Professional Documents

Culture Documents

Chapter 3 and 8 Revision Notes

Uploaded by

S Kellvien AseerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3 and 8 Revision Notes

Uploaded by

S Kellvien AseerCopyright:

Available Formats

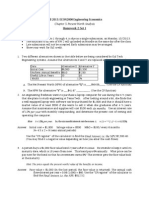

Chapter 3 and 8 - Revision

SEMESTER 1, 2015/2016, TEST 1

SECTION A: True/False Questions

1. Period costs are costs that are matched against revenues on a time period

basis. T

2. Fixed cost per unit varies with changes in volume of output. T

3. Total cost refers to activity cost per unit basis. F

Section B: Multiple Choice questions

1. After graduating from secondary school, Siew Chin had three choices, listed in

order of preference: (1) attend matriculation , (2) work in a printed circuit

board factory, or (3) do diploma at a college. Her opportunity cost of going to

matriculation includes which of the following?

A. the income she could have earned at the printed circuit board factory plus

the direct cost of attending matriculation (tuition, textbooks, etc.)

B. the income she could have earned at the printed circuit board factory plus

the benefits of attending college for diploma

C. the benefits she could have received from going to the college to

do diploma

D. cannot be determined from the given information

Question 2

a) A company manufactures and retails clothing. In the right-hand column, write

what type of expense each item is. These can be analysed as to whether they

are

direct materials (DM),

direct labour (DL),

manufacturing overhead (MOH),

administration expenses (AE),

selling and distribution expenses (S&D),

1)

2)

3)

4)

5)

6)

7)

Cost

Lubricants for sewing machines

Interest on bank overdraft

Woven silk

Wages of security guards for factory

Cost of advertising products on television

Wages of operators in the pattern & cut department

Wages of forklift truck drivers who handle raw

materials

Cost analysis

MOH

AE

DM

MOH

S&D

DL

MOH

Chapter 3 and 8 - Revision

b) Siti Moon has a catering business. One day she has to decide whether to

accept Lizas or Fazlis order, as she could not take both order at the same

time.

If she accepts Lizas, she has to incur total cost of RM 3,000, and get net

income of RM1,500.

If she accepts Fazlis, she has to incur total cost of RM 4,500, and get net

income of RM1,000.

If she declines both orders, she still has to incur RM500 on the cook fixed

salary (this was included in both orders total costs)

i.

What is Siti Moons opportunity costs if she accepts Lizas order?

Net income of RM1,000 from Fazlis order_

ii.

How much of the cost that should be considered as sunk cost if Siti accept

Lizas order?

Cooks fixed salary of RM500

SEMESTER 2, 2015/2016, TEST 2

4. Money has a time value whereby as an individuals earning grows, his/her

purchasing power also increases as time goes by. F

5. Under the simple interest scheme, you earn interest only on the principal

amount at the end of each interest period but for the compounding interest

scheme, you earn interest on the principal as well as interest on interest. T

6. The single payment present worth factor is designated as ( F/P, i ,N ) used in

the calculation to find the present worth of a future sum. F

7. The cash flow pattern of a linear gradient series produces an ascending or

descending line by a fixed amount. T

Section B: Multiple Choice questions

8. Contribution margin

A. is the difference between selling price per unit and total variable cost

B. is the total of fixed cost per unit and profit per unit

C. is the contribution that each unit makes towards absorbing variable costs

and showing a profit

D. is the firms profit at the break-even point

9. Economic equivalence

A. refers to a cash flow either for a single payment or a series of

payment that can be converted to an equivalent cash flow at any

point in time.

B. exists between cash flows that have the same economic effect but however

cannot be traded in the financial market place

C. refers to the fact that additional risk is not taken without additional return

by investors

2

Chapter 3 and 8 - Revision

D. is the concept of a nearby penny is worth a distant dollar

10. To increase a given future value, the discount rate should be adjusted

__________.

A.

upward

B.

downward

C.

first upward and then downward

D.

None of the above answers are correct; you should use PVIF.

A.

