Professional Documents

Culture Documents

Wade Vose Correspondence To Commission

Uploaded by

Jacob Engels0 ratings0% found this document useful (0 votes)

2K views3 pagesAttorney Wade Vose implores the commission to realize that no "factual or legal" reasons exist for the transfer.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAttorney Wade Vose implores the commission to realize that no "factual or legal" reasons exist for the transfer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views3 pagesWade Vose Correspondence To Commission

Uploaded by

Jacob EngelsAttorney Wade Vose implores the commission to realize that no "factual or legal" reasons exist for the transfer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

December 6, 2016

Via email (bapplegate@seminolecountyfl.gov)

A. Bryant Applegate

Seminole County Attorney

1101 East First Street

Sanford, FL 32771

Re:

Incoming Tax Collectors Objection to Transfer of all Tax Collector Real

Property to County by Outgoing Tax Collector

Dear Mr. Applegate:

As we have previously discussed, this firm has the pleasure of representing Seminole

County Tax Collector-elect Joel Greenberg.

I am in receipt of an agenda item scheduled for the Seminole BCCs December 13, 2016

meeting, in which the BCC will consider a proposal made by the outgoing Tax Collector Ray

Valdes, to transfer to the County, for no consideration whatsoever, over $5.6 million worth of

real estate owned by the Seminole County Tax Collectors office.

Tax Collector-elect Greenberg has addressed his strenuous objection to this proposed

action under separate cover, a copy of which is attached. I write to address the legal issues

attendant to this proposal, with a focus on the findings Mr. Wilkes made in his November 11,

2016, and December 1, 2016, memoranda.

Both memoranda proceed from a general legal position that prior to the 2011 revision to

Section 197.332, Fla. Stat., tax collectors were without legal authority to hold title to real

property. However, this legal position is entirely inconsistent with a long history of past

Seminole County practice and actions.

On January 8, 2008, the Seminole County BCC adopted Resolution 2008-R-6, which in

its recitals acknowledged that the Tax Collector plans to establish one or more additional branch

offices for the provision of such state and local services, and which authorized the Tax

Collector to conduct such county business as he agrees to undertake at any and all of his branch

offices, now and in the future, under applicable constitutional, statutory, and regulatory law.

Less than two months later, Mr. Valdes purchased for $3,144,800, the two office

buildings located at 805 and 845 Primera Blvd. in Lake Mary. The Seminole BCC was fully

aware of this transaction, and has taken numerous actions consistent with and affirming the

transactions legality, and the Tax Collectors legal right to hold the properties, since that time.

Such purchase was budgeted for in Mr. Valdes DOR-approved budget, a copy of which was

submitted to the BCC pursuant to Section 195.087(2), Fla. Stat. Thereafter, the Seminole County

COUNSEL TO EXTRAORDINARY FAMILIES, BUSINESSES & LEADERS WORLDWIDE SINCE 1973

324 W. MORSE BOULEVARD WINTER PARK, FLORIDA 32789

TELEPHONE: (407) 645-3735 FACSIMILE: (407) 628-5670 TOLL FREE: (866) 789-VOSE

INTERNATIONAL TEL. (LONDON, ENGLAND): +44 (0)20 3355 1473 INTERNET: WWW.VOSELAW.COM

A. Bryant Applegate, Seminole County Attorney

December 6, 2016

Page 2 of 3

Sheriff entered into an agreement with the Tax Collector to lease the 805 Primera Blvd. building,

paid for each year with funds budgeted by the BCC for this purpose.

Further, notwithstanding the memorandas legal assertion that prior to the 2011 statutory

revisions tax collectors were without legal authority to hold title to real property, as indicated in

AGO 97-02, cited in both memoranda, as far back as 1997, the Department of Revenue, in

reviewing requests for branch offices contained in a tax collectors budget, has approved a new

branch office for the tax collector, if justified Indeed, DORs 2008 budget approval of the

purchases of the Lake Mary properties was entirely consistent with this recognized DOR

practice.

Both memoranda rely on the general reasoning set forth in AGOs 78-135 and 97-02.

