Professional Documents

Culture Documents

Saudi Arabia's $17B Bond

Uploaded by

konspiratsiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Saudi Arabia's $17B Bond

Uploaded by

konspiratsiaCopyright:

Available Formats

Saudi Arabias $17.

5bn bond sale has lessons for debt market

1 of 6

https://www.ft.com/content/92158e52-95f4-11e6-a80e-bcd69f323a8b

Saudi Arabias ambitious plan to chart a course away from oil dependence and

towards a more diversified economy is off to a flying start with a blockbuster

$17.5bn debut sovereign bond sale (http://next.ft.com/content/b4f1f1da-95e6-11e6a1dc-bdf38d484582).

Investors shrugged off concerns about the prospect of the sustained oil slump

translating into years of anaemic growth, aggravating social concerns and a backdrop

of regional tensions.

The lure of investing in a large economy with little debt that has never before issued a

dollar-denominated bond, piqued global interest. Investor orders reached $67bn,

enabling Saudi Arabia (https://www.ft.com/topics/places/Saudi_Arabia) to borrow

more and more cheaply than initially suggested.

As bankers pat themselves on the back and officials plan their next move, here is what

25 Oct 16 8:57 AM

Saudi Arabias $17.5bn bond sale has lessons for debt market

2 of 6

https://www.ft.com/content/92158e52-95f4-11e6-a80e-bcd69f323a8b

we learnt from Saudi Arabias first sale of international debt.

Emerging market debt is still in fashion

This has been the year of the megabond, with the three largest sales of emerging

market sovereign debt in history coming within the space of a few months. At

$17.5bn, Saudi Arabias bond eclipses Argentinas (http://next.ft.com/content

/10066178-0550-11e6-a70d-4e39ac32c284) $16.5bn sale in April, making it a record

issue for an emerging economy. It far outweighs neighbouring Qatars $9bn bond

sold in May.

The order book was also sufficiently large to enable the country to raise the amount it

planned to sell from $15bn and tighten up prices. Investors had expected Saudi

Arabia to sell 10-year debt at a 50 basis point premium to Qatar, which carries a

higher credit rating.

Instead, the new 10-year bond was sold at a yield of 3.25 per cent, only 30 basis

points above Qatars. Five-year debt came with a yield of 2.375 per cent, while

30-year bonds were sold at a 4.5 per cent yield. Investors say the bond was received

well in secondary markets, with prices slightly up in initial trading.

25 Oct 16 8:57 AM

Saudi Arabias $17.5bn bond sale has lessons for debt market

3 of 6

https://www.ft.com/content/92158e52-95f4-11e6-a80e-bcd69f323a8b

While Saudi Arabia made a concerted effort to target a western audience, flying some

of its top officials to London, Boston, New York and Los Angeles to make the case,

Richard House of Standard Life Investments says demand was probably accelerated

by external factors beyond its control.

Interest rate cuts and central bank bond buying in the west has driven $12tn of

government bonds to trade at negative yields. As a result, after the hiccup caused by

the US rate rise in December and worries about China at the start of this year, money

has surged back into emerging markets (http://next.ft.com/content/6c04a842-55ad11e6-9664-e0bdc13c3bef).

There is a lot of demand for anything with a yield, says Mr House. Very few EM

bond sales have gone badly this year.

That said, some EM investors were ambivalent towards Saudi Arabias sale. The

10-year bond yield was far lower than the average yield on emerging market bonds

tracked by JPMorgans emerging market bond index which is currently 5.2 per

cent. As a G20 economy with an A rating from Standard & Poors, Fitch and Moodys,

the country was almost too good a credit for them.

I didnt participate there are other countries in the region that offer more value,

says Claudia Calich, emerging market fund manager at M&G.

Max Wolman, senior investment manager at Aberdeen Asset Management, says: The

bond sits awkwardly between developed and developing portfolios.

And the rates were not overly generous.

