Professional Documents

Culture Documents

Relationship Between Working Capital Management and Profitability

Uploaded by

Editor IJIRMFOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Relationship Between Working Capital Management and Profitability

Uploaded by

Editor IJIRMFCopyright:

Available Formats

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD

ISSN 2455-0620

Volume - 2, Issue - 8, Aug - 2016

Relationship between Working Capital Management and Profitability

Muhammad Iqbal1 , Sher Khan2, Syed Qaim Shah3, Wahid Raza4

1. MBA Scholar at Department of management sciences, National University of Modern Language Islamabad, Pakistan.

2. MS Scholar at Institute of business and Management Sciences, the University of Agriculture Peshawar, Pakistan.

3. MBA Scholar at Department of management sciences, National University of Modern Language Islamabad, Pakistan.

4. Ph.d Scholar at Department of Management Science, Islamia University Peshawar, Pakis.tan

Abstract: The aim of this research is to find the impact of working capital management on firms

profitability. The data of the thirty companies listed in KSE was taken as a sample from two sectors

cement and foods for the period of 2007 to 2011.The profitability is measured through two

variables; Return on Assets and Return on Equity, while the independent variables are Average

collection period, Inventory turnover in days and Current Ratio. Regression and Correlation analysis

was employed. The result shows that there is positive and significant relation between profitability

and current ratio and Average collection period while negative and insignificant relation between

profitability and inventory turnover in days.

Key Words: Capital Management, Data, Finance, Correlation, Stock Exchange.

Introduction:

Working capital management is the lifeblood of business and every manager's primary task is to help keep it

flowing and to use the cash flow to generate profits .Therefore Working capital management is a very important

component of corporate finance because it directly affects the liquidity and profitability of the firm (Rehman &

Nasr, 2007). It investigates the relationship between the working capital management and the firms profitability.

Efficient management of working Capital is one of the pre-conditions for the success of an enterprise.

Investments in current assets are inevitable to ensure delivery of goods or services to the ultimate customers and a

proper management of same should give the desired impact on either profitability for this reason significant

amount of funds is necessary to invest permanently in the form of various current assets. If resources are blocked

at different stage of supply chain, this will prolong cash operating cycle. Although this might increase

profitability (due to increase sales), it may also adversely affect the profitability. If the costs tied up in working

capital exceed the benefits of holding more inventories or granting more trade credit to customers (Khan & Jain).

The management of operating cycle is the most important part of the companys financial management. The most

efficient allocation of capital an Organization that to meet the need for profitability, the management of

circulating assets aims at achieving the operating cycle with a minimum level of circulating assets, and the

management of circulating liabilities aims at the lowest cost of procuring the necessary capital. In order to

decrease risk, determining the required circulating assets (stocks, debts and liquidities); determining how to

finance the required circulating assets (working capital, operating liabilities: suppliers, creditors) A popular

measure of working capital management is the cash conversion cycle, that is, the time span between the

expenditure for the purchases of raw materials and the collection of sales of finished goods.

Objectives of the Research:

The main objective of this research is to find the impact of effective working management on the profitability of

the firms listed in Karachi Stock Exchange.

Hypothesis:

The study will test the following hypothesis

H1: Working Capital Management has no Impact on firms profitability

H2: Working Capital management has an impact on firms profitability.

Scope of the research:

This research will be conducted on listed companies of KSE so the results are applicable to KSE listed companies

only.

Literature Review:

Danuletiu (2010) In their study tried to find out relationship between the efficiency of working capital

management and profitability. They collected Data from the financial statements of large companies Alba County

and taken sample of 20 annual financial statements of the companys period 2004-2008using correlation analyses.

Three politics of management operating cycle with different effects on profitability and risk. 1.

Relationship between Working Capital Management and Profitability

Page 180

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD

ISSN 2455-0620

Volume - 2, Issue - 8, Aug - 2016

Offensive/aggressive policy 2. Defensive/ protective policy 3. Balanced/ optimal policy. Variables use Net

Working Capital, Working capital necessary, Net Treasury. As a result there is a weak negative linear correlation

between Working capital management and Profitability.

Sagir et al (2011) their study found that the working capital management effect on firms profitability. Working

capital management is very important component of corporate finance because it directly affects the liquidity and

profitability of the Firm. They used a sample textile industry at KSE.There are three categories of whole textile

industry at KSE, textile spinning, textile weaving and textile composite and selected 60 large and well-known

textile companies listed at KSE, for a period from 2001 2006 . These are those firms which represent the overall

ACP

ITID

CR

ROA

ROE

industry Variables used No. of days A/R, No. of days Inventory, No. of days A/P, and Cash Conversion Cycle.

Purpose to establish a relationship that is of statistical significant which showed that there is statistically negative

significance between profitability and working capital management finally, ordinary least regression analysis

found a negative relationship between the Working capital management and profitability.

