Professional Documents

Culture Documents

Indian Pharmaceuticals Monthly: Steady and Improving

Uploaded by

umaganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Pharmaceuticals Monthly: Steady and Improving

Uploaded by

umaganCopyright:

Available Formats

SECTOR UPDATE

26 SEP 2016

Indian Pharmaceuticals Monthly

Steady and improving

The Indian pharma market (IPM) grew 15.3% YoY to

INR 96.4bn in Aug16, bolstered by superior growth

in seasonal therapies like Anti-infective, Acute

Respiratory and Gastro-intestinal. The performance

has been encouraging amidst prevailing confusion

over FDC products and frequent changes in NLEM

list.

Sun Pharma (20.3%), Glenmark (20.9%), Dr.

At present, FDC issue is under litigation and

Glenmark Pharma outpaced the IPM by 5% with

there is a stay on this ban. Despite this, AIOCD

data reflected 11.5% de-growth in FDC products.

This may be largely on account of proactive

efforts taken by Pharma companies to shift

prescription to single molecule/non-FDC

products. FDC portfolio of Indian companies and

MNCs declined 11.1% and 16.1% respectively.

On MAT (Moving Annual Total) basis till Aug16,

IPM grew by 10.5%, largely driven by price

growth of 4.3% and volume growth of 3.3%.

Our view on the IPM is positive and we believe it

will continue to grow at 12-13% CAGR over the

next few years aided by (1) Increased

penetration of healthcare and insurance services,

(2) Growing incidence of lifestyle diseases and (3)

Ageing population.

IPCA, Alkem, Sun & Glenmark outperform

Amey Chalke

amey.chalke@hdfcsec.com

+91-22-6171-7321

IPCA reported highest growth in Aug-16 at 28.0%

on account of significant growth in Antimalarials, much higher than 1Q growth of 3.7%.

Reddys Labs (17.3%), Alkem (21.1%) and

Alembic (20.5%) were ahead of the IPM (15.3%)

in Aug-16.

Alembic showed good growth across the board,

with Wikoryl (Respiratory) and Richar

(Gynaecological) being stand out performers.

the significant contributor being Zita Plus, from

the Anti-Diabetic portfolio.

On flip-side, Cipla (8.6%), Cadila (6.7%) and Lupin

(9.3%) underperformed significantly.

Growth recorded amongst all therapies

Strong growth was recorded in most therapies,

with Anti-infectivies (19.6% YoY) Anti-Diabetic

(19.0% YoY) and Respiratory (32.3% YoY) growing

in excess of 15%. In Anti-Diabetics, growth for

Janumet, Glycomet GP and Lantus brands were

higher at 29.3% YoY, 25.8% and 35.8%

respectively.

Corex, a leading brand in Respiratory therapy in

India, grew 20% YoY on MAT basis. However,

Aug-16 growth stood at -11%YoY.

Other therapies which registered double digit

growth in Aug-16 include Pain/Analgesic (15.4%

YoY), Gastro Intestinal (14.2% YoY), and Derma

(12.2% YoY).

HDFC securities Institutional Research is also available on Bloomberg HSLB <GO> & Thomson Reuters

PHARMACEUTICALS : SECTOR UPDATE

The overall annual trend was

decent; however, 1Q growth

was comparatively muted.

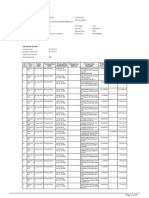

IPM - Top Companies

IPCA Laboratories was the 1M

growth leader, driven by a

strong performance in its

Anti-Malarials portfolio,

while Mankind Pharma had

the best 1Q.

IPM

Sun Pharma

Abbott India

Cipla

Zydus Cadila

Mankind Pharma

Alkem

Lupin

GSK Pharma

Pfizer

Glenmark

Sanofi India

Dr. Reddy's

Torrent Pharma

Alembic

IPCA Labs

Ajanta Pharma

Company

Value

(INR bn)

1,025

89

64

50

43

39

35

34

33

29

25

25

24

23

14

13

5

MAT Aug-16

Market

Share (%)

100.0

8.7

6.2

4.9

4.2

3.9

3.4

3.3

3.2

2.9

2.4

2.4

2.4

2.2

1.4

1.3

0.5

Growth

(%)

10.5

10.4

8.7

9.5

8.4

19.8

10.8

12.3

2.0

4.9

15.5

6.7

14.4

6.1

15.7

10.7

9.8

1Q

(%)

1M

(%)

6.4

4.5

8.9

5.4

3.1

16.2

6.3

8.8

-5.5

2.9

8.2

5.4

1.4

-1.5

9.2

3.7

10.7

15.3

20.3

12.6

8.6

6.7

19.4

21.1

9.3

4.0

6.8

20.9

13.4

17.3

12.7

20.5

28.0

10.0

Source: AIOCD, HDFC sec Inst Research

Top 10 brands were the major

contributors to the IPM

growth for Aug-16.

Brand wise growth distribution

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

% of sales

100.0

34.2

18.0

15.0

32.8

MAT growth (%)

10.4

11.6

11.0

12.5

7.8

Growth Contribution (%)

100.0

37.8

19.1

17.8

25.4

Source: AIOCD, HDFC sec Inst Research

Page | 2

PHARMACEUTICALS : SECTOR UPDATE

Abbotts Mixtard was the top

selling drug for the period,

despite de-growth of 11.7%.

Alkems Clavam brand

displayed a positive growth of

15.4%, in contrast to GSKs

Augmentin which posted a

de-growth for the period,

with both being the top 2

drugs in the anti-infectives

market.

IPM - Top 10 Drugs

MAT Aug-16

Drug

Therapy

Mixtard

Growth (%)

Value

(INR mn)

Growth

(%)

1Q

Aug-16

Anti Diabetic

4,792

-11.7

-17.4

-0.9

Glycomet Gp

Corex

Spasmo Proxyvon Plus

Lantus

Anti Diabetic

Respiratory

Gastro Intestinal

Anti Diabetic

3,537

3,156

3,088

3,045

12.5

20.6

31.8

26.2

13.5

12.1

-0.5

24.3

25.8

-11.0

18.1

35.8

Augmentin

Anti-Infectives

2,954

-10.3

-18.9

-5.6

Janumet

Anti Diabetic

2,568

22.4

12.5

29.3

Clavam

Anti-Infectives

2,559

15.4

8.8

26.4

Phensedyl Cough Linctus

Volini

Respiratory

Pain / Analgesics

2,475

2,368

0.3

15.9

-1.9

24.8

-10.5

15.2

Source: AIOCD, HDFC sec Inst Research

Page | 3

PHARMACEUTICALS : SECTOR UPDATE

Performance of Top Therapies

For Aug-16, the biggest

contributor to the IPM, antiinfectives, outperformed with

a growth of 19.6% YoY.

Respiratory drugs too posted

a significant growth of 32.3%

YoY.

Amongst therapies, antidiabetic recorded the highest

growth on MAT basis.

Therapy

IPM

Anti-Infectives

Cardiac

Gastro Intestinal

Vitamins / Minerals / Nutrients

Anti Diabetic

Respiratory

Pain / Analgesics

Neuro / CNS

Derma

Gynaecological

Ophthal / Otologicals

Vaccines

Hormones

Anti-Neoplastics

Blood Related

Others

Urology

Anti Malarials

Sex Stimulants / Rejuvenators

Stomatologicals

Value (INR bn)

1,025

155

127

120

90

86

80

71

63

61

52

19

18

17

15

12

11

11

6

6

5

MAT Aug-16

Market Share (%)

100.0

15.1

12.4

11.8

8.8

8.4

7.8

6.9

6.1

5.9

5.1

1.8

1.8

1.7

1.5

1.1

1.1

1.1

0.6

0.6

0.5

Growth (%)

10.5

9.2

10.7

11.4

7.4

16.7

11.7

10.3

11.6

12.1

9.3

7.0

3.4

9.9

-0.7

9.7

23.8

12.0

6.4

10.9

8.5

1M (%)

Aug-16

15.3

19.6

11.6

14.2

11.4

19.0

32.3

15.4

9.5

12.2

10.8

4.5

0.1

14.0

2.1

8.4

35.2

15.0

38.6

14.4

13.4

Source: AIOCD, HDFC sec Inst Research

Page | 4

PHARMACEUTICALS : SECTOR UPDATE

Dr. Reddys Laboratories

Dr. Reddys Labs (DRL) grew

14.4% YoY on an MAT basis,

but experienced a slow 1Q

growth at 1.4% YoY.

