Professional Documents

Culture Documents

Taxation Trends in The European Union - 2012 62

Uploaded by

d05register0 ratings0% found this document useful (0 votes)

6 views1 pagep62

Original Title

Taxation Trends in the European Union - 2012 62

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentp62

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageTaxation Trends in The European Union - 2012 62

Uploaded by

d05registerp62

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

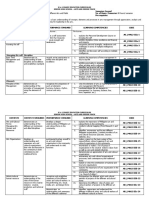

Part II

Developments in the Member States

Belgium

B

e

l

g

i

u

m

Overall trends in taxation

Structure and development of tax revenues

Belgium belongs to the group of EU countries with the highest tax levels, alongside the Nordic countries, Austria,

France and Italy. Although it has slightly declined over time, the tax-to-GDP ratio (2010: 43.9 %) is the third

highest in the EU, after Denmark and Sweden, and significantly above the EU average (2010: 35.6 %). The

structure of the Belgian tax system, in terms of the share of revenue raised by the broad categories of taxes, has

remained relatively stable since 2000.

A far-reaching tax reform of direct taxation that was gradually implemented in the first half of the last decade,

reduced PIT revenue, expressed as % of GDP, from 13.4 % in 2002 to 12.4 %, in 2006. The structure is however

still characterised by a relatively high share of direct taxes in GDP (3rd highest in the EU), reflecting a broad

reliance on personal and corporate income taxes, and social security contributions (6th highest in the EU). By

contrast, with 13.3 %, the share of indirect taxes is just below the EU average (EU-27 13.5 %). Following the 2002

corporate tax reform and a favourable business cycle, the share of corporate tax revenue had significantly increased

until 2006. A reduction in the tax base of corporations due to the ACE system and the unfavourable economic

conditions since 2008 seem to have reversed this trend. The subsequent introduction or increase of several tax

expenditures put the personal income tax revenues on a downward trend since 2003. The tax reform was

complemented by successive targeted reductions in employers' social security contributions. Since 2007, the trend

of SSC is reversed.

Belgium is a federal state with a large fiscal autonomy for the regions. This translates into varying specific tax

legislations across regions, e.g. registration duties, inheritance and estate taxes. While the revenue level of the

federal state is on the decline since the turn of the century, the revenues from the regions have remained relatively

stable over time. Regions benefited from the buoyant real estate markets. A larger share of tax revenue has also

been allocated to the Social Security Funds.

Keeping relatively stable until 2002, the overall tax burden declined almost continuously between 2003 and 2007.

(by 1.3 percentage points), notably owing to a drop in revenues from corporate and personal income taxes, and

SSC contributions, linked to the income tax reform, successive targeted reductions and the introduction of the ACE

system in 2005. Since 2008, an increasing trend of the tax-to-GDP ratio is masked by the economic cycle.

Taxation of consumption, labour and capital; environmental taxation

The implicit tax rate on consumption increased in 2010 due to improved economic conditions compared to 2009.

At 21.4 %, it was just above the EU average (EU-27 21.3 %), as for most of the last decade. As a percentage of

GDP, VAT and excise duties collection are at the lower end in the EU at respectively 7.1 % and 2.2 % (EU

average: 7.6 % and 3.2 %).

Despite noticeable labour taxation reforms, Belgium still imposes relatively heavy taxes on labour with an implicit

tax rate of 42.5 %, the second highest in the EU. Targeted rebates in employers' social contributions were used as

the main instrument to reduce labour costs. The 20002006 reform programme paved the way for easing the tax

burden on labour and led to a decrease in the ITR by 1.3 percentage points between 2004 and 2006. The ITR on

labour has been relatively stable since 2006, although it has declined in 2009 due to the economic slowdown.

However, the ITR on labour does not take into account wage subsidies, which have been increasingly used over the

past five years and should reduce the ITR further by 3 percentage points over the 2002-2009.(See Valenduc

(2011).

The ITR on capital increased from 29.5 % in 2000 to 32.8 % in 2006, after which it declined to 29.5 % in 2010.

