Professional Documents

Culture Documents

Asset Sample

Uploaded by

Dilakshini VjKumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Sample

Uploaded by

Dilakshini VjKumarCopyright:

Available Formats

CA1 ASET: Introduction

Page 1

ActEd Solutions with Exam Technique

(ASET)

Subject CA1

Introduction

This document includes all the questions from the April 2011 to September 2014

Subject CA1 exams, ie eight exam sittings in all. You should use this report as part of

your preparation for the 2015 exams.

ActEd Solutions with Exam Technique (ASET) differs from the Examiners Report in

that it includes not only a possible solution to each exam question but also:

comments to help you with your exam technique

alternative approaches to questions

references to the Subject CA1 course material.

How to use ASET

You can use this document to practise exam questions and to gain a feel for the depth

and breadth of knowledge required in the Subject CA1 exam. We recommend that you

work through this report actively, ie you should attempt the questions without reference

to your notes before reading the solutions.

Dont be disconcerted by the length of many of the solutions in ASET. You should be

aware that the solutions given here are often more detailed than would be required to

pass the exam. This is because ActEds study material is specifically designed for

distance learning and so we include extra explanation so that you can understand it

easily. Your task in the exam room is not to produce study material but to demonstrate

that you understand the Core Reading. You need to write enough to convince the

examiner that you understand the course, but not so much that you run into time

pressure.

The Actuarial Education Company

IFE: 2015 Examinations

Page 2

CA1 ASET: Introduction

Format of the solutions

The format of the solutions aims to help you easily identify the information you want.

In particular, it includes a number of icons to indicate the purpose of particular

paragraphs. The solution to each question therefore looks like this:

Solution 1

Overview

At the start of the solution to most questions there is a box like this, identified by a

globe icon. The text in this box gives an overview and relates to the question as a

whole. For example, it may include comments on the level of difficulty of the question

or how frequently the topic underlying this question has been tested in the past.

Comments or ideas about exam technique are contained in a box like this, identified

with a light-bulb icon.

The solution itself is written in normal font and without boxes. In order to show as

many valid points as possible, there may be more here than you could reasonably expect

to write in the time available: you should note that you may not need to include

everything in order to earn full marks.

Further explanation is contained in a box like this, identified by a teacher-withblackboard icon. The usual purpose of this is to help you to understand a particular

point in the solution.

At the end of each question (or sometimes each part) you may find an information box,

identified by the i icon. Here you will find other relevant information about the

question.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 ASET: Introduction

Page 3

ActEds Hints sheet

One of the best forms of preparation for the Subject CA1 exam is to practise answering

past questions. It is important to make a genuine attempt at the question without

looking at the solution or your Course Notes. However, you can sometimes be

frustrated when trying to do this, by getting stuck on a question or even being unable to

start it. In such cases, it may be that all you need is a little help or a hint in order to get

going.

ActEds Hints sheet is intended to address this need. The sheet contains a short hint for

most questions or parts of a question. Each aims to give you a little additional guidance

to help you to make a good attempt at a question, without needing to refer to your

Course Notes or the full ASET solution.

ActEds Hints sheet does not provide you with the answer, nor is it meant to be

comprehensive. Once you have attempted the question you can then look at the full

solutions for a complete analysis.

You will find ActEds Hints sheet at the back of the solutions for each exam paper.

Feedback on the style of the solutions

We welcome your views and feedback on the style of the solutions, including any

further things you would like to see included in ASET in the future. Please let us know

which parts of the material you find useful and where improvements could be made.

Please email your comments to ActEd@bpp.com.

How to increase your chances of success in the exam room

Remember that youll only have three hours (plus reading time) in the exam to prove to

the examiners that you are good enough to pass. Most well-prepared students find it

difficult to write out all of their answers in that time. The key to success in the exam

room is to write your answers efficiently.

Ideally, your answers should be:

sufficiently detailed to convince the examiners that you fully understand what

you have written

as short and succinct as possible (subject to the above).

The Actuarial Education Company

IFE: 2015 Examinations

Page 4

CA1 ASET: Introduction

Dont be too brief (or you wont score full marks for the point you are making), but

dont waffle (or youll run into time pressures and make your good points hard to find).

Remember that your aim should always be to give just enough information to convince

the examiner that you understand the points you are making.

In summary, write efficiently. Dont be too brief but dont waffle.

Examiners Reports

ASET is independent of the reports issued by the Board of Examiners and is intended to

complement them, not to replace them. (Students may wish to refer directly to the

reports of the Board of Examiners as part of their study programme.) The views

expressed in this document are the views of the ActEd tutors, and are not necessarily

the same as the views of the Examiners. The independence of the Board of Examiners

is an important concept that the profession is keen to safeguard.

There are occasions when the ideas and solutions in this report differ slightly from those

in the Examiners Reports. This is inevitable given the large number of points covered

and the extent to which there is more than one way to answer certain questions. You

should note, however, that the differences are sufficiently minor as to have no impact on

pass/fail type decisions.

Subject CA1 exam pass rates

Sept 2011

April 2012

Sept 2012

April 2013

Sept 2013

April 2014

Sept 2014

% of students passing at

this sitting

April 2011

The table below shows the pass rates for the Subject CA1 exam sittings covered in this

ASET.

43

47

47

51

46

52

43

54

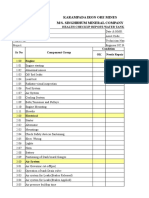

ASET Cross Reference Grid

The grid on the following pages shows you how the past exam questions covered in this

ASET relate to the topics in the Subject CA1 Course Notes for 2015. Numbers in bold

are Paper 1 questions. Number not in bold are Paper 2 questions. Italics indicate that

only part of a question relates to a particular topic.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 ASET: Introduction

Page 5

CA1 ASET Cross Reference Grid

How to do a professional job

Stakeholders

External environment

Regulation

3,

7

Introduction to financial products and

customer needs

Benefits overview and providers of

benefits

Life insurance overview and products

General insurance overview and

products

Cashflows of simple products

3

5

6,4

7

1

3,

6

2,

4

5,5

1,6

5,6

7,6

3,4

1,7

5

6,

4

2

4

7,1

,7

4,7

1,7

,1

10

Contract design

11

Project management

12

Capital project appraisal

13

Money markets

14

Bond markets

15

Equity markets

16

Property markets

17

Futures and options

18

Collective investment schemes

19

Overseas markets

The Actuarial Education Company

Sept 2014

April 2014

Sept 2013

April 2013

What is Subject CA1 all about?