However, the Aug-16 YoY

figure was more favourable

at 17.3%.

Top 10 Drugs

Drug

Therapy

Total

Omez

Omez D

Econorm

Grafeel

Stamlo

Nise

Razo d

Mintop

Atarax

Razo

Gastro Intestinal

Gastro Intestinal

Gastro Intestinal

Anti-Neoplastics

Cardiac

Pain / Analgesics

Gastro Intestinal

Derma

Respiratory

Gastro Intestinal

Value (INR mn)

24,382

1,281

1,017

731

662

652

639

555

531

504

499

MAT Aug-16

Growth (%) Contribution (%)

14.4

100.0

13.7

5.3

26.2

4.2

18.1

3.0

55.4

2.7

8.3

2.7

-0.8

2.6

16.6

2.3

3.4

2.2

19.5

2.1

13.4

2.0

Growth (%)

1Q

1.4

-3.9

2.1

0.3

-1.1

-13.0

-11.4

14.2

-22.0

23.5

6.1

Aug-16

17.3

-16.7

26.1

-4.2

12.0

-9.0

7.2

19.3

-10.0

70.1

37.7

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Anti-neoplastics portfolio

grew 21.3% YoY on MAT basis

with overall share in revenue

also up from 10.5% to 11.2%

YoY.

Share (%)

Total

Gastro Intestinal

Cardiac

Anti-Neoplastics

Respiratory

Anti-Infectives

Pain / Analgesics

Derma

Anti Diabetic

Urology

Neuro / CNS

100.0

21.5

14.1

11.2

8.8

8.2

6.7

6.7

6.6

4.1

3.6

MAT Growth (%)

14.4

14.9

6.3

21.3

12.8

17.7

7.8

17.9

10.3

24.5

32.5

Growth (%)

1Q

1.4

0.0

-9.0

4.1

2.9

11.2

-5.5

3.2

1.5

12.7

28.9

Aug-16

17.3

8.0

2.0

36.9

40.8

39.8

9.4

12.1

9.5

20.0

7.8

Source: AIOCD, HDFC sec Inst Research

Page | 5

PHARMACEUTICALS : SECTOR UPDATE

The above 50 brands segment

performed well in the

discussed period, contributing

33.4% to the overall growth

of Company revenues.

Brand wise growth distribution

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

% of sales

100.0

29.0

20.9

16.5

33.6

MAT growth (%)

14.4

16.4

9.3

17.9

14.2

Growth Contribution (%)

100.0

32.6

14.2

19.9

33.4

Source: AIOCD, HDFC sec Inst Research

The chronic portion of DRLs

portfolio decreased 2.7% YoY

and is less than the

corresponding IPM figure of

32% approximately.

Increasing volumes were the

key driver in DRLs growth

during the year.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC,

21%

7.14

ACUTE, 49%

3.00

3.10

Price GR (%)

New Product GR (%)

CHRONIC,

30%

Volume GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 6

PHARMACEUTICALS : SECTOR UPDATE

Abbott India

Mixtard was the highest

selling drug for Abbott India,

and the entire IPM, despite a

annual de-growth of 11.7%.

Phensedyl showed flat

growth for the year, but also

made it to the list of top 10

drugs of the IPM.

Top 10 Drugs

Drug

Therapy

Total

Mixtard

Phensedyl Cough Linctus

Novomix

Thyronorm

Duphaston

Udiliv

Vertin

Duphalac

Actrapid

Stemetil

Anti Diabetic

Respiratory

Anti Diabetic

Hormones

Gynaecological

Gastro Intestinal

Neuro / CNS

Gastro Intestinal

Anti Diabetic

Gastro Intestinal

Value (INR mn)

63,865

4,792

2,475

2,037

1,850

1,794

1,331

1,257

1,127

867

854

MAT Aug-16

Growth (%) Contribution (%)

8.7

100.0

-11.7

7.5

0.3

3.9

43.3

3.2

14.1

2.9

7.1

2.8

15.1

2.1

15.0

2.0

4.4

1.8

-6.3

1.4

17.7

1.3

Growth (%)

1Q

Aug-16

8.9

12.6

-13.9

-0.9

-1.7

-10.5

52.1

57.1

8.2

11.0

23.4

26.9

26.8

46.3

2.9

-3.4

0.3

2.3

-0.4

28.9

14.8

27.2

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Anti-Diabetic portfolio grew

7.5% on MAT basis, showing a

further spike in Aug-16

growth at 19.5% YoY.

Total

Anti Diabetic

Gastro Intestinal

Vitamins / Minerals / Nutrients

Neuro / CNS

Anti-Infectives

Cardiac

Respiratory

Derma

Pain / Analgesics

Hormones

Share (%)

MAT Growth (%)

100.0

20.7

15.7

10.5

9.6

9.3

8.7

6.4

5.0

4.6

4.0

8.7

7.5

13.7

3.9

7.4

9.5

10.5

3.0

17.1

0.3

10.8

Growth (%)

1Q

8.90

6.6

15.3

3.0

7.6

-1.3

15.2

-3.9

24.6

6.9

8.6

Aug-16

12.6

19.5

16.2

13.3

-0.5

12.3

14.6

3.5

10.6

-3.1

10.0

Source: AIOCD, HDFC sec Inst Research

Page | 7

PHARMACEUTICALS : SECTOR UPDATE

Above 50 Brands segment

dominates the revenues for

Abbott, but MAT growth was

below the average for the

company as a whole.

Brand wise growth distribution

% of sales

100.0

28.8

15.8

15.4

39.9

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

8.7

4.5

13.4

14.0

8.1

Growth Contribution (%)

100.0

15.5

23.5

23.7

37.3

Source: AIOCD, HDFC sec Inst Research

Chronic portfolio comprises

41% of the total mix, which is

relatively high for the

industry.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

19%

4.30

ACUTE

39%

Prices were largely

responsible for the growth

seen in Abbott for the period.

2.30

CHRONIC

41%

Volume GR (%)

2.09

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 8

PHARMACEUTICALS : SECTOR UPDATE

Cipla

Top 10 Drugs

Ciplas top 10 drugs were a

mixed bag in terms of YoY

MAT growth.

Duolin and Montair LC grew

in excess of 30% YoY for Aug16.

Drug

Therapy

Total

Foracort

Budecort

Asthalin

Seroflo

Duolin

Aerocort

Azee

Montair LC

Novamox

Emeset

Respiratory

Respiratory

Respiratory

Respiratory

Respiratory

Respiratory

Anti-Infectives

Respiratory

Anti-Infectives

Gastro Intestinal

Value (INR mn)

50,326

2,036

1,680

1,384

1,339

1,317

973

944

870

771

757

MAT Aug-16

Growth (%) Contribution (%)

9.5

100.0

10.6

4.0

19.0

3.3

-1.2

2.7

-1.9

2.7

14.3

2.6

-2.8

1.9

9.4

1.9

20.3

1.7

-1.6

1.5

15.0

1.5

Growth (%)

1Q

Aug-16

5.4

8.6

9.9

7.8

12.3

9.1

-2.9

7.8

-4.7

6.7

11.4

31.5

-6.1

2.0

1.4

-0.4

9.8

35.5

-7.4

-2.5

0.2

23.9

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

The respiratory portfolio is by

far Ciplas strongest revenue

stream, slightly exceeding the

overall average MAT growth.