Gondal (2013) in his study they discuss the Working capital management of Pakistan cement sector. Pakistan

exporting cement to India, middle east and Africa therefore it is need to properly operate the working capital

management for success and failure KSE 21 cement companies taken for the purpose to know that how working

capital management directly effect to profitability there for it is use quantitative method for research which result

negative relationship between them it is a big issue because it is providing basic material which need for

construction from starting to ending. many companies faces to loss like India, Turkish due to manager wrong

policies which highly effect to profitability in day to day operation there for regression analysis were used for all

the ratios and finally companies are strongly compete with each other and limited companies are investment and

they make monopoly because of positive relationship between growth and expected profitability.

Muhammad et al (2010) lto find out the working capital management effect on Firms profitability therefore

Working capital in business is considered as life blood. The study has been undertaken with the prime objective

of analyzing the effect of working capital management on the profitability of firms. Higher amount of working

capital will increase the liquidity but at the same time will create impact on profitability. In this study is used

secondary data collected from listed 25 Textile industry in Karachi stock exchange for the period of 2001-2006.

The effect of Working capital management on profitability is tested using the panel data methodology. Which

based on correlation and Regression analysis and show that there is a strong Positive relationship between

profitability and cash, accounts Receivable and, inventory and negative Relationship with accounts payable?

Objective of any Firm is to maximize profit. The fundamental principles of working capital management are to

reduce the capital employed and to improve efficiency.

Research Methodology:

Data and Sample:

Population of the study will be selected from two sectors cement and foods listed at Karachi Stock Exchange. In

the KSE there are taken as a sample 15 companies from cement sectors and 15 companies from foods

respectively. The data has been collected from the database provided by Karachi Stock exchange, which includes

financial statements and annual reports regarding listed public limited companies. Therefore selected data of the

companies listed at Karachi stock Exchange for a period of five years from 2007 2011 from both industry as a

sample. These are those firms which represent the overall industry.

Dependent Variable:

The dependent variables are following

Return on Assets

Return on Assets (ROA) =Net Income /Total Assets.

Return on Equity

Return on equity (ROE) = Net income/Equity.

Independent Variables

The independent variables are following

Average collection period, Inventory turnover in days, Current Ratio

Statistical tool Instrument used in this research is Regression and Correlation analysis. Regression analysis is

used to investigate the impact of Working Capital Management on corporate profitability. Therefore table

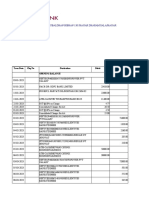

Table 1 Descriptive Statistics:Relationship between Working Capital Management and Profitability

Page 181

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD

Mean

Standard Error

Median

Mode

Standard

Deviation

Sample Variance

Kurtosis

Skewness

Range

Minimum

Maximum

Sum

Count

ISSN 2455-0620

Volume - 2, Issue - 8, Aug - 2016

10.66870241

1.014361515

7.554986998

0

57.00133684

6.150029803

32.31192769

68.01134059

1.154563

0.101971

0.856911

0.761208

0.039027598

0.009141766

0.020181872

-1.08001

1.340989

0.107442

12.42334064

75.3221746

1.248884

0.111963315

16.4237

154.3393926

11.80337274

2.765845467

80.60213052

0

80.60213052

1600.305361

150

5673.429987

26.6679749

4.30402274

643.8305076

1.224292562

645.0548002

8550.200526

150

1.559711

20.31182

4.090573

9.080416

0.100107

9.180523

173.1844

150

0.012535784

2.152942514

0.289768891

0.820856288

-0.419319949

0.401536339

5.854139634

150

269.7378

145.5775

-11.9562

222.9192

-199.417

23.50268

-162.001

150

Model Summary and ANOVA has been used to check the regression and significance of all variables used in

the study. Correlation analysis is used to measure the degree to which any two variables vary together as known

is Correlation. We have analyzed the data by using correlation, Model Summary and ANOVA

Results and Discussion:

Above table gives the descriptive statistics for variables that are used in this study. Their total

profitability depends upon how efficiently they manage their resources particularly all those which are

used for the daily operations of the firm. If they manage their current assets as well as current liabilities,

then it are sure that they are going to get profit, can compete their competitors and can capture

maximum market shares.ACP stands for Average Collection Period. ITID stands for Inventory turnover

in days. CR stands for Current Ratio. ROA (Return on Assets) and ROE (Return on Equity).

Mean: - Average Collection Period is need 10 days, Inventory turnover in days is required 57 days to

convert in cash CR is (1.154563), ROA Mean is less than 1 (0.039027598), and ROE is negative (1.08001).

Standard Error: - Average Collection Period is 1 day, Inventory turnover in days is 6 days is need to

convert in cash and ROE is positive above the Zero in the other hand CR is (0.101971) and ROA is

positive but less than Zero.

Median: - Average Collection Period is 7 days and Inventory turnover in days is 32 days is need to

convert in cash, CR (0.856911), ROA and ROE is less than 1

Mode: - Average Collection Period is Zero, Inventory turnover in days is 68 days, CR vale is less than

1 and the value of ROA and ROE is nil.

