Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

61

SUGAL & DAMANI SHARE BROKERS LTD.,

MEMBER:

National Stock Exchange of tndia Ltd., Bombay Stock Exchange Ltd.,

Mcx Stock Exchange, Central Depository Services (India) Ltd.,

SUGAL&

DAMANI

CIN : L65991TN 1993 PLC 028228

14.11.2016

To

BOMBAY

PHIROZE

(SECOND

MUMBAI

STOCK EXCHANGE LIMITED

JEEJEEBHOY TOWERS

FLOOR), DALAL STREET,

- 400001

SCRIP CODE:

511654

DEAR SIRS,

At the Board Meeting held today, the Board of Directors has taken on record the Unaudited Financial

Results accompanied by the Limited Review Report issued by the Statutory Auditor of our Company for

the quarter/half-year ended September 30, 2016 under the SEBI (Listing Obligations and Disclosure

Requirements) Regulations 2015.

Thanking you,

Yours faithfully,

FOR SUGAL AND DAMANI SHARE BROKERS LIMITED

~ JMD.vattul&aJkCl.tajWAPADMA VATill V ARADHARAJAN

COMPANY SECRETARY

ENCL.: As ABOVE

Regd. Office: City Centre Plaza, 1st Floor, No.7, Anna Salai, Chennai - 600 002.

Ph : 2858 7105 - 108 Fax: + 91-44-42155285 E-mail: sugalshare@sugalshare.com

Investor Grievance E-mail: grievanc~ugalshare.com

SUGAL & DAMANI SHARE BROKERS LTD.,

MEMBER:

National Stock Exchange of tndia Ltd., Bombay Stock Exchange Ltd.,

Mcx Stock Exchange, Central Depository Services (India) Ltd.,

SUGAL&

DAMANI

CIN : L65991TN 1993 PLC 028228

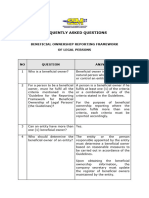

Statement of Standalone Unaudited Financial Results for the Quarter and Half Year Ended 30th September 2016

(Rs. In Lakbs)

PART - I

For the Quarter Ended

SL.

No

Particulars

30.09.2016

Unaudited

30.06.2016

Unaudited

For the Half Year Ended

30.09.2015

Unaudited

30.09.2016

Unaudited

Year Ended

30.09.2015

Unaudited

31.03.2016

Audited

Income from Operations

1

(a) Net Sales / Income from Operation

(b) Other Operating Income

Total Income from operations (net)

Expenditure

(a) Consumptionof raw materials

(b) Purchases of stock-in-trade

(c ) Changes in inventories of fmished goods,

work-in-progressand stock-in-trade

(d) Employeesbenefits expense

(e) Depreciationand amortisation expense

(f) Other expenditure

3

4

(g) Total expenses

(Any item exceeding 10 per cent of the

total expenditure to be shown separately)

Profitl(-Loss) from operations before other income,

fmance costs & exceptional items (1-2)

Other Income

Profitl(-Loss)from ordinary activities before finance

costs & exceptional items (3 + 4)

Finance Costs

Profitl(-Loss)from ordinary activities after finance costs

but before exceptional items (5 - 6)

8

9

10

11

12

13

Exceptional items

Profit (+)/1oss (-) from ordinary activities before tax (7

+ 8)

Tax expense

Net Profit (+)/1oss (-) from ordinary activities after tax

1(9- 10)

Extraordinary item (net of tax expense Rs. )

Net Profit (+)/1oss (-) for the period (11 - 12)

14 Paid-up equity share capital (Face Value Rs. 10/- Each)

Reserve excluding revaluation reserves

15

as per balance sheet of previous accounting year

Eamings per share (Not Annualised) (Basic and Diluted)

16

Rs.)

a) Before Extra Ordinary items

b) After Extra Ordinary items

109.25

88.93

24.23

113.16

104.58

198.18

201.67

29.62

138.87

40.13

144.71

53.85

252.03

64.61

266.28

20.09

19.57

1.85

24.31

2.41

39.65

1.31

61.45

51.12

4.36

99.73

9.12

52.35

73.77

129.47

82.85

56.02

368.72

182.36

551.08

67.87

94.59

3.17

113.79

156.61

184.95

241.89

350.74

39.39

50.12

95.42

81.33

200.34

56.02

39.39

50.12

95.42

81.33

200.34

7.83

5.40

12.79

13.24

29.87

45.68

48.19

33.99

37.33

82.18

51.46

154.66

48.19

37.33

7.50

82.18

15.00

33.99

11.00

26.00

51.46

12.00

154.66

44.45

33.19

22.99

29.83

56.18

39.46

110.21

33.19

22.99

29.83

625

625

625

0.53

0.53

0.37

0.37

0.48

0.48

56.18

39.46

110.21

625

625

625

310.29

0.90

0.90

0.63

0.63

1.76

1.76

.(* \)}L;;w

.

~~

'/tt'7 S}!,i-

.,_.

Regd. Office: City Centre Plaza, 1st Floor, No.7, Anna Salai, Chennai - 600 002.