Sept 2012

Chap

April 2012

Topic

Sept 2011

Part

April 2011

Exam sitting

7,7

6

5,

4

6

5

1,7

,6

5

4

6

7

5,6

5,6

5,6

,7

6

5

4

6

6,3

5,6

IFE: 2015 Examinations

All study material produced by ActEd is copyright and is sold

for the exclusive use of the purchaser. The copyright is owned

by Institute and Faculty Education Limited, a subsidiary of

the Institute and Faculty of Actuaries.

Unless prior authority is granted by ActEd, you may not hire

out, lend, give out, sell, store or transmit electronically or

photocopy any part of the study material.

You must take care of your study material to ensure that it is

not used or copied by anybody else.

Legal action will be taken if these terms are infringed. In

addition, we may seek to take disciplinary action through the

profession or through your employer.

These conditions remain in force after you have finished using

the course.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Questions

Page 1

Subject CA1 Paper 1 April 2011 Questions

If you get stuck on any question dont look at the solutions (yet!) but have a look at

ActEds Hints sheet, which youll find at the end of the solutions for this paper. Then

have another attempt at the question, using the hints to get you started.

A company provides a range of benefits to its employees.

(i)

Describe the key factors that influence the level and timing of contributions for

these benefits.

[3]

(ii)

Outline why the expected cost of the benefit payments may be different from the

price charged by an insurance company to insure these benefits.

[5]

[Total 8]

(i)

Describe, in the context of domestic property insurance, the following terms:

(a)

Excess

(b)

No claims discount

(c)

Exclusion clause.

[8]

A six storey residential property is divided into three self-contained apartments, each of

which occupies two floors of the building.

(ii)

Explain why property insurance premiums could vary depending on the position

of the apartment within the building.

[3]

[Total 11]

The Actuarial Education Company

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Questions

Page 2

A commercial television company produces and broadcasts a successful quiz show,

which has had high viewing figures over a number of years. After a short break, the

show is to be re-launched for an expected run of two years.

The format is that contestants, who are members of the public, have to answer a series

of general knowledge questions, which get progressively harder. The contestant wins

prizes depending on how many questions they get right. The more correct questions the

higher the prize. Should the contestant answer twelve questions correctly, they win a

jackpot of 10,000,000. The next highest prize, for answering eleven questions

correctly, is 1,000,000.

In conjunction with the show, the company intends to introduce a new competition for

viewers. A simple multiple-choice question will be asked during each show. Viewers

will be able to phone in their answers. Of the viewers who phone in with the correct

answer, one will be selected at random and a 5,000 cash prize will be given.

(i)

Outline the risks specific to this show for which the company may wish to take

out insurance cover.

[5]

(ii)

Discuss the factors that will contribute to the moral hazard an insurance

company will face when providing such cover.

[4]

(iii)

Set out the benefits to the insurance company, other than profits to be made on

the contract, of providing this cover.

[3]

[Total 12]

(i)

List reasons why a benefit scheme may need to calculate provisions.

[4]

A large benefit scheme has recently completed a valuation for supervisory purposes.

The basis for the supervisory valuation is more prudent than a best estimate of future

experience. The scheme is required to disclose a summary of the supervisory valuation

report to beneficiaries.

(ii)

List the information from the supervisory valuation report that should be

disclosed to beneficiaries.

[4]

The schemes investment advisor is about to conduct a review of the schemes

investment strategy.

(iii)

Discuss why the results of the supervisory valuation may not be appropriate for

use by the investment advisor in conducting this review. Your answer should

include commentary both on relevant specific assumptions and on broader

general issues.

[9]

[Total 17]

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Questions

Page 3

A large bank operates many business lines in many countries. One of the products it

offers is a derivative based on the level of property prices in a particular country with a

developed property market. The derivative increases in value if a specific property

price index (published by a local property surveyor) falls in value. An investor is

considering purchasing the derivative.

(i)

Comment, from the perspective of the investor, on the importance of different

financial risks relating to the derivative and the bank.

[9]

The bank has one employee in this country, who is assigned to price and monitor the

derivative.

(ii)

Describe the operational risks associated with this arrangement.

[4]

(iii)

Suggest ways the bank could reduce the operational risk presented by this

arrangement.

[3]

The derivative is frequently combined with a second derivative linked to the

profitability of the banks mortgage portfolio and then traded as a single investment.

The second derivative increases in value as profitability of the mortgage portfolio

increases.

(iv)

Discuss why the market price of this combined investment:

(a)

may be less volatile than the price of the separate derivatives; or

(b)

may be more volatile than the price of the separate derivatives.

[3]

[Total 19]

A company which writes general insurance business is developing a new line of

insurance policies aimed at university students.

(i)

List the types of insurance it could offer.

(ii)

Outline how the assumptions used to price these policies may differ from those

used for the companys existing business.

[9]

[Total 14]

The Actuarial Education Company

[5]

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Questions

Page 4

An airline that only operates within its domestic country is considering expanding by

offering overseas flights. It has started a project to decide the geographical region to

which it will commence flights, from a shortlist of three regions.

(i)

Outline the steps necessary to identify the risks facing the project.

[5]

(ii)

Identify the major risks to the airline of operating in overseas markets, and for

each risk suggest a way to mitigate that risk.

[8]

The airline has decided to focus on a region in which the authorities only offer

three-year licences to new airlines. For this region the airlines project team has

identified three possible scenarios which may occur.

Probability of occurrence

Set up costs

Net revenue:

Year 1

Year 2

Year 3

Scenario A

30%

m

Scenario B

59%

m

Scenario C

20%

m

100

110

120

50

50

50

40

40

45

30

30

30

(iii)

Calculate the Net Present Value of the project, using a discount rate of 5% per

annum.

[3]

(iv)

(a)

Comment on the probability of profit and loss on the project; and

(b)

List other factors which may influence the decision on whether to invest

in this project.

[3]

[Total 19]

END OF PAPER

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 1

Subject CA1 Paper 1 April 2011 Solutions

Overview of the paper

This is a reasonable paper, covering a range of topics. There is a distinct focus on risk,

with several (parts of) questions (Question 2(ii), Question 3(i)(ii) and Question 5 and

Question 7(i)(ii)) covering different aspects of this topic.

