Professional Documents

Culture Documents

1

Uploaded by

BookMaggotCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

BookMaggotCopyright:

Available Formats

The manufacturer of the A380 superjumbo has pledged to produce greener planes po

wered by radical "step change" technology before 2020 in response to airline cla

mour for more fuel-efficient aircraft.

Airbus said it would produce planes powered by "emerging technology" by the end

of the next decade, as the high oil price becomes a bigger driver for change tha

n the environmental debate.

Tom Enders, Airbus chief executive, said: "What we are looking for and what the

airlines are looking for is a step-change in terms of aircraft technology. The a

ircraft should be ready to go into service by the end of the next decade."

New planes such as the A380 and the Boeing 787 Dreamliner generate 20% less carb

on dioxide per journey than their predecessors did a decade ago, but airlines un

der threat from the crippling surge in oil prices are demanding planes that burn

fuel at an even lower rate. That, according to Airbus and Boeing, will take mor

e advanced technologies including major improvements by engine manufacturers Rol

ls-Royce and General Electric.

Both companies have looked at fuel cell and carbon capture technologies, but car

rying 300 passengers with engines based on those systems is currently impossible

. Ric Parker, head of research and technology at Rolls-Royce, told the Guardian

last year that fuel cell and carbon capture engines would be bigger than the pla

nes themselves, based on current designs.

Also under consideration is the "blended wing" design, which converts an airplan

e into a giant wing resembling a Stealth bomber. However, Boeing has so far limi

ted small prototypes to experiments for military customers and is not actively p

ursuing a passenger plane model.

Developing new airplane models is a costly business even when using established

technology, so planes that use "step-change" systems are likely to be approached

with caution by manufacturers and customers. The research and construction cost

s, allied to public doubts over new technologies being launched in a safety-obse

ssed industry, are much greater, analysts have warned.

Enders was speaking at the annual general meeting of the International

port Association alongside Scott Carson, chief executive of arch-rival

arson said the current dip in the airline market would affect aircraft

the short-term, but with production lines overbooked for years ahead,

ive the company more breathing space.

Air Trans

Boeing. C

orders in

it will g

"We recognise that there is going to be some effect on the total order book," he

said.

Airbus has predicted that 28,534 passenger and freight aircraft will be flying b

y 2026, more than double the current total of 13,284. Boeing is predicting a sim

ilar rise in air travel.

Aer Lingus, the Irish flag carrier, also weighed into the environmental debate b

y urging fellow airlines to hit back at the green lobby. Dermot Mannion, Aer Lin

gus chief executive, said governments had used airlines as "cash cows" over the

past three years and should now scrap taxes on an industry that is heading for a

$6bn (3bn) loss this year.

"Perhaps if there is any advantage to be gained from high fuel prices right now,

it is in the argument with the environmental lobby. They have had a freen run f

or two years. May be for the first time we can convince governments that the ind

ustry is not a cash cow, if it ever was one," he said.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- D4B8076AC8A-Servicing - 4-Cylinder 1 8L 2 0L 4V TFSI Engine (EA 888 Generation II) PDFDocument268 pagesD4B8076AC8A-Servicing - 4-Cylinder 1 8L 2 0L 4V TFSI Engine (EA 888 Generation II) PDFWiller Corporan Ruiz100% (7)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Information From Seneca II Manual & Multi Engine Oral Prep (Information From Rochester Air Center)Document45 pagesInformation From Seneca II Manual & Multi Engine Oral Prep (Information From Rochester Air Center)rajababu12100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sebu7173-12 BDocument7 pagesSebu7173-12 BSantos Junnior Hipolito SandovalNo ratings yet

- Vector Mechanics For Engineers-STATICSDocument15 pagesVector Mechanics For Engineers-STATICSBookMaggot0% (1)

- Weekly Nursing Student Planner and Study CalendarDocument2 pagesWeekly Nursing Student Planner and Study CalendarDavid BayerNo ratings yet

- Cover LetterDocument2 pagesCover LetterBookMaggotNo ratings yet

- Cover Letter!Document1 pageCover Letter!BookMaggotNo ratings yet

- 15Document5 pages15BookMaggotNo ratings yet

- Understanding The Concept of The Gear Ratio: 1.27 Inches / 2 0.635 InchesDocument1 pageUnderstanding The Concept of The Gear Ratio: 1.27 Inches / 2 0.635 InchesBookMaggotNo ratings yet

- 17) What Is The Symbol of The Field Effect Transistor?Document4 pages17) What Is The Symbol of The Field Effect Transistor?BookMaggotNo ratings yet

- Why Choose MBA MSC BUSDocument1 pageWhy Choose MBA MSC BUSBookMaggotNo ratings yet

- Composites SelectionDocument2 pagesComposites SelectionBookMaggotNo ratings yet

- Aircraft Refueling System Is A Refuelling Equipment For AircraftDocument1 pageAircraft Refueling System Is A Refuelling Equipment For AircraftBookMaggotNo ratings yet

- Test altimeter accuracy at room conditionsDocument1 pageTest altimeter accuracy at room conditionsBookMaggotNo ratings yet

- Exhausted After Long Registration on First Day at Aviation CollegeDocument1 pageExhausted After Long Registration on First Day at Aviation CollegeBookMaggotNo ratings yet

- The Silent EmergencyDocument5 pagesThe Silent EmergencyBookMaggotNo ratings yet

- QuestionaireDocument7 pagesQuestionaireBookMaggotNo ratings yet

- Defuel Aircraft: New Zealand Qualifications Authority 2006Document4 pagesDefuel Aircraft: New Zealand Qualifications Authority 2006Arie WibowoNo ratings yet

