Professional Documents

Culture Documents

The Super Project

Uploaded by

AbhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Super Project

Uploaded by

AbhiCopyright:

Available Formats

The Super Project

General Foods Corporation is a food company involved in the business of producing

ingredients for the dessert market. They currently have three categories of

products powders, mixes and ice creams. The powder division produces two

products JellO and Tasty. They are looking to introduce a new powder Super.

Crosby Sanberg, manager financial analyst, is tasked with the job of analyzing

the profitability of the new project and his opinion is that the incremental analysis

doesnt always work for the profitability of the project.

Super falls under a significant and growing segment, potentially increasing dessert

market share by 10% - 80% from new market and 20% from erosion of Jell-O

sales. The project will require Capital Expense of $200,000 ($80K for building

modification and $120K for packaging machinery), $15,000 as startup cost, and

test market expense of $360K, which has already incurred prior to fund

allocation. Super is discussing whether it will also incur an opportunity cost

($453K) by utilizing some of the existing facilities from Jell-O product building and

agglomerator. Finally, theres discussion about allocating some overhead costs,

starting in year 5 after initiation. These overhead costs are categorized as Capital

($40K) and Expenses on a per unit basis. There are certain pre-planned

overhead costs (Alternative III - Discussion) planned for year 1968, and if

approved, Super will benefits from this investment.

Based on positive NPV, IRR much higher than WACC, and 9 year payback time

period, General Foods should launch the new product line. In order to calculate the

key metrics, following assumptions were made.

Items NOT included as part of Free Cash Flow calculations:

Test Market Expenses: are sunk costs and cannot be recovered, regardless of

approval of Super.

Opportunity Cost: for building and agglomerator is not considered

incremental. Moreover, they are not generating any rental income that will

potentially be lost due to Super.

Overhead Capital: ($40K) for distribution systems, is based on the theory

that a number of individual decisions towards further expansion will result in

more fixed costs and facilities in Year 5. Some of this could be due to

introduction of new product lines, and some due to expansion in existing

product lines. Since this capital expense isnt incremental to Super project

alone, they should be considered as part of Free Cash Flow calculations for

future projects alone whether for new product or for expansion of existing

product lines.

Pre-planned expenses: The overhead costs are pre-planned and are expected

regardless of approval of Super. They will result in additional capacity, which

can be used for subsequent projects (if Super is not approved)

Following Costs should be taken into consideration, while calculating Free Cash

Flow.

Overhead Expense: in year 5 (Alternative III Method) will be incremental

only because of Super product. This SG&A expense wont be realized if the

company decides to kill this project.

Jell-O Erosion: Since 20% of sales of Super were to come from erosion of the

sales of an existing product, those erosions should be taken as a cost for the

project. If Super is launched, this revenue will be lost incremental cost.

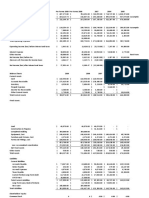

Considering the costs of the project, we can estimate the net operating profit of

the project (Exhibit 1). Combining the net operating profits of the project with the

various costs required at different stages along with the correct classification of

expenses, we can estimate the free cash flows of the project. Based on the

estimates, an estimated 10 year project life, no salvage value at maturity and a

10% cost of capital, we can calculate the different measures of profitability of

project:

1. NPV of the project: $891K

2. IRR of the project: 23.3%

3. Payback period of the project: 9 years

Based on the history, the firm has paid between 8.4% and 10.1% dividends on the

common shares. Since this project shows a return rate of over 20% (beats hurdle

rate by all 3 measures at 10% cost of capital), this project is more profitable than

the usual business of General Foods Corporation.

The past projects at General Foods Corporation have resulted in unexpected

increases in costs. The risks involved in the project are:

Much of the profitability of the project lies in deploying under-utilized resources.

Unexpected expansion in existing products could lead to competition for

resources which will alter the company profitability

A forecasting error in sales can alter the return rate on the project

Over the long run, variable costs may increase as a result of volume increase

and this may result in a lower rate of return than what is being displayed, so

Super may not be a long term profit generator.

The incremental investment in the packaging and machinery is specific to Super

and may pose a risk if they cannot be used to generate other products

Revenue growth may be limited or stagnant if Super cannibalizes other products

as in that case, the revenue will shift from the other products but not increase

overall.

