Professional Documents

Culture Documents

Chegg - A Textbook Story of Fiction

Uploaded by

Copperfield_ResearchCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Chegg - A Textbook Story of Fiction

Uploaded by

Copperfield_ResearchCopyright:

COPPERFIELD RESEARCH

-------------------------------------------------------------------

Chegg, Inc. (CHGG) A Textbook Story of Fiction

Exposing the promotional business pivot built on financial shenanigans, the

manipulation of business metrics & pro-forma results, shareholder value

destruction, and a structurally broken business model

Fair Value - $2.00 per share, 75% downside

________________________________________________________________________1

COPPERFIELD RESEARCH

-------------------------------------------------------------------

IMPORTANT Disclaimer Please read this Disclaimer in its entirety before

continuing to read our research opinion. You should do your own research and

due diligence before making any investment decision with respect to securities

covered herein. We strive to present information accurately and cite the sources

and analysis that help form our opinion. As of the date this opinion is posted, the

author of this report has a short position in the company covered herein and

stands to realize gains in the event that the price of the stock declines. The

author does not provide any advanced warning of future reports to others.

Following publication of this report, the author may transact in the securities of

the company, and may be long, short, or neutral at any time hereafter regardless

of our initial opinion. To the best of our ability and belief, all information

contained herein is accurate and reliable, and has been obtained from public

sources we believe to be accurate and reliable. However, such information is

presented as is, without warranty of any kind whether express or implied.

The author of this report makes no representations, express or implied, as to the

timeliness or completeness of any such information or with regard to the results

to be obtained from its use. All expressions of opinion are subject to change

without notice and the author does not undertake to update or supplement this

report or any of the information contained herein. This is not an offer to buy any

security, nor shall any security be offered or sold to any person, in any

jurisdiction in which such offer would be unlawful under the securities laws of

such jurisdiction.

________________________________________________________________________2

COPPERFIELD RESEARCH

------------------------------------------------------------------Executive Summary

Question: What do you do when your stock price declines by 50%, your diluted share count

doubles due to egregious stock based compensation and poorly structured financing rounds

with ill-conceived ratchets, and your business model is structurally broken less than two years

after your mispriced IPO?

Answer: Why of course you announce a business model pivot on the back of nebulous nonGAAP metrics, concoct a story about a low-cost customer acquisition channel that ignores

intense competition from Amazon.com and other economic realities, alter past financial

metrics lower to overstate current period growth, create ebullient out-year financial targets

only to surreptitiously adjust the target date and growth rates when results are below plan,

reclassify your pro-forma revenue definition multiple times while including physical goodsrelated revenue in your newly classified digital revenue category (attracting SEC

correspondence in the process), further inflate revenue growth rates by recording one-time

inventory transfers as profitless revenue, boast about your strong 80% [monthly] customer

retention rate which translates into something closer to 93% annual churn when the fine

print is read, claim to grow subscribers 40% despite your own subscriber figure from the prior

years press release suggesting growth of 15%, inflate EBITDA by increasing capitalized

expenses 340% year-over-year (as a % of revenue), make 10 acquisitions that obfuscate

organic growth (and subsequently write-off multiple deals), and exclude non-recurring

items from adjusted financial results for ten consecutive quarters to magically transform deep

operating losses and cash burn into marginally positive adjusted EBITDA. And that run-on

sentence is just the beginning

Sell-side promotions and hope-based investments are often built on the foundation of a

strategic business model pivot. These stories dismiss years of disappointing operating and

financial execution as yesterdays news. Management teams and their cadre of sell-side

promoters instead encourage investors to focus on non-GAAP metrics and aspirational target

models years into the future. As a result, accounting warts, irreconcilable financial results, and

operating inconsistencies that would traditionally cause severe stock price declines, can be

marginalized and ignored at least until the story is busted.

We believe Chegg, Inc. (CHGG) is an orchestrated promote. The carefully constructed,

disingenuous bull thesis, is that CHGG is in the midst of a transition from a low margin

textbook rental business into a high growth, high margin digital educational services

company. This report extensively details why we believe CHGG has fabricated pro-forma

financial results, misrepresented its unit economics, and repeatedly provided misleading

metrics that are subsequently altered. Based on recent correspondence with the Securities and

Exchange Commission (SEC), and conspicuous changes to its financial reporting, we believe

CHGGs shenanigans discussed herein are under the microscope.

Like most promotes, CHGG and its sell-side partners use buzzwords and endorsements that

appear to legitimize the story. For example, the sell-side points out that the company was

initially funded by prominent venture capital firms such as Foundation Capital, Insight

________________________________________________________________________3

COPPERFIELD RESEARCH

------------------------------------------------------------------Venture Partners, and Kleiner Perkins. The CEO, who was the former COO at Yahoo!, is a

veteran Silicon Valley executive who talks the talk when discussing the transition from a

capital intensive textbook rental business to a high margin digital services business. On its

most recent earnings call, the word Platform was used eleven times to describe the new

operating model, while Google, Netflix, Spotify, and Uber were audaciously listed as

compelling macro trend comps in the most recent investor deck. Bulls paint a compelling

picture of a textbook rental customer base that creates a low cost competitive advantage for

Chegg Services to acquire customers. Without appropriate diligence, managements elevator

pitch sounds enticing to retail investors and resonates with analysts.

We believe there is one problem with the compelling investment storyIT IS FICTION.

CHGGs strategic business model pivot has been marked by underperforming acquisitions,

weak execution, intense competition, and value destruction. Worse still, we believe CHGGs

management has utilized accounting gimmickry, deceptive segment reorganizations, and nonGAAP adjustments that directly violate SEC reporting standards. Management has

consistently inflated the companys non-GAAP profitability by excluding acquisition-related

compensation costs, transitional logistic charges, and/or restructuring charges for 10

consecutive quarters, while simultaneously including one-time gains on textbook

liquidations. Managements vague pro forma revenue metric is devoid of the reconciliations

required by the SECs Reg. G, while the companys aggressive and inconsistent investor

presentations appear designed to consistently overstate organic revenue growth.

CHGGs core textbook rental business is in secular decline marked by commoditization and

intense competition from Amazon, Pearson, and others. By managements own admission, the

textbook rental segment, which serves as the low-cost customer acquisition funnel for digital

services, will decline by at least 10% in 2016 and 2017. Rather than candidly address the

pervasive challenges in CHGGs core business, management has pursued a digital business

strategy through subscale, poorly performing acquisitions. Over the last six years, CHGG has

acquired 10 companies, of which four have been total write-offs, and just one has performed

to plan.

The amalgamation of these ten acquired properties represents CHGGs supposed high-growth,

high-margin digital services segment. But the facts tell a different story. We believe CHGGs

management made multiple alterations to its segment reporting to obfuscate the floundering,

low visibility, dynamics of its digital segment. Previously, management stated that its allimportant digital revenue growth would be 60% in 2016. Our analysis suggests 60% growth is

a blatant misrepresentation and digital revenue growth will be just 16% in 2016. Additionally,

based on CHGGs own disclosures, we show that customer churn in digital services is

approximately 93% annually. And while management claims its fastest growing services

business, Chegg Tutors, will pull blended corporate margins higher, our analysis shows this

segment generates a mere 30% gross margin.

We believe management has persistently altered its reporting methods to flatter digital

growth. As such, it comes as no surprise that CHGGs historical revenue reporting segments

________________________________________________________________________4

COPPERFIELD RESEARCH

------------------------------------------------------------------are replete with discrepancies that fail to reconcile from quarter-to-quarter. In the last three

years, CHGG has reported three different revenue derivations, which we believe blatantly

overstates digital revenue growth and masks an inability to hit financial targets. The SEC

appears to share our confusion based on its correspondence with CHGG management asking

for an explanation for certain revenue segment reporting.

