Professional Documents

Culture Documents

HCL Acquires Aerospace & Defense Engineering Services Provider Butler America Aerospace, LLC (Company Update)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HCL Acquires Aerospace & Defense Engineering Services Provider Butler America Aerospace, LLC (Company Update)

Uploaded by

Shyam SunderCopyright:

Available Formats

October 21, 2016

Mr. Girish Joshi

Mr. Avinash Kharkar

BSE Limited

Phiroze Jeejeebhoy Towers

Dalal Street

Mumbai 400 001

National Stock Exchange of India Limited

Exchange Plaza, 5th Floor, Plot No. C/1, G Block

Bandra Kurla Complex, Bandra (East)

Mumbai 400 051

Sub: HCL Acquires Aerospace & Defense Engineering Services Provider Butler America

Aerospace, LLC

Dear Sir,

Enclosed please find a release on the captioned subject being issued by the Company today.

Further, in terms of Regulation 30 (4) of the SEBI (Listing Obligations and Disclosures

Requirements) Regulations 2015, enclosed are the details of the aforesaid acquisition.

This is for your information and records.

Thanking you,

Yours faithfully,

For HCL Technologies Limited

Manish Anand

Company Secretary

Encl:a/a

HCL Acquires Aerospace & Defense Engineering Services Provider Butler

America Aerospace, LLC

Acquisition will strengthen HCLs position in the Aerospace and Defense Engineering Services space

Noida, India, 21st October, 2016: HCL Technologies (HCL), a leading global IT services provider, has entered into

an agreement to acquire Butler America Aerospace, LLC (Butler Aerospace), a provider of engineering, design

services and aftermarket engineering services to US Aerospace and Defense customers. Butler Aerospace is a

wholly owned subsidiary of Butler America LLC. The proposed acquisition will exclude the staffing business of

Butler America Inc.

Butler Aerospace serves customers primarily in the Aerospace and Defense industries in the US, to whom it

provides Engineering & Design services in the areas of Mechanical and Structural Design, Electrical Design, Tool

design and aftermarket engineering services

With over 900 highly skilled engineers and 7 design centers in the US, Butler Aerospace has a marquee list of

clients in the Aerospace & Defense industries and works with OEMs and their Suppliers. The acquisition will

bolster HCLs capabilities in this space and access to clients with large R&D spends.

The consideration for the proposed transaction is USD 85.0 million to be paid in cash. Butler Aerospace had

revenues of $85.4 million for the year ending Dec 31, 2015 at EBIT of 12.2%. The transaction when

consummated is likely to be EPS accretive.

The acquisition is subject to regulatory approvals including CFIUS approval in the US, along with other

customary closing conditions. It is expected to be completed by December 31, 2016.

About HCL Technologies

HCL Technologies is a leading global IT services company working with clients to impact and redefine the core of

their businesses. Since its emergence on the global landscape after its IPO in 1999 and listing in 2000, HCL

Technologies, along with its subsidiaries, today operates out of 32 countries and has consolidated revenues of

US$ 6.6 billion, for 12 Months ended 30 September, 2016. For the 21st Century Enterprise, HCL focuses on

business model transformation, underlined by innovation and value creation, offering an integrated portfolio of

services including BEYONDigitalTM, IoT WoRKSTM, Engineering Services Outsourcing and NextGeneration ITO that

focuses on integrated infrastructure services, applications services and business services. HCL leverages

DRYiCETM, its third generation autonomics and orchestration platform, global network of integrated innovation

labs, and global delivery capabilities to provide holistic multiservice delivery in key industry verticals including

Financial Services, Manufacturing, Telecommunications, Media, Publishing Entertainment, Retail CPG, Life

Sciences Healthcare, Oil Gas, Energy Utilities, Travel, Transportation Logistics and Government. With 109,795

professionals from diverse nationalities, HCL Technologies focuses on creating real value for customers by taking

'Relationships Beyond the Contract'. For more information, please visit www.hcltech.com

HCL

Forward-Looking

Statements

Certain statements in this release are forward-looking statements, which involve a number of risks, uncertainties,

assumptions and other factors that could cause actual results to differ materially from those in such forward-looking

statements. All statements, other than statements of historical fact are statements that could be deemed forward looking

statements, including but not limited to the statements containing the words 'planned', 'expects', 'believes, strategy',

