Professional Documents

Culture Documents

Banking Report Print

Uploaded by

donyacarlottaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Report Print

Uploaded by

donyacarlottaCopyright:

Available Formats

Secrecy of Bank Deposits (RA 1405)

A. Two-fold Purpose (Section 1, RA 1405)

(a) To give encouragement to the people to deposit their money in banking institutions; and

(b) To discourage private hoarding so that the same may be properly utilized by banks in

authorized loans to assist in the economic development of the country

B. Privacy

Zones of privacy are recognized and protected in our laws.

C. Absolute Confidentiality

all deposits of whatever nature including investment bonds issued by the government

unlawful for bank officials and employees to disclose any information concerning said deposits

1. Prohibition against inquiry into or disclosure of deposits under RA 8367 (An Act Providing for the

Regulation of the Organization and Operation of Non-stock Savings and Loan Associations)

(Section 6, RA 8367)

all deposits of whatever nature, absolutely confidential

except:

- written permission of depositor

- in cases of impeachment

- order of competent court in cases of bribery or dereliction of duty of public officials

- subject matter of litigation

2. Foreign Currency Deposits (Section 8, RA 6426)

absolutely confidential, except upon written permission of the depositor

exempt from attachment, garnishment, or any other order or process

3. Confidentiality of Deposits in Islamic Banks (Section 17, RA 6848)

all deposits of whatever nature

exceptions:

- inspection by the banks auditor

- written permission of depositor

- court order

unlawful for any official or employee of the Islamic Bank to disclose or reveal to any person any

confidential information

Exceptions to Secrecy of Deposits

A. Exceptions under the Bank Secrecy Law (Section 2, RA 1405)

written permission of the depositor

in cases of impeachment

order of competent court in cases of bribery or dereliction of duty of public officials

in cases where the money deposited or invested is the subject matter of litigation

Ayala, Charlotte Hannah E.

1

B. Garnishment (Rule 39, Section 9 (c), Rules of Court)

The officer may levy on debts due the judgment obligor and other credits, including bank deposits,

financial interests, royalties, commissions and other personal property not capable of manual delivery in the

possession or control of third parties.

The prohibition against examination of or inquiry into a bank deposit does not preclude its being garnished to

insure satisfaction of a judgment. (China Banking Corp v. Ortega, GR No. L- 34964, January 31, 1973)

Foreign currency deposits of Filipino depositors are not covered by the Foreign Currency Deposit Act, and are

thus not exempt from the processes duly-issued by the BIR. (Estrada v. Desierto, GR No. 156160, December

9, 2004 )

C. Secrecy and Exemption from Attachment and Garnishment of Foreign Currency Deposits Cannot be Used

as Device for Wrongdoing

Exemption from attachment, garnishment, or any other order of process of any court, legislative body,

government agency or any administrative body whatsoever, is not applicable to a foreign transient, otherwise,

injustice would result especially to a citizen aggrieved by a foreign guest. ( Salvacion v. Central Bank of the

Philippines, GR No. 94723, August 21, 1997)

D. Graft and Corruption

The Anti-Graft Law directs in mandatory terms that bank deposits shall be taken into consideration in its

enforcement, notwithstanding any provision of law to the contrary. It is intended to amend RA 1405 by providing an

additional exemption to the rule against the disclosure of bank deposits. It applies when there is a court order in

cases of unexplained wealth or inquiries into illegally acquired property or property not legitimately acquired.

(PNB v. Gancayco, 15 SCRA 91)

E. Authority to Inquire into Bank Deposits under AMLA (Section 11, RA 9160)

The AMLC may inquire into or examine any particular deposit or investment, including related

accounts, with any banking institution or non-bank financial institution upon order of competent court based on an

ex parte application in cases of violations of RA 9160, where it has been established that:

there is probable cause that the deposits or investments, including related accounts, are related to

an unlawful activity defined in Section 3(i); or

money laundering offense under Section 4

No court order in the following:

kidnapping for ransom under Article 267 of the RPC

violations of Sections 4, 5, 6, 8, 9, 10, 11, 12, 13, 14, 15, and 16 of RA 9165 (Comprehensive

Dangerous Drugs Act)

hijacking and other violations under RA 6235 (Anti-Hijacking Law); destructive arson and

murder under the RPC

terrorism and conspiracy to commit terrorism under RA 9372 (Human Security Act)

F. Periodic or Special Examinations

the BSP may inquire into or examine any deposit or investment in the course of periodic or special

examination (Section 11, RA 9160)

disclosure is also allowed when the Monetary Board has reasonable ground to believe that a bank fraud or

serious irregularity has been or is being committed, or during the conduct of a banks regular audit (Marquez

v. Desierto, GR No. 135882, June 27, 2001)

Ayala, Charlotte Hannah E.

