Professional Documents

Culture Documents

WORKING CAPITAL MANAGEMENT ADVISORY SERVICES

Uploaded by

Jonas MondalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WORKING CAPITAL MANAGEMENT ADVISORY SERVICES

Uploaded by

Jonas MondalaCopyright:

Available Formats

MANAGEMENT ADVISORY SERVICES

EXERCISES

Working Capital Policy

1

. Real Company has P8,000,000 in current assets, P3,500,000 of which are considered

permanent current assets. In addition, the firm has P6,000,000 invested in fixed assets. Real

Company wishes to finance all fixed assets and permanent current assets plus half of its

temporary current assets with long-term financing costing 15 percent. Short-term financing

currently costs 10 percent. Real Company's earnings before interest and taxes are

P2,200,000. Income tax rate is 40 percent.

Working Capital Management

A. What was Amores total debt in 2002?

B. How much new, long-term debt financing will be needed in 2003?

4

How much would Real Company's earnings after taxes under this financing plan?

2

A firm that is in the process of preparing its financial plan for the upcoming year has estimated

the following current assets (in P000,000) for the year.

Month

CA

Month

CA

Month

CA

Jan

19.2

May

36.6

Sept

26.9

Feb

21.6

June

43.8

Oct

25.5

Mar

24.5

Jul

40.5

Nov

23.4

Apr

33.4

Aug

34.4

Dec

20.7

The KRAM Company had the following data for the current year, 2004:

Sales, 2004

Sales, 2005

Items that vary directly with sales:

Assets

Liabilities

Net profit margin

Payout ratio

1. Compute the projected additional financing needed for 2005.

2. Compute the projected additional financing needed for 2005 under each assumption:

A. Payout ratio is 55%

1. How much will the firms permanent level of assets be for the coming year?

C. Sales next year is P5,000,000 and the payout ratio is 40%.

3. Compute the maximum temporary financing requirement of the firm.

External Financing Needed

3

. At year-end 2002, total assets for Amore Inc. were P1.2 million and accounts payable were

P375,000. Sales, which in 2002 were P2.5 million, are expected to increase by 25% in 2003.

Total assets and accounts payable are proportional to sales, and that relationship will be

maintained. Amore typically uses no current liabilities other than accounts payable. Common

stock amounted to P425,000 in 2002, and retained earnings were P295,000. Amore plans to

sell new common stock in the amount of P75,000. The firms profit margin on sales is 6

percent, 60 percent of earnings will be retained.

Exercises & Problems

45%

15%

15%

45%

Required:

The firms fixed assets should remain constant at P40 million. Owners equity is forecast to be

P25 million. Working capital policy requires that 50% of maximum current assets be financed

with permanent financing.

2. Compute the permanent financing requirement of the firm.

P4,000,000

5,500,000

B. Net profit margin is 10% and payout ratio is 30%

The 2003 sales of Reign Co. amounted to P8 million. The dividend payout ratio is 30%. The

percent of sales in each balance sheet item that varies directly with sales are expected to be

as follows:

Cash

8%

Receivables

15%

Inventories

16%

Net fixed assets

30%

Accounts payable

12%

Accrued expenses

6%

Net profit rate

9%

Required:

Page 1 of 9

MANAGEMENT ADVISORY SERVICES

Working Capital Management

A. Suppose that in 2004 sales increased by 25% over 2003 sales. How much additional

(external) capital will be required?

C. Calculate the amount of negotiated financing required to support the firms cash

conversion cycle.

B. What would happen to capital requirement if Reign can increase its sales by 40% and the

payout ratio is increased to 40%?

D. How could management reduce the cash conversion cycle?

8

A firm that has an annual opportunity cost of 12% is contemplating installation of a lockbox

system at an annual cost of P90,000. The system is expected to reduce mailing time by 2

days, reduce processing time by 1.5 days, and reduce check clearing time by 1 day. If the firm

collects P300,000 per day, would you recommend the system?

Calma Company uses a continuous billing system that results in average daily receipts of

P750,000. The company treasurer estimates that a proposed lock-box system could reduce its

collection time by 2 days.

Cash Management

6

. Samson Corporation, a leading producer of automobile batteries, turns out 1,500 batteries a

day at a cost of P600 per battery for materials and labor. It takes the firm 22 days to convert

raw materials into a battery. Samson allows its customers 40 days in which to pay for the

batteries, and the firm generally pays suppliers in 30 days.

A. What is the length of Samson's cash conversion cycle?

B. At a steady state in which Samson produces 1,500 batteries a day, what amount of

working capital must it finance?

A. How much cash would the lock-box system free up for the company?

B. What is the maximum amount that Calma would be willing to pay for the lock-box system

if it can earn 6 percent on available short-term funds?

C. By what amount could Samson reduce its working capital financing needs if it was able to

stretch its payables deferral period to 35 days?

D. Samson's management is trying to analyze the effect of a proposed new production

process on the working capital investment. The new production process would allow

Samson to decrease it s inventory conversion period to 20 days and to increase its daily

production to 1,800 batteries. However, the new process would cause the cost of

materials and labor to increase to P700. Assuming the change does not affect the

receivables collection period (40 days) or the payables deferral period (30 days), what will

be the length of the cash conversion cycle and the working capital financing requirement if

the now production process is implemented?

