Professional Documents

Culture Documents

Individual Tax Return Problem 2 Form 1040 Schedule A

Uploaded by

Henry PhamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Tax Return Problem 2 Form 1040 Schedule A

Uploaded by

Henry PhamCopyright:

Available Formats

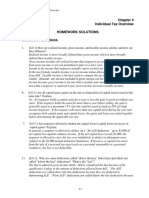

SCHEDULE A

(Form 1040)

OMB No. 1545-0074

Itemized Deductions

Department of the Treasury

Internal Revenue Service (99)

Information

about Schedule A and its separate instructions is at www.irs.gov/schedulea.

Attach to Form 1040.

Name(s) shown on Form 1040

2014

Attachment

Sequence No. 07

Your social security number

Karl and Ellie Frederickson

Medical

and

Dental

Expenses

Taxes You

Paid

1

2

3

4

5

6

7

8

Interest

You Paid

9

10

11

Note.

Your mortgage

interest

deduction may

be limited (see

instructions).

555-12-6789

Caution. Do not include expenses reimbursed or paid by others.

Medical and dental expenses (see instructions) . . . . .

1

Enter amount from Form 1040, line 38

2

135,000

Multiply line 2 by 10% (.10). But if either you or your spouse was

3

born before January 2, 1950, multiply line 2 by 7.5% (.075) instead

Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . .

State and local (check only one box):

a Income taxes, or

. . . . . . . . . . .

5

b

General sales taxes

Real estate taxes (see instructions) . . . . . . . . .

6

Personal property taxes . . . . . . . . . . . . .

7

Other taxes. List type and amount

8

Add lines 5 through 8 . . . . . . . . . . . . . . . .

Home mortgage interest and points reported to you on Form 1098 10

Home mortgage interest not reported to you on Form 1098. If paid

to the person from whom you bought the home, see instructions

and show that persons name, identifying no., and address

13,500

11

12 Points not reported to you on Form 1098. See instructions for

special rules . . . . . . . . . . . . . . . . .

12

13 Mortgage insurance premiums (see instructions) . . . . .

13

14 Investment interest. Attach Form 4952 if required. (See instructions.) 14

15 Add lines 10 through 14 . . . . . . . . . . . . . . .

Gifts to

16 Gifts by cash or check. If you made any gift of $250 or more,

see instructions . . . . . . . . . . . . . . . .

16

Charity

17 Other than by cash or check. If any gift of $250 or more, see

If you made a

gift and got a

instructions. You must attach Form 8283 if over $500 . . .

17

benefit for it,

18 Carryover from prior year . . . . . . . . . . . .

18

see instructions.

19 Add lines 16 through 18 . . . . . . . . . . . . . . .

Casualty and

Theft Losses

11,070

20 Casualty or theft loss(es). Attach Form 4684. (See instructions.) .

12,400

15

12,000

6,400

5,000

1,000

12,000

8,350

750

19

9,100

20

27

1,000

28

520

29

35,020

Job Expenses 21 Unreimbursed employee expensesjob travel, union dues,

and Certain

job education, etc. Attach Form 2106 or 2106-EZ if required.

Miscellaneous

21

(See instructions.)

Deductions

22 Tax preparation fees . . . . . . . . . . . . .

22

2,000

500

23 Other expensesinvestment, safe deposit box, etc. List type

and amount

23

Add lines 21 through 23 . . . . . . . . . . . .

24

Enter amount from Form 1040, line 38 25

135,000

Multiply line 25 by 2% (.02) . . . . . . . . . . .

26

Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- . . .

Otherfrom list in instructions. List type and amount Lottery Tickets $520

Investment Publications

Other

Miscellaneous

Deductions

24

25

26

27

28

29 Is Form 1040, line 38, over $152,525?

Total

No. Your deduction is not limited. Add the amounts in the far right column

Itemized

for lines 4 through 28. Also, enter this amount on Form 1040, line 40.

Deductions

1,200

3,700

2,700

.

Yes. Your deduction may be limited. See the Itemized Deductions

Worksheet in the instructions to figure the amount to enter.

30 If you elect to itemize deductions even though they are less than your standard

deduction, check here . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see Form 1040 instructions.