Broad issues relating to insurance are covered in Question 1(ii) and Question 3(iii),

with general insurance in particular covered in Question 2, Question 3 and Question 6.

Benefit schemes make an appearance in Question 1(i) and Question 4 and investment

topics appear in Question 4(iii) and Question 5(i)(iv). Question 7 is a relatively

straightforward question on Capital project appraisal a topic that is examined very

frequently in Subject CA1 exams.

There is a good mixture of straightforward bookwork, applied bookwork and harder

application questions. Question 4(iii) is probably the toughest question on the paper

and as such, good performance on this question is essential. Question 7 involves a

straightforward net present value calculation.

Although there are some fairly big (19 mark) questions on the exam, each is nicely

broken down into parts. The biggest individual part of a question is 9 marks.

Several questions on the paper may have been inspired by recent events / real-world

situations. For example, Question 3 describes a quiz show that may have been inspired

by the popular (UK) quiz show Who wants to be a millionaire? and Question 6 may

arisen from consideration of specialist insurance companies that target university

students (such as Endsleigh in the UK). That said, do make sure you make your

answers broad enough and not just based on recent experience.

Dont forget the Hints Sheet that youll find at the end of these solutions. If you are

stuck, try using this to get you started on a question.

The Actuarial Education Company

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Solutions

Page 2

Solution 1

Overview

This question is testing the material in Chapter 33, Pricing and financing strategies,

and in fact it does test both pricing and financing. Both parts to the question are

primarily bookwork.

The Examiners Report commented that this question was surprisingly poorly answered.

Students that considered benefits other than just pensions tended to score better.

(i)

Key factors influencing level and timing of contributions

There is no single section / list in the Core Reading that answers this question, however,

the relevant ideas can be found in Sections 3 and 4 of Chapter 33.

Note that the question asks for factors that influence both the level and timing of

contributions, so you may want to split your answer into these sections.

The examiners stated that consideration of the different funding methods that may be

used is not sufficient and that students needed to consider the factors that influence the

funding method.

Level of contributions

The level of contributions will be based on the cost of the benefits accruing over a

certain period.

The certainty of the benefits may affect whether or not the company decides to fund the

benefits in advance. Benefits will typically be more certain if they are:

regular

relatively small.

If the benefits are very predictable and/or small, then a PAYG approach might be

chosen. However, in most cases, money will be set aside in advance.

Timing of contributions

The sponsor may want to change the pace of funding of the scheme by paying a higher

or lower contribution in any year.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 3

Reasons for changes to the pace of funding include:

changes in the fortunes of the sponsor, eg if the sponsoring company has

performed particularly badly, it may have to cut contributions until it recovers

the opportunity cost of the contributions and alternative investment

opportunities.

(ii)

Difference in expected cost of benefits and price charged

The question asks why the price charged may not be the same as the expected cost of

the benefit payments. Again, this is not straightforward bookwork, however, the

relevant ideas can be found in Section 2 of Chapter 33.

The instruction word is outline, so you should avoid going into too much detail.

The expected cost (ie premium) could be calculated such that:

premium(s)

=

+

+

+

theoretical cost of benefit payments

expenses and commission

contribution to profit

other loadings

The contribution to expenses may be affected by the extent to which the insurer can

achieve economies of scale.

Changes may be needed for:

policyholder perceptions of the cover provided, eg the policyholder might value

having insurance cover highly, perhaps because the benefits are large relative to

the premiums

the level of competition in the market:

the more competitors, the more competitive the premium should be

(indeed the contribution to profit may be negative)

if there are few players in the market, then higher premiums could be

charged

the stage in the underwriting cycle

the strategy being followed, eg the insurance company might decide to sell the

product as a loss leader in order to:

increase market share

sell other more profitable lines of business

The Actuarial Education Company

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Solutions

Page 4

a higher premium may be charged to recoup earlier losses incurred by the insurer

the level of prudence required by the insurance company in its pricing basis.

The following questions also relate to financing:

April 2005, Paper 2, Question 7(i)(ii)

September 2008, Paper 2, Question 6(vi).

The following questions also relate to pricing (and why the premium charged is not

equal to the cost of cover):

September 2005, Paper 2, Question 5(iv)

September 2008, Paper 2, Question 5(iv).

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 5

Solution 2

Overview

This is a general insurance question in particular on domestic property insurance.

Even if you dont work in general insurance, you should have some appreciation of the

concepts being tested from your own experience of buying domestic property insurance,

motor insurance or other general insurance products.

The Examiners Report commented that this question was generally well answered.

(i)

Definitions

This question is testing your knowledge of certain Glossary definitions and your

application of those definitions to a specific product.

Glossary definitions are not frequently tested in Subject CA1 exams, so students could

be forgiven for not knowing the definitions word-for-word (and indeed examiners would

not expect you to know the definitions verbatim as long as you can convey the concept).

In any case, these terms are reasonably straightforward and you should be able to come

up with a reasonable definition yourself, which would satisfy the requirements.

The three descriptions need to merit eight marks between them, so it is worth thinking

about the areas you might want to cover. A good strategy to use here might be to start

by defining each term, give an example to clarify it, and then go on to describe how

each is relevant in the context of domestic property insurance. A good way to relate it to

domestic property insurance is to use examples of claim types / perils that are specific

to this type of insurance.

An idea generation technique that you might sometimes be able to use is to look through

the other questions in the paper and see if they help you to generate any more points.

This might be useful for part (c) here, because claims arising from moral hazard may

not be covered moral hazard is mentioned in Question 3(ii).

(i) (a) Excess

An excess is the sum, specified in the policy, that the insured must bear before any

liability falls upon the insurer. The insured pays the first E of every claim, where E is

the excess.

For example, if the excess is 100 and there is a claim for 500, then the insured will

pay the first 100 and the insurer will pay the remaining 400.

The Actuarial Education Company

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Solutions

Page 7

(i) (c) Exclusion clause

An exclusion clause sets out the events, perils or causes defined within the policy

document as being beyond the scope of the insurance cover, ie circumstances where the

insurer is not liable to pay a claim.

Examples of possible events / perils that may be excluded from domestic property

insurance are:

large-scale events / catastrophes such as war, terrorism, civil unrest

deliberate damage (of building or contents) by the policyholder

general wear and tear

criminal acts by the policyholder.

