Professional Documents

Culture Documents

Re Entry 2014

Uploaded by

Anonymous ZRsuuxNcC0 ratings0% found this document useful (0 votes)

63 views8 pages990

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document990

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

63 views8 pagesRe Entry 2014

Uploaded by

Anonymous ZRsuuxNcC990

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

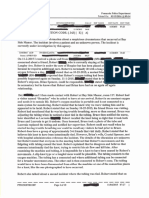

Short Form LOMB No 1548-1150

rom 990-EZ: Return of Organization Exempt From Income Tax

Under nction S010, 827, oF 4947a) of he Internal Revenue Code excep private foundations

e@ > Donate sec sceutynuntersonisfomasitmaytenede pic, — ERR

‘brat Reve Sana” > Information about Form 990-EZ and its instructions is at www.re.gov/form990.

1 For the 2014 calendar year, or tax year beginning JANUARY? ~201Gendending DECEMBER 31.2014

' Employer ideniicaon nurbor

38-3900382

Ta

850.032.0014

F Group Exemption

Number

G Accounting Method: [¥] Cash [J Accrual Other (specify) H Check ‘the organization is not

1 website: WWW-REAPREENTRY.ORG —— ]" tectirc to atach Senecule 8

J Tax-exempt status (check only one) ~ L] 501(0N3)_L1S01()( _) 4 Gnsert no) [14947(a1) or LJs27| (Form 990, 990-£2, or 990-PFI.

K Fort ergantzation: Comoran LI Trsst Tiassocation — Llother

1 Add ines 5b, Gc, and 70 olin 9 to determine gross receipt. groas recep are $200,000 or more, orf Taal aot

(Part, colmn ) balow) are $500,000 or moe, le Form 980 instead of Form 890-52 ms 0406.05

[ERIE Revenue, Expenses, and Changes in Net Assets or Fund Balances (see the insiructions for Part]

eck i the organization used Schedule Oo respond to any question nis Pat | .. OD

7 Contributions, gifs, grants, and similar amounts received 850.00

2 Program service revenue including government fees and contracts

3 Membership duesand assessments... ss se

4 Investmentincome :

5a Gross amount from sale of assets other than inventory 5a éaa.so

b

ecco)

leafs).

28

Less: cost or other basis and sales expenses - Sb

Gain or oss) om slo of assets other than inventory (Subtract ine Sb trom ine a) ~

©. Gaming and hncratng everts

2 Sts rcome tom gaming atch Schwale GH eater han

$18,000) ;

Gross income from fundraising events ot ncuding $ of contmbalons

ffom fundraising events reported online 1) (attach Schedule G We

sum of such gross income and contributions exceeds $15,000). . 6b

€ Lose: drect expenees fom gaming end tundralangevents [ee

o d Net income or Ge from gaming and funcrnising events: Da lines 6a and 6b and subtract

8 line 6) :

© | re cross sales of mventory, less retus and allowances a ial

© |" Less: costof goods sold 7

| & Stor or fos tom sie finery iat na om ne 7)

€

&

a

3633.50

8 Other revenue (desenbe in Schedule 0).

9 Total revenue. Add lines 1,2;3, 4, 5, 6d, 7o, and 6

Grants-and Srila amount paid (ist in Schedule O}

Bonet pad to or for members

ltée eBripehfation, BRU employee benetits

Profesional fees and other pefhents to independent cot

Oceuparey. AI thes Ard imantenance a ee

Prntingrablictions, pottage.ahd shipping - +f

Other expanses (describe in Schedule)... . «|

17_Total expenses. Add lines 10 through 16 :

18 — Excess or (deficit) for the year (Subtract line 17 from line 3 oe

19 Net assets or fund balances at beginning of year (from line 27, column “ Gee! sare with

end-of-year figure reported on prior year's elu)... 19 6143.00

Other changes in net assets o fund balances (explain in Schedule O) fo... Po °

Nt asselsor fund balances at end of year. Combine lines 18 ough 20... ||» [as wares

Paperwork Reduction Act Notice, soe the separate instructions. ah 18a Fam SOO-EZ wie

> [eo 70846.05

14 73766

15 “346.00

.. fe 3953.73

> far, 6676.39

3008.66

fir.

