Professional Documents

Culture Documents

Test Bank For QuickBooks Pro 2013 A Complete Course 14E 14th Edition

Uploaded by

Mohammed KhouliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Bank For QuickBooks Pro 2013 A Complete Course 14E 14th Edition

Uploaded by

Mohammed KhouliCopyright:

Available Formats

NAME

KEY

QUICKBOOKS 2013:

A COMPLETE COURSE

EXAM CHAPTERS 5-7

TRUE/FALSE:

ANSWER THE FOLLOWING QUESTIONS IN THE SPACE PROVIDED BEFORE THE

QUESTION NUMBER.

T

1. A withdrawal by an owner in a partnership reduces the owners capital.

2. If a customer issues a check that is returned marked NSF, you may charge

the customer the amount of the bank charges and any penalty charges you

impose.

3. Since purchase discounts are a cost of doing business, they are categorized

as an expense.

4. A single purchase order can be prepared and sent to several vendors.

5. Once an account has been used, the name cannot be changed.

6. QuickBooks keeps track of sales tax liability and will prepare the payment of

sales taxes to the appropriate agency when using the Pay Sales Tax feature

of the program.

7. If a return is made by a customer and the customer does not owe you any

money, a refund check is issued along with a credit memo.

8. When a credit is received from a vendor for the return of merchandise, it may

be applied to a payment to the same vendor.

9. Receiving part of an order closes the Purchase Order.

10. The adjusting entry for depreciation may be made in the depreciation account

register or in the General Journal.

EXAM CHAPTERS 5-7KEY

EXAM !

11. Receipt of purchase order items is never recorded before the bill arrives.

12. The Subtotal account calculates the sales discount.

13.When a customer uses a bank credit card, such as a Visa card, the amount of

the sale is placed into the Undeposited Funds account. When the actual bank

deposit is made, the amount is deposited into the checking or bank account

and bank fees for the charge cards are deducted directly from the bank

account.

14. QuickBooks automatically applies payments received from customers on

account to the most current invoice.

15. At the end of the year, QuickBooks transfers the net income into retained

earnings.

16. When receiving a discount for merchandise purchased, you use the Cost of

Goods Sold Merchandise Discounts account to record the discount.

17. You may use a credit card to pay for inventory items.

18. The Discounts and Credits button on the Receive Payments window allows

discounts to be applied to invoices being paid by clicking Cancel.

19. The retained earnings account should always be deleted.

20. To give a discount to a nonprofit organization, you must create a new discount

term.

MULTIPLE CHOICE

WRITE THE LETTER OF THE CORRECT ANSWER IN THE SPACE PROVIDED

BEFORE THE QUESTION NUMBER.

C

21. The

basis of accounting matches income for the period against expenses

for the period.

A. cash

B. credit

C. accrual

D. debit/credit

2014 Pearson Education, Inc. publishing as Prentice Hall

EXAM CHAPTERS 5-7KEY

EXAM !

22. To change a column width in a report without changing the size of the print,

you must

.

A. print the report in landscape orientation

B. use Fit report to one page wide option

C. change the column width manually

D. all of the above

23. If an invoice is

A. voided

B. deleted

C. corrected

D. printed

24. Adjustments for accrual basis accounting generally include adjustments to

.

A. petty cash

B. office supplies

C. sales discounts

D. accounts payable

25. A discount received for a purchase of merchandise is recorded in the

account.

A. Income account: Purchases Discounts

B. Expense account: Sales Discounts

C. Cost of goods sold account: Merchandise Discounts

D. Asset account: Inventory Asset

26. If a customer has a balance for an amount owed and a return is made, a

credit memo is prepared and

.

A. a refund check is issued

B. the amount of the return may be applied to the balance owed for the

invoice

C. the customer determines whether to apply the amount to the balance

owed or get a refund check

D. all of the above

27. The Make Payment dialog box appears on the screen

A. in order to print a check

B. when you enter a bill

C. after the bank reconciliation is complete

D. after the credit card reconciliation is complete

, it will not show up in the Customer Balance Detail Report.

2014 Pearson Education, Inc. publishing as Prentice Hall

EXAM CHAPTERS 5-7KEY

EXAM !

