Professional Documents

Culture Documents

Investor Presentation For June 30, 2016 (Company Update)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investor Presentation For June 30, 2016 (Company Update)

Uploaded by

Shyam SunderCopyright:

Available Formats

NANDAN DENIM LIMITED

Q1 FY17 RESULTS UPDATE

August 2016

India is favourably positioned to become a global

denim fabric and apparel production hub driven by

- Abundant availability of cotton, low cost of

production and competitive currency.

- Favourable central and state government textile

policies.

- Chinas decreasing competitiveness due to high

domestic demand, rising labour cost and

appreciating currency.

SAFE HARBOR STATEMENT

This presentation and the following discussion may contain forward looking statements by Nandan Denim

Limited (Nandan Denim) that are not historical in nature. These forward looking statements, which may include

statements relating to future results of operations, financial condition, business prospects, plans and objectives, are

based on the current beliefs, assumptions, expectations, estimates, and projections of the management of Nandan

Denim about the business, industry and markets in which it operates.

These statements are not guarantees of future performance, and are subject to known and unknown risks,

uncertainties, and other factors, some of which are beyond Nandan Denims control and difficult to predict, that

could cause actual results, performance or achievements to differ materially from those in the forward looking

statements. Such statements are not, and should not be construed, as a representation as to future performance or

achievements of Nandan Denim. In particular, such statements should not be regarded as a projection of future

performance of Nandan Denim. It should be noted that the actual performance or achievements of the company

may vary significantly from such statements.

Nandan Denim Limited

DISCUSSION SUMMARY

Q1 FY17 Results Highlights

04

Q1 FY17 Financials & Summary Outlook

05 07

About Us

08 18

Appendix

20 22

Nandan Denim Limited

Q1 FY17 RESULTS YoY Analysis

REVENUES

EBITDA & EBITDA MARGIN

3,005

2,805

PAT & PAT MARGIN

16.1%

16.2%

5.5%

5.3%

452

487

155

160

7%

3%

8%

Q1 FY16

Q1 FY17

Q1 FY16

REVENUES MIX

REVENUE MIX

% Growth

14.4%

11.8%

403

355

88.2% 2,650

85.6% 2,402

Q1 FY16

Exports

-12%

10%

4.1%

4.8%

136

9.2%

258

86.0%

2,412

Q1 FY17

Domestic

In Rs Mn, Volumes in Mn Metres, Realisations in Rs/Metre

4

Nandan Denim Limited

Q1 FY16

Q1 FY17

Q1 FY16

Denim

7.0%

124

209

VOLUMES & REALISATIONS

% Growth

137.6

-19%

132.7

100.1

17.5

88.9%

2,673

106.4

20.1

11%

2.6

Q1 FY17

Shirting

Others

Q1 FY17

2.0

Q1 FY16

Denim

Q1 FY17

Shirting

Denim Realisations

Shirting Realisations

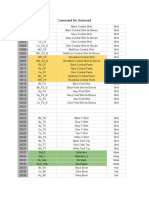

Q1 FY17 P&L STATEMENT

Q1 FY17

Q1 FY16

YOY%

Q4 FY16

QOQ%

FY16

FY15

YOY %

3,005

2,805

7.1%

2,943

2.1%

11,567

10,965

5.5%

Total Sales

3,005

2,805

7.1%

2,943

2.1%

11,567

10,965

5.5%

Cost of Goods Sold

2,010

1,873

7.3%

1,959

2.6%

7,666

7,578

1.2%

995

932

6.8%

984

1.1%

3,901

3,388

15.2%

33.1%

33.2%

-11 bps

33.4%

-34 bps

33.7%

30.9%

283 bps

Employee Expenses

149

111

33.8%

167

-10.9%

545

438

24.4%

Other Expenses

359

368

-2.6%

346

3.6%

1,445

1,295

11.6%

EBITDA

487

452

7.8%

471

3.4%

1,911

1,654

15.5%

16.2%

16.1%

10 bps

16.0%

20 bps

16.5%

15.1%

144 bps

170

166

2.0%

160

6.1%

660

596

10.8%

10

-40.3%

15

-60.8%

42

30

36.6%

324

296

9.4%

327

-0.9%

1,293

1,089

18.7%

89

97

-8.6%

113

-21.1%

412

377

9.2%

235

198

18.2%

214

9.7%

881

712

23.7%

75

43

72.3%

48

55.3%

248

198

25.3%

31.9%

21.9%

1002 bps

22.5%

937 bps

28.1%

27.8%

36 bps

160

155

3.0%

166

-3.6%

633

514

23.1%

PAT Margin %

5.3%

5.5%

-21 bps

5.6%

-31 bps

5.5%

4.7%

78 bps

EPS (Rs.)