Considering the risks, if the company doesnt have an alternate profitable project

in the pipeline to utilize the existing resources, the Super project is a good choice

to increase the returns for the shareholders equity. Moreover, Super project is a

good strategic fit for General Foods Dessert product line. The case presents

evidence that powdered desserts constituted a significant and growing segment,

so any project that strengths leadership in existing market segment should be

worth investing.

You might also like

- Tax RemediesDocument51 pagesTax RemediesBevz23100% (6)

- Nike Case Final Group 4Document15 pagesNike Case Final Group 4Monika Maheshwari100% (1)

- Marriott Corporation Cost of Capital Case AnalysisDocument11 pagesMarriott Corporation Cost of Capital Case Analysisjen1861269% (13)

- Anandam Manufacturing CompanyDocument9 pagesAnandam Manufacturing CompanyAijaz AslamNo ratings yet

- Sealed Air's Leveraged Recapitalization Drives Improved PerformanceDocument3 pagesSealed Air's Leveraged Recapitalization Drives Improved Performancenishant kumarNo ratings yet

- Hampton Machine Tool CompanyDocument2 pagesHampton Machine Tool CompanySam Sheehan100% (1)

- Marriott Corporation Case SolutionDocument6 pagesMarriott Corporation Case Solutionanon_671448363No ratings yet

- Financial analysis of American Chemical Corporation plant acquisitionDocument9 pagesFinancial analysis of American Chemical Corporation plant acquisitionBenNo ratings yet

- Ust SolutionDocument3 pagesUst SolutionAdeel_Akram_Ch_9271No ratings yet

- Ust SolutionDocument3 pagesUst SolutionAdeel_Akram_Ch_9271No ratings yet

- Analysis Slides-WACC NikeDocument25 pagesAnalysis Slides-WACC NikePei Chin100% (3)

- Financial analysis of company shares and earningsDocument1 pageFinancial analysis of company shares and earningsRoderick Jackson JrNo ratings yet

- Hampton Machine Tool CompanyDocument5 pagesHampton Machine Tool Companydownloadsking100% (1)

- Baird - Euroland Foods CaseDocument5 pagesBaird - Euroland Foods CaseKyleNo ratings yet

- Optimal Contract Lengths & Procurement MethodsDocument4 pagesOptimal Contract Lengths & Procurement MethodsAbhi71% (7)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Adecco Olesten Merger CaseDocument4 pagesAdecco Olesten Merger CaseAnonymous qbVaMYIIZ100% (1)

- EVA and MVADocument4 pagesEVA and MVAaftabasadNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Midland Energy Group A5Document3 pagesMidland Energy Group A5Deepesh Moolchandani0% (1)

- Corporation Finance - Adecco CaseDocument6 pagesCorporation Finance - Adecco CaseYing Wang0% (3)

- Facebook, Inc: The Initial Public OfferingDocument5 pagesFacebook, Inc: The Initial Public OfferingHanako Taniguchi PoncianoNo ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- Sampa VideoDocument18 pagesSampa Videomilan979No ratings yet

- Blaine KitchenwareDocument1 pageBlaine KitchenwareSam Skf100% (1)

- Calpine Corp. The Evolution From Project To Corporate FinanceDocument4 pagesCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Tax Review OutlineDocument18 pagesTax Review OutlineMyn Mirafuentes Sta AnaNo ratings yet

- Concerns with DCF analysis for Intermediate Chemicals Group projectDocument2 pagesConcerns with DCF analysis for Intermediate Chemicals Group projectJia LeNo ratings yet

- TTV Midterm 26 Aug - Sample - 3Document8 pagesTTV Midterm 26 Aug - Sample - 3Steven NimalNo ratings yet

- New Heritage Doll Company Capital Budgeting SolutionDocument10 pagesNew Heritage Doll Company Capital Budgeting SolutionBiswadeep royNo ratings yet

- Lex Service PLC - Cost of Capital1Document4 pagesLex Service PLC - Cost of Capital1Ravi VatsaNo ratings yet

- MANAGERIAL ECONOMICS & BUSINESS STRATEGY Chap014 SolutionsDocument3 pagesMANAGERIAL ECONOMICS & BUSINESS STRATEGY Chap014 SolutionsAbhi100% (2)