Ph : 2858 7105 - 108 Fax: + 91-44-42155285 E-mail: sugalshare@sugalshare.com

Investor Grievance E-mail: grievance@sugalshare.com

PART II

A PARTICULARS OF SHAREHOLDING

1

Public shareholding

- Number of shares

- Percentage of shareholding

Promoters and promoter group Shareholding

a) PledgedlEncumbered

- Number of Shares

- Percentageof shares (as a % of the total

shareholdingof promoter and

promoter group)

- Percentage of shares (as a % of the total share capital

of the company)

b) Non-encumbered

- Number of Shares

- Percentageof shares (as a % of the total

shareholdingof promoter and

promoter group)

- Percentageof shares (as a % of the total share capital

of the company)

Particulars

18,10,105

28.96%

18,10,105

28.96%

18,10,105

28.96%

18,10,105

28.96%

18,10,105

28.96%

18,10,105

28.96%

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

44,39,902

44,39,902

44,39,902

44,39,902

44,39,902

44,39,902

100%

100%

100%

100%

100%

100%

71.04%

71.04%

71.04%

71.04%

71.04%

71.04%

September

30 2016

B INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolvedat the end of the quarter

Nil

Nil

Nil

Nil

Notes:

1

The above results were taken on record by the Board of Directors at its meeting held on 14.11.2016

2 The Audit Committee has approved the above results.

3 The Company is engaged primarily in the business of Stock Broking. Accordingly,there are no separate reportable segments as per Accounting Standard (AS

17) Segment Reporting.

4

Limited Review has been carried out by the statutory auditor.

Figures for the earlier periods have been re-grouped / re-arranged wherever necessary.

Provision for income tax has been made and deferred tax will be considered at the year end.

For and on behalf of the Board

i (;,--tVvd:V~~(t0

PLACE: CHENNAI

DATE: 14.11.2016

(MAHESH CHANDAK)

Executive Director

DIN - 00050149

7. Standalone Statement of Assests & Liabilities

Particulars

S.No.

(Rs in Lakhs)

30th September-16

UNAUDITED

31st March-16

AUDITED

A EQUITY AND LIABILITIES

SHARE HOLDER'S FUNDS

(a) Share Capital

(b) Reserves and surplus

(c ) Money received against share warrants

Sub-total-Shareholders' funds

2 Share application money pending allotment

3 Non-Current Liabilities

(a) Long term borrowings

(b) Deferred tax liabilities (net)

(c ) Other long term liabilities

(d) Long-term provisions

Sub total-Non-Current Liabilities

4 Current Liabilities

(a) Short term borrowings

(b) Trade payables

(c) Other current term liabilities

(d) Short term provisions

Sub total-Current Liabilities

1

TOTAL-EQUITY AND LIABILITIES

625.00

366.47

625.00

310.29

991.47

0.00

935.29

0.00

0.00

11.51

0.00

22.15

33.66

0.00

11.51

0.00

21.05

32.56

590.91

753.24

205.63

0.00

1549.78

2574.91

281.94

584.01

120.24

0.00

986.19

1954.04

26.00

30.43

0.00

113.75

0.00

170.18

28.63

39.81

0.00

113.75

0.00

182.19

827.70

16.88

897.16

594.52

68.47

0.00

2404.73

2574.91

477.70

16.88

692.41

453.40

131.46

0.00

1771.85

B ASSETS

1 Non Current

Assets

(a) Fixed Assets

(b) Non-curent Investments

(c) Deferred tax assets (net)

(d) Long term loans and Advances

(e) Other non-current assets

Sub-total-Non-Current Assets

Current Assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short term loans and Advances

(f) Other current assets

Sub-total-Current Assets

TOTAL -ASSETS

Date: 14-11-2016

Place: Chennai

For and on behalf of the Board

(MAHESH CHANDAK)

Executive Director

DIN - 00050149

1954.04

CA.

ffl.

~.1

B.Com .. F.C.A.,L.L.B.

Chartered Accountant

"VANJULA"

10 (New No. 23), Arisikara Street,

Mylapore, Chennai - 600 004.

Phone : 2464 0742, 2493 9232

Fax:

2493 3289

Mobile: 98410 47064

Email : rmugunth@gmail.com

LIMITED REVIEW REPORT

Review Report to SUGAL AND DAMANI SHARE BROKERS LIMITED

1. I have reviewed the accompanying statement of un-audited financial results of

SUGAL AND DAMANI SHARE BROKERS LIMITED ("the Company") for the

quarter and half year ended 30th September, 2016 and assets and liabilities for the

half year ended 30th September 2016. This statement is the responsibility of the

Company's Management and has been approved by the Board of Directors. My

responsibility is to issue a report on the financial statements based on my review.

2. I conducted my review in accordance with the Standard on Review Engagements

(SRE) 2410, "Engagement to Review of Interim Financial Information performed by

the Independent Auditor of the Entity" issued by the Institute of Chartered

Accountants of India. This standard requires that I plan and perform the review to

obtain moderate assurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of Company

personnel and analytical procedures applied to financial data and thus provide less

assurance than an audit. I have not performed an audit and accordingly, I do not

express an audit opinion.

