Professional Documents

Culture Documents

Assignment Instructions

Uploaded by

Mohanish SoniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Instructions

Uploaded by

Mohanish SoniCopyright:

Available Formats

Instructions for Assignments (Management of Banking, Term V.

PGDM

2015-17)

General Instructions:

There are 5 group assignments for the course that will carry a total 65%

weightage for the course evaluation. The assignment objectives, instructions,

marks, and deadlines are given in the following pages for each assignment.

Each group has to put in a maximum of 350 contact hours to do proper justice to

the assignments. For groups of 7 members, this works out to 50 contact hours

per student. Since most of the assignments deal with aspects that are of

relevance in the context of todays banking business environment, the

assignments submitted by each group shall be shared (by me) with all students

enrolled in the course. It may be useful from a job-market interview standpoint

as well to go through the assignments done by other groups in addition to your

own work on the assignments.

For some assignments, I have given the deadlines whereas for others, I will

communicate the deadlines on completion of the relevant sessions.

Instructions for Assignments (Management of Banking, Term V. PGDM

2015-17)

Assignment 1: A Friendly Conversation (Total 8 Marks Part 1 3 Marks;

Part 2 - 5 Marks)

Assignment Objective: The primary objective of this assignment is to improve

your understanding of the various macro-issues surrounding the business of

banking and your ability to display a logical approach to the analysis of the

industry.

Part 1: For this part, each group has to summarize the different points of view put

forth by the protagonists in the article on the following eight hotly debated issues

in banking (discussed during the course)

Are banks special or not? - Devanjan

Banks and external macro-environment- Devanjan

Regulation as the provider of incentives/disincentives- Mohanish

Deposit Insurance and Capital Maintenance requirements - Mohanish

Liquidity Maintenance & Management- Raghav

Risk Management & Financial Innovation- Souvik

Off- Balance Sheet Activities of Banks & Securitization- Rohit

Excessive Risk Taking and Bank Failures- Nisarga

The assignment should be submitted in MS-Word or PDF format and must not

exceed 4 pages.

Assignment Deadline: Already submitted by all groups

Part 2: For this part, each group has to take the side of any one of the different

views put forth by the protagonists for each of the eight issues and provide

justifications for why they subscribe to such point of view. The justification must

be based on and related to the concepts covered during the discussions in the

first module of the course.

The assignment should be submitted in MS-Word or PDF format and must not

exceed 8 pages.

Assignment Deadline: Midnight of 17th October 2016

Instructions for Assignments (Management of Banking, Term V. PGDM

2015-17)

Assignment 2: Application of the Functional Framework (Total 10 Marks)

Assignment Objective: The primary objective of this assignment is to improve

your ability to apply a systematic framework (the functional framework in this

case) to understand the role of a category of financial intermediaries (e.g.

insurance companies, commercial banks, payment banks, Housing finance

companies etc.)

The functional framework that we have covered during the course is an

interesting and unique framework that allows one to identify the role of a

particular financial market, financial instrument, or a category of financial

institutions in an economy. As per the functional framework, the functions to be

performed by the financial system in an economy remain stable over time, but

the products, markets, and financial institutions that perform the functions

evolve over time. The main driver of such evolution is the carrying out of the

functions in the most efficient (i.e. lowest transaction cost) manner.

Each group has to select a financial product or a category of financial

intermediaries and apply the functional framework. The selected financial

product/financial intermediaries category has to be evaluated in terms of its role

in the six functions. It is not necessary for the product/financial intermediaries to

be involved in all of the six functions and some may be involved in only a few of

the six functions. For the functions in which the financial product/intermediaries

have a role, you are required to

A) Describe the mechanisms by which the function(s) is/are performed by

the product/intermediaries- Rohit

B) Identify the segment of the economy for which the functions are

provided (e.g. Microfinance Institutions primarily cater to the

unbanked/under-banked segment of the population) - - Mohanish

C) Identify the competitors/alternatives for performing the same functionDevanjan

D) Rank the competitors/alternatives using non-quantitative arguments Souvik

E) Draw up your inferences on the future role of the selected financial

product/financial intermediary category. - Nisarga

The assignment should be submitted in MS-Word or PDF format and must not

exceed 10 pages.

Assignment Deadline: Midnight of 20st October 2016

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- StrawmanDocument56 pagesStrawmanLisaNewlin0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Dockers Inc Proof of CashDocument1 pageDockers Inc Proof of CashJoemar LegresoNo ratings yet

- Cheque Issue & MGMTDocument51 pagesCheque Issue & MGMTVincent100% (1)

- Sample MoaDocument7 pagesSample MoaKool GuyNo ratings yet

- Account Statement 010122 31032Document40 pagesAccount Statement 010122 31032Ankur GuptaNo ratings yet

- Notice SamreenDocument5 pagesNotice Samreenmakwana100% (1)

- Role of Central Bank in Developing Economy - A Case Study of IndiaDocument77 pagesRole of Central Bank in Developing Economy - A Case Study of Indiasheemankhan100% (12)

- Integrated Payments APIDocument41 pagesIntegrated Payments APIsebichondoNo ratings yet

- Rural Bank Wins Case Against Central Bank Penalty ChargeDocument1 pageRural Bank Wins Case Against Central Bank Penalty ChargechatoNo ratings yet

- Product Mapping - V1.0Document13 pagesProduct Mapping - V1.0Mohanish SoniNo ratings yet