{ +L

Form 960-22 (2014) Page 2

Balance Sheets (the inaivactions for Part)

Check if the organization used Schedule O to respond to any question in this Part It Gl

Woammpare [wade

@e cast, savings, andimesiments soGoccacs ares of wae

23 Landand buildings. coco sacace. faa 3

24 Other assets deseribeinScheduleo) | | LL! ‘ala 2

25 Totalassets. : : area oo 26 wane

25 Totallahities esrbnin Schley fae] 3

Wot see or fund balances tn 27 of cohen) mut ge th ne 2) canada wats

ee —“—itis_

Check if the organization used Schedule O to respond to any question in this Parti|_._. 0) Expenses:

‘hati the organization's primary exempt purpose?” CHARITABLE SEE SCHEDULE 0 Seat cto

Describe the organization's program service accomplishments for each of its three largest program services, | oranatonsopterl er

‘a5 measured by expenses. in a clear and concise manner, describe the services provided, the number of | oe)

[Persons benefited, and other relevant information for each program tile

‘2B RE-ENTRY COURT (FEDERAL) MENTORING PROGRAM AND INMATE ART SHOW, WITH 55 MENTORS AND

MENTEES, OVER 50 ART SUBMISSIONS BY INMATES AT AREA FEDERAL PRISONS: OVER 300 ATTENDEES.

[AT ART SHOW AS PART OF GREATER GULF COAST ART SHOW.

Grants $ ©) If this amount includes foreign grants, check here. _ > G |2ea $2900.00

29. REAP COMMUNITY GARDEN, OVER 40 RAISED BEDS ON 1/2/ ACRE OF PROPERTY. PROJECTED WAS

‘SUPPORTED BY FEDERAL PRISON, COUNTY WORK CAMP, LOCAL BUSINESS AND ATTORNEYS PROVIDING.

SUPPORT, AND OVER 1000 COMMUNITY SERVICE HOURS, PLUS 15 COMMUNITY SERVICE WORKERS,

(Grants $ 0) {this amount includes foreign grants, check here _. > 0 |20e $3000.00

90 INMATE REFERRAL SERVICE OPERATING A MONDAY-FRIDAY 9-7 TELEPHONE REFERRAL SERVICE TO

LOCAL SERVICE PROVIDERS, AVERAGING 2-3 CALLS PER DAY, APPROXIMATELY 500 CALLS PER YEAR

(Grants $ 0) Ifthis amount includes foreign grants, check here... . » ©) |30a) 30000

81. Other program services (deseribe in Schedule 0) aee

Grants $ 0) If this amount includes foreign grants, check here. > sta 500

Total program service expenses (add lines 28a through Sta) zi care Ps [rao $6700.00

GENIN — Uist of ofcers, Directors, Trustees, and Key Employees (st each one even i nat compenssiod—see the nstrutons for Part)

Check if the organization used Schedule O to respond to any question in this PartIV_. ac]

aia {e) Reporte | Heaih boats,

or nena Sompensaton _rontutene to emplede) Etmated amount ot

\rome w-2009-isci|”" tenet plas, and | thor comperation

votesto poston Grmot paid enter) | dated compensation

‘RUFRED G, STUSBLEFIELD, PRESIDENT AND DIRECTOR 0

q o

RALPH A. PETERSON, VICE-PRESIDENT

q q °

DAVID C. PENZONE, TREASURER AND DIRECTOR [6

°

WARGERY THORPE, SECRETARY AND DIRECTOR |?

q q °

DAVIOL. MCGEE, DIRECTOR iz

q q °

RONALD W. JOHNSON, DIRECTOR iz

q q °

WILLIAM RANKIN, DIRECTOR lz

| ©

‘AURICK DYE, JR, EXECUTIVE DIRECTOR lao

d °

Fom 990-EZ gore)

Form 900-€2 204)

Pepe 3

‘Other information (Note the Schedule A and personal benefit contract statement requirements In the

instructions for Part V) Check ifthe organization used Schedule O to respond to any question inthis PartV___(.

