Professional Documents

Culture Documents

Capital Market Line

Uploaded by

Karan Bhatia0 ratings0% found this document useful (0 votes)

86 views2 pages-kewal suraiya

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document-kewal suraiya

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

86 views2 pagesCapital Market Line

Uploaded by

Karan Bhatia-kewal suraiya

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Capital market line (CML):

The next step in deriving capital asset pricing model is to

define a set of criteria for identifying preferred

investments. Probably the most straight forward method

is the mean-variance criteria. It utilizes only the mean

and variance of expected returns to identify the

investment that dominate. And Investment A Dominates

Investment B if Investor always prefer A to B. The Mean

Variance criteria assumes that continously compounded

return around the mean is standard deviation. Using the

mean as the measure of expected return and standard

deviation as the measure of risk, we can represent

any investment in this risk return space as a single

point. An examples of Investment A with expected return

and standard deviation.

By plotting the dominant investment in risk return space,

we can identify the set of investment that are not

dominated by any other investment. This is the meanvariance efficient set or efficient frontier of portfolios of

risky assets. The point of tangency between the efficient

frontier and the highest possible indifference curve of an

investment will identified the investor preferred portfolio.

Production of risk free assets with borrowing at the

risk free rate leads to capital market line. The CML is

the linear relationship between expected return

and total risk. Its become the new efficient frontier. The

point of tangency between the CML and the old efficient

frontier is risky assets identified the market portfolio. The

market portfolio id perfectly diversified mean-variance

efficient portfolio containing every investment in

quantity proportional to there total market value. The

tangency between the highest indifference curve and the

CML reveals the investors preferred portfolio mix.

The preferred portfolio is L on the indifference curve

U3. For this investor portfolio L would be the investment

alternative that maximizes expected return within the

investors risk contraints and yield the highest possible

utility.

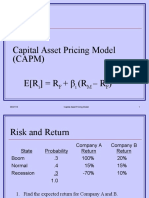

The empirical tests show that the CAPM is a fairly good

representation on the market but there seem to be

significant deviations of empirical results from the theory

and conclusions of many studies are often conflicting.

Therefore, several alternative have developed to this

model.

The Capital Assets Pricing Model gives a relationship

between a securities risk and return. The excess of return

earned on any other securities is the risk premium or the

reward for the excess risk pertaining to that security.

According to CAPM , the required rate of return on

security is equal to risk free rate + ( beta of security x

Market risk premium ). The market Risk premium is the

difference between average Rate of return on Market and

the BSE free Rate. The average Rate of Return on a

Market index like the BSE National Index can be taken as

Proxy for the average rate of return on the market.

You might also like

- 2lecture-6 CML.Document32 pages2lecture-6 CML.Habiba BiboNo ratings yet

- Risk and Return: Models Linking Risk and Expected ReturnDocument10 pagesRisk and Return: Models Linking Risk and Expected ReturnadafgsdfgNo ratings yet

- ... Fin 200 Assignment Final-1Document10 pages... Fin 200 Assignment Final-1Daniel JohnsonNo ratings yet

- Capital Market TheoryDocument36 pagesCapital Market TheoryNeelam MadarapuNo ratings yet

- CAPM and APT Models ExplainedDocument24 pagesCAPM and APT Models ExplainedRicha AroraNo ratings yet

- Lecture 28 PDFDocument13 pagesLecture 28 PDFAlson BenhuraNo ratings yet

- F-206 (Class-20)Document15 pagesF-206 (Class-20)Mostafizur Rahman AlifNo ratings yet

- Rangkuman Bab 9 Asset Pricing PrinciplesDocument4 pagesRangkuman Bab 9 Asset Pricing Principlesindah oliviaNo ratings yet

- Module 2 CAPMDocument11 pagesModule 2 CAPMTanvi DevadigaNo ratings yet

- Session 5Document17 pagesSession 5maha khanNo ratings yet

- CAPM - Capital Asset Pricing Model ExplainedDocument9 pagesCAPM - Capital Asset Pricing Model Explainedmahesh19689No ratings yet

- Portfolio Risk & Return: Calculating Expected Returns Using the Capital Allocation Line (CALDocument54 pagesPortfolio Risk & Return: Calculating Expected Returns Using the Capital Allocation Line (CALalibuxjatoiNo ratings yet

- Solution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiDocument10 pagesSolution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiJonathanBradshawsmkc100% (42)

- What Does Capital Asset Pricing Model - CAPM Mean?Document6 pagesWhat Does Capital Asset Pricing Model - CAPM Mean?nagendraMBANo ratings yet

- CAPM, Arbitrage and Linear Factor Models George Pennacchhi: Presented by Raja Reddy (FB14004)Document15 pagesCAPM, Arbitrage and Linear Factor Models George Pennacchhi: Presented by Raja Reddy (FB14004)Raja SNo ratings yet

- CAPM & APT Theory Guide to Capital Asset Pricing & Arbitrage ModelsDocument23 pagesCAPM & APT Theory Guide to Capital Asset Pricing & Arbitrage ModelsBhakti Bhushan MishraNo ratings yet

- The Formula: Security Market Line Systematic RiskDocument7 pagesThe Formula: Security Market Line Systematic RiskPrem Chand BhashkarNo ratings yet

- The Capital Asset Pricing ModelDocument5 pagesThe Capital Asset Pricing ModelFaisal KhanNo ratings yet

- CAPM and Capital Budgeting ExplainedDocument16 pagesCAPM and Capital Budgeting ExplainedHari HarishNo ratings yet

- CAPM Problems: 1. Risk-Averse InvestorsDocument5 pagesCAPM Problems: 1. Risk-Averse InvestorsAmeya DeshpandeNo ratings yet

- Efficient Frontier, CML, SML, RISKDocument8 pagesEfficient Frontier, CML, SML, RISKKhadija AbubakarNo ratings yet

- CAPM AssignmentDocument1 pageCAPM Assignmentshreyansh jainNo ratings yet

- Capital Asset Pricing ModelDocument6 pagesCapital Asset Pricing ModelQuazi KomolNo ratings yet

- Capital Asset Pricing Model (CAPM)Document25 pagesCapital Asset Pricing Model (CAPM)ktkalai selviNo ratings yet

- Sapm Unit 3Document13 pagesSapm Unit 3pm2640047No ratings yet

- Understanding the Security Market Line (SML) /TITLEDocument9 pagesUnderstanding the Security Market Line (SML) /TITLEnasir abdulNo ratings yet

- Efficient Capital Market Theory in Security Analysis: Defining The Forms of EMHDocument11 pagesEfficient Capital Market Theory in Security Analysis: Defining The Forms of EMHVandana DubeyNo ratings yet

- Capital Market TheoryDocument27 pagesCapital Market TheoryJade100% (1)

- Glossary of PerformanceDocument31 pagesGlossary of PerformanceAteeq Ur RehmanNo ratings yet

- Investments Chapter 7Document7 pagesInvestments Chapter 7b00812473No ratings yet

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioFrom EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioRating: 4.5 out of 5 stars4.5/5 (3)

- Portfolio Long Ans QuestionDocument5 pagesPortfolio Long Ans QuestionAurora AcharyaNo ratings yet

- What Is The Capital Asset Pricing Model?Document4 pagesWhat Is The Capital Asset Pricing Model?Klester Kim Sauro ZitaNo ratings yet

- Key TakeawaysDocument19 pagesKey TakeawaysSamuel DebebeNo ratings yet

- Portfolio Management 1Document28 pagesPortfolio Management 1Sattar Md AbdusNo ratings yet

- Capital Asset Pricing ModelDocument20 pagesCapital Asset Pricing ModelSattagouda M PatilNo ratings yet

- Capital Asset Pricing Model (CAPM) : by Himani GrewalDocument48 pagesCapital Asset Pricing Model (CAPM) : by Himani Grewalshekhar_anand1235807No ratings yet

- CAPMDocument8 pagesCAPMshadehdavNo ratings yet

- Compare Capital Market Line and Security Market LineDocument7 pagesCompare Capital Market Line and Security Market LineTinashe MambodzaNo ratings yet

- MPT SML APT CAPM Risk Return TheoriesDocument26 pagesMPT SML APT CAPM Risk Return TheoriesLyra Mica Aggabao100% (1)

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument78 pagesInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareEuphoric ArtistNo ratings yet

- Malinab Aira Bsba FM 2-2 Activity 3 Finman 1Document4 pagesMalinab Aira Bsba FM 2-2 Activity 3 Finman 1Aira MalinabNo ratings yet

- Saim Unit 3 & Unit 4 NotesDocument9 pagesSaim Unit 3 & Unit 4 NotesSantosh MaheshwariNo ratings yet