This reflects on one side the gradual increase on the household side since 2000, explained in part by the boom in

the real estate market that has resulted in an increase of registration duties. In 2010, taxes on stocks of

Taxation trends in the European Union

61

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Entertainment Law OutlineDocument98 pagesEntertainment Law Outlineifplaw100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 1z0 1056 AR PDFDocument34 pages1z0 1056 AR PDFkishore bv100% (2)

- Invoice SpeakerDocument1 pageInvoice Speakeranil kalraNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- K to 12 Arts and Design Track Subject on Leadership and ManagementDocument10 pagesK to 12 Arts and Design Track Subject on Leadership and ManagementKarl Winn Liang100% (1)

- Legal Aspects PowerpointDocument31 pagesLegal Aspects PowerpointMARITONI MEDALLA90% (10)

- Bills-Book & FuelDocument2 pagesBills-Book & FuelEdwin DevdasNo ratings yet

- Tax317 Group Project SSTDocument23 pagesTax317 Group Project SSTNik Syarizal Nik MahadhirNo ratings yet

- Taxation Trends in The European Union - 2012 223 PDFDocument1 pageTaxation Trends in The European Union - 2012 223 PDFd05registerNo ratings yet

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 223Document1 pageTaxation Trends in The European Union - 2012 223d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 225Document1 pageTaxation Trends in The European Union - 2012 225d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 221Document1 pageTaxation Trends in The European Union - 2012 221d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 219Document1 pageTaxation Trends in The European Union - 2012 219d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 215Document1 pageTaxation Trends in The European Union - 2012 215d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 222Document1 pageTaxation Trends in The European Union - 2012 222d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 217Document1 pageTaxation Trends in The European Union - 2012 217d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 214Document1 pageTaxation Trends in The European Union - 2012 214d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 212Document1 pageTaxation Trends in The European Union - 2012 212d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 211Document1 pageTaxation Trends in The European Union - 2012 211d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 213Document1 pageTaxation Trends in The European Union - 2012 213d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 203Document1 pageTaxation Trends in The European Union - 2012 203d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 198Document1 pageTaxation Trends in The European Union - 2012 198d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 195Document1 pageTaxation Trends in The European Union - 2012 195d05registerNo ratings yet

- Kadaikkal InvoiceDocument12 pagesKadaikkal InvoiceCinema TheatreNo ratings yet

- Knowledge Utilization as a Networking ProcessDocument27 pagesKnowledge Utilization as a Networking ProcessKathy lNo ratings yet

- CASE DIGEST 1st Batch and 2nd BatchDocument21 pagesCASE DIGEST 1st Batch and 2nd BatchElla EspenesinNo ratings yet

- ReviewerDocument8 pagesReviewerjescy pauloNo ratings yet

- Asdfsdafsda Sdaf AsewwDocument59 pagesAsdfsdafsda Sdaf AsewwLGRNnewsNo ratings yet

- Watchtaxes 2008Document31 pagesWatchtaxes 2008RobertNo ratings yet

- The Economic of Cloud ComputingDocument17 pagesThe Economic of Cloud ComputingLouise ANNo ratings yet

- Present Situation and Prospects of Sugar Mill in FaridpurDocument26 pagesPresent Situation and Prospects of Sugar Mill in Faridpurkhansha ComputersNo ratings yet

- State Life Building: Supply, Installation, Commissioning Testing of 150 Kva Diesel Generator SetDocument43 pagesState Life Building: Supply, Installation, Commissioning Testing of 150 Kva Diesel Generator SetZia Ur Rehman100% (1)

- Baker McKenzie Doing Business in Thailand Updated As of September 2019Document228 pagesBaker McKenzie Doing Business in Thailand Updated As of September 2019lindsayNo ratings yet

- Comparing Quantities Solved ProblemsDocument17 pagesComparing Quantities Solved ProblemsDock N DenNo ratings yet

- Budget AssignmentDocument9 pagesBudget Assignmentapi-537656189No ratings yet

- Paraguay's EconomyDocument10 pagesParaguay's EconomyDalinaNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationJayson TasarraNo ratings yet

- Anticipating Toc Wilson SelectDocument47 pagesAnticipating Toc Wilson SelectS. M. Hasan ZidnyNo ratings yet

- ComputationDocument6 pagesComputationRipfeelingsNo ratings yet

- Manage Cash Flow & Optimize Business FinancesDocument125 pagesManage Cash Flow & Optimize Business FinancesJeam Endoma-ClzNo ratings yet

- Commissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Document11 pagesCommissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Dino Bernard LapitanNo ratings yet

- To Be Filled Up by BIRDocument2 pagesTo Be Filled Up by BIRmay1st200867% (6)

- Tax exemptions under NIRC Sec 30(eDocument3 pagesTax exemptions under NIRC Sec 30(emartina lopezNo ratings yet

- KMC Property Tax FormDocument13 pagesKMC Property Tax FormbitunmouNo ratings yet

- RA 10754 - An Act Expanding The Benefits and Priviledges of Persons With Disability (PWD)Document6 pagesRA 10754 - An Act Expanding The Benefits and Priviledges of Persons With Disability (PWD)Therese Angelie CamacheNo ratings yet