Professional Documents

Culture Documents

Solutions To End-Of-Chapter Problems: BE D Ce D e U

Uploaded by

Mhd AminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions To End-Of-Chapter Problems: BE D Ce D e U

Uploaded by

Mhd AminCopyright:

Available Formats

SOLUTIONS TO END-OF-CHAPTER PROBLEMS

16-1

QBE = F/(P

16-3

If the company had no debt, its required return would be:

rs,U = rRF + bU RPM = 5.5% + 1.0(6%) = 11.5%.

With debt, the required return is:

rs,L = rRF + bL RPM = 5.5% + 1.6(6%) = 15.1%.

Therefore, the extra premium required for financial risk is 15.1% - 11.5% = 3.6%.

16-2

V) = $500,000/($75 - $50) = 20,000.

If wd = 0.2, then wce = 1 0.2 = 0.8. So D/S = wd/we = 0.2/0.8.

bU = b/[1 + (1-T)(D/S)]

= 1.15/[1 + (1-0.40)(0.2/0.8)] = 1.0.

16-4

S = (1

16-5

S = (1 wd)(Vop) = (1 1/3)($900) = $600 million.

P = [S + (D D0)] / n0 = [$600 + ($300 $0)]/30 = $30.

16-6

n = n0

16-7

a. Here are the steps involved:

(1)

(2)

wd)(Vop) = (1

(D/P) = 60

0.4)($500) = $300 million.

($150/$7.5) = 60 20 = 40 million.

Determine the variable cost per unit at present, V:

Profit

$500,000

50(V)

V

= P(Q) - FC - V(Q)

= ($100,000)(50) - $2,000,000 - V(50)

= $2,500,000

= $50,000.

Determine the new profit level if the change is made:

New profit = P2(Q2) - FC2 - V2(Q2)

= $95,000(70) - $2,500,000 - ($50,000 - $10,000)(70)

= $1,350,000.

(3)

Determine the incremental profit:

Profit = $1,350,000 $500,000 = $850,000.

Answers and Solutions: 16 - 3

(4)

Estimate the approximate rate of return on new investment:

Return = Profit/Investment = $850,000/$4,000,000 = 21.25%.

Since the return exceeds the 15 percent cost of equity, this analysis suggests that the

firm should go ahead with the change.

b. The change would increase the breakeven point:

Old:

QBE =

New: QBE =

P V

$2,000,000

= 40 units.

$100,000 $50,000

$2,500,000

= 45.45 units.

$95,000 $40,000

c. It is impossible to state unequivocally whether the new situation would have more or

less business risk than the old one. We would need information on both the sales

probability distribution and the uncertainty about variable input cost in order to make

this determination. However, since a higher breakeven point, other things held

constant, is more risky. Also the percentage of fixed costs increases:

Old:

FC

$2,000 ,000

=

= 44.44%.

FC V(Q)

$2,000 ,000 $2,500 ,000

New:

FC2

$2,500,000

=

= 47.17%.

FC2 V2 (Q 2 )

$2,500,000 $2,800,000

The change in breakeven points--and also the higher percentage of fixed costs-suggests that the new situation is more risky.

Answers and Solutions: 16 - 4

16-8

a. Expected ROE for Firm C:

ROEC = (0.1)(-5.0%) + (0.2)(5.0%) + (0.4)(15.0%)

+ (0.2)(25.0%) + (0.1)(35.0%) = 15.0%.

Note: The distribution of ROEC is symmetrical. Thus, the answer to this problem

could have been obtained by simple inspection.

Standard deviation of ROE for Firm C (for convenience, we express returns in

percentage form rather than in decimal form):

C

0.1( 5.0 15.0) 2

0.2(25.0 15.0) 2

0.1( 20) 2

0.2(5.0 15.0) 2

0.1(35.0 15.0) 2

0.2( 10 ) 2

40 20 0 20 40

0.4(0) 2

120

0.4(15.0 15.0) 2

0.2(10) 2

11.0%.

0.1( 20) 2

b. According to the standard deviations of ROE, Firm A is the least risky, while C is the

most risky. However, this analysis does not take into account portfolio effects-c.

its apparent riskiness would be reduced.

= BEP = 5.5%. Therefore, Firm A uses no financial leverage and has

no financial risk. Firm B and Firm C have ROE > BEP, and hence both use leverage.

Firm C uses the most leverage because it has the highest ROE - BEP = measure of

ROE

Answers and Solutions: 16 - 5

16-9

a. Original value of the firm (D = $0):

We are given that the book value of asset is equal to the market value of assets, so the

value is $3,000,000. Alternatively, we can calculate the value as the sum of the debt

(which is zero) and the stock (200,000 shares at a price of $15 per share):

V = D + S = 0 + ($15)(200,000) = $3,000,000.