While managements promotional cadence has been self-enriching, shareholders have

suffered. In CHGGs 10-year history, management has raised more than $400 million,

including $180 million from the companys IPO just three years ago. Despite incessant capital

raises, CHGG has (i) never generated a profit, (ii) has an accumulated deficit of $370 million,

and (iii) will end 2016 with less than $60 million of cash in the bank before considering $35

million of acquisition earn-out obligations and expected free cash flow burn of $25 million.

No wonder sell-side analysts have been such unabashed supporters!

Like all promotes, the too-good-to-be-true story can only persist for so long before facts

trump fiction. While CHGG beat sandbagged Q3 guidance (Chegg Services revenue was

down sequentially despite only a partial quarter of its Imagine Easy acquisition in Q216), the

company guided Q4 below consensus estimates and cut 2017 expectations. We believe more

negative revenue revisions are coming. With CHGGs accounting shenanigans exposed,

competitive pressures intensifying, and 2017 guidance that appears highly unobtainable, we

believe the rubber will soon meet the road. CHGGs pivot is nearly complete and in 2017

management can no longer utilize its pro-forma revenue cookie jar to hide poor results. We

believe CHGG is trapped and managements only options are (i) attempt larger acquisitions to

plug the impending revenue hole, or (ii) confess that actual growth rates and profitability are

less than what management has led investors to believe.

We believe CHGGs intrinsic value is less than $2.00 per share, which would represent

75% downside from the current trading price.

*****************

This initial report details the following topics, representing just the tip of the shenanigans on

the CHGG iceberg:

1) CHGGs inauspicious background and value-destroying CEO

I. Disastrous pre-IPO ratchets have caused substantial shareholder dilution

Increasingly onerous ratchet conditions on multiple rounds of pre-IPO financing and

indefensible stock-based compensation have resulted in the unjust enrichment of CHGGs

management at the expense of its unaffiliated shareholders. In less than three years,

shareholders have suffered nearly 100% dilution.

II. Dan Rosensweigs dubious leadership track record

Mr. Rosensweig served as CEO or COO of three companies prior to CHGG. He destroyed

significant value at all three companies.

________________________________________________________________________5

COPPERFIELD RESEARCH

------------------------------------------------------------------

Mr. Rosensweig was most recently CEO of Guitar Hero, one of the most popular video

game franchises in history. Under Mr. Rosensweigs stewardship, sales collapsed, a

leadership change ensued within one year, and Guitar Hero was temporarily discontinued.

2) CHGGs textbook rental business is commoditized & faces increased competition

A bullish perspective on CHGG assumes the companys textbook rental business can

serve as a low cost customer acquisition channel for its higher growth, higher margin

digital segment. This thesis appears to be false. Based on our analysis, CHGGs textbook

rental business has decelerated for three consecutive years and will decline by nearly 10%

in 2016.

Amazon has entered the textbook rental business and is aggressively targeting CHGGs

core customer base. Barnes & Noble Education, which operates over 750 college

bookstores, recently launched a price match guarantee.

Based on reviews of textbook rental comparison sites, CHGG is generally the most

expensive rental option.

3) Chegg Services stability, margins, and growth characteristics are misrepresented

I. Chegg Services faces persistently high customer churn

CHGG management claims Chegg Services renewal rate is 80%. However, management

does not openly highlight that this is a monthly renewal rate. Annual churn is

approximately 93%. Claims that Chegg Services is a recurring business are false.

II. Chegg Tutors pricing implies management misrepresented gross margins

Management claims overall gross margins will be driven substantially higher by growth In

Chegg Services. However, public disclosures do not support managements claims.

CHGGs fastest growing digital business, Chegg Tutors, appears to have gross margins of

just ~30%.

III. Management has historically squandered shareholder capital through poor acquisitions

In the last six years, CHGG has spent nearly $140 million of shareholder capital on 10

acquisitions.

4 of the 10 acquired companies/products have been shut down or discontinued, while 3

acquisitions are behind plan.

Based on our analysis, we believe just one of managements growth acquisitions is

performing to plan.

IV. Chegg Services subscriber growth is significantly overstated

While CHGG management claims subscriber growth accelerated in Q316 to over 40%,

we believe management furtively revised the metric to exclude declining eTextbook

customers and included Imagine Easy subscribers.

Based on our analysis, normalized subscriber growth decelerated to just 15% in Q3.

4) CHGG has consistently misrepresented its financial & segment reporting

1. Management has repeatedly reorganized reporting segments to artificially inflate digital

growth

Since CHGG came public three years ago, management has reported revenue under three

different segment derivations.

________________________________________________________________________6

COPPERFIELD RESEARCH

------------------------------------------------------------------

Each revenue reclassification appears to coincide with a specific quarter in which

management would have failed to achieve its financial targets.

II. Normalized digital revenue growth is significantly below managements target

Based on company disclosures, we believe normalized digital revenue growth would be

just 16% in 2016 had management maintained consistent reporting segments.

III. Multiple revenue reclassifications have discrepancies with reported pro forma financials

In August 2015, CHGG management publicly stated pro forma revenue was $142.7

million in 2014.

In February 2016, the same 2014 historical revenue was inexplicably adjusted downwards

by 6% to $134 million.

We believe the alteration of historical pro forma results was intended to set a lower bar in

previous years to artificially enhance perceived current year growth.

IV. The SEC requested information regarding CHGGs revenue reclassifications

In December 2015, the SEC sought an explanation for why management included

CHGGs Ingram commission on physical textbook rentals in its digital segment.

CHGG management defended its segment reporting in correspondence with the SEC.

However, just two months later, management again altered its revenue classifications in

what appeared to be another brazen tactic to obfuscate organic growth.

V. Did CHGGs inventory transfer sales to Ingram artificially inflate revenue?

Under CHGGs GAAP filings, the companys Sales line item includes just-in-time sales

of print textbooks and other required materials.

Our analysis shows Sales revenue should correlate with Rental revenue. However, in

2014 and 2015, Sales revenue inexplicably re-accelerated, diverging from Rental

revenue declines.

We believe CHGG artificially inflated revenue growth by recording initial inventory

transfers to Ingram as profitless revenue.

VI. CHGG appears to be in direct violation with SEC Regulation G

Despite the SECs recent Compliance and Disclosure Interpretations on perceived nonGAAP financial reporting abuses, CHGG management appears to willfully disregard

Regulation G with its reporting of non-GAAP profitability and revenue metrics.

5) Managements egregious compensation & other conflicts of interest

I. Abusive stock compensation transfers value from investors to management

CHGG spends nearly 23% of its pro forma revenue on stock-based compensation, which

is more than 500% greater than its peer group.

Sell-side models appear to neglect over 11 million anti-dilutive shares from the

companys current share count because CHGG is unprofitable.

At market prices, a potential acquirer would need to absorb a 12% increase in the

outstanding shares based on vesting schedules and current options.

II. Managements excessive pay is not tied to performance

In 2015, CHGG failed to achieve all performance based compensation targets and the total

shareholder return was negative. In recognition of this performance, the Board of

Directors rewarded Mr. Rosensweig with $10 million of compensation.

________________________________________________________________________7

COPPERFIELD RESEARCH

------------------------------------------------------------------

Since coming public three years ago, CHGGs stock price has declined by 45%,

underperformed the Russell 2000 by 60%, and management has repeatedly missed

performance targets. Nonetheless, Mr. Rosensweig has received nearly $24 million in

compensation.