2

G. In Camera Inspection by the Ombudsman (Section 15 (8), RA 6770)

the Ombudsman has the power to examine and have access to bank accounts and records, with the

following conditions:

- there is a pending case

- the account must be clearly identified

- the inspection must be limited to the subject matter of the pending case

- the bank personnel and the account holder must be notified to be present during the inspection

- the inspection should cover only the account identified

mere investigation would not warrant the opening of the bank account for inspection, since it is not considered

as pending litigation (Marquez v. Desierto, GR No. 135882, June 27, 2001)

H. Preliminary Attachment (Rule 57 of the Rules of Court)

Any person who has in his possession or or under his control debts and credits such as bank deposits

belonging to a party whose property has been attached may be ordered by the court to deliver such property to

the clerk of court or sheriff.

I. Disclosure of Dormant Accounts (Section 2, RA 3936, Unclaimed Balances Act)

All banks shall forward to the Insular Treasurer a statement, under oath of their respective managing

officers, of all credits and deposits held by them in favor of persons known to be dead, or who have not made

further deposits or withdrawals during the preceding 10 years or more.

J. Authority of the Commissioner of Internal Revenue to Inquire into Deposits (Section 6 (F), NIRC)

The Commissioner is authorized to inquire into the bank deposits of and other related information held

by financial institutions:

a decedent to determine his gross estate;

any taxpayer who has filed an application for compromise of his tax liability under Section

204 (A) (2) by reason of financial incapacity;

a specific taxpayer subject of a request for the supply of tax information from a foreign tax

authority pursuant to international convention or agreement

K. Waiver by DOSRI (Section 26, NCBA)

in case the DOSRI contracts a loan or any form or financial accommodation under Section 26 of the

NCBA, he shall be required by the lending bank to waive secrecy of his deposits of whatever nature in all

banks in the Philippines

information obtained shall be held strictly confidential, may be used by the examiner only in connection with

their supervisory and examination responsibility or by the BSP in case of legal action initiated involving the

deposited account

Ayala, Charlotte Hannah E.

3

You might also like

- Sabitsana v. Muertegui (Quieting of Title, RTC)Document13 pagesSabitsana v. Muertegui (Quieting of Title, RTC)donyacarlottaNo ratings yet

- Sample Police BlotterDocument1 pageSample Police BlotterdonyacarlottaNo ratings yet

- Sworn Statement For House ImprovementDocument1 pageSworn Statement For House ImprovementdonyacarlottaNo ratings yet

- ResumeDocument3 pagesResumeQuinÜQuintanaNo ratings yet

- Sabitsana v. Muertegui (Quieting of Title, RTC)Document13 pagesSabitsana v. Muertegui (Quieting of Title, RTC)donyacarlottaNo ratings yet

- San Pedro v. Asdala (Quieting of Title, But Not RTC)Document5 pagesSan Pedro v. Asdala (Quieting of Title, But Not RTC)donyacarlottaNo ratings yet

- ESWM For HHDocument5 pagesESWM For HHJotho CapistranoNo ratings yet

- Marine Mammals Case (Full)Document26 pagesMarine Mammals Case (Full)donyacarlottaNo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of AttorneyNowhere Man92% (12)

- Galicta v. Aquino (Certiorari, Declaratory Relief)Document15 pagesGalicta v. Aquino (Certiorari, Declaratory Relief)donyacarlottaNo ratings yet

- Heirs of Sps. Reterta v. Mores (Quieting of Title, But Not RTC)Document14 pagesHeirs of Sps. Reterta v. Mores (Quieting of Title, But Not RTC)donyacarlottaNo ratings yet

- Affidavit of Loss - Gun, LicensedDocument1 pageAffidavit of Loss - Gun, LicenseddonyacarlottaNo ratings yet

- Eo 98Document3 pagesEo 98judge_187722No ratings yet

- 110 2013Document10 pages110 2013Mark Reymond CanoNo ratings yet

- Sworn Statement: Page 1 of 1Document1 pageSworn Statement: Page 1 of 1donyacarlottaNo ratings yet

- CSC Revised Interim GuidelinesDocument7 pagesCSC Revised Interim GuidelinesKaren PahayahayNo ratings yet

- Affidavit of TransfereeDocument1 pageAffidavit of TransfereedonyacarlottaNo ratings yet

- Accomplishment Report FormDocument1 pageAccomplishment Report FormdonyacarlottaNo ratings yet

- Accomplishment Report FormDocument1 pageAccomplishment Report FormdonyacarlottaNo ratings yet

- Sworn Statement For House ImprovementDocument1 pageSworn Statement For House ImprovementdonyacarlottaNo ratings yet

- Extra Judicial Settlement With WaiverDocument3 pagesExtra Judicial Settlement With WaiverdonyacarlottaNo ratings yet

- Oratio Imperata COVID-19Document1 pageOratio Imperata COVID-19donyacarlottaNo ratings yet

- Affidavit of Loss - IdDocument1 pageAffidavit of Loss - IddonyacarlottaNo ratings yet

- Page 1 of 2 Waiver of RightsDocument2 pagesPage 1 of 2 Waiver of RightsdonyacarlottaNo ratings yet

