Professional Documents

Culture Documents

Steel Thailand

Uploaded by

Nadia ArityaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steel Thailand

Uploaded by

Nadia ArityaCopyright:

Available Formats

31/05/2012

Thailand economic and steel industry development

To

OECD STEEL COMMITTEE MEETING

By

Iron and Steel Institute of Thailand (ISIT)

MAY, 2012

CONTENTS

ISIT introduction

Thailand steel industry snapshot

Key drivers to Thailand steel market in medium term

Steel industry and AEC

31/05/2012

Iron and Steel Institute of Thailand, a network of the

Ministry of Industry

Ministry of Industry

Office of the Board of Investment

Permanent Secretary

Industrial Economics Sector

Office of the

Permanent Secretary

Office of the Minister

Production Control and Inspection Sector

Industrial Promotion Sector

Office of Industrial

Economics

Department

of Industrial Works

Department of

Industrial Promotion

Office of the Cane

And Sugar Board

Department of Primary

Industries and Mines

Thai Industrial

Standards Institute

Industrial Estate Authority of Thailand

Office of Small and Medium

Enterprises Promotion

Independent Bodies

1. Thai German Institute 2. Thailand Productivity Institute

3. Thailand Textile Institute 4. National Food Institute

5. Iron and Steel Institute of Thailand

6. Thailand Automotive Institute

7. Electrical and Electronics Institute

8. Management System Certification Institute

9. Institute for Small and Medium Enterprises Development

Mission and Vision

Vision

Mission

1. Encourage industrial

competitiveness

ISIT aims to

develop Thai iron and

steel industry to be

3. Develop iron and steel

industrial database

internationally

competitive and

effectively drive the

strategic industry.

development of

2. Co-operate and support

governments policy

4. Encourage the co-ordination

and co-operation among

involving stakeholders

5. Create value-added services

for iron and steel industry

31/05/2012

ISIT past major activities

Launching the

project of

downstream

industrys efficiency

and productivity

development

Issuing AntiDumping

Measure of HR,

CR, and CRSS

Defending

EU

Safeguard

Measure

2001

Steel Industry

Transformation

plan

2002

2003

Defending

Adjusting

201

Measure Harmonize

Code 10

Digits

Issuing Thai

Safeguard

Measure

Intelligence

Unit

2004

Launching the

project of steel

industrys

energy

development

Training

Custom

Officers

Expand scope

of testing to

non-Metal and

Environment

Structural

Steel

Consultation

Introduction

of Integrating Technology Center

Training

Platform

Course

2005

2006

2007

Upgrading

Testing

Center

Launching the

project of steel

industrys

efficiency and

productivity

development

2008

2010

2009

2011

Master Plan to

Energy

Management

for Steel

Industry in

next 20 years

2012

Leading Technical

Indicator Service

Encouragement

of Integrated

Steel Project

for High Quality

Steel

Guidelines

Set up for

Thailand

Steel

Feasibility Industry

Under

Study of

Neural

Sustainable ASEAN

Network

Integrated Iron Economic

for

Steel

Community

and Steel

Price

Industry

Forecast

Development

in Thailand

4

ISITs collaboration network

AACHEN

Worldsteel

AISC

CISRI

KOSA

JISF

NEDO

CISA

TSIIA

ISIT

Federation of Thai Industries

Ministry of Industry

Ministry of Finance

Ministry of Science

Ministry of Commerce

Steel companies

Steel fabricators

Part makers

Universities

Research Institutes

SEAISI

VSA

MISIF

PISI

IISIA

31/05/2012

CONTENTS

ISIT introduction

Thailand steel industry snapshot

Key drivers to Thailand steel market in medium term

Steel industry and AEC

Thailand steel industry development started from re-rolling business

Traders / Stockists

1950s

1960s

1960s

Rebar

old mill

Long

mini mills

Cold1996

1992

formed

section

& pipe Flat rolling

Flat

mills

mini mills

1995

Downstream Downstream

- Flat

- Flat

Capacity

- Semi Long: 5.8 million tpy

- Semi Flat: 3.0 million tpy

Mini mills

Rolling mills

- Rolled products: Long: 8.5 million tpy

- Rolled products: Flat: 12.9 million tpy

31/05/2012

that limit local production to serve overall demand

Apparent steel demand compares to crude steel production (000 Tonnes)

