Professional Documents

Culture Documents

Case Study 2 Chandpur

Uploaded by

Gaurav VermaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study 2 Chandpur

Uploaded by

Gaurav VermaCopyright:

Available Formats

CASE STUDY 2

CHANDPUR ENTERPRISES LIMITED,

STEEL DIVISION

Name:

SYED ABDUL RAHMAN BIN SYED AHAMED

816025

KHALIDUL ANWAR BIN ISHAK

818573

NOOR HANIM BINTI MD ISA

818933

UUM CASE STUDY 2

DECISION ANALYSIS

Date:

SQQP 5023

10 JANUARY 2015

Table of Content

Chapter Title

Page

1.0

Introduction & Problem Statement

2.0

Analysis & Discussion

3-11

3.0

References

11

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

1. INTRODUCTION & PROBLEM STATEMENT

Numerous administration choices include attempting to make the best utilization of a

organization's assets. Assets commonly incorporate hardware, work, cash, time,

warehouse space and crude materials. These assets might be utilized to make items such

as hardware, furniture, sustenance or apparel or benefits, for an occasion, plan for

aircrafts or creation, publicizing arrangements or venture choices.

Linear programming (LP) is a generally utilized scientific demonstrating method

designed to help supervisors in arranging and choice making with respect to asset

allocation. As talked about in Chandpur Enterprises Limited (CEL), Steel Division case

study, and the organization overseeing executive needs to settle on the crude materials

requirement for August creation at his steel plant.

Because of lower and upper limits on the measures of every crude material in a

batch

and changing measures of power and time devoured for distinctive crude materials,

Akshay Mittal, overseeing chief of CEL can't just utilize the least expensive crude

material. A linear program and Excel's Solver enhancement capacity will give the ideal

amounts that meet the imperatives.

2. DISCUSSION & ANALYSIS

2.1

There is couple of vital focuses should be breaking down for better choice

making which are;

a) What would be the best batch that could be making for one batch?

3

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

b) What is the profit associated with this batch?

Decision variables:

x i = kilograms of raw materials i to order per batch

Related variables: fi = recovery i *

x i = finished goods tons of raw material

i

The optimization is:

Max [Revenue Cost of RM Electricity Cost Consumables Cost Salary

Cost]

Where, per batch,

Revenue = 29000 *

Cost of RM =

ifi /1000

Rate per Tonx i /1000

i

Electricity Cost = 4.30 * [700 *(

Consumables Cost = 2000 *

ixi

/1000+1200

ifi /1000

Salary Cost = 3000

a)

Constraint on batch size of 4,000 kg

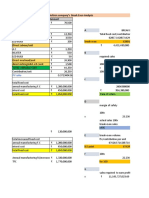

Figure 1: Solution to the batch model

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

So, to optimize a batch without any constraint related to monthly limits, profit per

batch will be INR5, 421.

b)

Batch optimization with limits implied by monthly supply

Figure 2: Solution to a model with batch variables and linear limits implied by

monthly supply

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

Alternative yields less per batch: INR 5,322. These shows yield more every month by

doing more groups, 328 versus 321. There are more batches every month this

optimization in light of the breaking point on the month to month supply. As a result of

this constraint, Solver now becomes strength to utilize all the more excessive material

rather than less expensive material. This enhances the general proficiency and in a

roundabout way diminishes the time of one bunch.

2.2

Second analysis, will the administrative requirement of 4,000 kg for each batch of

finished product hamper the capacity to make benefit? Is it worth to discover

administrative endorsement to expand that point of confinement?

Ideal answers for LP have hitherto been discovered called, deterministic

assumptions. Implies, presumption on complete assurance in information and

relationship of a issue are characterize. On the other hand, conditions are

continuing changing in certifiable just in this contextual analysis. Thus, to handle

the error, significance of seeing just how touchy that arrangement is to model

suspicions and information is essential.