11. Mr Rahman recently bought TNB share at RM12.00 and will sell it when the

share price has doubled. If the share price of TNB is expected to increase 15%

per year, how long will he wait before selling the TNB shares?

1.8 years

B. 4.8 years

C. 6.0 years

D. 10.8 years

Section C

Question 1 (10 marks)

Information below has been gathered for Jooel Boonger Sdn Bhd.

Selling Price per unit

RM17

Fixed Expenses

Selling & Administrative

RM130,000

Interest Expense

Variable Expenses per unit

Cost of Goods Sold (COGS)

Selling & Administrative

RM10,000

RM4

RM3

REQUIRED:

i. What is the companys contribution margin?

CM = (Selling price VC) = 17 (4+3) = 10

ii. What is the break-even point in units?

Break even quantity

= (Fixed Cost)/ (CM)

/10 = 14,000 units

= [(130,000 + 10,000) + 0]

iii. If the company wants to earn a profit of RM42,000 instead of breaking

even, what is the number of units the company must sell?

Quantity = (Fixed Cost + Profit)/ (CM) = (140,000) + 42,000) / 10 = 18,200

units

iv. The companys supplier increases his prices. The COGS per unit increases

to RM5.50. The business is not able to pass on the price increase to

Chapter 3 and 8 - Revision

customers. By how much must fixed costs fall in order for the business to

breakeven? (4)

Break even quantity

= (Fixed Cost)/ (CM)

14,000

= FC / (17 (5.50+3)) ; FC = 119,000

.: FC must be reduced by RM21,000 (140k-119k) for the co. to breakeven.

OR 15% reduction

Question 2 = 14 marks

i) Johana has deposited RM33,000 today once in an account which will earn 10

percent annually. She plans to leave the funds in this account for seven years

earning interest. If the goal of this deposit is to cover a future obligation of

RM65,000, what recommendation would you make to Johana?

Prove the sufficiency of the deposit

= 33,000(F/P,10%,7yr) = 33,000 x (1+0.1)7 = 33,000 x 1.9487 =

64,307.10

Thus 64,307.10 < 65,000 , not sufficient

Recommendation (either 1)

- increase amount of deposit, OR

- choose other plan with higher interest earning, OR

- leave the fund for longer than 7 years

ii) A company expects to pay RM20,000 per year for a contracted cleaning

service starting at the end of next year and continuing for a total of 5

payments. Construct the cash flow diagram to find the present worth of

the payments at an interest rate of 8% per year.

Answer: P is to be determined in year 0.

P=?

iii) For the cash flows shown below, calculate the future worth in year 8 using

i = 10%

Year

0

1

Cash flow,RM per year 100

2

100

3

100

4

200

5

200

6

200

200

Chapter 3 and 8 - Revision

FV n=8 =100(F/A,10%,3)(F/P,10%,6) + 200(F/A,10%,4)(F/P,10%,2)

= $1666

SPECIAL SEMESTER , 2015/2016, TEST 1

4. It is better to receive money earlier than later because our purchasing power

will increase in the future. F

5. Fixed costs are zero when production is equal to zero. F

6. Steel in bridge construction is a direct raw material. T

7. Heat and light costs associated with a companys administrative function is a

nonmanufacturing costs. T

8. Fixed cost per unit varies with changes in volume. T

9. The quantity of a variable at which revenues and costs are equal is known as

the maximum cost point. F

10.

The type of cost given below is a variable cost. T

Volume

Cost

1 unit

RM 18

10 units

180

100 units

1800

QUESTION 2 [13 marks]

QChair manufacturing company produces ergonomic small office chair that can

contribute to increased productivity , improved health and safety, increased job

satisfaction and

decreased injuries and workers compensation claim in

companies.

Financial data of the manufacturing process is as in the table below.

ITEM

RM

Direct Materials Per Unit

30

Direct Labor Per Unit

10

Variable Manufacturing Overhead Per Unit

10

Variable Marketing and Administrative

ExpensesPer Unit

10

Fixed Manufacturing Overhead

500,000

Fixed Marketing and Administrative Expenses

300,000

Selling Price Per Unit

160

Chapter 3 and 8 - Revision

(a)Calculate the contribution margin and interpret your answer.