16,000

14,647

13,877

14,000

10,758

12,000

10,000

8,000

6,000

3,837

4,000

1,814

5,161

5,565

4,238

3,646

2,000

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Apparent Steel Demand ('000 Tonnes)

2011

Crude Steel Production ('000 Tonnes)

Thailand imported all raw material, semis and finished products at 14.96 million tonnes in 2011

High grade steel products are imported from Japan, South Korea, Taiwan, EU and US at 6.59 million

tonnes in 2011 (45% of overall steel demand)

Intensive competition from Chinese steel products as import rose from 0.65 million tonnes in 2009 to

1.9 million tonnes in 2011

Thailand exported steel products at 0.73 million tonnes, 53% of total export go to ASEAN

Source: Iron and Steel Institute of Thailand

Overall steel market has increased on average 7.3% per year

during last 11 years

Thailand apparent steel use (000 Tonnes)

CAGR 11/00 (%)

16,000

14,653

13,876

13,581

14,000

12,661

12,000

10,967

14,012

12,154

7.3%

12,716

10,758

10,049

10,000

8,967

8,031

8,087

7,483

7,607

8,000

6,762

7,074

5,960

4.3 %

7.9%

6,000

3,837

4,000

1,559

2,000

1,388

-1.1 %

0

Production

Import

Export

Apparent steel use

9

Source: Iron and Steel Institute of Thailand

31/05/2012

Construction is major steel consuming sector

Demand per capita = 217 Kg.

Ratio Long product : Flat product = 33 : 67

Demand breakdown

- Construction

54%

- Automotive

16%

- Machinery & Industrial

13%

- Appliance

12%

- Packaging

5%

10

Source: Iron and Steel Institute of Thailand

Thai economy is expected to grow in the range of 5.5 - 6.5%

in 2012

11

Source: Office of the National Economic and Social Development Board

31/05/2012

Steel demand in 2012 is expected to expand by 6.1% to 15.55

million tonnes

Thailand apparent steel use projection in 2012 (000 Tonnes)

15,887

15,547

15,207

14,653

14,012

10,758

2009

2010

2011

2012E

Assumption

Construction sector expands by 1%-3%

Automotive sector expands by 20%-39%

Appliance sector expands by 5%-7%

Machinery sector expands by 3%-5%

Canned food sector expands by 2%-4%

12

Source: Iron and Steel Institute of Thailand

CONTENTS

ISIT introduction

Thailand steel industry snapshot

Key drivers to Thailand steel market in medium term

Steel industry and AEC

13

31/05/2012

Opportunity in Thailand construction market

Infrastructure

development

Mass transit development

Irrigation development

Residential and

commercial

building

New condominium and housing along subway and

skytrain lines

Industrial factory

New investment from appliances and machinery

sectors

Factory relocation from Japan

14

Source: Iron and Steel Institute of Thailand

Hope Thailand infrastructure development will perform

well during next five years

Thailand capital formation in construction outlook index

CAGR

15/10 (%)

160

4.8%

5.2%

5.8%

140

120

100

80

60

40

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Construction: Total

Construction: Building

Construction: Civil engineering

15

Source: Oxford Economics and ISIT analysis

31/05/2012

Path for Thailand automotive industry

Auto output

(Million units)

2010

2011

2012

2013

2014

2015

1.6

1.5

2.1

2.3

2.5

2.7

2.2

2.7

Auto capacity

(Million units)

Milestone

NissanMarch

Ford- Fiesta

HondaBrio

Eco carMitsu, Suzuki

3.0

Eco carToyota

GM: Pickup

export

Ford: More

Total

AEC-

export:

Free

1.3

labor

million

move

units

export

16

Source: Thailand Automotive Institute, Federation of Thailand Industry and Somboon Advance Technology PLC.