7

Abbey Products is concerned about managing cash efficiently. On the average, inventories

turns over 5 times, and accounts receivable are collected in 60 days. Accounts payable are

paid approximately 30 days after they arise. The firms spends P30 million on operating cycle

investments each year, at a constant rate. Assuming a 360-day year.

A. Calculate the firms operating cycle

B. Calculate the firms cash conversion cycle

Exercises & Problems

C. If the lock-box system could be arranged at an annual cost of P45,000, what would be the

net gain from instituting the system?

10

. Syl Company projects that cash outlays of P45 million will occur uniformly throughout the year.

Syl plans to meet its cash requirements by periodically selling marketable securities from its

portfolio. The firms marketable securities are invested to earn 12 percent, and the cost per

transaction of converting securities to cash P30.

A. What is the optimal transaction size for transfer from marketable securities to cash?

B. What will be Syls average cash balance?

C. Compute the annual cost of cash based on optimal transaction size

Receivables Management

11

. McPan Company sells on terms of 3/10, net 30. Total sales for the years are P900,000. Forty

percent of the customers pay on the 10th day and take discounts; the other 60 percent pay, on

average, 40 days after their purchases. Assume 360 days per year.

Page 2 of 9

MANAGEMENT ADVISORY SERVICES

A. What is the days sales outstanding?

Working Capital Management

16

. The Electra Car Company purchases 20,000 units of a major component part each year. The

firm's order costs are P200 per order and the carrying cost per unit is P2 per year.

B. What is the average amount of receivables?

A. Compute the total inventory costs associated with placing orders of 20,000, 10,000,

5,000, 1,000.

C. What would happen to average receivables if McPan toughened up on its collection policy

with the result that all no-discount customers paid on the 30th day?

B. Determine the EOQ for the component parts.

12

. S Mart has sales of P3 million. Its credit period and average collection periods are both 30

days, and 1.5% of its sales end as bad debts. The manager intends to extend the credit term

to 45 days which will increase sales to P3.3 million. However, bad debt losses on the

incremental sales would be 3%. Costs of products and related expenses amount to 40%,

exclusive of the cost of carrying receivables of 15% and bad debt expenses. Assuming 360

days a year, what incremental cost of investment is required to support the change in policy?

17

. Ever Company is considering switching from level production to seasonal production in order

to lower very high inventory costs. Average inventory levels would decline by P300,000 but

production costs would rise about P40,000 because of additional startups and other

inefficiencies. The firm's cost of financing inventory balances is 15%.

A. Should the firm switch to seasonal production? (ignore income taxes)

13

. Dessa, Inc. currently has sales of P2.5 million. Its credit period and days sales outstanding

(DSO) are both 30 days, and 1 percent of its sales end up as bad debts. The credit manager

estimates that, if the firm extends its credit period to 45 days so that its days sales outstanding

increases to 45 days, sales will increase by P250,000, but its bad debt losses on the

incremental sales would be 2.5 percent. Variable costs are 60 percent, and the cost of carrying

receivables, k, is 12.5 percent. Assume a tax rate of 40 percent and 360 days per year.

A. Compute the incremental investment required to finance the increase in receivables if the

change is effected.

B. What would be the incremental cost of carrying receivables?

C. What would be the effect of those changes in net income?

Inventory Management

14

. Wilbur Co. last year reported sales of P10,000,000 and an inventory turnover ratio of 2. The

company is now adopting a just-in-time inventory system. If the new system is able to reduce

the firm's inventory level and increase the firm's inventory turnover to 5, while maintaining the

same level of sales, how much cash will be freed up?

B. At what interest rate would the cost of financing additional inventory under level

production be equal to the added production costs of seasonal production?(ignore income

taxes)

C. Answer (A) and (B) if the applicable income tax rate is 40 percent.

Trade Credit

18

. Cash discount Decisions. The credit terms for each of three suppliers are shown below:

Supplier A

Supplier B

Supplier C

Supplier D

2/10 n/55

3/10 n/55

2/15 n/45

2/10 n/30

A. Determine the annual approximate cost of giving up the cash discount from each supplier.

B. Assuming that the firm needs short-term financing, recommend whether it would be better

to give up the cash discount or take the discount and borrow from a bank at 20% annual

interest. Evaluate each supplier separately using your findings in Question A.

15

. Tri Company's financial plan for next year- shows sales of P72 million and cost of sales of P45

million. It expects short-term interest rates to average 10% for the coming year. It aims to

increase inventory turnover form the present 9 times to 12 times next year. How much is the

incremental benefits in form of cost savings that can be achieved from the plan?

Exercises & Problems

C. Assuming that the entity continuously foregoes the cash discount, compute the annual

effective cost of giving up the discount on each supplier.

Page 3 of 9

MANAGEMENT ADVISORY SERVICES

Working Capital Management

Short-term Loan

19

. Divina Mendez, owner of DM Company is negotiating with Island City Bank for a P1M, 1-year

loan. Island City Bank has offered DM Company the following alternatives. Calculate the

effective annual interest rate for each alternative. Which alternative has the lowest effective

annual interest rate?