28. The

item must appear before the Nonprofit Discount item on an invoice in

order for QuickBooks to calculate the sales discount on the entire sale.

A. Subtotal

B. last sales item

C. no special item is required

D. QuickBooks does not calculate the discount, it must be computed

manually

29. If reports are prepared as of January 31 of the current year, net income will

appear in the

.

A. Profit & Loss Statement

B. Balance Sheet

C. both A and B

D. neither A nor B

30. If an invoice is entered and causes a customers account to exceed its limit,

QuickBooks

.

A. denies the transaction

B. automatically approves the transaction

C. provides a dialog box allowing you to approve the transaction

D. requires you to change the customers account limit

31. Even though transactions are entered via business documents such as

invoices and sales receipts, QuickBooks keeps track of all transactions

A. in a chart

B. in the master register

C. on a graph

D. in the Journal

32. The accounts that may be reconciled are

A. income and expenses

B. cost of goods sold

C. all balance sheet accounts

D. both A and B above

33. To print a reconciliation report that lists only totals, select

A. none

B. summary

C. detailed

D. complete

2014 Pearson Education, Inc. publishing as Prentice Hall

EXAM CHAPTERS 5-7KEY

EXAM !

34. The Fixed Asset Item list includes the name of the asset, the date of

purchase, and the

.

A. cost of the asset

B. asset account to use

C. description of the asset

D. All of the above

35. When using QuickBooks to pay bills that have been recorded in the Enter

Bills window, you may

and the bills will be marked Paid..

A. write checks to pay bills

B. use a credit card to pay bills

C. use the pay bills feature so QuickBooks will write the checks or prepare

the credit card charges

D. all of the above

36. If an order for an inventory item is received with a bill but is incomplete,

QuickBooks will

.

A. record the bill for the full amount ordered

B. record the bill only for the amount received

C. not allow the bill to be prepared until all the merchandise is received

D. close the purchase order

37. If a customer makes a payment on account and a return has been made, the

correct amount of the sales discount is calculated

.

A. automatically by QuickBooks on the full amount

B. automatically by QuickBooks on the amount due after the credit is

subtracted

C. manually by using QuickMath

D. all of the above

38. For owner withdrawals in a partnership, QuickBooks

.

A. allows you to establish a separate account for each owners withdrawals

B. requires that all owner withdrawals are combined within the same account

C. deducts the amount of withdrawals from retained earnings

D. does not allow owner withdrawals because each partner who works in the

business earns a salary

39. QuickBooks uses the

A. LIFO

B. average cost

C. FIFO

D. Actual Cost

method of inventory valuation

2014 Pearson Education, Inc. publishing as Prentice Hall

EXAM CHAPTERS 5-7KEY

A

EXAM !

40. If you change the minimum quantity for an item, it becomes effective

A. immediately

B. the beginning of next month

C. as soon as outstanding purchase orders are received

D. the beginning of the next fiscal year

FILL-IN

IN THE SPACE PROVIDED, WRITE THE ANSWER THAT MOST APPROPRIATELY

COMPLETES THE SENTENCE.

41. When receiving payments from customers, QuickBooks places the amount received

in an account called Undeposited Funds until the bank deposit is made.

42. The Sales Tax Liability

sales tax owed.

report shows the total taxable sales and the amount of

43. You may use QuickBookss pay bills feature to pay bills using a

credit card for payment.

check

44. In order for the entire invoice to receive a discount, a

the item immediately before a nonprofit discount.

must be used as

subtotal

45. Orders for merchandise are prepared using the QuickBooks

form.

or a

Purchase Order

46. Purchase, Sales, and Inventory information must be entered when creating a(n)

inventory item.

47. Changes to an inventory quantity are made by clicking the Inventory Activities icon

on the QuickBooks Home Page .

48. If the Quantity and Price Each are entered on an invoice, pressing the tab key

will cause QuickBooks to calculate and enter the correct information in the Amount

column of the invoice.

49. To see the bill payment information, checks must be printed

individually .

50. In the Vendor Center, expense accounts for vendors are assigned using the

Payment Settings tab when editing or adding a vendor.

