Professional Documents

Culture Documents

Seven Generations Energy LTD.: Canada Research

Uploaded by

Anonymous m3c6M1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seven Generations Energy LTD.: Canada Research

Uploaded by

Anonymous m3c6M1Copyright:

Available Formats

Canada Research

Published by Raymond James Ltd.

Seven Generations Energy Ltd.

April 23, 2015

Company Report - Initiation of Coverage

VII-TSX

Kurt Molnar | 403.221.0414 | kurt.molnar@raymondjames.ca

Gordon Steppan CFA (Associate) | 403.221.0411 | gordon.steppan@raymondjames.ca

Braden Purkis (Associate) | 403.509.0518 | braden.purkis@raymondjames.ca

Intermediate Oil & Gas Producers

Outperform 2

C$24.00 target price

Current Price ( Apr-20-15 )

Total Return to Target

52-Week Range

Suitability

Stacking the Deck/Chess Analogy

Recommendation

We believe Seven Generations Nest project (along with Paramounts offsetting

lands at Musreau) may be among the very best E&P projects in all of North America.

We note that this core asset and inventory gives Seven Generations the potential to

be a positive outlier on proved producing F&D costs and cash netbacks. That is a

rare combination which makes this stock particularly leveraged to a return to higher

oil prices at some date in the future. We are initiating coverage of Seven

Generations with an Outperform rating and $24.00 target price.

Analysis

The very first piece of research we published upon joining Raymond James Ltd. was

a white paper defining what we saw as the most likely drivers of both the best and

worst E&P businesses. In that research piece (Finding Easy Alpha in E&P

Enlightenment, from November 14, 2013), we noted our belief that the first, and

most important hurdle, to success or failure of an E&P business was/is defined by

where their core project(s) rank vis--vis an idea called the toe of the boot. Pat

Carlson, the CEO of Seven Generations, was the person who introduced us to this

idea/visual/economic discipline.

We fundamentally believe the competitiveness of the asset (in terms of return on

invested capital) is the most important data point to define success or failure of an

E&P business in the mid- to long-term. But we also know it is not the only important

data point. We think there are effectively a family of data points that are most

critical to the construction of a superior E&P business and business plan. We would

summarize the incremental key focus points that Seven Generations has identified

as critical to sustain and expand their success as: 1) continuous innovation, 2) scale

and diversity of opportunity, and 3) vertical integration. We believe Seven

Generations has their priorities straight on all of these fronts in terms of order of

things to concentrate on, and order of things that may yet come.

We also think that Seven Generations remains at the relative early stages of

optimizing type curves via refinements to their drilling and completions efforts, so

the company still holds the potential for meaningful improvements. Combine this

with the fact that we believe the Lower Montney will move from resource

optionality to defined reserve potential with the fullness of time and this equity

looks particularly compelling.

C$18.88

27%

C$24.70 - C$14.25

High Risk

Market Data

Market Capitalization (mln)

Current Net Debt (mln)

Enterprise Value (mln)

Shares Outstanding (mln, f.d.)

10 Day Avg Daily Volume (000s)

Dividend/Yield

Key Financial Metrics

2014A

P/CFPS

12.9x

WTI (US$/bbl)

US$92.95

AECO Gas (C$/mcf)

C$4.34

Exchange Rate (US$/C$)

0.91

Production (boe/d)

31,136

Natural Gas %

42%

Debt/Cash Flow

0.5x

EV/EBITDA

10.9x

C$4,630

C$160

C$4,790

245.2

410

C$0.00/0.0%

2015E

2016E

11.5x

9.0x

US$51.77

US$59.26

C$2.56

C$2.87

0.80

0.83

57,250

74,285

44%

46%

2.3x

3.1x

10.0x

7.3x

Company Description

Seven Generations is an intermediate oil & gas

producer focussed on the Montney in West-Central

Alberta.

Valuation

Our standard sum-of-parts valuation approach builds out to our $24.00 target price.

Please see our Valuation & Recommendation section on page 15 for more details.

CFPS

1Q

Mar

2Q

Jun

3Q

Sep

4Q

Dec

Full

Year

Revenues

(mln)

2014A

C$0.25

C$0.31

C$0.48

C$0.41

C$1.46

C$691

2015E

0.43

0.38

0.44

0.38

1.64

764

2016E

0.46

0.51

0.53

0.59

2.09

971

Source: Raymond James Ltd., Thomson One

Please read domestic and foreign disclosure/risk information beginning on page 23 and Analyst Certification on page 22.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 2 of 27

Seven Generations Energy Ltd.

Table of Contents

Investment Overview........................................................................................................................................... 3

The Hard Assets ................................................................................................................................................... 7

Valuation & Recommendation ............................................................................................................................ 15

Appendix: Financial Statements .......................................................................................................................... 16

Appendix: Management & Board of Directors .................................................................................................... 18

Risks ..................................................................................................................................................................... 21

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Investment Overview

We will start off with acknowledging a certain personal pride in getting the opportunity to cover

Seven Generations Energy Ltd. (7G) as a public E&P company. We say this because the very first

piece of research we published upon joining Raymond James Ltd. was a white paper defining what

we saw as the most likely drivers of both the best and worst E&P businesses. In that research

piece (Finding Easy Alpha in E&P Enlightenment, from November 14, 2013), we noted our belief

that the first, and most important hurdle, to success or failure of an E&P business was/is defined

by where their core project(s) rank vis--vis an idea called the toe of the boot. Pat Carlson, the

CEO of 7G, was the person who introduced us to this idea/visual/economic discipline. In short, it is

a simple way to note that any commodity producer must have both an asset, and a business

model design, that allows them to generate the highest returns on invested capital no matter the

commodity price, or that their business model requires the lowest commodity price in the

industry to cover their cost of capital. We already had a bias to the idea of return on capital being

more important than rate of growth (or that rate of return on invested capital must define the

value/multiple/quality on rate of growth) but the premise of toe of the boot became a huge tool

for us to try to get our point of view across to investors. So we are very happy to finally be able to

give Seven Generations and Pat Carlson public credit for being the unnamed company and person

noted in our Finding Easy Alpha white paper in the section where we introduced the toe of the

boot principle.

This concept is so important to us (and 7G it seems) because we also are devotees to the idea of

conditional probabilities and Bayes Theory (an obscure idea getting more attention these days

due the critical acclaim given by the movie The Imitation Game, which tells the story how a man

named Alan Turing used Bayes Theory to crack the German Enigma code in WWII). In short, our

job is to regularly be among the most successful at identifying both the best and worst E&P

businesses. We think the single most important factor that will infer the sustained success or

failure of an E&P business is where their project ranks vis--vis the premise of the toe of the boot.

In short, if your project truly can display the highest marginal returns on invested capital, at any

given commodity price, then you will be a successful E&P (and presumably a good stock) unless

you do something else very wrong or unless you have very little inventory. Obviously, the

opposite would be true too. Even if the stock market gives you a low cost of capital, and even if

you do everything else right, if you spend capital on projects that generate returns on invested

capital that are lower than your cost of capital, then you are most likely to be a poor E&P

business. Growth in equity value in E&P is a function of free cash flow and the marginal returns on

invested capital achieved where the latter of these is most important to us due to the capital

intensity of the E&P business. Thus, the probability that an E&P company is a good one (and a

good stock) is increased greatly if we know their project economics are among the best at any

given level of commodity price. There are other factors/indicators that can also raise the

probability that an E&P company is most likely to be a good one, but there may be no factor

whose relevance is bigger than marginal return on invested capital in our view. Many simplified

versions of this idea (conditional probabilities/Bayes Theory) can be found on the web where one

of the easiest analogies follows:

The probability that any given person has a cough on any given day may be only 5%. But

if we know or assume that the person has a cold, then they are much more likely to be

coughing. The conditional probability of coughing given that you have a cold might be a

much higher 75%.

