Professional Documents

Culture Documents

Ive Ishares S P 500 Value Etf Fund Fact Sheet en Us

Uploaded by

Abdulsalam91Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ive Ishares S P 500 Value Etf Fund Fact Sheet en Us

Uploaded by

Abdulsalam91Copyright:

Available Formats

IVE

iShares S&P 500 Value ETF

Fact Sheet as of 09/30/2016

The iShares S&P 500 Value ETF seeks to track the investment results of an index

composed of large-capitalization U.S. equities that exhibit value characteristics.

RISK PROFILE

Lower Risk/

Reward

WHY IVE?

1 Exposure to large U.S. companies that are thought to be undervalued by the

market relative to comparable companies

2 Targeted access to a specific category of large-cap domestic stocks

3 Use to tilt your portfolio towards value stocks

GROWTH OF 10,000 USD SINCE INCEPTION

Higher Risk/

Reward

Based on the 1 year standard deviation of

the fund. Standard deviation measures

how dispersed returns are around the

average. A higher standard deviation

indicates that returns are spread out over a

larger range of values and thus, more

volatile or risky. Each increment on the

scale above represents a 5% range of

standard deviation except for the last

segment which is >20%.

KEY FACTS

Inception Date

05/22/2000

Expense Ratio

0.18%

Benchmark

S&P 500(R) Value Index

30 Day SEC Yield

2.41%

Number of Holdings

359

Net Assets

$10,434,375,507

Fund

Benchmark

The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and

assumes reinvestment of dividends and capital gains. Fund expenses, including management

fees and other expenses were deducted.

Ticker

CUSIP

Exchange

PERFORMANCE

TOP HOLDINGS (%)

1 Year

3 Year

5 Year

10 Year

Since Inception

NAV

15.78%

9.16%

15.66%

5.39%

5.11%

Market Price

15.83%

9.14%

15.65%

5.38%

5.10%

Benchmark

15.98%

9.34%

15.87%

5.53%

5.26%

The performance quoted represents past performance and does not guarantee future

results. Investment return and principal value of an investment will fluctuate so that an

investors shares, when sold or redeemed, may be worth more or less than the original

cost. Current performance may be lower or higher than the performance quoted.

Performance data current to the most recent month end may be obtained by visiting

www.iShares.com or www.blackrock.com.

Market returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. eastern time

(when NAV is normally determined for most ETFs), and do not represent the returns you would

receive if you traded shares at other times.

EXXON MOBIL CORP

BERKSHIRE HATHAWAY INC

CLASS B

AT&T INC

JPMORGAN CHASE & CO

PROCTER & GAMBLE

WELLS FARGO

CHEVRON CORP

MERCK & CO INC

JOHNSON & JOHNSON

BANK OF AMERICA CORP

Holdings are subject to change.

IVE

464287408

NYSE Arca

3.94

2.99

2.72

2.62

2.61

2.19

2.12

1.88

1.80

1.74

24.61

FEES AND EXPENSES BREAKDOWN

TOP SECTORS (%)

Financials

Energy

Health Care

Industrials

Consumer Staples

Information Technology

Consumer Discretionary

Utilities

Telecommunications

Materials

Real Estate

Cash and Derivatives

22.46%

13.08%

12.05%

10.77%

10.34%

8.15%

7.08%

6.42%

4.41%

3.48%

1.54%

0.22%

Expense Ratio

Management Fee

Acquired Fund Fees and Expenses

Foreign Taxes and Other Expenses

0.18%

0.18%

0.00%

0.00%

FUND CHARACTERISTICS

Beta vs. S&P 500

Standard Deviation (3yrs)

Price to Earnings

Price to Book Ratio

0.91

10.57%

16.84

2.01

GLOSSARY

Beta is a measure of the tendency of securities to move with the market as a

whole. A beta of 1 indicates that the securitys price will move with the

market. A beta less than 1 indicates the security tends to be less volatile

than the market, while a beta greater than 1 indicates the security is more

volatile than the market.

The price to earnings ratio (P/E) is a fundamental measure used to

determine if an investment is valued appropriately. Each holding's P/E is the

latest closing price divided by the latest fiscal year's earnings per share.

Negative P/E ratios are excluded from this calculation.

Want to learn more?

www.iShares.com

The price to book (P/B) value ratio is a fundamental measure used to

determine if an investment is valued appropriately. The book value of a

company is a measure of how much a company's assets are worth assuming

the company's debts are paid off. Each holding's P/B is the latest closing

price divided by the latest fiscal year's book value per share. Negative book

values are excluded from this calculation.

www.blackrockblog.com

@iShares

Carefully consider the Fund's investment objectives, risk factors, and charges and expenses before investing. This and other information can be

found in the Fund's prospectus, and if available, summary prospectus, which may be obtained by calling 1-800-iShares (1-800-474-2737) or by

visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Diversification may not protect against market risk or loss of principal. Shares of iShares Funds are bought and sold at market price (not NAV) and are not

individually redeemed from the Fund. Brokerage commissions will reduce returns.

Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses.

Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

"Acquired Fund Fees and Expenses" reflect the Fund's pro rata share of the indirect fees and expenses incurred by investing in one or more acquired funds,

such as mutual funds, business development companies, or other pooled investment vehicles. AFFE are reflected in the prices of the acquired funds and

thus included in the total returns of the Fund.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, "BlackRock").

S&P and Standard & Poor's are trademarks of Standard & Poor's Financial Services LLC (a subsidiary of The McGraw-Hill Companies) and have been

licensed for use for certain purposes by BlackRock. iShares Funds are not sponsored, endorsed, issued, sold or promoted by Standard & Poor's, nor does

this company make any representation regarding the advisability of investing in iShares Funds. BlackRock is not affiliated with the companies listed above.

Index data source: Standard & Poors.

2016 BlackRock. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock Inc, or its subsidiaries. All other marks are the

property of their respective owners.

FOR MORE INFORMATION, VISIT WWW.ISHARES.COM OR CALL 1-800 ISHARES (1-800-474-2737)

iS-17464-1116

iS-IVE-F0916

Not FDIC Insured - No Bank Guarantee - May Lose Value

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Management 1 Risk and Return AnalysisDocument12 pagesFinancial Management 1 Risk and Return AnalysisANKITA M SHARMANo ratings yet

- Uv2499 PDF EngDocument3 pagesUv2499 PDF Engharisankar suresh100% (1)

- Avon Make A Payment Information July 2021 PDFDocument1 pageAvon Make A Payment Information July 2021 PDFHeggies StaeraNo ratings yet

- Exercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Document3 pagesExercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Sylvia GynNo ratings yet

- Commercial Bank of Ethiopia Shinile Branch Sales ReportDocument14 pagesCommercial Bank of Ethiopia Shinile Branch Sales ReportDaniel AbrahamNo ratings yet

- Xi Pre Final AccountsDocument7 pagesXi Pre Final AccountsDrishti ChauhanNo ratings yet

- Shubh Nivesh Brochure - BRDocument15 pagesShubh Nivesh Brochure - BRSumit RpNo ratings yet

- Accounting For Foreign Currency Transactions PDFDocument49 pagesAccounting For Foreign Currency Transactions PDFDaniel DakaNo ratings yet

- Extinguishment of ObligationsDocument13 pagesExtinguishment of ObligationsVirgie aquinoNo ratings yet

- Performance Appraisal of Gold ETFS in India: Finance ManagementDocument4 pagesPerformance Appraisal of Gold ETFS in India: Finance ManagementpatelaxayNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- Inbound Charges InvoiceDocument1 pageInbound Charges Invoicewiji astutik 534No ratings yet

- Forex Trading Machine EbookDocument0 pagesForex Trading Machine EbookMahadi MahmodNo ratings yet

- Métodos Cuantitativos: Alex Contreras MirandaDocument23 pagesMétodos Cuantitativos: Alex Contreras MirandaRafael BustamanteNo ratings yet

- Omtex Classes: "The Home of Success"Document4 pagesOmtex Classes: "The Home of Success"AMIN BUHARI ABDUL KHADERNo ratings yet

- Michelle Morrison - TransUnion Personal Credit ReportDocument23 pagesMichelle Morrison - TransUnion Personal Credit ReportchfthegodNo ratings yet

- Aids To TradeDocument2 pagesAids To TradeMeander ChenesaiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument1 pageStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGenial Manifold GroupNo ratings yet

- L2 Credit ManagementDocument17 pagesL2 Credit ManagementhansipereraNo ratings yet

- Preliminary ProspectusDocument229 pagesPreliminary ProspectusSteve LadurantayeNo ratings yet

- Service Marketing Mix or 7p'sDocument5 pagesService Marketing Mix or 7p'srasel_ustcNo ratings yet

- Aggregate Demand and SupplyDocument37 pagesAggregate Demand and SupplyFarooq AhmadNo ratings yet

- Intermediate Accounting 11th Edition Nikolai Test BankDocument61 pagesIntermediate Accounting 11th Edition Nikolai Test Bankesperanzatrinhybziv100% (27)

- DisruptionsandDigitalBankingTrends Wewegeetal200718Document43 pagesDisruptionsandDigitalBankingTrends Wewegeetal200718Khushi BhartiNo ratings yet

- What Is A Bank?: Roles of The Financial SystemDocument8 pagesWhat Is A Bank?: Roles of The Financial SystemMarwa HassanNo ratings yet

- Working Capital Management AssignmentDocument10 pagesWorking Capital Management AssignmentRitesh Singh RathoreNo ratings yet

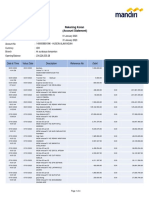

- Rek Koran Mandiri PT HAI Jan-April 2023Document14 pagesRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoNo ratings yet

- Aviva PLC - Interim Results Announcement 2013Document163 pagesAviva PLC - Interim Results Announcement 2013Aviva GroupNo ratings yet

- Icci BankDocument23 pagesIcci BankPhateh Krishna AgrawalNo ratings yet