A sharp spike is noted for the

Aug-16 growth statistic, at

17.2% YoY, the highest across

all therapies.

Total

Respiratory

Anti-Infectives

Cardiac

Gastro Intestinal

Urology

Neuro / CNS

Opthal / Otologicals

Pain / Analgesics

Derma

Vitamins / Minerals / Nutrients

Share (%)

MAT Growth (%)

100.0

30.5

26.7

11.8

8.0

4.6

3.4

3.3

3.2

2.6

1.9

9.5

9.9

11.3

2.4

17.0

6.5

1.9

6.7

21.0

13.3

12.1

Growth (%)

1Q

5.4

4.3

5.7

3.3

14.0

3.4

-2.4

6.8

14.7

11.2

12.3

Aug-16

8.6

17.2

3.5

8.9

16.0

1.8

-13.6

-2.8

16.0

9.4

6.5

Source: AIOCD, HDFC sec Inst Research

Page | 9

PHARMACEUTICALS : SECTOR UPDATE

MAT growth was even across

the brand distribution, with

the above 50 brands segment

contributing the highest to

Ciplas overall MAT growth of

9.5%.

Brand wise growth distribution

% of sales

100.0

24.0

16.4

16.0

43.6

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

9.5

7.8

11.1

7.6

10.6

Growth Contribution (%)

100.0

19.9

18.9

13.1

48.1

Source: AIOCD, HDFC sec Inst Research

Cipla has a chronic mix of

40%, which is healthy when

compared to the overall

markets 32%. However, a 3%

degrowth was noted.

Growth was largely a factor

of price and volume increases.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

12%

4.03

3.29

2.22

ACUTE

48%

CHRONIC

40%

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 10

PHARMACEUTICALS : SECTOR UPDATE

Cadila Healthcare

Cadila recorded average

growth (MAT),

underperforming the IPM.

Top drug, Skinlite, produced

an overall MAT de-growth,

with recent results no better.

On the flip side, Deriphyllin

recorded a strong Aug-16

growth of 42% YoY

approximately, also posting a

16.5% MAT growth.

Top 10 Drugs

Drug

Total

Skinlite

Atorva

Mifegest Kit

Deriphyllin

Pantodac

Falcigo

Aten

Zyrop

Amlodac

Clopitorva

Therapy

Derma

Cardiac

Gynaecological

Respiratory

Gastro Intestinal

Anti Malarials

Cardiac

Blood Related

Cardiac

Cardiac

Value (INR mn)

42,997

1,819

1,265

1,232

1,068

1,054

720

678

663

661

625

MAT Aug-16

Growth (%) Contribution (%)

8.4

100.0

-4.7

4.2

2.9

2.9

0.8

2.9

16.5

2.5

18.4

2.5

13.5

1.7

-0.4

1.6

-3.7

1.5

-14.4

1.5

21.8

1.5

Growth (%)

1Q

Aug-16

3.1

6.7

5.7

0.2

-2.0

-13.8

-20.7

-16.4

0.4

41.9

19.8

13.6

-19.6

-17.7

-11.2

-12.6

8.2

12.2

-21.4

-33.1

9.6

-21.7

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Cadila boasts a comparatively

even mix of therapies

contributing to its revenues,

with the anti-infectives

portfolio recording a strong

MAT growth of 18.5%.

The respiratory portfolio

recorded a high growth of

23.2% YoY for Aug-16.

Total

Cardiac

Anti-Infectives

Gastro Intestinal

Respiratory

Gynaecological

Pain / Analgesics

Derma

Anti-Neoplastics

Vitamins / Minerals / Nutrients

Anti Malarials

Share (%)

MAT Growth (%)

100.0

15.3

14.2

12.6

10.3

9.7

9.1

7.4

5.1

4.1

2.1

8.4

5.7

18.5

10.1

12.5

-2.1

18.8

2.7

0.9

11.4

2.1

Growth (%)

1Q

3.1

0.6

7.9

9.0

2.0

-13.1

15.3

6.9

4.9

12.0

-28.7

Aug-16

6.7

-2.8

13.6

6.5

23.2

-10.0

16.8

8.0

7.9

29.3

-17.8

Source: AIOCD, HDFC sec Inst Research

Page | 11

PHARMACEUTICALS : SECTOR UPDATE

The above 50 brands

contributes the majority of

the revenues for Cadila, with

the 11 to 25 brands segment

being the largest contributor

to growth for the year.

Brand wise growth distribution

% of sales

100.0

22.8

17.2

15.0

45.0

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

8.4

3.5

24.4

15.3

3.7

Growth Contribution (%)

100.0

9.9

43.7

25.7

20.7

Source: AIOCD, HDFC sec Inst Research

Cadilas chronic portfolio is

largely in line with the IPM

average of 32%.

New products were the major

contributor to Cadilas growth

during the year, a significant

outperformance of the IPM.

However, volumes de-grew

during the year.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

18%

4.12

4.37

ACUTE

49%

CHRONIC

33%

-0.11

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 12

PHARMACEUTICALS : SECTOR UPDATE

GlaxoSmithKline

GSK Pharma recorded a flat

growth (MAT).

Calpol was an outperformer

with 26.9% (MAT), and 57.8%

YoY growth for Aug-16.

Top 10 Drugs

Drug

Therapy

Total

Augmentin

Synflorix

Calpol

Zinetac

Betnovate C

Betnovate N

Eltroxin

Rotarix

Ceftum

Betnesol

Anti-Infectives

Vaccines

Pain / Analgesics

Gastro Intestinal

Derma

Derma

Hormones

Vaccines

Anti-Infectives

Hormones

Value (INR mn)

32,565

2,954

2,041

1,972

1,602

1,492

1,450

1,370

1,299

1,262

1,130

MAT Aug-16

Growth (%) Contribution (%)

2.0

100.0

-10.3

9.1

16.3

6.3

26.9

6.1

5.4

4.9

9.5

4.6

10.9

4.5

7.4

4.2

49.3

4.0

-0.8

3.9

11.2

3.5

Growth (%)

1Q

Aug-16

-5.5

4.0

-19.9

-5.6

6.8

25.0

10.6

57.8

5.3

3.4

-22.1

-16.6

-6.6

-29.2

5.1

2.8

59.7

-51.2

-5.5

9.9

-26.3

7.4

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Vaccines outperformed,

posting a growth of 39.5%

(MAT), 32.7% (1Q) and 24.6%

YoY for Aug-16.

Total

Anti-Infectives

Derma

Vaccines

Pain / Analgesics

Respiratory

Hormones

Vitamins / Minerals / Nutrients

Gastro Intestinal

Cardiac

Gynaecological

Share (%)

MAT Growth (%)

100.0

22.8

18.0

15.1

9.8

8.1

8.0

7.6

5.6

1.8

1.1

2.0

-2.3

-9.3

39.5

18.1

-7.4

8.9

2.9

0.9

-25.0

5.6

Growth (%)

1Q

-5.5

-8.2

-22.6

32.7

3.9

-6.2

-9.6

0.7

1.6

-25.2

16.7

Aug-16

4.0

0.9

-15.0

24.6

35.4

9.9

4.4

5.7

-1.8

-26.6

-21.5

Source: AIOCD, HDFC sec Inst Research

Page | 13

PHARMACEUTICALS : SECTOR UPDATE

The above 50 brands segment

posted a sharp decline.

Brand wise growth distribution

% of sales

100.0

50.9

21.2

14.4

13.5

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

2.0

8.8

12.0

11.5

-30.3

Growth Contribution (%)

100.0

207.5

113.8

74.4

-295.7

Source: AIOCD, HDFC sec Inst Research

The chronic portfolio is

significantly lower than the

IPM average of 32%.