Source: Wikipedia

This example demonstrates how one piece of meaningful information can vastly change the

probabilities/predictability of an event. We would suggest the odds of us being right in correctly

calling a particular E&P a good or bad business without measuring their return on invested capital

first might be as little as the 5% in the example above. Alternatively, if we can definitively prove to

ourselves that their core project is truly superior then the odds of correctly calling it a good E&P

business might rise to 75%. But clearly, not all information is as useful in changing the odds. If we

are told the person in question is buying cough medicine, we might be inclined to believe the odds

they have a cough are higher, but perhaps they have already finished a cold and are restocking

cough medicine for future needs. Thus, buying cough medicine is new information, but its

relevance to whether we are likely coughing is less important than explicit knowledge a person in

question has a cold.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 3 of 27

Canada Research | Page 4 of 27

Seven Generations Energy Ltd.

We are taking you through this process of discussion because we fundamentally believe the

competitiveness of the asset (in terms of return on invested capital) is the most important data

point to define success or failure of an E&P business in the mid- to long-term. But we also know it

is not the only important data point. We think there are effectively a family of data points that are

most critical to the construction of a superior E&P business and business plan. Apparently, the

folks at 7G agree with us too. When the company IPOd, the backbone of the marketing of the

business plan was the toe of the boot premise and the ranking of their best core asset (what 7G

calls the Nest) in terms of toe of the boot economics. That simple message and focus drove a

successful IPO at a time when commodity prices were selling off sharply, so the company plainly

had success at bringing investor interest and belief to the premise of both the toe of the boot and

the Nest. This was the backbone of a $932 million IPO equity raise.

In the months that have followed the IPO, 7G has become more detailed in the business plan they

are focused on, effectively listing a number of incremental critical path ideas that they seemingly

consider the most important (after toe of the boot) to heightening the likelihood of success for

the equity investor. The first incremental data point was securing firm access for sales of their

product. In this regard, 7G secured 500 mmcf/d of firm sales access on the Alliance pipeline by

2019. Over time, the equity market started to debate whether the associated take or pay contract

commitments with this firm access was a meaningful liability to worry about. In short, many

started to ask the question of whether 7G had committed too much too quickly, thus raising the

odds for a mistake pursuing growth in production volumes (to meet take or pay obligations) or

facing a liability for payment of volumes unfulfilled. We frankly take a different view on the

Alliance volume commitments and the associated take or pay obligation. We view the firm sales

capacity to be a critical asset with scarcity value as we expect many Canadian producers to face a

more difficult market for securing access for sales volumes (and growth in volumes) in the future

as Canadian pipeline systems find themselves increasingly full. In our view, there could be no

bigger crime for the 7G shareholder than for the company to have a project with superior

economics on toe of the boot and depth of inventory, but no secure access for sales and growing

production volumes. Certainly the take or pay obligation is a material volume of gas in a relatively

short period of time, but we see many ways for 7G to manage this question:

The easiest answer is that 7G displays relatively early that growth in production volumes

will handily deliver on the volume commitment they have made to Alliance. Certainly to

date, well performance has been strong and arguably improving as 7G concentrates

their capital in their best drilling windows within the Nest and as completion and

production methods continue to evolve;

They could effectively syndicate some portion of their firm transportation, essentially

renting out some of their space for a finite period of time if the profile of their own

production growth suggests they may fall short of their 500 mmcf/d commitment. As we

noted above, we think firm access for sales will increasingly become a scarce asset, so

we believe that 7G would find itself in a sellers market if they want to rent some

portion of their firm sales capacity on Alliance;

Further to our point immediately above, 7G could actually sell rather than rent some

portion of this commitment (reducing their commitment from 500 mmcf/d to 400-450

mmcf/d) if they think they have structurally taken on more than they prefer, or they find

themselves in such a good sellers market that they are compelled to sell down some of

the take or pay so as to reduce the price of capacity retained at the same time they

reduce the pace of growth needed to be pursued;

We are also of the belief that there is a good likelihood that the Chicago market for gas

will be higher priced than AECO market as at 2016E, such that if 7G has any volume

shortfall from its own production at the time, they could similarly simply buy spot

volumes of gas at AECO to deliver under their take or pay to Alliance. Any producer with

volumes they cannot get to sales at that time would likely take a discounted price to get

some sales rather than none, and effectively contribute to 7G volume commitments to

Alliance if invited but with no other access to sales.

The above is a simple scenario analysis addressing the question of the size of take or pay

commitment 7G has assumed to backstop their toe of the boot asset. While the market has

concentrated on the potential liability or shortfall question, we think the market is putting too

little value on the premise of de-risking firm access to sales at the same time the market sees too

little optionality in the way that 7G can manage that risk if drill bit success or capital availability

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

puts in question their capacity to reach 500 mmcf/d of sales by 2019E. Finally, we also think the

combination of a sharp sell-off in commodity prices, combined with 7Gs current relative financial

strength increases the likelihood that 7G may pursue M&A in the coming months, using their

equity as currency. A meaningful piece of M&A that increases the materiality of the 7G inventory

of toe of the boot projects would rapidly chase away an equity market concern we frankly dont

share in the first place. But the analysis above is another way that 7G management displays their

discipline to critical conditional probabilities. Not owning firm sales capacity is a certain way for

7G and its shareholders to lose. Owning too much sales capacity of a product we expect to

enjoy growing scarcity value offers the company many ways to manage or mitigate their take or

pay commitments if their secure access becomes greater than they decide they want. Frankly, we

expect that continued success with the drill bit, and/or potential M&A speculation/success will

chase this discussion away but we like the discipline of logic coming from management. First own

the best, then secure access to sales if you see that as the next most critical risk to address.

7G has also become increasingly vocal about communicating other critical factors/data points

they will focus on to heighten their odds of being a premier E&P equity/businesses. We would

summarize the incremental key focus points that 7G has identified as incrementally critical to

sustain and expand their success as below:

Continuous innovation;

Scale and diversity of opportunity; and

Vertical integration (relates to scale above).

The recent CEO message to the shareholders from 7Gs 2014 year-end report expands upon Pat

Carlsons views on the incremental drivers of ongoing success. The first is the idea of continuous

innovation or improvement. Frankly, one of the dangers to being at the toe of the boot is

becoming complacent about your competitive position and assuming that the only thing between

you and future success is merely continuous repetition of what you are already doing: if you have

a big inventory and sit at the toe of the boot, then rationally your success must be assured. We

should only need to say the names Haynesville or Barnett Shale to convince you that this is not

necessarily true. Both of these projects continue to hold large future drilling inventories and both

have enjoyed improvements in marginal economics over the years through ongoing technological

improvements, but neither project innovated/improved as fast as the biggest and best of the

competitor basins. As a result, they lost their competitive position at the toe of the boot. Not

because their project eroded or shrank, but because the rate of change in other basins was bigger

and/or faster. 7G has thus identified this point as a critical success factor going forward. While

they will strive to either make the Nest bigger and/or add other Nest with comparable assets, a

key driver of sustaining a strong equity premise will demand continuous innovation in the quality

of marginal returns from the assets already captured. In short, 7G is fundamentally aware that

they probably face a greater risk of someone leap-frogging them in the toe of the boot, rather

than their own inventory or execution driving them backwards toward the instep of the boot.