CM = Price Avg. Variable Cost

= 160 (30+10+10+10) = RM100 To cover for AFC and profit per

unit.

(b)What is the break-even sales?

BE (Sales) = [Fixed cost / CM per unit] x SP/unit = [800,000 / (160

60)]*160

(c) Calculate the total non manufacturing cost per unit at the break-even point.

(300,000 /8,000) + 10 = 37.5 + 10 = RM47.50

(d) i. Do you agree that the quantity manufactured and sold should increase

by 25% to make a profit of RM200,000 compared to the break even

point? Show your calculations.

(FC + PROFIT)/ MC

(800,000 + 200,000)/ 100 = 10,000 units

10,000 units -8,000 units= 2,000 units]; an increase of 2,000/8,000 = yes,

25%

Or

160Q (800,000+60Q)= 200,000; Thus Q = 10,000 units

From part (b), break-even units are 8,000

10,000 units - 8,000 units= 2,000 units; an increase of 2,000/8,000 = yes,

25%

ii. What is the profit per unit at RM200, 000 profit?

200,000 / 10,000 = RM20

(e)Due to the shortage of supply of materials used to make the seat pan, the

cost of direct material per unit increases by RM5, all else remain constant.

What will be the effect on quantity to maintain a profit of RM200, 000?

160Q (800,000 + 65Q) = RM200,000; Q = 1,000,000 / 95 = 10526 units;

an increase of 526 units to produce and sell.

SPECIAL SEMESTER , 2015/2016, TEST 2

Chapter 3 and 8 - Revision

1. Economic equivalence exists when

A. cash flows have the same economic effect and could be traded for

one another in the financial marketplace

B. cash flows have the same economic effect but could not be traded for one

another in the financial marketplace

C. cash flows have different economic effect but could be traded for one

another in the financial marketplace

D. cash flows have different economic effect and could not be traded for one

another in the financial marketplace

2.

The process of finding the future value is often called _______________

process.

A.

compounding

B.

disbursement

C.

discounting

D.

receipt

3.

Which of the following indicates a series of payments of a fixed amount for

a specified number of periods?

A.

Annuity

B.

Future Value

C.

Present Value

D.

Principal Amount

Question 4: [2 marks]

a. A person deposits RM10,000 into a money market account which pays interest

at a rate of 8% per year. Calculate the amount that would be in the account at

the end of ten years.

F= 10,000(F/P,8%,10) = 10,000 (2.1589)= RM21589

Question 5

A piece of machinery has a first cost of RM50,000 with a monthly operating cost

of RM10,000.

Calculate the monthly income if the company wants to recover its investment in

five years at an interest rate of 1% per month.

ANSWER

First cost:

A= 50,000(A/P,1%,60) [1 mark] = 50,000(0.0222) = RM1110

Monthly cost= RM1110 + RM10,000 = RM11,110

Income must be RM11,110

7

Chapter 3 and 8 - Revision

COEB 442, Semester 1, 2015/2016

QUESTION 4 [25 marks]

(a) A company has a fixed costs of RM20,000 per month, the variable cost for its

product is RM 400 per piece and break even quantity per month is 50 pieces.

(i) Calculate the price charged to break even.

(ii) Calculate the profit if 250 pieces were sold in the market.

(iii)

The company has a goal of RM100,000 profit next year. Determine

the change (in RM) in variable cost (assuming fixed cost and price remain

the same) necessary to meet this goal if the number of units sold is the

same i.e. 250 pieces.

(b)What would be the effect on the break even quantity if the fixed costs were

decreased by 10% and the variable cost per piece were increased by 10%

simultaneously?

i.

20,000/(P-400 ) = 50; P = RM800

ii.

250(800) [20,000 +400 (250)] = 200,000 120,000 = RM80,000

iii.