6) Weak operating performance, cash burn, & acquisition earn-outs impair the

balanced sheet

I. Management has misrepresented recent business momentum

In Q216, CHGG management boasted that EBITDA more than doubled year-over-year.

Excluding one-time gains/losses on textbooks liquidations, EBITDA actually declined

year-over-year.

II. Significant increases in capitalized expenses may be overstating EBITDA

After exiting textbook rentals, CHGG should have minimal capital intensity.

Historically CHGG spent 2-3% of revenue on capital expenditures. However, YTD16

capitalized expenditures inexplicably jumped to 9% of revenue.

III. Management quietly pushed out its target operating model by one year

Throughout CHGGs transition from a textbook rental company to a digital business,

management has stated its target operating model of 25% revenue growth, 60% gross

margins, and 25% EBITDA margins would be achieved by 2017.

In early 2016, without explanation, management inexplicably moved its target model date

to 2018 and lowered its growth target in an investor presentation.

IV. CHGGs business model(s) perpetually destroy capital and burn cash

In its most recent earnings call, management stated CHGG generates a lot of cash.

This statement is patently false. In less than three years, CHGGs cash balance has

declined from $160 million to less than $60 million.

Despite relying on excessive stock-based compensation in lieu of cash compensation,

management expects to burn ~$25 million of free cash flow in 2016.

V. Imagine Easy earn-out payments may impair CHGGs balance sheet

In addition to paying $25 million to close its Imagine Easy acquisition, CHGG committed

to a $35 million incremental earn-out, with $27 million due in 2017.

With approximately $55 million of cash at year-end and an annual burn rate exceeding

$25 million, we believe CHGG will need to access the capital markets in 2017.

7) Rubber meets the road in 2017 & VCs and insiders are voting with their feet

I. CHGG will struggle to meet 2017 guidance

Based on our analysis Chegg Services revenue has decelerated for three years to under

30% growth. To achieve 2017 guidance, the segments growth must meaningfully

reaccelerate.

II. VCs and insiders heading for the exits before the next reset

Three of CHGGs top six pre-IPO investors have sold their entire positions for a loss.

Since August 2016, CHGGs Chief Product Officer has sold more than 80% of his

holdings.

8) CHGG is significantly overvalued

________________________________________________________________________8

COPPERFIELD RESEARCH

------------------------------------------------------------------I. CHGG trades at a substantial premium to education-focused peers and a broader consumer

internet basket

CHGG trades at 42x EV/EBITDA compared to 5x -7x for publicly traded educationfocused peers.

Despite GAAP revenue declines, decelerating pro forma revenue growth, negative free

cash flow, and a structurally broken business model, CHGG trades at a substantial

premium to both AMZN and LNKD.

II. Generous valuation implies 75%+ downside

Applying a generous peer group valuation multiple, we believe CHGGs intrinsic value is

$1.72, or 75% lower than recent market prices.

________________________________________________________________________9

COPPERFIELD RESEARCH

------------------------------------------------------------------1) CHGGs inauspicious background and value-destroying CEO

I. Disastrous pre-IPO ratchets have caused substantial shareholder dilution

There will be a time when this bull market ends, and when it does these ratchets will be very

painful

*** Neeraj Agrawal, General Partner at Battery Ventures1

CHGG was founded in 2005 by Aayush Phumbhra, an Iowa State graduate student, with the

objective of saving college students money by allowing them to rent rather than buy

textbooks. 2 Since its inception, CHGG has raised more than $400 million, or 67% of its

current $600 million enterprise value. 3 As we will discuss in detail later, CHGG has

recklessly destroyed over $300 million of capital through operating losses, capital

expenditures, and disappointing acquisitions.

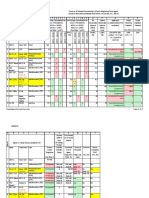

CHGG Fundraising Analysis

$ 000s

Round

Type

Date

1

VC-1st

08/31/05

2

VC-2nd

06/30/08

3

VC-3rd

12/17/08

4

VC-4th

11/19/09

5

Debt

11/29/09

6

Corporate 08/31/10

7

VC-5th

03/31/12

8

IPO

11/13/13

Total

Source: VentureSource.

Amount

4,230

4,700

25,020

57,000

55,000

75,000

25,000

180,000

425,950

Valuation

8,080

21,300

66,190

551,550

N/A

714,600

655,970

1,217,850

How has CHGG managed to raise nearly half-a-billion dollars despite never generating a

profit, never trading above its IPO price, and attempting to redesign its operating model two

years after going public? One word ratchets. According to a Wall Street Journal article,

Valuation-Hungry Startups Should Heed Cheggs Disastrous IPO Ratchet, CHGGs

management chose to grant onerous ratchet provisions to investors to achieve the highest

possible valuation. 4 While it may be easy to argue the past is the past, we believe

management teams have hardwired DNA, and a troubling pattern exists at CHGG of selfserving actions that conflict with the interests of unaffiliated shareholders.

These ratchet provisions provide investors in specific rounds incremental shares if future

capital raises occur below a specified price (e.g., at IPO). While ratchet provisions provide

anti-dilution protection to certain investors, early investors and employees can suffer extreme

dilution.

CHGG management first offered ratchet provisions as part of the companys series D

financing round in 2009. 5 According to an early angel investor, and former CHGG board

________________________________________________________________________10

COPPERFIELD RESEARCH

------------------------------------------------------------------member, Oren Zeev, CHGG received multiple financing offers without ratchets. Nevertheless,

CHGGs management chose the ratchet deal because it provided an initial 20% higher

valuation.6 In exchange for this paper-based wealth creation, CHGG provided Insight Venture

Partners a 2x ratchet provision. Simply, Insight would either double their money, or

CHGGs management would issue additional shares to Insight at the expense of earlier

investors and employees.7

Despite the notoriety of ratchet rounds, CHGG management raised two subsequent VC rounds

with ratchet provisions, each with conditions more onerous than the last. How aggressive was

management? Two of CHGGs fundraising rounds required the company to IPO at a price

greater than $25 in order to avoid triggering the ratchets.8 Due to clear missteps on the part of

management, CHGGs final round of pre-IPO financing, its Series F round, was raised at a

price below its previous two rounds (the dreaded down round). Although management must

have known the company faced a significant overhang due to its prior two ratchet rounds at

prices CHGG would not achieve, management again chose to raise capital with a ratchet

provision at $12.00.9

When CHGG filed its public prospectus, the IPO price range was set between $9.50 and

$11.50.10 Despite tepid institutional interest in its IPO, CHGG management priced its IPO at

$12.50, thus avoiding dilution from the additional Series F ratchet. While management was

protected, the stock price declined by 23% on its first day of trading and has never traded at

its IPO price. Due to the companys prior two capital raises with ratchet provisions, CHGG

was forced to issue 13.1 million additional shares on its IPO, which resulted in 25% dilution

to new shareholders.

Source: CHGG S-1.

Because of CHGGs costly ratchets and egregious stock compensation grants (detailed later),

pre-IPO shareholders have suffered nearly 90% dilution in less than three years.

________________________________________________________________________11

COPPERFIELD RESEARCH

------------------------------------------------------------------CHGG Shares Outstanding Analysis

000s

Shares Shares Issued

Outstanding

or Issuable

Pre-IPO

54,257

Post-Ratchets

67,328

13,072

Post-IPO

81,728

14,400

Q3 16 Basic

91,059

9,331

Fully Diluted

102,303

11,244

Source: Company filings.

*Some estimation required.

Dilution

24.1%

50.6%

67.8%

88.6%

II. Dan Rosensweigs dubious leadership track record

A focal theme of the CHGG bull thesis is that company management has created value for

shareholders in past endeavors. For example, a BMO Capital Markets report stated, We

believe Chegg has a very solid management team with a demonstrated track record of success.

