Professional Documents

Culture Documents

Sample Self Certification Form

Uploaded by

Sai PastranaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Self Certification Form

Uploaded by

Sai PastranaCopyright:

Available Formats

State of Oregon

Low Income Housing Tax Credit

Carryover Application 2015

CARRYOVER 10% SELF CERTIFICATION FORMAT

REPRODUCE ON SPONSOR'S LETTERHEAD

EXHIBIT 1

Certification of Costs Incurred

General Partner (Management) of

(partnership name)

(the "Partnership") asserts that for purposes of

determining the taxpayers' reasonably expected basis as defined by Treasury Regulations Section 1.42-6(b) as the

anticipated adjusted basis of land and depreciable real property, whether or not such amounts are included in eligible

basis. The total basis of $

, of the Partnership upon completion of the (project name )

was expected as of December 31, 2016 (DATE) to be as follows:

Total Reasonably Expected Basis

10% of the above Total Reasonably Expected Basis

Costs, below, have been incurred by the Partnership related to reasonably expected basis of

Land Acquisition

$

Architect Fees

$

Engineering and Survey Fees

$

Financing and Appraisal Fees

$

Construction Contract Costs

$

Legal and Accounting

$

Permits and Fees

$

Consulting Fees

$

Development Fee

$

Total costs incurred

Actual Percent

$

$

$

$

%

Costs incurred as of DATE (Cut-off date of expenditure accumulation) were based upon Internal Revenue Code

("IRC") Section 461 which outlines the rules to be used when determining if a liability has been incurred for income

tax purposes. The determination of when a liability has been incurred is provided by the "all events" test. IRC

Section 461(h)(4) states, "The 'all events' test is met with respect to any item if all events have occurred which

determine the fact of the liability and the amount of such liability can be determined with reasonable accuracy." IRC

461(h)(2) adds the requirement that economic performance with respect to the item must occur. A contract is a

common form of evidence that there is an obligation to make payment and often the contract states a fixed amount

to be paid for specific services performed should meet the conditions of the all events test for accrual of a liability.

Economic performance must be established based on actual services rendered pursuant to the agreement.

Management of the Partnership is responsible for ensuring compliance with federal regulations. Management

assessed its compliance with the 10 percent carryover rule in accordance with Internal Revenue Code (IRC) Section

42(h)(1)(E) and Treasury Regulations Section 1.42-6 as of DATE (Cut-off date of expenditure accumulation).

Based upon this assessment, management believes the Partnership has complied in all material respects with the10

percent carryover rule referred to above.

____________________________________

Authorized Signatory

Name / Title

____________________

Date

You might also like

- Agreement ContractDocument7 pagesAgreement ContractMelaine A. FranciscoNo ratings yet

- Job Description Company DriverDocument2 pagesJob Description Company DriverNoriega Lanee0% (1)

- Comprehensive CSHP Application FormDocument3 pagesComprehensive CSHP Application FormJUCONS ConstructionNo ratings yet

- Employee Final SettlementDocument1 pageEmployee Final SettlementZeeshan Mirza0% (1)

- Endorsement Letter For PEME (EPI5Document2 pagesEndorsement Letter For PEME (EPI5Nat HernandezNo ratings yet

- Re-Certification Audit of Iso 9001:2015: ST NDDocument4 pagesRe-Certification Audit of Iso 9001:2015: ST NDLiaqatNo ratings yet

- MEMO 01 - Completion of Employment RequirementsDocument2 pagesMEMO 01 - Completion of Employment Requirementsjamilove20100% (1)

- FDC-GSC-OP-001 F-28 Ver01 Vehicle Use Agreement PDFDocument2 pagesFDC-GSC-OP-001 F-28 Ver01 Vehicle Use Agreement PDFLeo CabacunganNo ratings yet

- Staff OJT / Internal & External Training Log Sheet: Name: SiteDocument1 pageStaff OJT / Internal & External Training Log Sheet: Name: Sitesangun75No ratings yet

- Subcontractor Accreditation Application FormDocument5 pagesSubcontractor Accreditation Application FormwnaelgasNo ratings yet

- Cash AdvanceDocument2 pagesCash Advancegreenapple015100% (1)