60. Barangay Bank has agreed to lend the money at a 12% rate with a 15% compensating

balance requirement. Townbank will lend at a 13% interest rate on a discounted loan from

three months.

A. What is the effective rate of interest charged by each bank?

A. A 12.5 percent annual rate on a simple interest loan, with no compensating balance

required and interest due at the end of the year.

B. What is the cost of foregoing the discount?

C. How much would Tyler have to borrow from each bank in order to take the discount?

B. A 9.25 percent annual rate on a simple interest loan, with a 20 percent compensating

balance required and interest again due at the end of the year.

D. Suppose that Tyler normally banks with Barangay Bank and maintains deposit balance of

P15,000, what amount would have to be borrowed and what would the effective interest

rate be?

C. A 8.75 percent annual rate on a discount loan, with a 20 percent compensating balance.

D. A 8.75 percent annual rate on a discount loan, with a 20 percent compensating balance

and an existing cash balance of P150,000

E. A 8.75 percent annual rate on a discount loan, with a 20 percent compensating balance

which earns 5% interest income.

F. A 8.75 percent annual rate on a discount loan, with a 20 percent compensating balance

and an existing cash balance of P150,000. The bank balance earns 5% interest income.

Redo requirement (A) to (F) assuming the loan is for four (4) months.

Short-term Financing Alternatives

20

. Lance Hardware can buy equivalent materials from two-distributors. Supplier A offers term

1/10, net 30 whereas Supplier B provides terms of 2/15, net 60.

22

. Dela Merced, owner of DM Company is negotiating with Island City Bank for a P500,000, 1year loan. Island City Bank has offered DM Company the following alternatives. Calculate the

effective annual interest rate for each alternative. Which alternative has the lowest effective

annual interest rate?

A. A 12 percent annual rate on a simple interest loan, with no compensating balance

required and interest due at the end of the year.

B. A 9 percent annual rate on a simple interest loan, with a 20 percent compensating

balance required and interest again due at the end of the year.

C. An 8.75 percent annual rate on a discount loan, with a 15 percent compensating balance.

D. Interest is figured as 8 percent of the P50,000 amount, payable at the end of the year, but

the P50,000 is repayable in monthly installments during the year.

A. If Lance foregoes the discount, which of the two suppliers should it purchase from if

supply prices are comparable.

B. If Lance can borrow from Lending Bank at a 16%, should it forego the discount?

C. If in (B) above the bank requires a 20% compensating balance for the loan, should the

firm forego the discount?

21

. Tyler Company needs P100,000 to take advantage of a discount based on terms of 3/10, net

Exercises & Problems

Page 4 of 9

MANAGEMENT ADVISORY SERVICES

Working Capital Management

MULTIPLE CHOICE

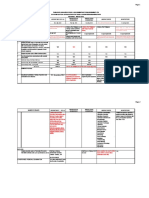

1. May Co. has total fixed assets of P100,000 and no current liabilities. The table below displays

its wide variation in current asset components.

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Cash

P 20,000

P 10,000

P 15,000

P 20,000

Accounts receivable

66,000

25,000

47,000

88,000

Inventory

20,000

65,000

59.000

10,000

Total

P106,000

P100,000

P121,000

P118,000

If May's policy is to finance all fixed assets and half the permanent current assets with longterm financing and rest with short time-financing, what is the level of long-term financing?

A. P68,000

C. P150,000

B. P100,000

D. P155,625

2. Silver Company has the following ratios: A*/S = 1.6; L*/S = 0.4: profit margin = 0.10; and

dividend payout ratio = 0.45, or 45 percent. Sales last year were P100 million. Assuming that

these ratios will remain constant and that all liabilities increase spontaneously with increases in

sales, what is the maximum growth rate Silver Company can achieve without having to employ

nonspontaneous external funds?

*Spontaneous assets and liabilities

A. 3.9 percent

C. 7.8 percent

B. 4.8 percent

D. 9.6 percent

3. Color Paint Company has plants in 3 major cities. Sales for last year were P100 million, and

the balance sheet at year-end is similar in percentage of sales to that of previous years (and

this will continue in the future). All assets (including fixed assets) and current liabilities will vary

directly with sales. Color Paint is already using assets at full capacity.

Balance Sheet (In million pesos)

Assets

Current assets

P50

Fixed assets

Total.

40

P90

Liability and Stockholders Equity

Accounts payable and accruals

Notes payable - long term

Common stock

Retained earnings

Total

P25

30

15

20

P90

Color Paint has an after-tax profit margin of 5 percent and a dividend payout ratio of 30

Exercises & Problems

percent.

If sales grow by 10 percent next year, the required new financing (RNF) to finance the

expansion is

A. P4,850,000

C. P2,650,000

B. P3,000,000

D. P5,000,000

4. The Gold Company has an inventory conversion period of 75 days, a receivables conversion

period of 38 days, and a payable payment period of 30 days. What is the length of the firm's

cash conversion cycle?