We note several members of the management team have occupied high positions in very

successful Silicon Valley tech companies, including the companys CEO, Dan Rosensweig,

who previously worked as the chief operating officer of Yahoo!11

The facts would suggest managements achievements warrant extreme caution. Prior to

becoming CHGGs CEO, Mr. Rosensweig held leadership roles at three companies ZDNet,

the technology news and information site, Yahoo!, and Guitar Hero. We believe Mr.

Rosensweig unambiguously destroyed shareholder value at each of his prior companies and

the recent CHGG promotion appears to mirror the value destroying playbook of his past

ventures.

From 1997 2000, Mr. Rosensweig was President and CEO of ZDNet, which he took public

in March 1999. In a sign of the times, ZDNets share price nearly doubled in its first day of

trading, closing at $36.00 from a $19.00 IPO price.12 The stock would never again reach this

level. In an eerily similar pattern to CHGG, ZDNet commenced a reorganization and business

pivot shortly after its IPO. Also mirroring CHGGs strategy of obfuscating organic growth,

Mr. Rosensweig quickly acquired six companies in the span of just nine months.13 ZDNet

investors did not fall for Mr. Rosensweigs hollow strategy. During the greatest bubble of our

lifetime, when companies like Webvan raised hundreds-of- millions of dollars without

sustainable business models, ZDNets stock price declined by 75%. 14 , 15 According to

Advertising Age, ZDNet's investors have battered the stock in part because no one seems to

know what the company will be when all is said and done. 16 While it might sound

convenient to use the internet bubble crash as a scapegoat for Mr. Rosensweigs failures at

ZDNet, we would point out that the during the time period ZDNet lost 75% of its value the

Nasdaq gained 61%.17

________________________________________________________________________12

COPPERFIELD RESEARCH

-------------------------------------------------------------------

Source: CapitalIQ.

After the ZDNet debacle, Mr. Rosensweig joined Terry Semel in 2002 to transform Yahoo!

into a media business. Mr. Rosensweig served as COO at Yahoo! from 2002 to 2006, which

encompassed historic strategic blunders. During Mr. Rosensweigs tenure, Yahoo! (a) had the

chance to buy Google, (b) failed to buy Google, which subsequently usurped Yahoo!s search

dominance, (c) purchased Overture for $1.4 billion, (d) failed to integrate Overture

successfully, (e) failed on its opportunity to buy a start-up called Facebook for $1 billion, and

finally (f) was forced to undo its entire media strategy and revert back to Yahoo!s technology

roots.18 Mr. Rosensweig departed Yahoo! during a management shakeup in late 2006 that was

marked by investor and employee unrest.19 According to an Associated Press article at the

time, the reorganization represented Yahoos mea culpa for meandering aimlessly during the

past year, to the chagrin of investors and the delight of competitors like Google Inc. that lured

away online traffic and advertisers.20 In 2008, Business Insider ran an article titled, Was

Yahoos Terry Semel the Worst Internet CEO Ever? 21 If Mr. Semel was indeed in the

running for Worst Internet CEO Ever, what does that say about Mr. Rosensweig as COO?

Despite his poor track record at ZDNet and Yahoo!, Mr. Rosensweig was again given a

wonderful opportunity when he became CEO of Guitar Hero, which was at the time the

fastest-selling video game ever. The franchise recorded more than $1 billion in revenue in

2007 and was a consumer juggernaut.22 Enter Mr. Rosensweig, who stated when he joined

Guitar Hero, With a platform and content that universally engages a wide range of

audiences, Guitar Hero has incredible growth potential. I look forward to continuing to

develop Guitar Hero into an even more successful enterprise.23 His new employer, Guitar

Heros parent Activision Blizzard, was equally enthusiastic about Mr. Rosensweig,

proclaiming, We are looking forward to leveraging [Rosensweigs] proven online experience

to build upon the billions of hours of entertainment we deliver each year in the Guitar Hero

network.24

________________________________________________________________________13

COPPERFIELD RESEARCH

------------------------------------------------------------------After joining Guitar Hero, Mr. Rosensweig embarked on a process to expand distribution

through new business partners and spin-offs, such as DJ Hero and Band Hero.25 It would be

an understatement to say Rosensweigs strategy was not successful. In less than a year, the

Guitar Hero juggernaut was experiencing rapid sales declines and Mr. Rosensweig quickly

departed. 26 In 2011, Activision Blizzard was forced to shutter the entire Guitar Hero

division.27

2) CHGGs textbook rental business is commoditized & faces increased

competition

As we move ahead, our textbook business by design will become a smaller part of our

overall company, and we are still able to glean great value from it. Our strategy is to use our

Required Materials business to build our brand, grow our reach, and acquire customers

profitably, enabling us to more efficiently introduce our higher growth and higher margin

services that students love. And as you can see from our results, it's working.

Dan Rosensweig, 2/22/16

Most education technology companies struggle because the unit economics for studentdependent businesses are often unprofitable. Specifically, the cost to acquire a studentcustomer is generally higher than the lifetime value of that customer. CHGG historically has

been no exception with its consistent GAAP, non-GAAP, and free cash flow losses. However,

the new promote argues that CHGG can use its commoditized textbook rental business to

funnel customers into its higher margin digital services segment. The bulls argue that

CHGGs textbook rental business, despite atrocious standalone unit economics, can lower the

companys digital services lead generation costs compared to the plethora of other education

technology providers. Like much of the CHGG promote, the story is not supported by the

facts. As discussed below, CHGGs textbook rental business is not self-sustaining and Chegg

Services is in fact neither a high growth, nor high margin business.

CHGGs textbook rental business has been renamed Required Materials. As seen in the

table below, the business has transitioned from decelerating growth to a nearly 10% structural

decline based on managements 2016 guidance.

CHGG Required Materials Analysis

$ 000s

2012

2013

2014

Pro Forma Required Materials Revenue

45,900

57,192

66,111

YoY Growth

24.6%

15.6%

Source: Company filings. 2016 based on midpoint of pro forma guidance.

2015

71,818

8.6%

2016G

65,500

(8.8%)

2017G

58,000

(11.5%)

When CHGG initially introduced its textbook rental offering in 2007, the concept was

revolutionary. 28 CHGG disrupted the prior model that forced college students to purchase

expensive, single use textbooks. Ten years ago, students paid approximately $1,200 per year

for textbooks and that cost has increased by nearly 50% over the last decade.29 CHGG had an

innovative model and a first mover advantage that resulted in revenue that grew from

________________________________________________________________________14

COPPERFIELD RESEARCH

------------------------------------------------------------------essentially zero in 2007 to nearly $150 million by 2010.30 [Like most uneconomical models,

CHGGs losses grew at a faster rate than revenue, but that is beside the point.]

CHGGs impressive revenue growth attracted significant competition. Numerous upstart

competitors entered the market, with sites such as AbeBooks, Half.com, ValoreBooks,

eCampus, BookRenter, Textbooks.com, and Boundless all entering CHGGs market; it is

abundantly clear there are no barriers to entry for textbook rentals. CHGGs first mover

advantage was unsustainable given the lack of product differentiation (an intermediate

accounting textbook from CHGG is substantially similar to the same intermediate accounting

book from BookRenter or Half.com). In addition to intense direct competition, comparison

shopping sites such as dealoz.com, textbookrentals.com, TextSurf, and StudentRate began to

appear, which allowed students to compare rental sites for the best price.