250(800) [20,000+V (250)] = 200,000 20,000-250V = RM100,000

V = 80,000/250 = RM320

Change in VC (decrease) = RM400-RM320 = RM80

b. FC reduced by 10% = RM18,000

VC increased by 10% = RM440

18,000/(800-440) = 50 pieces; No change occurred in the original break

even point.

COEB 442, Semester 1, 2015/2016

QUESTION 1 [25 marks]

(a)

Upin and Ipin are twins. Upin is planning for his retirement 19 years from

now. He plans to invest RM5,800 per year for the first 8 years and RM8,300 per

year for the following 11 years (assume all cash flows occur at the end of each

year). If both Upin and Ipin can invest in saving account with 9% interest rate,

how much Ipin has to deposit each year in equal amount into his account so

that after 19 years, the total amount in his account is the same as his brother

Upin? (Note: all cash flows occur at the end of the year).

FV n=19 = [5800 (F/A, 9%, 8) (F/P, 9%, 11) + 8300 (F/A, 9%, 11)] =

310806.55

A = 310806.55 (A/F, 9%, 19) = 6744.50

8

Chapter 3 and 8 - Revision

Or

FV n=19 = [5800 (P/A, 9%, 8) + 8300 (P/A, 9%, 11) (P/F, 9%, 8)] =

60450.73

A = 60450.73 (A/P, 9%, 19) = 6752.34

(b)

Ali just purchased a brand new machine worth RM40,000. He estimates

that the maintenance cost for the machine during the first year will be

RM2,800. The maintenance cost is expected to increase by RM800 per year

throughout its seven years useful life. Ali wants to set up an account and

all future maintenance expenses will be paid out of this account. Assuming

the maintenance cost occur at the end of year, how much does Ali has to

deposit in the account now at 10% interest rate?

P = A (P/A, 10%, 7) + G (P/G, 10% 7) = 2,800 (4.8684) + 800 (12.7631)

= 23,842

QUESTION 4 [25 marks]

Rinching Furniture Sdn Bhd operates a factory at the Beranang Industrial Zone

that manufacture ergonomic rattan chair. The data given below are for costs in

year 2014 for producing 3,000 units of the rattan chairs. Currently, each rattan

chair is been sold at RM120.

Units Produced

Direct labor

Direct raw materials

Manufacturing overhead:

Variable portion

Fixed portion

Selling and administrative costs:

Variable portion

Fixed portion

Costs (RM)

90,000

60,000

------------54,000

24,000

30,000

(a) Given that the manufacturing cost per unit is RM80, calculate the variable

portion value of the manufacturing overhead costs in year 2014. [Hint: Fill

in the missing value in the table]

Total manufacturing costs = RM80 x 3,000 = RM240,000

Variable Manuf. Overhead = RM240k -90k-60k-54k = RM36,000

(b) Using the answer that you have calculated in part (a), compute the

following:

i. Total variable costs

90k +60k +36k +24k = RM210,000

ii. Total variable costs per unit

210k /3,000 units = RM70

9

Chapter 3 and 8 - Revision

iii. Total costs

90k+60k+36k+54k+24k +30k = RM294,000

(c) Based on the current selling price set by the company, answer the

following:

i. What is the companys profit per unit for the sale of 3,000 units of

rattan chairs?

Profit = TR TC; = (RM120 x 3,000 units) 294k = RM66,000 /

3,000 = RM22

ii. Calculate the contribution margin per unit of the rattan chair when

sales are at 3,000 units. Interpret the meaning of your answer.

Contribution margin /unit = P AVC = RM120 RM70 = RM50

The contribution that each unit makes toward absorbing (i) fixed costs and

(ii) showing a profit.

iii. Prove that the profit per unit plus the average fixed costs is equal to the

contribution margin value as calculated in part c(ii).

Contribution margin = Profit per unit + AFC = RM22k + 84k / 3k

RM50

iv. Determine the break-even volume and sales.