- Modern Portfolio Theory: Session IV & VDocument30 pagesModern Portfolio Theory: Session IV & VAmit Singh RanaNo ratings yet

- 03.risk and Return IIIDocument6 pages03.risk and Return IIIMaithri Vidana KariyakaranageNo ratings yet

- Chapter 8 - Introduction To Asset Pricing ModelsDocument53 pagesChapter 8 - Introduction To Asset Pricing Modelsmustafa-memon-7379100% (3)

- Capm 1 PDFDocument8 pagesCapm 1 PDFAbhishek AroraNo ratings yet

- Chapter 6Document10 pagesChapter 6Seid KassawNo ratings yet

- Capital Asset Pricing ModelDocument8 pagesCapital Asset Pricing ModelJanani RaniNo ratings yet

- CAPM Model ExplainedDocument8 pagesCAPM Model ExplainedAshu158No ratings yet

- Capital Asset Pricing ModelDocument10 pagesCapital Asset Pricing Modeljackie555No ratings yet

- 4 Equilbrium in Capital MarketsDocument18 pages4 Equilbrium in Capital MarketsESTHERNo ratings yet

- 14 Chapter 7Document16 pages14 Chapter 7tarek khanNo ratings yet

- CMPMDocument8 pagesCMPMLarry DixonNo ratings yet

- Solution To Previous Year Questions Course Code: Course Name: AdvancedDocument20 pagesSolution To Previous Year Questions Course Code: Course Name: AdvancedSHAFI Al MEHEDINo ratings yet

- Topic Risk and ReturnDocument5 pagesTopic Risk and ReturnVic CinoNo ratings yet

- Dr. Ibha - CAPM1Document15 pagesDr. Ibha - CAPM1Ibha raniNo ratings yet

- Risk AversionDocument8 pagesRisk AversionFreddie Asiedu LarbiNo ratings yet

- Stratergies To Wins Heart of Muslim CommunityDocument2 pagesStratergies To Wins Heart of Muslim CommunityKaran BhatiaNo ratings yet

- Narendra ModiDocument6 pagesNarendra ModiKaran BhatiaNo ratings yet

- Even If A Snake Is Not PoisonousDocument5 pagesEven If A Snake Is Not PoisonousKaran BhatiaNo ratings yet

- Project Lic CompleteDocument49 pagesProject Lic CompleteKaran BhatiaNo ratings yet

- Black Book1 (Repaired)Document83 pagesBlack Book1 (Repaired)Karan BhatiaNo ratings yet

- Six Strategies To Deal Withcompetition SandhiDocument3 pagesSix Strategies To Deal Withcompetition SandhiKaran BhatiaNo ratings yet

- Even If A Snake Is Not PoisonousDocument5 pagesEven If A Snake Is Not PoisonousKaran BhatiaNo ratings yet

- Chutiya BanayaDocument1 pageChutiya BanayaKaran BhatiaNo ratings yet

- Role of National Income in Economic DevelopmentDocument3 pagesRole of National Income in Economic DevelopmentKaran BhatiaNo ratings yet

- Literature Review On Comparative StudyDocument5 pagesLiterature Review On Comparative StudyKaran BhatiaNo ratings yet

- Bank incentives study women empowermentDocument11 pagesBank incentives study women empowermentKaran BhatiaNo ratings yet

- Customer Satisfaction in LIC PDFDocument84 pagesCustomer Satisfaction in LIC PDFKaran BhatiaNo ratings yet

- CAPM Guide: Risk and Return FundamentalsDocument25 pagesCAPM Guide: Risk and Return FundamentalsKaran BhatiaNo ratings yet

- Questionnaire Black BookDocument2 pagesQuestionnaire Black BookKaran Bhatia100% (1)

- Literature Review On Comparative StudyDocument5 pagesLiterature Review On Comparative StudyKaran BhatiaNo ratings yet

- A Resarch Paper On GST and Its Impact On Service SectorDocument7 pagesA Resarch Paper On GST and Its Impact On Service SectorKaran BhatiaNo ratings yet

- Literature Review Sneha ProjectDocument3 pagesLiterature Review Sneha ProjectKaran BhatiaNo ratings yet

- Final DrafttttDocument9 pagesFinal DrafttttKaran BhatiaNo ratings yet

- A Resarch Paper On GST and Its Impact On Service SectorDocument7 pagesA Resarch Paper On GST and Its Impact On Service SectorKaran BhatiaNo ratings yet