Scale and diversity of opportunity have been silent issues for 7G up until recently. 7Gs

continuous addition of new lands outside their Nest core areas has been underway for some time

now. These areas have been acknowledged to offer lessor marginal returns than the Nest, yet

management has been compelled to add still more lands in these outlier areas, despite the fact

that these new lands/resources appear unlikely to challenge the Nest for toe of the boot anytime

soon. At first blush, this could be argued to be a strategic contradiction. Why use dear capital to

add arguably lessor inventory when you are already inventory rich in premier inventory why not

use that dear capital to just drill wells? Pat Carlsons recent message to shareholders directly

addressed this subject in that 7G plainly believes size (and diversity) matters. 7G believes that

critical mass is essential to attracting needed infrastructure expansion/growth/partnerships. If you

have both toe of the boot economics and scale, then your negotiating capacity and/or means to

pull infrastructure development and expansion to you is maximized. This is just another way to

pull flies to honey. Midstream and LNG infrastructure developers face the prospect of making

major capital commitments that are not portable and will need decades of operation to deliver

the kinds of returns on invested capital to make their large scale capital choices make sense. If a

producer of natural gas can offer a toe of the boot economic premise to their asset and a large

scale inventory, then they maximize their capacity to pull infrastructure capital investments to

them with the potential for multiple parties competing to provide the solution or a diversity of

solutions. In war, those with the defensive position can hold territory with fewer resources. If 7G

can pull infrastructure investments to its asset base (be it midstream and/or LNG) then their

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 5 of 27

Canada Research | Page 6 of 27

Seven Generations Energy Ltd.

position at the toe of the boot becomes more defendable/defensive, while also allowing for a

faster path to market share growth for the middle projects in their inventory. This understanding

has driven 7G to happily add to land inventory outside of the Nest. Even if relative commodity

price strips held their current relationships in the long-term, eventually the toe of the boot

projects/inventory will be exhausted, and only those with inventory of lessor projects in

businesses that are still prospering will be around to fill ongoing gas demand from perhaps higher

cost projects (that may also drive higher natural gas prices). Alternatively, should anything drive

up gas prices (higher demand or faster consumption of toe of the boot inventory) then 7G would

have preserved their potential ranking in the boot while already having access to critical

infrastructure that others may have to wait to see built or expanded. Scale with diversity

therefore gives 7G and its shareholders some protection from unexpected changes in relative

commodity price strips while also providing a scale of opportunity set that maximizes the diversity

of infrastructure plays/players that may wish to deal with 7G while simultaneously maximizing

7Gs options/negotiating position in such efforts.

The related subject to that of scale from above, is vertical integration. This effectively assumes

that 7G will seek the opportunity or optionality to get vertically integrated in infrastructure for

domestic consumption of gas and NGLs (pipes and plants) and/or similar infrastructure for

international markets in natural gas and NGLs (LNG and LPG). For many of 7Gs shareholders

this might be a controversial subject in that many US investors dont believe that E&Ps should

own their infrastructure. We think 7G will pursue a strategy to keep both sides of this theological

debate happy. We think that 7G will actively pursue the chance to get vertically integrated in

major infrastructure projects/expansions but also with the mindset to eventually monetize or

spin-out said downstream asset leverage after it has been built and confirmed to 7G a competitive

advantage to those that lack the resource scale to get vertically integrated or who ignore the

arguments for pursuit of said vertical integration. We think 7G sees vertical integration as a means

to an end, to further cement their toe of the boot advantage, their potential for further M&A

asset accumulation and then a potential future arbitrage windfall from crystallizing asset value

through a sale or spinout of such assets after they have served their competitive purpose as a

barrier to entry to less integrated E&P peers. We like this mindset and theory and note our

conviction in this thought process borne by Pat Carlsons words of temporary vertical

integration noted in his message to shareholders.

If you do enough things right, in the right order, you maximize the likelihood of inevitable

outcomes. This is why we introduced this piece with the idea of conditional probabilities and the

identification of the information/data that are the biggest relative drivers of a desired outcome.

Another way to address this concept is through reference to game theory. 7G cannot offer

guaranteed victory for its shareholders, but if they know the rules of the game and prioritize

those things that dually maximize their advantage and minimize their risks (or the damage done

by anything that doesnt go their way) they will have done all that they can do to heighten the

odds of being a superior E&P equity. In our view, success in E&P is rarely luck and rarely the result

of simple growth in production and cash flow. Rather, we see production and cash flow growth as

just one of the derivatives that flow from those that have superior strategy and the assets to go

with it. We cannot guarantee that 7G will be a successful E&P business and equity, but we do

suggest that they have put more strategic thought and intent to work towards that end than many

of their peers. We also believe that 7G has their priorities straight in terms of the order of things

to concentrate on and the order of things that may yet come. In our view, their Nest project

(along with Paramounts offsetting lands at Musreau) may well be among the very best E&P

projects in all of North America. Their fringe lands outside the Nest (aerially), along with the

incremental up and down their vertically stacked resource (including new layers of Montney)

provide scale and optionality that offer the appeal to attract new infrastructure and/or vertical

integration opportunities while also offering optionality/protection from unanticipated large scale

changes in current long-term commodity price strips. In short, a conscious and well thought out

strategy for both minimizing risks and maximizing rewards rather than targeting simple growth in

units of production or cash flow. Such a conscious intent is a strategic asset to 7G, and its

shareholders, on its own. Pat Carlson first impressed us with a simple picture and premise of toe

of the boot. He continues to impress us with added dimensions to his consideration of the E&P

chessboard.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

The Hard Assets

We have spent a great deal of time now on the strategic asset at 7G. We plainly view the business

model to be an outlier in game theory for lack of a better term. In short, we think they have

their priorities straight (and in the right order of importance). To this point, we have spent modest

time addressing the fundamental assets that brought the development of this larger strategy.

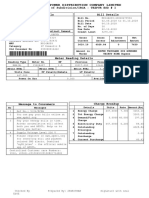

Exhibit 1: Montney Development History

Source: Seven Generations Energy Ltd.

The mosaic above gives a good snap shot of the development of the 7G land base over time. The

pink lands in the 2011-2012 map highlight what 7G eventually came to name the Nest, where

the Nest was/is a term of reference reserved for the very best of the 7G lands when it comes to

maximizing returns on invested capital. The lands in the Nest are prone to either/or both of

prolific gas rates along with very high liquids content with the bulk of said liquids being

condensate. As noted above, after capturing roughly two plus townships of land in the Nest, 7G

continued to accumulate Montney rights in the greater area with a focus on expanding to the

northwest and southwest. Generically, the additional lands captured from 2013 forward were

increasingly biased to Montney rights that could commonly be seen as leaner than the Nest and

with higher sour content. In the current commodity price strip scenario, these lands and future

drilling inventory would provide lesser returns than the Nest today, but as discussed in our lead in

on game theory and conditional probabilities, these additional lands offered both additional scale

(improving vertical integration opportunities) and diversity of inventory that we believe effectively

protects the 7G investor against currently unanticipated potential for a sea change in current

commodity price strips (i.e. the relative pricing of condensate and natural gas). 7G would highlight

that their Nest opportunity set alone will handily provide enough drilling inventory to drive 7G

production for the next 5 years at least such that the lands outside of the Nest have the

optionality for patience and the potential for being higher rate of return inventory at a future date

where relative natural gas pricing might also be much stronger. Finally, we will add a third

dimension to the maps noted above. To date, virtually all of the 7G inventory and drilling has been

defined within the Upper Montney, while the Lower Montney is a known resource, but with

largely unknown marginal economics in the current scenario. In the fullness of time we expect the

Lower Montney to go from being resource optionality to defined reserve potential, but where it

might rank on marginal economics is yet to be defined. Like the Upper Montney, we expect it to

be both overpressured and liquids rich. Given that it is deeper it can potentially store more

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 7 of 27

Canada Research | Page 8 of 27

Seven Generations Energy Ltd.

resource per section but will offer a technical trade off in terms of also likely being tighter rock

that might be tougher to drill and with the potential for lesser liquids/condensate than the Upper

Montney.