The insurer may also exclude high-risk situations, for which claims are very likely,

eg insuring a building located on a crumbling cliff face. In addition, there may be

exclusions for other causes, such as negligence (possibly arising from moral hazard),

eg a policyholder being less careful in locking the door when he/she goes out.

Exclusions may be necessary in order to ensure that premiums are affordable.

The following questions also test Glossary definitions:

April 2008, Paper 2, Question 5(i)(a)

September 2008, Paper 2, Question 5(i).

(ii)

Differences in property insurance premiums

This part of the question requires a bit more thought. You have been asked why

property insurance premiums would vary depending on whether the apartment is on the

ground and first floor, the second and third floor or the fourth and fifth floors.

Lets assume that apart from their distance from ground level, the apartments are

identical. This makes sense, given that the Examiners Report noted that better students

focussed on the position of the apartments.

A higher premium will be due to an increased likelihood of claims and/or greater claim

severity. Therefore you need to consider the different perils (ie causes) of claim, for

example, physical risks such as fire, flood, storm damage, burst pipes and also theft

risk, and how they might be different for each of the apartments.

The Actuarial Education Company

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Solutions

Page 9

Solution 3

Overview

This is an inventive applications question primarily on the topic of risk. The good

news is that the scenario you have been given isnt too complex (in fact, fans of the TV

quiz show Who wants to be a millionaire? should find this scenario rather familiar!).

The Examiners Report stated that there were a wide range of marks awarded for this

question. The best students ensured that their answers were specific to the show itself,

and the proposed insurance cover.

(i)

Risks to be insured

This question has asked for the risks specific to this show for which the company may

wish to take out insurance cover. A careful read of the question is very important here,

as you must make sure that you limit your considerations to those linked to the show,

rather than the general insurance requirements of a broadcasting company.

There are two possible ways of approaching this question:

1.

Consider the risks specific to the show and then consider which could be

reduced using insurance. You might be able to use ideas in Chapter 39, Sources

of risk to help generate ideas.

2.

Consider the different insurance products (in Chapters 7 and 8), and then

consider which of these might be appropriate to the television company.

Method 1 seems like the most appropriate approach, however, for some risks the show

might face eg low viewing figures it may be hard to obtain insurance cover.

Method 2 would probably be easier to use if you had been asked to outline the risks to

the broadcasting company, eg you might come up with products such as employers

liability and property damage insurance.

The approach used below is therefore the first approach. In the answer below, we have

linked the risks to a particular type of insurance cover for completeness, however this is

not necessary in order to score full marks.

There are 5 marks on offer, so you should be aiming for close to 10 risks to insure.

The Actuarial Education Company

IFE: 2015 Examinations

Page 10

CA1 Paper 1 ASET: April 2011 Solutions

The main risks are that:

a contestant (or perhaps too many contestants) wins the jackpot the amount

paid out is ten times the amount paid out for the next highest prize

lots of small prizes are won.

The company may be able to buy some insurance to share the cost of this risk.

The additional risks that may be covered insurance include:

the risk of needing to compensate the contestants and members of the audience

(or their estate) for accidental bodily injury, disease or death suffered, owing to

negligence of the company (public liability)

the risk of fines resulting from a failure in the phone-in, eg if a prize is not

awarded due to a failure of the system (a variant of professional indemnity)

death or serious illness of key employees (eg the show host) it may be

necessary to find a replacement at short notice, which may incur significant cost

(keyman insurance, health insurance)

the risk of failure of external suppliers (pecuniary loss insurance)

the risk of cancellation of the show two years is a relatively long intended run

time (a type of pecuniary loss insurance)

failure of employees, eg phone operators arranging for their friends to win the

phone-in competition (fidelity guarantee)

the risk of being sued by contestants, eg for unfair treatment (legal expenses

insurance)

the risk that telephone call revenue is lower than expected (if cover can be

obtained for this specific risk)

the risk of falling viewing figures (if cover can be obtained)

the risk of a fall in advertising revenue (if cover can be obtained).

(ii)

Factors contributing to moral hazard

In this type of question it would be good exam technique to firstly define the term moral

hazard. This helps ensure you stay on track with your answer and really do produce

examples that are linked to moral hazard, and there may be marks available on the

schedule for your definition.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 11

The definition in the Glossary is:

Moral hazard is the risk that an insured may attempt to take an unfair advantage of

the insurer, for example by suppressing information relevant to the assessment of risk

or by submitting a false claim.

However, moral hazard can also be thought of more widely as involving circumstances

where the policyholder takes less care as a result of having the insurance. For

example, with motor insurance, policyholders might drive less carefully if they know

they are insured!

In the answer to this question, it would be sensible to give examples of all the above

types of moral hazard.

Moral hazard is the risk that an insured may attempt to take an unfair advantage of the

insurer, for example by suppressing information relevant to the assessment of risk or by

submitting a false claim.

Moral hazard can also involve the insured acting differently, eg the insured taking less

care given the insurance cover is in place.

Both of these examples of moral hazard can lead to more and/or larger claims being

submitted.

Note that this is not the same as anti-selection which is also taking advantage of

particular aspects of an insurance contract, but within the terms offered by the insurer.

Moral hazard might arise in the following ways:

if the company is insured against (too many) jackpot wins, then it might take less

care in ensuring that the jackpot question (and the questions in the build up) is

hard enough (in fact, it might even make questions easier if this made the show

more popular!) the likelihood of this may depend on how much of each

jackpot claim the company is liable to pay

if the company has public liability insurance, it might take less care in ensuring

the safety of its contestants / audience this may depend on any legal

requirements on television companies to provide safety procedures and training,

eg to provide fire extinguishers

if the company is insured against poor ratings, then the company may take less

care to ensure it gets good ratings, eg by not advertising as much or by putting

the show in an unpopular time slot

The Actuarial Education Company

IFE: 2015 Examinations

Page 12

CA1 Paper 1 ASET: April 2011 Solutions

if the company has insurance against the show being cancelled and the

broadcasting company can make the decision to cancel the show, this leads to a

serious moral hazard

if the company has insurance against the revenue from viewer competition being

lower than expected, the company will have less incentive to run the viewer

competition well.

The insurer will try to reduce or eliminate moral hazard by:

limiting the number of claim payouts by using exclusions, eg the insurance

company would only pay out if the show gets cancelled where the cancellation is

outside of the broadcasting companys control

limiting the amount of claim payouts, eg by applying excesses and/or maximum

payout limits.