Standard Deviation: - Average Collection Period is 12 days; Inventory turnover in days is 75 days is

needed CR value is (1.248884) ROA is less than 1 and ROE is (16.4237).

Sample Variance: - Average Collection Period is 154 days; Inventory turnover in days is 5673 ROA

is less than 1 and ROE is (269.7378).

Kurtosis: - Average Collection Period is 11 days; Inventory turnover in days is 26 days is needed CR

value is (20.31182) ROA is (2.152942514) and ROE is (145.5775).

Skewness: -, Average Collection Period is 2 days; Inventory turnover in days is 4 days is needed CR

value is (4.090573) ROA is (0.289768891) ROE is less than 1 and the value of ROE is negative.

Range: - ACP value is (80.60213052), ITID value is (643.8305076), CR is (9.080416) ROA is less

than 1 therefore it is (0.820856288) and ROE value is (222.9192).

Minimum: - Average Collection Period is 0, ITID is (1.224292562), CR and ROA value are less than 1

and ROE is negative.

Maximum:- Average Collection Period is almost 81 days and Inventory turnover in days is 645 days is

need to convert in cash, CR is (9.180523), ROA is less than 1, but positive (0.401536339) ROE value

is positive(23.50268).

Sum:- - Average Collection Period is 1600 days and Inventory turnover in days is 8550 days is need to

convert in cash, CR is (173.1844), ROA is (5.854139634) Only ROE is negative

(-162.001)

Count: - 150 in the entire above table

Relationship between Working Capital Management and Profitability

Page 182

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD

AVERAGE

COLLECTION

PERIOD

AVERAGE COLLECTION

PERIOD

INVENTORY TURNOVER IN

DAYS

CURRENT RATIO

ROA

ROE

ISSN 2455-0620

INVENTORY

TURNOVER IN

DAYS

CURRENT

RATIO

Volume - 2, Issue - 8, Aug - 2016

ROA

ROE

0.1227

-0.0092

0.1130

0.0593

0.1227

-0.0110

0.0005

-0.0295

-0.0092

0.1130

0.0593

-0.0110

0.0005

-0.0295

1

0.2851

0.0565

0.2851

1

0.1445

0.0565

0.1445

1

Table 4.2 Pearson Correlation Results:

In above Table 4.2 Average collection period relationships with Average collection period is

perfectly positive because it is 1, so therefore it has strong positive relation. Average collection period

with Inventory turnover in days has weak positive relation (0.1227). Average collection period with

Current ratio is weak negative relation (-0.0092). Average collection period with ROA (0.1130) and

ROE (0.1130) weak positive relation. Inventory turnover in days, relationship with Average collection

period is positive weak. Own self perfect positive relationship Inventory turnover in days with Current

ratio weak negative relation weak positive relation with ROA and weak negative with ROA. Current

ratio relation with Average collection period and Inventory turnover in days weak negative, and

Current ratio with ROA and ROE weak positive. Return on Asset relation with Average collection

period, Inventory turnover in days, Current ratio and ROE weak positive. Return on Equity relation with

Average collection period, Current ratio, and ROA have weak positive relationship and weak negative

relationship with Inventory turnover in days.

Table 4.3: Regression Results with Dependent Variable: R.O.A.

Summary Output

R square

Adjusted R square

Standard error

Observations

0.094831932

0.076232589

0.107611099

150

ANOVA

Regression

Residual

Total

Variable

Constant

AVERAGE

COLLECTION PERIOD

INVENTORY

TURNOVER IN DAYS

Coefficient

-0.000941316

Df

SS

3

146

149

0.1771301

1.690701709

1.867831809

Std. error

MS

Significance

F

0.059043 5.098671 0.002196644

0.01158

0

0

0

0

0

t-value

p-value

0.015379717

-0.06121

0.951279607

0.001054965

0.000715046

1.475379

0.142263946

-1.58597E-05

0.025652854

0.000117939

0.007059633

-0.13447

3.633738

0.893213064

0.000386203

R2 = 0.094831932,F-value =5.098670856 , P-value = 0.002196644

The results of Table 4.3 shows that Average collection period is positively and insignificant correlated

with dependent variable R.O.A. because the value of T-Test statistics is (1.475379) which is less than 2.

Inventory turnover in days is also insignificant correlated with dependent variable R.O.A. because t its

value is less than 2 and the value of. Inventory turnover in days is negative as well as (-0.13447).

Current ratio is significant correlated with dependent variable R.O.A (3.633738) because T value is

greater than 2.

To check the goodness of model (F-Test)

Null Hypothesis: The fit is good

Alternate: The fit is not good

Relationship between Working Capital Management and Profitability

Page 183

INTERNATIONAL JOURNAL FOR INNOVATIVE RESEARCH IN MULTIDISCIPLINARY FIELD

ISSN 2455-0620

Volume - 2, Issue - 8, Aug - 2016

Since the value of P in ANOVA table is greater than 0.002 so we accept Null hypothesis The model is t

good because there is F Value is greater than Significance F value like 5.098670856>0.002196644

therefore this model should be accept.