- Final Format of Covering PageDocument5 pagesFinal Format of Covering PageKaran BhatiaNo ratings yet

- Capmm ProjDocument3 pagesCapmm ProjKaran BhatiaNo ratings yet

- Literature Review On Comparative StudyDocument5 pagesLiterature Review On Comparative StudyKaran BhatiaNo ratings yet

- Exercise of Caution: Read The Text To Answer Questions 3 and 4Document3 pagesExercise of Caution: Read The Text To Answer Questions 3 and 4Shantie Susan WijayaNo ratings yet

- ICS ModulesDocument67 pagesICS ModulesJuan RiveraNo ratings yet

- Logitech Case Analysis: Solving Problems of Transportation Cost and Political RiskDocument7 pagesLogitech Case Analysis: Solving Problems of Transportation Cost and Political RiskdinishaNo ratings yet

- When Technology and Humanity CrossDocument26 pagesWhen Technology and Humanity CrossJenelyn EnjambreNo ratings yet

- Selected Candidates For The Post of Stenotypist (BS-14), Open Merit QuotaDocument6 pagesSelected Candidates For The Post of Stenotypist (BS-14), Open Merit Quotaامین ثانیNo ratings yet

- B MBA I To IV Semesters Syllabus 2015-16Document258 pagesB MBA I To IV Semesters Syllabus 2015-16bcamaresh8054No ratings yet

- ALM & Liquidity RiskDocument11 pagesALM & Liquidity RiskPallav PradhanNo ratings yet

- ACCA F6 Taxation Solved Past PapersDocument235 pagesACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- AZ 104 - Exam Topics Testlet 07182023Document28 pagesAZ 104 - Exam Topics Testlet 07182023vincent_phlNo ratings yet

- Buku Drawing - REV - 02Document40 pagesBuku Drawing - REV - 02agung kurniawanNo ratings yet

- RoughGuide之雅典Document201 pagesRoughGuide之雅典api-3740293No ratings yet

- March 3, 2014Document10 pagesMarch 3, 2014The Delphos HeraldNo ratings yet

- The Human Person As An Embodied SpiritDocument8 pagesThe Human Person As An Embodied SpiritDrew TamposNo ratings yet

- Document 6Document32 pagesDocument 6Pw LectureNo ratings yet

- Unit 2 Management of EthicsDocument19 pagesUnit 2 Management of Ethics088jay Isamaliya0% (1)

- Supply Chain Management PepsiDocument25 pagesSupply Chain Management PepsivenkateshNo ratings yet

- Carnival Panorama Deck Plan PDFDocument2 pagesCarnival Panorama Deck Plan PDFJuan Esteban Ordoñez LopezNo ratings yet

- Noli Me TangereDocument26 pagesNoli Me TangereJocelyn GrandezNo ratings yet

- 021810the History of Lent and EasterDocument28 pages021810the History of Lent and EasterTrinity of Orange100% (2)

- KYC FAQsDocument5 pagesKYC FAQsmicorreNo ratings yet

- Effectiveness of Environmental Impact Assessment Process in The MDocument136 pagesEffectiveness of Environmental Impact Assessment Process in The MJoel AntonyNo ratings yet

- MNC diversity factors except expatriatesDocument12 pagesMNC diversity factors except expatriatesGanesh Devendranath Panda100% (1)

- 30 Chichester PL Apt 62Document4 pages30 Chichester PL Apt 62Hi TheNo ratings yet

- Narcotic Drugs (Control Enforcement and Sanctions) Law, 1990Document32 pagesNarcotic Drugs (Control Enforcement and Sanctions) Law, 1990Kofi Mc SharpNo ratings yet

- Static pile load test using kentledge stackDocument2 pagesStatic pile load test using kentledge stackHassan Abdullah100% (1)

- Ca NR 06 en PDFDocument251 pagesCa NR 06 en PDFZafeer Saqib AzeemiNo ratings yet

- UGC Project FormatDocument19 pagesUGC Project FormatAmit GautamNo ratings yet

- The Christian WalkDocument4 pagesThe Christian Walkapi-3805388No ratings yet

- English For Informatics EngineeringDocument32 pagesEnglish For Informatics EngineeringDiana Urian100% (1)

- Đa S A The PESTEL Analysis of VinamilkDocument2 pagesĐa S A The PESTEL Analysis of VinamilkHiền ThảoNo ratings yet