A. 83 days

C. 113 days

B. 67 days

D. 45 days

5. Texas Company turns out 200 calculators a day at a cost of P250 per calculator for materials

and variable conversion cost. It takes the firm 18 days to convert raw materials into calculator.

Texas usual credit terms to its customers is 30 days, and the firm generally pays its suppliers

in 20 days. If the foregoing cycles are constant, what amount of working capital must Texas

finance?

A. P1,400,000

C. P2,400,000

B. P900,000

D. P1,800,000

6. Hep Inc., has a total annual cash requirement of P9,075,000 which are to be paid uniformly.

Hep has the opportunity to invest the money at 24% per annum. The company spends, on the

average, P40 for every cash conversion to marketable securities.

What is the optimal cash conversion size?

A. P60,000

C. P45,000

B. P55,000

D. P72,500

7. Collectrite Company sells on terms 3/10, net 30. Total sales for the year are P900,000. Forty

percent of the customers pay on the tenth day and take discounts; the other 60 percent pay,

on average, 45 days after their purchases. What is the average amount of receivables?

A. P70,000

C. P77,200

B. P77,500

D. P67,500

8. Palma Company's budgeted sales for the coming year are P40,500,000 of which 80% are

expected to be credit sales at terms of n/30. Palma estimates that a proposed relaxation of

credit standards will increase credit sales by 20% and increase the average collection period

from 30 days to 40 days. Based on a 360-day year, the proposed relaxation of credit to

standards will result in an expected increase in the average accounts receivable balance of

Page 5 of 9

MANAGEMENT ADVISORY SERVICES

A. P540,000

B. P2,700,000

Working Capital Management

C. P900,000

D. P1,620,000

9. The Tempo Company has an inventory conversion period of 60 days, a receivable conversion

period of 30 days, and a payable payment period of 45 days. The Tempo's variable cost ratio is

60 percent and annual fixed costs of P600,000. The current cost of capital for Tempo is 12%. If

Tempo's annual sales are P3,375,000 and all sales are on credit, what is the firm's carrying

cost on accounts receivable, using 360 days year?

A. P281,250

C. P20,250

B. P168,750

D. P56,250

10. Globe, Inc. is considering changing its credit terms from 2/15, net 30, to 3/10, net 30. In order

to speed collections. At present, 40 percent of Globe's customers take the 2 percent discount.

Under the new term, discount customers are expected to rise to 50 percent. Regardless of the

credit terms, half of the customers who do not take the discount are expected to pay on time,

whereas the remainder will pay 10 days late. The change does not involve a relaxation of

credit standards; therefore bad debt losses are not expected to rise above their present 2

percent level. However, the more generous cash discount terms are expected to increase

sales from P2 million to P2.6 million per year.

Globe's variable cost ratio is 75 percent, the interest rate on funds invested in accounts

receivable is 9 percent, and the firm's income tax rate is 40 percent

What are the days sales outstanding (DSO) before- and after the- change of credit policy?

A. 27 days and 22.5 days, respectively

C. 22.5 days and 27 days, respectively

B. 22.5 days and 21.5 days, respectively

D. 21.5 days and 22.5 days respectively

11. If a firm purchases raw materials from its supplier on a 2/10, n/50 term, the equivalent annual

effective interest (using 360-day year) of continuously giving up a cash discount and making

payment on the 50th day is

A. 14 percent

C. 12.29 percent

B. 19.94 percent

D. 14.69 percent

Questions 12 & 13 are based on the following information.

A firm buys on terms of 2/10, net 30, but generally does not pay until 40 days after the invoice date.

Its purchases total P1,080,000 per year.

12. How much "non-free" trade credit does the firm use on average each year?

A. P120,000

C. P60,000

B. P90,000

D. P30,000

13. What is approximate cost of the "non-free" trade credit?

A. 16 2%

C. 21.9%

B. 19.4%

D. 24.5%

14. A company obtained a short-term bank loan of P500,000 at an annual interest rate of 8%. As a

condition of the loan, the company is required to maintain a compensating balance of

P100,000 in its checking account. The checking account earns interest at an annual rate of

3%. Ordinarily, the company maintains a balance of P50,000 in its account for transaction

purposes. What is the effective interest rate of the loan?

A. 7.77%

C. 9.44%

B. 8.50%

D. 8.56%

Questions 15 thru 18 are based on the following information.

You plan to borrow P100,000 from your bank, which offers to lend you the money at a 15 percent

nominal, or stated, rate on a 1-year loan.

15. What is the effective interest rate if the loan is discount loan?

A. 17.65%

C. 17.50%

B. 13.00%

D. 30.00%

16. What is the approximate effective interest rate if the loan is an add-on interest loan with 12

monthly payments?

A. 17.65%

C. 20.00%

B. 15.00%

D. 26.50%

17. What is the effective interest rate if the loan is a discount loan with a 10 percent compensating

balance?

A. 17.65%

C. 17.50%

B. 20.00%

D. 26.50%

18. Under the terms of question no. 17, how much would you have to borrow to have the use of

P100,000?