Of the limited increase in

GSKs growth, 61% of it can

be attributed to volumes.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

22%

1.22

0.69

CHRONIC

13%

ACUTE

66%

0.13

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 14

PHARMACEUTICALS : SECTOR UPDATE

Lupin Ltd

Lupin outperformed the IPM,

with its top drug, GluconormG, posting excellent growth

on MAT (24.1%), 1Q (25.7%)

and for Aug-16 (30.8% YoY).

Top 10 Drugs

Drug

Total

Gluconorm-G

Tonact

Budamate

Rablet-D

Esiflo

Rablet

Ramistar

R-Cinex

Cetil

Telekast-L

Therapy

Anti Diabetic

Cardiac

Respiratory

Gastro Intestinal

Respiratory

Gastro Intestinal

Cardiac

Anti-Infectives

Anti-Infectives

Respiratory

Value (INR mn)

34,017

1,538

949

896

561

507

500

484

466

453

432

MAT Aug-16

Growth (%) Contribution (%)

12.3

100.0

24.1

4.5

0.8

2.8

21.2

2.6

13.0

1.6

4.2

1.5

6.7

1.5

-3.6

1.4

-1.5

1.4

27.1

1.3

9.5

1.3

Growth (%)

1Q

Aug-16

8.8

9.3

25.7

30.8

3.1

-8.1

17.4

39.0

11.9

12.1

-2.4

-7.5

4.4

1.1

-8.0

-15.2

-5.3

-10.5

36.1

14.2

5.8

18.9

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Of Lupins bigger portfolios,

respiratory and anti-diabetic

posted strong growths on

MAT basis.

Amongst the smaller

therapies, gynaecological

grew significantly.

Total

Cardiac

Anti-Infectives

Respiratory

Anti Diabetic

Gastro Intestinal

Vitamins / Minerals / Nutrients

Neuro / CNS

Pain / Analgesics

Gynaecological

Opthal / Otologicals

Share (%)

MAT Growth (%)

100.0

24.7

21.0

12.6

11.6

7.9

5.3

5.0

4.3

3.6

0.7

12.3

10.5

6.7

17.3

23.4

12.7

-0.4

8.8

4.6

34.2

17.1

Growth (%)

1Q

8.8

7.4

0.1

12.0

25.5

7.8

-4.8

13.5

-2.0

21.4

17.7

Aug-16

9.3

2.8

2.9

23.4

29.4

10.2

-5.9

2.9

3.3

16.7

12.6

Source: AIOCD, HDFC sec Inst Research

Page | 15

PHARMACEUTICALS : SECTOR UPDATE

Lupins above 50 brands

segment outperformed during

the current year, contributing

54% approximately of the

overall growth.

Brand wise growth distribution

% of sales

100.0

19.9

15.6

16.8

47.6

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

12.3

11.3

9.6

11.3

14.1

Growth Contribution (%)

100.0

18.4

12.5

15.5

53.6

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

Lupin has a very strong mix of

chronic drugs, at 49% of its

total portfolio.

SUB

CHRONIC

19%

Growth Distribution (%)(MAT Aug-16)

5.90

ACUTE

32%

Volume was the key driver for

Lupins overall growth during

the period.

3.36

CHRONIC

49%

Volume GR (%)

Price GR (%)

3.09

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 16

PHARMACEUTICALS : SECTOR UPDATE

Sanofi India

Lantus, Sanofis biggest drug,

in contrast to the sluggish

overall growth, posted an

impressive growth of 26.2%

on MAT basis and 35.8% YoY

for Aug-16.

Top 10 Drugs

Drug

Total

Lantus

Combiflam

Allegra

Clexane

Cardace

Amaryl M

Enterogermina

Frisium

Avil

Vaxigrip

Therapy

Anti Diabetic

Pain / Analgesics

Respiratory

Cardiac

Cardiac

Anti Diabetic

Gastro Intestinal

Neuro / CNS

Respiratory

Vaccines

Value (INR mn)

24,602

3,045

1,538

1,334

1,252

1,046

1,026

1,019

826

823

812

MAT Aug-16

Growth (%) Contribution (%)

6.7

100.0

26.2

12.4

-3.3

6.3

16.1

5.4

7.5

5.1

13.6

4.3

19.6

4.2

36.9

4.1

-1.0

3.4

33.2

3.3

30.4

3.3

Growth (%)

1Q

Aug-16

5.4

13.4

28.9

35.8

-13.4

42.9

11.0

35.3

19.5

30.0

7.6

-2.6

22.5

39.4

27.0

30.3

-10.3

-23.5

22.2

65.0

-10.2

-46.1

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Amongst therapies, antidiabetic recorded significant

growth, in keeping with the

overall IPM trend.

Respiratory and gastro

intestinal portfolios too

performed well.

Vaccines endured de-growth

of 33% on MAT basis

approximately % YoY

approximately.

Total

Anti Diabetic

Cardiac

Respiratory

Vaccines

Pain / Analgesics

Neuro / CNS

Gastro Intestinal

Anti-Infectives

Vitamins / Minerals / Nutrients

Derma

Share (%)

MAT Growth (%)

100.0

25.0

19.6

10.0

9.9

9.2

8.9

5.2

5.1

4.4

2.1

6.7

24.0

14.5

20.7

-32.7

-2.1

5.4

27.1

-7.9

23.3

14.5

Growth (%)

1Q

5.4

26.4

15.6

12.6

-37.6

-10.9

1.9

17.5

-9.8

18.8

16.5

Aug-16

13.4

30.6

5.2

43.7

-18.5

33.9

-5.8

18.2

-4.0

39.2

4.3

Source: AIOCD, HDFC sec Inst Research

Page | 17

PHARMACEUTICALS : SECTOR UPDATE

More than half of Sanofis

revenues flow from the top 10

brands segment, the growth

of which was offset by degrowth in the 11 to 25 brands

segment.

Brand wise growth distribution

% of sales

100.0

51.7

25.0

14.4

8.9

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

6.7

16.5

-12.3

18.9

2.3

Growth Contribution (%)

100.0

116.1

-55.5

36.2

3.2

Source: AIOCD, HDFC sec Inst Research

Sanofi holds a very

favourable mix of 54% chronic

drugs.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

4%

Volumes de-grew over the

year, with prices providing

the thrust for Sanofis growth.

5.89

ACUTE

42%

1.14

CHRONIC

54%

-0.28

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 18

PHARMACEUTICALS : SECTOR UPDATE

Torrent Pharma

Torrents top 2 drugs posted

negative growth on MAT

basis, contributing majorly to

the flat 6% growth seen

overall.

Top 10 Drugs

Drug

Total

Shelcal

Chymoral Forte

Nikoran

Dilzem

Nebicard

Azulix-Mf

Nexpro Rd

Nexpro

Shelcal CT

Alprax

Therapy

Vitamins / Minerals / Nutrients

Pain / Analgesics

Cardiac

Cardiac

Cardiac

Anti Diabetic

Gastro Intestinal

Gastro Intestinal

Vitamins / Minerals / Nutrients

Neuro / CNS

Value (INR mn)

22,988

1,860

1,104

866

644

629

611

552

489

475

390

MAT Aug-16

Growth (%) Contribution (%)

6.1

100.0

-2.8

8.1

-0.7

4.8

10.3

3.8

3.4

2.8

15.4

2.7

19.2

2.7

8.7

2.4

3.9

2.1

59.0

2.1

3.6

1.7

Growth (%)

1Q

Aug-16

-1.5

12.7

-11.7

20.4

-5.1

-5.6

9.2

5.8

0.6

10.9

4.6

19.9

15.2

36.9

1.0

30.5

-0.5

19.1

51.4

37.2

-8.3

11.2

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

76% of Torrents revenues

flow from the top 4 therapies,

which recorded an average

growth of only 8%

approximately.

However, encouragingly,

average Aug-16 growth

across the top 4 portfolios

was 16% YoY approximately.