- Annexure VII Sample AMC DocumentDocument6 pagesAnnexure VII Sample AMC DocumentChirag MittalNo ratings yet

- The Stages of The Recruitment Process IncludeDocument3 pagesThe Stages of The Recruitment Process IncludeAashir Nadeem Saeed KhokharNo ratings yet

- CS Form No. 7 Clearance Blank FormDocument5 pagesCS Form No. 7 Clearance Blank FormNachoNo ratings yet

- AAO Electronic Online System Form - 18mar2021-1Document1 pageAAO Electronic Online System Form - 18mar2021-1CherryMaeRamirezAustinNo ratings yet

- HR Performance Evaluation Policy and ProcedureDocument4 pagesHR Performance Evaluation Policy and ProcedureJumadi SuburNo ratings yet

- Sample President Performance AppraisalDocument5 pagesSample President Performance Appraisal1105195794100% (1)

- Contractor's Accreditation ChecklistDocument12 pagesContractor's Accreditation Checklistalvin castroNo ratings yet

- Provision of Food, Accommodation, and Meal Allowance To PHWsDocument6 pagesProvision of Food, Accommodation, and Meal Allowance To PHWsNoel Ephraim AntiguaNo ratings yet

- CCTV Technician Job DescriptionDocument2 pagesCCTV Technician Job DescriptionCyril Rei Raymundo100% (1)

- Change in Authorised Signatories CorporateDocument3 pagesChange in Authorised Signatories Corporateaniruddhajana2394246No ratings yet

- 2 Policies and Guidelines On Overtime Services 2-22-19Document4 pages2 Policies and Guidelines On Overtime Services 2-22-19Tin EstrellaNo ratings yet

- EFI Application Form SUPPLEMENTARY PDFDocument1 pageEFI Application Form SUPPLEMENTARY PDFJhoie GeeCeeNo ratings yet

- Property Plant and Equipment Schedule TemplateDocument3 pagesProperty Plant and Equipment Schedule TemplateKabile MwitaNo ratings yet

- GPPB NPM 011-2010Document4 pagesGPPB NPM 011-2010Eric DykimchingNo ratings yet

- Internship ContractDocument8 pagesInternship ContractAbelardo DaculongNo ratings yet

- Rules and Regulations Governing Contract of Service & Job Orders PDFDocument22 pagesRules and Regulations Governing Contract of Service & Job Orders PDFJB SevillaNo ratings yet

- Delivery Receipt TemplateDocument1 pageDelivery Receipt Templatejaguirre_03No ratings yet

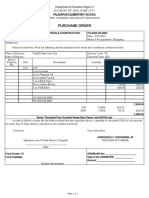

- PurchaseOrder-raq PrincipalDocument1 pagePurchaseOrder-raq PrincipalTheresa Faye De GuzmanNo ratings yet

- FSCS02 Granting Liquidation and Accounting For Cash AdvancesDocument12 pagesFSCS02 Granting Liquidation and Accounting For Cash AdvancesPauline Caceres AbayaNo ratings yet

- Form 2307Document2 pagesForm 2307Dino Garzon OcinoNo ratings yet

- Procurement OfficerDocument7 pagesProcurement OfficerChuz'n OelNo ratings yet

- 07 Job Performance Evaluation Form Job Order PersonnelDocument3 pages07 Job Performance Evaluation Form Job Order PersonnelCharlene Mana SalvadorNo ratings yet

- Offences and Penalties Under Cooperative Societies ActDocument8 pagesOffences and Penalties Under Cooperative Societies ActPious MudgilNo ratings yet

- How To Automate SSSDocument3 pagesHow To Automate SSSinfoNo ratings yet

- Gate Pass FormDocument77 pagesGate Pass FormJessel Emily Shyra PolicarpioNo ratings yet

- Uniform AgreementDocument1 pageUniform AgreementalbertoNo ratings yet

- Procurement ChecklistDocument2 pagesProcurement ChecklistGenesis ArsuloNo ratings yet

- Membership Savings Remittance Form (MSRF) : HQP-PFF-053Document2 pagesMembership Savings Remittance Form (MSRF) : HQP-PFF-053Steve SmithNo ratings yet