3. Based on my review conducted as stated above, nothing has come to my attention

that causes me to believe that the accompanying statement of unaudited financial

results prepared in accordancewith the Accounting Standards and other recognized

accounting practices and policies has not disclosed the information required to be

disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015 including the manner in which it is to be disclosed,

or that it contains any material misstatement, subject to non provision of Deferred

Tax

Place: Chennai

Date: 14/11/2016

R.MUGUNTHAN

CHARTERED ACCOUNTANT

(M No.21397)

You might also like

- Ashrae Energy AuditsDocument24 pagesAshrae Energy AuditsMohamed Mostafa Aamer100% (1)

- Internal Auditing - A Refresher Course (Planning & Performing)Document68 pagesInternal Auditing - A Refresher Course (Planning & Performing)Arlene DacpanoNo ratings yet

- Risk Assessment Policy and ProtocolDocument20 pagesRisk Assessment Policy and ProtocolSyamsul ArifinNo ratings yet

- Appendix 6 Sub Contractor HSE Assessment HSEMS-04-SCACC-33Document10 pagesAppendix 6 Sub Contractor HSE Assessment HSEMS-04-SCACC-33Dheeraj MenonNo ratings yet

- CISA Practice Questions IT GovernanceDocument4 pagesCISA Practice Questions IT GovernanceJoeFSabaterNo ratings yet

- Environment, Health & Safety Management System Manual: Tata Steel Limited Steel Works & CRM Complex-Bara, JamshedpurDocument54 pagesEnvironment, Health & Safety Management System Manual: Tata Steel Limited Steel Works & CRM Complex-Bara, JamshedpurMonchito AdecerNo ratings yet

- Jio Platforms Limited - 20200331Document38 pagesJio Platforms Limited - 20200331JamesNo ratings yet

- Software Change Request Process Workflow PDFDocument7 pagesSoftware Change Request Process Workflow PDFgovindvbNo ratings yet

- Case Studies Internal ControlDocument3 pagesCase Studies Internal Controlakq153No ratings yet

- Prince2 PDFDocument166 pagesPrince2 PDFAccenture AustraNo ratings yet

- IRCA CPD Log ExampleDocument8 pagesIRCA CPD Log ExamplePink ImperialNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Fraud Examination 6th Edition Albrecht Test BankDocument26 pagesFraud Examination 6th Edition Albrecht Test Bankpropelomnifi.cw3100% (27)

- 2a Bilingual Amfori QMI TOI For Producers - For Distribution - 0Document4 pages2a Bilingual Amfori QMI TOI For Producers - For Distribution - 0Junayed FerdousNo ratings yet

- Strategic Audit and Its ImportanceDocument11 pagesStrategic Audit and Its Importanceshashwat shuklaNo ratings yet

- Sarbanes Oxley ActDocument6 pagesSarbanes Oxley ActBiggun554No ratings yet

- D - Data Processing Agreement For SAP ServicesDocument10 pagesD - Data Processing Agreement For SAP ServicesUlysse TpnNo ratings yet

- Chapter 1 SummaryDocument11 pagesChapter 1 SummaryMiaNo ratings yet

- AE10-GBERMIC-Module 2Document10 pagesAE10-GBERMIC-Module 2Jemalyn PiliNo ratings yet

- WSH Officer - Appointment LetterDocument3 pagesWSH Officer - Appointment LetterfuturejainsNo ratings yet

- FAQs On BO (06012020) (RDSD) (English) (Updated 26012021)Document5 pagesFAQs On BO (06012020) (RDSD) (English) (Updated 26012021)Nur Batrisyia BalqisNo ratings yet

- Hse PlanDocument206 pagesHse PlanSidharth VijayNo ratings yet

- CAS Focus Areas 2024Document76 pagesCAS Focus Areas 2024Asteway MesfinNo ratings yet

- Anna Fatima: Accounting Graduate and Marketing EnthusiastDocument1 pageAnna Fatima: Accounting Graduate and Marketing EnthusiastannaNo ratings yet

- Name-Samruddhi Nalode Roll No. - 20230020032Document3 pagesName-Samruddhi Nalode Roll No. - 20230020032Samruddhi NalodeNo ratings yet

- Appen 10Document4 pagesAppen 10tgaNo ratings yet

- Audit Program BasisDocument27 pagesAudit Program Basisintlaudit 1No ratings yet

- Chapter 25Document8 pagesChapter 25Clar Aaron BautistaNo ratings yet

- Audit Report Final Draft - EditedDocument31 pagesAudit Report Final Draft - EditedKaran BhavsarNo ratings yet

- Wockhardt Annual Report 2012 13 FinalDocument120 pagesWockhardt Annual Report 2012 13 FinalKalyan Srinivas AmboruNo ratings yet

- Hapter 6: © 2008 Prentice Hall Business Publishing Accounting Information Systems, 11/e Romney/SteinbartDocument314 pagesHapter 6: © 2008 Prentice Hall Business Publishing Accounting Information Systems, 11/e Romney/SteinbartShania ChristantriNo ratings yet