While Attorney Generals Opinions are generally entitled to careful consideration, Florida law is

clear that courts will give great weight to the statutory interpretation of an agency entrusted with

the implementation and enforcement of a particular set of laws.1 Here, the Department of

Revenues approval of Mr. Valdes 2008 purchase of the Lake Mary properties, together with its

approval year after year of Tax Collector budgets recognizing substantial Facility Lease Income

from the lease of the 805 Primera Blvd. to the Sheriff, clearly indicate that DOR, statutorily

entrusted with the regulation of tax collector budgets, saw nothing legally impermissible or

irregular about this arrangement.

As a result, any argument or assertion that there is some legal imperative that, all of a

sudden, the 805 Primera Blvd. property must be immediately conveyed to the County, represents

an abrupt and complete reversal of the Countys longstanding and consistent position and actions

on the matter, and also runs entirely contrary to DORs numerous budgetary determinations over

the past several years.

Likewise, the assertion that there is a legal imperative to immediately transfer the

Altamonte property to County ownership because construction is not imminent has no basis in

fact or law. The mere fact that Mr. Valdes has thus far been ineffective in bringing the new

Altamonte branch office to completion cant conceivably be used to justify depriving his elected

successor of title to the property. Indeed, this assertion runs contrary to Mr. Valdes pretextual

justification for the transfer, to be of assistance to the incoming Tax Collector to build on this

site.

On this point, in addition to the patent insincerity of Mr. Valdes involuntary assistance

of Mr. Greenberg by giving away the Altamonte property, Mr. Valdes stated justification for the

property transfer is entirely meritless. He posits that by re-annexing (presumably he means deannexing, or the statutory correct term, contraction) the Altamonte property out of the city limits,

the applicable minimum density on the parcel will lessened, allowing the construction of a

smaller building.

See, generally, Heftler Const. Co. v. Fla. Dept. of Rev., 334 So.2d 129, 132 (Fla. 3d DCA 1976) (Construction of

a statute by the administrative agency charged with its enforcement and interpretation is entitled to great weight.),

citing State v. Fla. Dev. Comn., 211 So.2d 8 (Fla. 1968).

A. Bryant Applegate, Seminole County Attorney

December 6, 2016

Page 3 of 3

First off, whether the County actually holds title to a parcel is entirely irrelevant to

whether the parcel can be de-annexed out of the boundaries of a municipality. As a result, the

thought that the Tax Collectors Altamonte property must be owned by the County in order for it

to be de-annexed into the jurisdiction of the unincorporated County is entirely specious.

Further, I have been informed that the Tax Collectors Altamonte property is subject to

an interlocal agreement of long standing between Seminole County and the City of Altamonte

Springs, intended to eliminate enclaves and effectuate sound annexation practices. Deannexation of this parcel would run counter to this interlocal, and would be entirely contrary to

the municipal boundary contraction criteria set forth in Ch. 171, Fla. Stat. As such, Altamonte

Springs staff have communicated to Mr. Greenberg that the City will firmly oppose the deannexation of this parcel.

In short, the thought that there is some legal imperative to transfer these properties to the

County is without merit. The notion that there is some newly discovered pressing urgency in

addressing these matters so precipitously has no legal or factual basis, other than the exploitation

of a disgruntled lame duck politician who lost an election. I urge you to advise your

Commissioners accordingly.

Thank you once again for your professionalism throughout this matter. As always, I am

at your disposal to offer any further thoughts on these issues.

Sincerely,

Wade C. Vose

cc:

The Honorable Joel Greenberg

You might also like

- Response of Dallas County and Tarrant County To Debtors' Fourth Omnibus Objection To ClaimsDocument4 pagesResponse of Dallas County and Tarrant County To Debtors' Fourth Omnibus Objection To ClaimsChapter 11 DocketsNo ratings yet

- SMIETANKA v. FIRST TRUST & SAV BANK - FindLawDocument4 pagesSMIETANKA v. FIRST TRUST & SAV BANK - FindLawPatricia BenildaNo ratings yet

- Ratterman v. Western Union Telegraph Co., 127 U.S. 411 (1888)Document8 pagesRatterman v. Western Union Telegraph Co., 127 U.S. 411 (1888)Scribd Government DocsNo ratings yet

