Professional Documents

Culture Documents

A Study On Saving and Spending Habit of Youth

Uploaded by

Vipin ReghunathOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Saving and Spending Habit of Youth

Uploaded by

Vipin ReghunathCopyright:

Available Formats

A Study on Spending and Saving Habit of College Students.

A STUDY ON SPENDING AND SAVING HABIT OF COLLEGE

STUDENTS

Dissertation submitted to Mahatma Gandhi University, Kottayam in the

practical fulfilment of the requirement for the Degree of Bachelor of Commerce

PROJECT REPORT

SHAMNAS SHAJI

VIPIN REGHUNATH

VISHNU CHANDRADATHAN

Final Year B.Com

Under the guidance of

Ms. RINTU JOSE

DEPARTMENT OF COMMERCE

NEWMAN COLLEGE THODUPUZHA

(Reaccredited by NAAC with A Grade)

MARCH 2016

A Study on Spending and Saving Habit of College Students.

INTRODUCTION

With the revolution in the retail sector in India and advent of mall culture,

the spending and saving habits of youth have changed over the years. An over

exposure to marketing communication activities of the companies, the youth has

turned to be more brand conscious and also spend a considerable amount of their

income on entertainment and gadgets. With the increase in spending power of adults,

even the young have become free-hand spenders and spendthrifts in some cases. This

study address the question of why, where, and how the youth spend? The youth

referred to here are college students in under graduation and post graduation. The age

group of 15-25 years is that part of the society which is immortalized in

advertisements. The west depicts this youth as financially and emotionally free, but in

India the case is not the same. Despite being financially dependent on the parents till

about an age of 15-25 years, there is a radical difference observed in the spending

behaviour of the youth of our country.

Youth savings accounts are one tool with the potential to encourage both youth

development and financial inclusion possibly even in a financially sustainable way.

For individuals, a financial cushion such as savings is clearly useful in mitigating the

impact of economic shocks. Research has shown that making formal sector savings

accounts available can boost this financial cushion among both youth and adults.

Research and experience to date suggest that savings accounts for low-income youth

may be a high-leverage tool to achieve both youth development and financial

inclusion objectives.

The study has been undertaken to analyses the spending and saving habit of college

students especially in Newman college Thodupuzha. The main reason behind the

study is the youth spend more than their income and saving habit is declining. This

study shows the various spending and saving avenues for youth and how they

maintain their financial requirements with limited income and high expenses.

A Study on Spending and Saving Habit of College Students.

STATEMENT OF THE PROBLEM

With cultural shift to westernization in India and advent of mall culture, the spending

and savings habits of the students have changed over the years. Youth has started to

spend more money on entertainment and lifestyle and has become more brand

conscious. With the increase in standard of living of adults, the young have also been

empowered with more money and have got more spending power. Similarly the

saving habit in youth is drastically declining over the years. This paper is an attempt to

study the spending and saving habit of undergraduate and postgraduate students in

Newman College, Thoupuzha.

SIGNIFICANCE OF THE STUDY

The spending and saving habit of college students is a relevant topic in this current

scenario because the income of students is very low and expenses are very high. It is

important to study that how will they manage their expenses with their limited

income. The studies proves that savings in students is declining. This study is

conducted to understand the various spending patterns of college students specifically;

the spending patterns of male students were compared to the spending patterns of

female students. The post graduate students and under graduate students are separately

studied.

OBJECTIVES OF THE STUDY

To study the spending pattern of two groups (graduation, post graduation)

To study the avenues of savings practiced by the youth today.

To study gender wise spending of the students.

A Study on Spending and Saving Habit of College Students.

SCOPE OF THE STUDY

The scope of the study is restricted to the students studying in Newman College

Thodupuzha. Both arts and science students in undergraduate and postgraduate level

are considered for the survey.

RESEARCH METHODOLOGY

This study is based on primary as well as secondary data, however primary data

collection has given more importance since it is overhearing factor is students

attitude. The population studied here is the under graduation and post graduation

students in Newman College Thodupuzha. The research is analytical and tool used for

data collection is structured questionnaire.