Table 4 Regression Results with Dependent Variable R.O.E

Variable

Constant

AVERAGE

COLLECTION PERIOD

INVENTORY

TURNOVER IN DAYS

Coefficient

-2.393175527

Std. error

2.361600514

t-value

-1.013370175

p-value

0.312559818

0.085185832

0.109797472

0.775845115

0.439095391

-0.00803228

0.018109877

-0.443530334

0.688888661

0.658038759

0.491986613

CURRENT RATIO

0.746774132

1.084027324

2

R = 0.00812929,F-value =0.398867974, P-value = 0.75401331

The results of Table 4 show that Average collection period is insignificant because its value is

(0.775845115) less than 2. Inventory turnover in days is also insignificant its value is less than 2 and the

value of Inventory turnover in days is negative as well as (-0.443530334). Current ratio is insignificant

because its value is (0.688888661) less than 2.

To check the goodness of fit of model (F-Test)

Null Hypothesis: The fit is not good.

Alternate fit is good.

Since the value of P in ANOVA table is less than 0.75 so we reject Null hypothesis. The model is not

good because there is F Value is smaller than Significance F value like 0.398867974 <0.75401331

therefore this model should be rejected.

Conclusion:

The aim of this research is to find the impact of working capital management on firms profitability. The

data of the thirty companies listed in KSE was taken as a sample from two sectors cement and foods for

the period of 2007 to 2011.The profitability is measured through two variables; Return on Assets and

Return on Equity, while the independent variables are Average collection period, Inventory turnover in

days and Current Ratio. Regression and Correlation analysis was employed. The result shows that there

is positive and significant relation between profitability and current ratio and Average collection period

while negative and insignificant relation between profitability and inventory turnover in days.

References:

1. Arshad, Z., Gondal,M., Yasir. (June 2010)Impact of Working Capital Management on

Profitability, A Case of Pakistan Cement IndustryInterdisciplinary Journal of Contemporary

Research in Business. Volume 5, NO 2, 384-390

2. Danuletiu, A., Elena, (2010)Working Capital Management and Profitability: A Case of ALBA

County Companies. Annales Universities Apulensis Series Oeconomica Volume 12(1), 364374.

3. Gill, A., Biger, N., Mathur,N., (July 31, 2010)The Relationship between Working Capital

Management on Profitability: Evidence from the United States. Business and Economic

Journal Volume, 2010:BEG-10, (1-9)

4. Muhammad M., Jan, W., Ullah, Ullah. Working Capital Management on Profitability, An

Analysis of Firm of Textile of Pakistan. Journal of Managerial Sciences. Volume 4. 156-165.

5. Shubita, M., F. (July2013)Working Capital Management and Profitability: A Case of Industrial

Jordanian CompaniesThe Special Issue on Contemporary Research. Volume NO 4, NO 8

(108-115)

6. Saghir, A., Hashmi, F., Mehmood, Hussain, M., Nehal. (December, 2011)Working Capital

Management and Profitability Evidence from Pakistan Firm. Interdisciplinary Journal of

Contemporary Research in Business Volume 12, NO 8, 1093-1105.

7. Yadva, S., Sharma, D. (July- September 2013)Multivate Analysis to Study the Impact

Profitability onWorking Capital Management in Dadur India Limited. International Journal of

Research in Management and Social Sciences volume 1, 34-42.

Relationship between Working Capital Management and Profitability

Page 184

You might also like

- Review of LiteratureDocument10 pagesReview of Literatureamuliya v.sNo ratings yet

- WCM in Textile Industry in BangladeshDocument18 pagesWCM in Textile Industry in BangladeshMahesh BendigeriNo ratings yet

- Impact of Working Capital Management On Profitability of Textile Sector of PakistanDocument15 pagesImpact of Working Capital Management On Profitability of Textile Sector of PakistanshahrukhziaNo ratings yet

- Working Capital Management An Analysis of Sri Lankan Manufacturing CompaniesDocument14 pagesWorking Capital Management An Analysis of Sri Lankan Manufacturing CompaniesMiranda Sumith SilvaNo ratings yet

- Literature ReviewDocument8 pagesLiterature ReviewGoutam SoniNo ratings yet

- Working Capital Management and Corporate Profitability: Empirical Evidences From Nepalese Manufacturing SectorDocument16 pagesWorking Capital Management and Corporate Profitability: Empirical Evidences From Nepalese Manufacturing SectorJulia ConceNo ratings yet

- Working Capital Management of Ambuja Cements Limited Through Ratio AnalysisDocument5 pagesWorking Capital Management of Ambuja Cements Limited Through Ratio AnalysisSri KamalNo ratings yet

- Evaluating The Impact of Working Capital Management Components On Corporate Profitability: Evidence From Indian Manufacturing FirmsDocument10 pagesEvaluating The Impact of Working Capital Management Components On Corporate Profitability: Evidence From Indian Manufacturing FirmsderihoodNo ratings yet

- Review of Literature 1Document3 pagesReview of Literature 1amuliya v.sNo ratings yet