- Falls Chase Special Taxing District Elba, Inc. Sunshine Land Development, Inc. and E. Lamar Bailey Associates v. City of Tallahassee, 788 F.2d 711, 11th Cir. (1986)Document6 pagesFalls Chase Special Taxing District Elba, Inc. Sunshine Land Development, Inc. and E. Lamar Bailey Associates v. City of Tallahassee, 788 F.2d 711, 11th Cir. (1986)Scribd Government DocsNo ratings yet

- City of Taylor, TIFA Lawsuit Against Wayne CountyDocument132 pagesCity of Taylor, TIFA Lawsuit Against Wayne CountyDavid KomerNo ratings yet

- Dawson v. Kentucky Distilleries & Warehouse Co., 255 U.S. 288 (1921)Document7 pagesDawson v. Kentucky Distilleries & Warehouse Co., 255 U.S. 288 (1921)Scribd Government DocsNo ratings yet

- Letter To Town of Highlands Re Short Term Rental Regulations 2022.08.10Document46 pagesLetter To Town of Highlands Re Short Term Rental Regulations 2022.08.10Michael JamesNo ratings yet

- Heublein, Inc. v. South Carolina Tax Comm'n, 409 U.S. 275 (1972)Document8 pagesHeublein, Inc. v. South Carolina Tax Comm'n, 409 U.S. 275 (1972)Scribd Government DocsNo ratings yet

- Local Texas Tax Authorities' Objection To Confirmation of Debtors' Second Amended Joint Plan of ReorganizationDocument6 pagesLocal Texas Tax Authorities' Objection To Confirmation of Debtors' Second Amended Joint Plan of ReorganizationChapter 11 DocketsNo ratings yet

- Higgins v. Commissioner, 312 U.S. 212 (1941)Document5 pagesHiggins v. Commissioner, 312 U.S. 212 (1941)Scribd Government DocsNo ratings yet

- Collin County Commissioners Report Draft of Letter 6-22-15 Re: McKinney Wanting More ETJ ControlDocument3 pagesCollin County Commissioners Report Draft of Letter 6-22-15 Re: McKinney Wanting More ETJ ControlBridgetteNo ratings yet

- White'S Bank v. SmithDocument9 pagesWhite'S Bank v. SmithScribd Government DocsNo ratings yet

- Coe v. Errol, 116 U.S. 517 (1886)Document9 pagesCoe v. Errol, 116 U.S. 517 (1886)Scribd Government DocsNo ratings yet

- Fcca DarleneDocument15 pagesFcca DarleneAdele JeterNo ratings yet

- Hopkins v. Southern Cal. Telephone Co., 275 U.S. 393 (1928)Document8 pagesHopkins v. Southern Cal. Telephone Co., 275 U.S. 393 (1928)Scribd Government DocsNo ratings yet

- Uson v. DiosomitoDocument3 pagesUson v. DiosomitoPaul Joshua SubaNo ratings yet

- Collections: Unpaid Utility Bills and Tax LiensDocument36 pagesCollections: Unpaid Utility Bills and Tax Liensmlbenham100% (1)

- Missouri Ex Rel. Harshman v. Winterbottom, 123 U.S. 215 (1887)Document5 pagesMissouri Ex Rel. Harshman v. Winterbottom, 123 U.S. 215 (1887)Scribd Government DocsNo ratings yet

- Butler Brothers v. McColgan, 315 U.S. 501 (1942)Document6 pagesButler Brothers v. McColgan, 315 U.S. 501 (1942)Scribd Government DocsNo ratings yet

- Commissioners of Laramie County v. COMMISSIONERS OF ALBANY COUNTY, 92 U.S. 307 (1876)Document7 pagesCommissioners of Laramie County v. COMMISSIONERS OF ALBANY COUNTY, 92 U.S. 307 (1876)Scribd Government DocsNo ratings yet

- The Second National Bank of New Haven, of The Will of Frederick F. Brewster, Late of Hamden, Deceased v. United States, 422 F.2d 40, 2d Cir. (1970)Document5 pagesThe Second National Bank of New Haven, of The Will of Frederick F. Brewster, Late of Hamden, Deceased v. United States, 422 F.2d 40, 2d Cir. (1970)Scribd Government DocsNo ratings yet

- Williams v. Hagood, 98 U.S. 72 (1878)Document4 pagesWilliams v. Hagood, 98 U.S. 72 (1878)Scribd Government DocsNo ratings yet