- Report Duty FormDocument1 pageReport Duty FormMohd HarrizNo ratings yet

- CEO-Certificate of Completion-Building-editedDocument1 pageCEO-Certificate of Completion-Building-editedEdward PagayonaNo ratings yet

- AEP REQUIREMENTS - ExclusionDocument1 pageAEP REQUIREMENTS - ExclusionChristineNo ratings yet

- Mou FormatDocument5 pagesMou Formatsaravanan ramasamyNo ratings yet

- Pre Procurement ConferenceDocument5 pagesPre Procurement ConferenceMisty HughesNo ratings yet

- DOLE Monitoring of Compliance With JMC 20-04A Checklist As of 08 Jun 21Document4 pagesDOLE Monitoring of Compliance With JMC 20-04A Checklist As of 08 Jun 21Colleen Rose GuanteroNo ratings yet

- ("The Corporation"), A Domestic Corporation Duly Organized and Existing Under Philippine Laws, WithDocument6 pages("The Corporation"), A Domestic Corporation Duly Organized and Existing Under Philippine Laws, WithRaysunArellanoNo ratings yet

- Last Pay CertificateDocument1 pageLast Pay CertificateJamshid UllahNo ratings yet

- Memorandum No. 149-2022Document3 pagesMemorandum No. 149-2022Aldwin OlivoNo ratings yet

- 2022-001 Use of VehicleDocument4 pages2022-001 Use of Vehiclekrismae fatima de castroNo ratings yet

- PPSs Response To Letter of Intent Fro M Macadam Forbes - Final - April 27Document1 pagePPSs Response To Letter of Intent Fro M Macadam Forbes - Final - April 27Portland Business JournalNo ratings yet

- Recommendation Letter SampleDocument3 pagesRecommendation Letter SampleAshish JoshiNo ratings yet

- Car Gas Consumption PolicyDocument7 pagesCar Gas Consumption PolicyDivine Grace MandinNo ratings yet

- Electronic Filing and Payment System (EFPS)Document12 pagesElectronic Filing and Payment System (EFPS)Karissa GaviolaNo ratings yet

- Memo 4 Submission of DocumentsDocument1 pageMemo 4 Submission of DocumentsChristopher BlasurcaNo ratings yet

- Appendix I Template Letter of AcceptanceDocument4 pagesAppendix I Template Letter of AcceptanceSithick MohamedNo ratings yet

- Cancellation of DependnetsDocument1 pageCancellation of Dependnetsavelyn saraspeNo ratings yet

- Subcontract AgreementDocument4 pagesSubcontract AgreementNick PalmaNo ratings yet

- Den FY2021 Financial Report-10Document6 pagesDen FY2021 Financial Report-10PAVANKUMAR S BNo ratings yet

- Delta3 122006Document6 pagesDelta3 122006Sajid AnothersonNo ratings yet

- January 2005 6-1 6-101: Local Governments, and Non-Profit OrganizationsDocument31 pagesJanuary 2005 6-1 6-101: Local Governments, and Non-Profit OrganizationsDoxCak3No ratings yet

- Legal Department MetricsDocument36 pagesLegal Department MetricsSai PastranaNo ratings yet

- NCCT Child Friendly TV Standards As PromulgatedDocument7 pagesNCCT Child Friendly TV Standards As PromulgatedSai PastranaNo ratings yet

- Trademark Lawandthe Public DomainDocument19 pagesTrademark Lawandthe Public DomainSai PastranaNo ratings yet

- AC No. 11774, March 21 2018 (Ready Form, Inc. Vs Atty. Castillon, JR.)Document2 pagesAC No. 11774, March 21 2018 (Ready Form, Inc. Vs Atty. Castillon, JR.)Sai PastranaNo ratings yet

- DRAFT - OMBUDSMAN-MINDANAO VS. MARTEL AND ABEL A. GUI+æARES - 04062019Document3 pagesDRAFT - OMBUDSMAN-MINDANAO VS. MARTEL AND ABEL A. GUI+æARES - 04062019Sai PastranaNo ratings yet