TR= TC; P x Q= FC +( AVC x Q); 120Q = 84,000+ 70Q ; Q = 1680

COEB 442, Semester 2, 2014/2015

QUESTION 4 [25 marks]

The following are the data for LightSys Software Corporation per month.

Units Sold

Total Variable Costs

Contribution Margin Per unit

Profit

40,000 units of pendrives

RM560, 000

RM6

RM70, 000

(a) What is the price per unit of the pendrive?

Avg Variable Cost = 560,000/40,000 = RM14

CM = Price AVC; Thus P= RM6 + RM14 = RM20

(b)How much sales can the company generate?

RM20 x 40,000 [1 m] = RM800, 000

(c) Do you agree that the average fixed cost is RM1.75? Calculate to answer.

20(40,000) (560,000 + FC)= RM70,000

AFC = RM170, 000 / 40,000 = RM 4.25; NO

10

Chapter 3 and 8 - Revision

(d) How many units of pendrive must LightSys sell in order to break even?

(round to the nearest whole unit)

20Q = 170,000 + 14Q; Q = 170,000/6 = 28334 units; thus Sales: 28334 x

RM20 = RM566680

(e) Given the variable production cost per unit increases by RM 2, but no

change in fixed costs, can the company maintain the same level of profit

if it sells 50,000 units of pendrive per month? Calculate to answer.

TR = RM20(50000) = RM1,000,000

TC= RM16(50000) + RM170000 = RM970000

PROFIT: RM30,000

NO; A DECLINE IN PROFIT OF RM70000-RM30000 = RM40000

11

You might also like

- A Sample Digital Marketing Agency Business Plan TemplateDocument24 pagesA Sample Digital Marketing Agency Business Plan TemplateSoulFront Attack50% (2)

- The Ultimate Guide To Order Flow TradingDocument45 pagesThe Ultimate Guide To Order Flow Tradingkien tran dong100% (11)

- AccountingDocument9 pagesAccountingVaibhav BindrooNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Tata Motors SWOT TOWS CPM MatrixDocument6 pagesTata Motors SWOT TOWS CPM MatrixPreetam Pandey33% (3)

- Group Accounts Consolidation Questions BankDocument43 pagesGroup Accounts Consolidation Questions BankAli Sheikh93% (14)

- Mas.1416 Profit Planning and CVP AnalysisDocument24 pagesMas.1416 Profit Planning and CVP AnalysisCharry Ramos70% (10)

- Imc PlanDocument39 pagesImc Planapi-485317347100% (2)

- Introduction To Business PlanDocument43 pagesIntroduction To Business PlanAdnan KachwalaNo ratings yet

- T1 Exercises QuestDocument4 pagesT1 Exercises QuestXin XiuNo ratings yet

- Cost allocation methods and break-even analysis questionsDocument11 pagesCost allocation methods and break-even analysis questionssarahbeeNo ratings yet

- Lesson 11.future Worth MethodDocument7 pagesLesson 11.future Worth MethodOwene Miles AguinaldoNo ratings yet

- ESCOPETE Assignment CVPDocument6 pagesESCOPETE Assignment CVPmiljane perdizoNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- ME 11 Midterm ExamDocument3 pagesME 11 Midterm ExamRena Jocelle NalzaroNo ratings yet

- MGTS 301 Feb 16, 2014Document10 pagesMGTS 301 Feb 16, 2014subash shrestha100% (1)

- A5 MockDocument13 pagesA5 MockEjaz KhanNo ratings yet

- Test 9Document23 pagesTest 9Ankit Khemani100% (1)

- Program/Course Bcom (A&F) Class Tybcom (A&F) Semester VI Subject Financial Accounting-Vii Subject Code 85601 Exam Date 05.10.2020Document28 pagesProgram/Course Bcom (A&F) Class Tybcom (A&F) Semester VI Subject Financial Accounting-Vii Subject Code 85601 Exam Date 05.10.2020hareshNo ratings yet

- Sample Cases 1-11 With SolutionsDocument10 pagesSample Cases 1-11 With SolutionsJenina Rose SalvadorNo ratings yet