- Thompson v. Kentucky, 209 U.S. 340 (1908)Document7 pagesThompson v. Kentucky, 209 U.S. 340 (1908)Scribd Government DocsNo ratings yet

- H.I. Hettinger & Co. v. Municipality of St. Thomas and St. John H.I. Hettinger & Co. v. Municipality of St. Croix, 187 F.2d 774, 3rd Cir. (1951)Document5 pagesH.I. Hettinger & Co. v. Municipality of St. Thomas and St. John H.I. Hettinger & Co. v. Municipality of St. Croix, 187 F.2d 774, 3rd Cir. (1951)Scribd Government DocsNo ratings yet

- Pittman v. Home Owners' Loan Corp., 308 U.S. 21 (1939)Document5 pagesPittman v. Home Owners' Loan Corp., 308 U.S. 21 (1939)Scribd Government DocsNo ratings yet

- The Michigan Law Review Association Michigan Law ReviewDocument40 pagesThe Michigan Law Review Association Michigan Law ReviewKristian PomidaNo ratings yet

- City of Alameda Ginsburg Case June 2016Document27 pagesCity of Alameda Ginsburg Case June 2016Action Alameda NewsNo ratings yet

- HB1059Document3 pagesHB1059SenRomerNo ratings yet

- Philibotte v. Nisource Corp. Services Co., 1st Cir. (2015)Document19 pagesPhilibotte v. Nisource Corp. Services Co., 1st Cir. (2015)Scribd Government DocsNo ratings yet

- Fairbanks Steam Shovel Company, Appt. v. William v. Wills, Trustee in Bankruptcy of Federal Contracting Company, 240 U.S. 642 (1915)Document6 pagesFairbanks Steam Shovel Company, Appt. v. William v. Wills, Trustee in Bankruptcy of Federal Contracting Company, 240 U.S. 642 (1915)Scribd Government DocsNo ratings yet

- Goldberg Gage: Via Certified Mail-Return Receipt RequestedDocument4 pagesGoldberg Gage: Via Certified Mail-Return Receipt RequestedfryingpannewsNo ratings yet

- Statcon Case DigestDocument15 pagesStatcon Case DigestJohnlery O. PugaoNo ratings yet

- Northwestern Cement Co. v. Minn., 358 U.S. 450 (1959)Document34 pagesNorthwestern Cement Co. v. Minn., 358 U.S. 450 (1959)Scribd Government DocsNo ratings yet

- Estate of Spiegel v. Commissioner, 335 U.S. 701 (1949)Document33 pagesEstate of Spiegel v. Commissioner, 335 U.S. 701 (1949)Scribd Government DocsNo ratings yet

- Lloyd Merrell v. City of Sealy (Case No. 2012V-0027)Document46 pagesLloyd Merrell v. City of Sealy (Case No. 2012V-0027)Austin County News Online100% (1)

- Folio v. City of Clarksburg, 4th Cir. (1998)Document11 pagesFolio v. City of Clarksburg, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Andrew Seger Motion For Leave To Amend Complaint Exhibit BDocument85 pagesAndrew Seger Motion For Leave To Amend Complaint Exhibit Bamber stegall100% (1)

- Baltimore County, Maryland, A Body Corporate and Politic v. Simkins Industries, Inc, 776 F.2d 1043, 4th Cir. (1985)Document3 pagesBaltimore County, Maryland, A Body Corporate and Politic v. Simkins Industries, Inc, 776 F.2d 1043, 4th Cir. (1985)Scribd Government DocsNo ratings yet

- Howard v. Commissioners of Sinking Fund of Louisville, 344 U.S. 624 (1953)Document5 pagesHoward v. Commissioners of Sinking Fund of Louisville, 344 U.S. 624 (1953)Scribd Government DocsNo ratings yet

- Uson vs. DiosmitoDocument4 pagesUson vs. DiosmitoNivla YacadadNo ratings yet

- Arkansas Building and Loan Assn. v. Madden, 175 U.S. 269 (1899)Document5 pagesArkansas Building and Loan Assn. v. Madden, 175 U.S. 269 (1899)Scribd Government DocsNo ratings yet

- Quill Corp. v. North Dakota, 504 U.S. 298 (1992)Document28 pagesQuill Corp. v. North Dakota, 504 U.S. 298 (1992)Scribd Government DocsNo ratings yet