Next, while limited brand differentiation and zero sustainable barriers to entry destroyed

most, if not all, economic profit potential among mono-line textbook rental companies,

Amazons entry into the market in further assured CHGGs demise. After launching a digital

textbook rental service in 2011, Amazon quickly followed with a full-scale physical textbook

rental program in 2012. Unsurprisingly, Amazons size, scale, and technological advantages

destroyed the incumbents. According to Uwire, a popular college student website, Amazon is

already considered one of the best places to buy or rent textbooks:

Through Amazon, students are able to order books based on condition, price and shipping.

Students can also order Kindle versions of textbooks, which can be used through the free

Kindle app. Book rentals are also provided and are priced based on how long one plans to

use the textbooks. Amazon provides students with one of the most cost effective routes for

purchasing or renting textbooks.

Today, CHGG is rarely the low cost option for students. For example, the textbook

Intermediate Accounting rents for $320.95, which is 123% more expensive than the lowest

cost option from knetbooks. Additionally, CHGGs most popular textbook, Campbell

Biology, also illustrates the price uncompetitive nature of CHGGs textbook rental

business.

Comparison Rental Pricing for Intermediate Accounting

________________________________________________________________________15

COPPERFIELD RESEARCH

-------------------------------------------------------------------

Source: dealoz.com, accessed 8/24/16. Rental prices may vary throughout a semester.

Comparison Rental Pricing for Campbell Biology

Source: dealoz.com, accessed 8/26/16. Rental prices may vary throughout a semester.

CHGGs inability to compete in the rental textbook market, as evidenced by managements

implied ~10% revenue decline and basic comparison shopping, represents a clear indication

this segment is not a sustainable source of low cost customer acquisition for the companys

digital services. Additionally, we believe competition is poised to become even more intense.

Barnes & Noble Education (BNED), which operates over 750 college bookstores and related

e-commerce sites, piloted a price-match program at 70-80 schools in 2015. Based on its

________________________________________________________________________16

COPPERFIELD RESEARCH

------------------------------------------------------------------success, BNED recently announced the price-match program will be expanding in 2016 to the

majority of its campus bookstores.31 The program offers student a refund during the first week

of class if they find a lower price on used, new, or rental textbooks.32 CHGG will face the full

brunt of the implementation of this program in Q416, which could explain managements

implied guidance for Required Materials to decline by nearly 40% in Q416.

Amazon is also increasingly focused on attracting college student customers by rolling out

branded mailrooms on university campuses. The program, called Campus Pick-up Point,

was initially piloted in 2015 at Purdue University as a service for students who live in dorms

or apartments, where receiving packages can be challenging.33 In 2016, Amazon is expanding

the program to the University of California at Davis, the University of California at Berkeley,

the University of Texas at Austin, the University of Massachusetts at Amherst, the Georgia

Institute of Technology, and the University of Pennsylvania. 34 Amazon also has plans for

several more pickup points on or near other university campuses.35 As part of the program,

universities receive 2% of every Amazon purchase delivered, further aligning interests around

the program.36

And just last month, Pearson, one of the largest textbook publishers in the country, announced

a partnership with Follett Higher Education, the largest campus retailer nationwide. The

partnership will provide Folletts 1,200 campus bookstores nationwide access to Pearsons

Digital Direct Access model, which is a suite of e-textbooks and other digital content.37 Tom

Malek, Senior Vice President of Partnerships at Pearson, stated, By partnering with Follett,

were making these pricing and delivery models available to all of Folletts partners,

increasing student affordability and access, and improving faculty access to real-time data and

analytics.38

Given substantial and increasing competition in the textbook rental market, we believe

CHGGs purported low cost customer acquisition channel doesnt have a chance to compete

successfully.

3) Chegg Services stability, margins, and growth characteristics are

misrepresented

I. Chegg Services faces persistently high customer churn

The vast majority of CHGGs businesses target college students (Chegg Study, Chegg Tutors,

and Internships.com are all higher education focused). Assuming the average college student

is enrolled for four years, CHGG numerically has at least 25% of its customers churning

annually (assume cohort linearity). We believe actual annual churn is closer to 100%.

Management often highlights Chegg Studys high renewal rate. In its most recent quarter,

CHGG reported an 80% renewal rate for this segment.39 While this renewal rate may appear

respectable, the fine print discloses CHGGs renewal rate is actually the monthly renewal rate

for the quarter. As such, CHGGs renewal rate is closer to 7% on an annualized basis.

Obviously, this means CHGG must replace 93% of its customers every year.

________________________________________________________________________17

COPPERFIELD RESEARCH

------------------------------------------------------------------We readily admit that while the table below is correct for a steady cohort, the analysis is

imperfect. Students may cancel their CHGG memberships at different points (e.g., over the

summer or winter holidays) and re-enroll later. However, no matter how the data is sliced, the

80% monthly renewal rate, or 20% monthly churn, creates retention challenges that are

typically only found in the online dating industry.

Chegg Study Renewal Rate Analysis

Month

Students

Monthly Renewal Rate

0

100

80%

1

80

80%

2

64

80%

3

51

80%

4

41

80%

5

33

80%

6

26

80%

7

21

80%

8

17

80%

9

13

80%

Annual Renewal Rate

Source: CHGG Q3'16 earnings release and internal analysis.

10

11

80%

11

9

80%

12

7

80%

7%

II. Chegg Tutors pricing implies management misrepresented gross margins

CHGG management has consistently stated that the companys digital services segment is a

higher growth, higher margin business compared to textbook rentals. According to

management, CHGG will have gross margins of at least 60% when the company reaches its

target operating model (we discuss later how management quietly pushed out its target model

by a year). Management has also stated Chegg Tutors is its fastest growing segment and will

be the fastest segment to reach $100 million in revenue despite de minimis revenue today.40

The inference is that the drive towards 60% gross margins will be driven by the fastest

growing segment, Chegg Tutors, which mathematically would require gross margins well in

excess of the overall target model of 60%. However, the implied math driving managements

future promises appears faulty.

CHGG pays its tutors $20 per hour.41 As can be seen below, the standard pricing for Chegg

Tutors is $30 per hour.42 (30 minutes at $15 per week plus 50 cents for each additional minute

equates to $30/hour) Making the laughable assumption that revenue from Chegg Tutors

carries no incremental costs like hosting, technology, or customer care, advertised gross

margin would be only 33%. It is unclear how these publicly advertised figures reconcile with

managements story of 60%+ gross margins.

________________________________________________________________________18

COPPERFIELD RESEARCH

-------------------------------------------------------------------

Source: https://www.chegg.com/tutors/pricing/

III. Management has historically squandered shareholder capital through poor acquisitions

In a repeat of Mr. Rosensweigs playbook from ZDNet, CHGG has chased revenue growth

through murky acquisitions. In the last six years, CHGG has completed at least 10

acquisitions. We believe every current digital services offering came by way of acquisition, as

CHGG has not developed a single product internally. This begs the question, on what exactly

did CHGG spend $60 million in 2015 for technology and development?

Contrary to managements claim that its acquisition strategy has been a success, we believe

Cramster, which was renamed Chegg Study, is the only acquisition that has performed to plan.

Four of the ten products/companies acquired by CHGG have subsequently been shut down or

discontinued, while three others are behind plan. While it is too early to determine whether

Imagine Easy will be a success, the $139 million of wasteful acquisition expenditures to date

bode poorly for the return on the incremental $35 million of earn-out payments.

CHGG Acquisition Analysis

$ 000s

Target

Date

Price

CHGG Product

Courserank

8/19/10

N/A

Course Reviews

Cramster

12/8/10

N/A

Chegg Study

Notehall

6/22/11

4,700

N/A

Student of Fortune

8/23/11

5,200

N/A

Zinch

10/6/11

27,200

Enrollment Marketing

Bookstep

3/7/14

3,000

N/A

CampusSpecial

4/9/14

16,000

Chegg Deals

InstaEDU

6/5/14

30,000

Chegg Tutors

Internships.com

10/2/14

11,000

Careers

Imagine Easy

5/1/16

42,000

Writing Tools

Total

139,100

Source: Company filings, management commentary, and Factiva.