Original cost of capital:

WACC = wd rd(1-T) + wcers

= 0 + (1.0)(10%) = 10%.

With financial leverage (wd=30%):

WACC = wd rd(1-T) + wcers

= (0.3)(7%)(1-0.40) + (0.7)(11%) = 8.96%.

Because growth is zero, FCF is equal to EBIT(1-T). The value of operations is:

Vop =

FCF

WACC

( EBIT )(1 T)

WACC

($500,000 )(1 0.40)

$3,348,214 .286 .

0.0896

Increasing the financial leverage by adding $900,000 of debt results in an increase in

b. Using its target capital structure of 30% debt, the company must have debt of:

D = wd V = 0.30($3,348,214.286) = $1,004,464.286.

Therefore, its value of equity is:

S = V D = $2,343,750.

Alternatively, S = (1-wd)V = 0.7($3,348,214.286) = $2,343,750.

The new price per share, P, is:

P = [S + (D D0)]/n0 = [$2,343,750 + ($1,004,464.286

= $16.741.

Answers and Solutions: 16 - 6

0)]/200,000

c. The number of shares repurchased, X, is:

X = (D D0)/P = $1,004,464.286 / $16.741 = 60,000.256

60,000.

The number of remaining shares, n, is:

n = 200,000

60,000 = 140,000.

Initial position:

EPS = NI/n0

= [(EBIT Int.)(1-T)] / n0

= [($500,000 0)(1-0.40)] / 200,000 = $1.50.

With financial leverage:

EPS = [($500,000 0.07($1,004,464.286))(1-0.40)] / 140,000

= [($500,000 $70,312.5)(1-0.40)] / 140,000

= $257,812.5 / 140,000 = $1.842.

Thus, by adding debt, the firm increased its EPS by $0.342.

d. 30% debt:

TIE =

EBIT

EBIT

=

.

I

$70,312 .5

Probability

0.10

0.20

0.40

0.20

0.10

TIE

( 1.42)

2.84

7.11

11.38

15.64

The interest payment is not covered when TIE < 1.0.

occurring is 0.10, or 10 percent.

The probability of this

Answers and Solutions: 16 - 7

16-10 a. Present situation (50% debt):

WACC = wd rd(1-T) + wcers

= (0.5)(10%)(1-0.15) + (0.5)(14%) = 11.25%.

V=

FCF

WACC

70 percent debt:

( EBIT )(1 T ) ($13.24)(1 0.15)

= $100 million.

WACC

0.1125

WACC = wd rd(1-T) + wcers

= (0.7)(12%)(1-0.15) + (0.3)(16%) = 11.94%.

V=

FCF

WACC

( EBIT )(1 T ) ($13.24)(1 0.15)

= $94.255 million.

WACC

0.1194

30 percent debt:

WACC = wd rd(1-T) + wcers

= (0.3)(8%)(1-0.15) + (0.7)(13%) = 11.14%.

V=

FCF

WACC

( EBIT )(1 T )

WACC

16-11 a.

($13 .24 )(1 0.15)

= $101.023 million.

0.1114

U=b/(1+

(1-T)(D/S))=1.0/(1+(1-0.40)(20/80)) = 0.870.

b. b = bU (1 + (1-T)(D/S)).

At 40 percent debt: bL = 0.87 (1 + 0.6(40%/60%)) = 1.218.

rS = 6 + 1.218(4) = 10.872%

c. WACC = wd rd(1-T) + wcers

= (0.4)(9%)(1-0.4) + (0.6)(10.872%) = 8.683%.

V=

FCF

WACC

( EBIT )(1 T) ($14.933)(1 0.4)

= $103.188 million.

WACC

0.08683

Answers and Solutions: 16 - 8

16-12 Tax rate = 40%

bU = 1.2

rRF = 5.0%

rM rRF = 6.0%

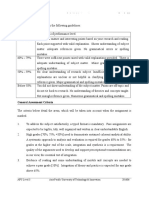

From data given in the problem and table we can develop the following table:

0.00

0.20

0.40

0.60

0.80

D/A

E/A

1.00

0.80

0.60

0.40

0.20

0.0000

0.2500

0.6667

1.5000

4.0000

D/E

7.00%

8.00

10.00

12.00

15.00

rd

4.20%

4.80

6.00

7.20

9.00

rd(1

T)

1.20

1.38

1.68

2.28

4.08

Levered

betaa

12.20%

13.28

15.08

18.68

29.48

Notes:

These beta estimates were calculated using the Hamada equation,

b = bU[1 + (1 T)(D/E)].