A. P100,000

C. P120,000

B. P111,110

D. P133,333

Exercises & Problems

Page 6 of 9

MANAGEMENT ADVISORY SERVICES

Working Capital Management

19. Three suppliers of baseball equipment offer different credit terms to City Sports. X Co. offer

terms of 1 / 15, net 30. Y Enterprises offers terms of 1/10, net 30. Z Inc. offers terms of 2/10,

net 60. City Sports would have to borrow from a bank at an annual rate of 10% in order to take

any cash discounts. Which one of the following would be the most attractive for City Sports?

A. Purchase from X and pay in 30 days

B. Purchase from X, pays in 15 days, and borrows any money needed from the bank

C. Purchase from Y and pay in 30 days

D. Purchase from Z and pay in 60 days

20. Gees Pipeline, Inc., has developed plans for new pump that will allow more economical

operation of the companys oil pipelines. Management estimates that P2,400,000 will be

required to put this new pump into operation. Funds can be obtained from a bank at 10

percent discount interest, or the company can finance the expansion by delaying to payment

to its suppliers. Presently, Gees purchases under terms of 2/10, net 40, but management

believes payment could be delayed 30 additional days without penalty; that is, payment could

be made in 70 days. Which means of financing should Gees use? (Use the approximate cost

of trade credit.)

A. Trade credit, since the cost is about 12.24 percent.

B. Trade credit, since the cost is about 3.13 percentage points less than the bank loan

C. Bank loan, since the cost is about 1.13 percent points less than trade credit

D. Bank loan, since the cost is about 3.13 percentage points less than trade credit

SOLUTIONS

Exercises & Problems

Page 7 of 9

. 1.

2. Permanent financing = 61,900,000

3. Max. temporary financing = 21,900,000

. A.

P480,000

(1,200,000 295,000 425,000)

B. P18,750

(206,250 112,500) 75,000

127,500

Permanent assets = 59,200,000 (40,000,000 + 19,200,000)

(40,000,000 + 43,800,000 x 0.50)

(43,800,000 x 0.5)

1

2a

2b

2c

Inc in SNA450,000.450,000.450,000.300,000Inc in RE(453,750)(311,250)(385,000)(450,000)

(3,750)78,75065,000(150,000)

.

(a)

(b)

Inc in SNA1,020,0001,632,000Inc in RE(630,000)(604,800)390,0001,027,200

. A.

Cash conversion cycle = 32 days (22 + 40 30)

B. 28.8 million

(1,500 x 600 x 32)

C. 4.5 million

(35 30) x 1,500 x 600

D. New CCC = 30 days

(20 + 40 30)

WC 37.8 million

1,800 x 700 x 30

.

B.

C.

D.

. A.

P1,500,000

(P750,000 x 2)

B. P90,000

P1,500,000 x 6%

C. P45,000

P90,000 P45,000

10

. A.

P150,000

B. P75,000

C. P18,000

11

. A.

B. AR = 70,000

C. AR = 55,000

A.

132 days

(72 + 60)

102

(132 30)

8.5 M

(30 M x 102/360

reduce days AR (increase AR turnover), reduce days inventory(increase inventory turnover), increase days AP

72,000

(300,000 x 4.5 days x 12%) 90,000

DSO = 28 days (10 x 40%) + (40 x 60%)

(900,000/360 x 28)

DSO = 22 days (10 x 40% +30 x 60%)

12

OldNewChangeP&L EffectSales3,000,0003,300,000300,000x 60%180,000Bad debts %S1.5%

3%Bad

debts45,0009,000(9,000)DSO3045AR250,000412,500162,500VC ratiox 40%Inc. in AR Invt65,000x 15%(9,750)Inc. Inc

bef tax161,250

13

OldNewChangeP&L EffectSales2,500,0002,750,000250,000x 0.4100,000Bad debtsx

2.5%(6,250)DSO3045AR208,333343,750135,417

x 0.6Inc. in AR Invt81,250.20x 12.5%(10,156.28)Inc. Inc bef

tax83,593.720.6Incl Net Income50,156.23

14

. 3,000,000

OldNewDiffSales10 million10 millionInventory turnover25Inventory5,000,0002,000,0003,000,000

15

. 125,000 (1,250,000 x 10%)

OldNewDiffCost of Sales45 million45,000,000Inventory turnover912Inventory5,000,0003,750,0001,250,000

16

. A.

Order Size# of ordersOrder CostCarrying CostTotal20,0001 20020,00020,20010,0002 40010,00010,400 5,0004 800

5,000 5,800 1,000204,000 1,000 5,000

2(20,000)(200

B. 2,000

17

. A.

B. 13.33%

C. Answer is the same

Yes, cost savings of 5,000 (300,000 x 15%) 40,000

(40/300)

18

.

daysXNominalEffectiveSupplier A2/10 net 5545816.33%17.54%Supplier B3/10 net 5545824.74%27.59%Supplier C2/15

net 45301224.49%27.43%Supplier D2/10 net 30201836.73%43.86%

19

.

One-year4-monthsA.12.5%12.5%B.11.5625%

9.25 8011.5625%C.12.28%

20)11.35%D.10.145%9.5%E.10.88%10.05%F.9.86%9.23%

8.75

20

. A.

