Professional Documents

Culture Documents

Eportfolio Assignment

Uploaded by

api-300155997Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eportfolio Assignment

Uploaded by

api-300155997Copyright:

Available Formats

Running head: Finance- Compound interest 1

EPortfolio Assignment: Compound Interest

Kaley Gill

Fin 1050

Finance- Compound interest 2

EPortfolio Assignment: Compound Interest

Compound Interest is calculated periodically over the life of the loan or investment.

Compound interest is calculated on the principal and is adjusted as the principal changes.

Therefor compound interest is the interest on the principal plus the interest of prior periods. The

final amount of the loan or investment is called the Future Value. For example, lets say we have

$1 in the bank for 5 years at 7% annually. The present value of our investment would be $1. Each

year, our investment would gain 7% compound. After one year, we would have $1.07 in the

bank. Compounding interest takes the present value of the dollar and determines the future value.

Compound interest can be compounded annually (Once a year), semiannually (every six

months), quarterly (Every 3 months) , monthly, and daily. Once how the interest will be

compounded, you then break it down into periods. To make it simple, we will use semiannually

for 5 years at 10%. Our investment would be broken down into 10 periods ( 5 years x 2). You

would also divide the rate by the number of times the interest in compounded. For our example,

it would be 5% (10% 2).

Understanding how compound interest works can help people and businesses invest their

money effectively and double the amount they have. The main difference between simple interest

and compounded interest is that compound interest gains interest on the principal and the interest

gained. Therefor making it easier and more likely to double your money. You can determine how

long it will take to double your money by the rule of 72. The Rule of 72 states that if you divide

your annual return by 72, it will give you the amount of years it would take to double your

money. Simple interest on the other hand, multiplies the interest by the time and the principal.

The interest is only applied to the principal.

Now that we have a basic understanding of compounding and simple interest, we will go

over how it is used in everyday life. In businesses, Compounding interest is used to generate

profits, ensuring pension payments, and can be used as a benefit. Compounding interest can turn

into a liability, If you have a loan that uses compounding interest, it can take the loan longer to

pay off because your payments are being applied to the interest and not the principal. On the

other hand, if you have invested money in stocks, retirement plans or other forms of investments

that have compounding interest, it can benefit you by increasing your money not only on

principal but the interest as well.

Reflection

Finance- Compound interest 3

Compounding and simple interest is important to know because it can either make you

lose a lot of money or help you double your money. If your borrowing money, you want the

money to compound less which means youll owe less. On the other hand, if you are investing,

the more times your money is compounded a year, the more money you will earn. One way

interest affects our life, whether it is compound or simple, is through our retirement plans. Some

plans allow you to withdraw an amount of your choice and save it until you retire. In return you

earn interest on the amount of time your money sits. Understanding your goals and how interest

works can help you decide which interest to invest in.

Finance- Compound interest 4

References

Mcgraw Connect (2016). Compounding Interest. Chapter 12 Pages 302 -320

Finance- Compound interest 5

Footnotes

1

[Add footnotes, if any, on their own page following references. For APA formatting

requirements, its easy to just type your own footnote references and notes. To format a footnote

reference, select the number and then, on the Home tab, in the Styles gallery, click Footnote

Reference. The body of a footnote, such as this example, uses the Normal text style. (Note: If

you delete this sample footnote, dont forget to delete its in-text reference as well. Thats at the

end of the sample Heading 2 paragraph on the first page of body content in this template.)]

Finance- Compound interest 6

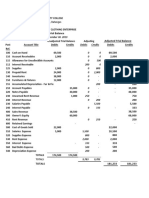

Tables

Table 1

[Table Title]

Column Head

Row Head

Row Head

Row Head

Row Head

Row Head

Row Head

Column Head

123

456

789

123

456

789

Column Head

123

456

789

123

456

789

Column Head

123

456

789

123

456

789

Column Head

123

456

789

123

456

789

Note: [Place all tables for your paper in a tables section, following references (and, if applicable,

footnotes). Start a new page for each table, include a table number and table title for each, as

shown on this page. All explanatory text appears in a table note that follows the table, such as

this one. Use the Table/Figure style, available on the Home tab, in the Styles gallery, to get the

spacing between table and note. Tables in APA format can use single or 1.5 line spacing.

Include a heading for every row and column, even if the content seems obvious. A default table

style has been setup for this template that fits APA guidelines. To insert a table, on the Insert tab,

click Table.]

Finance- Compound interest 7

Figures title:

6

Category 1

Category 2

Series 1

Category 3

Series 2

Category 4

Series 3

Figure 1. [Include all figures in their own section, following references (and footnotes and tables,

if applicable). Include a numbered caption for each figure. Use the Table/Figure style for easy

spacing between figure and caption.]

For more information about all elements of APA formatting, please consult the APA Style

Manual, 6th Edition.