Exhibit 2: Seven Generations Reserves

Source: Seven Generations Energy Ltd.

To date, virtually all of 7Gs drilling has focused on the Nest. Not surprisingly then that is also the

focus of their current reserves as highlighted by the table and the map above. You will note the

early stage of development still of this opportunity set given the modest reserves booked as PDP.

This is a two sided coin, noting we are still in the earliest stages of development while

simultaneously also highlighting that much of 7Gs asset still sits in the lower categories of

reserves which also still require large amounts of future development capital. We are relatively

comfortable that 7Gs drilling activity (and that of their offsetting peers Paramount and NuVista)

have set up strong parameters for resource boundaries and makeup which helps to highly

mitigate this risk, but the investor should be explicitly aware that the PDP portion of the reserve

report is currently the smallest part of the reserve report wherein the balance of the report offers

some degree of greater technical risk and much greater degrees of needed incremental future

capital.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Canada Research | Page 9 of 27

Exhibit 3: Production Results within the Nest

= Wells highlighted in table to the right

Source: Seven Generations Energy Ltd., Raymond James Ltd.

The map immediately above is a tighter focus on what 7G identifies as the Nest. Within the Nest

the company has actually defined a Nest 1 and a Nest 2, where the very best economics are in

Nest 2 which is where 7G will concentrate its drilling focus in the coming few years. The table

below the map identifies the average IP30s, IP90s and IP180s for drilling to date on the first 46

wells. We have also marked up the 7G map to highlight the best wells to date from the table on

the right, identifying the current hot spots for the very best IPs on a total boe/d basis.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 10 of 27

Seven Generations Energy Ltd.

Exhibit 4: With Condensate to Gas Ratios

CGR

(bbl/MMcf)

= Wells circled in table to the right

116

289

53

121

178

218

118

83

98

52

159

134

105

85

176

140

89

126

195

118

227

137

123

181

207

213

282

231

241

208

210

249

136

163

75

148

218

117

337

194

195

110

125

373

173

170

167

Source: Seven Generations Energy Ltd., Raymond James Ltd.

We have also taken the liberty of marking up the 7G data farm to specifically address the idea of

the best condensate wells. We have highlighted the best of these thus far, noting that the investor

should be aware that we expect that CGR ratios will moderate with time, so any well with a short

production data file and a high CGR needs to be adjusted in the investors eye when comparing

with wells that have greater vintage. Again, we simply added this data point to look at the Nest

with a potential different lens, given the fact that higher CGRs currently trump higher total boe/d

wells with lessor CGRs simply given the boe equivalency differences in the price decks for natural

gas and condensate.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Exhibit 5: Nest Gas & Condensate Type Curves

Source: Seven Generations Energy Ltd.

The data immediately above plainly shows why the focus on near-term capital spending is most

likely heavily weighted toward Nest 2 lands. Simply, both gas and condensate rates are higher in

Nest 2 versus Nest 1. Accordingly, unless Nest 1 capital costs could be reduced to something far

less than Nest 2, then Nest 2 is where the 7G smart money should go unless something changes

on relative performance curves.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 11 of 27

Canada Research | Page 12 of 27

Seven Generations Energy Ltd.

Exhibit 6: Individual Well Economic Sensitivities

Source: Seven Generations Energy Ltd.

While Nest 2 is plainly the best current project in the inventory list, the value per well or value of

the inventory of wells is clearly in a state of flux given the near-term commodity price

volatility/weakness, and the bigger question of what level might commodity prices recover to. 7G

has provided a useful matrix of key measures for Nest 1 & 2 wells under a variety of commodity

price scenarios. The most important takeaways for the investor from this data is that we think

7Gs Nest 2 wells will compare favourably against virtually any E&P project in Canada on a profit

to investment or IRR basis regardless of the likely near-term commodity price scenarios and will

similarly rank as a superior project on time to payout or velocity of money as we like to call it. In

light of the aggressive capital spending program we expect 7G to follow this year and in the years

to come, the speed at which their invested capital is recycled and enters the free cash flow

window is a critical factor to consider in the likelihood for success as a superior E&P equity. We

think that 7G also remains at the relative early stages of optimizing type curves via refinements to

their drilling and completions efforts, so the company still holds the potential for meaningful

improvements in these stats, and even in the what if commodity price scenarios this really

doesnt change.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Exhibit 7: Continuing to Improve Cost Efficiencies

Source: Seven Generations Energy Ltd.

The final critical asset to focus on in the more immediate-term is the hedgebook. 7G has a hedge

position that is particularly well protected in calendar 2015, with the relative value of that asset

moderating in 2016 due to lessor amounts hedged, greater volume growth predicted and lower

strike prices on the hedges. With that said, 2015 is arguably the most important window for 7G in

terms of its own development, and most likely coincidentally the likely weakest period for spot

commodity prices so the value of the hedge positions defined below (roughly 42% for gas and 50%

for oil and condensate in calendar 2015) is tangible in both hard and strategic value.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 13 of 27

Canada Research | Page 14 of 27

Seven Generations Energy Ltd.

Exhibit 8: Hedging Summary as of March 31, 2015

Source: Seven Generations Energy Ltd.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Canada Research | Page 15 of 27

Valuation & Recommendation

Using our standard sum-of-parts valuation methodology we derive a target price of $24.00 and

therefore are initiating coverage with an Outperform rating. We view the Kakwa Musreau as a

special project in the basin and we note that this core asset and inventory gives 7G the potential

to be a positive outlier on proved producing F&D costs and cash netbacks. That is a rare

combination which makes this stock particularly leveraged to a return to higher oil prices at some

date in the future. While the company is not the most oil levered in our coverage universe, we

expect them to have a PDP F&D cost that is 40-50% of typical oil levered peers while offering

netbacks that are 70% of those oil levered peers. So in short, few stories will have greater

leverage to improving liquids pricing when it comes to rate of change in return on invested capital

and rate of change in free cash flow. That makes the purchase of the stock at these levels

particularly compelling, in our view, because of the equity leverage imbedded to any material

improvements in oil prices. At the time of publishing of this report a material block of stock is

coming out of lock up which offers the potential for larger liquidity in the near-term which may

also provide a short-term buyers market which should be a one-time opportunity.