(iii)

Benefits to the insurance company (other than profit)

This part of the question is slightly tricky. You might be able to come up with a couple

of reasons why the insurance company would want to provide cover, but coming up with

3 marks worth (ie around 6 ideas) is harder.

It might help to consider the main objectives of an insurance company. High profits is

obviously a major consideration, but insurance companies will have other

(intermediate) objectives (often with the ultimate aim of increasing profits), such as:

increasing market share by selling other products to this company or to other

companies, hence increasing profits

improving its reputation and increasing public awareness of the insurer (which

should in turn increase business volumes)

achieving special benefits for the insurers employees (such as preferential

treatment to get on the quiz show).

Note that no marks would be given for stating that risk might be reduced due to

diversification as:

no information has been given on whether the insurer already sells this type of

business

this would be a relatively small policy to the insurer and so wouldnt lead to a

much diversification.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 13

Try to relate the benefits that you come up with to the company in question, for

example, it might improve its reputation by insuring a high-profile television company.

In addition, the company might let the insurer advertise itself on the show (this could be

invaluable if the previous high viewing figures are repeated).

Other benefits

The company may use this sale to increase its portfolio of business by:

selling the television company other products, eg to cover other shows, or other

risks

selling similar products to other broadcasters.

It may also be able to advertise its (individual) insurance products (eg domestic

buildings and contents insurance, private motor insurance etc) to employees of the

company and increase its customer base this way.

In addition, it might be able to negotiate with the broadcasting company to arrange

discounts on products linked to the broadcaster (eg board games) for customers who

take out insurance.

The television company may allow the insurance company to advertise its products

during the quiz show, eg just before/after advert breaks. This will be particularly

valuable if the quiz show continues to be successful and enjoy high viewing figures.

There may also be a chance for publicity during the show, eg mentioning the insurers

name.

Insuring the television company might also help to increase the insurance companys

reputation, if knowledge of this is made public. The section of the public who watch

this program may be a target market for the insurer.

It may also be the case that insuring the show leads to opportunities for the insurers

employees to be part of the audience or appear as contestants.

The following question also relates to insuring risks:

September 2005, Paper 2, Question 3(ii).

The Actuarial Education Company

IFE: 2015 Examinations

Page 14

CA1 Paper 1 ASET: April 2011 Solutions

Solution 4

Overview

This question covers the topics of benefit schemes and investment. There is a mixture of

bookwork and application.

Most students should produce a good answer to parts (i) and (ii), which are relatively

straightforward bookwork. Part (iii) is harder, requiring discussion of different bases

and the level of information available for a statutory valuation compared to an

investment strategy investigation.

(i)

Reasons for calculating provisions (for a benefit scheme)

This is (nearly) straightforward bookwork from Chapter 35 of the Course Notes on

Valuing liabilities. The only application needed is to and ensure the remaining ones are

stated in the context of a benefit scheme. This is a list question, so no explanation is

required.

A very similar question was asked in September 2009 (Paper 1, Question 5(i)).

The reasons for calculating the provisions needed by a benefit scheme:

to determine the benefit schemes liabilities to be shown in the sponsors

published accounts and reports

to determine the benefit schemes liabilities for supervisory purposes

to determine the liabilities to be shown in internal management accounts and

reports of the sponsor

to value the benefit scheme in case of merger or acquisition of the sponsor

to determine the excess of assets over liabilities and whether any discretionary

benefits can be awarded

to set future contributions to a benefit scheme, given the schemes funding

position

to value benefit improvements for a benefit scheme

to calculate discontinuance benefits, eg transfer values

to influence investment strategy

for disclosure to members

to review experience.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

(ii)

Page 15

Information to disclose

This is a question covering material in Chapter 37 of the Course Notes on Accounting

and disclosure. There have been a number of questions on disclosure and there is a

handy acronym (DISCLOSURE) that might help you remember the key ideas:

Directors pension costs

Investment strategy and performance

Surplus / deficit arising in the last year and total accrued to date

Calculation method and assumptions

Liabilities arising in the last year and total accrued to date

Options and guarantees

Sponsors contributions

Uncertainties and risks

Rights on wind up

Expenses

You need to pick well here, given this is a supervisory valuation and the information

will be at a high level. For example, it wont disclose details of individual benefits.

Instead, you should focus on the overall position of the scheme, eg the funding level.

The examiners noted that most students scored well on this part, although some diverted

on to discussing individual benefits.

There are 4 marks on offer and you have been asked to list, so you should be aiming for

8 items of information to disclose, although you can always add a couple of extra items

just in case some of your original 8 arent on the marking schedule!

value of the assets, liabilities and hence the funding level

how the funding level has changed since the last valuation and why

basis / methodology used

cashflows over the period, including benefits, expenses and contributions

investment strategy and investment return achieved

future contribution schedule

risks involved and risk management arrangements

entitlement on insolvency

number of members and changes in membership since the last valuation

The Actuarial Education Company

IFE: 2015 Examinations

Page 16

CA1 Paper 1 ASET: April 2011 Solutions

The following questions also relate to disclosure for a DB scheme:

April 2005, Paper 2, Question 6(i)

September 2010, Paper 1, Question 1

September 2010, Paper 2, Question 6(iii).

(iii)

Why results may not be appropriate for use by investment advisor

This is a tricky question. It is not immediately clear which part of the course is being

tested. Two chapters of the Course Notes spring to mind:

Chapter 35 Valuing liabilities; in particular, Section 2 (Factors affecting the

strength of basis) and Section 3.3 (Setting the assumptions with regard to the

purpose)

Chapter 48 Monitoring; in particular, Section 4 (Use of the results).

The question also clearly requires some careful consideration and application to the

specifics of the situation.

You have been told to comment on both the relevant specific assumptions as well as the

broader general issues. The chapters above should help with the latter. For the

former, you need to consider what the main assumptions are for a benefit scheme. The

key assumptions are:

mortality

investment returns

inflation (price and salary)

expenses

terms for options / guarantees.

The Examiners Report commented that students typically scored well on the

appropriate strength of basis, but failed to comment on general issues, such as the time

lapse since the valuation date, or the specific assumptions.

General issues

The main problem with using the results of the supervisory valuation to review the

schemes investment strategy is that the basis used is unlikely to be appropriate for

reviewing the strategy.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 17

The main factors affecting the strength of the basis used are:

the purpose of the valuation

the needs of the client

the requirements of any legislative or regulatory authority.