- LTFRB v. Stronghold Insurance Company, G.R. No. 200740, October 2, 2013Document2 pagesLTFRB v. Stronghold Insurance Company, G.R. No. 200740, October 2, 2013Sai PastranaNo ratings yet

- Plameras v. People, G.R. No. 187268, September 4, 2013Document2 pagesPlameras v. People, G.R. No. 187268, September 4, 2013Sai PastranaNo ratings yet

- Capalla v. COMELEC, G.R. No. 201112, June 13, 2012Document4 pagesCapalla v. COMELEC, G.R. No. 201112, June 13, 2012Sai PastranaNo ratings yet

- DRAFT - Joson Vs COA - 04052019Document3 pagesDRAFT - Joson Vs COA - 04052019Sai PastranaNo ratings yet

- GR No. 219708, October 3, 2018 (TIEZA Vs Global-V Builders CO.)Document3 pagesGR No. 219708, October 3, 2018 (TIEZA Vs Global-V Builders CO.)Sai PastranaNo ratings yet

- Capalla v. COMELEC, G.R. No. 201112, October 23, 2012Document3 pagesCapalla v. COMELEC, G.R. No. 201112, October 23, 2012Sai PastranaNo ratings yet

- 12-6-18-SC, August 7, 2018 (Re Contracts With Artes International, Inc.)Document8 pages12-6-18-SC, August 7, 2018 (Re Contracts With Artes International, Inc.)Sai PastranaNo ratings yet

- GR No. 227405, September 5, 2018 (Ombudsman Vs Amado M. Blor, Et. Al.)Document4 pagesGR No. 227405, September 5, 2018 (Ombudsman Vs Amado M. Blor, Et. Al.)Sai PastranaNo ratings yet

- GR No. 232532, October 1, 2018 (Germar Vs Legaspi)Document2 pagesGR No. 232532, October 1, 2018 (Germar Vs Legaspi)Sai PastranaNo ratings yet

- DRAFT - de Guzman Vs OMB - 04062019Document3 pagesDRAFT - de Guzman Vs OMB - 04062019Sai PastranaNo ratings yet

- GR No. 230566, January 22, 2019 (Subic Bay Metropolitan Authority, Et Al. vs. Commission On Audit)Document5 pagesGR No. 230566, January 22, 2019 (Subic Bay Metropolitan Authority, Et Al. vs. Commission On Audit)Sai PastranaNo ratings yet

- GR No. 213323, January 22, 2019 (Teresita S. Lazaro, Et Al. vs. Commission On Audit)Document3 pagesGR No. 213323, January 22, 2019 (Teresita S. Lazaro, Et Al. vs. Commission On Audit)Sai PastranaNo ratings yet

- GR No. 223063, February 11, 2019 (People of The Philippines vs. Hon. Sandiganbayan, Et Al.) (REMEDIAL)Document1 pageGR No. 223063, February 11, 2019 (People of The Philippines vs. Hon. Sandiganbayan, Et Al.) (REMEDIAL)Sai PastranaNo ratings yet

- Updating NCSB Policies and Procedures - Best Practice Guide and Process Flow ChartDocument3 pagesUpdating NCSB Policies and Procedures - Best Practice Guide and Process Flow ChartSai PastranaNo ratings yet

- GR No. 217158, March 12, 2019 (Gios-Samar, Inc. Vs DOTC and Civil Aviation Athority of The Philippines (CAAP) )Document2 pagesGR No. 217158, March 12, 2019 (Gios-Samar, Inc. Vs DOTC and Civil Aviation Athority of The Philippines (CAAP) )Sai Pastrana75% (4)

- Nunga Jr. Vs Nunga IIIDocument21 pagesNunga Jr. Vs Nunga IIISai PastranaNo ratings yet

- Japan-Chile FTADocument8 pagesJapan-Chile FTASai PastranaNo ratings yet

- Ediza Apatan ResumeDocument3 pagesEdiza Apatan ResumeSai PastranaNo ratings yet

- ANTONIO L. CO, President Training On ISO 9001:2015Document1 pageANTONIO L. CO, President Training On ISO 9001:2015Sai PastranaNo ratings yet