Supplier A = 18.18%

Supplier B = 16.33%

B. Borrow at 16%, pay supplier within discount period

C. 20% (16/80), Yes, forego the discount.

21

A.

Barangay Bank = 14.12%

Townbank = 13.44%

(3.25/96.75) x 4

B. Trade discount = 22.27%

C. Barangay Bank = 117,647 (100,000 0.85)

Townbank = 103,359 (100,000 0.9675)

D. Principal = 100,000,

Effective interest rate = 12%

(12/85)

22

. A.

B. 11.25%

1148% 8.75/(100 8.75 15)

8/50

9/80

12%

C.

D. 16%

(100 8.75

You might also like

- FINANCE TESTBANKDocument9 pagesFINANCE TESTBANKKeir GaspanNo ratings yet

- Xex10 - Working Capital Management With SolutionDocument10 pagesXex10 - Working Capital Management With SolutionJoseph Salido100% (1)

- Maximizing Cash Inflows Through Collection MethodsDocument57 pagesMaximizing Cash Inflows Through Collection MethodsMadelle Q. PradasNo ratings yet

- MSQ-09 - Working Capital FinanceDocument11 pagesMSQ-09 - Working Capital FinanceMark Edward G. NganNo ratings yet

- The Operating Results in Summarized Form For A Retail ComputerDocument1 pageThe Operating Results in Summarized Form For A Retail ComputerAmit PandeyNo ratings yet

- Chapter 15 Managing ShortDocument44 pagesChapter 15 Managing ShortLede Ann Calipus Yap0% (1)

- Cash and Receivables ReportingDocument29 pagesCash and Receivables ReportingJunneth Pearl Homoc0% (1)

- Exam 7Document15 pagesExam 7mohit verrmaNo ratings yet

- International School Taxation Exam GuideDocument5 pagesInternational School Taxation Exam GuideROMAR A. PIGANo ratings yet

- Exercise 3 BudgetingDocument4 pagesExercise 3 BudgetingGabrielleNo ratings yet

- Homework NoDocument3 pagesHomework NoPrinceMontalanNo ratings yet

- Working Capital Management SimulatedDocument9 pagesWorking Capital Management SimulatedSarah Balisacan67% (3)

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessLINDIE MARIE RABENo ratings yet

- MSQ-08 Capital BudgetingDocument14 pagesMSQ-08 Capital BudgetingMarilou Olaguir Saño100% (3)

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocument15 pagesMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad EstoqueNo ratings yet

- Direct and Absorption Costing 2014Document15 pagesDirect and Absorption Costing 2014Aj de CastroNo ratings yet

- Financial Management BSATDocument9 pagesFinancial Management BSATEma Dupilas GuianalanNo ratings yet

- Ratio Reviewer 2Document15 pagesRatio Reviewer 2Edgar Lay60% (5)

- CTDI Tax Formatting QuestionsDocument13 pagesCTDI Tax Formatting QuestionsMaryane AngelaNo ratings yet

- Comprehensive Accounting Final Preboard ReviewDocument13 pagesComprehensive Accounting Final Preboard ReviewJims Leñar CezarNo ratings yet

- FS Analysis SimulatedDocument8 pagesFS Analysis SimulatedSarah BalisacanNo ratings yet

- Managerial AccountingDocument9 pagesManagerial AccountingChristopher Price100% (1)

- Multiple Choice Theory: Choose The Best Answer. 1 Point EachDocument9 pagesMultiple Choice Theory: Choose The Best Answer. 1 Point EachPao SalvadorNo ratings yet

- QuestionsDocument71 pagesQuestionsChan Chan50% (4)

- Learning MaterialsDocument38 pagesLearning MaterialsBrithney ButalidNo ratings yet

- Calculate net income accrual basis rental cash receiptsDocument3 pagesCalculate net income accrual basis rental cash receiptsSophia AprilNo ratings yet

- Test BDocument5 pagesTest Bhjgdjf cvsfdNo ratings yet

- Chapter 13: Capital Structure and LeverageDocument66 pagesChapter 13: Capital Structure and LeverageNguyen Hai AnhNo ratings yet

- Financial Statements Analysis and Cash FlowsDocument8 pagesFinancial Statements Analysis and Cash FlowstanginamotalagaNo ratings yet

- Capital Budgeting Payback Period CalculationDocument6 pagesCapital Budgeting Payback Period CalculationWendyMayVillapaNo ratings yet

- Accounting principles for branches and agenciesDocument4 pagesAccounting principles for branches and agenciesJohn Bryan100% (1)

- Assignment and Quiz For Finals (September To October 2016)Document23 pagesAssignment and Quiz For Finals (September To October 2016)Jhuneth DominguezNo ratings yet

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- Grand Manufacturing net profit calculationDocument10 pagesGrand Manufacturing net profit calculationRichfredlyn Moreno100% (1)

- CAD ROI and Residual IncomeDocument7 pagesCAD ROI and Residual IncomeRen100% (1)

- 5 6116113633723285546Document45 pages5 6116113633723285546Renelyn David100% (1)