- Mid Term Exam Dec 2020Document5 pagesMid Term Exam Dec 2020tiraNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2012 - Dec2014 - Set 1Document16 pagesAnswer To MTP - Intermediate - Syllabus 2012 - Dec2014 - Set 1Crizhae OconNo ratings yet

- Unit Trust (UT) Sample Questions - Set 3Document12 pagesUnit Trust (UT) Sample Questions - Set 3joshuagohejNo ratings yet

- 09Document10 pages09anonimasutokumeiNo ratings yet

- Assignments: Program: Mba Ib Semester-IiDocument13 pagesAssignments: Program: Mba Ib Semester-IiSekla ShaqdieselNo ratings yet

- La Consolacion College Manila: Finman IiDocument14 pagesLa Consolacion College Manila: Finman Iigerald calignerNo ratings yet

- Sup Questions 4Document17 pagesSup Questions 4Anonymous bTh744z7E6No ratings yet

- Soal Uas MK Gasal 2021-2022 KkiDocument6 pagesSoal Uas MK Gasal 2021-2022 KkiRifqi RinaldiNo ratings yet

- ECO120 Apr 2009Document12 pagesECO120 Apr 2009Azie MahmoodNo ratings yet

- 2017 12 Economics Sample Paper 02 Ans t9939Document6 pages2017 12 Economics Sample Paper 02 Ans t9939Bharat BhushanNo ratings yet

- Intermediate Group II Test Papers (Revised July 2009)Document55 pagesIntermediate Group II Test Papers (Revised July 2009)Sumit AroraNo ratings yet

- 8103-Managerial Economics - Executive MBA - Question PaperDocument4 pages8103-Managerial Economics - Executive MBA - Question Papergaurav jainNo ratings yet

- Economics Final Exam SolutionsDocument4 pagesEconomics Final Exam SolutionsPower GirlsNo ratings yet

- BAFB3013 Financial ManagementDocument9 pagesBAFB3013 Financial ManagementSarah ShiphrahNo ratings yet

- CVP Analysis Tutorial: Break-Even, Contribution Margin & Profit CalculationDocument6 pagesCVP Analysis Tutorial: Break-Even, Contribution Margin & Profit CalculationMan yeeNo ratings yet

- FAM Nov 14 Practice Questions - : Answers Investment Appraisal Project BDocument8 pagesFAM Nov 14 Practice Questions - : Answers Investment Appraisal Project Bmohsin1024No ratings yet

- PS3 ADocument10 pagesPS3 AShrey BudhirajaNo ratings yet

- Case Study 16-3 Bill FrenchDocument28 pagesCase Study 16-3 Bill FrenchShah 6020% (2)

- Variable Costing vs. Absorption CostingDocument3 pagesVariable Costing vs. Absorption CostingLaraNo ratings yet

- eco 文書Document19 pageseco 文書Cindy LamNo ratings yet

- Quiz Management AccountingDocument8 pagesQuiz Management AccountingLouise Kyle NgoNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Chapter On CVP 2015 - Acc 2Document16 pagesChapter On CVP 2015 - Acc 2nur aqilah ridzuanNo ratings yet

- Tutorial 4 5 - FA MA QuestionDocument6 pagesTutorial 4 5 - FA MA Questionyongjin95No ratings yet

- Working Capital ManagementDocument17 pagesWorking Capital ManagementMpho Peloewtse TauNo ratings yet

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- Final Exam Questions on Financial ManagementDocument3 pagesFinal Exam Questions on Financial ManagementAnaSolitoNo ratings yet

- Lecture 8 NotesDocument9 pagesLecture 8 NotesAna-Maria GhNo ratings yet

- MT Exam - Strategic Cost ManagementDocument8 pagesMT Exam - Strategic Cost ManagementMarilou DomingoNo ratings yet

- IFRS 15 Revenue - Out-Of-Class practice-ENDocument9 pagesIFRS 15 Revenue - Out-Of-Class practice-ENDAN NGUYEN THENo ratings yet