- Stewart v. United States, 58 U.S. 116 (1855)Document14 pagesStewart v. United States, 58 U.S. 116 (1855)Scribd Government DocsNo ratings yet

- Smietanka, Collector of Internal Revenue v. First Trust & Savings Bank, 257 U.S. 602 (1921)Document4 pagesSmietanka, Collector of Internal Revenue v. First Trust & Savings Bank, 257 U.S. 602 (1921)Scribd Government DocsNo ratings yet

- Municipality of Candijay, Bohol v. CA and Municipality of Alicia, BoholDocument4 pagesMunicipality of Candijay, Bohol v. CA and Municipality of Alicia, BoholMDR Andrea Ivy DyNo ratings yet

- Helvering v. Minnesota Tea Co., 296 U.S. 378 (1935)Document7 pagesHelvering v. Minnesota Tea Co., 296 U.S. 378 (1935)Scribd Government DocsNo ratings yet

- Lee County 2 03 27 PDFDocument11 pagesLee County 2 03 27 PDFJudicial_FraudNo ratings yet

- Work v. United States Ex Rel. Lynn, 266 U.S. 161 (1924)Document7 pagesWork v. United States Ex Rel. Lynn, 266 U.S. 161 (1924)Scribd Government DocsNo ratings yet

- Nat. Bellas Hess v. Dept. of Revenue, 386 U.S. 753 (1967)Document11 pagesNat. Bellas Hess v. Dept. of Revenue, 386 U.S. 753 (1967)Scribd Government DocsNo ratings yet

- Alameda County - Adding or Changing Names On DeedsDocument15 pagesAlameda County - Adding or Changing Names On DeedswuliaNo ratings yet

- Chaudhari - Original Petition FinalDocument9 pagesChaudhari - Original Petition FinalAnonymous Pb39klJ100% (1)

- Letter Carroll Ton County Sheriff Counter Affidavit NAACPDocument3 pagesLetter Carroll Ton County Sheriff Counter Affidavit NAACPUGRHomeownerNo ratings yet

- Joseph v. Rafferty v. Commissioner of Internal Revenue, 452 F.2d 767, 1st Cir. (1971)Document10 pagesJoseph v. Rafferty v. Commissioner of Internal Revenue, 452 F.2d 767, 1st Cir. (1971)Scribd Government DocsNo ratings yet

- United States v. Bekins, 304 U.S. 27 (1938)Document8 pagesUnited States v. Bekins, 304 U.S. 27 (1938)Scribd Government DocsNo ratings yet

- Sarasola and David Full TextDocument8 pagesSarasola and David Full TextMatthew McgowanNo ratings yet

- Sample Request Letter For DemolitionDocument20 pagesSample Request Letter For DemolitionKalahi LibacaoNo ratings yet

- Florida Central & Peninsular R. Co. v. Reynolds, 183 U.S. 471 (1902)Document11 pagesFlorida Central & Peninsular R. Co. v. Reynolds, 183 U.S. 471 (1902)Scribd Government DocsNo ratings yet

- INSERT # Senate DistrictDocument10 pagesINSERT # Senate District83jjmack100% (1)

- Rosewell v. LaSalle Nat. Bank, 450 U.S. 503 (1981)Document36 pagesRosewell v. LaSalle Nat. Bank, 450 U.S. 503 (1981)Scribd Government DocsNo ratings yet

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemFrom EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemRating: 4 out of 5 stars4/5 (16)

- Luna High School Restraining OrderDocument22 pagesLuna High School Restraining OrderJacob EngelsNo ratings yet

- North Florida APL 1Document9 pagesNorth Florida APL 1Jacob EngelsNo ratings yet

- APL Uncle Refutes Anna's LiesDocument21 pagesAPL Uncle Refutes Anna's LiesJacob EngelsNo ratings yet

- Sexual Harassment Complaint Bob DallariDocument11 pagesSexual Harassment Complaint Bob DallariJacob EngelsNo ratings yet

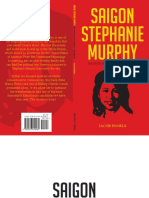

- Saigon Stephanie Murphy by Jacob Engels (2020)Document85 pagesSaigon Stephanie Murphy by Jacob Engels (2020)Jacob EngelsNo ratings yet

