Professional Documents

Culture Documents

Fundamentals of Accounting

Uploaded by

JessicaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Accounting

Uploaded by

JessicaCopyright:

Available Formats

AQUINAS UNIVERSITY OF LEGAZPI

College of Business, Management and Accountancy

A.Y. 2016 2017

Course Outline

Subject Details

Subject:

Schedule:

Faculty:

SY / Term:

Acctg 101 Basic Accounting, Part 1

3BSHM1, MW, 7:30AM-10:30AM, Cocofed1

Esmena, Jessica C.

Second Semester, 2016 2017

Course Description

This course provides an introduction to accounting, within the context of business and business decisions. Students obtain

basic understanding of the principles and concepts of accounting as well as their applicability and relevance in the national

context and learn how to use various types of accounting information found in financial statements and annual reports.

Emphasis is placed on understanding the reasons underlying basic accounting concepts and providing students with an

adequate background on the recording, classification, and summarization functions of accounting to enable them to

appreciate the varied uses of accounting data.

Course Outline

1.

Introduction to accounting

1.1

Definition, purpose, nature, functions, scope and objectives of accounting

1.2

Different branches of accounting (financial, managerial, etc)

1.3

The classical notion of stewardship

1.4

Users of accounting information (internal vs. external users)

1.5

Double entry bookkeeping

1.6

History

1.6.1

1.6.2

1.6.3

1.6.4

1.6.5

1.6.6

1.6.7

of accounting:

The Florentine vs. the Venetian approach to reporting

Savory and the Napoleonic Commercial Code

The industrial revolution and the share-issuing company

The arrival of income taxation and the conflict with financial accounting

Schmalenbach and the charts of accounts

The rise of the group of companies and the need for consolidated accounts

Internationalization of markets and reporting

1.7

Accounting variations among countries

1.7.1 Why practices differ from one country to another even though the same set of basic principles is

followed

1.7.2

The linkage of tax laws and accounting principles requirements for enterprises in certain countries

1.7.3 Differences in the degree of development of the capital markets in countries and their effect on the

development and use of generally accepted international principles of accounting

1.8

Basic professional values and ethics

1.8.1 Reputation

1.8.2 Integrity and due care

1.8.3 Competence

1.8.4 Objectivity

1.8.5 Client relations and confidentiality

1.8.6 Reporting breaches of conduct

1.8.7 Unlawful activities

1.8.8 Fees and remuneration

1.8.9 Publicity and advertising

1.8.10 Disciplinary procedures

1.9

1.10

Forms of business organization and their activities (e.g., financing, investing and operating)

Accounting concepts and principles

Page 1 of 3

AQUINAS UNIVERSITY OF LEGAZPI

Basic Accounting Course Outline

1.11

1.12

1.13

1.14

1.15

2.

The basic financial statements of business organizations

Relationships among the financial statements

Definition, classification and examples of assets, liabilities, capital or owners equity, income, and expenses

The accounting profession: career opportunities

Specialized accounting fields (public accounting, private accounting, government accounting, accounting

education)

Introduction to accounting information system

2.1

Features of an effective information system

2.2

Overview of an accounting information system

2.3

The three stages of data processing: A comparison of computerized

and manual accounting system

3.

Analyzing and summarizing business transactions

3.1

Definition of business transactions and source documents

3.2

Summary of business activities (financing, investing, operating)

3.3

The accounting equation

3.4

Analyzing and accounting for business transactions

3.5

Presentation of results of routine transactions by preparing the Basic Income statement, Owners equity

statement, Balance sheet, and Statement of cash flows)

3.6

Relationship among the financial statements

4.

Recording transactions of a service company (sole proprietorship)

4.1

Double-entry accounting and accounting systems: Florentine vs. Venetian approach to reporting, Savory and

Napoleonic Commercial Code, and Schmalenback

4.2

The account and T-account

4.3

Rules of debit and credit

4.4

Chart of accounts and normal balances of an account

4.5

Recording in two-column journal (initial investment by owner, changes in assets, liabilities and capital,

changes in income and expenses, withdrawals of owner)

4.6

Posting to the ledger

4.7

Preparing the trial balance

5.