Exhibit 9: Seven Generations Sum-of-Parts Valuation

2014 Reserve Value

2014 Reserves (mmboe)

Quality Adjustment

Adjusted 2014 Reserves (mmboe)

Cash Flow Factor ($/boe)

Reserve Value Factor $/boe (1.35:1)

Current 2014 Reserve Value

2014 Exit Net Debt ($mn)

Future Capital ($mn)

Dilution Proceeds ($mn)

Current Value of 2014 Assets ($mn)

Fully Diluted Units (mn)

Per Unit (FD) Value

788.6

100%

788.6

$25.64

$18.99

$14,979.6

($160.2)

($8,892.0)

$155.5

$6,082.9

283.6

$21.45

2015E Value Add

2015 Gross Capex ($mn)

Less: Land, Seismic & Facilities ($mn)

Drilling Spending ($mn)

Average Cost per Well ($mn)

Forecast 2015 Net Wells

Success Factor

Forecast Successful Wells

Average Reserves/Well (boe)

2015 Forecast Depletion (mmboe)

Wells to Offset Depletion

Net Growth Wells

Net Reserve Growth (mmboe)

Forecast Revisions (mmboe)

Acquisitions (mmboe)

Forecast Net Reserves Growth (mmboe)

Cash Flow Factor ($/boe)

Reserve Value Factor $/boe (1.35:1)

Value Add ($mn)

Change in Net Debt ($mn)

2015 Value Add ($mn)

2015 Net Risk Adj. Equity Value Add (100% )

Fully Diluted Shares (mn)

Per Share (FD) Value

Sum of the Parts Valuation

2014 Reserve Value

G&A/Interest Burden

2015E Value Add

2016E Value Add

2 yrs of Dividends

Target Equity Value

Source: Seven Generations Energy Ltd., Raymond James Ltd.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

$1,335.0

($430.0)

$905.0

$13.00

69.6

95%

66.1

1,400,000

20.9

14.9

51.2

71.7

0.0

0.0

71.7

$25.64

$18.99

$1,361.7

($887.3)

$474.5

$474.5

283.6

$1.67

$mn

$6,082.9

($192.2)

$474.5

$473.8

$0.0

$6,838.9

2016E Value Add

2016 Gross Capex ($mn)

Less: Land, Seismic & Facilities ($mn)

Drilling Spending ($mn)

Average Cost per Well ($mn)

Forecast 2016 Net Wells

Success Factor

Forecast Successful Wells

Average Reserves/Well (boe)

2016 Forecast Depletion (mmboe)

Wells to Offset Depletion

Net Growth Wells

Net Reserve Growth (mmboe)

Forecast Revisions (mmboe)

Acquisitions (mmboe)

Forecast Net Reserves Growth (mmboe)

Cash Flow Factor ($/boe)

Reserve Value Factor $/boe (1.35:1)

Value Add ($mn)

Change in Net Debt ($mn)

2016 Value Add ($mn)

2016 Net Risk Adj. Equity Value Add (90% )

Fully Diluted Units (mn)

Per Unit (FD) Value

$1,280.0

($380.0)

$900.0

$13.00

69.2

95%

65.8

1,400,000

27.1

19.4

46.4

65.0

0.0

0.0

65.0

$25.64

$18.99

$1,233.9

($707.5)

$526.4

$473.8

283.6

$1.67

Per Unit

$21.45

($0.68)

$1.67

$1.67

$0.00

$24.12

Canada Research | Page 16 of 27

Seven Generations Energy Ltd.

Appendix: Financial Statements

Exhibit 10: Seven Generations Financial Summary

2014A

2015E

2016E

Commodity Price Assumptions

WTI Oil (US$/bbl)

$92.95

$51.77

$59.26

Canadian Par (C$/bbl)

$94.73

$56.59

$63.58

NYMEX Gas (US$/mcf)

$4.27

$2.81

$3.11

AECO Gas (C$/mcf)

$4.34

$2.56

$2.87

FX (US$/C$)

$0.91

$0.80

$0.83

Oil & NGL ($/bbl)

$61.63

$50.66

$49.11

Natural Gas ($/mcf)

$4.50

$3.16

$3.37

18,049

31,784

40,077

78.5

152.8

205.2

31,136

57,250

74,285

42%

44%

46%

Realized Price

Production

Oil & NGL (bbl/d)

Natural Gas (mmcf/d)

Total (boe/d 6:1)

% Gas

Netback ($/boe)

Total Sales

$47.06

$36.57

$35.82

Royalties

$4.57

$2.93

$2.87

Operating

$4.77

$5.00

$5.00

Transport

$3.06

$3.00

$3.00

$34.66

$25.64

$24.95

Field Operating Netback

Cash Flow ($mln)

$328

$448

$572

CFPS ($/share, basic)

$1.65

$1.83

$2.33

CFPS ($/share, diluted)

$1.46

$1.64

$2.09

Basic

198.7

245.2

245.2

Diluted

224.7

273.6

273.6

Weighted Average Shares Outstanding (mln)

Capital Spending ($mln)

Land & Seismic

$49

$20

$20

Drilling, Completions & Other

$742

$905

$900

Well Equipment & Facilities

$323

$410

$360

$6

$0

$0

Other

Acquisitions/Dispositions

Total Capex

$0

$0

$1,111

($9)

$1,335

$1,280

$160

$1,047

$1,755

Net debt ($mln)

Net Debt

Source: Seven Generations Ltd., Raymond James Ltd.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Canada Research | Page 17 of 27

Exhibit 11: Seven Generations Income Statement and Balance Sheet

2014A

2015E

2016E

Income Statement Summary

Total Revenue (incl. Hedges)

$691

$764

$971

Royalties

$52

$61

$78

Opex + Transport

$89

$167

$217

G&A

$20

$58

$24

DD&A

$159

$313

$407

Interest

$64

$30

$80

Other

$91

$0

$0

Taxes

Net Income

$72

$51

$63

$144

$83

$103

$922

$922

$922

Balance Sheet Summary

Current Assets

Derivative (current)

Net PPE

$138

$138

$138

$2,050

$3,071

$3,945

Other

$5

$5

$5

$3,115

$4,136

$5,010

$268

$268

$268

$0

$0

$0

Long Term Debt

$814

$1,701

$2,409

Other Liabilities

$53

$53

$53

Total Assets

Current Liabilities

Derivative (current)

Future Income Taxes

Total Liabilities

$69

$120

$183

$1,204

$2,142

$2,913

Total Share Capital

$1,911

$1,994

$2,097

Total Liabilities & Equity

$3,115

$4,136

$5,010

Source: Seven Generations Ltd., Raymond James Ltd.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 18 of 27

Seven Generations Energy Ltd.

Appendix: Management & Board of Directors

Patrick Carlson, Chief Executive Officer and Director Mr. Carlson has served as Chief Executive

Officer and a Director of the company since its inception in May 2008. He was also President of

the company from May 2008 until May 2014. Previously, he was the President, Chief Executive

Officer and a director of North American Oil Sands Corporation from October 2001 until June 2007

and was the President of Krang Energy Ltd. from December 2001 to July 2005. Mr. Carlson

received a Bachelor of Science in Chemical Engineering from the University of Calgary (1975). Mr.

Carlson is a Professional Engineer and an active member of the Association of Professional

Engineers and Geoscientists of Alberta (APEGA). In 2008, Mr. Carlson received the ICD.D

designation from the Institute of Corporate Directors.

Marty Proctor, President and Chief Operating Officer Mr. Proctor has served as President and

Chief Operating Officer of the company since May 2014. Previously, he was Chief Operating

Officer of Baytex Energy Corp. from December 2010 until May 2014 and Chief Operating Officer of

Baytex Energy Ltd. from January 2009 until December 2010. Mr. Proctor has over 25 years of

experience in the Canadian and international oil and natural gas industries. Prior to joining Baytex

Energy Ltd., he was Senior Vice President responsible for upstream operations for Statoil Hydro

Canada. Prior to that, Mr. Proctor was Senior Vice President of North American Oil Sands

Corporation and Vice President of Murphy Oil Company. Earlier in his career, he held technical

and management positions with Maxx Petroleum, Central Resources (USA), BP Resources Canada

and Husky Oil. Mr. Proctor received a Bachelor of Science in Petroleum Engineering (1984) and a

Master of Science in Petroleum Engineering (1985), both from the University of Alberta. Mr.

