Professional Documents

Culture Documents

What Is A Flexible Benefit Plan in A Salary Breakup? - Quora

Uploaded by

SiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is A Flexible Benefit Plan in A Salary Breakup? - Quora

Uploaded by

SiCopyright:

Available Formats

What is a flexible benefit plan

in a salary breakup?

Good Question, Thank you for A2A.

Sachet Desai has given a good answer and it more or less covers the

concept of Flexible Benefit Plan. I think I can share some more insight

on the same.

As quoted by Sachet Desai, Flexible Benefit plan (FBP) is that

portion of salary that can be received as against different expenses,

to primarily save on income tax. Employees have the freedom to

design (play around) their salary structure within the FBP amount,

based on anticipated expenses.

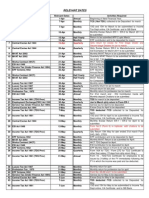

Now, Letss take the below example:

The FBP in the above example includes:

HRA

Conveyance

LTA

Medical

Other allowances that can be part of FBP (but not limited to):

Periodic Journals Reimbursement

Telephone Reimbursement

What does it mean to you?

First, It simply means, you can reduce your taxable salary by

providing proof of expense for the mentioned FBP heads.

By doing so, you get a chance to save more tax and my suggestion is

to always declare everything under FBP even if you do not intend to

spend your money on FBP heads.

Second, another benefit is, Employees have the freedom to design

(play around) their salary structure within the FBP amount.

Say, you live with your parents and do not spend on House Rent, in

that case you are allowed to move the HRA allowance under LTA head

and then claim LTA for that amount to save tax.

When does this amount get paid? Is it paid in full?

First, Lets say you declare to spend the FBP heads and provide

receipts of the same to you company. Some company trust their

employee and pays the FBP amount upfront and ask for receipts at

financial year end. On not submitting the receipt tax is deducted.

On the other hand, some companies deduct the FBP amount (except

HRA) from your in hand salary monthly and reimburse the same to

you after you submit the receipts at financial year end. On not

submitting the receipt tax is deducted from the FBP, and remaining is

credit to you.

Second, In any case the company will pay you that amount in full

post tax deduction. FBP is a fixed head and not a variable head.

Hope it helps.

12.7k Views View Upvotes Answer requested by Kartikey

Luthra

Downvote

Comment1

Share

Raghav Garg, Entrepreneur at heart, HR by profession!!

Updated Aug 28

Originally Answered: What is the flexi basket salary component

in India? Is it proof-based (claiming amount after providing

proofs)?

Flexi basket salary salary can be either a benefit or allowance.

If its an allowance like petrol allowance, mobile allowance etc. then

you need not show any proofs for it and the same will be paid out

along with your basic salary. These allowances might not be tax.

On the other hand, if its a benefit like mobile benefit or petrol benefit,

then you indeed need to show proofs of expenditure before you can

avail the benefits. these are generally tax free, if appropriate proofs

have been showed.

Please ask your HR to clarify what type of component is this.

7.9k Views View Upvotes

Downvote

Comments1+

Share

Aditi Sharma, Recruitment, Technology Recruitment, Blogging,

HR related queries

Written Jun 8

Flexible benefit plans may include health insurance, retirement

benefits such as 401(k) plans, and reimbursement accounts that

employees can use to pay for out-of-pocket health or dependent care

expenses.

4k Views Answer requested by Accounts Gandhidham

Downvote

Comment

Share

Vidhya Raghunath, A super mom :)

Written Jul 11

Flexi Benefit Plan - FBP is something which allows you to compute

your own salary other than Basic.

Usually companies now gives you a basic salary and remaining as FBP,

where you can maximize your take home. Generally you can take HRA,

Conveyance Allowance, Medical, LTA and Special Allowance.

2.9k Views

Downvote

Comment

Share

Charu Sharma, Talent Management Professional

Written Aug 31

A flexible benefit plan or fbp is a component of your salary. It is

generally used to save tax. It includes sodexo or Accor food coupons,

LTA, special reimbursements etc. A person must use them to save tax.

Always consult your payroll person for making best of it.

1k Views Answer requested by Vaidyanathan Palaniappan

Downvote

Comment

Share

Sachet Desai, Managing the most important capital of an

organisation.