Affectability examination only for the group without month to month

requirements in view of this case study:

Figure 3: Sensitivity analysis for batch model without supply limits

Variable Cells

Name

Tasla Raw Material per Batch (Kg)

Rangeen Raw Material per Batch (Kg)

Sponge Raw Material per Batch (Kg)

Local Scrap Raw Material per Batch (Kg)

Imported Scrap Raw Material per Batch (Kg)

HC Raw Material per Batch (Kg)

Final

Reduced

Value

Cost

Objective

Coefficient

Allowable

Increase

Allowable

Decrease

1391.788450

1391.788450

556.715379

835.073069

0.000000

1113.430760

0

0

0

0

0

0

2.67

3.37

2.14

2.37

0.18

1.24

0.72127846

1.E+30

0.56473868

0.65316276

2.93138483

1.E+30

0.56199723

1.00457297

6.98050847

4.65367232

1.E+30

0.49234907

UUM CASE STUDY 2

DECISION ANALYSIS

Pig Iron Raw Material per Batch (Kg)

SQQP 5023

278.357690

2.24

0.80967742

13.9610169

Constraints

Tasla Raw Material per Batch (Kg)

Rangeen Raw Material per Batch (Kg)

Sponge Raw Material per Batch (Kg)

Local Scrap Raw Material per Batch (Kg)

Imported Scrap Raw Material per Batch (Kg)

Final

Value

Shadow

Price

1391.788450

1391.788450

556.715379

835.073069

0

0

1.03952679

0

`

0

Constraint

R.H. Side

0

0

0

0

0

Allowable

Increase

1.E+30

1441.96107

1.E+30

1.E+30

1.E+30

Allowable

Decrease

1391.78845

1344.98991

2226.86152

3618.64997

4453.72303

HC Raw Material per Batch (Kg)

Pig Iron Raw Material per Batch (Kg)

Tasla Raw Material per Batch (Kg)

Rangeen Raw Material per Batch (Kg)

Sponge Raw Material per Batch (Kg)

Local Scrap Raw Material per Batch (Kg)

Imported Scrap Raw Material per Batch (Kg)

HC Raw Material per Batch (Kg)

Pig Iron Raw Material per Batch (Kg)

Total Finished Product per batch (Kg)

1113.430760

278.357690

1391.788450

1391.788450

556.715379

835.073069

0

1113.430760

278.357690

4000

0.57320807

0

0

0

-0.56395268

-0.63952679

-2.93138483

0

-0.80347947

3.39526792

0

0

0

0

0

0

0

0

0

4000

1751.31349

1.E+30

1391.78845

1391.78845

1386.96255

1344.98991

1331.55792

1113.43076

276.243094

1.E+30

956.36581

278.35769

1.E+30

1.E+30

557.491289

852.878465

0

1.E+30

280.504909

4000

Discussion:

i.

ii.

iii.

Batch size is a big constraint on profits

If increase the batch size by 1 kg, profit increase per batch by INR3.40

If increase batch size by ~320 batches per month, profit increase to

iv.

INR109, 000 (~6.25%)

If it requires approximately INR1, 300,000 in capital and time investment

to increase the batch size by just 100 kg, will able to recover that cost in

less than 12 months

2.3

Third analysis, what amount of benefit will Akshay Mittal lose in the event that he

should use in any event one unit of a crude material in a clump given or pick not

to utilize that crude material? This is to stay away from miserable if CEL does not

arrange a specific sort of crude material

From the sensitivity analysis in the case study:

UUM CASE STUDY 2

DECISION ANALYSIS

i.

SQQP 5023

Row 13 indicates, Imported Scrap is the only raw material not being used

in the current optimized plan which is the maximum profit per batch

ii.

without any monthly limit constraint.

Row 31 shows, CEL would losing INR2.93 per additional kilogram if use

iii.

Imported Scrap.

Suggest buying Imported Scrap if necessary and the price must below

INR20, 070 per ton.

2.4

Forth analysis, Akshay Mittal must know the suggestions from ideal batch from

question 2.1 on month to month commitment.

At the point when run Solver for boosting the benefit every month, benefit every

month shows INR1, 788,705 which is much higher than the benefit every month

assessed in question 2.1, INR1, 739,245. In the meantime, benefit per clump

INR4, 873 dropped essentially from inquiry 2.1 INR1, 739,245.