Proctor is a Professional Engineer, a practicing member of APEGA, and is a member of the

Canadian Heavy Oil Association and the Society of Petroleum Engineers.

Christopher Law, Chief Financial Officer Mr. Law has been with the company since 2008 and has

managed all of the bank and high yield debt and equity financings that the company has done

since 2011, including the IPO, raising a total of nearly three billion dollars. Mr. Law has over a

decade of industry experience with diverse roles in finance/treasury, corporate planning and

corporate development and holds a Bachelor of Arts in Economics (with distinction) from the

University of Victoria and a Master of Business Administration in Finance and Corporate Strategy

from the University of Calgary.

Randy Evanchuk, Executive Vice President Mr. Evanchuk was Executive Vice President,

Production, Construction and Marketing of the company from May 2012 until August 2014 when

he was appointed Executive Vice President responsible for corporate HS&E. He has more than 30

years of oil and natural gas industry experience in various business and technical roles. Prior to

joining the Company he served as Vice President, New Ventures at Sinopec Daylight Energy Ltd.

and at Murphy Oil Corporation as Manager Special Projects and Planning where he lead the

economic evaluation and long range planning for Murphys BC Montney projects. Mr. Evanchuk

also has extensive marketing and midstream experience where he served as a senior executive at

Canrock Pipeline, a predecessor to Spectra Midstreams unregulated business and at AltaGas

Services. He received a Bachelor of Civil Engineering Honours degree from the Royal Military

College of Canada (1975) and is a Professional Engineer and an active member of APEGA.

Steve Haysom, Senior Vice President Mr. Haysom has been with the company since July 2008

and currently serves as Senior Vice President. Previously, Mr. Haysom served as Vice President,

Exploration and Chief Geoscientist of the company. He is responsible for mergers and acquisitions

and stakeholder relations. Prior to joining the company he served as Vice President, Exploration

for Northpine Energy Ltd. from August 2005 until June 2008 and Senior Geologist for Krang Energy

Ltd. from September 2002 until July 2005. He is a Petroleum Geoscientist with over 18 years of

expertise in both conventional reservoir exploration geology and resource play development

geology. Mr. Haysom received a Bachelor of Science (Honours) in Geology from Saint Marys

University (1994) and is a Professional Geologist and a member of APEGA.

Susan Targett, Vice President, Land Ms. Targett has served as Vice President, Land of the

company since July 2008. Previously, Ms. Targett was Vice President, Land for Artemis Exploration

Ltd. and prior to that served in a variety of positions at Tom Brown Resources Limited, Ranger Oil

Limited and Pembina Resources Ltd. Ms. Targett has extensive experience in land negotiations,

contracts, regulatory issues and stakeholder communications and is a graduate of Mount Royal

College in Petroleum and Mineral Resource Land Management (1981). Ms. Targett is also an

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

active member of the Canadian Association of Petroleum Landmen (1981) with the designation of

Professional Landman (P. Land, 1992).

Glen Nevokshonoff, Vice President, Development Mr. Nevokshonoff has been with the

company since October 2008 and has served as Vice President, Development since June 2013. Mr.

Nevokshonoff is a professional geologist with 14 years of experience in shallow gas, carbonates

and deep basin reservoirs in Canada, the United States and internationally. He previously worked

as a resource-trained geologist at Encana Corporation and its predecessor, Alberta Energy

Company Ltd., and has held senior geologist positions at intermediate exploration and production

companies. Mr. Nevokshonoff holds a Bachelor of Science (Honours) in Earth and Ocean Science

from the University of Victoria (2000) and is a Professional Geologist and a member of APEGA.

Merlyn Spence, Vice President, Construction and Marketing Mr. Spence has served as Vice

President, Construction and Marketing of the company since December 2012. Mr. Spence has

over 32 years of engineering and marketing experience in the oil industry. Previously, he was

General Manager, Engineering for Murphy Exploration and Production Company in Houston,

Texas with primary responsibility for the engineering development in the Eagle Ford field of South

Texas. Prior thereto he was the General Manger, Engineering for Murphy Oil Company in Calgary

with primary responsibility for the development of Murphys Montney assets in BC. Mr. Spence

was also President of Kentrin Corporation from August 1997 until November 2007. Mr. Spence

received an Honours degree in Civil Engineering from the Royal Military College of Canada (1976).

He is a Professional Engineer and an active member of APEGA and the Society of Petroleum

Engineers.

Barry Hucik, Vice President, Drilling Mr. Hucik has served as Vice President, Drilling since August

2008. Mr. Hucik has over 32 years of experience in the oil and natural gas drilling industry. Prior to

joining the company in 2008, Mr. Hucik held positions as a Senior Drilling Superintendent for

Talisman Energy Ltd., Canadian Natural Resources Ltd., Rio Alto Exploration and Cabre Exploration

Ltd. Mr. Hucik has spent a vast majority of his career drilling wells in the Deep Basin/Foothills of

Alberta and northeast BC. He received a Diploma of Technology from the Southern Alberta

Institute of Technology (1979) and is a Certified Engineering Technologist and member of the

Association of Science and Engineering Technology Professionals of Alberta.

Randall Hnatuik, Vice President, Business Development Mr. Hnatuik has served as Vice

President, Business Development of the company since September 2014. Mr. Hnatuik is a

professional engineer with more than 25 years of experience in the oil and gas industry. He

previously held various positions at Encana Corporation, culminating in the position of Advisor,

Business Development. Mr. Hnatuik received a Bachelor of Science in Mechanical Engineering

from the University of Saskatchewan (1985) and has been a member of APEGA since 1987. Mr.

Hnatuik is also a Certified Professional Coach, holding a Certified Professional Coach Certificate

from the Demers Group (2010).

Kevin Johnston, Vice President Accounting Kevin recently left his role as Manager, Consolidated

Reporting at a competitor to join the company. Kevin holds a Bachelor of Commerce (Honours)

from the University of Calgary and a Masters of Professional Accounting from the University of

Saskatchewan. Kevin is a Chartered Accountant and was awarded the Governor General's Gold

Medal for the highest standing in Canada for the CICA Uniform Final Evaluation (UFE) exam in

2005. Including his time at a large international accounting and audit firm, Kevin brings over a

decade of accounting experience in the energy industry.

Board of Directors

Kent Jespersen, Chairman of the Board and Director Mr. Jespersen has served as Chairman of

the Board and a Director of the company since its inception in May 2008. Mr. Jespersen has been

the Chair and Chief Executive Officer of LaJolla Resources International Ltd. since 1999. He has

also held senior executive positions with NOVA Corporation of Alberta, Foothills Pipe Lines Ltd.,

and Husky Oil Limited before assuming the Presidency of Foothills Pipe Lines Ltd. and later, NOVA

Gas International Ltd. (NOVA). At NOVA, he led the non-regulated energy services business

(including energy trading and marketing) and all international activities. Mr. Jespersen is a

Director of TransAlta Corporation, Axia NetMedia Corporation, PetroFrontier Corp., MATRRIX

Energy Technologies Inc. and CanElson Drilling Ltd. Mr. Jespersen was also Chairman of the Board

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 19 of 27

Canada Research | Page 20 of 27

Seven Generations Energy Ltd.

and a Director of North American Oil Sands Corporation. Mr. Jespersen received a Bachelor of

Science in Education (1969) and a Master of Science in Education (1970), both from the University

of Oregon.