Total

Cardiac

Neuro / CNS

Vitamins / Minerals / Nutrients

Gastro Intestinal

Pain / Analgesics

Anti Diabetic

Anti-Infectives

Derma

Gynaecological

Urology

Share (%)

MAT Growth (%)

100.0

29.1

16.3

15.8

14.8

7.8

6.2

4.0

2.7

1.6

0.4

6.1

6.6

7.8

13.3

4.1

9.8

13.3

-30.1

28.3

-9.7

30.5

Growth (%)

1Q

-1.5

-0.7

-0.1

4.9

-4.9

3.6

8.9

-37.3

20.8

-19.0

38.0

Aug-16

12.7

8.1

12.4

23.0

18.8

4.9

26.9

-7.0

35.5

-5.5

33.1

Source: AIOCD, HDFC sec Inst Research

Page | 19

PHARMACEUTICALS : SECTOR UPDATE

The major segments, top 10

brands and above 50 brands,

grew 6.6% YoY and 4.2% YoY

respectively, in line with the

overall company growth.

Brand wise growth distribution

% of sales

100.0

33.2

18.3

16.1

32.4

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

6.1

6.6

11.4

3.0

4.2

Growth Contribution (%)

100.0

36.1

32.8

8.1

23.0

Source: AIOCD, HDFC sec Inst Research

Torrent possessed a

favourable chronic mix of 50%

approximately.

Acute v/s Chronic Breakup

SUB

CHRONIC

26%

Growth Distribution (%)(MAT Aug-16)

4.70

ACUTE

24%

Volumes were down during

the year, with price

contributing the highest to

the growth.

1.71

CHRONIC

50%

-0.35

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 20

PHARMACEUTICALS : SECTOR UPDATE

Glenmark Pharma

Top 10 Drugs

Glenmarks top 10 drugs all

posted good to significant

growth rates YoY, Zita Plus

being the highest with 750%.

Drug

Total

Telma

Telma H

Ascoril Plus

Candid

Candid-B

Telma AM

Ascoril LS

Onabet

Ascoril D

Zita Plus

Therapy

Cardiac

Cardiac

Respiratory

Derma

Derma

Cardiac

Respiratory

Derma

Respiratory

Anti Diabetic

Value (INR mn)

24,746

1,744

1,461

1,126

987

951

790

542

421

349

341

MAT Aug-16

Growth (%) Contribution (%)

15.5

100.0

10.5

7.0

16.0

5.9

14.7

4.6

29.9

4.0

11.5

3.8

23.6

3.2

35.0

2.2

50.0

1.7

20.8

1.4

749.8

1.4

Growth (%)

1Q

Aug-16

8.2

20.9

-5.2

-3.0

17.8

16.1

6.6

59.8

39.7

20.1

12.5

13.7

17.8

15.8

11.5

72.9

39.1

49.8

-6.5

47.9

1,032.4

55.7

Source: AIOCD, HDFC sec Inst Research

Therapies grew across the

board with varying degrees.

Amongst the bigger

contributors, derma and

respiratory therapies posted

healthy numbers.

Therapy Mix %

Total

Derma

Cardiac

Respiratory

Anti-Infectives

Anti Diabetic

Vitamins / Minerals / Nutrients

Gastro Intestinal

Gynaecological

Pain / Analgesics

Opthal / Otologicals

Share (%)

MAT Growth (%)

100.0

28.5

22.3

15.9

13.4

7.9

2.7

2.6

2.3

2.0

1.5

15.5

17.6

13.8

22.0

8.9

7.5

27.6

20.8

18.9

9.4

2.0

Growth (%)

1Q

8.2

17.6

7.9

4.4

-3.0

-6.9

35.6

9.4

13.4

6.9

-8.3

Aug-16

20.9

12.8

10.2

57.7

31.4

-17.1

-8.7

72.1

26.3

-7.2

15.2

Source: AIOCD, HDFC sec Inst Research

Page | 21

PHARMACEUTICALS : SECTOR UPDATE

Top 10 brands contribute the

most to Glenmarks revenues,

and this segment grew by a

healthy 23% YoY.

Brand wise growth distribution

% of sales

100.0

35.2

17.5

18.1

29.3

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

15.5

23.0

-4.8

23.2

17.3

Growth Contribution (%)

100.0

49.1

-6.5

25.3

32.2

Source: AIOCD, HDFC sec Inst Research

Glenmarks acute vs chronic

mix is roughly in line with the

IPM average.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

23%

7.19

ACUTE

40%

The majority of Glenmarks

growth was down to

incremental revenue from

new product launches, such

as Zita Plus.

4.69

3.65

CHRONIC

37%

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 22

PHARMACEUTICALS : SECTOR UPDATE

Ajanta Pharma

Rosutor Gold recorded a

significant 113.5% MAT and

44.6% YoY in Aug-16.

Various other drugs also

outperformed.

However, the top 3 drugs

posted poor growth numbers,

leading to underperformance

of the IPM by Ajanta on an

overall basis.

Top 10 Drugs

Therapy

Total

Met XL

Melacare

Atorfit CV

Soft Drops

Rosufit CV

Feburic

Met Xl AM

Rosutor Gold

Cinod

Olopat

Cardiac

Derma

Cardiac

Ophthal / Otologicals

Cardiac

Pain / Analgesics

Cardiac

Cardiac

Cardiac

Ophthal / Otologicals

Value (INR mn)

4,952

489

429

349

158

149

144

131

97

96

84

MAT Aug-16

Growth (%) Contribution (%)

9.8

100.0

6.8

9.9

-3.4

8.7

6.2

7.0

23.4

3.2

33.5

3.0

20.4

2.9

14.8

2.6

113.5

2.0

24.7

1.9

15.3

1.7

Growth (%)

1Q

Aug-16

10.7

10.0

21.3

11.7

-12.9

-6.6

-1.7

-3.6

13.4

5.6

37.5

44.4

25.9

13.8

25.6

33.4

91.4

44.6

23.5

34.2

26.7

-3.2

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Cardiac, being Ajantas main

revenue stream, posted a

healthy growth of 16.4% on

MAT basis.

Total

Cardiac

Opthal / Otologicals

Derma

Vitamins / Minerals / Nutrients

Pain / Analgesics

Gastro Intestinal

Neuro / CNS

Anti-Infectives

Anti Diabetic

Respiratory

Share (%)

MAT Growth (%)

100.0

34.6

24.2

21.7

5.6

4.8

2.4

2.0

1.7

1.2

0.6

9.8

16.4

10.6

-0.7

-1.0

3.4

-11.1

-0.5

78.4

15107.5

-25.7

Growth (%)

1Q

10.7

20.0

13.7

-2.9

-6.2

2.7

-19.4

0.8

57.0

100.0

-12.6

Aug-16

10.0

17.9

5.4

2.7

-13.3

-0.3

-8.9

12.9

40.7

1850.1

-3.6

Source: AIOCD, HDFC sec Inst Research

Page | 23

PHARMACEUTICALS : SECTOR UPDATE

43% of Ajantas revenues flow

from the top 10 brands

segment, which outperformed

when compared to the overall

company growth.

Brand wise growth distribution

% of sales

100.0

42.9

17.2

17.4

22.5

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

9.8

12.0

9.1

10.2

6.1

Growth Contribution (%)

100.0

51.4

16.1

18.0

14.5

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

Ajanta holds a favourable mix

of 49% chronic drugs.

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

12%

5.10

4.60

ACUTE

39%

Volumes were flat over the

year, with prices and new

products providing the thrust

for Ajantas growth.

CHRONIC

49%

0.09

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 24

PHARMACEUTICALS : SECTOR UPDATE

Alembic Pharma

Alembic significantly

outperformed the IPM, in

spite of underwhelming

performance of top 3 drugs.

Boosted by performance of

drugs such as Gestofit and

Richar, 15.7% MAT and 20.5%

YoY Aug-16 growth was

recorded.