You might also like

- My RenaissanceDocument3 pagesMy Renaissanceapi-300155997No ratings yet

- Final Statement 3Document1 pageFinal Statement 3api-300155997No ratings yet

- IncomeDocument1 pageIncomeapi-300155997No ratings yet

- Financial Analysis 1Document8 pagesFinancial Analysis 1api-300155997No ratings yet

- Trail Balance 3Document1 pageTrail Balance 3api-300155997No ratings yet

- Final Statement 2Document1 pageFinal Statement 2api-300155997No ratings yet

- Trial Balance 2Document1 pageTrial Balance 2api-300155997No ratings yet

- Trial BalanceDocument1 pageTrial Balanceapi-300155997No ratings yet

- General LedgerDocument2 pagesGeneral Ledgerapi-300155997No ratings yet

- Pet Villiage ResumeDocument1 pagePet Villiage Resumeapi-300155997No ratings yet

- LedgerDocument3 pagesLedgerapi-300155997No ratings yet

- Description PDFDocument2 pagesDescription PDFapi-300155997No ratings yet

- Instruction PDFDocument2 pagesInstruction PDFapi-300155997No ratings yet

- Congo PowerpointDocument9 pagesCongo Powerpointapi-300155997No ratings yet

- Organizational Culture of A Wildlife BiologistDocument14 pagesOrganizational Culture of A Wildlife Biologistapi-300155997No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TheUpticks Round1 ExcelDocument66 pagesTheUpticks Round1 ExcelDewashish RaiNo ratings yet

- Jblab Company Chart of AccountsDocument5 pagesJblab Company Chart of AccountsVillanueva MenosaNo ratings yet

- CFAS QUIZ 3 PrelimDocument8 pagesCFAS QUIZ 3 Prelim수지50% (2)

- AE 25 Module 1 Lesson 1Document99 pagesAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNo ratings yet

- Understanding You Pay Guide 2018Document28 pagesUnderstanding You Pay Guide 2018Rodríguez CésarNo ratings yet

- Mission & VisionDocument41 pagesMission & Visionparthshah123456789No ratings yet

- Marketing Plan For A New ProductDocument27 pagesMarketing Plan For A New ProductFahadBinAzizNo ratings yet

- (FINAL) - TELKOMSEL 2018AR Web-Ver PDFDocument180 pages(FINAL) - TELKOMSEL 2018AR Web-Ver PDFnanda bstnNo ratings yet

- Chapter 2 WileyDocument29 pagesChapter 2 Wileyp876468No ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- Packages Internship ReportDocument110 pagesPackages Internship ReportWaqas97986% (7)

- On January 1 2013 Porter Company Purchased An 80 InterestDocument1 pageOn January 1 2013 Porter Company Purchased An 80 InterestMuhammad ShahidNo ratings yet

- Scarcity PDFDocument26 pagesScarcity PDFM Ridwan UmarNo ratings yet

- Lecture NotesDocument23 pagesLecture Notescarol solankiNo ratings yet

- Byron Capital TSX.V:AVC Initiation ReportDocument16 pagesByron Capital TSX.V:AVC Initiation ReportRichard J MowatNo ratings yet

- PROSIELCODocument1 pagePROSIELCOnarras11No ratings yet

- QT Past Exam Question Papers. Topic by TopicDocument25 pagesQT Past Exam Question Papers. Topic by TopicalbertNo ratings yet

- HANDOUT 3 Cash Internal Controls For Cash Disbursment ChecklistDocument3 pagesHANDOUT 3 Cash Internal Controls For Cash Disbursment ChecklistZee100% (1)

- XertechDocument10 pagesXertechFernando Aguilar0% (1)

- Tyre Industry PDFDocument134 pagesTyre Industry PDFAnmol LimpaleNo ratings yet

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocument11 pagesABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- Imperfect CompetitionDocument4 pagesImperfect CompetitionUmerNo ratings yet

- Moelis Valuation AnalysisDocument27 pagesMoelis Valuation AnalysispriyanshuNo ratings yet

- Form of DecentralisationDocument3 pagesForm of DecentralisationWandi Krisnandi100% (1)

- Microsoft IPO ProspectusDocument52 pagesMicrosoft IPO Prospectusjohnnyg31100% (1)

- Budgets and Financial StatementsDocument3 pagesBudgets and Financial StatementsAbdul KarimNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Congress of The Philippines: Metro ManilaDocument155 pagesCongress of The Philippines: Metro ManilaJV Reobaldez MirandaNo ratings yet

- Company Valuation P&G 2023Document16 pagesCompany Valuation P&G 2023santiagocorredor602No ratings yet

- A Industry Demand and Firm Company DemanDocument4 pagesA Industry Demand and Firm Company DemanSharan Sharma100% (1)