Pat Carlson, Chief Executive Officer and Director See description above.

Michael Kanovsky, Director Mr. Kanovsky has served as a Director of the company since its

inception in May 2008. Mr. Kanovsky co-founded Northstar Energy Corp.s parent in 1978 and

Bonavista Energy in 1997. Mr. Kanovsky is President of Sky Energy Corporation, a position he has

held since 1993, and also serves as a Director of Bonavista Energy Corporation, Pure Technologies

Ltd., TransAlta Corporation and Devon Energy Corporation. Mr. Kanovsky received a Bachelor of

Applied Science with Honours in Mechanical Engineering from Queens University (1970) and an

MBA from Ivey School of Business, Western University (1973). Mr. Kanovsky is a Professional

Engineer.

Kevin Brown, Director Mr. Brown has served as a Director of the company since September

2010. Mr. Brown is co-Chief Executive Officer and Director of ARC Financial Corp. He has been

with ARC Financial Corp. since April 1989 and currently represents the ARC Energy Funds on the

Boards of Unconventional Resources Canada, LP, Unconventional Resources, LLC, and Kanata

Energy Group. Mr. Brown received a Master of Arts in Economics (1984) and a Bachelor of Science

in Chemical Engineering (1982), both from the University of Alberta.

Jeff van Steenbergen, Director Mr. van Steenbergen has served as a Director of the company

since its inception in May 2008. Mr. van Steenbergen is a co-founder and the Managing Partner of

KERN Partners Ltd. He joined KERN Partners Ltd. in 2001. Mr. van Steenbergen also serves as a

Director for Steelhead LNG Corp., Altex Energy Ltd., Cobalt International Energy L.P., Magma

Global Ltd., Fairfield Energy Limited and Osum Oil Sands Corp. He has 37 years of diverse Canadian

and global energy sector experience. Mr. van Steenbergen received a Bachelor of Applied Science

with honors in Civil Engineering from Queens University (1977) and a Master of Business

Administration in International Business and Finance from Dalhousie University (1988). He is a

Professional Engineer and a member of the Association of Professional Engineers of Nova Scotia.

Jeff Donahue, Director Mr. Donahue has served as a Director of the company since May 2012.

Mr. Donahue is Vice President, Natural Resources Principal Investing of CPPIB, and is responsible

for developing and leading CPPIBs private equity activities focused on the natural resources

industries including oil and natural gas, mining and agricultural lands. Mr. Donahue also serves as

director on behalf of CPPIB for Black Swan Energy, Laricina Energy, Quantum Utility Generation

and Teine Energy. Prior to joining CPPIB, Mr. Donahue was Vice President, Strategy and Business

Development at BHP Billiton PLC in London. Previously, he had a range of senior corporate

development roles at Enron Corp. and spent several years as both an investment banker and

consultant to natural resource companies. Mr. Donahue received a Bachelor of Arts from Harvard

University (1984) and a Master of Business Administration from the University of Chicago (1990).

Kaush Rakhit, Director Mr. Rakhit has served as a Director of the company since its inception in

May 2008. Mr. Rakhit has been the President of Rakhit Petroleum Consulting Ltd. since September

1990 and the President of Canadian Discovery Ltd. since December 2004. He also held the position

of Vice-President, New Initiatives with Trident Exploration Corp. from March 2006 to May 2008.

Mr. Rakhit currently serves as a director of Kinwest Resources 2008 Inc., Matrix Solutions Inc.,

Canadian Discovery Ltd., Coda Petroleum Inc. and Petrofeed Inc. Mr. Rakhit received a Bachelor of

Science in Earth Sciences from the University of Waterloo (1983) and a Master of Science in

Petroleum Hydrogeology from the University of Alberta (1987). Mr. Rakhit is a Professional

Geologist and an active member of APEGA.

Dale Hohm, Director Mr. Hohm has served as a Director of the company since May 2014. Mr.

Hohm has been engaged by KERN on a part-time basis as a Senior Advisor since September 2014.

Mr. Hohm served as the Chief Financial Officer of MEG Energy Corp. from March 2004 to July 2013

and served as a Director of Lone Pine Resources Inc. from November 2011 to January 2014. Before

entering the energy sector, Mr. Hohm worked in the audit and assurance practice of Deloitte LLP,

where he earned his Chartered Accountant designation. Mr. Hohm received a Bachelor of

Commerce degree from the University of Alberta (1980).

W.J. (Bill) McAdam, Director Mr. McAdam was President and Chief Executive Officer of Aux

Sable in the United States and Canada from 2000 to year end 2013 when he retired from Aux

Sable. Prior to joining Aux Sable, Mr. McAdam held progressively more senior positions with

Imperial Oil and Exxon Chemical from 1974 to 1994 in the Engineering, Refining, Fertilizer,

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Canada Research | Page 21 of 27

Petrochemicals, Planning and Natural Gas Liquids businesses in Sarnia, Toronto, New York,

Edmonton and Calgary. He began working with Aux Sable in 1995 during its development phase

until 1998, and was President of Mapco Canada Energy Inc. from 1998 until 1999. He joined Aux

Sable in late 1999 to lead the start-up and development of the Aux Sable business in conjunction

with the construction and commissioning of the $3.5 billion Alliance pipeline/Aux Sable rich gas

system in December, 2000. Mr. McAdam also serves as a director for Canexus Corporation. Mr.

McAdam received a Bachelor of Science in Chemical Engineering from Queens University (1974)

and a Master of Business Administration from McMaster University (1980). He has served on

several industry association boards over his career.

Risks

Risks to Seven Generations Include:

1. Cash flow exposure to fluctuations in energy prices. In this case the company is specifically

exposed to lower oil prices (WTI and Edmonton Par) and gas prices (HHub and AECO pricing).

2. Foreign exchange rates, more specifically the relationship between the Canadian and US dollar.

3. Due to the nature of its operations, Seven Generations also faces risks associated with weatherrelated interruptions, dry holes, restricted access to facilities, unplanned pipeline shutdowns, and

unexpected production delays.

4. The company is exposed to the risk that there could be unexpected increases in decline rates

specific to its wells or plays. It is also exposed to potentially lower corporate production volumes,

resulting in lower cash flow. Some of the companys operations are in unexplored/less explored

areas and the risk for dry holes or lower production wells could be higher. For Seven Generations,

this specifically relates to the Lower Montney.

5. Unexpected cost overruns or increasing costs of drilling/completing wells and infrastructure.

6. Change in government policies (local, provincial and federal); specifically as it relates to royalty

rates and the treatment of oil and gas production.

7. Interest rate fluctuations could also negatively impact net income and cash flow.

8. Some of Seven Generations acreage is non-operated in nature; therefore the company is at risk

of changes in corporate direction by the operator. The company is also at risk of higher funding

requirements if operators in the area increase the number of wells to drill.

Company Citations

Company Name

Baytex Energy Corp.

BP

Canadian Natural Resources Ltd

Canexus Corporation

Devon Energy Corporation

Exxon Mobil Corp.

Husky Energy Inc.

Imperial Oil Limited

MEG Energy Corp.

Murphy Oil Corp.

NuVista Energy Ltd.

Paramount Resources Ltd.

Talisman Energy Inc.