- P3Document18 pagesP3Rezzan Joy MejiaNo ratings yet

- Part 4C (Quantitative Methods For Decision Analysis) 354Document102 pagesPart 4C (Quantitative Methods For Decision Analysis) 354Noel Cainglet0% (1)

- Mas 2 Final ExamDocument3 pagesMas 2 Final ExamMax50% (2)

- Chapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceDocument15 pagesChapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceadssdasdsadNo ratings yet

- Master Budget, BudgetingDocument2 pagesMaster Budget, BudgetinggeminailnaNo ratings yet

- WC QUIZ Theory and ProblemDocument5 pagesWC QUIZ Theory and ProblemRachelle Anne M PardeñoNo ratings yet

- 14 x11 Financial Management BDocument10 pages14 x11 Financial Management BChristine Elaine Laman100% (3)

- RewDocument69 pagesRewMargenete Casiano100% (2)

- Foreign Exchange Rates and TransactionsDocument29 pagesForeign Exchange Rates and TransactionsYing LiuNo ratings yet

- Ae 114 - PrelimDocument8 pagesAe 114 - PrelimMa Angelica BalatucanNo ratings yet

- AssignDocument13 pagesAssignvnp100% (1)

- Financial Management Quiz AnalysisDocument14 pagesFinancial Management Quiz AnalysisAdiansyach Patonangi100% (1)

- TEST BANK FINANCIAL ACCOUNTING THEORYDocument15 pagesTEST BANK FINANCIAL ACCOUNTING THEORYRod100% (2)

- Mercader Cherry May LDocument8 pagesMercader Cherry May LKindred WolfeNo ratings yet

- Universal College of Parañaque: Working Capital ManagementDocument23 pagesUniversal College of Parañaque: Working Capital ManagementEmelita ManlangitNo ratings yet

- Finals Exercise 1 - WC Management Receivables and InventoryDocument4 pagesFinals Exercise 1 - WC Management Receivables and InventoryMarielle SidayonNo ratings yet

- 06 - Working Capital Management ProblemsDocument4 pages06 - Working Capital Management ProblemsMerr Fe PainaganNo ratings yet

- Working CapitalDocument3 pagesWorking CapitalSiidolohNo ratings yet

- Finals Exercise 2 - WC Management InventoryDocument3 pagesFinals Exercise 2 - WC Management Inventorywin win0% (1)

- Quiz#1 MaDocument5 pagesQuiz#1 Marayjoshua12No ratings yet

- Diagnostic Examination (Batch 2020)Document71 pagesDiagnostic Examination (Batch 2020)KriztleKateMontealtoGelogo75% (4)

- B BDocument6 pagesB BNile Alric AlladoNo ratings yet

- Working Capital FinanceDocument27 pagesWorking Capital FinanceZenedel De JesusNo ratings yet

- Name: - Date: - QuizDocument4 pagesName: - Date: - QuizKatrine Clarisse BlanquiscoNo ratings yet

- 30 Increment 52week Money ChallengeDocument2 pages30 Increment 52week Money ChallengeCaitlin BacallanNo ratings yet

- XXXXXXXDocument17 pagesXXXXXXXJonas MondalaNo ratings yet

- Press ReleaaaaaaseDocument2 pagesPress ReleaaaaaaseJonas MondalaNo ratings yet

- Sec 35 of NIRCDocument1 pageSec 35 of NIRCjonas_1229No ratings yet

- CVDocument5 pagesCVMuhammad AdityaNo ratings yet

- Rupaul WinnersDocument1 pageRupaul WinnersJonas MondalaNo ratings yet

- Sample BitchDocument1 pageSample BitchJonas MondalaNo ratings yet

- Chapter 15 Problems UHFM 7th EditionDocument13 pagesChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Itinerary PDFDocument5 pagesItinerary PDFJonas MondalaNo ratings yet

- Get A Grip, Get A Life, and Et Over ItDocument1 pageGet A Grip, Get A Life, and Et Over ItJonas MondalaNo ratings yet

- Transportation ExpensesDocument9 pagesTransportation ExpensesJonas MondalaNo ratings yet

- Session 5 Capital BudgetingDocument6 pagesSession 5 Capital BudgetingKevin PhamNo ratings yet

- Grab Receipt ADR-2335218-2-036Document1 pageGrab Receipt ADR-2335218-2-036Jonas MondalaNo ratings yet

- Date Time Charge CodeDocument2 pagesDate Time Charge CodeJonas MondalaNo ratings yet

- Love Will Find A Way Chords TabDocument2 pagesLove Will Find A Way Chords TabJonas MondalaNo ratings yet

- Kimi No NawaDocument1 pageKimi No NawaJonas MondalaNo ratings yet

- Resume Mondala JonathanDocument5 pagesResume Mondala JonathanJonas MondalaNo ratings yet

- MANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSDocument7 pagesMANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSJonas MondalaNo ratings yet

- Chapter 15 Problems UHFM 7th EditionDocument13 pagesChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Income Statement For MeatDocument36 pagesIncome Statement For MeatJonas MondalaNo ratings yet

- Battle of The Voices Season 3 Blind AuditioneesDocument1 pageBattle of The Voices Season 3 Blind AuditioneesJonas MondalaNo ratings yet