- Conformity of ShareDocument1 pageConformity of SharedonyacarlottaNo ratings yet

- GPPB Resolution No. 06-2020Document14 pagesGPPB Resolution No. 06-2020Princess SarahNo ratings yet

- LBC No115 PDFDocument19 pagesLBC No115 PDFAlgen S. GomezNo ratings yet

- DBM Dof Dilg Joint Memorandum Circular No 1 Dated November 4 2020 PDFDocument4 pagesDBM Dof Dilg Joint Memorandum Circular No 1 Dated November 4 2020 PDFdonyacarlottaNo ratings yet

- GPPB Resolution No. 03-2020Document15 pagesGPPB Resolution No. 03-2020Villa BernaldoNo ratings yet

- Cutting Guide - ENGDocument1 pageCutting Guide - ENGdonyacarlottaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sem 4 - Minor 2Document6 pagesSem 4 - Minor 2Shashank Mani TripathiNo ratings yet

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNo ratings yet

- Barangay Tanods and The Barangay Peace and OrderDocument25 pagesBarangay Tanods and The Barangay Peace and OrderKarla Mir74% (42)

- Saic-M-2012 Rev 7 StructureDocument6 pagesSaic-M-2012 Rev 7 StructuremohamedqcNo ratings yet

- POM 3.2 Marketing Management IIDocument37 pagesPOM 3.2 Marketing Management IIDhiraj SharmaNo ratings yet

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocument6 pagesConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworNo ratings yet

- Grace Strux Beton PDFDocument33 pagesGrace Strux Beton PDFmpilgirNo ratings yet

- Troubleshooting For Rb750Glr4: Poe Does Not WorkDocument7 pagesTroubleshooting For Rb750Glr4: Poe Does Not Workjocimar1000No ratings yet

- Prepositions Below by in On To of Above at Between From/toDocument2 pagesPrepositions Below by in On To of Above at Between From/toVille VianNo ratings yet

- Basic Electronic Troubleshooting For Biomedical Technicians 2edDocument239 pagesBasic Electronic Troubleshooting For Biomedical Technicians 2edClovis Justiniano100% (22)

- Qualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Document23 pagesQualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Saqlain Siddiquie100% (1)

- VoIP Testing With TEMS InvestigationDocument20 pagesVoIP Testing With TEMS Investigationquantum3510No ratings yet

- Expected MCQs CompressedDocument31 pagesExpected MCQs CompressedAdithya kesavNo ratings yet

- DTMF Controlled Robot Without Microcontroller (Aranju Peter)Document10 pagesDTMF Controlled Robot Without Microcontroller (Aranju Peter)adebayo gabrielNo ratings yet

- Fortigate Fortiwifi 40F Series: Data SheetDocument6 pagesFortigate Fortiwifi 40F Series: Data SheetDiego Carrasco DíazNo ratings yet

- MSDS Bisoprolol Fumarate Tablets (Greenstone LLC) (EN)Document10 pagesMSDS Bisoprolol Fumarate Tablets (Greenstone LLC) (EN)ANNaNo ratings yet

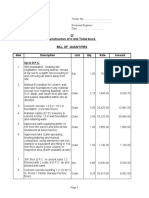

- Financial StatementDocument8 pagesFinancial StatementDarwin Dionisio ClementeNo ratings yet

- SDM Case AssignmentDocument15 pagesSDM Case Assignmentcharith sai t 122013601002No ratings yet

- Chap 06 Ans Part 2Document18 pagesChap 06 Ans Part 2Janelle Joyce MuhiNo ratings yet

- X HM11 S Manual AUpdfDocument228 pagesX HM11 S Manual AUpdfAntonio José Domínguez CornejoNo ratings yet

- Electric Arc Furnace STEEL MAKINGDocument28 pagesElectric Arc Furnace STEEL MAKINGAMMASI A SHARAN100% (3)

- Comparative Analysis of Mutual Fund SchemesDocument29 pagesComparative Analysis of Mutual Fund SchemesAvinash JamiNo ratings yet

- The April Fair in Seville: Word FormationDocument2 pagesThe April Fair in Seville: Word FormationДархан МакыжанNo ratings yet

- Well Stimulation TechniquesDocument165 pagesWell Stimulation TechniquesRafael MorenoNo ratings yet

- EP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4Document5 pagesEP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4doyaNo ratings yet

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsDocument3 pagesQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarNo ratings yet

- T R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentDocument1 pageT R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentJapCon HRNo ratings yet

- Gowtham Kumar Chitturi - HRMS Technical - 6 YrsDocument4 pagesGowtham Kumar Chitturi - HRMS Technical - 6 YrsAnuNo ratings yet

- DevelopersDocument88 pagesDevelopersdiegoesNo ratings yet

- Spine Beam - SCHEME 4Document28 pagesSpine Beam - SCHEME 4Edi ObrayanNo ratings yet