Top 10 Drugs

Drug

Total

Azithral

Althrocin

Roxid

Gestofit

Wikoryl

Ulgel

Rekool D

Rekool

Glisen MF

Richar

Therapy

Anti-Infectives

Anti-Infectives

Anti-Infectives

Gynaecological

Respiratory

Gastro Intestinal

Gastro Intestinal

Gastro Intestinal

Anti Diabetic

Gynaecological

Value (INR mn)

14,490

1,393

840

591

571

438

356

332

253

253

251

MAT Aug-16

Growth (%) Contribution (%)

15.7

100.0

3.2

9.6

-9.1

5.8

6.5

4.1

22.5

3.9

19.4

3.0

13.1

2.5

9.6

2.3

15.5

1.7

12.9

1.7

65.4

1.7

Growth (%)

1Q

Aug-16

9.2

20.5

-16.8

23.8

2.6

6.9

-1.4

21.2

17.0

17.3

8.0

72.8

-2.9

3.2

-1.3

-4.3

12.8

-5.1

1.3

4.3

59.4

34.8

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Anti infectives portfolio

remained flat during the year.

The company was boosted by

strong growth in cardiac,

gynaecological, vitamins and

anti diabetic portfolios.

Total

Anti-Infectives

Cardiac

Gastro Intestinal

Respiratory

Gynaecological

Vitamins / Minerals / Nutrients

Anti Diabetic

Pain / Analgesics

Urology

Derma

Share (%)

MAT Growth (%)

100.0

23.3

13.9

13.7

13.0

10.8

7.8

6.3

3.7

2.0

1.9

15.7

0.7

31.4

11.7

17.6

26.2

24.5

36.8

20.4

17.7

9.0

Growth (%)

1Q

9.2

-7.5

21.9

5.8

-5.9

22.4

30.4

28.1

14.5

32.2

-10.4

Aug-16

20.5

17.7

19.3

6.5

41.9

19.9

27.7

37.6

18.9

46.5

-13.2

Source: AIOCD, HDFC sec Inst Research

Page | 25

PHARMACEUTICALS : SECTOR UPDATE

While the bigger top 10

brands segment

underperformed, the

remaining 3 segments all

grew at a fast pace.

Brand wise growth distribution

% of sales

100.0

36.4

19.2

17.3

27.0

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

15.7

8.3

22.9

27.1

15.1

Growth Contribution (%)

100.0

20.5

26.3

27.2

26.0

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

Alembics mix of chronic

products is on the lower side

at 22%.

Growth distribution indicates

that volumes were the

primary driver for the period,

closely followed by price.

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

19%

6.95

5.19

3.59

CHRONIC

22%

ACUTE

59%

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 26

PHARMACEUTICALS : SECTOR UPDATE

Pfizer

Corex, Pfizers top drug, and

one of the highest selling

drugs in the IPM, recorded a

20.6% MAT growth, despite a

overall flat performance from

the company.

Top 10 Drugs

Drug

Total

Corex

Becosules

Magnex

Gelusil MPS

Dolonex

Minipress XL

Mucaine

Wysolone

Folvite

Dalacin C

Therapy

Respiratory

Vitamins / Minerals / Nutrients

Anti-Infectives

Gastro Intestinal

Pain / Analgesics

Cardiac

Gastro Intestinal

Hormones

Blood Related

Anti-Infectives

Value (INR mn)

29,281

3,156

2,195

1,384

1,370

1,369

1,351

1,117

1,034

792

724

MAT Aug-16

Growth (%) Contribution (%)

4.9

100.0

20.6

10.8

-14.9

7.5

-8.3

4.7

-3.3

4.7

4.0

4.7

4.7

4.6

20.8

3.8

11.4

3.5

13.9

2.7

-1.3

2.5

Growth (%)

1Q

Aug-16

2.9

6.8

15.6

-11.0

-13.3

-4.5

-17.5

3.1

-8.4

5.6

3.6

5.7

13.0

36.9

22.1

17.3

14.6

15.1

13.7

-11.3

-3.6

0.6

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Pfizers top therapy de-grew

during the year by 2%, on

MAT basis contributing to the

poor overall company

growth.

Total

Anti-Infectives

Respiratory

Gastro Intestinal

Vitamins / Minerals / Nutrients

Hormones

Gynaecological

Neuro / CNS

Cardiac

Pain / Analgesics

Vaccines

Share (%)

MAT Growth (%)

100.0

15.6

13.9

10.5

9.7

8.9

8.0

7.2

6.9

6.4

3.3

4.9

-1.9

21.6

4.6

-11.4

7.2

16.8

12.3

-5.1

1.0

15.4

Growth (%)

1Q

2.9

-13.0

17.3

2.7

-12.0

9.2

16.3

10.8

4.2

-0.5

-4.8

Aug-16

6.8

-4.7

2.8

7.5

-0.8

7.4

18.9

-4.3

24.4

8.8

77.7

Source: AIOCD, HDFC sec Inst Research

Page | 27

PHARMACEUTICALS : SECTOR UPDATE

Half of Pfizers revenues flow

from the top 10 brands, which

grew at only 3.4% YoY.

Brand wise growth distribution

% of sales

100.0

49.5

24.6

14.8

11.1

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

4.9

3.4

8.4

10.0

-1.6

Growth Contribution (%)

100.0

34.9

40.4

28.5

-3.8

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

Chronic vs. acute breakup is

unfavourable, with only 16%

chronic drugs in the portfolio.

Volume growth was on the

decline during the year, and

close to no contribution to

growth from new products.

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

19%

5.51

CHRONIC

16%

ACUTE

65%

0.17

-0.75

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 28

PHARMACEUTICALS : SECTOR UPDATE

Mankind Pharma

Manforce, Mankinds top

seller, de-grew on MAT basis.

Contributing to Mankinds

status as the IPM leader for

growth during the period

were drugs such as Unwanted

Kit, Glimestar M and

Amlokind-AT, all posting high

growth rates.

Top 10 Drugs

Drug

Total

Manforce

Moxikind CV

Unwanted Kit

Glimestar M

Amlokind-AT

Prega News

Gudcef

Candiforce

Mahacef

Cefakind

Therapy

Sex Stimulants / Rejuvenators

Anti-Infectives

Gynaecological

Anti Diabetic

Cardiac

OTHERS

Anti-Infectives

Anti-Infectives

Anti-Infectives

Anti-Infectives

Value (INR mn)

39,488

1,799

1,693

1,208

809

760

700

677

647

491

479

MAT Aug-16

Growth (%)

19.8

-3.8

2.4

35.5

64.3

35.0

26.0

26.3

77.8

14.5

18.0

Mkt Share (%)

100.0

4.6

4.3

3.1

2.0

1.9

1.8

1.7

1.6

1.2

1.2

Growth (%)

1Q

Aug-16

16.2

19.4

4.8

14.5

23.5

8.9

11.9

-33.4

34.0

59.4

11.7

29.8

18.4

25.1

43.3

76.6

9.6

61.0

-4.7

59.2

35.4

37.8

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Mankind recorded high

growth in a variety of

therapies such as vitamins,

cardiac, respiratory,

gynaecological and antidiabetic.

However, anti-infectives, its

most significant revenue

contributor, underperformed.

Total

Anti-Infectives

Vitamins / Minerals / Nutrients

Gastro Intestinal

Cardiac

Respiratory

Gynaecological

Anti Diabetic

Pain / Analgesics

Sex Stimulants / Rejuvenators

Derma

Share (%)

MAT Growth (%)

100.0

23.6

14.4

11.1

8.8

6.5

6.0

5.5

5.0

4.8

4.7

19.8

13.2

28.5

16.3

29.2

25.0

20.1

40.5

13.9

-0.6

31.8

Growth (%)

1Q

16.2

4.8

23.5

11.9

34.0

11.7

18.4

43.3

9.6

-4.7

35.4

Aug-16

19.4

25.7

14.9

12.7

20.4

45.4

-11.1

42.9

13.1

14.2

24.0

Source: AIOCD, HDFC sec Inst Research

Page | 29

PHARMACEUTICALS : SECTOR UPDATE

The above 50 brands segment

is Mankinds most significant

contributor to sales, and grew

in line with the overall

company.