- Chapter 15 Problems UHFM 7th EditionDocument13 pagesChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- PRC List of RequirementsDocument24 pagesPRC List of RequirementscharmainegoNo ratings yet

- CCH Axcess Paperless and Data Rich White PaperDocument6 pagesCCH Axcess Paperless and Data Rich White PaperJonas MondalaNo ratings yet

- XXXXXXXDocument17 pagesXXXXXXXJonas MondalaNo ratings yet

- Chapter 15 Problems UHFM 7th EditionDocument13 pagesChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Thomasian Resume FormatDocument5 pagesThomasian Resume FormatJonas MondalaNo ratings yet

- Rachelle Pomperada Ramos #2675 A. Bautista St. Punta Sta. Ana, ManilaDocument2 pagesRachelle Pomperada Ramos #2675 A. Bautista St. Punta Sta. Ana, ManilaJonas MondalaNo ratings yet

- Letter For WalwalanDocument1 pageLetter For WalwalanJonas MondalaNo ratings yet

- Lovett School offers over $2.5M in financial aidDocument2 pagesLovett School offers over $2.5M in financial aidrdmcneilNo ratings yet

- NTCC Final Report by Riya JainDocument16 pagesNTCC Final Report by Riya Jainriya jainNo ratings yet

- Prospectus - L&T BondsDocument163 pagesProspectus - L&T Bondsajay_ghuwalewalaNo ratings yet

- Financial Literacy Exam ReviewDocument3 pagesFinancial Literacy Exam ReviewDiane GuilaranNo ratings yet

- Module 016: ANTICHRESIS (Arts. 2132-2139.)Document6 pagesModule 016: ANTICHRESIS (Arts. 2132-2139.)Krisel JoseNo ratings yet

- Banking Awareness Quick Reference Guide 2015 PDFDocument64 pagesBanking Awareness Quick Reference Guide 2015 PDFRajivNo ratings yet

- WP Content Uploads FHA Waterfall Worksheet Users GuideDocument46 pagesWP Content Uploads FHA Waterfall Worksheet Users GuideKathy Westbrooke Powell-WadeNo ratings yet

- BankingDocument377 pagesBankingUzma Shafi100% (3)

- Chinabank Vehicles ListDocument10 pagesChinabank Vehicles ListrapturereadyNo ratings yet

- Chapter 07-Bank Loans: Name: Class: DateDocument11 pagesChapter 07-Bank Loans: Name: Class: DateLê Đặng Minh ThảoNo ratings yet

- ErtalDocument8 pagesErtalYonatanNo ratings yet

- Math - P301 - Simple InterestDocument2 pagesMath - P301 - Simple InterestCarlos OliveroNo ratings yet

- 2 New PN 1Document2 pages2 New PN 1Ray VirayNo ratings yet

- StatconDocument299 pagesStatconruben diwasNo ratings yet

- TEST2 Actual Marking Schemes BPK30902Document6 pagesTEST2 Actual Marking Schemes BPK30902Amirah Aini100% (1)

- Consumer credit report for Prem SagarDocument3 pagesConsumer credit report for Prem SagarmohitNo ratings yet

- 133 (2012) 5 CLJ Philomena Mathalamuthu v. Mayglobe Logistics (M) SDN BHDDocument14 pages133 (2012) 5 CLJ Philomena Mathalamuthu v. Mayglobe Logistics (M) SDN BHDSrikumar RameshNo ratings yet

- Summer Internship Project ReportDocument33 pagesSummer Internship Project ReportAnkit Kumar Singh0% (1)

- Kiva Micro Funds: Inside StoryDocument13 pagesKiva Micro Funds: Inside StorySarthak MehtaNo ratings yet

- Loan Form 2021 PDFDocument5 pagesLoan Form 2021 PDFClaribelle MaquilavaNo ratings yet

- Loan Documentation EssentialsDocument13 pagesLoan Documentation EssentialsDza SunnyNo ratings yet

- TestDocument87 pagesTestRithik Reddy KothwalNo ratings yet

- Bank of America Leaks Allege Fraud Forced Placed InsuranceDocument3 pagesBank of America Leaks Allege Fraud Forced Placed Insurance83jjmack100% (1)

- Macro & Micro Finance in Dena Bank: T I M SDocument56 pagesMacro & Micro Finance in Dena Bank: T I M Skomal1989No ratings yet

- DPRPACKAGEDocument29 pagesDPRPACKAGEakki_6551No ratings yet

- Seed Processing Plant Project ReportDocument36 pagesSeed Processing Plant Project ReportPrashant Naikwadi91% (11)

- BSP officials not liable for using bank's financial data in trainingDocument94 pagesBSP officials not liable for using bank's financial data in trainingJuralexNo ratings yet

- Circuit Court Discovery RequestDocument9 pagesCircuit Court Discovery RequestMw LintonNo ratings yet

- Housing For HSTU Employees: IntroductionDocument35 pagesHousing For HSTU Employees: Introductionবায়েজিদ সরকারNo ratings yet

- AC405 Lecture 3Document9 pagesAC405 Lecture 3TINASHENo ratings yet