Path for Thailand automotive industry

New model in 2012 and beyond

17

Source: Somboon Advance Technology

31/05/2012

Farm machinery and petrochemical business are potential

sectors under industrial

Projection of business growth 2009 - 2015

Sub-sector

2009/2008

(%)

2012/2009

2015/2012

2015/2009

(% per year)

(% per year)

(% per year)

Sugar &

Ethanol

4.4

5.7

5.7

4.7

Food

processing

3.6

5.8

5.1

4.5

Power plant

1.7

2.7

1.9

1.8

Farm machine

20.3

13.1

8.8

8.7

5.6

9.0

10.6

8.3

1.7

2.0

1.6

Chemical &

petrochemical plant

Paper

18

Source: ISIT survey on Market Analysis and Forecast of Thailand Stainless Steel, 2010

New major investments come from local and abroad

2010

Millcon Steel Industries invested THB 2.9bn ($87.6m) on a melting shop to support its

long products rolling operations with capacity 500,000 tonnes per year

2011

JFE Steel Corporation established JFE Steel Galvanizing (Thailand) Ltd to produce high

end hot-dip galvanized steel sheet with capacity 400,000 tonnes per year to serve

automakers steel demand

2012

Nippon Steel Corp invested $300 million to build a steel galvanising production line in

Thailand named Nippon Steel Galvanizing (Thailand) Co., Ltd. This mill will supply hotdip galvanized and galvannealed steel sheets for automotive

Tycoons Worldwide Group (Thailand) has announced that the company is going to

invest about TWD 1.672 billion to build the electric furnace in its Thailand mill. The

designed annual capacity of this new billet production line will be 500,000 tonnes per

year

19

10

31/05/2012

CONTENTS

ISIT introduction

Thailand steel industry snapshot

Key drivers to Thailand steel market in medium term

Steel industry and AEC

20

Milestones of ASEAN

Bangkok

Declaration

40th Anniversary of ASEAN

Cebu The Philippines

INDONESIA

AFTA

PHILIPPINES

Declaration of

ASEAN Concord II

Bali Indonesia

SINGAPORE

MALAYSIA

ASEAN Community

VIETNAM

CAMBODIA

THAILAND

1967

1984 1992

BRUNEI DARUSSALAM

1995

1997

1999

2003

2007

2015

MYANMAR

LAOS

21

11

31/05/2012

Overview of the ASEAN Economic Community

characteristic

AEC

Single Market and

Production base

objective

Free flow of goods

services, investment,

and skilled labor

To create a stable, prosperous

and highly competitive ASEAN

economic region

Freer flow of capital

22

Characteristics of ASEAN steel industry

Fragmented production facilities

Lack of ironmaking

Scrap base steelmaking limits capability

to produce high grade steel products

Net import of semi-finished product,

especially slab

Net import of long and flat products,

especially high grade products

Rising intra-competition among

producers in region

23

Source: Iron and Steel Institute of Thailand

12

31/05/2012

Implications to the ASEAN steel industry

Private sector roles

Steel trade center/network

ASEAN Joint Venture Firm

ASEAN Holding Firm

Government roles

Rule of Origin (ROO)

Mutual Recognition Agreement

Trade Facilitation

New investment in high grade steel product

Preparation for new trade regulations

Steel association/institute can play roles in

Cooperation with private sector and government to create solid and fast action

Data center in trade statistics, trade regulations, and insightful market information

24

Source: Iron and Steel Institute of Thailand

THANK YOU

25

13

You might also like

- Spot Welding Interview Success: An Introduction to Spot WeldingFrom EverandSpot Welding Interview Success: An Introduction to Spot WeldingNo ratings yet

- Project II & IIIDocument14 pagesProject II & IIIElroy JohnsonNo ratings yet

- Acquisition of Millennium Steel 22dec2005Document23 pagesAcquisition of Millennium Steel 22dec2005vermanavalNo ratings yet

- Iron and Steel Industries in IndiaDocument13 pagesIron and Steel Industries in IndiaShyam AbhishekNo ratings yet

- EXPORT POTENTIAL OF STEEL BILLETS AND HOT ROLLED COIL IN MENA AND SOUTH EAST ASIAN REGION at SAIL (Steel Authority of India)Document100 pagesEXPORT POTENTIAL OF STEEL BILLETS AND HOT ROLLED COIL IN MENA AND SOUTH EAST ASIAN REGION at SAIL (Steel Authority of India)haidersyed06No ratings yet

- K e S S H R o F F C o L L e G e o F A R T S A N D C o M M e R C eDocument28 pagesK e S S H R o F F C o L L e G e o F A R T S A N D C o M M e R C eSiddharth SidNo ratings yet

- Project Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaDocument48 pagesProject Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaHillary RobinsonNo ratings yet