Brand wise growth distribution

% of sales

100.0

23.5

15.4

15.1

46.1

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

19.8

19.4

17.7

23.2

19.6

Growth Contribution (%)

100.0

23.1

14.0

17.2

45.7

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

Chronic portion of the product

portfolio is currently 25%

below IPM average of 32%

approximately.

Growth in volumes proved to

be the key thrust in

Mankinds outperformance of

the IPM (MAT).

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

19%

9.87

6.79

CHRONIC

24%

ACUTE

57%

3.10

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 30

PHARMACEUTICALS : SECTOR UPDATE

IPCA Labs

Zerodol SP & P outperformed,

growing in excess of 27%

(MAT).

There was also significant

growth amongst various anti

malarial drugs.

Top 10 Drugs

Drug

Total

Zerodol SP

Zerodol P

HCQS

Larinate

Rapither-AB

Lariago

Glycinorm M

Folitrax

Lumerax

Zerodol

Therapy

Pain / Analgesics

Pain / Analgesics

Anti Malarials

Anti Malarials

Anti Malarials

Anti Malarials

Anti Diabetic

Anti-Neoplastics

Anti Malarials

Pain / Analgesics

Value (INR mn)

13,224

945

783

631

534

481

394

372

334

288

271

MAT Aug-16

Growth (%) Contribution (%)

10.7

100.0

27.1

7.1

27.9

5.9

5.3

4.8

25.9

4.0

16.5

3.6

18.2

3.0

19.7

2.8

12.4

2.5

6.7

2.2

6.1

2.0

Growth (%)

1Q

Aug-16

3.7

28.0

8.8

4.3

-3.2

43.9

6.3

3.0

0.9

89.9

-8.6

139.9

8.7

138.6

-1.0

20.0

15.3

22.3

-10.3

55.7

4.2

-13.2

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Pain/analgesics posted a

19.5% growth (MAT), helping

IPCA Labs outperform the

IPM.

Anti-malarials recorded an

outstanding Aug-16 growth

of 75% YoY.

Total

Pain / Analgesics

Anti Malarials

Cardiac

Gastro Intestinal

Anti-Infectives

Anti Diabetic

Respiratory

Anti-Neoplastics

Neuro / CNS

Derma

Share (%)

MAT Growth (%)

100.0

25.7

20.2

16.7

7.8

5.8

5.2

4.2

4.1

3.4

2.9

10.7

19.5

12.5

9.6

5.6

-6.9

10.3

9.5

17.9

-1.7

2.3

Growth (%)

1Q

3.7

8.8

-3.2

6.3

0.9

-8.6

8.7

-1.0

15.3

-10.3

4.2

Aug-16

28.0

19.3

75.0

5.3

5.5

14.1

10.3

30.2

26.0

21.9

30.0

Source: AIOCD, HDFC sec Inst Research

Page | 31

PHARMACEUTICALS : SECTOR UPDATE

IPCAs main contributor, the

top 10 brands segment,

contributed 60%

approximately to the

companys growth during the

year.

Brand wise growth distribution

% of sales

100.0

38.0

21.8

17.5

22.7

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

10.7

18.2

12.9

9.9

-1.1

Growth Contribution (%)

100.0

60.5

25.7

16.4

-2.7

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

SUB

CHRONIC

6%

IPCAs chronic mix is below

the IPM average of 32%.

Volumes were the key driver

for IPCA during the period.

Growth Distribution (%)(MAT Aug-16)

6.42

CHRONIC

27%

3.33

0.95

ACUTE

67%

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 32

PHARMACEUTICALS : SECTOR UPDATE

Alkem

Top 10 Drugs

Clavam recorded a 15.4%

MAT growth and 26.4% (Aug16 YoY), outperforming the

company. On the flip side,

Taxim de-grew by 21.7%

MAT.

Drug

Total

Clavam

Pan

Taxim O

Pan D

Taxim

Xone

Gemcal

Ondem

Sumo

A To Z NS

Therapy

Anti-Infectives

Gastro Intestinal

Anti-Infectives

Gastro Intestinal

Anti-Infectives

Anti-Infectives

Vitamins / Minerals / Nutrients

Gastro Intestinal

Pain / Analgesics

Vitamins / Minerals / Nutrients

Value (INR mn)

35,336

2,559

2,058

1,965

1,692

1,441

975

876

868

860

825

MAT Aug-16

Growth (%) Contribution (%)

10.8

100.0

15.4

7.2

12.9

5.8

9.3

5.6

13.0

4.8

-21.7

4.1

13.1

2.8

2.9

2.5

11.7

2.5

5.0

2.4

12.6

2.3

Growth (%)

1Q

Aug-16

6.3

21.1

0.8

26.4

13.8

14.1

4.2

10.2

7.1

28.1

28.6

10.6

8.2

53.5

11.9

16.8

-7.2

3.6

8.4

54.4

26.4

16.4

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Anti-infectives contribute

close to half of Alkems

revenues, underperforming

the overall company in MAT

growth.

Total

Anti-Infectives

Gastro Intestinal

Vitamins / Minerals / Nutrients

Pain / Analgesics

Neuro / CNS

Derma

Gynaecological

Respiratory

Cardiac

Anti Diabetic

Share (%)

MAT Growth (%)

100.0

42.7

16.9

12.9

7.4

4.5

3.3

3.3

2.9

2.4

2.3

10.8

8.0

13.8

7.4

11.9

26.1

16.5

15.8

8.0

15.2

25.5

Growth (%)

1Q

6.3

0.8

13.8

4.2

7.1

28.6

8.2

11.9

-7.2

8.4

26.4

Aug-16

21.1

26.6

21.4

7.8

31.6

11.1

4.6

2.9

36.0

10.9

32.9

Source: AIOCD, HDFC sec Inst Research

Page | 33

PHARMACEUTICALS : SECTOR UPDATE

The top 10 brands segment

significantly underperformed,

while the other 3 segments

posted healthy growth rates.

Brand wise growth distribution

% of sales

100.0

40.0

18.1

12.1

29.8

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

10.8

6.8

14.9

12.4

13.5

Growth Contribution (%)

100.0

26.0

24.0

13.6

36.3

Source: AIOCD, HDFC sec Inst Research

Acute v/s Chronic Breakup

Alkem has a poor mix of

chronic drugs in its product

line at only 10%.

Volumes and prices both

provided the impetus for

Alkem to outperform the IPM

growth.

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

24%

4.51

4.36

1.96

CHRONIC

10%

ACUTE

65%

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 34

PHARMACEUTICALS : SECTOR UPDATE

Sun Pharma

Sun Pharma posted a MAT

growth of 10.4%, aided by a

15.9% growth in sales of

Volini, its top drug.

Revital H recorded a huge

growth of 231.8% (MAT).

Sun also posted the highest

growth for Aug-16 YoY with

20.3%.