- ISO ApprovalDocument1 pageISO ApprovalSai PastranaNo ratings yet

- Republic of The Philippines Judicial Affidavit MGLDocument16 pagesRepublic of The Philippines Judicial Affidavit MGLSai PastranaNo ratings yet

- Process Flow For Processing of Letter Requests (B) - SAI & WAKSDocument2 pagesProcess Flow For Processing of Letter Requests (B) - SAI & WAKSSai PastranaNo ratings yet

- Assignment No.3 Case DigestsDocument13 pagesAssignment No.3 Case DigestsSai PastranaNo ratings yet

- Business FinanceDocument10 pagesBusiness FinanceMike Reyes (XxMKExX)No ratings yet

- Corporation Law Notes Dimaampao PDFDocument29 pagesCorporation Law Notes Dimaampao PDFThea FloresNo ratings yet

- Labor Law CodalsDocument10 pagesLabor Law CodalsRuby ReyesNo ratings yet

- Guidote Vs BorjaDocument6 pagesGuidote Vs Borjayangkee_17No ratings yet

- FlowchartsDocument6 pagesFlowchartsesanchezfloat100% (1)

- Outsourcing Pharmaceutical IndustryDocument12 pagesOutsourcing Pharmaceutical IndustryRyan PereiraNo ratings yet

- David Hicks, KPMG, Counter FraudDocument24 pagesDavid Hicks, KPMG, Counter FraudAnca JivanNo ratings yet

- CH 14 ProblemDocument3 pagesCH 14 ProblemGene'sNo ratings yet

- Prelim Exam, Partnership Formation and Operation PDFDocument2 pagesPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNo ratings yet

- Actreg1 Notes 2Document17 pagesActreg1 Notes 2nuggsNo ratings yet

- 4 Mendiola V CADocument9 pages4 Mendiola V CACharmila SiplonNo ratings yet

- SAS9 FIN081 1st Periodical ExamDocument17 pagesSAS9 FIN081 1st Periodical ExamIra CuñadoNo ratings yet

- 1 9489496609 PDFDocument23 pages1 9489496609 PDFneelam jainNo ratings yet

- Unit 5 - Indian Partnership Act, 1932Document29 pagesUnit 5 - Indian Partnership Act, 1932Prabhnoor KaurNo ratings yet

- Partnership Operations and Financial ReportingDocument50 pagesPartnership Operations and Financial ReportingMark Ambuang100% (1)

- Business Economics Unit - 1Document19 pagesBusiness Economics Unit - 1Naresh GuduruNo ratings yet

- Business OwnershipDocument24 pagesBusiness OwnershipAye KayNo ratings yet

- Business Organization TypesDocument18 pagesBusiness Organization TypesKaifa FebrianaNo ratings yet

- Partnership Deed Sample File in Word FormatDocument2 pagesPartnership Deed Sample File in Word FormatBkas100% (1)

- Countryside Agency Market Towns Healthcheck Handbook March-2005Document79 pagesCountryside Agency Market Towns Healthcheck Handbook March-2005Gordon MorrisNo ratings yet

- EUFEMIA EVANGELISTA VDocument3 pagesEUFEMIA EVANGELISTA VLina RheaNo ratings yet

- Lone Pine CaféDocument4 pagesLone Pine CaféHardik GuptaNo ratings yet

- Quiz 1Document6 pagesQuiz 1Jonathan VidarNo ratings yet

- Investments and ForeignIncentives ReviewerDocument20 pagesInvestments and ForeignIncentives ReviewerCarlo AgdamagNo ratings yet

- Tender DocumentsDocument101 pagesTender DocumentsSharvari SankheNo ratings yet

- Constitution of Business and Classification of MSMEDocument30 pagesConstitution of Business and Classification of MSMERaj ChauhanNo ratings yet

- Partener SawwalDocument20 pagesPartener SawwalArun SomanNo ratings yet

- Law Chapter 1Document10 pagesLaw Chapter 1Angela Miles DizonNo ratings yet

- Joint Venture Agreement For Calm LessonDocument3 pagesJoint Venture Agreement For Calm Lessonapi-296884529No ratings yet

- Quiz 1 Partnership 09 10Document3 pagesQuiz 1 Partnership 09 10Aldyn Jade GuabnaNo ratings yet