- Report Ended 26th AprilDocument7 pagesReport Ended 26th AprilvenkatadeepaksNo ratings yet

- "Conveyor Operation and MaintenanceDocument157 pages"Conveyor Operation and MaintenancealiNo ratings yet

- Performance Divergence and Financial Dis PDFDocument12 pagesPerformance Divergence and Financial Dis PDFSindhu GNo ratings yet

- Steel Industry Swot AnalysisDocument26 pagesSteel Industry Swot AnalysisDebabrata Bera100% (1)

- EDCP Presentation by SS, SAILDocument40 pagesEDCP Presentation by SS, SAILHarshita VoraNo ratings yet

- Global Competitiveness of Indian Industry - StatusDocument39 pagesGlobal Competitiveness of Indian Industry - Statusjeet_singh_deepNo ratings yet

- OperationDocument3 pagesOperationtomNo ratings yet

- 168 Research Report - TIN PLATEDocument8 pages168 Research Report - TIN PLATEPriyank PatelNo ratings yet

- The Steel Industry: World Steel Production (In MT) Over TimeDocument4 pagesThe Steel Industry: World Steel Production (In MT) Over Timesuvin91No ratings yet

- A Presentation of Economics Analysis ON Tata Steel LTDDocument35 pagesA Presentation of Economics Analysis ON Tata Steel LTDDhaval PatelNo ratings yet

- 2011MBA SM MP1 Name Anisha, Roll No 11021E0101, Topic TatasteelDocument12 pages2011MBA SM MP1 Name Anisha, Roll No 11021E0101, Topic TatasteelShalini NagavarapuNo ratings yet

- Steel Industry in India AbstractDocument8 pagesSteel Industry in India AbstractPawan Kumar VulluriNo ratings yet

- SAIL (Final)Document41 pagesSAIL (Final)SuhailUltronNo ratings yet

- Comprehensive Study On The Indian Steel Industry - REPORTDocument126 pagesComprehensive Study On The Indian Steel Industry - REPORTRahul FofaliaNo ratings yet

- Project Report On Vizag Steel Plant Distribution ChannelDocument94 pagesProject Report On Vizag Steel Plant Distribution ChannelOm Prakash78% (9)

- A Project Report ON Inventory Mangement AT Tata Steel LTDDocument91 pagesA Project Report ON Inventory Mangement AT Tata Steel LTDMoin MansooriNo ratings yet

- Indian Steel Industry: An OverviewDocument7 pagesIndian Steel Industry: An OverviewAshwin KelwadkarNo ratings yet

- Iron and Steel IndustryDocument15 pagesIron and Steel IndustryKRNo ratings yet

- Eco Project ReportDocument21 pagesEco Project Reportswapnil_thakre_1No ratings yet

- Wgrep CementDocument176 pagesWgrep CementSurendra SharmaNo ratings yet

- 2013 Daewoo InternationalDocument35 pages2013 Daewoo InternationalJohnathan WoodNo ratings yet

- Prepared By-Divya Katragadda Roll No 30 Mba (Pharm Tech) - 4 YearDocument17 pagesPrepared By-Divya Katragadda Roll No 30 Mba (Pharm Tech) - 4 YearDivya KatragaddaNo ratings yet

- Engineering SectorDocument7 pagesEngineering SectorNiftyQuant StrategyNo ratings yet

- 4Document65 pages4Pappu KumarNo ratings yet

- Management of Technology - Project Abstract: Research ObjectiveDocument5 pagesManagement of Technology - Project Abstract: Research ObjectiveKaustubh KirtiNo ratings yet

- Internship ReportDocument41 pagesInternship ReportPankaj KumarNo ratings yet

- Market Structure-Indian Steel SectorDocument6 pagesMarket Structure-Indian Steel SectorRakesh RanjanNo ratings yet

- Precision Steel TubesDocument9 pagesPrecision Steel TubesRam KumarNo ratings yet

- 28 Annual Report 2009-10Document96 pages28 Annual Report 2009-10Haritha IduriNo ratings yet

- Strategic Analysis and Recommendation For TATA SteelDocument16 pagesStrategic Analysis and Recommendation For TATA SteelSupriyaThengdi88% (8)