Figure 4: Nonlinear model with batch decision variables and a monthly objective

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

The past methodology finishes up a shabby and ease crude material such as HC

great in cluster plan and might incorporated in with the general mish-mash. Be

that as it may, subsequent to this is a nonlinear model, there is probability that this

enhancement may not produce a worldwide most extreme and only one of

numerous nearby maxima. Along these lines, nonlinear model required to check if

worldwide optima have. Nonlinear model need to use at many distinctive

beginning stages to see dependably wind up at same ideal arrangement.

An approach to detail a straight month to month model is to utilize month to

month crude material choice variables and include a choice variable for the

quantity of batches. Month to month enhancement:

y i = tons of raw material i to order per month

b = number of batches in a month

Revenue = 29000 *

Cost of RM =

igi

Rate per Ton yi

i

Electricity Cost = 4.30 * 700 *(

Consumables Cost = 2000 *

iyi

+1200b

igi

Salary Cost = 3000 * b

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

Subject to min and max constraint for each i, constraint on batch size of 4,000 kg,

batch size limit and hours available per month.

Monthly optimization:

Max [Revenue Cost of RM Electricity Cost Consumables Cost Salary

Cost]

Figure 5: Linear model with batch decision variables and a monthly objective

10

UUM CASE STUDY 2

DECISION ANALYSIS

SQQP 5023

Discussion:

i.

ii.

2.5

Profit per month is same as profit per month for nonlinear monthly model.

Nonlinear model did provide a global optimal

Last analysis, what are the suggestions to improve profits?

Based on sensitivity analysis (Fig 3):

i.

ii.

Find other sources for Rangeen to increase supply.

Negotiate a deal with supplier and pay an amount up to an additional

INR919 per ton of supply for each ton over the current limit of 500 tons.

iii.

Improve time per month from 600 hours to higher. Every one hour

increase in time will result profit by INR2, 981. This additional profit

iv.

would be applicable for the next 7.7 hours.

Improve the time per month:

a. Hire better maintenance personnel to reduce maintenance time

b. Use better / costlier machinery to reduce breakdown periods

c. Timely supply of consumables and spare parts to reduce waiting

time (emergency)

d. Put in place a better safety plan for workers to reduce time in

related activities.

3. REFERENCES

i.

Render B., Stair, R.M., & Hanna, M.E. (2006). Quantitative Analysis for

ii.

Management. Prentice Hall.

(2011), Chandpur Enterprises Limited, Steel Division: Teaching Note

11

You might also like

- BMW Coding Esys PDFDocument2 pagesBMW Coding Esys PDFZakaria El100% (1)

- Oracle Database 12c SQL 1Z0 071 ExamDocument40 pagesOracle Database 12c SQL 1Z0 071 Exammarouli90100% (4)

- SDM VodafoneDocument21 pagesSDM VodafoneSivaganesh GeddadaNo ratings yet

- Scope Management Plan Template With InstructionsDocument6 pagesScope Management Plan Template With InstructionsshimelisNo ratings yet

- What Is SPARCS System? Examine World's Inventory and Financial Performance To Understand How Successful The System WasDocument17 pagesWhat Is SPARCS System? Examine World's Inventory and Financial Performance To Understand How Successful The System WasraviNo ratings yet

- Case Study 2 - ChandpurDocument11 pagesCase Study 2 - Chandpurpriyaa03100% (3)

- Final Project Strategic Management and PolicyDocument10 pagesFinal Project Strategic Management and PolicyBushra ImranNo ratings yet

- Alesoft NC: Vinit Chheda Ankita Ray Dixi Zaveri Kanika Ahuja Shraddha Patel Aditi BhattacharyaDocument39 pagesAlesoft NC: Vinit Chheda Ankita Ray Dixi Zaveri Kanika Ahuja Shraddha Patel Aditi BhattacharyaAnkita RayNo ratings yet

- Sathish (SAP SD) ResumeDocument4 pagesSathish (SAP SD) ResumeSathish Sarika100% (4)

- Oracle Taleo Recruiting: Requisition Management Training Guide - Section 2Document50 pagesOracle Taleo Recruiting: Requisition Management Training Guide - Section 2krishnaNo ratings yet