[Yes] No

Da he organization engage in any significant activity nt previously reported tothe IRS? If"Yes” prove a

detailed description of each activity in Schedule O 33. v

‘Were any significant changes made to the organizing or governing documents? If“Yes,” attach a conformed

Copy ofthe arended decumens they recta change to the erganizatn's name, Otherwise, explain he

‘change on Schedule © (see instructions) : Ed v

Did the organization have unrelated business gross income of $1,000 or more during the year from business

activities (such as those reported on lines 2, 68, and 7a, among others)? . 350 v

tes," tone 35a, has the organization fled a Form 990 forthe year? "No," provide an explanation in Schedule (386) v

‘Was the organization a section 501(, 501(e¥8), or 501(c\(6) organization subject to section 609%e) notice,

reporting, and proxy tax requirements during the year? If “Yes,” complete Schedule C, Part Il. 350 v

bad the organization undergo a tguidatin,cissokation, tention, or sgnteant postion of net assets

during the year? If “Yes,” complete applicable parts of Schedule N 36 v

Enter amount of political expenditures, crect or indirect, as described in the instructions [37a

Did the organization file Form 1120-POL for this year? 370 v

Did the organization borrow from, of make any loans to, any officer, director, trustee, or key employee or were

‘any such loans made in a prior year and stil outstanding at the end of the tax year covered by this return? 96a v

*Yes,” complete Schedule L, Part Il and enter the total amount volved. ~ (Sab.

Section 501(¢)() organizations. Enter:

Initiation fees and capital contributions included on line 9 ho ‘308

Gross receipts, included on line ®, for public use of club facilities [396

Section 501) organizations. Enter amount of tax imposed on the organization during the year under

section 4911 > section 4912 0; section 4955 > °

Section 501(c)), 501(6)@), and 501(c)(29) organizations. Did the organvzation engage in any section 4958

excess benefit transaction during the year, or did it engage in an excess benefit transaction in a prior year

‘that has not been reported on any ofits pnor Forms 990 or 990-£27 If “Yes,” complete Schedule L, Part! | aot v

Section 501(6)3), 501(c)4), and §01(c)28) organizations. Enter amount of tax imposed

‘on organization managers or disqualified persons during the year under sections 4912, i

4955, and 4958... > |

Section 501(0)(}, SO1(eN4), and 501(¢\29) organizations. Enter amount of tax on line

40c reimbursed by the organization ' > °

‘All organizations. At any time during the tax year, was the croazation 8 ary toa pitied a ehater

transaction? if*Yes,” complete Form 8886-T . . 400 v

st the states with which a copy ofthis retum is fled FLORIDA

‘The organization's books are in care of & RALPH PETERSON, ESQ “Telephone no, 880-432-2451

Located at P 501 COMMENDENCIA STREET PENSACOLA FLORIDA ZIP +4 32502-5983

[At any time during the calendar year, did the organization have an interest in or a signature or other authority over [Yes | No

‘financial account in a foreign country (such as a bank account, securities account, or other financial account)? [4b v

Yes," enter the name ofthe foreign country:

‘See the instructions for exceptions and fling requirements Tor FINGEN Form 114, Repor of Foreign Bank and:

Financial Accounts (BAR).

‘At any time during the calendar year, did the organization maintain an office outside the U.S.? 426 | v

If *Yes,” enter the name of the foreign country:

Section 4947(a),t) nonexempt chantable truss fling Form 890-€Z in leu of Form 1041—Check 7 eo

and enter the amount of tax-exempt interest received or accrued during the taxyear. . . . . ® | 43 |

[Yes] Ne

Did the organization main any donor advised funds dung the year? “Yes,” Form 880 must be i

completed instead of Form 990-EZ . aaa v

Did the organization operate one or more hosptal facities during the year? I “Yes,” Form 990 must be

completed instead of Form 990-EZ. 44 v

Did the organization recenve any payments for indoor tanning services during the year? aac v

I "Yoo" toe 44, has the onparization fed a Fo 720 to report these payments? “No, * provide ‘an

explanation in Schedule 0 : aaa

Dic he organization have a controled ent within the meaning of section 51200(19)? 45a v.

Did the organization receive any payment from or engage in any transaction with a controlled entity within the

meaning of section S12(0(1)? H "Yes," Form 880 and Schedule may need to be completed instead of

Form 990-E2 (see instructions)... : 450 v

Fom 990-EZ (2014

Form 980-€2 2014) Page 4

Yea]

46 Did the organization engage, directly or indirectly, in political campaign activities on behalf of or in opposition [—

to candidates for pubic office? H Yes,” complete Schedule G, Parts snes sn wl ly

QBS 2cti01 501(6)) organizations onty

‘All section 501(6).3) organizations must answer questions 47-496 and 52, and complete the tables for lines

‘50 and 51.

[Check if the organization used Schedule O to respond to any question in this Part VI e od

Yes | No.