3.41

3.40

0.3%

3.64

-6.3%

13.90

11.28

23.1%

Sales from Operations

Other Operating Income

Gross Profit

Gross Margin %

EBITDA Margin %

Depreciation

Other Income

Profits Before Interest and Taxes

Interest Expense

Profits Before Taxes

Taxes

Tax rate

Profits After Tax

Nandan Denim Limited

Q1 FY17 FINANCIAL UPDATE

Q1 FY17 Revenues grew by 7.1% YoY

Healthy growth in Denim volumes (+15% YoY) driven by healthy demand in the domestic markets.

The company focussed on driving growth in the denim business by utilizing the weaving capacity for

manufacturing denim fabrics as the shirting demand continued to remain weak.

Q1 FY17 Gross Margin remained largely stable at 33.1%

Q1 FY17 EBITDA margins expanded by 10 bps YoY to 16.2%

Q1 FY17 PBT increased by 18.2% YoY to Rs 235 mn driven by lower finance costs.

Q1 FY17 PAT grew by 3.0% YoY to Rs 160 mn. PAT growth was disproportionate to the growth in PBT primarily due

to higher tax rate.

Nandan Denim Limited

SUMMARY OUTLOOK

STRONG DOMESTIC AND GLOBAL DEMAND FOR DENIM APPARELS

IMPROVING CAPACITY UTILISATION OF THE EXPANDED DENIM CAPACITY

10% - 15% GROWTH IN REVENUES

EBITDA MARGIN IMPROVEMENT FROM 16% TO 20% DUE TO SPINNING CAPACITY EXPANSION

HIGHER ROCE

NET INTEREST COST OF 1% (SPINNING CAPACITY) AND 2%-3% (DENIM CAPACITY) ON EXPANSION CAPEX

HIGHER ROE

Nandan Denim Limited

ABOUT US: CHIRIPAL GROUP EMERGING CONGLOMERATE

BUSINESS DIVISION

GROUP COMPANIES

DETAILS

Nandan Denim Ltd.

Chiripal Industries Ltd.

(Processing Division)

Textiles

Fully integrated facilities for manufacturing range of products viz. woven fabrics, circular knitted fabrics, polar

fleece fabrics, cotton hosiery, denim, etc.

Offers integrated range of products ranging from POY 50-250 denier and FDY 50-150 denier.

Employs latest and fully automated machinery operated with Japanese and German technology.

Operates two major divisions Adhesives & Speciality Performance Chemicals.

Equipped to provide world class solutions to the paints, paper, leather, packaging & textile industries

World Class two imported Biaxial orientation of polypropylene (BOPP) lines from Bruckner, Germany for

manufacturing films capacity of 77,550 MTPA.

In addition, CPFL has two Metalizers for producing metalized films.

The company is also implementing BOPET Line to cater to wide demand for BOPET Products.

Operates a fully equipped industrial park for SME enterprises in the textile sector

Has made a successful foray in the area of residential infrastructure as well.

Runs 5 schools under the brand Shanti Asiatic across the country with over 3,000 students.

Present in the management education space having student strength of 560 students.

Successfully running over 185 pre-K franchise Shanti Juniors with over 10,000 students.

Vishal Fabrics Ltd.

Petrochemicals

Chiripal Industries Ltd.

(Petrochemicals Division)

CIL Nova Petrochemicals Ltd.

Chemicals

Packaging

Chiripal Industries Ltd.

(Chemicals Division)

Chiripal Poly Films Ltd.

Shanti Developers

Infrastructure

Dholi Integrated Spinning Park

Vraj Integrated Textile Park

Education

Shanti Educational Initiatives Ltd.