Measuring business income

5.1

Accrual-basis accounting vs. Cash-basis accounting

5.2

Accounting period

5.3

Revenue principle

5.4

Matching principle

5.5

Time-period concept

5.6

Overview of the adjusting process

5.7

Adjustments for prepayments (deferrals), accruals, uncollectible accounts receivable, depreciation of

property, plant and equipment

5.8

Preparation of the adjusted trial balance and financial statements

5.9

Use of accounting information for decision making

6.

Completing the accounting cycle

6.1

Overview of the accounting cycle

6.2

Preparing an accounting worksheet

6.3

Using the worksheet

6.4

Preparing financial statements from the worksheet [income statement, owners equity statement, balance

sheet, cash flow statement (simple cash receipts & disbursements statement)]

6.5

Journalizing and posting adjusting entries

6.6

Journalizing and posting closing entries

6.7

Preparing the post-closing trial balance

6.8

Preparing the reversing entries

7.

Recording merchandising business transactions

7.1

Merchandising operations (Nature and operating cycle of a merchandising business, business documents)

Page 2 of 3

AQUINAS UNIVERSITY OF LEGAZPI

Basic Accounting Course Outline

7.2

7.3

7.4

7.5

7.6

7.7

7.8

Recording merchandising business transactions in a two-column general journal (sales revenue, sales returns

and allowances, sales discounts, purchases of merchandise, purchases returns and allowances, purchase

discounts, transportation costs)

Inventory systems (perpetual and periodic inventory procedures)

Determination of merchandise inventory, costs of good sold and gross margin

Worksheet preparation

Adjusting and closing process for a merchandising business

Financial statements of a merchandising business

Use of accounting information in decision making

8.

Recording transactions in special journals

8.1

Nature and use of control accounts and subsidiary ledgers

8.2

Types of special journals (sales journal, purchases journal, cash receipts journal, cash disbursements

journal)

8.3

Recording of financing, investing and operating transactions in the special journals and general journal

9.

Manufacturing operations

9.1

Nature of manufacturing business

9.2

Transactions related to the manufacturing process

9.3

Elements of manufacturing costs

9.4

Preparation of financial statements of a manufacturing enterprise (balance sheet, income statement,

statement of cost of goods manufactured and sold)

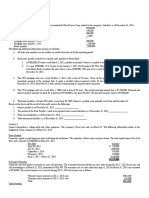

Grading System

Requirement/Assessment Task

Quizzes

Activities/Seatwork

Class participation (Recitation and Board work)

Attendance

Major exams (Prelim, Midterm and Final)

Total

Maximum Points

40%

10%

10%

10%

30%

100%

Text, Materials and References

Basic Accounting Made Easy by Win Ballada 2016 Edition

Page 3 of 3

You might also like

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Accounting Concepts and Accounting Equation DrillsDocument3 pagesAccounting Concepts and Accounting Equation Drillsken garciaNo ratings yet

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- Final Exam-Basic AccountingDocument2 pagesFinal Exam-Basic AccountingNoel Buenafe JrNo ratings yet

- NCR Cup JR Basic Accounting FinalDocument6 pagesNCR Cup JR Basic Accounting FinalNicolaus CopernicusNo ratings yet

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorNo ratings yet

- NVCC Accounting ACC 211 EXAM 1 PracticeDocument12 pagesNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2No ratings yet

- ACCT101 - Prelim - THEORY (25 PTS)Document3 pagesACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Chapter 2 Cost Concepts and ClassificationDocument40 pagesChapter 2 Cost Concepts and ClassificationJean Rae RemiasNo ratings yet