Ticker

BTE

BP.L

CNQ

CUS

DVN

XOM

HSE

IMO

MEG

MUR

NVA

POU

TLM

Exchange

TSX

LSE

TSX

TSX

NYSE

NYSE

TSX

TSX

TSX

NYSE

TSX

TSX

NYSE

Currency

C$

p

C$

C$

US$

US$

C$

C$

C$

US$

C$

C$

US$

Closing Price

22.85

480.00

40.13

1.83

65.28

86.88

27.25

54.60

23.47

49.27

8.37

36.95

7.90

RJ Rating

3

3

3

3

2

3

3

3

2

4

2

1

3

RJ Entity

RJ LTD.

RJ Europe

RJ LTD.

RJ LTD.

RJ & Associates

RJ & Associates

RJ LTD.

RJ LTD.

RJ LTD.

RJ & Associates

RJ LTD.

RJ LTD.

RJ LTD.

Notes: Prices are as of the most recent close on the indicated exchange and may not be in US$. See Disclosure section for rating definitions.

Stocks that do not trade on a U.S. national exchange may not be registered for sale in all U.S. states. NC=not covered.

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Canada Research | Page 22 of 27

Seven Generations Energy Ltd.

IMPORTANT INVESTOR DISCLOSURES

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in

the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg,

FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for

the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd., Suite 2100, 925 West Georgia Street,

Vancouver, BC V6C 3L2, (604) 659-8200; in Latin America, Raymond James Latin America, Ruta 8, km 17, 500, 91600 Montevideo,

Uruguay, 00598 2 518 2033; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La

Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Bishopsgate Court, 4-12 Norton Folgate,

London, England, E1 6DB, +44 207 426 5600.

This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in

any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or

regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to

sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not

constitute a personal recommendation nor does it take into account the particular investment objectives, financial situations, or needs

of individual clients. Information in this report should not be construed as advice designed to meet the individual objectives of any

particular investor. Investors should consider this report as only a single factor in making their investment decision. Consultation with

your investment advisor is recommended. Past performance is not a guide to future performance, future returns are not guaranteed, and

a loss of original capital may occur.

The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell

any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such

information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available

to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute

transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication.

With respect to materials prepared by Raymond James Ltd. (RJL), all expressions of opinion reflect the judgment of the Research

Department of RJL, or its affiliates, at this date and are subject to change. RJL may perform investment banking or other services for, or

solicit investment banking business from, any company mentioned in this document.

All Raymond James Ltd. research reports are distributed electronically and are available to clients at the same time via the firms website

(http://www.raymondjames.ca). Immediately upon being posted to the firms website, the research reports are then distributed

electronically to clients via email upon request and to clients with access to Bloomberg (home page: RJLC), Capital IQ and Thomson

Reuters. Selected research reports are also printed and mailed at the same time to clients upon request. Requests for Raymond James

Ltd. research may be made by contacting the Raymond James Product Group during market hours at (604) 6598000.

In the event that this is a compendium report (i.e., covers 6 or more subject companies), Raymond James Ltd. may choose to provide

specific disclosures for the subject companies by reference. To access these disclosures, clients should refer to:

http://www.raymondjames.ca (click on Equity Capital Markets / Equity Research / Research Disclosures) or call tollfree at

18006672899.

ANALYST INFORMATION

Analyst Compensation: Equity research analysts and associates at Raymond James are compensated on a salary and bonus system.

Several factors enter into the compensation determination for an analyst, including i) research quality and overall productivity, including

success in rating stocks on an absolute basis and relative to the local exchange composite Index and/or a sector index, ii) recognition from

institutional investors, iii) support effectiveness to the institutional and retail sales forces and traders, iv) commissions generated in

stocks under coverage that are attributable to the analysts efforts, v) net revenues of the overall Equity Capital Markets Group, and vi)

compensation levels for analysts at competing investment dealers.

Analyst Stock Holdings: Effective September 2002, Raymond James equity research analysts and associates or members of their

households are forbidden from investing in securities of companies covered by them. Analysts and associates are permitted to hold long

positions in the securities of companies they cover which were in place prior to September 2002 but are only permitted to sell those

positions five days after the rating has been lowered to Underperform.

The views expressed in this report accurately reflect the personal views of the analyst(s) covering the subject securities. No part of said

person's compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this

research report. In addition, said analyst has not received compensation from any subject company in the last 12 months.

RATINGS AND DEFINITIONS

Raymond James Ltd. (Canada) definitions: Strong Buy (SB1) The stock is expected to appreciate and produce a total return of at least

15% and outperform the S&P/TSX Composite Index over the next six months. Outperform (MO2) The stock is expected to appreciate and

Raymond James Ltd. | 2100 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Seven Generations Energy Ltd.

Canada Research | Page 23 of 27

outperform the S&P/TSX Composite Index over the next twelve months. Market Perform (MP3) The stock is expected to perform

generally in line with the S&P/TSX Composite Index over the next twelve months and is potentially a source of funds for more highly

rated securities. Underperform (MU4) The stock is expected to underperform the S&P/TSX Composite Index or its sector over the next

six to twelve months and should be sold.

Raymond James & Associates (U.S.) definitions: Strong Buy (SB1) Expected to appreciate, produce a total return of at least 15%, and

outperform the S&P 500 over the next six to 12 months. For higher yielding and more conservative equities, such as REITs and certain

MLPs, a total return of at least 15% is expected to be realized over the next 12 months. Outperform (MO2) Expected to appreciate and

outperform the S&P 500 over the next 12-18 months. For higher yielding and more conservative equities, such as REITs and certain MLPs,

an Outperform rating is used for securities where we are comfortable with the relative safety of the dividend and expect a total return

modestly exceeding the dividend yield over the next 12-18 months. Market Perform (MP3) Expected to perform generally in line with the

S&P 500 over the next 12 months. Underperform (MU4) Expected to underperform the S&P 500 or its sector over the next six to 12

months and should be sold. Suspended (S) The rating and price target have been suspended temporarily. This action may be due to

market events that made coverage impracticable, or to comply with applicable regulations or firm policies in certain circumstances,

including when Raymond James may be providing investment banking services to the company. The previous rating and price target are

no longer in effect for this security and should not be relied upon.

Raymond James Latin American rating definitions: Strong Buy (SB1) Expected to appreciate and produce a total return of at least 25.0%

over the next twelve months. Outperform (MO2) Expected to appreciate and produce a total return of between 15.0% and 25.0% over

the next twelve months. Market Perform (MP3) Expected to perform in line with the underlying country index. Underperform (MU4)

Expected to underperform the underlying country index. Suspended (S) The rating and price target have been suspended temporarily.

This action may be due to market events that made coverage impracticable, or to comply with applicable regulations or firm policies in

certain circumstances, including when Raymond James may be providing investment banking services to the company. The previous

rating and price target are no longer in effect for this security and should not be relied upon.

Raymond James Europe rating definitions rating definitions: Strong Buy (1) Expected to appreciate, produce a total return of at least

15%, and outperform the Stoxx 600 over the next 6 to 12 months. Outperform (2) Expected to appreciate and outperform the Stoxx 600

over the next 12 months. Market Perform (3) Expected to perform generally in line with the Stoxx 600 over the next 12 months.

Underperform (4) Expected to underperform the Stoxx 600 or its sector over the next 6 to 12 months. Suspended (S) The rating and

target price have been suspended temporarily. This action may be due to market events that made coverage impracticable, or to comply

with applicable regulations or firm policies in certain circumstances, including when Raymond James may be providing investment