b

These rs estimates were calculated using the CAPM, rs = rRF + (rM rRF)b.

c

These WACC estimates were calculated with the following equation:

WACC = wd(rd)(1 T) + (wce)(rs).

rsb

12.20%

11.58

11.45

11.79

13.10

Answers and Solutions: 16 - 9

You might also like

- Solutions to End-of-Chapter ProblemsDocument12 pagesSolutions to End-of-Chapter ProblemsHadia ZafarNo ratings yet

- Chapter 16 AssignmentDocument13 pagesChapter 16 Assignmentshoaiba1No ratings yet

- Tugas FM CH 14 SD 17 - Fitriyanto - NewDocument12 pagesTugas FM CH 14 SD 17 - Fitriyanto - NewiyanNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument7 pagesSolutions To End-Of-Chapter ProblemsYaam MedwedNo ratings yet

- Optimal Capital Structure for Zippy PastaDocument11 pagesOptimal Capital Structure for Zippy PastaMira miguelitoNo ratings yet

- Capital Structure Decisions: Part I: Answers To End-Of-Chapter QuestionsDocument8 pagesCapital Structure Decisions: Part I: Answers To End-Of-Chapter Questionssalehin1969No ratings yet

- CFM4 Solns Chap 08Document5 pagesCFM4 Solns Chap 08Sultan AlghamdiNo ratings yet

- Cost of Capital Brigham Answer KeyDocument16 pagesCost of Capital Brigham Answer KeyRommel Lubon75% (4)

- Chapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument19 pagesChapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- Numerical Example:: Calculating Cost of CapitalDocument5 pagesNumerical Example:: Calculating Cost of CapitalurdestinyNo ratings yet

- Fitriyanto - Financial Management Asignment - CH 14 15Document6 pagesFitriyanto - Financial Management Asignment - CH 14 15iyanNo ratings yet

- FM Assignment 7 - Group 4Document7 pagesFM Assignment 7 - Group 4Puspita RamadhaniaNo ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- Chapter 14Document44 pagesChapter 14Hery PrambudiNo ratings yet

- CH19Document8 pagesCH19Lyana Del Arroyo OliveraNo ratings yet

- Finman Asnwer KeyDocument6 pagesFinman Asnwer KeyLopez, Azzia M.No ratings yet

- Kewangan Korporat LatihanDocument4 pagesKewangan Korporat LatihanfahmiyyahNo ratings yet

- Wacc SolutionsDocument8 pagesWacc SolutionssrassmasoodNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Mgt201 Solved SubjectiveDocument17 pagesMgt201 Solved Subjectivezahidwahla1No ratings yet

- Chapter 13 - Basic - ET3Document3 pagesChapter 13 - Basic - ET3anthony.schzNo ratings yet

- 5 - Cost of CapitalDocument6 pages5 - Cost of CapitaloryzanoviaNo ratings yet

- Chapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalDocument7 pagesChapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalMASPAKNo ratings yet

- Practice Problems SolutionsDocument13 pagesPractice Problems SolutionsEMILY100% (1)

- Capital Structure: Aamer ShahzadDocument52 pagesCapital Structure: Aamer Shahzadmaham qaiserNo ratings yet

- 14W-Ch 16 Capital Structure Decisions - BasicsDocument31 pages14W-Ch 16 Capital Structure Decisions - BasicsMuhammadHammadNo ratings yet

- The Cost of Capital: Answers To End-Of-Chapter QuestionsDocument21 pagesThe Cost of Capital: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- Solutions To End-Of-Chapter Problems 11Document6 pagesSolutions To End-Of-Chapter Problems 11weeeeeshNo ratings yet

- Cost of CapitalDocument9 pagesCost of CapitalFahad RahimNo ratings yet

- Chapter 10 SolutionsDocument8 pagesChapter 10 Solutionsalice123h2150% (2)

- Capital StructureDocument52 pagesCapital StructureIbrar IshaqNo ratings yet

- FM COE FineDocument14 pagesFM COE FineBenzon Agojo OndovillaNo ratings yet

- Capital Structure and Gearing - Solutions To The Remaining QuestionsDocument4 pagesCapital Structure and Gearing - Solutions To The Remaining QuestionsGadafi FuadNo ratings yet

- Present Value of Cash Flow Stream $2.8MDocument9 pagesPresent Value of Cash Flow Stream $2.8Misgigles157No ratings yet

- Modigliani & Miller + WACCDocument39 pagesModigliani & Miller + WACCNaoman ChNo ratings yet

- Chapter 12 - ET3Document6 pagesChapter 12 - ET3anthony.schzNo ratings yet

- FM II Assignment 17 Solution 19Document3 pagesFM II Assignment 17 Solution 19RaaziaNo ratings yet