- 10 1 1 734 7796 PDFDocument9 pages10 1 1 734 7796 PDFGizachewNo ratings yet

- How Working Capital Management Impact On Profitability in Textile Sector in PakistanDocument16 pagesHow Working Capital Management Impact On Profitability in Textile Sector in PakistanALI SHER HaidriNo ratings yet

- Research Final DraftDocument6 pagesResearch Final Draftmonis shakeelNo ratings yet

- 481 492 PDFDocument12 pages481 492 PDFAP SinghNo ratings yet

- Appuhami Ranjith BDocument8 pagesAppuhami Ranjith Bnational coursesNo ratings yet

- Cost of CapitalDocument22 pagesCost of CapitalddfaasdNo ratings yet

- Cogs PDFDocument14 pagesCogs PDFRa KumalaNo ratings yet

- Analysis of Impact of Working Capital Management On Profitability of Adani Wilmar Ltd.Document6 pagesAnalysis of Impact of Working Capital Management On Profitability of Adani Wilmar Ltd.Shruti UpadhyayNo ratings yet

- Working Capital Management 2Document7 pagesWorking Capital Management 2Nomi AliNo ratings yet

- Impact of Working Capital Management On Profitability: A Case of Pakistan Textile IndustryDocument4 pagesImpact of Working Capital Management On Profitability: A Case of Pakistan Textile IndustryUmar AbbasNo ratings yet

- Review of The Literature ProfitabilityDocument17 pagesReview of The Literature Profitabilitysheleftme100% (3)

- An Empirical Study On Working Capital Management and ProfitabilityDocument5 pagesAn Empirical Study On Working Capital Management and Profitabilityanjali shilpa kajalNo ratings yet

- Manage-Working Capital Management of Paper Mills-K MadhaviDocument10 pagesManage-Working Capital Management of Paper Mills-K MadhaviImpact JournalsNo ratings yet

- Exploring The Link Between Operational Efficiency and Firms' Financial Performance An Empirical Evidence From The Ghana Stock Exchange GSEDocument7 pagesExploring The Link Between Operational Efficiency and Firms' Financial Performance An Empirical Evidence From The Ghana Stock Exchange GSEEditor IJTSRDNo ratings yet

- 1 s2.0 S221256711600037X Main PDFDocument7 pages1 s2.0 S221256711600037X Main PDFfiestaNo ratings yet

- Effects of Working Capital Management On SME Profitability: Pedro Juan García TeruelDocument8 pagesEffects of Working Capital Management On SME Profitability: Pedro Juan García TeruelGaurav Kumar BhagatNo ratings yet

- 1 PBDocument12 pages1 PB155- Salsabila GadingNo ratings yet

- Summer Internship Project Report On: Benchmarking-Working Capital of Specific Indian IndustriesDocument4 pagesSummer Internship Project Report On: Benchmarking-Working Capital of Specific Indian Industriesanjali shilpa kajalNo ratings yet

- The Effect of Working Capital ManagementDocument11 pagesThe Effect of Working Capital ManagementTesfu AknawNo ratings yet

- Working Capital Management and Profitability: A Study On Cement Industry in BangladeshDocument12 pagesWorking Capital Management and Profitability: A Study On Cement Industry in BangladeshSudip BaruaNo ratings yet

- Rastogi (2013) Working Capital Management Nasional FertilizerDocument4 pagesRastogi (2013) Working Capital Management Nasional FertilizerRahmadhani PutriNo ratings yet

- 2 BM1307-012Document8 pages2 BM1307-012makmurNo ratings yet

- 10 11648 J Ijefm 20170502 16Document8 pages10 11648 J Ijefm 20170502 16samiha jahanNo ratings yet

- Factors Influencing Corporate Working Capital Management: Evidence From An Emerging EconomyDocument20 pagesFactors Influencing Corporate Working Capital Management: Evidence From An Emerging Economyhamza_butt15No ratings yet

- Effect of Working Capital Management On Firm ProfitabilityDocument15 pagesEffect of Working Capital Management On Firm ProfitabilityBagus Alaudin AhnafNo ratings yet

- Summer Internship Project Report On: Benchmarking-Working Capital of Specific Indian IndustriesDocument7 pagesSummer Internship Project Report On: Benchmarking-Working Capital of Specific Indian Industriesanjali shilpa kajalNo ratings yet

- Investigating The Effect of Corporate Governance On Profit Management and Expenditure Cohesion in Corporations of Accepted in Tehran Stock ExchangeDocument13 pagesInvestigating The Effect of Corporate Governance On Profit Management and Expenditure Cohesion in Corporations of Accepted in Tehran Stock ExchangeTerizlaNo ratings yet

- Effect of Cash Conversion Cycle On Profitability: Listed Plantation Companies in Sri LankaDocument6 pagesEffect of Cash Conversion Cycle On Profitability: Listed Plantation Companies in Sri LankaBlok ProgramNo ratings yet