Commentary

Discontinued

Performing well

Discontinued

Discontinued

Reset growth expectations Q3 14

Never provided

Discontinued

Behind plan as of Q4 15

No monetization until 2017

???

________________________________________________________________________19

COPPERFIELD RESEARCH

------------------------------------------------------------------IV. Chegg Services subscriber growth is significantly overstated

While CHGG management has recently touted its strong subscriber growth as a key metric for

business momentum, this metric is never actually defined nor is it included in a single formal

SEC filing. If this metric is indeed important for investors and analysts to evaluate

managements progress, why would management exclude it from its formal filings with the

SEC?

We believe the answer is because management consistently alters the metric to fit its shifting

narrative. For example, in Q315 management reported 825,000 digital subscribers,

representing 23% year-over-year growth. However, management reported 800,000

subscribers in Q316, which they claimed represented over 40% year-over-year growth.

Shrinking subscribers from 825,000 to 800,000 would seem to represent 3% contraction, NOT

40% growth.

Source: Q315 CHGG earnings press release.

Source: Q316 CHGG earnings press release.

As part of CHGGs shifting segment disclosures (which we discuss in detail below), we

believe management also altered its definition of a subscriber. Based on our understanding of

CHGGs revised reporting, the companys subscriber count conveniently no longer includes

eTextbook customers (which is now in decline). Fortunately, because management provided

historical CHGG Services subscribers for the first time in its Q316 data sheet, we can

calculate implied historical eTextbook customers. Next, if we assume these customers

grow/decline at the same rate as overall Required Materials (the segment to which eTextbooks

was shifted in order to inflate perceived digital growth), we can calculate a normalized digital

subscriber metric. Finally, because CHGG acquired Imagine Easy in Q216, we must

therefore remove an estimate for these customers. As can be seen in the analysis below, we

believe organic digital subscriber growth has been quickly decelerating throughout 2016.

________________________________________________________________________20

COPPERFIELD RESEARCH

------------------------------------------------------------------CHGG Subscriber Analysis

Q1 15

Q2 15

Q3 15

750,000

550,000

200,000

700,000

540,000

160,000

825,000

560,000

265,000

Normalized Digital Subscribers

750,000

Imagine Easy Subscriber Estimate

Organic Digial Subscribers

750,000

YoY Growth

Source: Company filings and internal estimates.

700,000

700,000

825,000

825,000

Reported Digital Subscribers

Revised Chegg Services Subscribers

Implied/Est. eTextbook Customers

YoY Growth

Q1 16

Q2 16

Q3 16

750,000

182,218

(8.9%)

760,000

153,642

(4.0%)

800,000

275,345

3.9%

932,218

932,218

24.3%

913,642

75,000

838,642

19.8%

1,075,345

125,000

950,345

15.2%

4) CHGG has consistently misrepresented its financial & segment

reporting

1. Management has repeatedly reorganized reporting segments to artificially inflate digital

growth

In the ~3 years since CHGG has gone public, management has reported company revenue

under three different derivations. We believe the primary goal of constantly reshuffling

revenue segments is to obfuscate the companys poor results.

At the time of its IPO, CHGG had two straightforward revenue categories Print

Textbooks and Non-print Products and Services. Print Textbooks represented the slower

growth textbook rental business while Non-print Products and Services represented the

companys faster growing eTextbook, subscription, and advertising segments.

CHGG Revenue Classifications

Period

At IPO

Revenue Classification

Print Textbooks

Non-print Products and Services

Description

Online print textbook rentals

eTextbooks, subscription services, and enrollment marketing

2015

Print Textbooks

Digital Offerings

Rental or sale of print textbooks

Connected learning platform, eTextbooks, online tutoring, Chegg Study, College

Admissions, Scholarship Services, and internship services + Ingram commission revenues

2016

Required Materials

Chegg Services

Print textbooks, eTextbooks, and Ingram commission revenues

Chegg Study, Chegg Tutors, Enrollment Marketing, Brand Partnerships, Writing Tools and

Careers

Source: Company filings.

In 2015, management reorganized its reporting segments to include Print Textbooks and

Digital Offerings. While the change appeared innocuous, we believe the modification

contained details that had the undeniable impact of overstating digital segment growth. As

discussed in more detail below (and has garnered specific SEC attention), management

________________________________________________________________________21

COPPERFIELD RESEARCH

------------------------------------------------------------------attributed Ingram commissions from print textbooks rentals to the companys digital

revenue group. While there was no net impact to consolidated revenue, the categorization of

print textbook rental commissions as digital revenue undeniably overstated digital growth,

which has become the most important metric for the investment community.

We believe the reporting reorganization in 2016 was an even more duplicitous attempt to hide

weak performance and further manipulate digital revenue growth. Management once again

changed CHGGs revenue segments, this time to Required Materials and Chegg Services.

Under the newest iteration, management shifted both its Ingram textbook rental commissions

and its eTextbooks revenues to Required Materials (formerly Print Textbooks).

Previously, both eTextbooks and the Ingram commissions had been classified under digital

services revenue. The attribution reconfiguration of these two sub-segments had the effect of

overstating year-over-year comparisons for digital revenues not once, but twice (as seen in the

illustration below).

In 2015, nearly all of the commission revenue from Ingram was new compared to the

previous year (the program was piloted in late 2014 and fully rolled out in 2015). Therefore,

including Ingram commissions (front print textbook rentals) as digital revenue vastly

improved the growth profile for this segment in 2015. However, these commissions would

need to be lapped in 2016, which would have created a challenging comparison for digital

growth. Supporting our belief that management manipulated its segment reporting, the

company moved the Ingram commissions out of digital (the segment management believed to

be appropriate in 2015) and into Required Materials in 2016. The net effect was that the

new Chegg Services segment faced a remarkably easier comparison in 2016.

In addition to shifting CHGGs Ingram commission revenue, management also inexplicably

removed its eTextbook business from the companys digital revenue category. Given

________________________________________________________________________22

COPPERFIELD RESEARCH

------------------------------------------------------------------eTextbooks is a 100% digital business, why would management feel compelled to make this

arbitrary change? We believe the shift was a blatant attempt to hide slowing digital growth.

CHGGs eTextbook segment had historically been a fast growth business based on market

share gains versus print textbooks. However, in late 2015 publishers raised the relative prices

for eTextbooks (compared to print textbooks), which significantly curtailed eTextbook

growth. According to management, eTextbook unit growth was greater than 60% in 2014.43

However, because of the publisher pricing changes, management expected eTextbook revenue

to decline in 2016.44 As such, similar to managements conundrum regarding the companys

Ingram commissions, eTextbooks would become an unwelcome drag on digital revenue

growth in 2016. We believe the reason for the unorthodox maneuvers by management is

crystal clear: move eTextbooks and Ingram commissions to Print Textbooks (now Required

Materials) to hide the rapid deceleration of Digital revenue (now Chegg Services).

II. Normalized digital revenue growth is significantly below managements target

Our digital businesses are expected to grow better than 60% in Q4 and we anticipate

similar growth in 2015.