- Capital Structure & Leverage - ExercisesDocument11 pagesCapital Structure & Leverage - ExercisesDrehfcie100% (1)

- Gitman - IM - ch11 (CFM)Document19 pagesGitman - IM - ch11 (CFM)jeankoplerNo ratings yet

- Final TestDocument9 pagesFinal TestIqtidar KhanNo ratings yet

- Solutions to End-of-Chapter ProblemsDocument6 pagesSolutions to End-of-Chapter ProblemsayeshadarlingNo ratings yet

- Calculating Cost of CapitalDocument10 pagesCalculating Cost of CapitalMelissaNo ratings yet

- On capital structure, dividend policy and bankruptcy costsDocument3 pagesOn capital structure, dividend policy and bankruptcy costsAdi AliNo ratings yet

- ECON S-190 Mock Final Exam SolutionsDocument6 pagesECON S-190 Mock Final Exam SolutionsADITYA MUNOTNo ratings yet

- Brooks Problem SolutionsDocument25 pagesBrooks Problem Solutionsimperdible0No ratings yet

- Lahore School of Economics Financial Management II The Cost of CapitalDocument3 pagesLahore School of Economics Financial Management II The Cost of CapitalDaniyal AliNo ratings yet

- 333893Document12 pages333893Char MonNo ratings yet

- Eva ProblemsDocument10 pagesEva Problemsazam4989% (9)

- Engineering Economy 8th Edition Blank Solutions ManualDocument38 pagesEngineering Economy 8th Edition Blank Solutions Manualleogreenetxig100% (17)

- Engineering Economy 8th Edition Blank Solutions Manual Full Chapter PDFDocument45 pagesEngineering Economy 8th Edition Blank Solutions Manual Full Chapter PDFaffreightlaurer5isc100% (10)

- MGT201 Subj SHortnotesDocument15 pagesMGT201 Subj SHortnotesmaryamNo ratings yet

- Bank Overdrafts, Bank Loans and Ordinary Shares AnalysisDocument6 pagesBank Overdrafts, Bank Loans and Ordinary Shares AnalysissyddrazNo ratings yet

- Seminar 5Document6 pagesSeminar 5vofmichiganrulesNo ratings yet

- RWJ CHPT 17Document23 pagesRWJ CHPT 17coffeedanceNo ratings yet

- Tutorial 5Document4 pagesTutorial 5Mohamed HamedNo ratings yet

- Capital Structure and LeverageDocument51 pagesCapital Structure and LeverageGian Alexis FernandezNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- WALMART Organizational Behavior - Docx RDocument15 pagesWALMART Organizational Behavior - Docx RLibyaFlower100% (1)

- Assessment Grade:: AQ015-3.5-3 CORP Individual Assignment Page 1 of 3Document3 pagesAssessment Grade:: AQ015-3.5-3 CORP Individual Assignment Page 1 of 3Mhd AminNo ratings yet

- Portfolio Management AssignmentDocument24 pagesPortfolio Management AssignmentMhd AminNo ratings yet

- MAHSA/HiU Assignment for Marketing ManagementDocument3 pagesMAHSA/HiU Assignment for Marketing ManagementMhd AminNo ratings yet

- Solutions To End-Of-Chapter Problems: BE D Ce D e UDocument7 pagesSolutions To End-Of-Chapter Problems: BE D Ce D e UMhd AminNo ratings yet

- DellDocument11 pagesDellbug_phamNo ratings yet

- Solutions To End-Of-Chapter Problems: BE D Ce D e UDocument7 pagesSolutions To End-Of-Chapter Problems: BE D Ce D e UMhd AminNo ratings yet

- Understanding Control AccountsDocument19 pagesUnderstanding Control AccountsMhd Amin0% (1)

- FA 2 Chapter 11 Manufacturing AccountsDocument20 pagesFA 2 Chapter 11 Manufacturing AccountsMhd AminNo ratings yet

- Portfolio TheoryDocument2 pagesPortfolio TheoryMhd AminNo ratings yet

- Co Curricular Studies - Marking SchemeDocument1 pageCo Curricular Studies - Marking SchemeMhd AminNo ratings yet

- Chapter Three - The Employment Contract - Student - SDocument16 pagesChapter Three - The Employment Contract - Student - SMhd AminNo ratings yet

- PRMGT Assignment Q 22jan2014 V2Document9 pagesPRMGT Assignment Q 22jan2014 V2Jegathis PalanivelooNo ratings yet

- What Is Case StudiesDocument4 pagesWhat Is Case StudiesagathaNo ratings yet