- What Drives Working Capital Behaviour of Indian FMCG Sector?Document17 pagesWhat Drives Working Capital Behaviour of Indian FMCG Sector?Dr-Vikas BhargawNo ratings yet

- Review of LiteratureDocument9 pagesReview of LiteratureShankar ChinnusamyNo ratings yet

- Artikel Rico EnglishDocument17 pagesArtikel Rico EnglishMuhammad Ghulam RobbaniNo ratings yet

- The Relationship Between Working Capital Management and Profitability: Evidence From PakistanDocument12 pagesThe Relationship Between Working Capital Management and Profitability: Evidence From PakistanJudith N Gavidia MNo ratings yet

- Research Paper On Working CapitalDocument7 pagesResearch Paper On Working CapitalRujuta ShahNo ratings yet

- International Journal of Accounting ResearchDocument8 pagesInternational Journal of Accounting Researchsant1.massisNo ratings yet

- Working Capital PropertyDocument27 pagesWorking Capital PropertyHaris HanifNo ratings yet

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocument8 pagesImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulNo ratings yet

- Impact of CCC On WCM Through PrfitabilityDocument8 pagesImpact of CCC On WCM Through Prfitabilityراجہ رفیع ترکNo ratings yet

- A Study of Working Capital Management Efficiency of India Cements LTDDocument4 pagesA Study of Working Capital Management Efficiency of India Cements LTDSumeet N ChaudhariNo ratings yet

- Impact of Working Capital Management in The Profitability of Hindalco Industries LimitedDocument7 pagesImpact of Working Capital Management in The Profitability of Hindalco Industries LimitedMuhammad Khuram ShahzadNo ratings yet

- 10 1 1 904 7812 PDFDocument10 pages10 1 1 904 7812 PDFfisayobabs11No ratings yet

- Corporate Governance and Financial LeverDocument9 pagesCorporate Governance and Financial LeverRika Ircivy Agita YanguNo ratings yet

- Intro and LitDocument3 pagesIntro and LitAmanj AhmedNo ratings yet

- A Study of Selected Manufacturing Companies Listed On Colombo Stock Exchange in Sri LankaDocument10 pagesA Study of Selected Manufacturing Companies Listed On Colombo Stock Exchange in Sri LankaAlexander DeckerNo ratings yet

- Working Capital Management and Financial Performance 1528 2635 23 2 356Document10 pagesWorking Capital Management and Financial Performance 1528 2635 23 2 356Kingston Nkansah Kwadwo EmmanuelNo ratings yet

- Waqas Bin Khidmat Mobeen Ur Rehman Impact of Liquidity Solvency On ProfitabilityDocument11 pagesWaqas Bin Khidmat Mobeen Ur Rehman Impact of Liquidity Solvency On ProfitabilityValeed ChNo ratings yet

- Working Capital Management in Tata Steel LimitedDocument8 pagesWorking Capital Management in Tata Steel LimitedImpact JournalsNo ratings yet

- Review of Literature: 2.1 Chapter OverviewDocument37 pagesReview of Literature: 2.1 Chapter OverviewJannpreet KaurNo ratings yet

- Effect of Corporate Governance On Financial Reporting Quality Evidence From Listed Textile Sector Firms On Pakistan Stock ExchangeDocument14 pagesEffect of Corporate Governance On Financial Reporting Quality Evidence From Listed Textile Sector Firms On Pakistan Stock ExchangeSamra MuzafarNo ratings yet

- A Study On Capital Structure Analysis of Tata Motors LimitedDocument5 pagesA Study On Capital Structure Analysis of Tata Motors LimitedAntora HoqueNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- The Effects of Poor Drainage System On Road Pavement: A ReviewDocument8 pagesThe Effects of Poor Drainage System On Road Pavement: A ReviewEditor IJIRMF50% (2)

- A Study On The Purpose & Utilization of Whatsapp Application by College Students in Salem DistrictDocument11 pagesA Study On The Purpose & Utilization of Whatsapp Application by College Students in Salem DistrictEditor IJIRMFNo ratings yet

- MEDIA AND PUBLIC POLICY: An Analysis On The Information Dissemination of National Policy by Mainstream MediaDocument9 pagesMEDIA AND PUBLIC POLICY: An Analysis On The Information Dissemination of National Policy by Mainstream MediaEditor IJIRMFNo ratings yet

- Comparative Study of Religions: A Message of Love and PeaceDocument4 pagesComparative Study of Religions: A Message of Love and PeaceEditor IJIRMFNo ratings yet

- Impact of Performance Parameters On Customers' Satisfaction Level of Bancassurance Services in Public and Private Sector BanksDocument8 pagesImpact of Performance Parameters On Customers' Satisfaction Level of Bancassurance Services in Public and Private Sector BanksEditor IJIRMFNo ratings yet

- Description of Women in Print Media in Tamil Nadu: Analysis On The Coverage of Women Based News by Regional NewspapersDocument10 pagesDescription of Women in Print Media in Tamil Nadu: Analysis On The Coverage of Women Based News by Regional NewspapersEditor IJIRMFNo ratings yet