47 Did te egaiatonengoo in ibing actives or ave a secon S01 lection nec ing the tax

year? "Yes," complete Schedule, Pantll . . : a| |v

48s the organization a school as deseribed in section 17OR)KHVAIEI? "Yes," complete Schedule»... [awl tw

49a Did the organization make any transfers to an exempt non-charitable related organization? . 2s [48a v

1b 1f Ves," was the related organization a section 527 organization? 490]

‘50 Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and Key

employees) who each received more than $100,000 of compensation from the organization. f there is none, enter “None.”

: : crear

inane mnths a ee

trot peaion | Fore Wartes Insc) POP Pans ng

¥ Total number of other employees paid over $100,000... . >

‘Complete this table for the organization's five highest compensated independent contractors who each received more than

‘$100,000 of ‘compensation from the organization. I there is none, enter “None.”

(a) Name ane business adres ofeach independent contractor (01) of sevice (2 Compensation

‘@- Total number of other independent contractors each receiving over $100,000...»

52 Did the ergaization complete Schedule A? Note, Al section 501(c)8) organizations must attach 3

completed Schedule A... : . PU ves (No

Seopa of pry, der fh ve earned our ndudng accompanying schoades wd Harris adobe of my knowedg nest, ie

nd compa. ere (her than gar based on al oration of which preparer has Sy owe.

Sign » ‘Signature of officer Date

Here [ALFRED G. STUBBLEFIELO, PRESIDENT AND CHAIRMAN OF BOARD OF DIRECTORS

Timor rae ana

Prep prepares name, Presaers sonatue = ‘check C1 a] P™

Sarno

faonane = rns

ens acres Phone ne

Hay tho IRS discuss this relum wih the preparer Shown above? See nebuctions 7.7 Cl Yes LINo

(00a No. 1545:9087

SCHEDULE A Public Charity Status and Public Support

bee aeh haat) Comets the organzstion sa soction SOIC) oroanization ora ection 2014

'28¢7(lt) nonexompt charitable rust.

(> attach to Form 990 or Form 990-E2.

Depart of te Tay

Eiiralfi Svc” | Intormation about Sctredula A (Form 900 oF $0-EZ) and Its instructions i at wiw.re.gov/fom00.|

Tame cite aemeaion ‘poor eiiezon rer

RE-ENTRY ALLIANCE PENSACOLA, INC. 389908383

Reason for Public Charity Status (il organizations must complete Wis part) See hstuctions.

‘The organization fs nota private foundation because its (For ines 1 through 11, check only one BOX)

1. C1Acturch, convention of churches, or association of churches described in section 17OQBIHVAND.

2 CA school deserted in section 170K WAN. (Attach Schedule E)

3 CA hospital or a cooperative hospital service organization described in section 170(b) 1)A)Gi).

4 D)Amecical research organization operated in conjunction with a hospital described in section 170(6)(1)(A)(il). Enter the

hospital's name, ety, and state:

‘5. Clan organization operated for the benefit of college or unWversty owned or operated by @ governmental unit described in

‘section 17OBKKA)OW.(Completo Par iL)

CA tederal, state, o local goverment or govermental unt described In section 170(RK NAN.

7 Clan organization that normally receives a substantial pat of ts suppor from a govermental uit or from the general pubic

described in section 170(b)(1HA)(i). (Complete Part Il.)

8 (CA community trust described in section 170(b)(1)(A)(vi). (Complete Part If.)

9 Blan organization that normally receives: (1) more then 23°79 offs support from conbibuttons, membership fee, and gross

receipts from activites related to its exempt hnctions—subject to oaraln exceptions, and (2) no more than 337396 of Rs

[Support from gross Investment Income and unrelated business taxable income (ess section 511 tax) from businesses

‘toquired by the organization after June 30, 1975. See section S08{aK2}. (Complete Pat ill)

10 C1An organization organized and operated exclusively to test for public safety. See section 509(a)(4).

+1 Glan organization orgaized and operated exclusively forthe bento, to perfor tho functions of, or to cary out the purposes of

‘one or more publicly supported organizations described in section 509{a){1) or section 509{a){2}. See section 509{a)(3). Check

the boxtin ines 11a trough 11d that desonbes the type of supporting organization and complete lines 1¥¢, 11f, and 119.