Primary Data A questionnaire was prepared and the primary data was

collected through survey method.

Secondary Data Web sites, Publications.

Sample Size - The population being large the survey was carried among 100

respondents. They will be considered adequate to represent the characteristics

of the entire population.

Sampling procedure - Convenient Sampling

Sampling Technique Convenient Sampling

Sample Size 100

Sample Design Data has been presented with the help of bar diagram, pie

charts etc.

A Study on Spending and Saving Habit of College Students.

LIMITATIONS OF THE STUDY

The study is limited to the 50 undergraduate and 50 postgraduate students in

Newman College Thodupuzha.

An interpretation of the study is based on the assumption that the respondents

are given correct information.

Besides, the study has the limitation of time, place, and resources.

CHAPTERISATION

The present study A Study on the Spending and saving habit of College Students is

organized and presented in various chapters.

The first chapter contain introduction, statement of the problem, significant of the

study, research methodology, limitations and chapter scheme.

The second chapter deals with the theoretical framework, which contain details about

various spending and savings avenues for youth

The third chapter consist of findings, suggestions, recommendations and conclusion.

A questionnaire is also included at last in Appendix.

A Study on Spending and Saving Habit of College Students.

CHAPTER 2

SAVING AVENUES

1, BANK DEPOSIT

The most important function of bank is to accept deposit from the public. Through this

function banks pools together the scattered savings of the society for being used for

productive purposes. The various types of deposits accepted by banks form a good

avenue of investment to customers. The different types of deposits by a commercial

bank are:

1) Fixed Deposit or Time Deposit.

In the case of fixed deposit, money is deposited for a fixe period of time and can be

withdrawn only after the expiry of the period. The rate of interest on this type of

deposit is higher as compared to other type of deposits. At the time of making FD, the

bank issues a receipt to the depositor known as fixed deposit receipt. It contains the

amount deposited, the name of the depositor, rate of interest, and maturity date. It has

to be surrendered to the bank on the due date for getting back the deposit amount

together with interest.

Key features

Involves placing funds with the bank for a fixed term (not less than 30 days)

for a certain stipulated amount of interest.

The ideal investment time for bank FDs is 6 to 12 months as normally interest

on bank less than 6 months bank FDs likely to be low.

The time frame assumes importance as early withdrawal may carry penalty.

A Study on Spending and Saving Habit of College Students.

2) Current Deposit or Demand Deposits

Current deposit are those deposits into which money can be deposited any number of

times and form which money can be withdrawn as many times as the depositor wants.

These accounts are usually maintained by traders and business men who have to make

number of payments on a single day. Current deposit s are payable on demand and

hence are called demand deposits. Very low rate of interest only is paid on these

accounts and hence it cannot be considered as an investment.

3) Saving Deposits

In the case of saving deposits, customers can deposit any amount of money at any

number of times. But certain restrictions imposed on the number of withdrawals.

Cheque facility is provided to the saving depositors. Currently interest is calculated on

the daily balance available in the account.

Key features

Often the first banking product people use.

Low interest however, high liquidity

Suitable for inculcating the habit of saving among customers.

4) Recurring Deposits

In the case of recurring deposits or RD, a fixed sum of money is invested every month

for a predetermined period. The rate of interest on these deposits is almost the same as

that of FD. The period for which such a deposit is opened varies between one year to

ten years. On maturity the depositor gets back the amount deposited together with the

interest accrued.

7

A Study on Spending and Saving Habit of College Students.

Key features

Some fixed amount is deposited at monthly intervals for a pre-fixed term.

Earn higher interest than savings bank account

Helps in the saving of fixed amount every month.

2, POST OFFICE SAVING SCHEME

Post office saving scheme provides a safe or risk free and attractive savings for small

investors. Since post offices are spread all over the country, post office savings are

ideal saving avenues, particularly to small investors with limited income. There are

about 155000 post offices across the country from which various the products offered

by the postal department suiting the investment requirements of the customers can be

purchased. The following are the major saving schemes offered by the Indian Postal

Department.