- 737sec1 PDFDocument10 pages737sec1 PDFBookMaggotNo ratings yet

- System DescriptionDocument2 pagesSystem DescriptionBookMaggotNo ratings yet

- Seat Pitch Position On Two Seats, One Behind The Other - It Is NOT The Legrest Area As SomeDocument3 pagesSeat Pitch Position On Two Seats, One Behind The Other - It Is NOT The Legrest Area As SomeBookMaggotNo ratings yet

- System DescriptionDocument10 pagesSystem DescriptionBookMaggotNo ratings yet

- Typical Aircraft Charging CircuitDocument1 pageTypical Aircraft Charging CircuitBookMaggotNo ratings yet

- Assignment CabinDocument5 pagesAssignment CabinBookMaggotNo ratings yet

- Project p-37Document2 pagesProject p-37BookMaggotNo ratings yet

- The Problems of Instrument Part On Jet Streaming AircraftDocument2 pagesThe Problems of Instrument Part On Jet Streaming AircraftBookMaggotNo ratings yet

- RECOMMENDATIONSDocument4 pagesRECOMMENDATIONSBookMaggotNo ratings yet

- Assignment Fire 1Document14 pagesAssignment Fire 1BookMaggotNo ratings yet

- Toefl 3Document8 pagesToefl 3sangho,wooNo ratings yet

- PENTINGDocument5 pagesPENTINGBookMaggotNo ratings yet

- Toefl 2Document8 pagesToefl 2sangho,wooNo ratings yet

- RecipDocument5 pagesRecipBookMaggotNo ratings yet

- Maintaining Generators Extends Lifespan Over 50,000 HoursDocument70 pagesMaintaining Generators Extends Lifespan Over 50,000 HoursbrahimNo ratings yet

- Electrical Wiring Diagrams PDFDocument39 pagesElectrical Wiring Diagrams PDFfely67% (3)

- 07a60304 - Dynamics of MachineryDocument8 pages07a60304 - Dynamics of MachineryRajaganapathy GanaNo ratings yet

- GMOD Engine Build Manual Sections 4-11 02152016Document51 pagesGMOD Engine Build Manual Sections 4-11 02152016ullwnNo ratings yet

- Engine Mechanical (D6A, D8A)Document168 pagesEngine Mechanical (D6A, D8A)Manuales De Maquinaria JersoncatNo ratings yet

- LG Series: 28kVA - 50kVADocument8 pagesLG Series: 28kVA - 50kVALuis Maragaño AguilarNo ratings yet

- Mariners Repository - Propeller Inspection, Defects and RepairsDocument13 pagesMariners Repository - Propeller Inspection, Defects and RepairsATT2016No ratings yet

- 16th-Exam-Paper-3-Sup Set B 2 PDFDocument22 pages16th-Exam-Paper-3-Sup Set B 2 PDFSaurabh RautNo ratings yet

- Varisco CatalogueDocument32 pagesVarisco CatalogueEli Naguit100% (1)

- SpecificationDocument2 pagesSpecificationQ8123No ratings yet

- 840 Series Hygienic Pump: Watson-Marlow PumpsDocument2 pages840 Series Hygienic Pump: Watson-Marlow PumpsCesar Armando Hernandez ViteNo ratings yet

- Module Configuration Parameters OverviewDocument2 pagesModule Configuration Parameters Overviewedgarcoo100% (1)

- Klingersil C-4430 DataDocument2 pagesKlingersil C-4430 DataangelelpedrosaNo ratings yet

- Energy Reports: Prachuab Peerapong, Bundit LimmeechokchaiDocument13 pagesEnergy Reports: Prachuab Peerapong, Bundit LimmeechokchaikhaledNo ratings yet

- Adjusting total ignition advance vs RPM and MAPDocument14 pagesAdjusting total ignition advance vs RPM and MAPFirdaus AbdullahNo ratings yet

- 404a 22G1Document5 pages404a 22G1ddzoningcomNo ratings yet

- Hitachi Wheel Loader ZW90Document7 pagesHitachi Wheel Loader ZW90Leandro SalNo ratings yet

- Land Rover 2010 06 Defender My07 Workshop Manual CompleteDocument20 pagesLand Rover 2010 06 Defender My07 Workshop Manual Completethomas100% (38)

- Sample Problem - Pump Power Calculations - EnggcyclopediaDocument6 pagesSample Problem - Pump Power Calculations - EnggcyclopediaMuhammadObaidullahNo ratings yet

- Capacitor BankDocument49 pagesCapacitor Bankishika sharma100% (1)

- Diploma Teknologi Automotif: Principle of Enjin 2 Tajuk Tugasan:Top OverhaulDocument15 pagesDiploma Teknologi Automotif: Principle of Enjin 2 Tajuk Tugasan:Top Overhaularulz6080% (1)

- Dominar 400 Abs Non Abs SPCDocument82 pagesDominar 400 Abs Non Abs SPCAlex Philip0% (1)

- Basic Automobile Design: Prepared By, Chirag BhangaleDocument66 pagesBasic Automobile Design: Prepared By, Chirag BhangaleMustapha LAARAJNo ratings yet

- Syllabus of B.E. Mechanical Engineering ProgrammeDocument131 pagesSyllabus of B.E. Mechanical Engineering ProgrammegetflybondNo ratings yet

- Vane PumpsDocument3 pagesVane PumpsSudheer Nair100% (1)

- TIP Mechanical Engineering Final Exam for Power Plant DesignDocument17 pagesTIP Mechanical Engineering Final Exam for Power Plant DesignHerson Fronda BucadNo ratings yet

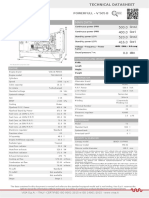

- 500kW Diesel Generator Technical SpecificationsDocument1 page500kW Diesel Generator Technical SpecificationsSamuel J. GamezNo ratings yet