- 9780521190176Document344 pages9780521190176Habib MradNo ratings yet

- Chandpur Enterprises LTDDocument8 pagesChandpur Enterprises LTDPritam KarmakarNo ratings yet

- PGP2 Nict 2013PGPM010Document3 pagesPGP2 Nict 2013PGPM010Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM039Document5 pagesPGP2 Nict 2013PGPM039Rachit PradhanNo ratings yet

- Sale SoftDocument2 pagesSale SoftHarsimran KharoudNo ratings yet

- Demonetisation 422Document14 pagesDemonetisation 422swethabonthula vsNo ratings yet

- SalesoftDocument32 pagesSalesoftBhuvaneswari HarikrishnanNo ratings yet

- Company Customers Competitors Collaborators ContextDocument3 pagesCompany Customers Competitors Collaborators ContextSanjay SankhalaNo ratings yet

- Problem SetDocument6 pagesProblem SetKunal KumarNo ratings yet

- Godrej HomeAppliance Case StudyDocument6 pagesGodrej HomeAppliance Case StudySabiha Parveen SalarNo ratings yet

- Key ElectronicsDocument10 pagesKey ElectronicsAaditya VasnikNo ratings yet

- Deltron Company's Break Even Analysis Particulars Amount: PV RatioDocument7 pagesDeltron Company's Break Even Analysis Particulars Amount: PV RatiorajyalakshmiNo ratings yet

- Three Squirrels and A Pile of NutsDocument6 pagesThree Squirrels and A Pile of NutsAnurag GoelNo ratings yet

- QMDocument87 pagesQMjyotisagar talukdarNo ratings yet

- Managing Change at Disney's European OperationsDocument11 pagesManaging Change at Disney's European OperationsGiskardNo ratings yet

- Dipesh - The Project ManagerDocument3 pagesDipesh - The Project ManagerJana50% (2)

- ISM Case Analysis (Cisco Systems) : Group 13 Section - ADocument6 pagesISM Case Analysis (Cisco Systems) : Group 13 Section - AManish Kumar BansalNo ratings yet

- Goodmorning BreakFast Cereal - Dimensioning Teaching NoteDocument13 pagesGoodmorning BreakFast Cereal - Dimensioning Teaching Notesunil sakriNo ratings yet

- Rougir Cosmetics CaseDocument4 pagesRougir Cosmetics CaseRafay FarooqNo ratings yet

- Service Quality Gap Model - Singpore Post Case - Group15Document3 pagesService Quality Gap Model - Singpore Post Case - Group15FuckYou TradingNo ratings yet

- TFC Scenario AnalysisDocument3 pagesTFC Scenario AnalysisAshish PatelNo ratings yet

- Buckeye Power Light CompanyDocument0 pagesBuckeye Power Light CompanybalamaestroNo ratings yet

- A Note On Quality - Group RDocument6 pagesA Note On Quality - Group RPuneet AgrawalNo ratings yet

- Case American Well Group6 PGPUAE2013Document3 pagesCase American Well Group6 PGPUAE2013saurabhpontingNo ratings yet

- Barbie faces Islamic DollsDocument4 pagesBarbie faces Islamic DollsSiddharth AgrawalNo ratings yet

- Optimizing Soda Promotional SpendingDocument10 pagesOptimizing Soda Promotional SpendingzqasimNo ratings yet

- Diagnose The Underlying Cause of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?Document2 pagesDiagnose The Underlying Cause of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?SARTHAK NAVALAKHA100% (1)

- Case Study 1Document5 pagesCase Study 1Trang Pham50% (2)

- AG6 MooreDocument5 pagesAG6 MooreKavan VaghelaNo ratings yet

- Classic Ltd.Document3 pagesClassic Ltd.Alexandra CaligiuriNo ratings yet

- Product & Brand Management Group-1: Coffee Wars in India: Café Coffe E DayDocument15 pagesProduct & Brand Management Group-1: Coffee Wars in India: Café Coffe E DayAjay KumarNo ratings yet

- Waterloo Mongolian Grill OptimizationDocument4 pagesWaterloo Mongolian Grill OptimizationAdvait BopardikarNo ratings yet