- Anaheim Public Records - Gaetz / Greene RallyDocument2 pagesAnaheim Public Records - Gaetz / Greene RallyJacob EngelsNo ratings yet

- Hunter Biden Laptop Lawsuit by John Paul Mac IssacDocument175 pagesHunter Biden Laptop Lawsuit by John Paul Mac IssacJacob EngelsNo ratings yet

- Sheena Rena's Disciplinary FileDocument7 pagesSheena Rena's Disciplinary FileJacob EngelsNo ratings yet

- Media Amicus BriefDocument24 pagesMedia Amicus BriefJacob Engels100% (1)

- Democrat Operative Representing Corrupt Roger Stone JurorsDocument32 pagesDemocrat Operative Representing Corrupt Roger Stone JurorsJacob EngelsNo ratings yet

- Greenberg Letter To Seminole Board of County CommissionersDocument1 pageGreenberg Letter To Seminole Board of County CommissionersJacob EngelsNo ratings yet

- DOJ Reponse To Release of Jury QuestionnairesDocument7 pagesDOJ Reponse To Release of Jury QuestionnairesJacob Engels100% (1)

- Prepared by The Black@ Airbnb Employee Resource Group: Activism & Allyship GuideDocument6 pagesPrepared by The Black@ Airbnb Employee Resource Group: Activism & Allyship GuideJacob Engels100% (1)

- Roger Stone AppealDocument40 pagesRoger Stone AppealChuck RossNo ratings yet

- Stone Motion To Show Cause RE: Illegal Leak of IndictmentDocument6 pagesStone Motion To Show Cause RE: Illegal Leak of IndictmentJacob Engels100% (6)

- Roger Stone Request For Transcript ReleaseDocument4 pagesRoger Stone Request For Transcript ReleaseChuck RossNo ratings yet

- Planned Parenthood Thanks Mike MillerDocument2 pagesPlanned Parenthood Thanks Mike MillerJacob EngelsNo ratings yet

- PR Sturgill - Immigrants Must Fund The WallDocument2 pagesPR Sturgill - Immigrants Must Fund The WallJacob EngelsNo ratings yet

- Erik Gomez Cordero Animal Cruelty ArrestDocument3 pagesErik Gomez Cordero Animal Cruelty ArrestJacob EngelsNo ratings yet

- Animal Services Report Cordero/Ward Horror HouseDocument14 pagesAnimal Services Report Cordero/Ward Horror HouseJacob EngelsNo ratings yet

- POLICE REPORT: Thwarted Valencia ShootingDocument2 pagesPOLICE REPORT: Thwarted Valencia ShootingJacob EngelsNo ratings yet

- Yoho Letter Praising Robert MuellerDocument2 pagesYoho Letter Praising Robert MuellerJacob EngelsNo ratings yet

- Christian Candidate Responds To Terrorist Linked OpponentDocument2 pagesChristian Candidate Responds To Terrorist Linked OpponentJacob EngelsNo ratings yet

- Shroyer Developer Votes (City Meeting Minutes)Document14 pagesShroyer Developer Votes (City Meeting Minutes)Jacob EngelsNo ratings yet

- Perverted History: Gwen Graham's Client ExposedDocument5 pagesPerverted History: Gwen Graham's Client ExposedJacob EngelsNo ratings yet

- Mike Miller MailoutDocument2 pagesMike Miller MailoutJacob EngelsNo ratings yet

- Horan Arrest ReportDocument2 pagesHoran Arrest ReportJacob EngelsNo ratings yet

- Shroyer Corruption DocumentsDocument17 pagesShroyer Corruption DocumentsJacob EngelsNo ratings yet

- PLO Prosecutor Ally Tries To Disbar OpponentDocument9 pagesPLO Prosecutor Ally Tries To Disbar OpponentJacob EngelsNo ratings yet

- Jay Miller Arrest ReportDocument2 pagesJay Miller Arrest ReportJacob EngelsNo ratings yet

- Corporate Account: Department of Commerce Doctor Harisingh Gour Vishwavidyalaya (A Central University) SAGAR (M.P.)Document6 pagesCorporate Account: Department of Commerce Doctor Harisingh Gour Vishwavidyalaya (A Central University) SAGAR (M.P.)Aditya JainNo ratings yet