Type tA supporting organization operated, supervised, or controled by its supported organization(s), typcaly by gving

‘the supported organizations) the power to regulary appoint or elect a majority of the crectos or trustees ofthe supporting

‘organization. You must complote Part V, Sections A and B.

Type i. A supporting organization supervised of contrlled in connection with ts supported organizations), by having

Control or management ofthe supporting organization vested in the samme pereons that contol or manage the supported

‘rganizaton(). You must complete Part IV, Sections A and C.

¢ Ci Typelll tunctionally integrated, A supporting organization operated in connection with, and functional integrated with,

its supported organization(s) (00 instruction). You must complete Part MV, Sections A, D, and E.

dCi Type ill non-functionaily integrated. A supporting organization operated in connection with its supported organization(s)

‘that i it functlonaly integrated. The organization generally must salty a disrbution requirement and an atientweness

‘equirement (se Instructions). You must complete Part V, Sections A and O, and PartV.

‘© CiCheck this box ifthe organization recelved a wrten determination from the IS that itis @ Type, Type i, Type i

‘functional integrated, or Type Il nonfunctional integrated supporting organization.

1 Exterthe numberof supported organizations. betes re

‘9. Provide the flowing information sbout the supported organizations).

Nave sspred eaaion THEN | Giypecf organ [Gunso cin [Arm deonaar] Ma aman

Boesaeers [Stieen| meee | ot Siete

Soesnescen | sort Fran) omens

‘ca runcinah

Yea_[ We

a

e

tc)

co)

Total :

For Paperwork Reaucion Act Nico, se te ttructons for Cana eR Sain Fon 00 or OER aE

Form 900 or 990-E2.

Schaal A Farm 900. 900-£2 2014

‘Support Schedule for Organizations Described in Sections TTOINANW and TOBA)

(Complete only i you checked the box on ine 5, 7, or 8 of Part lor ifthe organization failed to qualify under

Part Il. the organization falls to qualify under the tests listed below, please complete Part I)

‘Section A Public Support

Page 2

‘Calendar year (or fiscal year beginning in) | (a) 2010 [2011 [tia | (aos | 20 | row!

1

Gifts, grants, contributions, and

membership fees received. (Do not

include any "unusual grants").

Tax revenues levied for the

‘organization's beneft and either paid

to or expended on ts behalf

The valle of services or facities

fumiched by a governmental unit to the

‘organization without charge .

‘Total. Add tines 1 through 3.

‘The portion of total contibutions by

each person (other than a

govemmental unt or publicly

Supported organization) inctuded on

line 1 that exceeds 2% of the amount

shown on fine 11, column (9

Public support. Subtract ine 5 trom ine 4. [=a fe - -

sciion 6. Tort Support

Calendar year (or fiscal year beginning in) > | (a) 2010 | (2011 | (aor | (201s | (e204 |‘ Towal

7

a

10

1”

2

2

‘Amounts fromline 4...

Gross income from interest, dividends,

payments received on securities foans,

rents, royalties and income from similar

Net income from unrelated business

activities, whether or not the business

is regularly carried on

‘Other income. Do not incude gain or

loss tom the sal of capital assets

(Explainin Partvi) =.

“Total support. Add lines 7 through 10

Gross receipts trom related activities, etc. (Ses watructIONS) wz

Fret tie yaar. the Farm 090 for tho rparzation's ret Second, hid fourth, or th ax yar a a sot SOTEGT

‘organization, check this box and stop here ‘i ae oO

‘Seation GC. Computation of Public Support Percentage

"14 Public support percentage for 2014 (ine 6, column () divided byline V1, column)... [14 %

15 Public support percentage from 2013 Schedule A, Part line 14... 75. %

16a 33% support test—2014. Ifthe organization did not check the box on ine 13, and ine 14 is 334896 or more, check Tis

‘box and stop here. The organization qualifies as a publicly supported organization. - >» oO

cy {a support tet 2013 I hw organzaon dnt check Box on 19 oF 68, and te 15 391% oF moe,

‘check this box and stop here. The organization qualifies as a publicly supported organization. . Po

11a

10%-facts-and-circumstances test—-2014. If the organization did not check a box on line 19, 16a, or 16b, and line 14 is.