- Somrote Komolavanij: Innovation Capability With Internal and External Sources. ERIA Research ProjectDocument55 pagesSomrote Komolavanij: Innovation Capability With Internal and External Sources. ERIA Research ProjectJustin BelieberNo ratings yet

- Porter Five Forces Analysis For Tata SteelDocument9 pagesPorter Five Forces Analysis For Tata Steelneelimabcom18.scmtNo ratings yet

- 2005 Cementing FutureDocument64 pages2005 Cementing FutureLê DũngNo ratings yet

- Rashtriya Ispat Nigam LimitedDocument101 pagesRashtriya Ispat Nigam LimitedFelix Amirth Raj100% (1)

- Question Paper Integrated Case Studies - IV (362) : October 2006 Case StudyDocument33 pagesQuestion Paper Integrated Case Studies - IV (362) : October 2006 Case StudyWise MoonNo ratings yet

- Strategic Analysis and Recommendation For TATA SteelDocument17 pagesStrategic Analysis and Recommendation For TATA SteelmomNo ratings yet

- Kirloskar Ferrous Industries Limited, KoppalDocument69 pagesKirloskar Ferrous Industries Limited, KoppalAmar G Patil0% (1)

- Management Control System Tata SteelDocument38 pagesManagement Control System Tata SteelPiyush MathurNo ratings yet

- Drgorad SM ProjectDocument10 pagesDrgorad SM ProjectDeepak R GoradNo ratings yet

- Project Final Report On Distribution Channel Vizag Steel PlantDocument100 pagesProject Final Report On Distribution Channel Vizag Steel PlantOm PrakashNo ratings yet

- TATA Annual Report 2011 12Document252 pagesTATA Annual Report 2011 12Moinuddin Bagwaan100% (1)

- Tata Steel Final Report 1Document116 pagesTata Steel Final Report 1Manu Srivastav50% (2)

- Vivek Kumar SinghDocument47 pagesVivek Kumar SinghVivek SinghNo ratings yet

- A Study of Electronic Data Storage Steel Factory in Mumbai11Document71 pagesA Study of Electronic Data Storage Steel Factory in Mumbai11Thirupal Nk100% (3)

- Thai Autobook 2013 - PreviewDocument38 pagesThai Autobook 2013 - PreviewUlrich KaiserNo ratings yet

- Competition & Strategy Mid Term Report On Steel Industry: Submitted To Prof. Rishikesh T. KrishnanDocument19 pagesCompetition & Strategy Mid Term Report On Steel Industry: Submitted To Prof. Rishikesh T. KrishnanNidhi AshokNo ratings yet

- Profitability and Consistency Analysis of Steel Sector in IndiaDocument9 pagesProfitability and Consistency Analysis of Steel Sector in IndiaRajesh JadavNo ratings yet

- Investor Presentation August 11Document15 pagesInvestor Presentation August 11Nivedita KumraNo ratings yet

- Financial AnalysisDocument107 pagesFinancial AnalysisRamachandran Mahendran100% (4)

- Sec-F Grp-3 CF-II Project - Tata SteelDocument20 pagesSec-F Grp-3 CF-II Project - Tata SteelPranav BajajNo ratings yet

- Increasing The Competitiveness of Indian Steel Industry?: MFSA ProjectDocument11 pagesIncreasing The Competitiveness of Indian Steel Industry?: MFSA ProjectJaimin JadavNo ratings yet

- Engineering Applications: A Project Resource BookFrom EverandEngineering Applications: A Project Resource BookRating: 2.5 out of 5 stars2.5/5 (1)

- The Bretton Woods Institutions and Their RoleDocument12 pagesThe Bretton Woods Institutions and Their RoleUwayo NoelNo ratings yet

- Effectiveness Analysis of Drone Use For Rice Production in Central ThailandDocument8 pagesEffectiveness Analysis of Drone Use For Rice Production in Central ThailandMuhamad AbdullahNo ratings yet

- Mahatma Gandhi National Rural Employment Guarantee Act - Wikipedia, The Free EncyclopediaDocument3 pagesMahatma Gandhi National Rural Employment Guarantee Act - Wikipedia, The Free Encyclopediasubho21mukherjee4076100% (3)

- Module 1 Cecpm ReviewerDocument8 pagesModule 1 Cecpm ReviewerkaicaNo ratings yet