Andy Brown, CHGG CFO, Q314 earnings call, 11/3/14

As discussed above, we believe CHGG management reorganized its reporting segments to

hide slowing growth in its all-important digital segment. We also believe actual digital growth

is a fraction of what CHGG has represented publicly. At the end of 2014, management

unequivocally stated that it expected digital revenue to grow at least 60% in 2015, which was

prior to Ingram commission revenue shifting from print to digital. In fact, when asked in the

conference calls Q&A about this exact topic, (whether 60% forecast included or excluded

Ingram), CFO Brown unmistakably stated:

Question Douglas T. Anmuth: And can I just follow up on 2015, the 60% digital

growth number that you mentioned. Does that include and make some assumption for

how much of for a part of the business that is, of course, moving over to Ingram and

has revenues getting booked in digital?

Answer Andrew J. Brown: No Doug, it doesn'tanything that Ingram adds would

just be bigger [and] that would add to that total.45

Despite (a) the benefit of multiple acquisitions throughout 2014 that would have aided the

2015 year-over-year growth rate, and (b) shifting Ingram print textbook commissions to the

digital segment, CHGGs digital revenue slowed substantially in 2015 and was well below

managements stated target that excluded the large benefit that was ultimately received from

the Ingram segment reorganization.

________________________________________________________________________23

COPPERFIELD RESEARCH

------------------------------------------------------------------CHGG Digital Revenue Growth

$ 000s

Reported Digital Revenue

YoY Growth

Source: Company filings.

2013

2014

2015

52,498

91,177

73.7%

140,005

53.6%

Entering 2016, CHGG was already behind its targeted growth plan and now faced the

difficulties of lapping its Ingram commission benefit. Management had committed to

substantial growth that would not be achievable. Rather than candidly address the

disappointing digital growth, as discussed above management again altered CHGGs revenue

reporting segments. We have not seen one sell-side report that identified managements

changes or attempts to independently analyze the actual growth rate of CHGGs digital

business. However, an estimate for the digital growth rate can be calculated.

Chegg Services revenue is simply the former digital revenue segment excluding the

companys Ingram commission and eTextbooks. We can therefore calculate historical implied

revenue for these sub-segments by deducting restated Chegg Services revenue from originally

reported Digital revenue. Next, if we assume revenue from Ingram and eTextbooks declines

in 2016 at the same rate as the overall guidance for Required Materials, we can determine

2016 estimated revenue for Ingram and eTextbooks. With this straightforward calculation, we

can create a clean compare for digital revenue growth by adding Ingram commissions and

eTextbooks to managements guidance for Chegg Services. The math is scary and illustrates

why we believe management has gone to such great lengths to avoid straightforward

reporting. Using the companys own segments, financials, and guidance, normalized digital

revenue growth will be just 16% in 2016. As discussed above, we believe the substantial

deceleration in digital revenue growth is the primary driver for managements unjustifiable

changes to its revenue reporting segments and altered long-term targets. Above all else, with a

16% normalized digital revenue growth rate, we believe the company will not achieve

managements 2017 guidance (which itself is already below prior consensus estimates).

________________________________________________________________________24

COPPERFIELD RESEARCH

------------------------------------------------------------------CHGG Normalized Digital Revenue Growth

$ 000s

Reported Digital Revenue

Restated Chegg Services Revenue

Implied Ingram + eTextbooks

YoY Growth

2013

2014

2015

52,498

41,830

10,668

91,177

68,117

23,060

116.2%

140,005

94,286

45,719

98.3%

2016E

41,697

(8.8%)

Chegg Services Guidance (excluding ImagineEasy)

120,500

Ingram + eTextbook Estimate

41,697

Normalized Digital Revenue

52,498

91,177

140,005

162,197

YoY Growth

73.7%

53.6%

15.9%

Source: Company filings.

Ingram + eTextbooks 2016 estimated decline in-line with management's guidance for Required

Materials.

III. Multiple revenue reclassifications have discrepancies with reported pro forma financials

Possibly because CHGG management has reclassified revenue so many times, or because of

creative retroactive changes to PowerPoint slides that artificially inflate current-year revenue

growth, historical pro-forma revenue disclosures fail to reconcile. For example, in an IR

presentation from August 2015, CHGG reported 2014 pro forma revenue of $142.7 million,

implying 2014 growth of 40% compared to $101.9 million in 2013. Just six months later, in

CHGGs 2016 IR presentation, the historical 2014 revenue was revised down by 6% to $134

million ($66M + $68M).

Perhaps the revenue changes were a mistake, but the lower 2014 revenue baseline obviously

flatters the 2015 growth rate. We have been unable to find any disclosure or explanation for

the change and it remains unclear why historical revenue would change well over a year after

it was initially reported. Based on what we believe to be a consistent pattern of

misrepresentation and misleading reporting, we would point out that the 2014 revenue

alteration resulted in 24% reported growth for 2015, as opposed to only 16% growth had the

originally reported revenue figures been maintained.

________________________________________________________________________25

COPPERFIELD RESEARCH

-------------------------------------------------------------------

Source: CHGG IR Presentation, 8/4/15

Source: CHGG IR Presentation, 2/22/16

IV. The SEC requested information regarding CHGGs revenue reclassifications

Source: https://www.sec.gov/Archives/edgar/data/1364954/000000000015056977/filename1.pdf

If not clear by now, we believe CHGGs multiple revenue reclassifications and dubious

presentation of textbook rental commissions as digital are highly misleading. On December

8, 2015, the SEC sent a letter to Mr. Rosensweig, which appeared to focus on CHGGs digital

revenue classification.46 Specifically, the SEC inquired, Please tell us how you determined

commission fees related to the Ingram Content Group (Ingram) partnership, where Ingram

fulfills print text book transactions, are most appropriately presented as revenue from Digital

offerings.47

Less than two weeks later, CHGG responded with a vigorous defense, despite openly

conceding that the Ingram commissions are tied to physical product sales:

Response: Chegg respectfully advises the Staff that, although the product delivered by

the Ingram Content Group (Ingram) is physical in nature, Chegg provides a digital

service through its website by serving as the interface between the student and Ingram.

The marketplace service that Chegg provides is similar regardless of whether the

textbook is print or digital. When a student places an order on the Chegg.com website

for a textbook that is owned by Ingram, Chegg facilitates the transaction between the

student and Ingram but Ingram fulfills the rental textbook order. Chegg never takes

possession of the textbook; rather we offer a textbook owned by Ingram for rental by a

student. All of the activities required for Chegg to earn its commission from Ingram

are executed through the Chegg website and are digital, and thus we have determined

________________________________________________________________________26

COPPERFIELD RESEARCH

------------------------------------------------------------------to be similar in nature. Based on these considerations, Chegg records the commission

fees earned from Ingram on the transaction as component of digital revenue on its

Consolidated Statement of Operations. We continue to record revenue earned in

connection with orders of print textbooks owned by Chegg as a component of print

revenue. This differentiation of print versus digital revenue is useful to our investors

as it provides a view into our transition from owning a capital intensive print textbook

business to a fully digital business. This allows investors to properly model Cheggs

go-forward business.48

Despite vehemently defending its revenue characterization to the SEC on December 21, 2015,

management took the unusual step of completely reversing course and removing Ingram

commissions from its digital segment when it provided guidance for 2016. Concomitant with

this illogical step (based on the justification provided months earlier to the SEC), management

reclassified its Ingram commission revenue and renamed its segments Chegg Services and

Required Materials. On CHGGs Q415 earnings call, the companys CFO Andy Brown

stated, We will also be reporting and guiding separately on total Required Materials which

includes revenue from textbooks, eTextbooks as well as the Ingram commission. We are

doing this to increase transparency into our slow growth business, but more importantly it

matches the way students come to Chegg to search for textbooks and our goal is providing

students the textbooks they need in the format they want.49

While the explanation and new segment names implied broad changes, the only effective

modifications were to remove eTextbook and Ingram commissions from digital (both of

which are now in decline). Interestingly, when a sell-side analyst asked a question regarding

the reclassification, management admitted the change was driven entirely by the motivation to

remove Ingram commissions and eTextbooks from the digital segment:

So what's in the Required Materials is this. It is all of the Ingram commission, all of

the print books that we deliver, and all of the eTextbooks. And so essentially what is

done and let me put it in a different format. If you take what our Digital revenue was

last year, take out the Ingram commission and take out eTextbooks and put it with our

print, that gives you Required Materials. That's how it works. Andy Brown, CHGG

CFO, 2/22/16

Managements staunch defense to the SEC, which was immediately followed by another resegmentation, adds further support to our belief Messrs. Rosensweig and Brown orchestrated

their segment reporting in a misleading and inappropriate manner to overstate digital revenue.