Nandan Denim Limited

ABOUT US: COMPANY OVERVIEW

STRONG

PEDIGREE

Nandan Denim Limited is a part of a leading conglomerate, Chiripal Group, which was established in 1972 and is

currently diversified across several businesses like Textiles, Petrochemicals, Chemicals, Packaging, Infrastructure

and Education.

Nandan Denim commenced its operations in 1994 with textile trading business and forayed into textile

manufacturing in 2004. The company currently engages in manufacturing of denims, cotton fabrics and khakis.

The company is run by a professional management team with an average experience of more than two decades..

Nandan Denim has one of the largest denim fabric manufacturing capacities in the world.

LEADING

INTEGRATED

DENIM

MANUFACTURER

The company expanded its denim fabric capacity from 71 MMPA to 99 MMPA in FY16.

The company plans to backward integrate by expanding its spinning capacity from 70 TPD (tonnes per day) to 124

TPD in FY17 resulting into higher operating margins and improved return ratios.

The company also owns a captive power plant of 15 MW.

STRONG

FINANCIAL

PERFORMANCE

Consolidated revenues, EBITDA and PAT were Rs 11,567 mn, Rs 1,911 mn and Rs 633 mn in FY16 having grown at

CAGR of 19%, 23% and 36% over FY12-FY16.

Stable EBITDA margins of around 14% - 16% over FY12-FY16.

Return ratios have improved over last five years driven by improving asset turnover.

ROCE 11.7% in FY12 to 15.7% in FY16.

ROE 12.3% in FY12 to 20.9% in FY16.

FY16 Debt : Equity was 1.5:1.

* Post complete expansion

Nandan Denim Limited

ABOUT US: INTEGRATED DENIM FABRIC FACILITY

FIBRE

YARN

FABRIC

Ginned Cotton

70% of cotton requirement

is met from Gujarat

Spinning

Ring Spinning 20 TPD

Open End Spinning 44 TPD

Weaving & Processing

Denim 110 * MMPA

Shirting 10 MMPA

KEY HIGHLIGHTS

One of the largest denim fabric facility in the world and second largest in India.

Machinery with latest technology from Germany and Japan, capable of producing wide range of denim fabrics.

~10% domestic fabric market share.

~80% denim capacity utilisation.

Sufficient power through 15 MW captive power plant.

* Post complete expansion

10

Nandan Denim Limited

ABOUT US: STRATEGIC LOCATION OF MANUFACTURING FACILTIES

THE GUJARAT ADVANTAGE

GUJARAT TEXTILE HUB OF INDIA

SUPERIOR CONNECTIVITY

Largest producer of denim fabric (6570%) in India and third largest in the

world.

Largest producer of cotton in India

with ~31% share.

Textile hub of India housing the entire

textile value chain.

Located in Ahmedabad, the financial

capital of Gujarat.

Superior infrastructure connectivity

through roads, rail , airport and ports.

GUJARAT TEXTILE POLICY BENEFITS

Interest Subsidy (in addition to Central

subsidies) for 5 years:

7% - Spinning & garment facilities

6% - Technical textiles

5% - All other facilities

Power tariff subsidy @ Rs 1/unit for 5

years.

VAT/Entry Tax reimbursement for 8

years.

100% stamp duty reimbursement.

11

Nandan Denim Limited

PROXIMITY TO MARKET

Close proximity to machinery vendors,

fabric dealers and leading garment

manufacturers resulting in faster

delivery and service.

Lower marketing and transportation

overheads.

LOW COST OF PRODUCTION

Easy availability of key raw material - Cotton.

Uninterrupted power supply in state of Gujarat.

Gujarat meets around 70% of the cotton

requirement.

Easy availability of skilled and unskilled labour.

ABOUT US: LEVERAGING THE CHIRIPAL GROUP ECO-SYSTEM

LEVERAGE CHIRIPAL GROUP ECO-SYSTEM

Nandan Denim

Denim fabric,

shirting fabric

Denim Fabric

Customer

12

Chiripal Industries (Processing)

wovens, knitted, polar fleece,

flock, hosiery, embroidery,

synthetic adhesives and acrylic

emulsions

Chiripal Industries

(Petrochemical)

POY, FDY, DTY

Chiripal Polyfilms

Thermal Films,

Tape Textile BOPP,

Packaging films

Vishal Fabrics

Shirting, Synthetic, Botton

Weight, Bedsheets,

dyeing, printing

Chiripal Customer Network

Access to the large customer network of the Chiripal Group.