- Wilkerson Company Case Numerical Approach SolutionDocument3 pagesWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroNo ratings yet

- WorkingGroup - A1 - Ingersoll Rand (A)Document5 pagesWorkingGroup - A1 - Ingersoll Rand (A)Apoorva SharmaNo ratings yet

- American Well: The Doctor Will E-See You Now - CaseDocument7 pagesAmerican Well: The Doctor Will E-See You Now - Casebinzidd007No ratings yet

- NICT at a crossroads: To diversify or consolidateDocument3 pagesNICT at a crossroads: To diversify or consolidateRachit PradhanNo ratings yet

- Mis Case Submission: CISCO SYSTEMS, Inc.: Implementing ERPDocument3 pagesMis Case Submission: CISCO SYSTEMS, Inc.: Implementing ERPMalini RajashekaranNo ratings yet

- Managerial Communication: Assignment 1: Facebook Fake News The Post-Truth WorldDocument3 pagesManagerial Communication: Assignment 1: Facebook Fake News The Post-Truth WorldMittal Kirti MukeshNo ratings yet

- The Power of Direct Sales Growth Through Motivation and TrainingDocument8 pagesThe Power of Direct Sales Growth Through Motivation and TrainingSaurabh PalNo ratings yet

- Jindi EnterprisesDocument2 pagesJindi EnterprisesVvb SatyanarayanaNo ratings yet

- BarillaDocument7 pagesBarillaspchua18100% (1)

- Classic Knitwear CaseDocument4 pagesClassic Knitwear CaseSwapnil JoardarNo ratings yet

- Inventory ProblemsDocument6 pagesInventory ProblemsSubhrodeep DasNo ratings yet

- Icrosoft Canada Sales AND Product Management Working TogetherDocument7 pagesIcrosoft Canada Sales AND Product Management Working TogetherManoj TyagiNo ratings yet

- ME Problem Set-IIIDocument2 pagesME Problem Set-IIIDivi KhareNo ratings yet

- The Fashion ChannelDocument6 pagesThe Fashion ChannelSankha BhattacharyaNo ratings yet

- Cottle-Taylor Expanding The Oral Care Group in India Group-6Document17 pagesCottle-Taylor Expanding The Oral Care Group in India Group-6ayush singlaNo ratings yet

- Arogya Parivar Case Analysis Group 4 Sec - CDocument5 pagesArogya Parivar Case Analysis Group 4 Sec - CMuktesh SinghNo ratings yet

- SalesDocument3 pagesSalesEdgardo MartinezNo ratings yet

- Choosing the Right Cloud Services Provider for FintechDocument11 pagesChoosing the Right Cloud Services Provider for FintechAkshay BNo ratings yet

- CiscoDocument80 pagesCiscoAnonymous fEViTz3v6No ratings yet

- Iggy's Bread of the World Case AnalysisDocument8 pagesIggy's Bread of the World Case AnalysisNitish Mohan Saxena100% (1)

- Case Study (Midtown Medical Centre)Document3 pagesCase Study (Midtown Medical Centre)Sarmad AminNo ratings yet

- New Year Eve CrisisDocument6 pagesNew Year Eve CrisisManoj Kumar MishraNo ratings yet

- Chandragupt Institute of Management Patna: Case StudyDocument11 pagesChandragupt Institute of Management Patna: Case StudyAdarsh KumarNo ratings yet

- SmedDocument10 pagesSmedGaurav VermaNo ratings yet

- ProdinnochartDocument12 pagesProdinnochartGaurav VermaNo ratings yet

- Schmedders Karl CV 0410 PDFDocument8 pagesSchmedders Karl CV 0410 PDFGaurav VermaNo ratings yet

- Abstract and Numerical Assessment ReportDocument2 pagesAbstract and Numerical Assessment ReportGaurav VermaNo ratings yet

- List of Textbooks - Term 4Document1 pageList of Textbooks - Term 4Gaurav VermaNo ratings yet

- CRO ChangeDocument2 pagesCRO ChangeGaurav VermaNo ratings yet

- PwC Technology Consulting Intern JobDocument1 pagePwC Technology Consulting Intern JobGaurav VermaNo ratings yet