'opportunity', 'anticipates', 'hopes' or other similar words. The risks and uncertainties relating to these statements include,

but are not limited to, risks and uncertainties regarding impact of pending regulatory proceedings, fluctuations in earnings,

our ability to manage growth, intense competition in IT services, Business Process Outsourcing and consulting services

including those factors which may affect our cost advantage, wage increases in India, customer acceptances of our services,

products and fee structures, our ability to attract and retain highly skilled professionals, our ability to integrate acquired

assets in a cost effective and timely manner, time and cost overruns on fixed-price, fixed-time frame contracts, client

concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for

technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and

integrate potential acquisitions, the success of our brand development efforts, liability for damages on our service contracts,

the success of the companies /entities in which we have made strategic investments, withdrawal of governmental fiscal

incentives, political instability, legal restrictions on raising capital or acquiring companies outside India, and unauthorized

use of our intellectual property, other risks, uncertainties and general economic conditions affecting our industry. There can

be no assurance that the forward looking statements made herein will prove to be accurate, and issuance of such forward

looking statements should not be regarded as a representation by the Company, or any other person, that the objective and

plans of the Company will be achieved. All forward looking statements made herein are based on information presently

available to the management of the Company and the Company does not undertake to update any forward-looking

statement that may be made from time to time by or on behalf of the Company.

For enquiries please contact:

Global

Ajay Davessar

HCL Technologies Ltd.

ajay.davessar@hcl.com

+911206126000

Details under Reg. 30(4) of SEBI (LODR) Regulations, 2015

S. No

Question

Name of the target entity (details in brief such as size, turnover etc.)

Target: Butler America Aerospace, LLC , ("Butler Aerospace") a wholly owned subsidiary of Butler

America Inc.

Target description: Butler Aerospace serves customers primarily in the Aerospace and Defense

Industries in the US to whom it provides Engineering & Design services in the areas of

Mechanical and Structural Design, Electrical Design,Tool design and aftermarket engineering

services.

Whether the acquisition would fall within related party transaction(s) and whether the

promoter/ promoter group/ group companies have any interest in the entity being acquired?

If yes, nature of interest and details thereof and whether the same is done at arms length

This transaction does not fall within the definition of related party transaction.

Industry to which the entity being acquired belongs

IT Industry (Engineering and R&D services)

Objects and effects of acquisition (including but not limited to, disclosure of reasons for

acquisition of target entity, if its business is outside the main line of business of the listed

entity)

The acquisition will bolster HCLs capabilities in engineering services and access to clients with

large R&D spends.

Brief details of any governmental or regulatory approvals required for the acquisition

Indicative time period for completion of the acquisition

Nature of consideration - whether cash consideration or share swap and details of the same

Cost of acquisition or the price at which the shares are acquired

The Consideration for this proposed transaction is USD 85.0 million to be paid in Cash

Percentage of shareholding / control acquired and / or number of shares acquired

Acquiring 100% of Butler America Aerospace, LLC through cash consideration.

Brief background about the entity acquired in terms of products/line of business acquired,

date of incorporation, history of last 3 years turnover, country in which the acquired entity has

presence and any other significant information (in brief)

Butler America Aerosapce, LLC ("Butler Aerospace") is a recently formed entity, formed by spun

off of Aerospace and Defense business of Butler America Inc. It is a wholly owned subsidiary of

Butler America Inc. Butler Aerospace serves customers primarily in the Aerospace and Defense

Industries in the US to whom it provides Engineering & Design services in the areas of

Mechanical and Structural Design, Electrical Design, Tool design and aftermarket engineering

services.

Year of Incorporation of Butler

America Inc. (the parent entity): 1946

Country in which Acquired entity has presence: US

Revenue: $46.3M in Jan-June 2016, $85.4 M in FY15, (FY ending December). $78.3m FY 14. The

company had EBIT of 10.9% in FY 14, 12.2% in FY 15 and 12.4% in Jan-June 2016.

10

The acquisition is subject to certain regulatory approvals (including Committee for Foreign

Investment in US ).