Successful customer acquisition and retention through the cross-leveraging of group capabilities and cross-selling of group

offerings.

One of the largest group level processing capacity of ~0.8 MMPD adding significant value to customers by fulfilling their

printing, dyeing, bleaching, synthetic yarn and other processing requirements under one roof.

Nandan Denim Limited

ABOUT US: SUPERIOR MARKETING & DISTRIBUTION

MARKETING & DISTRIBUTION DOMESTIC MARKETS

MARKETING & DISTRIBUTION EXPORTS MARKETS

Leveraging the strong agent-based domestic network

of the Chiripal group.

Leveraging the strong agent-based global network of

the Chiripal group.

Strong pan-India network of around 35 40

distributors associated with the company for close to

a decade.

Strong global network of around 15 distributors

spread across 8 countries Peru, Mauritius, Hong

Kong, Dubai, Thailand, Bangladesh, New York,

Columbia.

Strategic tie-ups with 10 firms to exclusively sell

Nandan Denims products.

Around 2/3rd of the orders are confirmed through

long term agreements involving minimum yearly

quantity commitment.

Export of denim fabric to over 27 countries across the

globe.

Merchant exports through various star export houses

to give an additional boost to exports.

Despite the current over-supply in the domestic denim market, Nandan Denim has been able to grow its

revenues at a CAGR of 19% (compared to industry growth of 12% - 15%) over last 5 years,

while improving EBITDA margins to 16% - 17%.

13

Nandan Denim Limited

ABOUT US: BUILDING GLOBAL PRESENCE

TURKEY

UZBEKISTAN

DUBAI

INDIA

GREECE

CHINA

SOUTH KOREA

USA

HONDURAS

COLOMBIA

PORTUGAL

BANGLADESH

HONG KONG

MOROCCO

THAILAND

EGYPT

PHILIPPINES

GAUTEMALA

INDONESIA

PANAMA

PERU

VENEZUELA

SRILANKA

LESOTHO

AUSTRALIA

MADAGASCAR

SOUTH AFRICA

CHILE

Nandan Denim exports its denim fabric to over 27 countries across the globe through its

strong global dealer-distribution network.

14

Nandan Denim Limited

ABOUT US: GLOBAL ACCEPTANCE FROM LEADING BRANDS

DOMESTIC

BRANDS

GLOBAL DENIM FABRIC SUPPLIER TO MAJOR BRANDS AROUND THE WORLD

GLOBAL

BRANDS

15

Nandan Denim Limited

ABOUT US: CAPACITY EXPANSION PLAN

CAPACITY EXPANSION

Capacity

FY13

FY14

FY15

FY16

Post Completion

54

64

64

70

124

Denim

71

76

99

99

110

Shirting

10

10

10

10

Spinning (TPD)

Fabric (MMPA)

CAPACITY EXPANSION:

Capacity expansion plan to increase the denim fabric manufacturing capacity, spinning capacity and shirting capacity.

Total capital requirement of Rs 6,120 mn to be funded with a D:E ratio of 2.4 : 1.

16

Nandan Denim Limited

RATIONALE FOR CAPACITY EXPANSION AND INTEGRATION

STRONG

DOMESTIC

AND

GLOBAL DEMAND

LOCATION

ADVANTAGE

BENEFITS UNDER

CENTRAL AND STATE

GOVERNMENT POLICY

Strong domestic demand backed by majority young population (78% < 45 years), rising

disposable incomes and fashion consciousness and increasing organised retail industry

penetration in Tier II and III cities.

Strong global demand and potential for being a global production hub driven by easy availability

of cotton, competitive currency and low cost labour.

Set to benefit from Chinas decreasing competitiveness . As per CITI estimates, if China loses 10%

market share in global textiles, Indias market share will increase by 80%.

Located in Gujarat Textile hub of India, largest exporter of denim fabric, largest producer of

cotton etc.

Easy availability of cotton (Gujarat meets 70% requirement) and skilled & unskilled labour.

Close proximity to machinery vendors, fabric dealers and leading garment manufacturers

resulting in faster delivery and service and lower overheads.