In many cases, presentation of a range of values, or values for alternative scenarios

may be more useful to the client in making any necessary decisions.

The key features of provisions for demonstrating supervisory solvency are usually:

prudence (this has been stated to be the case here)

prescription of methods / assumptions by the supervisory authority.

In addition, the valuation may have been required to assume a going concern basis or,

alternatively, a discontinuance basis.

Other rules governing the preparation of the supervisory results might concern the:

method of valuation used to value both the assets and the liabilities,

eg market-based, discounted cashflow the rules might also specify a link

between the liability valuation basis and the features (usually the yield) of the

backing assets)

assumptions used to value both the assets and the liabilities (discussed below)

types of assets than can be held, and those that can be used to demonstrate an

adequate funding level, eg admissibility requirements.

As a result of the above, the liabilities may be overstated, the assets understated, and

therefore the funding position understated so that the level of investment freedom

available is not fully appreciated.

In contrast, for the review of the schemes investment strategy, it might be preferable to:

use an overall best estimate basis, as this will give a realistic result this is

likely to be more important for setting a future investment strategy

perform projections / calculations for a potentially large number of options /

potential scenarios.

It will also be important to project the likely impact on investment choices on the

supervisory valuation basis to determine the effect.

The Actuarial Education Company

IFE: 2015 Examinations

CA1 Paper 1 ASET: April 2011 Solutions

Page 18

Other issues for consideration are:

the valuation may have been some time ago and factors relating to the scheme

may have changed, eg:

a significant change in membership, due to a recruitment or redundancy

exercise

a change in market conditions, eg a stock market crash or a different

stage in the economic cycle

one-off events, eg scheme closure

the level of detail in the statutory valuation:

the investment strategy investigation considers cashflows rather than

absolute values

the investment strategy investigation requires a detailed breakdown of

liabilities by category of member.

The investment advisor would also want to take account of whether there have been (or

will be) any constraints on fund managers past performance, such as a shortage of

cashflow within the scheme this may restrict the funds available for investment or

lead to disinvestments that may not be timed as well as would otherwise be the case.

Relevance of specific assumptions

The main assumptions used in the supervisory valuation are:

mortality

investment returns

inflation (price and salary)

expenses

terms for options / guarantees.

Mortality

Prudent assumptions (as used in the supervisory valuation and which may be

prescribed) will tend to understate mortality, ie members will be assumed to have a long

life expectancy. This means that benefit payments will be over-estimated.

If the assets used to back these liabilities are chosen to match the liabilities by term,

then longer-dated assets may be included in the supervisory valuation.

Instead, a best estimate approach should be adopted, considering a suitable table, given

the scheme membership, allowing for mortality improvements.

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 19

Investment returns

The investment advisor would want to consider the likely proceeds (in terms of amount

and timing) from a range of asset classes.

Inflation

If the benefit payments are linked to inflation, then prudence in the supervisory

valuation would dictate over- (rather than under-) estimating inflation. Inflation may

affect liabilities, eg:

the impact on pension increases, if linked to price inflation

the impact on the revaluation of pensions in deferment.

Instead, a market-related inflation rate assumption is required for the investment

strategy investigation.

Expenses

In the supervisory valuation, prudence will dictate that the expenses (which make up

part of the liabilities of the scheme) are overstated, and there may be a prescribed

loading to liabilities. However, for the investment strategy investigation, a best estimate

of expenses will be required.

Terms for options / guarantees

A best estimate allowance for the likely take up of options and terms of options /

guarantees should be included.

Options may change the timing of cashflows and this should be considered for the

investment strategy investigation. In the statutory valuation, this might have been

ignored, or, alternatively, the most expensive option may have been valued.

A consistent market-related approach should be adopted.

Other assumptions

Other assumptions also need to be considered and a best estimate value obtained,

eg withdrawals, new entrants.

The Actuarial Education Company

IFE: 2015 Examinations

Page 20

CA1 Paper 1 ASET: April 2011 Solutions

The following questions also relate to the purpose of valuing liabilities or the use of

results:

September 2007, Paper 1, Question 7(ii)

September 2008, Paper 1, Question 5(iii)

September 2009, Paper 1, Question 5(ii).

IFE: 2015 Examinations

The Actuarial Education Company

CA1 Paper 1 ASET: April 2011 Solutions

Page 45

Subject CA1 Paper 1 April 2011 ActEds Hints

Question 1

(i)

Mostly bookwork from Chapter 33, Sections 3 and 4.

(ii)

Mostly bookwork from Chapter 33, Sections 1 and 2.

Question 2

(i)

Consider the definitions in the Glossary. Now relate them to domestic property

insurance.

(ii)

Premiums vary with claim frequency and claim size. Can you identify perils

that are likely to affect different apartments to different extents or to have a

higher / lower resulting cost?

Question 3

(i)

Consider the different insurance products. Which ones could be of use to the

television company?

(ii)

Define moral hazard. How might moral hazard arise for the insurance cover you

have suggested in part (i)? How likely is moral hazard in each case?

(iii)

What other possible objectives might the insurance company have? Increased

market share? Increased publicity? How would these benefit the insurance

company?

Question 4

(i)

Bookwork from Chapter 35, Section 3.2. Remember to phrase the reasons in the

context of a benefit scheme.

(ii)

Primarily bookwork from Chapter 37, Accounting and disclosure.

(iii)

How strong should the basis be for an investment strategy review? In what ways

might the situation have changed since the statutory valuation was carried out?

List the key assumptions and consider how each one may need to be adjusted.

The Actuarial Education Company

IFE: 2015 Examinations

Page 46

CA1 Paper 1 ASET: April 2011 Solutions

Question 5

(i)

Financial risks include: market risks, credit risks, liquidity risks and business

risks. These are described in Chapter 39: do any of them apply to this situation?

Dont forget to consider both the derivative and the bank.

(ii)

Operational risks are described in Chapter 39 (Section 6) which of these risks

is most important in this situation. Role play can help: what could happen to the

individual that would mean he/she does not have a correct / available price on

each day?

(iii)

Work through your risks in part (ii) and suggest a way to mitigate each.

(iv)

Consider the circumstances in which: (a) one derivative will perform well and

the other poorly and (b) both derivatives will perform well (or poorly). One

clear example of each situation will be sufficient.

Question 6

(i)

Go through the general insurance products described in Chapter 8 and consider

those which are relevant for university students. Consider other types of

insurance that you may have purchased when you were a student.