V. Did CHGGs inventory transfer sales to Ingram artificially inflate revenue?

In August 2014, CHGG announced a strategic alliance with Ingram Content Group. Under the

agreement, CHGG would continue to market textbooks and provide customer service, while

Ingram would be responsible for textbook inventory, fulfillment, shipping, and returns. As

part of the deal, CHGG would transfer its textbook inventory to Ingram at cost.50 While the

transaction would clearly impact CHGGs balance sheet (debit to cash or accounts receivable

________________________________________________________________________27

COPPERFIELD RESEARCH

------------------------------------------------------------------and credit to inventory), the inventory transfer created no economic benefit and thus should

have had a non-recurring impact on CHGGs income statement. However, we believe these

transitory inventory transfers, which should have been recorded as one-time gains/losses,

were instead included as profitless revenue as yet one more mechanism to inflate perceived

growth. On CHGGs GAAP income statement (which unsurprisingly is not discussed by

management), the company reports three revenue line items:

1.

2.

3.

Rental rental of print textbooks

Services Chegg Study, brand advertising, eTextbooks, tutoring, enrollment

marketing, and commerce

Sales just-in-time sale of print textbooks and the sale of other required materials

Based on the companys business drivers, rental revenue (1) and sales revenue (3) should be

highly correlated as both segments are tied to student demand for physical textbooks. Each

year, some students rent textbooks, while others purchase course materials. However, growth

in these two segments diverged significantly in 2014 and 2015, which coincided with

CHGGs Ingram alliance. In 2014, rental revenue declined by 4%, yet sales revenue increased

by 145%. Management did not bother to discuss this unique development and revenue driver.

CHGG "Sales" Revenue Analysis

$ 000s

2013

GAAP Rental Revenue

189,004

GAAP Sales Revenue

14,613

Rental Revenue Growth

Sales Revenue Growth

Source: Company filings.

2014

181,570

35,804

2015

120,365

49,012

(3.9%)

145.0%

(33.7%)

36.9%

YTD 15

93,199

46,019

YTD 16

32,081

32,157

(65.6%)

(30.1%)

What is more confounding than the revenue growth variance is the profit (or lack thereof)

generated on the Sales increase. In 2015, gross margin on sales revenue was only 2% and

year-to-date 2016 gross margin is negative 5%, which implies CHGG generates essentially

zero incremental profit on these transactions and thus further demonstrates the impressive

revenue growth may have been a function of profitless textbook inventory sales to Ingram.

VI. CHGG appears to be in direct violation with SEC Regulation G

The SEC implemented Regulation G in 2003 to prohibit material misstatements or omissions

that would make the presentation of a non-GAAP financial measure misleading to investors.51

Earlier this year, the SEC issued new Compliance and Disclosure Interpretations (C&DIs)

regarding the use of non-GAAP financial measures to further curb perceived abuse. 52

Specifically, the updated C&DIs state, a non-GAAP measure that is adjusted only for nonrecurring charges when there were non-recurring gains that occurred during the same period

could violate Rule 100(b) of Regulation G. 53 The SEC is effectively telling management

teams they may not exclude one-time charges while also including one-time gains when

reporting non-GAAP measures.

________________________________________________________________________28

COPPERFIELD RESEARCH

------------------------------------------------------------------Despite the SECs clear guidelines, CHGG management appears to continue its disregard for

regulatory reporting requirements. Specifically, for 10 straight quarters CHGGs management

has excluded acquisition-related compensation (which is clearly recurring at this point),

restructuring charges, and other one-time expenses from its adjusted EBITDA calculation.

Striking at the heart of the SECs newest C&DIs, CHGG has simultaneously included onetime gains repeatedly on the liquidation of textbooks. What is also noteworthy is that CHGGs

supposed one-time adjustments have grown from $1.2 million in 2013 to $12.2 million in

2015.

CHGG "One-Time" Gains and Losses

$ 000s

EBIT - excluding gains on textbook liquidations

D&A

Stock-based compensation

EBITDA

Gain on textbook liquidations

Acquisition-related compensation, restructuring,

and other "one-time" expenses

Total adjustments

Company reported adjusted EBITDA

Source: Company filings.

2013

2014

2015

YTD 16

(52,217)

10,078

36,958

(5,181)

(69,689)

11,160

36,888

(21,641)

(57,158)

11,511

38,775

(6,872)

(39,817)

10,001

32,701

2,885

1,186

4,555

4,326

523

1,186

4,135

8,690

7,904

12,230

3,488

4,011

(3,995)

(12,951)

5,358

6,896

In addition to CHGGs abuse of non-GAAP profit adjustments, we believe management has

also violated Regulation G regarding its opaque non-GAAP pro forma revenue metric.

According to the SEC, Regulation G requires the registrant to provide a reconciliation (by

schedule or other clearly understandable method), which shall be quantitative for historic

measures and quantitative, to the extent available without unreasonable efforts, for

prospective measures, of the differences between the non-GAAP financial measure presented

and the most directly comparable financial measure or measures calculated and presented in

accordance with GAAP.54

In the midst of its promotional business model pivot, CHGG continues to rent its own

textbook inventory (for which the company receives 100% of revenue), while also receiving

commissions for orders that are fulfilled by Ingram. Management has publicly stated CHGG

receives an approximate 20% commission for each Ingram transaction.55 Thus, while CHGG

is undergoing its transition, management is reporting pro forma revenue metrics as if

Ingram already owned all textbooks. Considering management has disclosed the Ingram

commission, an as if revenue reconciliation table reconciling GAAP to non-GAAP revenue

that is clearly understandable and quantitative should not be difficult. Nonetheless,

CHGGs quarterly earnings press releases provide one line item titled Adjustments. What

exactly these adjustments entail, and how they are calculated, is unclear. In fact, as shown

extensively above, CHGGs adjusted results change without explanation. In early 2015,

________________________________________________________________________29

COPPERFIELD RESEARCH

------------------------------------------------------------------management introduced certain pro forma metrics to assist investors in understanding the

business model shift. Those same adjustments are now periodically included by management

in certain quarters, while excluded altogether in others.56

5) Managements egregious compensation & other conflicts of interest

I. Abusive stock compensation transfers value from investors to management

CHGGs stock-based compensation represents an astounding 28% of revenue. Across a broad

spectrum of education businesses, marketplaces, and consumer internet companies, average

stock-based compensation expense as a percent of revenue is less than 4%. While we would

gladly debate whether stock based compensation should be considered an expense (yes, it

should), that is not the point. CHGGs rate of spend on stock compensation is not even

comparable to the companys education-focused peers, which typically spend less than 1% of

revenue on stock comp. CHGGs stock based compensation expense is also many multiples

higher than that of its technology peers, which are generally known for aggressive stock

compensation in the first place. The only company we could find with remotely similar stock

compensation to CHGG as a percent of revenue is Twitter (TWTR).

Incredibly, despite outlandish levels of non-cash stock compensation expense, CHGG