2014 Pearson Education, Inc. publishing as Prentice Hall

You might also like

- Quickbooks Practice MCQ'sDocument5 pagesQuickbooks Practice MCQ'sdiastye75% (4)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- QuickBooks company data access and securityDocument54 pagesQuickBooks company data access and securityyes1nth100% (2)

- Sample QuickBooks Online Certification Exam Answers Questions 1 1Document25 pagesSample QuickBooks Online Certification Exam Answers Questions 1 1Bhargav Patel0% (1)

- Quickbooks Test BankDocument4 pagesQuickbooks Test Bankminseok kim100% (2)

- Qbo 2018 TBDocument20 pagesQbo 2018 TBWilson CarlosNo ratings yet

- Lesson Review Answer KeyDocument20 pagesLesson Review Answer KeyGinnie G Cristal100% (1)

- Expenses and Vendors - Module IV Beginner SkillsDocument26 pagesExpenses and Vendors - Module IV Beginner SkillsHumberto PortilloNo ratings yet

- Financial Accounting Vol. 2 Example QuestionsDocument8 pagesFinancial Accounting Vol. 2 Example QuestionsMarisolNo ratings yet

- Supporting Your Small Business ClientsDocument13 pagesSupporting Your Small Business ClientsRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Accounting ProblemsDocument7 pagesAccounting ProblemsMarisolNo ratings yet

- Introduction To QBOA - Part 2 - PresentationDocument93 pagesIntroduction To QBOA - Part 2 - PresentationherrajohnNo ratings yet

- Quick Guide to the QuickBooks Desktop Conversion ToolDocument35 pagesQuick Guide to the QuickBooks Desktop Conversion ToolLouiseCuentoNo ratings yet

- QBO Cert Exam Module 3 - 4Document121 pagesQBO Cert Exam Module 3 - 4Nikka ella LaraNo ratings yet

- Accounting Fundamentals/Bookkeeper Practice TestDocument8 pagesAccounting Fundamentals/Bookkeeper Practice TestLindcelle Jane Dalope100% (1)

- Quickbooks Online Certification Practice TestDocument9 pagesQuickbooks Online Certification Practice TestErika Mie Ulat100% (1)

- QBO Cert Exam Module 2Document77 pagesQBO Cert Exam Module 2Nikka ella LaraNo ratings yet

- Chapter 06 (Part II) - AssignmentDocument4 pagesChapter 06 (Part II) - AssignmentRawan YasserNo ratings yet

- QB Pro ExamDocument6 pagesQB Pro ExamRamij BabuNo ratings yet

- Quick BooksDocument22 pagesQuick BooksENIDNo ratings yet

- DocxDocument58 pagesDocxFluk75% (4)

- QBO Core Cert Glossary 2024Document17 pagesQBO Core Cert Glossary 2024antoniomuscanti00No ratings yet

- QuickBooks Online 2024 ProAdvisor Certification ReviewerDocument226 pagesQuickBooks Online 2024 ProAdvisor Certification ReviewerRonald Nadon100% (1)

- 63ea52fcc0dcd Quickbooks Online Exams AnsDocument149 pages63ea52fcc0dcd Quickbooks Online Exams AnsCarlo Cariaso0% (1)

- Quickbooks ExamDocument15 pagesQuickbooks ExamRobelyn LacorteNo ratings yet

- QBO Cert Exam Module 7 - 8Document114 pagesQBO Cert Exam Module 7 - 8John AnthonyNo ratings yet

- Become A QuickBooks ProAdvisorDocument6 pagesBecome A QuickBooks ProAdvisorpriyanshu saraswat0% (1)

- Accounts PayableDocument5 pagesAccounts Payablesamsam9095No ratings yet

- Qbo TBDocument19 pagesQbo TBWilson Carlos100% (2)

- QuickBooks - ReviewerDocument41 pagesQuickBooks - ReviewerSeverus HadesNo ratings yet

- Quickbooks Practice With Answers FeedbackDocument35 pagesQuickbooks Practice With Answers Feedbackmzkaramel75% (4)

- Part 1 Recognition Measurement Valuation Disclosure Current AssetsDocument20 pagesPart 1 Recognition Measurement Valuation Disclosure Current AssetsRox accountNo ratings yet