25 Oct 16 8:57 AM

Saudi Arabias $17.5bn bond sale has lessons for debt market

4 of 6

https://www.ft.com/content/92158e52-95f4-11e6-a80e-bcd69f323a8b

Long-dated debt is still hot

One of the most peculiar aspects of Saudi Arabias debut on global bond markets was

that it sold more 30-year debt than five or 10-year debt. Of the $17.5bn issued, $6.5bn

was sold to investors who will not get their money back until 2046.

EM investors typically prefer shorter-dated bonds which reduce the risk of

unforeseen circumstances damaging their chances of being repaid. Saudi Arabia is

not without risk. The country is an undiversified oil economy accustomed to a world

where crude prices are double the current level. The non-oil economy has ground to a

halt and is on the brink of its first full-year of contraction since 1987.

Saudi Arabia also sits in a region suffering geopolitical tension and without enough

jobs for its youthful population. The kingdom is accused of ideologically fostering

Sunni jihadism, and has now become a target for Islamist extremists Isis.

But the appetite for 30-year bonds echoes a trend across global markets, where

demand for long-dated debt has been flattening yield curves (http://next.ft.com

/content/f87fc01a-2edc-11e6-bf8d-26294ad519fc).

The culprit is central bank policy, particularly that of the UK, Europe and Japan,

where interest rates have been cut back to record lows and mass bond-buying

schemes are in place to try to lift growth and inflation.

Before Saudi Arabia issued its bond, officials visited a number of countries in Asia

25 Oct 16 8:57 AM

Saudi Arabias $17.5bn bond sale has lessons for debt market

5 of 6

https://www.ft.com/content/92158e52-95f4-11e6-a80e-bcd69f323a8b

(http://next.ft.com/content/ba0895b0-6f95-11e6-9ac1-1055824ca907), including

Japan, to meet investors. Bankers close to the deal told the Financial Times in August

that investors, such as pension funds and insurance companies in the region, were

planning to put down large bids for the bonds and that they were particularly

interested in longer-dated debt to match their long-dated liabilities.

Saudi Arabia is serious about reinventing its economy

The kingdoms decision to launch its first dollar-denominated bond was driven by one

thing: oil. The largest economy in the Middle East is still heavily reliant on oil

exports, meaning the crash in prices from more than $100 a barrel in 2014 to as low

as $30 at the start of 2016 has inflicted serious damage.

In response, Saudi Arabia has created an ambitious plan to reduce the role of the

state, cutting public wages, cancelling infrastructure projects and planning the

worlds largest IPO in Saudi Aramco.

Selling dollar-denominated bonds is part of the same vision, and sets a benchmark

against which other entities can raise their own debt. By 2020, Saudi Arabia expects

its debt to reach 30 per cent of GDP, from less than 8 per cent now.

But to do that, officials are aware that they will have to become more comfortable

with a greater level of transparency. Gregory Saichin, chief investment officer for

emerging market bonds at Allianz Global Investors, said Saudi officials were acutely

aware of the changes needed, and called the bond roadshow polished.

They spoke about making the government more accountable and improving

transparency while stressing the size of the economy and near lack of existing debt,

he says. They pushed every button investors wanted to hear.

However, some investors complained that representatives were cagey about their

views on the outlook for oil, preferring to talk about plans to trim the fat from

government spending than discuss contingency plans for possible future oil price

falls.

And most observers remain deeply sceptical about the governments ability to

reinvent the economy, no matter how strong its commitment to the task.

Unfortunately, this bond is not about preparing for the future so much as paying for

the excesses of the past, said one seasoned observer in the Gulf. The investors havet

understood this, and dont really believe in the changes for reform but they do

understand low interest rates

This bond is just the beginning

25 Oct 16 8:57 AM

Saudi Arabias $17.5bn bond sale has lessons for debt market

6 of 6

https://www.ft.com/content/92158e52-95f4-11e6-a80e-bcd69f323a8b

In the lengthy bond prospectus, and at investor meetings, Saudi officials were clear

that the kingdom intends to use this sovereign bond as a jumping off point for a flurry

of deals. The country expects to issue as much as $120bn of debt in the coming years.

This a deliberate change in terms of their long-term financing plans, says Rick

Harrell at Loomis Sayles. They will look to come every or every other year to

international markets.

The sale of debt may have broken records for an emerging market issuer, but it will

only finance about a third of next years budget deficit, calculates Jason Tuvey,

Middle East economist at Capital Economics.

That, though, should mean the kingdoms foreign exchange reserves are unlikely to

fall much beyond their current level in the coming years.

This should dampen any lingering concerns that the riyal will be devalued, he says.

The governments debt-to-GDP ratio will rise as a result of the bond sale but, given

its low starting point, it is hardly on a worrying pathand if were right in expecting

oil prices to edge up over the coming years, then most of the spending cuts needed to

rein in the deficit and stabilise the debt ratio have already happened.

Additional reporting by Eric Platt

Print a single copy of this article for personal use. Contact us if you wish to print more

to distribute to others. The Financial Times Ltd.

Political rhetoric is against refugees taking

vacant jobs

Fear over Brexit has reignited interest in

backdoor ways of securing residency in

Europe

25 Oct 16 8:57 AM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Mastering watercolor techniques with the Watercolour ClockDocument7 pagesMastering watercolor techniques with the Watercolour Clockkonspiratsia92% (12)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 248Document66 pages248konspiratsiaNo ratings yet

- Sovereign Debt, Migration Pressure, and Government SurvivalDocument38 pagesSovereign Debt, Migration Pressure, and Government SurvivalkonspiratsiaNo ratings yet

- TH Plantation AR2016 Part1-FINALDocument49 pagesTH Plantation AR2016 Part1-FINALkonspiratsiaNo ratings yet

- MoudawanaDocument72 pagesMoudawanamareedatunNo ratings yet

- Sovereign Debt, Migration Pressure, and Government SurvivalDocument38 pagesSovereign Debt, Migration Pressure, and Government SurvivalkonspiratsiaNo ratings yet

- Residential Renovation of A SchoolhouseDocument28 pagesResidential Renovation of A SchoolhousekonspiratsiaNo ratings yet

- Sketching Faces FasterDocument16 pagesSketching Faces FasterOla Gf Olamit97% (30)

- Urban SketchersDocument45 pagesUrban Sketcherscentralla100% (29)

- Liman Irrigation SystemDocument2 pagesLiman Irrigation SystemkonspiratsiaNo ratings yet

- Stockholm Bed Frame AA 809121 6 PubDocument20 pagesStockholm Bed Frame AA 809121 6 PubkonspiratsiaNo ratings yet

- Najib - No Cover Up in Missing Jet Engine Case - TheSundailyDocument2 pagesNajib - No Cover Up in Missing Jet Engine Case - TheSundailykonspiratsiaNo ratings yet

- The Emergence of Abandoned Paddy Fields in Negeri Sembilan, MalaysiaDocument28 pagesThe Emergence of Abandoned Paddy Fields in Negeri Sembilan, MalaysiakonspiratsiaNo ratings yet

- Saudi TransportationDocument24 pagesSaudi TransportationkonspiratsiaNo ratings yet

- IslamicDocument120 pagesIslamicsalahuddin_md5935No ratings yet

- Recent Developments in Natural Rubber PricesDocument3 pagesRecent Developments in Natural Rubber PriceskonspiratsiaNo ratings yet

- En The DajjaalDocument24 pagesEn The Dajjaalobl97No ratings yet

- Depreciation and Error Analysis A Depreciation Schedule For Semi PDFDocument1 pageDepreciation and Error Analysis A Depreciation Schedule For Semi PDFAnbu jaromiaNo ratings yet

- M7C Adjusting Process Prepaid ExpensesDocument8 pagesM7C Adjusting Process Prepaid ExpensesCharles Eli AlejandroNo ratings yet

- FIM Exercises 1Document15 pagesFIM Exercises 1Hoang Hieu LyNo ratings yet

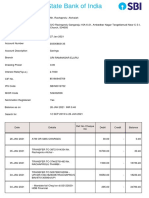

- State Bank of India savings account statement for Mr. Rachaprolu AtchaiahDocument12 pagesState Bank of India savings account statement for Mr. Rachaprolu AtchaiahRajesh pvkNo ratings yet