(ii)

What are the main assumptions used to price general insurance business? How

might these assumptions (particularly those relating to claims) vary for the

different types of insurance listed in part (i)?

Question 7

(i)

Straightforward bookwork from Chapter 12, Section 5.

(ii)

Consider the different categories of risk (political, natural, economic, financial,

crime, project, business) and make sure you relate to the specific situation,

ie entering the market for overseas flights.

(iii)

Firstly, make a sensible assumption about when the cashflows occur. Next,

calculate the net present value of each scenario and then take a weighted average

to get an expected net present value.

(iv)(a) At a high level, what might you say about how profitable the project is? What is

the probability of a loss?

(iv)(b) Can you identify four big issues that should be considered? Think about the

money available, and alternative uses for it.

IFE: 2015 Examinations

The Actuarial Education Company

You might also like

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- IELTS Academic Writing: How To Write 8+ Answers For The IELTS Exam!From EverandIELTS Academic Writing: How To Write 8+ Answers For The IELTS Exam!Rating: 4.5 out of 5 stars4.5/5 (6)

- Fixed Income Coursework 18Document2 pagesFixed Income Coursework 18Baderalhussain0No ratings yet

- Ca3 Pu 15 PDFDocument10 pagesCa3 Pu 15 PDFPolelarNo ratings yet

- Actuarial Talk PDFDocument28 pagesActuarial Talk PDFAlvin KhewNo ratings yet

- CourseWork1 20122013 SolutionsDocument10 pagesCourseWork1 20122013 Solutionsyous123No ratings yet

- Laguna II Equip ElectricoDocument1,310 pagesLaguna II Equip ElectricoAntonio BmNo ratings yet

- CS2 B Chapter 1 Poisson Processes - QuestionsDocument2 pagesCS2 B Chapter 1 Poisson Processes - QuestionsSwapnil SinghNo ratings yet

- SA3 General Insurance PDFDocument4 pagesSA3 General Insurance PDFVignesh Srinivasan100% (1)

- Student Guide For Actuarial Home Based Online Examination - FinalDocument21 pagesStudent Guide For Actuarial Home Based Online Examination - FinalVishesh MalikNo ratings yet

- Extreme Event Statistics Coursework 1 2013-14Document4 pagesExtreme Event Statistics Coursework 1 2013-14yous123No ratings yet

- ST4 Pu 14 PDFDocument10 pagesST4 Pu 14 PDFPolelarNo ratings yet

- CP1 Study Guide 2021Document37 pagesCP1 Study Guide 2021yash mallNo ratings yet

- Acteduk Ct6 Hand Qho v04Document58 pagesActeduk Ct6 Hand Qho v04ankitag612No ratings yet

- m97 Speciman Coursework Assignment 2016Document40 pagesm97 Speciman Coursework Assignment 2016KELOILWE KEOTSHEPHILENo ratings yet

- CS2 Booklet 7 (Mortality Projection) 2019 FINALDocument38 pagesCS2 Booklet 7 (Mortality Projection) 2019 FINALAnsh ParmarNo ratings yet

- CM1 Mock Paper B 2021 Answers 12345Document44 pagesCM1 Mock Paper B 2021 Answers 12345vanessa8pangestuNo ratings yet

- CT1 PDFDocument6 pagesCT1 PDFfireaterNo ratings yet

- CK1 Booklet 1 PDFDocument52 pagesCK1 Booklet 1 PDFAndersonNo ratings yet

- Institute of Actuaries of India: Subject ST4 - Pensions and Other Employee BenefitsDocument4 pagesInstitute of Actuaries of India: Subject ST4 - Pensions and Other Employee BenefitsVignesh SrinivasanNo ratings yet

- CK1 Booklet 1 PDFDocument218 pagesCK1 Booklet 1 PDFAndersonNo ratings yet

- CS2 Booklet 11 (Risk Models) 2019 FINALDocument124 pagesCS2 Booklet 11 (Risk Models) 2019 FINALAnsh ParmarNo ratings yet

- CK1 Booklet 1 PDFDocument130 pagesCK1 Booklet 1 PDFAndersonNo ratings yet

- LifeInsRetirementValuation M15 AppraisalValues 181205Document46 pagesLifeInsRetirementValuation M15 AppraisalValues 181205Jeff JonesNo ratings yet

- CK1 Booklet 1 PDFDocument58 pagesCK1 Booklet 1 PDFAnderson100% (1)

- Sa2 Pu 14 PDFDocument150 pagesSa2 Pu 14 PDFPolelarNo ratings yet

- SP1 2021Document1,848 pagesSP1 2021HANSHU LIUNo ratings yet

- Actuarial SocietyDocument35 pagesActuarial Societysachdev_researchNo ratings yet

- IFoA Syllabus 2019-2017Document201 pagesIFoA Syllabus 2019-2017hvikashNo ratings yet

- Mahler S Guide To Basic RatemakingDocument145 pagesMahler S Guide To Basic Ratemakingnight_98036100% (2)

- ST5 PC 16Document1,112 pagesST5 PC 16Maryam YusufNo ratings yet

- CB3 Guide201907Document7 pagesCB3 Guide201907Ranjana DasNo ratings yet

- ct42005 2011Document404 pagesct42005 2011okotieno75% (4)

- CT6Document7 pagesCT6Vishy BhatiaNo ratings yet

- Exam MFE Study Program GuideDocument11 pagesExam MFE Study Program GuideDurga SainathNo ratings yet

- SOA Exam P SyllabusDocument3 pagesSOA Exam P SyllabusMuneer DhamaniNo ratings yet

- Actuarial ScienceDocument3 pagesActuarial SciencePriyanshuNo ratings yet

- Caa Student Actuarial Analyst Handbooknov14Document62 pagesCaa Student Actuarial Analyst Handbooknov14SiphoKhosaNo ratings yet

- CP3 Sept 2022 NotesDocument49 pagesCP3 Sept 2022 Notesharihfam0% (1)

- CT8 Financial Economics PDFDocument6 pagesCT8 Financial Economics PDFVignesh SrinivasanNo ratings yet

- SOA Recent Curriculum ChangesDocument25 pagesSOA Recent Curriculum ChangeskidNo ratings yet

- Edu 2015 Exam FM Ques Theory PDFDocument65 pagesEdu 2015 Exam FM Ques Theory PDF彭雅欣No ratings yet