10% or more, and ifthe organization meets the “facts-and-circumstances” test, check this box and stop here. Explain in

Par Vi how the organization meets the fact-and cumstances tet. The cganzaton quae = pblily supported

organization. : : a

10%-facte-and-crcumetances test-2013. th organization di not chock a box on ine 13,168, 16b, or 17a, as

15 is 1096 or more, and if the organization meets the “facts-and-circumstances” test, check this box and stop here.

Explain in Pat how the organization meets tho “tacte-and-cieunstances tet, The organization qualifies as publicly

‘supported organization. : - Po

Private foundation. He organization del ot check box one 19, 16, 16, aor, check this box and see

Ingtructions : : a _- care

‘chee A Form G80 or S00 ZON4

stealer 0 oa 8

‘Support Schedule Tor Organkzations Described ii Section BOSD)

(Complete only if you checked the box online of Part | orf the organization failed to quality under Part.

Ifthe organization falls to qualify under the tests listed below, please complete Part Il)

@ Bn ee

Povo 3

Calendar year (or focal year begining in) ®

2

(2010

2011,

207

a208

qwz014

roa

its, gars, contoutons, and membership fees

rosie (Donat include any “unusual grat")

11.430)

aso]

0280

‘umished in any activity that S related to the

‘rganizaton’s tax-exempt purposo

‘Gross receipts om activites that are not an

unrelated rade or business under secon 513

Tax revenues levied for the

organization's benefit and either paid

toorexpendedon Rs behalf.

The value of services or facilities

fumished by a governmental unit to the

organization without charge...

Total. Add lines 1 through 5...

Tas

‘Amounts included on lines 1, 2, and’3

‘received trom disqualified persons.

‘Amounts included on tines 2 and 3

received from other than disqualified

‘persons that excood the greater of $5,000,

(0F1% ofthe amount on ine 13 forthe year

‘Add ines Zand 7.

Public support (Subtract te Te rom

line 6) « -

18200

Section 8. Total Support

elendar year (or fact year bogining ie)

tt

1"

2

8

4

‘Seailon C. Computation of Public Support Porcentage

(22010

200

(ear

qa 2018

Weta

‘Amounts from fine 6

IRE

18280

Gross moome tom Intrest_ dhidends,

ayents recived on secures loans, rent,

royalties and income from sma sources

25s

255

Unrelated business taxable income (ess

section 511 taxes) from businesses

acquired ater June 30, 1975 . -

‘Addiines 10aand 10D. =

Net income from unrated business

‘actives not included in fine 10D, whether

‘Fr not the business is regularly caried on

a3

Other income. Do not include gain or

loss from the sale of capital assets

(Eoplsinin Pat). =

30s

363350

Total support. Add tines 9, 106, 11,

and 12) :

‘nanl__so-ase

2191605

Fist vo yar he Form 29 a tn Sa Wa SSO Ud, our, oF x yore wencton SOVEHS)

‘organization, check this box and stop here

->g

"16 Public support percentage for 2014 (ine 8, colurmn (0) divided by line 19, column)

16__ Public support percentage from 2013 Schedule A, Part Il, ing 15

‘Section D. Computation of Investment income,

%

%

%

17

8

eo

>

Investment income percentage for 201 line 10c, colurmn (9 divided by ine 13, column (h) . -

Investment income percentage from 2013 Schedule A, Part Il line 17 .

‘33'n% support tests—2014. If the organization cid not check the box on fine 14, and line 15 is more than 37a%, and The

17 is not more than 338%, check this Box and stop here. The organization qualifies as a publicly supported organization

7

%

78

3%

-o

_33'n% support tests—2015. Ifthe organization did not check a box on ine 14 or ine 19a, and line 16 is more than 33%, and

tine 18 is not more than 33'2%6, check this box and stop here. The organization qualifies asa publicly supported organization > []

20 _ Private foundation. if the organization did not check a box on line 14, 19a, oF 19b, check this box and see instructions

‘Schwa A (Form 000 0-5) 2014

‘SCHEDULE O ‘Supplemental Information to Form 990 or 990-EZ OMB No. 1545-0047

omen anti r teaten reper pnt o

Tan soto SE pct ty cao aa 2014

even nes ame meee

Pasrate” | patna io Foe Oe in geiome

——— a

Rech ANE PONAGOLA WE ao

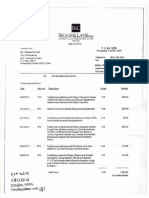

‘L990EZ PART 1 LINE 16: OTHER EXPENSES. TOTAL $3953.72, THIS FIGURE REPRESENTS $53.05 IN BANK FEES, $2000.00 IN EXPENSE

REIMBURSEMENT FOR GAS, TRAVEL AND SUPPLIES, AND 1900.681N COSTS FOR THE INMATE ART SHOW HELD IN NOVEMBER 2014.