- MAS Ass1Document4 pagesMAS Ass1Tin BulaoNo ratings yet

- Exam61 05Document9 pagesExam61 05Rabah ElmasriNo ratings yet

- MS-MidtermExam 5thyrABSA 2019 AnsDocument8 pagesMS-MidtermExam 5thyrABSA 2019 AnsKarla OñasNo ratings yet

- ECO 301 - Economic Study MethodsDocument8 pagesECO 301 - Economic Study MethodsHerson Marvin LealNo ratings yet

- Tutorial 6 QDocument5 pagesTutorial 6 Qmei tanNo ratings yet

- 38 Marginal CostingDocument9 pages38 Marginal CostingAbhishek SinhaNo ratings yet

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhNo ratings yet

- MCQ Marginal Cost QuestionsDocument3 pagesMCQ Marginal Cost Questionsunknown nooneNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Market Research and AnalysisDocument22 pagesMarket Research and AnalysisJimmy DuldulaoNo ratings yet

- SAMPLE There Are Experts Who Write A Business PlanDocument16 pagesSAMPLE There Are Experts Who Write A Business PlanEmmanuel MwilaNo ratings yet

- Practice Question -2 Portfolio ManagementDocument5 pagesPractice Question -2 Portfolio Managementzoyaatique72No ratings yet

- FXDocument119 pagesFXyahooshuvajoyNo ratings yet

- Marketing Management Chapter 15Document22 pagesMarketing Management Chapter 15Soumya Jyoti BhattacharyaNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document11 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- 7 Int Parity RelationshipDocument40 pages7 Int Parity RelationshipumangNo ratings yet

- Tesla Case SolutionDocument2 pagesTesla Case SolutionMarutiNo ratings yet

- Register of Cash in Bank and Other Related Financial TransactionsDocument10 pagesRegister of Cash in Bank and Other Related Financial TransactionsJoel Dawn Tumanda Sajorga100% (1)

- Walmart's competitive advantage through low-cost strategiesDocument9 pagesWalmart's competitive advantage through low-cost strategiesLovely De Castro0% (1)

- The Best Metric of Success For CompaniesDocument100 pagesThe Best Metric of Success For CompaniesKasim TatićNo ratings yet

- WFS Item LabelingDocument2 pagesWFS Item LabelingAhsanur KabirNo ratings yet

- Embedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)Document46 pagesEmbedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)skasnerNo ratings yet

- Ndubueze 09 PH DDocument450 pagesNdubueze 09 PH DJoy MainaNo ratings yet

- Nguyễn Đức Anh-chap-12-TOMDocument3 pagesNguyễn Đức Anh-chap-12-TOMĐức Anh LeoNo ratings yet

- The Impact of Digital Media and Technology On The Marketing MixDocument40 pagesThe Impact of Digital Media and Technology On The Marketing MixFatin IzzatiNo ratings yet

- 215MI5202 Nhóm 3 Gap Predicting Consumer TastesDocument34 pages215MI5202 Nhóm 3 Gap Predicting Consumer TastesNguyên Nguyễn Ngọc PhươngNo ratings yet

- Economics For Pharmaceutical ManagementDocument29 pagesEconomics For Pharmaceutical ManagementTifa IstiwaNo ratings yet

- Business Strategy LO1Document135 pagesBusiness Strategy LO1Shreya KanjariyaNo ratings yet

- Exercise 3: Chapter 3Document5 pagesExercise 3: Chapter 3ying huiNo ratings yet

- Dyer2013 PDFDocument574 pagesDyer2013 PDFMiguel Alejandro Diaz CastilloNo ratings yet

- Literature ReviewDocument28 pagesLiterature ReviewIshaan Banerjee50% (2)

- 21 Financial - Asset - FV - Reclassification - Sample - ProblemsDocument4 pages21 Financial - Asset - FV - Reclassification - Sample - ProblemsSheila Grace BajaNo ratings yet

- BBF Assignment Within 500 WordsDocument3 pagesBBF Assignment Within 500 WordsMuhammad RubelNo ratings yet