Gujarat textile policy: 5% (7% - spinning facility) interest subsidy and power subsidy @ Rs1/unit

for 5 years, VAT/Entry Tax reimbursement for 8 years, 100% stamp duty reimbursement.

TUFS (Central textile policy): 5% interest subsidy and 10% capital subsidy for period of 7 years.

CITI Confederation of Indian Textiles Industry

17

Nandan Denim Limited

RATIONALE FOR CAPACITY EXPANSION AND INTEGRATION

IMPROVED

OPERATIONAL

FLEXIBILITY

Integrated facility will improve the overall operational flexibility, helping the company to absorb

the increasing market demand.

Faster delivery and timely execution due to limited dependency on external factors along the

value chain.

Achieve optimum capacity utilisation.

Maintain consistency and high quality standards.

IMPROVED

MARGINS

THROUGH

BACKWARD

INTEGRATION

In-house production of cotton yarn would result in ~10% - 15% savings compared to purchase of

yarn from the market.

Integrated facility to help in better management of the working capital and improve the

operational efficiencies.

Better market response, efficient capacity utilisation and cost savings on captive yarn would result

in EBITDA margin improvement from current 14% - 15% to around 19% - 20%.

FUTURE

IMPROVEMENT

IN ASSET TURNOVER

AND

RETURN RATIOS

18

Upfront expansion capex of Rs 6,120 mn at financing cost of only 1% - 3% (post state and central

interest subsidies).

Higher asset turnover along with improved operating margins will result in positive operating

leverage and better return ratios.

Nandan Denim Limited

FOR ANY FURTHER QUERIES CONTACT -

THANK YOU

Ms. Krishna Patel

Deputy Manager (Finance)

Email: krishnapatel@chiripalgroup.com

Mr. Ammeet Sabarwal / Mr. Nilesh Dalvi

IR Consultant

Email: ammeet.sabarwal@dickensonir.com

nilesh.dalvi@dickensonir.com

Contact No: +91 9819576873 / 9819289131

ANNEXURE

ABOUT US: FINANCIAL SUMMARY

REVENUES (RS MN)

EBITDA (RS MN)

CAGR 19.2%

CAGR 23.3%

10,965

CAGR 35.5%

11,567

8,938

5,738

1,654

7,031

826

FY12

FY13

FY14

FY15

FY16

MARGIN ANALYSIS (%)

14.4%

15.2%

PAT (RS MN)

14.8%

15.1%

FY12

1,069

633

1,911

514

1,327

311

393

188

FY13

FY14

FY15

FY16

FY12

LEVERAGE ANALYSIS (RS MN)

FY13

FY14

2.2

2.0

1.8

FY16

RETURN METRICS (%)

16.5%

1.8

FY15

18.1%

19.6%

11.7%

13.1%

14.1%

FY12

FY13

FY14

1.5

21.6%

20.9%

15.8%

15.7%

FY15

FY16

12.3%

3.3%

FY12

4.4%

4.4%

5.5%

2,864

1,589

FY13

FY14

EBITDA Margin

21

4.7%

FY15

FY16

PAT Margin

Nandan Denim Limited

FY12

5,184

4,015

4,307

4,709

1,836

2,165

2,588

3,472

FY13

FY14

FY15

FY16

Equity

Debt

D/E

ROCE

ROE

ABOUT US: OPERATIONAL SUMMARY

DENIM FABRIC CAPACITY (MMPA)

71.9%

57

FY12

77.9%

79.2%

71

76

FY13

Capacity

FY14

DENIM REALISATIONS (RS/METRE)

82.1%

81.2%

99

99

120.5

40.9

FY15

FY16

Capacity Utilisation

FY12

SALES BREAKUP

89.7%

90.9%

10.3%

9.1%

FY12

22

120.2

53.5

56.3

FY13

FY14

Denim Sales (Metres)

132.7

135.3

70.8

76.8

FY15

FY16

Realisations

SALES BREAKUP

98.6%

99.1%

1.4%

0.9%

90.2%

88.7%

90.8%

87.6%

87.3%

9.8%

11.3%

9.2%

12.4%

12.7%

FY13

FY14

Domestic Sales

FY15

FY16

80.5%

19.5%

FY13

FY14

Manufactured Goods

Nandan Denim Limited

111.7

FY15

FY16

Traded Goods

FY12

Exports

You might also like

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bebop Assessment Level 1Document18 pagesBebop Assessment Level 1Luisa UlloaNo ratings yet