- Job Description Form (Summers) : Name of The FirmDocument2 pagesJob Description Form (Summers) : Name of The FirmGaurav VermaNo ratings yet

- Missile GuidanceDocument25 pagesMissile GuidanceGaurav VermaNo ratings yet

- Pro MechanismDocument6 pagesPro MechanismKleberCunhaNo ratings yet

- Two Wheelers DataDocument19 pagesTwo Wheelers DataGaurav VermaNo ratings yet

- Guidance by Paul ZarchanDocument26 pagesGuidance by Paul ZarchanUmar BhattiNo ratings yet

- Missile GuidanceDocument25 pagesMissile GuidanceGaurav VermaNo ratings yet

- Macaw Pipeline Defects PDFDocument2 pagesMacaw Pipeline Defects PDFMohamed NouzerNo ratings yet

- Cyrus Beck AlgorithDocument6 pagesCyrus Beck AlgorithromeorockNo ratings yet

- Coca ColaDocument7 pagesCoca ColaKhushi Chadha100% (2)

- Ifix 6.0Document63 pagesIfix 6.0sugesusNo ratings yet

- 2012 Endeavour Awards Referee ReportDocument2 pages2012 Endeavour Awards Referee ReportKarma Wangdi100% (1)

- C# - Loops: Loop Control StatementsDocument2 pagesC# - Loops: Loop Control Statementspbc3199No ratings yet

- Essentials of Adobe FlashDocument111 pagesEssentials of Adobe FlashWhite909No ratings yet

- White Paper On SkypeDocument6 pagesWhite Paper On Skypem2ei24No ratings yet

- Micom S1 V2 For Micom Px40Document58 pagesMicom S1 V2 For Micom Px40Insan AzizNo ratings yet

- Coreboot Tutorial - OSCON 2013Document81 pagesCoreboot Tutorial - OSCON 2013Dacaen DanNo ratings yet

- BBC Service ManualDocument90 pagesBBC Service ManualJeremy VinesNo ratings yet

- WellCost Data SheetDocument4 pagesWellCost Data SheetAmirhosseinNo ratings yet

- Simulation and Implementation of An Embedded Hybrid Fuzzy Trained Artificial Neural Network Controller For Different DC MotorDocument18 pagesSimulation and Implementation of An Embedded Hybrid Fuzzy Trained Artificial Neural Network Controller For Different DC MotorvmspraneethNo ratings yet

- Computer NetworksDocument47 pagesComputer NetworksJeena Mol AbrahamNo ratings yet

- ACA Unit 4Document27 pagesACA Unit 4PoonkothaiMyilNo ratings yet

- State Estimation in Electric Power SystemsDocument1 pageState Estimation in Electric Power Systemsruben773No ratings yet

- ORACLE EPM 11.1.2.2 - First Look: EPM 11.1.2.2 Deployment Topology ReportDocument4 pagesORACLE EPM 11.1.2.2 - First Look: EPM 11.1.2.2 Deployment Topology ReportPriyanka GargNo ratings yet

- ConclusionDocument1 pageConclusionParas JatanaNo ratings yet

- Project Proposal PI ControllerDocument10 pagesProject Proposal PI ControllerMuhammad ArsalNo ratings yet

- 01 - Building Universal Windows Apps - Part 1Document31 pages01 - Building Universal Windows Apps - Part 1Samuel Peña LucianoNo ratings yet

- ICMS Table 215-00-000Document7 pagesICMS Table 215-00-000nicoloh2002No ratings yet

- Steps To Convert Autoplant Piping To Caepipe / Caesar Ii: Step 1Document1 pageSteps To Convert Autoplant Piping To Caepipe / Caesar Ii: Step 1carlawtNo ratings yet

- C Multiple Choice Questions and Answers MCQ With AnsDocument22 pagesC Multiple Choice Questions and Answers MCQ With AnsVishwa KrishnanNo ratings yet

- Gkapantow2, Jurnal Epm Danko Yakobus Bahabol 9Document10 pagesGkapantow2, Jurnal Epm Danko Yakobus Bahabol 9sittinurjennah24No ratings yet