Written Dec 14, 2014

Flexible Benefit plan (FBP) is that portion of salary that

can be received as against different expenses, to primarily

save on income tax. Employees have the freedom to design (play

around) their salary structure within the FBP amount, based

on anticipated expenses mentioned below.

Medical reimbursement : A portion of the FBP can be blocked to be

received as the taxable benefit for medical expenses during the financial

year.

Leave travel allowance: Again, the same FBP portion can be used to

claim tax benefits on travel expenses for your vacation.

Phone reimbursement : To save tax by paying phone bills.

If an employee does not wish to claim/incur such expenses,

he/she can receive the salary as FBP, which then becomes purely

taxable.

Different companies have different names for this component,

however the concept remains the same.

Hope this helps. ..

16.2k Views View Upvotes

Downvote

Comments4+

Share

There's more on Quora...

Pick new people and topics to follow and see the best answers

on Quora.

Related Questions

My friend in India has an offer with flexible benefit

plans: Basic5.5 lakh; PF0.95 lakh; or FBP7.5 lakh.

How much can he expect as in-hand ...

Flexible compensation plan : I have been offered a job

with flexible compensation plan

of Rs 6 Lac. Does this

mean i get 6 Lac as cash, or do...

What is the best possible breakup for 12lac salary?

What are the salary breakups with formulae?

If I don't declare my expenses, does that mean I will

get 0 rs from my flexible benefit plan and my salary will

be calculated only based on ba...

What are some of the best practices of companies offering

flexible benefits to its employees?

What is the meaning of several terms in the salary breakup

below?

Can salary breakup be considered as an offer letter?

What is the salary breakup that Housing offered in IITM?

I got a salary breakup from Amazon India, but whythey

are delaying on providing offer letter?

More Related Questions

Question Stats

38 Followers

33,192 Views

Last Asked 9h ago

5 Merged Questions

Edits

You might also like

- Thankyou LetterDocument18 pagesThankyou LetterarvindranganathanNo ratings yet

- Contract Management AgreementDocument4 pagesContract Management Agreementabdul_salahiNo ratings yet

- Accident Investigation ReportDocument3 pagesAccident Investigation ReportKhan Mohammad Mahmud HasanNo ratings yet

- Group Dynamics and Work Teams 1.ppt 2018-19Document86 pagesGroup Dynamics and Work Teams 1.ppt 2018-19Deeksha Singh100% (1)

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDocument6 pagesSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwNo ratings yet

- Flexible Benefits: Cost Optimization & Talent RetentionDocument36 pagesFlexible Benefits: Cost Optimization & Talent RetentionAndrew100% (1)

- Agrarian Law and Social Legislation by P. UngosDocument390 pagesAgrarian Law and Social Legislation by P. UngosLorena Lagarde33% (3)

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNo ratings yet

- PromissoryDocument1 pagePromissoryDiyames RamosNo ratings yet

- DGM Annexure B Know Your Pay ComponentsDocument3 pagesDGM Annexure B Know Your Pay ComponentsaakritishellNo ratings yet

- Case Study AnalysisDocument10 pagesCase Study AnalysisRupali Pratap SinghNo ratings yet

- Old Vs New Tax Rates Regime (6 Cases)Document6 pagesOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviNo ratings yet

- Salary Break UpDocument17 pagesSalary Break UpRam Surya Prakash DommetiNo ratings yet

- HRMS QuestionnaireDocument16 pagesHRMS Questionnairearif61400% (1)

- FAQ (Flexi) PDFDocument4 pagesFAQ (Flexi) PDFDivyansh Chand BansalNo ratings yet

- Addressing ExerciseDocument5 pagesAddressing ExerciseKaranveer Singh GahuniaNo ratings yet

- FAQ - India-Leave Policy Ver1.5Document5 pagesFAQ - India-Leave Policy Ver1.5Amarnath Reddy100% (1)

- Ethics Justice and Fair Treatment in HR Management PDFDocument2 pagesEthics Justice and Fair Treatment in HR Management PDFJeremyNo ratings yet

- CompensationDocument28 pagesCompensationSomalKantNo ratings yet

- Doctrine of Piercing The Corporate Veil - Case DigestDocument2 pagesDoctrine of Piercing The Corporate Veil - Case DigestlookalikenilongNo ratings yet