- What is Venture Capital Funding and How Does it Work? (39Document24 pagesWhat is Venture Capital Funding and How Does it Work? (39Ashish MahendraNo ratings yet

- Financial Management MCQ QuestionsDocument8 pagesFinancial Management MCQ QuestionsAbhijeet Singh BaghelNo ratings yet

- Hammersmith and Fulham: Interest Rate Swaps DebacleDocument20 pagesHammersmith and Fulham: Interest Rate Swaps Debaclenikhil_paiNo ratings yet

- Facebook - DCF ValuationDocument9,372 pagesFacebook - DCF ValuationDibyajyoti Oja0% (2)

- LBO Fundamentals: Structure, Performance & Exit StrategiesDocument40 pagesLBO Fundamentals: Structure, Performance & Exit StrategiesSouhail TihaniNo ratings yet

- GST Paper 11Document44 pagesGST Paper 11Vipin MisraNo ratings yet

- FINA 5120 - Fall (1) 2022 - Session 6 (With Answers) - Risk and Return CAPM - 26 August22Document94 pagesFINA 5120 - Fall (1) 2022 - Session 6 (With Answers) - Risk and Return CAPM - 26 August22Yilin YANGNo ratings yet

- Transaction Conversion Form PNB Credit CardsDocument1 pageTransaction Conversion Form PNB Credit Cardserwin lumibaoNo ratings yet

- 1 Associate (SOFP SOCI) - Class NotesDocument9 pages1 Associate (SOFP SOCI) - Class NotesIshtiaq KhaliqNo ratings yet

- Goldline Defence Towers 04-Aug-23Document11 pagesGoldline Defence Towers 04-Aug-23Faizan KarsazNo ratings yet

- Deposits in Transit and Outstanding Checks PDFDocument1 pageDeposits in Transit and Outstanding Checks PDFAaliyah Joize LegaspiNo ratings yet

- Sprott Gold Report: The Gold Investment Thesis RevisitedDocument8 pagesSprott Gold Report: The Gold Investment Thesis RevisitedOwm Close CorporationNo ratings yet

- Multinational Inventory ManagementDocument2 pagesMultinational Inventory ManagementPiyush Chaturvedi75% (4)

- State Bank of India2 PDFDocument2 pagesState Bank of India2 PDFibicengNo ratings yet

- Moniepoint Document 2023-07-28T05 05.xlaDocument42 pagesMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNo ratings yet

- Karnataka Thanda Development Corporation Tender DocumentDocument34 pagesKarnataka Thanda Development Corporation Tender DocumentNasir AhmedNo ratings yet

- Financial Markets and Institutions Test Bank (021 030)Document10 pagesFinancial Markets and Institutions Test Bank (021 030)Thị Ba PhạmNo ratings yet

- Study On Saving & Investment Pattern of SalariedpersonDocument109 pagesStudy On Saving & Investment Pattern of SalariedpersonTasmay Enterprises100% (3)

- Mekidelawit Tamrat MBAO9550.14BDocument4 pagesMekidelawit Tamrat MBAO9550.14BHiwot GebreEgziabherNo ratings yet

- SESSION14Document10 pagesSESSION14RADHIKA RASTOGINo ratings yet

- Net Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BDocument23 pagesNet Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BNaila FaradilaNo ratings yet

- Sun Life Financial - Unlocking The Value in A BusinessDocument37 pagesSun Life Financial - Unlocking The Value in A BusinessDanny KlinbuppaNo ratings yet

- The Open EconomyDocument44 pagesThe Open EconomySuruchi SinghNo ratings yet

- MARK MARTIN SETS UP BUSINESSTITLE JANET FAIRBRASS BEAUTY BUSINESS TRIAL BALANCEDocument2 pagesMARK MARTIN SETS UP BUSINESSTITLE JANET FAIRBRASS BEAUTY BUSINESS TRIAL BALANCESam TaylorNo ratings yet

- Unit 1 ActvitiesDocument6 pagesUnit 1 ActvitiesLeslie Mae Vargas ZafeNo ratings yet

- 2018 BBB Scam Tracker Risk Report InfographicDocument1 page2018 BBB Scam Tracker Risk Report InfographicKOLD News 13No ratings yet