PART Il: REAP IS A FLORIDA NOT-FOR-PROFIT ORGANIZATION WITH A MISSION TO IMPROVE THE SAFETY AND QUALITY OF LIFEIN

NORTHWEST FLORIDA BY ENABLING INDIVIDUALS RETURNING FROM INCARCERATION TO BE SELF-SUFFICIENT, CRIME-FREE

[PRODUCTIVE CITIZENS AND NEIGHBORS. IT HAS PROVIDED ORGANIZATION AND DIRECTION TO THE MENTORING PROJECT FOR THE

FEDERAL COURT RE-ENTRY PROGRAM, ESTABLISHED AND MANAGED THE COMMUNITY GARDEN, AND PROVIDES A MF 9-7 REFERRAL

‘SERVICE FOR RETURNING CITIZENS. ITIS PRESENTLY EXPANDING THE SERVICES IT OFFERS TO INCLUDE INMATES AT STATE.

PRISONS AND COUNTY JAILS IN NORTHWEST FLORIDA, IT HAS SPONSORED THE NORTHWEST FLORIDA CRIMINAL JUSTICE IMPROV-

[MENT PROJECT, AND HAS STARTED THE ESCAMBIA COUNTY JAIL REENTRY PILOT PROGRAM

‘THE THREE MOST EFFECTIVE SERVICE PROGRAMS ARE (1) FEDERAL COURT RE-ENTRY PROGRAM INCLUDING MENTORING AND,

anaes son, os: Tra. POP SERVE, APROHBNTELY SoM EPENE: THE COMMNIY GARDEN ACH

HAS MORE THAN 1000 VOLUNTEER HOURS, SERVING MORE THAN 60 MENTORS AND MENTEES, PLUS AN ADDITIONAL 25 COMMUNITY

SERVICE WORKERS, AND PROVIDING FRESH FRUITS AND VEGETABLE TO A LOCAL FOOD PANTRY, WITH APPROXIMATELY $3000

EXPENSE: AND (3) REAP RE-ENTRY REFERRAL SERVICE AND HOTLINE, OPERATING MONDAY-FRIDAY, 9-7, PROVIDING TELEPHONE

RESPONSES TO APPROXIMATELY 500 INMATE CALLS PER VEAR. NO GRANTS WERE RECEIVED BY REAP IN 2014.

‘For Paperwork Reduction Act Notice, ove the Instructions for Form 600 oF @90-EZ. Cat Nn STORGK Sched O Form 00 o 90-E) 2014)

You might also like

- PR-Sisson Personnel FileDocument51 pagesPR-Sisson Personnel FileAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0035Document1 pageScan Doc0035Anonymous ZRsuuxNcCNo ratings yet

- Schmitt SchedulingDocument7 pagesSchmitt SchedulingAnonymous ZRsuuxNcCNo ratings yet

- Potential SuspectDocument6 pagesPotential SuspectAnonymous ZRsuuxNcCNo ratings yet

- M. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionDocument1 pageM. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionAnonymous ZRsuuxNcCNo ratings yet

- Handwritten NotesDocument1 pageHandwritten NotesAnonymous ZRsuuxNcCNo ratings yet

- DocumentsDocument6 pagesDocumentsAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0004Document2 pagesScan Doc0004Anonymous ZRsuuxNcCNo ratings yet

- Scan Doc0005Document3 pagesScan Doc0005Anonymous ZRsuuxNcCNo ratings yet

- B&L InvoicesDocument6 pagesB&L InvoicesAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0001Document1 pageScan Doc0001Anonymous ZRsuuxNcCNo ratings yet

- MX-2615N 20160204 171738Document24 pagesMX-2615N 20160204 171738Anonymous ZRsuuxNcCNo ratings yet

- Taxi Denied Appeal ListDocument3 pagesTaxi Denied Appeal ListAnonymous ZRsuuxNcCNo ratings yet

- City of Pensacola Penny For Progress Unfunded Projects: T T R RiDocument1 pageCity of Pensacola Penny For Progress Unfunded Projects: T T R RiAnonymous ZRsuuxNcCNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)