- Quiz 1 Final PeriodDocument3 pagesQuiz 1 Final PeriodalestingyoNo ratings yet

- Principles of AccountingDocument12 pagesPrinciples of AccountingEliza Mae SumangilNo ratings yet

- MCQ Adjusting EntriesDocument7 pagesMCQ Adjusting EntriesMara Clara100% (1)

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Basic Accounting Chapter 1-5 QuizzesDocument6 pagesBasic Accounting Chapter 1-5 QuizzesLuna Shi100% (1)

- First Semester: (Accounting Research Proposal)Document2 pagesFirst Semester: (Accounting Research Proposal)Vanessa FajardoNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Financial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreDocument15 pagesFinancial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreCUSTODIO, JUSTINE A.No ratings yet

- Of Alabang: Multiple ChoiceDocument8 pagesOf Alabang: Multiple ChoiceLEE ANNNo ratings yet

- ACC 211 - Review 2 (Chapters 5, 6, & 7)Document4 pagesACC 211 - Review 2 (Chapters 5, 6, & 7)Brennan Patrick WynnNo ratings yet

- Chapter 2 Review Sheet AnswersDocument7 pagesChapter 2 Review Sheet AnswersKenneth DayohNo ratings yet

- Grade 11, Accounting, Chapter 3 Recording of Transaction IDocument75 pagesGrade 11, Accounting, Chapter 3 Recording of Transaction Ihum_tara1235563100% (1)

- Chapter 3-Adjusting The AccountsDocument26 pagesChapter 3-Adjusting The Accountsbebybey100% (1)

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1Cjhay Marcos100% (1)

- Module 7 Topic 1 Posting To The LedgerDocument7 pagesModule 7 Topic 1 Posting To The LedgerMary GraceNo ratings yet

- Quiz 1 - Chapters 1-2Document4 pagesQuiz 1 - Chapters 1-2Kim Nicole ReyesNo ratings yet

- Methods of DepreciationDocument12 pagesMethods of Depreciationamun din100% (1)

- Accounting 1 Chapter 1Document1 pageAccounting 1 Chapter 1Ralph Christer MaderazoNo ratings yet

- Sole Proprietorship Accounting TransactionsDocument17 pagesSole Proprietorship Accounting TransactionsErica Mae GuzmanNo ratings yet

- Ex-08 - Comprehensive Review 2.0Document14 pagesEx-08 - Comprehensive Review 2.0Jedidiah Smith0% (1)

- Fundamentals of Financial Accounting Final ExamDocument3 pagesFundamentals of Financial Accounting Final ExamGrnEyz79100% (1)

- Theory (1) 1Document18 pagesTheory (1) 1Debela RegasaNo ratings yet

- Chapter 1 MaterialsDocument6 pagesChapter 1 MaterialsSirvie FersifaeNo ratings yet

- Final AdjustingjyjDocument36 pagesFinal AdjustingjyjAlayka Ann Pirante50% (2)

- Reviewer in AccountingDocument6 pagesReviewer in AccountingJoseph AndrewsNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- AccountingDocument2 pagesAccountingretchiel love calinogNo ratings yet

- Self Test Questions - Chap-3Document6 pagesSelf Test Questions - Chap-3Fahad MushtaqNo ratings yet

- BS3 - 2 - Mr. Florande S. PolisticoDocument35 pagesBS3 - 2 - Mr. Florande S. PolisticoPitel O'shoppeNo ratings yet

- Adjusting EntriesDocument19 pagesAdjusting EntriesMasood Ahmad AadamNo ratings yet

- Principles of Accounting ExercisesDocument3 pagesPrinciples of Accounting ExercisesAB D'oriaNo ratings yet

- Adjusting Entries QuizDocument2 pagesAdjusting Entries QuizOfelia YanosNo ratings yet

- Basic AccountingDocument6 pagesBasic AccountingViolet Gomez RedNo ratings yet

- Merchandising Operations - CRDocument21 pagesMerchandising Operations - CRNicole CagasNo ratings yet