- Response Surface Optimization of Treated Turbid Water Using Banana Stem JuiceDocument10 pagesResponse Surface Optimization of Treated Turbid Water Using Banana Stem JuiceEditor IJIRMFNo ratings yet

- Effects of Audio - Visual Aids in Achievement of Students of Home - Science at Senior Secondary School LevelDocument4 pagesEffects of Audio - Visual Aids in Achievement of Students of Home - Science at Senior Secondary School LevelEditor IJIRMF100% (1)

- Users' Behavior Regarding Electronic Information Resources in The Library of NIPER MohaliDocument5 pagesUsers' Behavior Regarding Electronic Information Resources in The Library of NIPER MohaliEditor IJIRMFNo ratings yet

- A Novel Algorithm For Load Balancing in P2P SystemDocument7 pagesA Novel Algorithm For Load Balancing in P2P SystemEditor IJIRMFNo ratings yet

- E-Madadindia Household Service ProviderDocument4 pagesE-Madadindia Household Service ProviderEditor IJIRMFNo ratings yet

- An Investigative Study About Deregulation (Restructuring) of Indian Power SectorDocument6 pagesAn Investigative Study About Deregulation (Restructuring) of Indian Power SectorEditor IJIRMFNo ratings yet

- Length-Weight Relationship of Catfish Clarias Batrachus (Linn.) in Bhadravathi Area, KarnatakaDocument4 pagesLength-Weight Relationship of Catfish Clarias Batrachus (Linn.) in Bhadravathi Area, KarnatakaEditor IJIRMFNo ratings yet

- A Survey On UML Modeling and Design InconsistencyDocument3 pagesA Survey On UML Modeling and Design InconsistencyEditor IJIRMFNo ratings yet

- Spot Weld Optimization in Wheel RimDocument5 pagesSpot Weld Optimization in Wheel RimEditor IJIRMFNo ratings yet

- Review of Experiment On Spiral Heat ExchangerDocument4 pagesReview of Experiment On Spiral Heat ExchangerEditor IJIRMFNo ratings yet

- A Study On Financial Derivatives With Special Reference To Nifty F&oDocument5 pagesA Study On Financial Derivatives With Special Reference To Nifty F&oEditor IJIRMFNo ratings yet

- Review Note On The Application of Metagenomics in Emerging Aquaculture Systems and Aquatic Animal Health ManagementDocument8 pagesReview Note On The Application of Metagenomics in Emerging Aquaculture Systems and Aquatic Animal Health ManagementEditor IJIRMFNo ratings yet

- A Review Note On Depleting Fish Stock - Unicorn Cod in IndiaDocument6 pagesA Review Note On Depleting Fish Stock - Unicorn Cod in IndiaEditor IJIRMFNo ratings yet

- Secure Automative Locking Control and Anti Theft Using GPS & BluetoothDocument6 pagesSecure Automative Locking Control and Anti Theft Using GPS & BluetoothEditor IJIRMFNo ratings yet

- To Study About The Behaviour of Mechanical Properties of The Material in Cryo-Rolling Process: A Review ApproachDocument6 pagesTo Study About The Behaviour of Mechanical Properties of The Material in Cryo-Rolling Process: A Review ApproachEditor IJIRMFNo ratings yet

- Extraction of Natural Dye From Rose Flower For Dyeing Cotton FabricsDocument3 pagesExtraction of Natural Dye From Rose Flower For Dyeing Cotton FabricsEditor IJIRMFNo ratings yet

- Framework Based Mobile Library Usage and Success Factor: Review and Extention ConceptDocument8 pagesFramework Based Mobile Library Usage and Success Factor: Review and Extention ConceptEditor IJIRMFNo ratings yet

- The Struggle and The Victory of Savitri in Aurobindo Ghosh's Epic "Savitri"Document2 pagesThe Struggle and The Victory of Savitri in Aurobindo Ghosh's Epic "Savitri"Editor IJIRMFNo ratings yet

- A Framework To Evaluate Digital Literacy Awareness: Tengku Adil, Tengku Izhar, Nurhidayah Abdul JabarDocument8 pagesA Framework To Evaluate Digital Literacy Awareness: Tengku Adil, Tengku Izhar, Nurhidayah Abdul JabarEditor IJIRMFNo ratings yet

- Therapeutic Uses and Action of Neem On Skin Diseases Vs InnoVision Neem Capsule/tabletDocument5 pagesTherapeutic Uses and Action of Neem On Skin Diseases Vs InnoVision Neem Capsule/tabletEditor IJIRMFNo ratings yet

- Role of Ashwagandha in Management of Stress Vis Innovision Ashwagandha Capsule & TabletDocument4 pagesRole of Ashwagandha in Management of Stress Vis Innovision Ashwagandha Capsule & TabletEditor IJIRMFNo ratings yet

- Recent Trends in Catalytic Converter For Automobile: A Review ApproachDocument3 pagesRecent Trends in Catalytic Converter For Automobile: A Review ApproachEditor IJIRMF100% (1)

