratings yet

- Statement of Account: Penyata AkaunDocument4 pagesStatement of Account: Penyata AkaunseelanshathiaNo ratings yet

- Bank Reconciliation Statement Solved Example 2Document2 pagesBank Reconciliation Statement Solved Example 2TAFARA MUKARAKATENo ratings yet

- Bank Statement Template 16 PDFDocument2 pagesBank Statement Template 16 PDFBara CreativesNo ratings yet

- Bank Statement Template 3Document1 pageBank Statement Template 3Frank GallagherNo ratings yet

- Bank Statement FinalDocument1 pageBank Statement Finalshem dennisNo ratings yet

- Account Statement Basic Bank (01.07.2021-30.06.2022)Document10 pagesAccount Statement Basic Bank (01.07.2021-30.06.2022)ashif.cloudaccNo ratings yet

- Nicole Hayward Paystub Feb 27 2024Document1 pageNicole Hayward Paystub Feb 27 2024Fake Documents of Simply Jodan's LLCNo ratings yet

- Salary Slip (31503284 June, 2019)Document1 pageSalary Slip (31503284 June, 2019)Hassan RanaNo ratings yet

- Anz Pensioner Advantage Statement: Welcome To Your Anz Account at A GlanceDocument12 pagesAnz Pensioner Advantage Statement: Welcome To Your Anz Account at A GlanceMohitNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementProttasha AsifNo ratings yet

- Chime Bank Statement-5Document1 pageChime Bank Statement-5dmarcumNo ratings yet

- Carasa 0808Document17 pagesCarasa 0808thefranknessNo ratings yet

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoNo ratings yet

- Business Account Statement: Account Summary For This PeriodDocument2 pagesBusiness Account Statement: Account Summary For This PeriodBrian TalentoNo ratings yet

- Statement of Account: 863 M. DELA FUENTE SAMPALOC Barangay 452 Sampaloc East Metro ManilaDocument1 pageStatement of Account: 863 M. DELA FUENTE SAMPALOC Barangay 452 Sampaloc East Metro ManilaJayson IbardalozaNo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Bank StatementDocument2 pagesBank StatementsukujeNo ratings yet

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- BillingStatement - LOLITA P. AREVALO - 2Document2 pagesBillingStatement - LOLITA P. AREVALO - 2Franco Evale YumulNo ratings yet

- Result PDF Watermark J0CircODocument4 pagesResult PDF Watermark J0CircOHAMID EL ASRINo ratings yet

- Tax Invoice / Statement of Account: Invoice Cukai / Penyata AkaunDocument3 pagesTax Invoice / Statement of Account: Invoice Cukai / Penyata Akaunqasihsuci82No ratings yet

- Statement of Account: Penyata AkaunDocument3 pagesStatement of Account: Penyata AkaunYanz NelsonzNo ratings yet

- Bank StatementDocument1 pageBank StatementBobbi Ryan BrayNo ratings yet

- Oceanic Bank - Letter From John Aboh - CEODocument1 pageOceanic Bank - Letter From John Aboh - CEOOceanic Bank International PLCNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFDocument1 pageMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaNo ratings yet

- Fees IU PDFDocument1 pageFees IU PDFMOIN UDDIN AHMEDNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

- Bill To: Account Summary: Date: Statement # Account Number Page 1 of 1Document1 pageBill To: Account Summary: Date: Statement # Account Number Page 1 of 1Ullah KunNo ratings yet

- Prime It Bank Statement - July 2019Document4 pagesPrime It Bank Statement - July 2019api-306226330No ratings yet

- Model Bank StatementDocument2 pagesModel Bank StatementhanhNo ratings yet

- Financials VTL - Merged - RemovedDocument15 pagesFinancials VTL - Merged - Removedmuhammadasif961No ratings yet

- 2017 Year End FinancialsDocument37 pages2017 Year End FinancialsFryan GreenhousegasNo ratings yet

- FF 2011 enDocument55 pagesFF 2011 enWang Hon YuenNo ratings yet

- Auditing and Assurance - Mining Industries WORDDocument16 pagesAuditing and Assurance - Mining Industries WORDJazmine Hupp UyNo ratings yet

- AIS 01 - Handout - 1Document7 pagesAIS 01 - Handout - 1Melchie RepospoloNo ratings yet

- Sampling Acce 311 - Operations Audit (Week 15 16)Document22 pagesSampling Acce 311 - Operations Audit (Week 15 16)Alyssa Paula AltayaNo ratings yet

- Module 1 Overview of Auditing Merged 1Document61 pagesModule 1 Overview of Auditing Merged 1Rhejean LozanoNo ratings yet

- Mercia EIS Fund: Tax-Advantaged InvestmentsDocument33 pagesMercia EIS Fund: Tax-Advantaged InvestmentsdeanNo ratings yet

- Soal Soal Latihan Internal AuditDocument17 pagesSoal Soal Latihan Internal Auditsheila maghviraNo ratings yet

- Auditing NotesDocument121 pagesAuditing Noteslipsa PriyadarshiniNo ratings yet

- Chapter OneDocument55 pagesChapter OneWILLMORE PRINCE DUBENo ratings yet

- CFO or COO or CAO or Director or Finance ExecutiveDocument4 pagesCFO or COO or CAO or Director or Finance Executiveapi-79290895No ratings yet

- Managerial Accounting: An OverviewDocument48 pagesManagerial Accounting: An OverviewAhmad Tawfiq DarabsehNo ratings yet

- Audit Planning - TheoriesDocument13 pagesAudit Planning - TheoriesLovenia M. FerrerNo ratings yet

- Chapter 1 Test Bank Aud Internal ControlDocument8 pagesChapter 1 Test Bank Aud Internal ControlAnika BlairNo ratings yet

- Audit of Robotic Process Automation (RPA) Software BOTsDocument8 pagesAudit of Robotic Process Automation (RPA) Software BOTsRahul KarkiNo ratings yet

- At-09 (Understanding The Entity - S Internal Control)Document3 pagesAt-09 (Understanding The Entity - S Internal Control)Michelle GubatonNo ratings yet

- Consolidated Financial StatementDocument36 pagesConsolidated Financial StatementArt KingNo ratings yet

- Auditing ReserchDocument64 pagesAuditing ReserchNetsanet ShikurNo ratings yet

- Rhea Application Letter Resume CorrectDocument5 pagesRhea Application Letter Resume CorrectrerguizaNo ratings yet

- BHM 210 Auditing PDFDocument152 pagesBHM 210 Auditing PDFAnonymous qAegy6GNo ratings yet

- MPL FR An 2016 17Document76 pagesMPL FR An 2016 17Jähäñ ShërNo ratings yet

- PT2 OM24 Question 1Document7 pagesPT2 OM24 Question 1hayatiammadNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Special Audit PDFDocument0 pagesSpecial Audit PDFVasantha NaikNo ratings yet

- Internal Control and Cash Management Manual and Questionnaires November 1995Document18 pagesInternal Control and Cash Management Manual and Questionnaires November 1995Anonymous VtsflLix1100% (2)