Cat. No. 17145C

Schedule A (Form 1040) 2014

You might also like

- Credit For The Elderly or The Disabled: Publication 524Document16 pagesCredit For The Elderly or The Disabled: Publication 524api-115350234No ratings yet

- 4100.05.A. Overview of Partnership RulesDocument11 pages4100.05.A. Overview of Partnership Rulesgerarde moretNo ratings yet

- IG CH 03Document20 pagesIG CH 03Basa TanyNo ratings yet

- Partnership July 7 FinalDocument26 pagesPartnership July 7 FinalPaoNo ratings yet

- Cruz16e Chap09 IMDocument10 pagesCruz16e Chap09 IMJosef Galileo SibalaNo ratings yet

- Personal Tax Checklist 2022Document2 pagesPersonal Tax Checklist 2022ShujaRehmanNo ratings yet

- Tax Organizer ShortDocument28 pagesTax Organizer ShortExactCPANo ratings yet

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Document6 pages(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNo ratings yet

- Quizl Tax IIDocument14 pagesQuizl Tax IITonyaNo ratings yet

- Tax Assignment 7Document2 pagesTax Assignment 7Monis KhanNo ratings yet

- Homework Chapter 4Document10 pagesHomework Chapter 4ChaituNo ratings yet

- Tax Organizer PDFDocument13 pagesTax Organizer PDFMarcelousNo ratings yet

- 2016 - Tax ReturnDocument37 pages2016 - Tax Returncara harrisNo ratings yet

- Choosing A Business Structure For AaronDocument7 pagesChoosing A Business Structure For AaronJoshua GikuhiNo ratings yet

- 1065 Case StudyDocument5 pages1065 Case StudyHimani SachdevNo ratings yet

- Chapter 4-Gross Income: ExclusionsDocument15 pagesChapter 4-Gross Income: Exclusionsapenalv1No ratings yet

- Tax Geek Tuesday - Allocation of Partnership LiabilitiesDocument15 pagesTax Geek Tuesday - Allocation of Partnership LiabilitiesWill CNo ratings yet

- Ai Tax Matters Tax Basis Capital Account ReportingDocument1 pageAi Tax Matters Tax Basis Capital Account ReportingAshley OweyaNo ratings yet

- Gather Data LO1Document8 pagesGather Data LO1Samson GirmaNo ratings yet

- Treasury Inspector General For Tax Administration: Interim Results of The 2021 Filing SeasonDocument36 pagesTreasury Inspector General For Tax Administration: Interim Results of The 2021 Filing SeasonABC Action NewsNo ratings yet

- Tax11 1040Document144 pagesTax11 1040Kasirun -No ratings yet

- Individual Inc Tax Exam 1 Study GuideDocument20 pagesIndividual Inc Tax Exam 1 Study GuideMary Tol100% (1)

- Self-Employment Tax (Social Security and Medicare Taxes) : o o o oDocument16 pagesSelf-Employment Tax (Social Security and Medicare Taxes) : o o o oChauale Da Linda ChameNo ratings yet

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- Contractual Mechanisms of Investor Protection in Non-Listed Limited Liability Companies PDFDocument58 pagesContractual Mechanisms of Investor Protection in Non-Listed Limited Liability Companies PDFmariam machaidzeNo ratings yet

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Tax Checklist REV 2Document1 pageTax Checklist REV 2Rocka FellaNo ratings yet

- A Sole ProprietorshipDocument2 pagesA Sole Proprietorshipkishorepatil8887100% (1)

- Publication 4491 Examples and CasesDocument54 pagesPublication 4491 Examples and CasesNorma WahnonNo ratings yet

- Appendix C - GlossaryDocument27 pagesAppendix C - GlossarySoriano GabbyNo ratings yet

- 1065-Entity 1-Investor 001-2021Document18 pages1065-Entity 1-Investor 001-2021nerminm16No ratings yet

- US Internal Revenue Service: f1065sk1 - 2003Document2 pagesUS Internal Revenue Service: f1065sk1 - 2003IRSNo ratings yet

- Index: Page NoDocument322 pagesIndex: Page NoDINESH BANSALNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- Partnerships: Save $ and Experience The DifferenceDocument2 pagesPartnerships: Save $ and Experience The DifferenceFinn KevinNo ratings yet

- How To Convert A Traditional IRA To A Roth IRA: Key TakeawaysDocument2 pagesHow To Convert A Traditional IRA To A Roth IRA: Key Takeawayssaivijay2018No ratings yet

- Individual Tax CalculationDocument11 pagesIndividual Tax CalculationSunil ChelladuraiNo ratings yet

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Document69 pagesCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519No ratings yet

- Profit and Loss Statement TemplateDocument8 pagesProfit and Loss Statement TemplateJerarudo BoknoyNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- 2021 - Robinhood Securities 1099Document8 pages2021 - Robinhood Securities 1099Estranged GedNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- New Age w-2 Forms ExcelDocument42 pagesNew Age w-2 Forms Excelapi-429923183No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- ACCT 3326 Tax II Cengage CH 2 199ADocument6 pagesACCT 3326 Tax II Cengage CH 2 199Abarlie3824No ratings yet

- Utah Form TC-20 Tax Return and InstructionsDocument26 pagesUtah Form TC-20 Tax Return and InstructionsBrandonNo ratings yet

- Mental Status Assessment: Identifying DataDocument8 pagesMental Status Assessment: Identifying DataAmy Rose abuevaNo ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerNo ratings yet

- Chapter#act 34 Small Business, Entrepreneurship, and General PartnershipsDocument57 pagesChapter#act 34 Small Business, Entrepreneurship, and General PartnershipsAhsan AliNo ratings yet