- Fabm 1 Test QDocument7 pagesFabm 1 Test QJemimah CorporalNo ratings yet

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- 0 Accounting For Merchandising BusinessDocument114 pages0 Accounting For Merchandising BusinessIan RanilopaNo ratings yet

- Fundamentals of AccountingDocument1 pageFundamentals of AccountinghaggaiNo ratings yet

- Fabm 1 Quiz TheoriesDocument4 pagesFabm 1 Quiz TheoriesJanafaye Krisha100% (1)

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- II. Multiple Choice.: Archdiocese of TuguegaraoDocument3 pagesII. Multiple Choice.: Archdiocese of TuguegaraoRamojifly LinganNo ratings yet

- ACTBAS1 SyllabusDocument5 pagesACTBAS1 SyllabustjpalancaNo ratings yet

- Recording TransactionsDocument39 pagesRecording Transactionspranali suryawanshiNo ratings yet

- Achieve Test 01Document7 pagesAchieve Test 01Aldi HerialdiNo ratings yet

- Quiz 5 Books of Accounts Without AnswerDocument5 pagesQuiz 5 Books of Accounts Without AnswerHello KittyNo ratings yet

- Exam Type With Answer KeyDocument7 pagesExam Type With Answer KeyAngelieNo ratings yet

- Fundamentals of Accounting 1 and 2Document8 pagesFundamentals of Accounting 1 and 2CPALawyer01286% (7)

- Actg 1 Fundamentals of Accounting, Part IDocument4 pagesActg 1 Fundamentals of Accounting, Part IVanessa L. VinluanNo ratings yet

- Acctg 1Document8 pagesAcctg 1justineNo ratings yet

- Fundamentals of Accounting IDocument5 pagesFundamentals of Accounting Itarekegn gezahegn0% (1)

- Research#2 PDFDocument18 pagesResearch#2 PDFJessicaNo ratings yet

- Basic Documents and Transactions Related To Bank DepositsDocument15 pagesBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- RFM Business Review PDFDocument32 pagesRFM Business Review PDFJessicaNo ratings yet

- Financial StatementDocument10 pagesFinancial StatementJessica100% (1)

- Accounting Books - Journals and LedgersDocument17 pagesAccounting Books - Journals and LedgersJessicaNo ratings yet

- Applied Auditing Audit of Investment: Problem No. 1Document3 pagesApplied Auditing Audit of Investment: Problem No. 1JessicaNo ratings yet

- Introduction To AccountingDocument9 pagesIntroduction To AccountingJessicaNo ratings yet

- Introduction To AccountingDocument9 pagesIntroduction To AccountingJessicaNo ratings yet

- Time Value of MoneyDocument27 pagesTime Value of MoneyJessicaNo ratings yet

- Applied AuditingDocument3 pagesApplied AuditingJessicaNo ratings yet

- Applied Auditing - LiabilitiesDocument2 pagesApplied Auditing - LiabilitiesJessicaNo ratings yet

- Advanced Accounting 1Document4 pagesAdvanced Accounting 1JessicaNo ratings yet

- Aquinas University of LegazpiDocument3 pagesAquinas University of LegazpiJessicaNo ratings yet

- Configuration of Tax Calculation Procedure TAXINNDocument8 pagesConfiguration of Tax Calculation Procedure TAXINNdharmesh6363No ratings yet

- 1 Quiz ChapterDocument7 pages1 Quiz ChapterJoebet DebuyanNo ratings yet

- Módulo 17: Propiedades, Planta y Equipo: Fundación IASC: Material de Formación Sobre La NIIF para Las PYMESDocument49 pagesMódulo 17: Propiedades, Planta y Equipo: Fundación IASC: Material de Formación Sobre La NIIF para Las PYMESYesenia EscobarNo ratings yet