- Supplemental Guide: Module 4: Reporting & TroubleshootingDocument75 pagesSupplemental Guide: Module 4: Reporting & TroubleshootingEdward DubeNo ratings yet

- 2017 Cert Prep Webinar - EM.062617 - Attendee PDFDocument272 pages2017 Cert Prep Webinar - EM.062617 - Attendee PDFSrabonBarua100% (1)

- User Guide: SmallbusinessaccountingDocument22 pagesUser Guide: SmallbusinessaccountingAPRIL LYN VILLETA100% (1)

- Quickbooks Pro Advisor Certification GuideDocument5 pagesQuickbooks Pro Advisor Certification GuidePappy Tres100% (1)

- Accounting Journal Entries With Business Transactions PDFDocument7 pagesAccounting Journal Entries With Business Transactions PDFBackchodi OverLoadedNo ratings yet

- How to create and manage sales documents in XeroDocument13 pagesHow to create and manage sales documents in XeroKelly Fernandico IntalNo ratings yet

- 08 QuickBooks Online Certification Part 1-2 Training Instructor-Gisele DoucetDocument99 pages08 QuickBooks Online Certification Part 1-2 Training Instructor-Gisele DoucetReazoen Kabir Romel100% (1)

- Accounting For ReceivablesDocument4 pagesAccounting For ReceivablesMega Pop Locker50% (2)

- QBO Cert Course1 Getting Started Product OverviewDocument36 pagesQBO Cert Course1 Getting Started Product Overviewinfiniti786No ratings yet

- QB Exam Questions CompilationDocument22 pagesQB Exam Questions CompilationDiane Hufemia100% (1)

- Exam Preparation QuickbooksDocument29 pagesExam Preparation QuickbooksSyed ShafanNo ratings yet

- Advising Clients Q1Document8 pagesAdvising Clients Q1Mandela EscaladaNo ratings yet

- 203 Cat Generalbrochure Topnotch NEWDocument16 pages203 Cat Generalbrochure Topnotch NEWMichael Shaffer100% (2)

- QBO Cert Exam Module 5 - 6Document122 pagesQBO Cert Exam Module 5 - 6John AnthonyNo ratings yet

- QuickBooks Online Setup GuideDocument327 pagesQuickBooks Online Setup Guiderbreddy74No ratings yet

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- QBO ProAdvisor Certification Part 2 SlidesDocument157 pagesQBO ProAdvisor Certification Part 2 SlidesMichael GaoNo ratings yet

- CBA - Fundamentals of Accounting - UpdatedDocument4 pagesCBA - Fundamentals of Accounting - UpdatedVher DucayNo ratings yet

- QBO Certification Training Guide - v031122Document308 pagesQBO Certification Training Guide - v031122Jonhmark AniñonNo ratings yet

- 63ea52fcc0dcd Quickbooks Online Exams AnsDocument149 pages63ea52fcc0dcd Quickbooks Online Exams AnsCarlo CariasoNo ratings yet

- QuickBooks Online Section 1 GuideDocument18 pagesQuickBooks Online Section 1 GuidecrimsengreenNo ratings yet

- Review Answers: Quickbooks Online CertificationDocument1 pageReview Answers: Quickbooks Online Certificationsmn123456No ratings yet

- A. QB Lesson 1 (All About QB)Document27 pagesA. QB Lesson 1 (All About QB)Shena Mari Trixia Gepana100% (1)

- QBO Cert Exam Module 1Document68 pagesQBO Cert Exam Module 1Nikka ella LaraNo ratings yet

- QuickBooks Premier Accounting Course ManualDocument21 pagesQuickBooks Premier Accounting Course ManualWaivorchih Waibochi GiterhihNo ratings yet

- Double Entry Bookkeeping Exercise 6Document2 pagesDouble Entry Bookkeeping Exercise 6naseebNo ratings yet

- 2022 QB ProDocument31 pages2022 QB ProJen Adviento0% (1)

- It App Tools in Business. Qbo ReviewerDocument13 pagesIt App Tools in Business. Qbo ReviewerCenelyn PajarillaNo ratings yet

- Faculty of Engineering Mechanical Engineering Department: Strength of Materials LABDocument5 pagesFaculty of Engineering Mechanical Engineering Department: Strength of Materials LABMohammed KhouliNo ratings yet

- EE 306 - Electrical Engineering LaboratoryDocument3 pagesEE 306 - Electrical Engineering LaboratoryMohammed KhouliNo ratings yet

- EE 306 - Electrical Engineering LaboratoryDocument6 pagesEE 306 - Electrical Engineering LaboratoryMohammed KhouliNo ratings yet

- تسويق شابتر 15aDocument41 pagesتسويق شابتر 15aMohammed KhouliNo ratings yet

- Public Finance2Document5 pagesPublic Finance2Mohammed KhouliNo ratings yet

- EE 306 - Electrical Engineering LaboratoryDocument10 pagesEE 306 - Electrical Engineering LaboratoryMohammed KhouliNo ratings yet

- EE 306 - Electrical Engineering LaboratoryDocument7 pagesEE 306 - Electrical Engineering LaboratoryMohammed KhouliNo ratings yet

- Chapter 11Document28 pagesChapter 11Mohammed KhouliNo ratings yet

- EE 306 - Electrical Engineering LaboratoryDocument7 pagesEE 306 - Electrical Engineering LaboratoryMohammed KhouliNo ratings yet

- Chapter 12 Marketing Channels Delivering Customer Value 14ed NewDocument21 pagesChapter 12 Marketing Channels Delivering Customer Value 14ed NewMohammed KhouliNo ratings yet

- TB Ch01 Romney 13eDocument28 pagesTB Ch01 Romney 13e斌王86% (14)

- Orca Share Media1483233841562Document21 pagesOrca Share Media1483233841562Mohammed KhouliNo ratings yet

- Chapter 8 FinalDocument17 pagesChapter 8 FinalMichael Hu67% (9)

- Horisantal Vs Vertical EquityDocument1 pageHorisantal Vs Vertical EquityMohammed KhouliNo ratings yet

- Accounting for Equity and Treasury SharesDocument46 pagesAccounting for Equity and Treasury SharesMohammed Khouli100% (3)

- تسويق شابتر 3Document42 pagesتسويق شابتر 3Mohammed KhouliNo ratings yet

- TB Ch01 Romney 13eDocument28 pagesTB Ch01 Romney 13e斌王86% (14)

- MKT Second TBDocument83 pagesMKT Second TBMohammed KhouliNo ratings yet

- CH 6 Even E and PDocument27 pagesCH 6 Even E and PMohammed KhouliNo ratings yet

- Advanced Chapter 5 Test BankDocument16 pagesAdvanced Chapter 5 Test BankMohammed Khouli50% (2)

- تسويق شابتر 12 bDocument33 pagesتسويق شابتر 12 bMohammed KhouliNo ratings yet

- Chapter 5 تسويقDocument53 pagesChapter 5 تسويقMohammed KhouliNo ratings yet

- تسويق شابتر 15aDocument41 pagesتسويق شابتر 15aMohammed KhouliNo ratings yet

- Incremental Analysis Decision MakingDocument75 pagesIncremental Analysis Decision MakingMohammed KhouliNo ratings yet

- Chapter 10Document45 pagesChapter 10Mohammed KhouliNo ratings yet

- Chapter 01 - Business CombinationsDocument17 pagesChapter 01 - Business CombinationsTina LundstromNo ratings yet

- Chapter 5 تسويقDocument53 pagesChapter 5 تسويقMohammed KhouliNo ratings yet

- Managerial Acc Test BankDocument2 pagesManagerial Acc Test BankMohammed KhouliNo ratings yet

- Target Market Segmentation & EvaluationDocument48 pagesTarget Market Segmentation & EvaluationMohammed KhouliNo ratings yet

- CH 7 Even e and PDocument23 pagesCH 7 Even e and PMohammed KhouliNo ratings yet

- 30 - Tow Truck Regulation Working Document PDFDocument11 pages30 - Tow Truck Regulation Working Document PDFJoshNo ratings yet

- SSS Presentation PDFDocument50 pagesSSS Presentation PDFEMMANUEL SSEWANKAMBO100% (2)

- 5 6271466930146640792Document1,225 pages5 6271466930146640792Supratik SarkarNo ratings yet