- Tanroads KilimanjaroDocument10 pagesTanroads KilimanjaroElisha WankogereNo ratings yet

- DLL - Science 6 - Q3 - W3Document6 pagesDLL - Science 6 - Q3 - W3AnatasukiNo ratings yet

- Housekeeping NC II ModuleDocument77 pagesHousekeeping NC II ModuleJoanne TolopiaNo ratings yet

- Module 6: 4M'S of Production and Business ModelDocument43 pagesModule 6: 4M'S of Production and Business ModelSou MeiNo ratings yet

- Cost Allocation Methods & Activity-Based Costing ExplainedDocument53 pagesCost Allocation Methods & Activity-Based Costing ExplainedNitish SharmaNo ratings yet

- Marrickville DCP 2011 - 2.3 Site and Context AnalysisDocument9 pagesMarrickville DCP 2011 - 2.3 Site and Context AnalysiskiranjiNo ratings yet

- 00.arkana ValveDocument40 pages00.arkana ValveTrần ThànhNo ratings yet

- Red Orchid - Best PracticesDocument80 pagesRed Orchid - Best PracticeslabiaernestoNo ratings yet

- Solidworks Inspection Data SheetDocument3 pagesSolidworks Inspection Data SheetTeguh Iman RamadhanNo ratings yet

- Kedudukan Dan Fungsi Pembukaan Undang-Undang Dasar 1945: Pembelajaran Dari Tren GlobalDocument20 pagesKedudukan Dan Fungsi Pembukaan Undang-Undang Dasar 1945: Pembelajaran Dari Tren GlobalRaissa OwenaNo ratings yet

- Sri Lanka Wildlife and Cultural TourDocument9 pagesSri Lanka Wildlife and Cultural TourRosa PaglioneNo ratings yet

- Topic 4: Mental AccountingDocument13 pagesTopic 4: Mental AccountingHimanshi AryaNo ratings yet

- Auto TraderDocument49 pagesAuto Tradermaddy_i5100% (1)

- Chapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Document6 pagesChapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Barry Lutz Sr.No ratings yet

- Belonging Through A Psychoanalytic LensDocument237 pagesBelonging Through A Psychoanalytic LensFelicity Spyder100% (1)

- Tong RBD3 SheetDocument4 pagesTong RBD3 SheetAshish GiriNo ratings yet

- Legal validity of minor's contracts under Indian lawDocument8 pagesLegal validity of minor's contracts under Indian lawLakshmi Narayan RNo ratings yet

- Supply Chain AssignmentDocument29 pagesSupply Chain AssignmentHisham JackNo ratings yet

- FOCGB4 Utest VG 5ADocument1 pageFOCGB4 Utest VG 5Asimple footballNo ratings yet

- 110 TOP Survey Interview QuestionsDocument18 pages110 TOP Survey Interview QuestionsImmu100% (1)

- Hadden Public Financial Management in Government of KosovoDocument11 pagesHadden Public Financial Management in Government of KosovoInternational Consortium on Governmental Financial ManagementNo ratings yet

- Environmental Science PDFDocument118 pagesEnvironmental Science PDFJieyan OliverosNo ratings yet

- ILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTDocument54 pagesILOILO STATE COLLEGE OF FISHERIES-DUMANGAS CAMPUS ON-THE JOB TRAINING NARRATIVE REPORTCherry Lyn Belgira60% (5)

- Quiz 1 model answers and marketing conceptsDocument10 pagesQuiz 1 model answers and marketing conceptsDavid LuNo ratings yet

- Java Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingDocument2 pagesJava Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingGopal JoshiNo ratings yet

- 1.1.1 Adverb Phrase (Advp)Document2 pages1.1.1 Adverb Phrase (Advp)mostarjelicaNo ratings yet

- R19 MPMC Lab Manual SVEC-Revanth-III-IIDocument135 pagesR19 MPMC Lab Manual SVEC-Revanth-III-IIDarshan BysaniNo ratings yet

- Sergei Rachmaninoff Moment Musicaux Op No in E MinorDocument12 pagesSergei Rachmaninoff Moment Musicaux Op No in E MinorMarkNo ratings yet

- Comal ISD ReportDocument26 pagesComal ISD ReportMariah MedinaNo ratings yet