- Chapter 10 PDFDocument22 pagesChapter 10 PDFJay BrockNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- UnknownDocument24 pagesUnknownanyanwuchigozie560No ratings yet

- A Accrual Accounting MethodDocument19 pagesA Accrual Accounting MethodVivian Montenegro GarciaNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- HR Block Income Tax Return Checklist Individuals 0620 FADocument1 pageHR Block Income Tax Return Checklist Individuals 0620 FAdeNo ratings yet

- 2016 1040 Individual Tax Return Engagement LetterDocument11 pages2016 1040 Individual Tax Return Engagement LettersarahvillalonNo ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- TAX 2202E TBS01 02.solutionDocument2 pagesTAX 2202E TBS01 02.solutionZhitong LuNo ratings yet

- Rodrigo Tax Evasion ChargingDocument4 pagesRodrigo Tax Evasion ChargingJoe EskenaziNo ratings yet

- 8 - Deductions From Gross Income 2Document6 pages8 - Deductions From Gross Income 2RylleMatthanCorderoNo ratings yet

- What Are The Stages of Taxation ?Document15 pagesWhat Are The Stages of Taxation ?Federico Dipay Jr.No ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Taxation Laws - 2017Document2 pagesTaxation Laws - 201718651 SYEDA AFSHANNo ratings yet

- Income Statement HumaidDocument1 pageIncome Statement HumaidMercians RXNo ratings yet

- Module 1: An Introduction To TaxationDocument64 pagesModule 1: An Introduction To TaxationFreddy MolinaNo ratings yet

- Income Tax Payment Challan: PSID #: 165120097Document1 pageIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNo ratings yet

- Final Book by RajoanDocument76 pagesFinal Book by RajoanAtik RahatNo ratings yet

- Tax Invoice: FromDocument1 pageTax Invoice: FromShekhar AlleNo ratings yet

- 05 Essay 1: Jeremeh C. Pande BSIT 301ADocument2 pages05 Essay 1: Jeremeh C. Pande BSIT 301AJeremeh PandeNo ratings yet

- Notice of Assessment 2023 04 11 11 51 12 947361Document4 pagesNotice of Assessment 2023 04 11 11 51 12 947361Amelia D. LopezNo ratings yet

- Saps Sasseta Internship Programme 2021Document12 pagesSaps Sasseta Internship Programme 2021Laly MofokengNo ratings yet

- Pay Slip For June - 2021: EarningsDocument2 pagesPay Slip For June - 2021: EarningsBagadi AvinashNo ratings yet

- Pesco Full Bill AbuDocument2 pagesPesco Full Bill AbuSyed Muhammad ZeeshanNo ratings yet

- GST Calculator: If The Calculations Do Not Update, Hit F9Document1 pageGST Calculator: If The Calculations Do Not Update, Hit F9computech instituteNo ratings yet

- P 11 DBDocument2 pagesP 11 DBLynsay SmithNo ratings yet

- Finance Act 2020:: Key Changes and ImplicationsDocument5 pagesFinance Act 2020:: Key Changes and ImplicationsAdebayo Yusuff AdesholaNo ratings yet

- Library Stock ListDocument1,032 pagesLibrary Stock ListVaratha RajNo ratings yet

- TASK 3 - Activity 1Document2 pagesTASK 3 - Activity 1Jose LopezNo ratings yet

- Wey FinMan 4e TB AppI Payroll-AccountingDocument15 pagesWey FinMan 4e TB AppI Payroll-AccountingJim AxelNo ratings yet

- Inv TG B1 50939724 101360733900 September 2021Document2 pagesInv TG B1 50939724 101360733900 September 2021b kranthi kumarNo ratings yet

- Work Order: Add: IGST Add: SGST Add: CGST 0.00 5,022.00 5,022.00Document1 pageWork Order: Add: IGST Add: SGST Add: CGST 0.00 5,022.00 5,022.00VinodNo ratings yet

- 18 VA Semifinalists-NatlMeritProgramDocument4 pages18 VA Semifinalists-NatlMeritProgramDavid FritzNo ratings yet

- Undertaking of TDS FinalDocument1 pageUndertaking of TDS FinalAbhi RajputNo ratings yet

- 91 02 Individual TaxDocument10 pages91 02 Individual Taxjohn paulNo ratings yet

- Hays County Tax Ceiling For Age 65 Plus and Disabled ResidentsDocument1 pageHays County Tax Ceiling For Age 65 Plus and Disabled ResidentsCrit John KennedyNo ratings yet

- Inbound 6310719506126591666Document4 pagesInbound 6310719506126591666MarielleNo ratings yet

- Ctaa040 - Ctaf080 - Test 4 Solution - 2023Document7 pagesCtaa040 - Ctaf080 - Test 4 Solution - 2023Given RefilweNo ratings yet