- Illuminati Confessions PDFDocument227 pagesIlluminati Confessions PDFberlinczyk100% (1)

- Amplus SolarDocument4 pagesAmplus SolarAbhishek AbhiNo ratings yet

- Resltado OBJ Preliminar Ensino Medio Completo Guarda Municipal de 2a ClasseDocument341 pagesResltado OBJ Preliminar Ensino Medio Completo Guarda Municipal de 2a Classefrancisca pachecoNo ratings yet

- Industry Analysis1Document72 pagesIndustry Analysis1Walter InsigneNo ratings yet

- Forecasting - Penilaian BisnisDocument63 pagesForecasting - Penilaian BisnisyuliyastutiannaNo ratings yet

- Recolonizing Ngugi Wa Thiongo PDFDocument20 pagesRecolonizing Ngugi Wa Thiongo PDFXolile Roy NdlovuNo ratings yet

- Privacy & Big Data Infographics by SlidesgoDocument33 pagesPrivacy & Big Data Infographics by SlidesgoNadira WANo ratings yet

- Bangla Book "Gibat" P2Document34 pagesBangla Book "Gibat" P2Banda Calcecian100% (3)

- Biosphere Reserves of IndiaDocument4 pagesBiosphere Reserves of IndiaSrinivas PillaNo ratings yet

- Case Study 2, Domino?s Sizzles With Pizza TrackerDocument3 pagesCase Study 2, Domino?s Sizzles With Pizza TrackerAman GoelNo ratings yet

- Annex D Initial Evaluation Results IER 2Document6 pagesAnnex D Initial Evaluation Results IER 2ruffaNo ratings yet

- Ch9A Resource Allocation 2006Document31 pagesCh9A Resource Allocation 2006daNo ratings yet

- Procter &gamble: Our PurposeDocument39 pagesProcter &gamble: Our Purposemubasharabdali5373No ratings yet

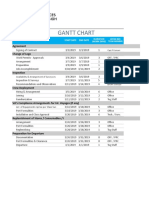

- Gantt Chart TemplateDocument3 pagesGantt Chart TemplateAamir SirohiNo ratings yet

- Rural Marketing Presention - WIPDocument31 pagesRural Marketing Presention - WIPRuee TambatNo ratings yet

- Universiti Kuala Lumpur Intra Management System: Unikl-ImsDocument16 pagesUniversiti Kuala Lumpur Intra Management System: Unikl-ImsAfnanFadlanBinAzmiNo ratings yet

- LRTA v. Navidad, G.R. No. 145804, 6 February 2003Document3 pagesLRTA v. Navidad, G.R. No. 145804, 6 February 2003RENGIE GALO0% (1)

- Dyesebel 3Document7 pagesDyesebel 3Leachez Bbdear BarbaNo ratings yet

- Hlimkhawpui - 06.06.2021Document2 pagesHlimkhawpui - 06.06.2021JC LalthanfalaNo ratings yet

- Lecture 4 The Seven Years' War, 1756-1763Document3 pagesLecture 4 The Seven Years' War, 1756-1763Aek FeghoulNo ratings yet

- Literary Structure and Theology in The Book of RuthDocument8 pagesLiterary Structure and Theology in The Book of RuthDavid SalazarNo ratings yet

- The Paradox ChurchDocument15 pagesThe Paradox ChurchThe Paradox Church - Ft. WorthNo ratings yet

- Why The Irish Became Domestics and Italians and Jews Did NotDocument9 pagesWhy The Irish Became Domestics and Italians and Jews Did NotMeshel AlkorbiNo ratings yet

- Passwordless The Future of AuthenticationDocument16 pagesPasswordless The Future of AuthenticationTour GuruNo ratings yet

- Marketing PlanDocument18 pagesMarketing PlanPatricia Mae ObiasNo ratings yet

- Eschatology in The Old Testament PDFDocument175 pagesEschatology in The Old Testament PDFsoulevansNo ratings yet

- 0025 Voters - List. Bay, Laguna - Brgy Calo - Precint.0051bDocument3 pages0025 Voters - List. Bay, Laguna - Brgy Calo - Precint.0051bIwai MotoNo ratings yet