- ST8 General Insurance Pricing PDFDocument4 pagesST8 General Insurance Pricing PDFVignesh SrinivasanNo ratings yet

- Benifit Pension ObligationDocument20 pagesBenifit Pension ObligationTouseefNo ratings yet

- Casualty Actuarial SocietyDocument43 pagesCasualty Actuarial SocietyChinmay P KalelkarNo ratings yet

- Statistics and Probability-Lesson 1Document109 pagesStatistics and Probability-Lesson 1Airene CastañosNo ratings yet

- GARP FRM Practice Exam 2011 Level2Document63 pagesGARP FRM Practice Exam 2011 Level2Kelvin TanNo ratings yet

- Solutions Paper - TVMDocument4 pagesSolutions Paper - TVMsanchita mukherjeeNo ratings yet

- Actuarial Science Consists of Total 15 PapersDocument5 pagesActuarial Science Consists of Total 15 PapersAkku Chaudhary100% (1)

- QM Learning Module: 1 The Time Value of Money: Nominal Risk-Free Rate Real Risk-Free Interest Rate +Document198 pagesQM Learning Module: 1 The Time Value of Money: Nominal Risk-Free Rate Real Risk-Free Interest Rate +Xi Wei100% (2)

- MFE FormulasDocument7 pagesMFE FormulasahpohyNo ratings yet

- Sa6 Pu 14 PDFDocument118 pagesSa6 Pu 14 PDFPolelarNo ratings yet

- Stolyarov MFE Study GuideDocument279 pagesStolyarov MFE Study GuideChamu ChiwaraNo ratings yet

- 2007 FRM Practice ExamDocument116 pages2007 FRM Practice Examabhishekriyer100% (1)

- LifeInsRetirementValuation M06 Profit 181205Document57 pagesLifeInsRetirementValuation M06 Profit 181205Jeff Jones100% (1)

- Lecture 1Document67 pagesLecture 1Rochana RamanayakaNo ratings yet

- Examiners ' Commentaries 2012: AC1025 Principles of AccountingDocument40 pagesExaminers ' Commentaries 2012: AC1025 Principles of AccountingManFang NeoNo ratings yet

- 2015 Commentary NewDocument49 pages2015 Commentary NewHung Faat ChengNo ratings yet

- Principles of AccountingDocument40 pagesPrinciples of Accountingzameerahmad100% (1)

- What Do These Criteria Mean?: An ExampleDocument6 pagesWhat Do These Criteria Mean?: An ExampleMax Mayol TeranaNo ratings yet

- Lateritic NickelDocument27 pagesLateritic NickelRAVI1972100% (2)

- ThaneDocument2 pagesThaneAkansha KhaitanNo ratings yet

- Participate in Safe Food Handling Practices SITXFSA002 - PowerpointDocument71 pagesParticipate in Safe Food Handling Practices SITXFSA002 - PowerpointJuan Diego Pulgarín Henao100% (2)

- Conveyor Control Using Programmable Logic ControllerDocument7 pagesConveyor Control Using Programmable Logic ControllerWann RexroNo ratings yet

- Specialty Coffee Association of Indonesia Cupping Form (ARABICA)Document1 pageSpecialty Coffee Association of Indonesia Cupping Form (ARABICA)Saiffullah RaisNo ratings yet

- SEC CS Spice Money LTDDocument2 pagesSEC CS Spice Money LTDJulian SofiaNo ratings yet

- Code ExplanantionDocument4 pagesCode ExplanantionVivek JadiyaNo ratings yet

- P. E. and Health ReportDocument20 pagesP. E. and Health ReportLESSLY ABRENCILLONo ratings yet

- PCI Bridge ManualDocument34 pagesPCI Bridge ManualEm MarNo ratings yet

- AcousticsDocument122 pagesAcousticsEclipse YuNo ratings yet

- Financial Accounting 1: Chapter 5 Cash and Short Term InvestmentDocument31 pagesFinancial Accounting 1: Chapter 5 Cash and Short Term InvestmentCabdiraxmaan GeeldoonNo ratings yet

- LS01 ServiceDocument53 pagesLS01 ServicehutandreiNo ratings yet

- BS en Iso 06509-1995 (2000)Document10 pagesBS en Iso 06509-1995 (2000)vewigop197No ratings yet

- Usm 1Document47 pagesUsm 1Abhishek KumarNo ratings yet

- Unit 4Document15 pagesUnit 4David Lopez LaraNo ratings yet

- Microeconomics Term 1 SlidesDocument494 pagesMicroeconomics Term 1 SlidesSidra BhattiNo ratings yet

- Mode of Action of Vancomycin: L D D D D DDocument8 pagesMode of Action of Vancomycin: L D D D D DNolanNo ratings yet

- LM2TB8 2018 (Online)Document252 pagesLM2TB8 2018 (Online)SandhirNo ratings yet

- Water Tanker Check ListDocument8 pagesWater Tanker Check ListHariyanto oknesNo ratings yet

- Lesson: The Averys Have Been Living in New York Since The Late NinetiesDocument1 pageLesson: The Averys Have Been Living in New York Since The Late NinetiesLinea SKDNo ratings yet

- HU - Century Station - PAL517PDocument232 pagesHU - Century Station - PAL517PTony Monaghan100% (3)

- Metalcor - 1.4507 - Alloy - F255 - Uranus 52N - S32520Document1 pageMetalcor - 1.4507 - Alloy - F255 - Uranus 52N - S32520NitinNo ratings yet

- A - PAGE 1 - MergedDocument73 pagesA - PAGE 1 - MergedGenalyn DomantayNo ratings yet

- List of Phrasal Verbs 1 ColumnDocument12 pagesList of Phrasal Verbs 1 ColumnmoiibdNo ratings yet

- Protection in Distributed GenerationDocument24 pagesProtection in Distributed Generationbal krishna dubeyNo ratings yet

- Japanese GardensDocument22 pagesJapanese GardensAnmol ChughNo ratings yet

- TRICARE Behavioral Health Care ServicesDocument4 pagesTRICARE Behavioral Health Care ServicesMatthew X. HauserNo ratings yet

- IPM GuidelinesDocument6 pagesIPM GuidelinesHittesh SolankiNo ratings yet

- Ae - Centuries Before 1400 Are Listed As Browsable DirectoriesDocument3 pagesAe - Centuries Before 1400 Are Listed As Browsable DirectoriesPolNeimanNo ratings yet