1) Savings Bank [SB] account

The savings bank account facility offered by Indian Postal Department is on similar

lines with that of the SB account of commercial banks. The post office saving bank is

the oldest and one of the largest banking system in the country, serving the investment

needs of both urban and rural people. The post office SB enables the account holder to

make regular deposit and withdrawals from the account. Cheque facility is also

available in this account. Tax benefit is another important attraction because interest

on post office saving bank is absolutely tax free.

2) Recurring Deposit [RD] account

This is a five year monthly investment option which offers a higher annual interest.

Deposits of small denominations are possible without any maximum limit. At the end

of five years there is an option to extend the account period for another five year to

year basis. Insurance cover facility is also available with some conditions.

8

A Study on Spending and Saving Habit of College Students.

3) Time Deposit [TD]

This is a fixed deposit option for period ranging from one to five years with facility to

draw yearly interest offered at compounded rates. Interest is payable annually but

calculated quarterly. The interest rate ranges from 8.2 percent from one year deposit to

8.5 percent for that of five years. There is a facility for automatic credit of interest to

SB account. The minimum amount of deposit is Rs 200 and multiples thereof. There

is no maximum limit for the amount of deposit. Investment in TD is eligible for tax

benefit under section 80C.Only individual can open TD account. Group accounts and

institutional accounts are not permissible.

4) Monthly Income Scheme (MIS)

The MIS is a safe and sure way to get regular monthly income. This scheme offers an

opportunity for fixed investment for five years with monthly interest payment facility.

The facility for automatic credit of interest to SB account available. It is especially

suitable for retired employees, senior citizens, etc. The rate of interest is 8.50 percent.

The minimum amount of deposit is Rs 1500 in both single and joint account.

3, CHIT FUNDS

A Chit fund is a kind if savings scheme practiced in India. A Chit fund company is a

company that manages, conducts, or supervises a chit scheme. It is regulated by

provisions of Chit Fund Act, 1982.

According to Sec 2(b) of the Chit Fund Act, 1982, Chit means a transaction whether

called chit, chit fund, chitty, committee, kuris or by any another name by or under

which a person enters into an agreement with a specified of persons that every one of

them shall subscribe a certain sum of money (or a certain quantity of grain instead) by

way of periodical instalments over a definite period and that each such subscriber

shall, in his turn, as determined by lot or by auction or by tender or in such other

manner as may be specified in the chit agreement, be entitled to the price amount.

A Study on Spending and Saving Habit of College Students.

Why People join in chit funds?

Easy to join as there is no formalities needed.

High promised return

Option of small deposit

High liquidity

Door to door collection by the agent

Kinds of Chit Funds in India

There are three kinds of chit funds in India

Chit funds run by State Governments like Kerala State Financial Enterprises

(KSFE) and Mysore Sales International Ltd and PSU runs chit funds.

There are registered chit funds which are run by big business houses and are

registered.

Unregistered chit funds, which are run on the basis of friendship and close

proximity of the members.

10

A Study on Spending and Saving Habit of College Students.

CHAPTER 3

ANALYSIS AND INTERPRETATION OF DATA

GENDER WISE CLASSIFICATION OF RESPONDENTS

Table 3.1

UNDER

GRADUATION

POST

GRADUATION

MALE

FEMALE

13

37

43

Figure 3.1

45

40

35

30

MALE

25

FEMALE

20

15

10

5

0

UG

PG

INTERPRETATION:

The study is conducted in UG and PG level. In 13 male students and 37 female

students and in PG 7 male students and 43 female students are taken for the study.

11

A Study on Spending and Saving Habit of College Students.

EDUCATION WISE CLASSIFICATION OF RESPONDENTS

Table 3.2

UNDER

50

GRADUATION

POST

50

GRADUATION

Figure.3.2

POST

GRADUATION

50%

UNDER

GRADUATION

50%

INTERPRETATION:

For this study 50 UG students and 50 PG students are taken.