- CSC Accords WMSU With PRIME HRM Bronze AwardDocument2 pagesCSC Accords WMSU With PRIME HRM Bronze AwardLiezel ParreñoNo ratings yet

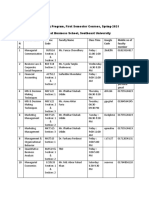

- SL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty MemberDocument2 pagesSL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty Memberএ.বি.এস. আশিকNo ratings yet

- Where Can I Find An Excel Template That Measures Credit RiskDocument13 pagesWhere Can I Find An Excel Template That Measures Credit RiskSirak AynalemNo ratings yet

- Types of Accounting Source DocumentsDocument4 pagesTypes of Accounting Source Documentsnyasha chanetsaNo ratings yet

- Five-Forces Analysis For CSD Cola Wars CDocument2 pagesFive-Forces Analysis For CSD Cola Wars CasheNo ratings yet

- PBO - Lecture 02 - Value Chains and Global OperationsDocument32 pagesPBO - Lecture 02 - Value Chains and Global OperationspreeyalNo ratings yet

- TAX 2 v2Document339 pagesTAX 2 v2Stephanie PeraltaNo ratings yet

- Offer Letter For Marketing ExecutivesDocument2 pagesOffer Letter For Marketing ExecutivesRahul SinghNo ratings yet

- PRAN-RFL Group Public Affairs ActivitiesDocument5 pagesPRAN-RFL Group Public Affairs ActivitiesFU.NahianNo ratings yet

- Property, Plant, and EquipmentDocument3 pagesProperty, Plant, and EquipmentIzza Mae Rivera KarimNo ratings yet

- Internship Report On: J & L Fashion LTDDocument38 pagesInternship Report On: J & L Fashion LTDSabari SabariNo ratings yet

- Examiners' Report Principal Examiner Feedback January 2020Document6 pagesExaminers' Report Principal Examiner Feedback January 2020DURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- 2012 - IsSN - Influence of Working Capital Management On Profitability A Study On Indian FMCG CompaniesDocument10 pages2012 - IsSN - Influence of Working Capital Management On Profitability A Study On Indian FMCG CompaniesThi NguyenNo ratings yet

- Contemporary Management 11th Edition Test Bank Chapter 11Document52 pagesContemporary Management 11th Edition Test Bank Chapter 11Manal Al OjailiNo ratings yet

- Gujarat Government's Large Number of Incentives To Spark New Life To Material IndustryDocument3 pagesGujarat Government's Large Number of Incentives To Spark New Life To Material IndustryKanhaiya GuptaNo ratings yet

- Equity Fincing RiskDocument62 pagesEquity Fincing RiskBrian HughesNo ratings yet

- Assignment-Managerial Economics AssignmentDocument17 pagesAssignment-Managerial Economics Assignmentnatashashaikh93No ratings yet

- Lehman Brothers:: Too Big To Fail?Document13 pagesLehman Brothers:: Too Big To Fail?abbiecdefgNo ratings yet

- Part 3. Write An Essay of 300-350 Words On The Following TopicDocument3 pagesPart 3. Write An Essay of 300-350 Words On The Following TopicVo Quynh ChiNo ratings yet

- SWOT Analysis of NestleDocument2 pagesSWOT Analysis of NestleMuddasar AbbasiNo ratings yet

- Leases Discount Rates: What's The Correct Rate?Document41 pagesLeases Discount Rates: What's The Correct Rate?PAMELA AMARO JAQUEZNo ratings yet

- Enterprise Resource Planning (ERP) System Implementation: Promise and ProblemsDocument10 pagesEnterprise Resource Planning (ERP) System Implementation: Promise and ProblemsNimra Aamir FastNUNo ratings yet

- HRM in Nishat MillsDocument6 pagesHRM in Nishat MillsSabaNo ratings yet

- Week 11 - Cost Structure - Sir VelosoDocument23 pagesWeek 11 - Cost Structure - Sir VelosoJinky CarolinoNo ratings yet

- Accounting For Cancelled Checks: Become Stale, Voided or SpoiledDocument4 pagesAccounting For Cancelled Checks: Become Stale, Voided or SpoiledRafael Capunpon VallejosNo ratings yet

- Discussion Forum 4.4B SolutionsDocument5 pagesDiscussion Forum 4.4B SolutionsSidra UmairNo ratings yet