- Leave PolicyDocument5 pagesLeave PolicyraviNo ratings yet

- Measurement Invariance of The Job Satisfaction Survey Across Work ContextsDocument17 pagesMeasurement Invariance of The Job Satisfaction Survey Across Work ContextsMarthen PeterNo ratings yet

- PCN HCN TCNDocument10 pagesPCN HCN TCNKaran ChhatparNo ratings yet

- Annual Report 2011-12: Planning Commission Government of India WWW - Planningcommission.gov - inDocument213 pagesAnnual Report 2011-12: Planning Commission Government of India WWW - Planningcommission.gov - inRaghuNo ratings yet

- Missing Pieces by Kevin CurtisDocument9 pagesMissing Pieces by Kevin CurtisJim Pence100% (1)

- 1.2 KM Long Pipe Lines and Concrete Pump Schwing StetterDocument4 pages1.2 KM Long Pipe Lines and Concrete Pump Schwing StetterHiren DesaiNo ratings yet

- Income Under The Head "Salaries": Shubhangi Gupta Roll No. 11 Financial Management Bhartiya Vidya BhavanDocument44 pagesIncome Under The Head "Salaries": Shubhangi Gupta Roll No. 11 Financial Management Bhartiya Vidya Bhavanhny0910No ratings yet

- Annexure - Flexible Benefit PlanDocument3 pagesAnnexure - Flexible Benefit PlanpvkmanoharNo ratings yet

- CCS LTC RULES PPT 20210617141434Document28 pagesCCS LTC RULES PPT 20210617141434Kumar KumarNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- CTS Marriage Loan PolicyDocument5 pagesCTS Marriage Loan PolicyshaannivasNo ratings yet

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Presented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreDocument30 pagesPresented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreshraddhavanjariNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationGoutam HotaNo ratings yet

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocument52 pagesCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGNo ratings yet

- PF TransferDocument11 pagesPF TransfersinniNo ratings yet

- Salary AdministrationDocument17 pagesSalary AdministrationMae Ann GonzalesNo ratings yet

- Benefits & Contributory Conditions: (I) (A) Sickness BenefitDocument4 pagesBenefits & Contributory Conditions: (I) (A) Sickness BenefitKunwar Sa Amit SinghNo ratings yet

- Income Tax DepartmentDocument19 pagesIncome Tax DepartmentSharathNo ratings yet

- Overtime AllowanceDocument3 pagesOvertime AllowanceKumudha Devi100% (1)

- Incentive Compensation: 1 © 2008 by Paul L. Schumann. All Rights ReservedDocument27 pagesIncentive Compensation: 1 © 2008 by Paul L. Schumann. All Rights ReservedsanjeevraviNo ratings yet

- RegistrationDocument15 pagesRegistrationpratikdhond100% (3)

- Esic ChallanDocument7 pagesEsic Challanrgsr2008No ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- PF Pension Settlement Form-TCSDocument4 pagesPF Pension Settlement Form-TCSSridhara Krishna BodavulaNo ratings yet

- Daksh Leave Policy (India)Document12 pagesDaksh Leave Policy (India)ajithk75733No ratings yet

- Online Registration of Establishment With DSC: User ManualDocument39 pagesOnline Registration of Establishment With DSC: User ManualroseNo ratings yet

- Form of Pension Proposals FormDocument14 pagesForm of Pension Proposals Formlakshmi naryanaNo ratings yet

- USSP User Manual v1.0Document18 pagesUSSP User Manual v1.0Siva ChNo ratings yet

- Kar Shops Commercial Forms FormatDocument16 pagesKar Shops Commercial Forms FormatbelvaisudheerNo ratings yet

- EPF CalenderDocument1 pageEPF CalenderAmitav TalukdarNo ratings yet

- Compliance PDFDocument20 pagesCompliance PDFSUBHANKAR PALNo ratings yet

- Attendance Register FormatDocument1 pageAttendance Register Formatvishal_mtoNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Contract Labour RegisterDocument34 pagesContract Labour Registerravinder.singh19853857No ratings yet