- LegmaDocument14 pagesLegmaAica Vivas-BalagtasNo ratings yet

- The Why and How of Auditing - Au - Charles HallDocument158 pagesThe Why and How of Auditing - Au - Charles HallIan ApindiNo ratings yet

- LembarDocument26 pagesLembarIbnu Kamajaya75% (4)

- Implementation Docu SAP S4HANA Loc Extension Belarus EPAM ENDocument31 pagesImplementation Docu SAP S4HANA Loc Extension Belarus EPAM ENksoleti8254No ratings yet

- Double-Entry Accounting System: C C CC CCDocument28 pagesDouble-Entry Accounting System: C C CC CCanand chawanNo ratings yet

- HO2-B - Risk-Based Audit of Financial Statements Part 2 (Risk Assessment)Document10 pagesHO2-B - Risk-Based Audit of Financial Statements Part 2 (Risk Assessment)Jaynalyn MonasterialNo ratings yet

- Bab2 Act Development & ClassificationDocument26 pagesBab2 Act Development & ClassificationagustadivNo ratings yet

- Factory Overhead: AssumptionsDocument6 pagesFactory Overhead: AssumptionsRey Joyce AbuelNo ratings yet

- Presentation3.1 - Audit of Receivables, Revenue and Other Related AccountsDocument36 pagesPresentation3.1 - Audit of Receivables, Revenue and Other Related AccountsRoseanne Dela CruzNo ratings yet

- HKMU BAFS 2022 P2A Question EngDocument11 pagesHKMU BAFS 2022 P2A Question EngJaeeeNo ratings yet

- 02 Trade PayableDocument14 pages02 Trade PayableRuwan GunarathnaNo ratings yet

- Stock Register 13Document10 pagesStock Register 13Debasis SahaNo ratings yet

- 428Document17 pages428xjammerNo ratings yet

- Chapter 15 From Textbook T.S. Grewal (2018) For Class 11 ACCOUNTANCYDocument59 pagesChapter 15 From Textbook T.S. Grewal (2018) For Class 11 ACCOUNTANCYvkbm42100% (2)

- Chapter 07Document16 pagesChapter 07julie anne mae mendozaNo ratings yet

- Assignment 24Document4 pagesAssignment 24Shamraj E. Sunderamurthy100% (1)

- Kayes Arman11-6265-Term PaperDocument7 pagesKayes Arman11-6265-Term PaperTAWHID ARMAN100% (1)

- Accounting QuestionsDocument8 pagesAccounting QuestionsHuryaNo ratings yet

- Accounting Information System Midterm ReviewDocument1 pageAccounting Information System Midterm ReviewSintos Carlos MiguelNo ratings yet

- RoadMap BBADocument4 pagesRoadMap BBARizwan AslamNo ratings yet

- Valdevieso, Afrielin S. BSA - 1101 Bsa 1-Bda: Date Asset LiabilitiesDocument5 pagesValdevieso, Afrielin S. BSA - 1101 Bsa 1-Bda: Date Asset LiabilitiesAfrielin ValdeviesoNo ratings yet

- Consultants DirectoryDocument36 pagesConsultants DirectoryAnonymous yjLUF9gDTSNo ratings yet

- Units 1 and 2 TextbookDocument360 pagesUnits 1 and 2 TextbookCuong Duong100% (1)

- Assignment Questions - Suggested Answers (M13-6, M13-7, E6-3, E6-18, E6-21, E6-24, P6-3, P6-7)Document8 pagesAssignment Questions - Suggested Answers (M13-6, M13-7, E6-3, E6-18, E6-21, E6-24, P6-3, P6-7)Ivy KwokNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument21 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancelalit JainNo ratings yet

- F3 - Questions & Examples FINALDocument64 pagesF3 - Questions & Examples FINALThùy Vân NguyễnNo ratings yet

- Intermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFDocument61 pagesIntermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFwilliambrowntdoypjmnrc100% (7)