Professional Documents

Culture Documents

SQB - Chapter 4 Questions

Uploaded by

racsoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SQB - Chapter 4 Questions

Uploaded by

racsoCopyright:

Available Formats

Financial Accounting: GAAP Principles 3e

Tutorial 4.1

(Solution in SQB)

Chapter 4

Recognising property, plant

an equipment

Basic level

Part A

Required:

Indicate whether the accounting treatments are CORRECT or INCORRECT. If you believe the

treatment to be incorrect, briefly state reason(s) why.

1. A company recently acquired a machine and management have capitalised the following to

the cost account:

Purchase price

Delivery costs

Installation and assembly costs

R2 000 000

R45 000

R30 000

2. Equipment was purchased for R400 000 and is revalued every two years, using the

revaluation model. The equipment has no residual value, and has a useful life of 10 years.

The carrying amount prior to the first revaluation was R320 000. The fair value of a new

piece of equipment was R600 000. The following entries were therefore recorded:

Dr

Accumulated Depreciation

Equipment cost

R80 000

Cr

R280 000

Cr

Equipment cost

Revaluation gain (P&L)

Dr

R80 000

R280 000

3. A company has four investment properties. It has chosen the fair value model for three of the

properties as they are in good areas and will increase in value over time. The revaluation

model has been used for the sole remaining property.

4. A building correctly had the following balances at year-end prior to an impairment test:

Revalued amount

Accumulated depreciation

Revaluation surplus

R800 000

R120 000

R60 000

The impairment test revealed a recoverable amount of R300 000. The following entry was

therefore recorded:

Dr

Dr

Cr

Revaluation surplus

Impairment loss (P&L)

Accumulated Impairment

60 000

320 000

380 000

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Chapter 4

Part B

Ricky Ltd purchased a large computer server on 30 June 20x5 for R400 000. At the time, the

residual value was estimated to be R60 000, with a useful life of four years. These estimates

were confirmed at the 31 December year-end for both 20x5 and 20x6.

At the end of 20x7, however, the residual value was estimated to be R20 000, and the remaining

useful life was believed to be three years.

Required:

Calculate the depreciation charge for the 20x7 financial year.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.2

(Solution in SQB)

Chapter 4

PPE cost model

and revaluation model

Basic level

1.

Why do companies typically prefer to use the historic cost model rather than the revaluation

model?

2.

A company seeks to revalue a machine at the beginning of the year. A new machine is

valued at R100m. The machine (which has been used for two years) has a carrying amount

of R60m. Machines of this nature are expected to have a useful life of 10 years, with a

residual value of R10m. What is the amount of the revaluation surplus that needs to be

recorded?

3.

Using the scenario in 2 above, discuss the journal entry(ies) that should be passed when

recording the revaluation. Amounts are not required.

4.

A building correctly had the following balances at year-end prior to an impairment test:

Gross replacement cost

Accumulated depreciation

Revaluation surplus

R800 000

R120 000

R60 000

The impairment test revealed a recoverable amount of R300 000. Show the journal entry that

should be recorded.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.3

PPE revaluation model

and deferred tax

Chapter 4

Intermediate level

HomeChoice Ltd revalued its plant for the first time on 1 January 20x9 to net replacement cost.

The gross replacement cost on that date (1 January 20x9) was R800 000. The plant was

purchased for R600 000 on 1 January 20x5. At that date the useful life was estimated at 10 years

with no residual value (both estimates have not changed). Capital allowances (for income tax

purposes) are at 10% per annum, on a straight-line basis.

The companys policy on plant states that:

Depreciation is provided on the straight-line basis

Accumulated depreciation (at revaluation date) is eliminated or offset against the gross

carrying amount, and

The revaluation surplus is released to retained earnings as the asset is depreciated.

The companys financial year-end is 31 December. The income tax rate is 28% and the capital

gains tax is 14%.

Required:

(a) Prepare the journal entries recording the revaluation of plant on 1 January 20x9, including

the deferred tax effect. (Note: Journal entries for depreciation, deferred tax, or transfer to or

from the revaluation surplus at 31 December 20x9 are NOT required.)

(b) Calculate the deferred tax balance as at 31 December 20x9.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.4

PPE and investment

property

Chapter 4

Intermediate level

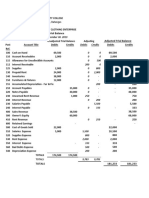

Thorne (Pty) Ltd had the following balances in their trial balance at 31 March 20x8 (the previous

reporting date):

Land and buildings

Vehicles

Machinery

Accumulated depreciation on buildings

Accumulated depreciation on vehicles

Accumulated depreciation on machinery

Total

R

2 000 000

500 000

640 000

(48 500)

(50 000)

(280 000)

2 520 000

Additional information:

(a) The land and buildings consist of two properties. The first property, located in Milnerton was

purchased for R1 000 000 on 1 January 20x4. At this date the value of the land was

considered to be R250 000. The fair value of the property on 1 July 20x8 was R1 400 000.

On this day, Thorne moved all of their production facilities to the second building owned by

the company, located in Montague Gardens, and the Milnerton property was let to tenants

from this date, at R25 000 per month. At 31 March 20x9, the market value of the Milnerton

property was R1 460 000.

(b) The property located in Montague Gardens was purchased on 1 April 20x6. The value of the

land was considered to be R400 000. At 31 March 20x9, the market value of this property

was R1 600 000.

(c) The fleet of vehicles was acquired on 1 October 20x7, to be used for a fixed period of four

years, with an estimated residual value of R100 000.

The following accounting policies are applied by Thorne:

Buildings are depreciated over 75 years, using the straight-line method.

Vehicles are depreciated using the straight-line method over the estimated useful life of the

vehicle.

Machinery is depreciated using the diminishing balance method at 25%.

The fair value model is used for investment property.

The cost model is used for property, plant and equipment.

Required:

Calculate income and expenses relating to the information above that would be included in the

statement of comprehensive income of Thorne (Pty) Ltd for the year ended 31 March 20x9.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.5

Chapter 4

PPE properties and

revaluation model

Intermediate

Moolenberg Ltd (Moolenberg) held various non-current assets during the year, and has

consistently applied the following accounting policies relating to non-current assets:

Investment property is recognised according to the fair value model;

All other properties are revalued at the start of every third year according to the revaluation

model. Revalued properties are reported on the net basis, that is, accumulated depreciation

is eliminated at each revaluation date. The revaluation surplus is released only on disposal of

the asset.

Equipment is recognised according to the cost model.

Required:

You are required to assist the management of Moolenberg with the correct application of their

accounting policies, using the additional information below.

Additional information:

Woodstock property

This property was purchased on 1 January 20x3 for R1 000 000. It consists of land and a building

that is rented out to other businesses. Moolenberg bought this property in case they needed the

extra office space. So far they have not needed to occupy it, and therefore it is held in order to

earn rental income and for capital appreciation.

The following information relates to the Woodstock property:

Date

31/12/x4

31/12/x5

31/12/x6

Market value

R1 300 000

R1 500 000

R1 800 000

Total useful life

40 years

40 years

40 years

On 30 June 20x6 an amount of R140 000 was paid for repairing the air conditioning of the

building.

Oranjezicht property

This property was purchased on 1 January 20x2 for R52 000 000, of which 45% related to land

and the rest to the building. The building is used by Moolenberg as its head office, and when

purchased, it was expected to have a useful life of 30 years, with a residual value of R4 200 000.

These estimates have been reviewed every year and have remained unchanged.

The following valuations were obtained for the Oranjezicht property:

Date

01/01/x4

01/01/x6

Net replacement

cost of the

building

R30 800 000

R30 200 000

Market value of

the land

R24 000 000

R24 800 000

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Chapter 4

Project Nossie

Moolenberg is involved in a new project (called Nossie) for which an expensive piece of

equipment was imported from Europe. Risks and rewards passed on 1 October 20x4 when the

equipment arrived at the harbour and it was correctly costed at R6 800 000. After a delay due to

lengthy inspection procedures, the equipment was transported to the factory on 1 January 20x5

at a cost of R200 000. The total useful life of the equipment was initially estimated at 5 years with

a residual value of R2 000 000.

At 1 January 20x6 an important component of the equipment was identified as being badly

damaged and was replaced. The damaged component had a carrying amount of R340 000

(original cost R400 000) and was sold for only R100 000. A new component was purchased for

R600 000 and installed on the same day.

At 31 December 20x6, the total useful life of the equipment was now estimated at eight years and

the residual value at R1 850 000. Changes in estimates are applied evenly over the current and

future periods affected.

Required:

(a) Briefly explain how Moolenberg Ltd should recognise its Woodstock property in its financial

statements for the year ended 31 December 20x6. (Your answer should not address the

definition and recognition criteria of an asset, but should focus on the classification and

accounting of the asset).

(b) Prepare ALL of the journal entries relating to the following properties for the year ended

31 December 20x6 (dates, narrations and closing journal entries are not required):

Woodstock property

Oranjezicht property.

(c) Show how the equipment used for Project Nossie should be disclosed in the notes to the

financial statements of Moolenberg Ltd for the year ended 31 December 20x6, in

compliance with IAS16, Property, Plant and Equipment. Comparatives are not required.

Show all your workings.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.6

Chapter 4

PPE revaluation model

& changes in estimates

Intermediate

You have been provided with the following extract from the fixed asset register and accounting

policies of Southern Ltd as at 30 June 20x4:

Valuation/cost

Accumulated depreciation

Carrying amount at 30 June 20x4

Building

R3 900 000

(190 000)

R3 710 000

Historical cost

Accumulated depreciation

Net carrying amount based on historical cost

R4 000 000

(550 000)

R3 450 000

Equipment

R250 000

(88 000)

R162 000

The company has applied the following accounting policies consistently:

The company has selected the revaluation model for buildings, and the cost model for

equipment.

Revaluations are performed every three years, and the next revaluation date is 1 July 20x4.

The company transfers a portion of the revaluation surplus to retained earnings based on its

usage.

The effects of any change in estimates are applied evenly over the current and future years.

The market value (that is, fair value) of the building was determined at R4 500 000 at 1 July 20x4.

You obtained the following estimates from the directors of Southern Ltd at 30 June 20x5:

Revised residual value

Estimated remaining useful

life

Building

R2 250 000

(20x4: R2 000 000)

15 years

(20x4: 18 years)

Equipment

R30 000

(20x4: R30 000)

4 years

(20x4: 6 years)

Required:

1.

2.

3.

IAS16, Property, Plant and Equipment allows for two measurement models to determine the

carrying amount of property, plant and equipment at each subsequent reporting date, the

cost model and the revaluation model. List two reasons why a company may decide to

rather apply the revaluation model to recognise its property, plant and equipment at

subsequent reporting dates, as opposed to the cost model.

Prepare all the journal entries relating to the building and equipment to be processed during

the financial year ended 30 June 20x5, assuming that the company has elected to eliminate

accumulated depreciation with each revaluation. Closing journal entries are not required.

Narrations are required.

Prepare the note disclosure as required by IAS8, Accounting Policies, Changes in

Accounting Estimates, and Errors, to be included in the financial statements of Southern Ltd

for the year ended 30 June 20x5 (comparatives are not required).

Notes relating to accounting policies and Property, Plant and Equipment are NOT required.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.7

Chapter 4

PPE revaluation model &

disclosure

Intermediate

Ignore tax.

Jelly Ltd is a company which manufactures jelly from organic fruit syrups for the local market. Its

business involves technologically advanced machinery. Machinery was acquired on 1 July 20x2

at which date it had an estimated useful life of 10 years, with no residual value.

The accounting policy is to revalue the machinery every three years. Revalued assets are

disclosed at the revalued amount when the asset is revalued (that is, accumulated depreciation is

eliminated against the cost of the asset at the revaluation date), and the revaluation surplus is

released to retained earnings as the asset is depreciated.

The following information appeared in the fixed asset register on 30 June 20x5.

Cost

Accumulated depreciation

Machine A

R000

4 800

1 440

3 360

Machine B

R000

4 500

1 350

3 150

On 1 July 20x5 the independent valuator, a Mr Brown, valued Machines A and B at a gross

replacement value of R6 million and R5,4 million respectively. On the same date, the production

foreman indicated that Machine A was likely to have an estimated life of two years less than that

originally anticipated at its acquisition date.

In June 20X6 the directors decided that Machine B should be replaced by a more technologically

advanced machine. The value in use of this machine is considered immaterial, and it is estimated

that this machine could be sold for R1 million early in the following financial year.

Required:

Prepare the journal entries relating to Machines A and B for the financial year ended 30 June

20x6.

Provide all note disclosure relating to the above information in the financial statements of Jelly

Ltd for the year ended 30 June 20x6. Comparatives are not required.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.8

Chapter 4

PPE disclosure

Intermediate

The following is an extract from the notes to the financial statements of Trendy Limited at

30 September 20x3, its previous financial year-end:

Land

Valuation

Cost

Accumulated depreciation

Carrying amount at 30/09/20x3

Buildings

R

32 500

R

200 500

32 500

(15 600)

184 900

Furniture &

equipment

R

110 000

(45 520)

64 480

Motor

vehicles

R

121 000

(43 200)

77 800

Total

R

233 000

231 000

(104 320)

359 680

Additional information:

Land and buildings were purchased ten years ago on 1 October 1994 at a cost of R21 000 and

R198 500, respectively. On that date, the buildings were estimated to have a useful life of

50 years and a residual value of R25 000 (both estimates have been confirmed at each

subsequent reporting date).

The companys policy is to revalue land and buildings at their fair value based on an open market

valuation (in other words, the net replacement value) at the end of every five years. On

30 September 20x4, the fair values of land and buildings were determined by an independent

valuer at R40 000 and R195 000 respectively. Buildings are depreciated using the straight-line

method. Land is not depreciated.

Assets are revalued at the end of the financial year, after taking into account any depreciation

expense for the year. When assets are revalued, the accumulated depreciation is offset against

the carrying amount.

Motor vehicles, furniture and equipment are depreciated as follows (no residual values):

Motor vehicles: straight-line basis over expected useful life of 5 years

Furniture and equipment: diminishing (reducing) balance method, at 12,5% per annum.

The company sold a motor vehicle (cost R36 000, accumulated depreciation R14 400 at date of

sale) on 1 October 20x3 for a profit of R3 600. The vehicle was bought on 1 October 20x1. A

replacement motor vehicle was purchased at a cost of R45 000 on 1 October 20x3.

You can assume that there were no purchases or sales other than those listed in the question.

Required:

Show how Trendy Ltd should disclose property, plant and equipment in the notes to the

financial statements at 30 September 20x4.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.9

Chapter 4

PPE revaluation model

and deferred tax

Advanced level

You are provided with the following information relating to a specific asset acquired by a

company:

Asset acquired cost

Gross replacement cost

1 January 01

1 January 03

1 January 04

R200 000

R300 000

R360 000

Capital allowances

Depreciation

20% per annum, not apportioned

10% per annum, straight line

Normal tax rate =

Capital gains tax =

Year-end =

40%

20%

31 December

The asset was revalued for first time on 1 January 20x3 and annually thereafter.

Policy on revaluations:

Accumulated depreciation is netted off against the gross carrying amount of the asset on

revaluation, and the revaluation surplus is released to retained earnings as realised. The tax

component of items of other comprehensive income is disclosed separately on the statement of

comprehensive income.

The company has chosen to present the statement of comprehensive income in two separate

statements: an income statement and a statement of comprehensive income.

Required:

(a) Journal entries in 20x3 and 20x4. Closing entries are not required.

(b) Discuss the treatment in 20x4 if a decision was made in December 20x4 to sell the asset for

R220 000, and the sale is expected to be concluded at the end of March 20x5. Assume that

the classification as held for sale has not been met.

(c) Disclosure relating to deferred tax.

(d) Show how the revaluation of the asset and any related tax entries would be reflected in the

statement of comprehensive income and the notes thereto for the year ended 31 December

20x4.

(e) Prepare the revaluation surplus column in the statement of changes in equity for the year

ended 31 December 20x4, with comparatives.

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Tutorial 4.10

Chapter 4

PPE revaluation model

and disclosure

Advanced

The following extract was obtained from the trial balance of Factory 17 at 30 September 20x6:

Machinery cost

Accumulated depreciation machinery

Factory building carrying amount

Additional

information

1

1

2

R

600 000

?

?

Additional information:

1.

Machinery is measured by applying the cost model.

The company uses two machines in the factory:

Machine A is used to cut the wood into various sizes. This machine was acquired on

1 April 20x4 at a cost of R250 000. At the acquisition date it was estimated that this

machine would have an estimated useful life of five years and a residual value of

R50 000. Resulting from the continued use of this machine for the current contract, it is

estimated at 30 September 20x6 that this machine will be used for only a further

18 months, at which date it will be scrapped at a zero residual value.

Machine B was previously used as a back-up for Machine A, and as the company had

very low production levels before securing the current contract, this machine was

recognised at its recoverable amount of R100 000 at 30 September 20x5. This machine

was originally bought for R350 000 and accumulated depreciation (excluding any

impairment loss) at 30 September 20x5 amounted to R75 000. This machine is now

again in full production to support Machine A, and it is estimated that at 30 September

20x6 this machine will have a remaining useful life of three years, with a residual value of

R30 000. The recoverable amount of this machine is estimated at R280 000 at

30 September 20x6.

2.

The land and factory building are measured based on the revaluation model.

Revaluations are done at the beginning of each financial year. Revalued assets are disclosed

on the net basis, which means that accumulated depreciation is eliminated against the gross

carrying amount of the asset at each revaluation. The revaluation surplus is released to

retained earnings as the asset is depreciated.

The following details relate to the land and factory building:

Acquisition date: 1 October 20x3

Cost of land

Cost of building

Residual value of building (remained unchanged since acquisition date)

R750 000

R1 650 000

R250 000

Total useful life of building as estimated on 1 October 20x3 (unchanged

from acquisition date until 30 September 20x5)

Remaining useful life as estimated on 30 September 20x6

7 years

9 years

Market value (fair value) of land and building at:

1 October 20x4

1 October 20x5

1 October 20x6

Land

R800 000

R820 000

R880 000

Building

R1 702 000

R1 915 000

R2 050 000

Department of Accounting, UCT and Oxford University Press Southern Africa

Financial Accounting: GAAP Principles 3e

Chapter 4

Ignore VAT and other forms of taxation. The year-end of Factory 17 is 30 September.

Required:

Prepare the note disclosure relating to property, plant and equipment, to be included in the

notes to the financial statements of Factory 17 (Pty) Limited, for the year ended 30 September

20x6, in compliance with IAS16. Accounting policy notes and comparatives are NOT required.

Department of Accounting, UCT and Oxford University Press Southern Africa

You might also like

- Excel Instructions CAUTION: Read Appendix A For Specific Instructions Relating To These TemplatesDocument40 pagesExcel Instructions CAUTION: Read Appendix A For Specific Instructions Relating To These TemplatesEmily Cerney40% (5)

- Profit from Change: Retooling Your Agency for Maximum ProfitsFrom EverandProfit from Change: Retooling Your Agency for Maximum ProfitsNo ratings yet

- Billionaire Sam Zell Talks Trump, SPACs, and Interest Rates in Forbes Q+A - 12-2020Document6 pagesBillionaire Sam Zell Talks Trump, SPACs, and Interest Rates in Forbes Q+A - 12-2020Peter KaiserNo ratings yet

- How To Start and Run A Profitable Cleaning Business: by Eric LoiacanoDocument82 pagesHow To Start and Run A Profitable Cleaning Business: by Eric LoiacanoLakshmi PillaiNo ratings yet

- Cross-Examination: Sharpstein/TabernackiDocument222 pagesCross-Examination: Sharpstein/TabernackiWashington Free BeaconNo ratings yet

- 100+ Ways To Reduce Expenses and Increase ProfitsDocument9 pages100+ Ways To Reduce Expenses and Increase ProfitsSapient Business Solutions, Inc.No ratings yet

- Million Dollar ManualDocument38 pagesMillion Dollar ManualAnonymous w5GzQ6fNo ratings yet

- Vending MachineDocument38 pagesVending MachineBryan ScofieldNo ratings yet

- RiskBuster: Start or Grow Any Small Business Wherever You Are with Whatever You Have Right NowFrom EverandRiskBuster: Start or Grow Any Small Business Wherever You Are with Whatever You Have Right NowNo ratings yet

- Ultimate Mini-Importation GuideDocument29 pagesUltimate Mini-Importation GuideGreen SectorNo ratings yet

- Why Customers Come Back: How to Create Lasting Customer LoyaltyFrom EverandWhy Customers Come Back: How to Create Lasting Customer LoyaltyNo ratings yet

- ServiceMaster Magazine Issue1Document18 pagesServiceMaster Magazine Issue1Sophia AvraamNo ratings yet

- Oracle Payroll Interview QuestionsDocument19 pagesOracle Payroll Interview QuestionskrishnaNo ratings yet

- Welcome To Jim's: Franchisee Induction ProgramDocument11 pagesWelcome To Jim's: Franchisee Induction ProgramJerry PrasetiaNo ratings yet

- Improving Recruitment Agency Business Practices in Sri Lanka - ILODocument72 pagesImproving Recruitment Agency Business Practices in Sri Lanka - ILOHaris MirandoNo ratings yet

- The Human Being’s Guide to Business Growth: A Simple Process For Unleashing The Power of Your People for GrowthFrom EverandThe Human Being’s Guide to Business Growth: A Simple Process For Unleashing The Power of Your People for GrowthNo ratings yet

- Sweat, Scale, Sell: Build Your Business Into An Asset of ValueFrom EverandSweat, Scale, Sell: Build Your Business Into An Asset of ValueNo ratings yet

- Financial and Business Risk Management 1 PDFDocument75 pagesFinancial and Business Risk Management 1 PDFrochelleandgelloNo ratings yet

- The Growth Code: The Key to Unlocking Sustainable Growth in any Modern BusinessFrom EverandThe Growth Code: The Key to Unlocking Sustainable Growth in any Modern BusinessNo ratings yet

- A Digital Marketing AgencyDocument10 pagesA Digital Marketing AgencyAlex StampanoneNo ratings yet

- Air BNB Business AnalysisDocument40 pagesAir BNB Business AnalysisAdolf NAibaho100% (1)

- Selling Real Estate Services: Third-Level Secrets of Top ProducersFrom EverandSelling Real Estate Services: Third-Level Secrets of Top ProducersNo ratings yet

- Case 1 - Walt Disney - 2009Document13 pagesCase 1 - Walt Disney - 2009Yatiri0% (2)

- The Fortune at The Bottom of PyramidDocument14 pagesThe Fortune at The Bottom of Pyramidrohitpatil222No ratings yet

- Task2 SufiDocument18 pagesTask2 Sufimuhammad sufyanNo ratings yet

- Medical Shop Business PlanDocument8 pagesMedical Shop Business PlanPrajwal Vemala JagadeeshwaraNo ratings yet

- Sap-Sample Soal TeoriDocument28 pagesSap-Sample Soal TeoriLina Melina100% (1)

- The Startup Leap: Finding Structure in the Chaotic Journey of Startup BuildingFrom EverandThe Startup Leap: Finding Structure in the Chaotic Journey of Startup BuildingNo ratings yet

- Optimizing Growth: Predictive and Profitable Strategies to Understand Demand and Outsmart Your CompetitorsFrom EverandOptimizing Growth: Predictive and Profitable Strategies to Understand Demand and Outsmart Your CompetitorsNo ratings yet

- Power Up Powerpoint Presentation For Team 1Document11 pagesPower Up Powerpoint Presentation For Team 1api-378130472No ratings yet

- Credit Pitch Deck 1Document10 pagesCredit Pitch Deck 1Paul PoetNo ratings yet

- Retail Isn't Dead: Innovative Strategies for Brick and Mortar Retail SuccessFrom EverandRetail Isn't Dead: Innovative Strategies for Brick and Mortar Retail SuccessRating: 5 out of 5 stars5/5 (1)

- The Professional Network For Remote WorkDocument36 pagesThe Professional Network For Remote WorkRavi BheesettyNo ratings yet

- BUS 2100 Milestone 1 Planned Business Outline NXU Learner NameDocument8 pagesBUS 2100 Milestone 1 Planned Business Outline NXU Learner NameARNOLD RONALD MUYOMBANo ratings yet

- Maj IntroDocument2 pagesMaj IntroMajkel Benche Custodio MllNo ratings yet

- Micaren Exel Franchise Disclosure DocumentDocument27 pagesMicaren Exel Franchise Disclosure DocumentMB ManyauNo ratings yet

- The Ten Faces of Innovation 2007Document6 pagesThe Ten Faces of Innovation 2007Fahry Yanuar Rahman100% (1)

- Flowcasting | See Your Money Future Clearly Today | Change It Now for a Better Tomorrow | The Must-Have Money Management, Planning, Budgeting, Mapping Tool and Practical Skill to Succeed Financially.From EverandFlowcasting | See Your Money Future Clearly Today | Change It Now for a Better Tomorrow | The Must-Have Money Management, Planning, Budgeting, Mapping Tool and Practical Skill to Succeed Financially.No ratings yet

- Business Plan FOR: AppendixDocument30 pagesBusiness Plan FOR: AppendixNOUN UPDATE100% (1)

- Opticon OPN-2002 Pairing InstructionsDocument1 pageOpticon OPN-2002 Pairing InstructionsetherNo ratings yet

- Motorola Communication StructureDocument25 pagesMotorola Communication Structureyo5208No ratings yet

- Build your empire: learning to lead the life of a leaderFrom EverandBuild your empire: learning to lead the life of a leaderNo ratings yet

- A Study of Agricultural Finance by CommercialDocument7 pagesA Study of Agricultural Finance by CommercialBiju JosephNo ratings yet

- Automated Linkedin Outreach A Complete Guide - 2021 EditionFrom EverandAutomated Linkedin Outreach A Complete Guide - 2021 EditionNo ratings yet

- Assignment Capital BudgetingDocument29 pagesAssignment Capital BudgetingYasha Sahu0% (1)

- Jimoh Ibrahim - Why I Buy Dead CompaniesDocument6 pagesJimoh Ibrahim - Why I Buy Dead CompaniesAdékúnlé BínúyóNo ratings yet

- EENG410 Microprocessors IDocument12 pagesEENG410 Microprocessors ISarwer Hussain FaisalNo ratings yet