- AgricultureDocument4 pagesAgriculturemohan rathoreNo ratings yet

- CTS Medical Emergencies Loan PolicyDocument5 pagesCTS Medical Emergencies Loan PolicyshaannivasNo ratings yet

- Salary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureDocument6 pagesSalary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureSagar ShindeNo ratings yet

- Statutory ComplianceDocument2 pagesStatutory Compliancemax997No ratings yet

- Karnataka Shops and Commercial Establishments Act, 1961Document44 pagesKarnataka Shops and Commercial Establishments Act, 1961Latest Laws TeamNo ratings yet

- Annexure II Details of AllowancesDocument4 pagesAnnexure II Details of AllowancesPravin Balasaheb GunjalNo ratings yet

- EPF Provident Fund CalculatorDocument6 pagesEPF Provident Fund CalculatorUtkal SolankiNo ratings yet

- Genpact Vs InfosysDocument3 pagesGenpact Vs InfosysNidhi MishraNo ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- Guidelines Mediclaim L&TDocument5 pagesGuidelines Mediclaim L&Tnidnitrkl051296No ratings yet

- Cheklist For Employers: Statutory Deposits & ReturnsDocument4 pagesCheklist For Employers: Statutory Deposits & ReturnsVas VasakulaNo ratings yet

- YTD Statement-1326013854886Document108 pagesYTD Statement-1326013854886deepson800No ratings yet

- Employee Benefits IndiaDocument2 pagesEmployee Benefits Indiabaskarbaju1No ratings yet

- ECMS User Manual - : PAN IndiaDocument70 pagesECMS User Manual - : PAN IndiaKrishNo ratings yet

- Relieving Letter FormatDocument1 pageRelieving Letter FormatIgor FroninNo ratings yet

- Leave StructureDocument8 pagesLeave StructureJignesh V. KhimsuriyaNo ratings yet

- Several Basic Terms Related To PayrollDocument9 pagesSeveral Basic Terms Related To PayrollAnjali PandeNo ratings yet

- CTCDocument17 pagesCTCPallavi VartakNo ratings yet

- 502 Sem ExamDocument25 pages502 Sem ExamMotilal JaiswalNo ratings yet

- Interview QuestionsDocument5 pagesInterview QuestionsRonnel Aldin FernandoNo ratings yet

- Manalo Vs Roldan-ConfesorDocument7 pagesManalo Vs Roldan-ConfesorEileen Eika Dela Cruz-Lee0% (1)

- SBA UnemploymentDocument18 pagesSBA UnemploymentRichard DerbyNo ratings yet

- Professional Reference Letter CoworkerDocument4 pagesProfessional Reference Letter Coworkerpuhjsoqmd100% (1)

- Analysing On The Recruitment and Selection Process of Employees of Finploy TechnologiesDocument10 pagesAnalysing On The Recruitment and Selection Process of Employees of Finploy TechnologiesADITYA GUPTANo ratings yet

- A Study On DBBL LoanDocument31 pagesA Study On DBBL LoanRashed HossainNo ratings yet

- BPP June 2019 Mock CBDocument9 pagesBPP June 2019 Mock CBTehreem KhanNo ratings yet

- Guide To Composition of Safety CommitteeDocument2 pagesGuide To Composition of Safety CommitteeDexter Abrenica AlfonsoNo ratings yet

- DR - Reddy's Annualreport2013Document204 pagesDR - Reddy's Annualreport2013DrUpasana MishraNo ratings yet

- Excavation Competent PersonDocument1 pageExcavation Competent PersonshoaibNo ratings yet

- PagesDocument82 pagesPagesEslam EltaweelNo ratings yet

- Vishwa Bharati Public School: Grams: VishwabhartiDocument4 pagesVishwa Bharati Public School: Grams: Vishwabhartimittal_y2kNo ratings yet

- Nokia Kronos Case Study inDocument2 pagesNokia Kronos Case Study inRocio DonisNo ratings yet

- Call Data Record of Prashun Jain Sonu Jain Custosm House Agent Prashant Gupta Icdtkd Global Log Ic Noida Rajdhani Crafts JaipurDocument13 pagesCall Data Record of Prashun Jain Sonu Jain Custosm House Agent Prashant Gupta Icdtkd Global Log Ic Noida Rajdhani Crafts JaipurjainNo ratings yet