- Kaki Shooting Draft: Scene 01 - Title Card (Drone Shot)Document5 pagesKaki Shooting Draft: Scene 01 - Title Card (Drone Shot)Sunil BharadwajNo ratings yet

- CB Uniqlo FinalDocument11 pagesCB Uniqlo FinalArshia ChatterjeeNo ratings yet

- Taco Bell Uniform CatalogDocument7 pagesTaco Bell Uniform CatalogLeila Poole17% (6)

- Breve Antologia PoeticaDocument11 pagesBreve Antologia PoeticaPauliRodriguezNo ratings yet

- UK Garments ImporterDocument8 pagesUK Garments ImporterAhsan Ullah Tutul95% (22)

- Listening and Speaking Fluency Lesson 6 Water and An AppleDocument4 pagesListening and Speaking Fluency Lesson 6 Water and An ApplelimpezasNo ratings yet

- (Alison Darren) Lesbian Film Guide (Sexual Politics)Document257 pages(Alison Darren) Lesbian Film Guide (Sexual Politics)Andreea0% (1)

- Pierre Balmain - Fashion Designer PresentationDocument13 pagesPierre Balmain - Fashion Designer Presentationapi-319239991No ratings yet

- Command For UnturnedDocument411 pagesCommand For UnturnedBerliano PutraNo ratings yet

- Presentation Line BalancingDocument25 pagesPresentation Line Balancingmpedraza-1100% (1)

- Kingdoms of Amalur Reckoning CraftingDocument18 pagesKingdoms of Amalur Reckoning CraftingGRAFiEQNo ratings yet

- This, That, These or Those?: Activity TypeDocument4 pagesThis, That, These or Those?: Activity TypeMário André De Oliveira CruzNo ratings yet

- Colourless - Izzy - Winchester1864Document92 pagesColourless - Izzy - Winchester1864Hazel Mae LunaNo ratings yet

- ParvejDocument8 pagesParvejjhparvejNo ratings yet

- 14 Station of The CrossDocument9 pages14 Station of The CrossRewel LacorteNo ratings yet

- Tender Niftem HousekeepingDocument27 pagesTender Niftem HousekeepingD S RajawatNo ratings yet

- Sewing Tools and EquipmentDocument2 pagesSewing Tools and EquipmentJustine Lee PatumbonNo ratings yet

- TF Textile Gate 2011 Question PaperDocument17 pagesTF Textile Gate 2011 Question PaperShailendra Mishra100% (2)

- Gorenje WA 82145 PDFDocument28 pagesGorenje WA 82145 PDFИван АлексиевNo ratings yet

- Splash 2 20142015Document8 pagesSplash 2 20142015Simona Brezan AioaniNo ratings yet

- Amet, TM Sample Canada Cpr-Whmis Ghs SdsDocument20 pagesAmet, TM Sample Canada Cpr-Whmis Ghs SdsEcogeneticsNo ratings yet

- Unit 03 Possessions - Lesson BDocument31 pagesUnit 03 Possessions - Lesson BJackelyn RamirezNo ratings yet

- Practical Plumbing Handbook PDFDocument56 pagesPractical Plumbing Handbook PDFAgustinus Vino100% (2)

- TableskirtingDocument28 pagesTableskirtingCba Jrmsu-KatipunanNo ratings yet

- Module 6-Product Information - Garment InformationDocument33 pagesModule 6-Product Information - Garment InformationMendi GorencaNo ratings yet

- 3 Rothe ErdeDocument173 pages3 Rothe ErdeOscar CruzNo ratings yet

- Brief Industrial Profile of KANNUR District: MSME-Development Institute, ThrissurDocument20 pagesBrief Industrial Profile of KANNUR District: MSME-Development Institute, ThrissurSaad AbdullaNo ratings yet

- Backstrap Weaving With Pick UpDocument7 pagesBackstrap Weaving With Pick UpAntonio Canabarro80% (5)

- Village Life of PakistanDocument37 pagesVillage Life of PakistanAndersen HarrisNo ratings yet