- 2014wesp Country Classification PDFDocument8 pages2014wesp Country Classification PDFPradip KadelNo ratings yet

- Einstein Fridge Design Can Help Global CoolingDocument2 pagesEinstein Fridge Design Can Help Global CoolingMohanish SoniNo ratings yet

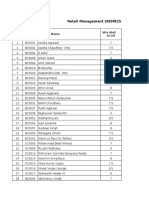

- Marks of REM 15-17Document6 pagesMarks of REM 15-17Mohanish SoniNo ratings yet

- Coca ColaDocument2 pagesCoca ColaMohanish SoniNo ratings yet

- Idea Mid TermDocument6 pagesIdea Mid TermMohanish SoniNo ratings yet

- Vic HaarDocument2 pagesVic HaarMohanish Soni0% (1)

- Retailers Insights: Airtel Was Generally Preferred by Higher Income Groups Because ofDocument2 pagesRetailers Insights: Airtel Was Generally Preferred by Higher Income Groups Because ofMohanish SoniNo ratings yet

- Retailers Insights: Airtel Was Generally Preferred by Higher Income Groups Because ofDocument2 pagesRetailers Insights: Airtel Was Generally Preferred by Higher Income Groups Because ofMohanish SoniNo ratings yet

- Transmission Line Case StudyDocument15 pagesTransmission Line Case StudyMohanish SoniNo ratings yet

- Risk Management - Workshop For Class BMDocument75 pagesRisk Management - Workshop For Class BMMohanish SoniNo ratings yet

- Office of The Executive Engineer, Transmission Line Maintenance Division-Iii, UdhampurDocument3 pagesOffice of The Executive Engineer, Transmission Line Maintenance Division-Iii, UdhampurMohanish SoniNo ratings yet

- Project Management TechniquesDocument70 pagesProject Management TechniquesMohanish SoniNo ratings yet

- Devanjan PJM Mid TermDocument30 pagesDevanjan PJM Mid TermMohanish SoniNo ratings yet

- Emergence of Payment Banks in IndiaDocument4 pagesEmergence of Payment Banks in IndiaMohanish SoniNo ratings yet

- Retail MNT B15088Document1 pageRetail MNT B15088Mohanish SoniNo ratings yet

- 3B FinalDocument43 pages3B FinalMohanish SoniNo ratings yet

- Hazina Loan Form Revised March 2021Document4 pagesHazina Loan Form Revised March 2021benson17yatorNo ratings yet

- Navi Consumer Loans Case SubmissionDocument4 pagesNavi Consumer Loans Case SubmissionABHIRAM MOLUGUNo ratings yet

- Federal Laws of EthiopiaDocument42 pagesFederal Laws of EthiopiaSolomon Tekalign100% (2)

- Other Bank Functions Estrella, Jin Paula CDocument6 pagesOther Bank Functions Estrella, Jin Paula CJin EstrellaNo ratings yet

- Calculate Savings, Loans, Annuities and Present/Future ValuesDocument1 pageCalculate Savings, Loans, Annuities and Present/Future ValuesNaveed NawazNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationKhalid omer Khalid alaminNo ratings yet

- Deed of UndertakingDocument5 pagesDeed of UndertakingPeter Roderick M. OlpocNo ratings yet

- FABM2 Q3 Module 8Document28 pagesFABM2 Q3 Module 8JADE DINGLASA FRAGANo ratings yet

- CA Inter Advanced Account - Regular Course by CA P S BeniwalDocument346 pagesCA Inter Advanced Account - Regular Course by CA P S BeniwalHarry PotterNo ratings yet

- Most Important Terms & ConditionsDocument6 pagesMost Important Terms & ConditionsshanmarsNo ratings yet

- 2020 113 Taxmann Com 36 SAT Mumbai 10 10 2019Document23 pages2020 113 Taxmann Com 36 SAT Mumbai 10 10 2019Sejal LahotiNo ratings yet

- Icici Syn HRMDocument18 pagesIcici Syn HRMbhatiaharryjassiNo ratings yet

- Mercial ApplicationsDocument7 pagesMercial ApplicationsChris TonNo ratings yet

- Industry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaDocument12 pagesIndustry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaBhakti GuravNo ratings yet

- Income Under The Head Capital Gains Section 45 (1) : (Charging Section)Document9 pagesIncome Under The Head Capital Gains Section 45 (1) : (Charging Section)hemantNo ratings yet

- Important Simple Interest Practice Questions for Bank ExamsDocument15 pagesImportant Simple Interest Practice Questions for Bank ExamsKothapalli VinayNo ratings yet

- TITLE PAYMENTDocument10 pagesTITLE PAYMENTJeff FernandezNo ratings yet

- Syllabus For Agribusiness Management (COQP01)Document80 pagesSyllabus For Agribusiness Management (COQP01)Sachin PalNo ratings yet

- Guide to Distressed Investing in IndiaDocument10 pagesGuide to Distressed Investing in IndiacbuhksmkNo ratings yet

- ICRA Detailed Report On Indian Broking Industry, Mar 04, 2013 PDFDocument26 pagesICRA Detailed Report On Indian Broking Industry, Mar 04, 2013 PDFvivektolatNo ratings yet

- Thomson Reuters Knowledge to Act OverviewDocument19 pagesThomson Reuters Knowledge to Act OverviewSashi DandamudiNo ratings yet