- SQB - Chapter 10 QuestionsDocument8 pagesSQB - Chapter 10 QuestionsracsoNo ratings yet

- SQB - Chapter 9 QuestionsDocument3 pagesSQB - Chapter 9 QuestionsracsoNo ratings yet

- SQB - Chapter 7 QuestionsDocument16 pagesSQB - Chapter 7 QuestionsracsoNo ratings yet

- SQB - Chapter 8 QuestionsDocument8 pagesSQB - Chapter 8 Questionsracso0% (1)

- SQB - Chapter 5 QuestionsDocument6 pagesSQB - Chapter 5 QuestionsracsoNo ratings yet

- SQB - Chapter 6 QuestionsDocument5 pagesSQB - Chapter 6 QuestionsracsoNo ratings yet

- SQB - Chapter 3 QuestionsDocument6 pagesSQB - Chapter 3 QuestionsracsoNo ratings yet

- SQB - Chapter 2 QuestionsDocument4 pagesSQB - Chapter 2 QuestionsracsoNo ratings yet

- SQB - Chapter 1 QuestionsDocument3 pagesSQB - Chapter 1 QuestionsracsoNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- Principles of Accounting - POA - Semester (Spring 2023)Document2 pagesPrinciples of Accounting - POA - Semester (Spring 2023)Umer SiddiquiNo ratings yet

- Balance Sheet 2022Document4 pagesBalance Sheet 2022Llus NaruamNo ratings yet

- What Are The Indirect TaxesDocument3 pagesWhat Are The Indirect Taxesatmiya2010No ratings yet

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- Understanding You Pay Guide 2018Document28 pagesUnderstanding You Pay Guide 2018Rodríguez CésarNo ratings yet

- AE 25 Module 1 Lesson 1Document99 pagesAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNo ratings yet

- EssilorLuxottica - Credit AnalysisDocument4 pagesEssilorLuxottica - Credit AnalysisManfredi SopraniNo ratings yet

- Sources of FinanceDocument8 pagesSources of Financejuzzy52100% (2)

- Rectification of ErrorsDocument4 pagesRectification of ErrorsRoshini ANo ratings yet

- Introduction To The Canback Global Income Distribution Database (C-GIDD)Document41 pagesIntroduction To The Canback Global Income Distribution Database (C-GIDD)IVANNo ratings yet

- SDFFDocument10 pagesSDFFNidhi AshokNo ratings yet

- Module 13 - Inventories: IFRS Foundation: Training Material For The IFRSDocument47 pagesModule 13 - Inventories: IFRS Foundation: Training Material For The IFRSSamantha DionisioNo ratings yet

- ACCT 202: Managerial Accounting: Job Order CostingDocument38 pagesACCT 202: Managerial Accounting: Job Order CostingHieu DamNo ratings yet

- SBAPL DRAFT 4th Month VdistributionDocument76 pagesSBAPL DRAFT 4th Month VdistributionRushikesh GadreNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesRieva Jean PacinaNo ratings yet

- Taxation of Income Earned From Selling SharesDocument5 pagesTaxation of Income Earned From Selling Sharesphani raja kumarNo ratings yet

- Medium Term Business Plan 3Document16 pagesMedium Term Business Plan 3Ravi HettigeNo ratings yet

- Project DescriptionDocument6 pagesProject Descriptionnaztig_017No ratings yet

- Finance 33Document16 pagesFinance 33iris100% (1)

- Advantages of Marginal CostingDocument2 pagesAdvantages of Marginal CostingdevilNo ratings yet

- Tata SteelDocument15 pagesTata SteelanwaritmNo ratings yet

- Rule 122 and 127Document153 pagesRule 122 and 127Bam GuerreroNo ratings yet

- Heritage Foods LTD: Dairy Sector Outlook - PositiveDocument31 pagesHeritage Foods LTD: Dairy Sector Outlook - PositiveGourav BaidNo ratings yet