- Role of Ashwagandha in Management of Stress Vis Innovision Ashwagandha Capsule & TabletDocument4 pagesRole of Ashwagandha in Management of Stress Vis Innovision Ashwagandha Capsule & TabletEditor IJIRMFNo ratings yet

- Chrysler CDS System - Bulletin2Document6 pagesChrysler CDS System - Bulletin2Martin Boiani100% (1)

- NA ReadingStrategies U5M11L03Document1 pageNA ReadingStrategies U5M11L03Lila AlwaerNo ratings yet

- Dummy 13 Printable Jointed Figure Beta FilesDocument9 pagesDummy 13 Printable Jointed Figure Beta FilesArturo GuzmanNo ratings yet

- Structure of NABARD Grade ADocument7 pagesStructure of NABARD Grade ARojalin PaniNo ratings yet

- CrimDocument29 pagesCrimkeziahmae.bagacinaNo ratings yet

- Calendar of Activities A.Y. 2015-2016: 12 Independence Day (Regular Holiday)Document3 pagesCalendar of Activities A.Y. 2015-2016: 12 Independence Day (Regular Holiday)Beny TawanNo ratings yet

- Hand Winches 122 Load Sheaves 126 Gear-And Worm Gear Winches 127 Electric Worm Gear Winches 131 Snatch Blocks 133Document14 pagesHand Winches 122 Load Sheaves 126 Gear-And Worm Gear Winches 127 Electric Worm Gear Winches 131 Snatch Blocks 133Rajaram JayaramanNo ratings yet

- Chudamani Women Expecting ChangeDocument55 pagesChudamani Women Expecting ChangeMr AnantNo ratings yet

- Iso 22301 2019 en PDFDocument11 pagesIso 22301 2019 en PDFImam Saleh100% (3)

- C103 - General Checklist - ISO-IEC 17025:2017 Accreditation of Field Testing and Field Calibration LaboratoriesDocument19 pagesC103 - General Checklist - ISO-IEC 17025:2017 Accreditation of Field Testing and Field Calibration LaboratorieshuidhyiuodghNo ratings yet

- S3 U4 MiniTestDocument3 pagesS3 U4 MiniTestĐinh Thị Thu HàNo ratings yet

- Ec 0301Document25 pagesEc 0301Silvio RomanNo ratings yet

- Simple Enzymes Kinetics and Kinetics ModelDocument14 pagesSimple Enzymes Kinetics and Kinetics ModelSidra-tul MuntahaNo ratings yet

- Furniture AnnexDocument6 pagesFurniture AnnexAlaa HusseinNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- NauseaDocument12 pagesNauseakazakom100% (2)

- VTB Datasheet PDFDocument24 pagesVTB Datasheet PDFNikola DulgiarovNo ratings yet

- Chapter 6 Strategy Analysis and Choice: Strategic Management: A Competitive Advantage Approach, 16e (David)Document27 pagesChapter 6 Strategy Analysis and Choice: Strategic Management: A Competitive Advantage Approach, 16e (David)Masum ZamanNo ratings yet

- Class 1 KeyDocument3 pagesClass 1 Keyshivamsingh.fscNo ratings yet

- Operator's ManualDocument110 pagesOperator's ManualAdam0% (1)

- Details Philippine Qualifications FrameworkDocument6 pagesDetails Philippine Qualifications FrameworkCeline Pascual-RamosNo ratings yet

- Presentation LI: Prepared by Muhammad Zaim Ihtisham Bin Mohd Jamal A17KA5273 13 September 2022Document9 pagesPresentation LI: Prepared by Muhammad Zaim Ihtisham Bin Mohd Jamal A17KA5273 13 September 2022dakmts07No ratings yet

- V13 D03 1 PDFDocument45 pagesV13 D03 1 PDFFredy Camayo De La CruzNo ratings yet

- Full Download University Physics With Modern Physics 14th Edition Young Test Bank PDF Full ChapterDocument13 pagesFull Download University Physics With Modern Physics 14th Edition Young Test Bank PDF Full Chapterpoetrycloudyzjm12q100% (19)

- Passage Planning: Dr. Arwa HusseinDocument15 pagesPassage Planning: Dr. Arwa HusseinArwa Hussein100% (3)

- Shoshana Bulka PragmaticaDocument17 pagesShoshana Bulka PragmaticaJessica JonesNo ratings yet

- KM170, KM171, KM172, F3A21, F3A22: 3 SPEED FWD (Lock Up & Non Lock Up)Document4 pagesKM170, KM171, KM172, F3A21, F3A22: 3 SPEED FWD (Lock Up & Non Lock Up)krzysiek1975No ratings yet

- Training Design SprintDocument11 pagesTraining Design Sprintardi wiantoNo ratings yet

- 1id Abstracts Season 2 Episode 6Document406 pages1id Abstracts Season 2 Episode 6Jennifer BrownNo ratings yet

- QSasDocument50 pagesQSasArvin Delos ReyesNo ratings yet