The transaction is likely to be closed by 31st December, 2016

HCL America Inc., a subsidiary of HCL Technologies Limited, ("HCL") will be acquiring 100% Stock

of the Company with cash consideration

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Major Issues Relating To Infrastructure of Indian RailwaysDocument80 pagesMajor Issues Relating To Infrastructure of Indian Railwayssri103120% (5)

- New Coke/coke2Document3 pagesNew Coke/coke2Hamza Bin TariqNo ratings yet

- Xylia's Xylia's Cup Cup Hunt Hunt: Racing RoyaltyDocument64 pagesXylia's Xylia's Cup Cup Hunt Hunt: Racing RoyaltyadamdobbinNo ratings yet

- Sem-1 Syllabus Distribution 2021Document2 pagesSem-1 Syllabus Distribution 2021Kishan JhaNo ratings yet

- Air India (HRM) - Invitation Letter - 2 PDFDocument2 pagesAir India (HRM) - Invitation Letter - 2 PDFNilesh Sanap100% (2)

- Revenue Cycle ReportDocument15 pagesRevenue Cycle ReportKevin Lloyd GallardoNo ratings yet

- Design Technology Project Booklet - Ver - 8Document8 pagesDesign Technology Project Booklet - Ver - 8Joanna OlszańskaNo ratings yet

- Isj 045Document36 pagesIsj 0452imediaNo ratings yet

- Beer Industry IndiaDocument33 pagesBeer Industry Indiaallen1191919No ratings yet

- Assessing ROI On CloudDocument6 pagesAssessing ROI On CloudLeninNairNo ratings yet

- 10 - Over The Top Player EU PDFDocument137 pages10 - Over The Top Player EU PDFVicky Cornella SNo ratings yet

- Lampiran PMK 156 2015Document3 pagesLampiran PMK 156 2015Torang Shakespeare SiagianNo ratings yet

- Qa DocumentDocument40 pagesQa Documentapi-260228939No ratings yet

- Stevenson7ce PPT Ch03Document86 pagesStevenson7ce PPT Ch03Anisha SidhuNo ratings yet

- Sip Project ReportDocument45 pagesSip Project ReportRachit KhareNo ratings yet

- Surfcam Velocity BrochureDocument8 pagesSurfcam Velocity BrochureLuis Chagoya ReyesNo ratings yet

- Vyshnavikambar@Yahoo Com 193481Document3 pagesVyshnavikambar@Yahoo Com 193481sudhirreddy1982No ratings yet

- Research Paper - Sample SimpleDocument15 pagesResearch Paper - Sample Simplewarblade_02No ratings yet

- Circular 25 2019Document168 pagesCircular 25 2019jonnydeep1970virgilio.itNo ratings yet

- Revised Accreditation Form 1 Pharmacy Services NC IIIDocument23 pagesRevised Accreditation Form 1 Pharmacy Services NC IIICamillNo ratings yet

- Association of Differently Abled Person in The Province of AntiqueDocument2 pagesAssociation of Differently Abled Person in The Province of AntiqueLucifer MorningstarNo ratings yet

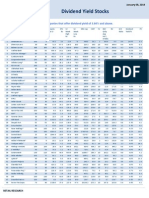

- High Dividend Yield StocksDocument3 pagesHigh Dividend Yield StockskaizenlifeNo ratings yet

- MARS Brochure NewDocument13 pagesMARS Brochure NewMars FreightsNo ratings yet

- Cost AccountingDocument57 pagesCost AccountingM.K. TongNo ratings yet

- Industrial Development in Nepal (Final)Document4 pagesIndustrial Development in Nepal (Final)susmritiNo ratings yet

- Book IndiaandSouthAsia PDFDocument278 pagesBook IndiaandSouthAsia PDFAmit KumarNo ratings yet

- Approved Employers - LahoreDocument15 pagesApproved Employers - Lahoreraheel97No ratings yet

- Leave Travel Concession (LTC) Rules: Office MemorandumDocument2 pagesLeave Travel Concession (LTC) Rules: Office Memorandumchintu_scribdNo ratings yet

- Mosque DetailsDocument21 pagesMosque DetailsdavinciNo ratings yet

- Asset Issuance SlipDocument105 pagesAsset Issuance SlipMuneer HussainNo ratings yet