Top 10 Drugs

Drug

Total

Volini

Rosuvas

Istamet

Gemer

Levipil

Susten

Pantocid

Revital H

Pantocid DSR

Storvas

Therapy

Pain / Analgesics

Cardiac

Anti Diabetic

Anti Diabetic

Neuro / CNS

Gynaecological

Gastro Intestinal

Vitamins / Minerals / Nutrients

Gastro Intestinal

Cardiac

Value (INR mn)

89,295

2,368

1,824

1,693

1,682

1,586

1,524

1,423

1,320

1,210

1,169

MAT Aug-16

Growth (%) Contribution (%)

10.4

100.0

15.9

2.7

26.7

2.0

22.3

1.9

16.3

1.9

20.9

1.8

10.8

1.7

4.7

1.6

231.8

1.5

9.2

1.4

4.2

1.3

Growth (%)

1Q

Aug-16

4.5

20.3

27.9

15.2

25.4

30.3

16.6

37.4

9.3

41.5

16.1

22.7

4.2

10.8

-1.7

21.0

92.1

40.2

-0.3

15.5

-7.4

-6.1

Source: AIOCD, HDFC sec Inst Research

Therapy Mix %

Sun Pharmas top 4 therapies

account for 60% of its

revenues approximately.

These recorded an average

growth of 10.6% YoY, in line

with the companys overall %.

Total

Cardiac

Neuro / CNS

Gastro Intestinal

Anti-Infectives

Anti Diabetic

Pain / Analgesics

Derma

Vitamins / Minerals / Nutrients

Gynaecological

Respiratory

Share (%)

MAT Growth (%)

100.0

18.3

17.2

12.0

11.7

9.0

7.2

4.7

4.0

4.0

3.8

10.4

14.3

10.7

9.0

8.5

11.7

10.0

15.6

15.1

6.7

10.8

Growth (%)

1Q

4.5

8.2

4.5

1.7

0.2

4.2

5.2

11.4

25.5

-2.5

-0.6

Aug-16

20.3

27.6

20.5

16.2

11.2

23.9

14.8

25.4

23.7

6.0

49.0

Source: AIOCD, HDFC sec Inst Research

Page | 35

PHARMACEUTICALS : SECTOR UPDATE

Top 10 brands segment grew

at 21.7% (MAT), partially

compensating for the sluggish

growth in the important

above 50 brands segment.

Brand wise growth distribution

% of sales

100.0

17.7

13.0

12.8

56.5

Total

Top 10 Brands

11 to 25 Brands

26 to 50 Brands

Above 50 Brands

MAT growth (%)

10.4

21.7

11.1

11.2

6.9

Growth Contribution (%)

100.0

33.6

13.9

13.7

38.8

Source: AIOCD, HDFC sec Inst Research

Sun Pharma has a favourable

mix of chronic drugs in its

product portfolio as

compared to most other

players in the IPM.

Growth contributions were

spread relatively evenly

across volumes, prices and

new products.

Acute v/s Chronic Breakup

Growth Distribution (%)(MAT Aug-16)

SUB

CHRONIC

14%

4.0

3.1

ACUTE

41%

3.3

CHRONIC

45%

Volume GR (%)

Price GR (%)

New Product GR (%)

Source: AIOCD, HDFC sec Inst Research

Page | 36

PHARMACEUTICALS : SECTOR UPDATE

Disclosure:

I, Amey Chalke, MBA, author and the name subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject

issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for

information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be

construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC

Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may

not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services

for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report,

or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any

other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is

not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach

different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served

as an officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research

Report. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

HDFC securities

Institutional Equities

Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel, Mumbai - 400 013

Board : +91-22-6171-7330 www.hdfcsec.com

Page | 37

You might also like

- Here's Your FEBRUARY 2020 Bank Statement.: Michael E Pease 109 Fallview Ter ITHACA NY 14850Document5 pagesHere's Your FEBRUARY 2020 Bank Statement.: Michael E Pease 109 Fallview Ter ITHACA NY 14850Mucho FacerapeNo ratings yet

- The Child Medication Fact Book for Psychiatric PracticeFrom EverandThe Child Medication Fact Book for Psychiatric PracticeRating: 5 out of 5 stars5/5 (1)

- Dmgt512 Financial Institutions and ServicesDocument265 pagesDmgt512 Financial Institutions and ServicesASIF100% (1)

- Managing Operaions GSKDocument14 pagesManaging Operaions GSKSheinee100% (2)

- Pharma Sector Formulations MoSLDocument150 pagesPharma Sector Formulations MoSLSunil ParnamiNo ratings yet

- Robinsons Bank SpaDocument1 pageRobinsons Bank SpaMaricar Dasal BulandresNo ratings yet

- Citeline Pharma RD Annual Review 2011Document12 pagesCiteline Pharma RD Annual Review 2011Koushik BhattacharyyaNo ratings yet

- Nepalese Pharmaceutical Industries & Who GMPDocument6 pagesNepalese Pharmaceutical Industries & Who GMPJaya Bir Karmacharya100% (1)

- Internal Control and Risk ManagementDocument26 pagesInternal Control and Risk ManagementPrasad LadNo ratings yet

- RBSA Indian PharmaDocument19 pagesRBSA Indian PharmaCorey HuntNo ratings yet

- Income Tax ReviewerDocument99 pagesIncome Tax ReviewerKarlo Marco Cleto100% (1)

- Pakistan Pharmaceutical IndustryDocument37 pagesPakistan Pharmaceutical IndustryTalha A SiddiquiNo ratings yet

- Factors Affecting the Sales of Independent Drugstores (A Historical Perspective)From EverandFactors Affecting the Sales of Independent Drugstores (A Historical Perspective)No ratings yet

- Presentation 4 Sales and LeaseDocument106 pagesPresentation 4 Sales and Leaselouise_canlas_1No ratings yet

- Project Report On ICICI BankDocument22 pagesProject Report On ICICI Bankahemad_ali1080% (5)

- Customer Satisfaction-ICICI BankDocument98 pagesCustomer Satisfaction-ICICI BankSabinYadav88% (16)

- Crocin Marketing StrategyDocument41 pagesCrocin Marketing StrategyPrabhudas Gaikwad33% (3)

- Pharmaceuticals Sector Analysis ReportDocument2 pagesPharmaceuticals Sector Analysis Reportabhinay reddyNo ratings yet

- Healthcare: COVID-19-led Contraction in Acute Therapies Impacts IPM's PerformanceDocument26 pagesHealthcare: COVID-19-led Contraction in Acute Therapies Impacts IPM's PerformanceJehan BhadhaNo ratings yet

- IDirect HealthCheck Aug16Document31 pagesIDirect HealthCheck Aug16Dinesh ChoudharyNo ratings yet

- 12-Sydney Clark-OTC Market in Latin AmericaDocument18 pages12-Sydney Clark-OTC Market in Latin Americasmanna77No ratings yet

- Equity Research Pharmaceutical SectorDocument53 pagesEquity Research Pharmaceutical SectorJayant Singh Yadav100% (1)

- PHARMA - Monthly 20211109 MOSL RU PG026Document26 pagesPHARMA - Monthly 20211109 MOSL RU PG026Ravi KumarNo ratings yet

- Pharma 20161018 Mosl Su PG022Document22 pagesPharma 20161018 Mosl Su PG022r.elakkiya mscNo ratings yet

- The Indian Pharmaceutical Industry Is Highly FragmentedDocument3 pagesThe Indian Pharmaceutical Industry Is Highly FragmentedSanchit SawhneyNo ratings yet

- Market Study and Improvements For Voltaren Gel in IndiaDocument18 pagesMarket Study and Improvements For Voltaren Gel in IndiaPathikrit GhoshNo ratings yet

- Indian PharmaDocument49 pagesIndian PharmaChristina HarmonNo ratings yet

- 1337161382an Overview of The Pharmaceutical Sector in Bangladesh (May 2012)Document12 pages1337161382an Overview of The Pharmaceutical Sector in Bangladesh (May 2012)Sharmin SultanaNo ratings yet

- Pharma Co's DetailsDocument13 pagesPharma Co's Detailsvishal chaudharyNo ratings yet

- Pharmaceutical: Sector UpdateDocument8 pagesPharmaceutical: Sector UpdateWajeeha IftikharNo ratings yet

- IDirect Healthcare AnnualUpdate 2016Document41 pagesIDirect Healthcare AnnualUpdate 2016Jasjivan AhluwaliaNo ratings yet