- Case The Super ProjectDocument6 pagesCase The Super ProjectpaulNo ratings yet

- Marriot Corporation - Cost of CapitalDocument3 pagesMarriot Corporation - Cost of CapitalInderpreet Singh Saini100% (17)

- FPL Dividend Policy-1Document6 pagesFPL Dividend Policy-1DavidOuahba100% (1)

- 2013 SGV Cup Level Up FinalDocument17 pages2013 SGV Cup Level Up FinalAndrei GoNo ratings yet

- General Foods Capital Budgeting AnalysisDocument5 pagesGeneral Foods Capital Budgeting Analysisgpadhye123No ratings yet

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyNo ratings yet

- Druthers Forming Answer KeyDocument3 pagesDruthers Forming Answer KeyDesventes AdrienNo ratings yet

- Sampa Video Home Delivery ProjectDocument26 pagesSampa Video Home Delivery ProjectFaradilla Karnesia100% (2)

- Victoria Chemicals Part 5Document3 pagesVictoria Chemicals Part 5cesarvirata100% (1)

- Amazon Strategic Management Case AnalysisDocument13 pagesAmazon Strategic Management Case AnalysisTrishaIntrîgüeAaronsNo ratings yet

- General Foods Super Project Investment AnalysisDocument8 pagesGeneral Foods Super Project Investment Analysisbtarpara1No ratings yet

- Super Project - July 2019Document4 pagesSuper Project - July 2019Wally WannallNo ratings yet

- Super Project CaseDocument16 pagesSuper Project Casekanne_phNo ratings yet

- Super Case Study ReportDocument3 pagesSuper Case Study Reportankurhbti100% (1)

- Analisis Super ProjectDocument4 pagesAnalisis Super Projectrcatherineb50% (2)

- Super ProjectDocument2 pagesSuper ProjectAnkit MehtaNo ratings yet

- Super ProjectDocument1 pageSuper ProjectVaibhav SaithNo ratings yet

- Super ProjectDocument2 pagesSuper ProjectQiang ChenNo ratings yet

- Dessert Market Share Changes 1966-1967Document6 pagesDessert Market Share Changes 1966-1967Mônica MelloNo ratings yet

- Super ProjectDocument12 pagesSuper Projectkaran_w3No ratings yet

- Super Project FinalDocument29 pagesSuper Project FinalSamuel ChuquistaNo ratings yet

- Super ProjectDocument12 pagesSuper ProjectSrija LahiriNo ratings yet

- Super Project AnalysisDocument6 pagesSuper Project AnalysisPeeyush Khandka0% (1)

- Nagornov Super Project CaseDocument3 pagesNagornov Super Project Casetbsssilva100% (1)

- CBRM Calpine Case - Group 4 SubmissionDocument4 pagesCBRM Calpine Case - Group 4 SubmissionPranavNo ratings yet

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- BKI's Capital Structure and Payout PoliciesDocument4 pagesBKI's Capital Structure and Payout Policieschintan MehtaNo ratings yet

- Assignment 2 Lockheed CaseDocument6 pagesAssignment 2 Lockheed CaseBob MarlowNo ratings yet

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncUmair ahmedNo ratings yet

- Investme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementDocument8 pagesInvestme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementANKUR PUROHITNo ratings yet

- Arcadian Business CaseDocument20 pagesArcadian Business CaseHeniNo ratings yet

- Calculation of Blain Kitchenware CaseDocument2 pagesCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- 3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveDocument4 pages3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveMinh NguyenNo ratings yet

- Pan-Europa Foods Corporate Strategy Case Study AnalysisDocument6 pagesPan-Europa Foods Corporate Strategy Case Study AnalysisPrathibha VemulapalliNo ratings yet

- Super Project Case SolutionDocument3 pagesSuper Project Case SolutionasaqNo ratings yet

- Capital Budgeting - Adv IssuesDocument21 pagesCapital Budgeting - Adv IssuesdixitBhavak DixitNo ratings yet

- Capital Budgeting and Dividend Policy TutorialsDocument7 pagesCapital Budgeting and Dividend Policy TutorialsThuỳ PhạmNo ratings yet

- Euroland FoodsDocument4 pagesEuroland FoodsHanzalah MunirNo ratings yet

- Greece03 PDFDocument253 pagesGreece03 PDFAbhiNo ratings yet

- Prob Set 5Document2 pagesProb Set 5AbhiNo ratings yet

- Advertising TempDocument2 pagesAdvertising TempAbhiNo ratings yet

- Greece03 PDFDocument253 pagesGreece03 PDFAbhiNo ratings yet

- Nucleon TempDocument5 pagesNucleon TempAbhiNo ratings yet

- UST TempDocument1 pageUST TempAbhiNo ratings yet

- How Much Capital?: ProfitDocument2 pagesHow Much Capital?: ProfitAbhiNo ratings yet

- Cola WarsDocument2 pagesCola WarsAbhi100% (1)

- Ust Case STudy SolutionDocument1 pageUst Case STudy SolutionAbhiNo ratings yet

- Cola WarsDocument2 pagesCola WarsAbhi100% (1)

- Cola WarsDocument2 pagesCola WarsAbhi100% (1)

- Canvas Shoes PDFDocument8 pagesCanvas Shoes PDFnabayeelNo ratings yet

- 15.2.18 Individual Assignment 2Document6 pages15.2.18 Individual Assignment 2nadiaNo ratings yet

- MARK SCHEME For The June 2004 Question PapersDocument9 pagesMARK SCHEME For The June 2004 Question PapersRobert EdwardsNo ratings yet

- Activities and AssessmentDocument5 pagesActivities and AssessmentGiane Gayle CadionNo ratings yet

- QuestionsDocument30 pagesQuestionsArra VillanuevaNo ratings yet

- Closing X Post Closing ActivitiesDocument9 pagesClosing X Post Closing ActivitiesJasmine ActaNo ratings yet

- Accounting Igcse Schemes Year 9Document6 pagesAccounting Igcse Schemes Year 9Maoga2013100% (1)

- Marketing Strategies Used by The BanksDocument20 pagesMarketing Strategies Used by The BanksJāfri Wāhid100% (1)

- Appendix 18 - Saaodb by Oe - Far 1-ADocument3 pagesAppendix 18 - Saaodb by Oe - Far 1-ARogie ApoloNo ratings yet

- Chapter 9. Integrated Case Model: RF M RFDocument6 pagesChapter 9. Integrated Case Model: RF M RFHAMMADHRNo ratings yet

- Maf451 Question July 2020Document12 pagesMaf451 Question July 2020JannaNo ratings yet

- Ebook College Accounting 12Th Edition Slater Solutions Manual Full Chapter PDFDocument60 pagesEbook College Accounting 12Th Edition Slater Solutions Manual Full Chapter PDFkhucly5cst100% (10)

- Uniform CPA Examination May 1981-May 1985 Selected Questions &Document647 pagesUniform CPA Examination May 1981-May 1985 Selected Questions &Abdelmadjid djibrineNo ratings yet

- Assignment# 3: Submitted byDocument14 pagesAssignment# 3: Submitted byHassan AwaisNo ratings yet

- S20 TX BWA Sample AnswersDocument10 pagesS20 TX BWA Sample AnswersKAM JIA LINGNo ratings yet

- Receivables Ledger & Partnership AccountsDocument6 pagesReceivables Ledger & Partnership AccountsAbdul Gaffar0% (1)

- Maddox Fine Art - MayfairDocument21 pagesMaddox Fine Art - MayfairGuy WilkinsonNo ratings yet

- 2.1. Perfect CompetitionDocument73 pages2.1. Perfect Competitionapi-3696178100% (5)

- De Grey MiningDocument30 pagesDe Grey MiningSergey KNo ratings yet

- Alvaro De Camps MBA Finance Resume ColumbiaDocument1 pageAlvaro De Camps MBA Finance Resume ColumbiaAlvaroDeCampsNo ratings yet

- Activity Based ManagementDocument75 pagesActivity Based ManagementDonna KeeNo ratings yet

- Problems of IBMDocument5 pagesProblems of IBMMurugesh SanjeeviNo ratings yet

- 3Document36 pages3api-505638589No ratings yet

- Bingcang & Tamon (CVP, Module 5)Document67 pagesBingcang & Tamon (CVP, Module 5)FayehAmantilloBingcangNo ratings yet