12

A Study on Spending and Saving Habit of College Students.

SOURCE OF INCOME

(EDUCATION WISE)

Table 3.3

Source of Income

UG

PG

Total

Pocket Money

38

40

78

Scholarship/ Grant

21

11

31

Job (Part time/ Weekend)

Others

11

17

Figure 3.3

40

35

30

25

20

15

10

5

0

UG

PG

INTERPRETATION:

From the above graph it is evident that about 57.78% of income of student is from

pocket money. And of 23.7% is from scholarship and Grand. Here 6% of incomes

from part time or weekend job and that of 12.6 % income from other sources.

13

A Study on Spending and Saving Habit of College Students.

SOURCE OF INCOME

(GENDER WISE)

Table 3.4

Source of Income

Pocket Money

Scholarship/ Grant

Job (Part time/ Weekend)

Others

Male

Female

Total

19

59

78

(59.375%)

(57.28%)

(57.78%)

26

32

(18.75%)

(25.24%)

(23.7%)

(12.5%)

(3.89%)

(6%)

14

17

(9.37%)

(13.6%)

(12.6%)

Figure 3.4

Others

Job(part time/ weekend)

Female

Male

Scholarship/Grant

Pocket money

0

10

20

30

40

50

60

INTERPRETATION:

About 78% of students get their income through pocket money. 59% male students

have pocket money. Among females, their majority source of income is pocket

money. 12.5% male students do part time job to earn money. Only 4 % female

14

A Study on Spending and Saving Habit of College Students.

students do part time jobs. 18% males get money through scholarships and grant and

25% of girls get scholarships and grants.

AMOUNT OF MONEY GETTING PER MONTH

(EDUCATION WISE)

Table 3.5

Class

UG

PG

Total/ Percentage

<500

31

27

58

500 1000

12

12

24

1000 2000

13

>2000

Figure 3.5

35

30

25

20

UG

15

PG

10

5

0

<500

500-1000

1000-2000

>2000

15

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

Here, majority of students have income less than Rs 500 per month. That is about 58%

of students have income less than Rs 500. Only 5% of students have income more

than Rs 2000. About 24% is in between the class 500 1000. Here about 13% of

students have income in the class of 1000 -2000.

AMOUNT OF MONEY GETTING PER MONTH

(GENDER WISE)

Table 3.6

Class

MALE

FEMALE

Total/ Percentage

<500

10(50%)

48(60%)

58

500 1000

5(25%)

19(24%)

24

1000 2000

1(1%)

12(15%)

13

>2000

4(20%)

1(1.25%)

Figure 3.6

>2000

1000-2000

Female

Male

500-1000

<500

0

10

20

30

16

40

50

60

A Study on Spending and Saving Habit of College Students.

INTERPRETATION

The above table and figure shows that only 20% of males are getting more than Rs

2000 per month. About 58% of students have income less than Rs 500. In male it is

50% and in female it is 60%.

SPENDING PATTERN OF STUDENTS

(EDUCATIONAL WISE)

POST GRADUATE STUDENTS

Table 3.7

Spending Avenue

Weighted Score

Rank

Entertainment

199

Fast Food

184

Health & Fitness

181

Mobile & Laptop Expenses

295

Studies & Tuition fees

334

Shopping

255

Transportation

301

Cosmetic & Beauty care

156

17

A Study on Spending and Saving Habit of College Students.

Figure 3.7

Spending Pattern of Post Graduate Students

INTERPRETATION:

When studying the spending pattern of post graduate students it is clear that they give

first rank to studies and tuition as their top most spending area. Students give second

rank to transportation and third rank to mobile and laptop expenses. Shopping is an

important factor in their spending and it is comes in the fourth rank. Students are not

much interested in spending on entertainment activities. Students less spends on fast

food and health and fitness and they give last ranks to these area of spending. only a

minor portion of students give importance to cosmetics and beauty care.

18

A Study on Spending and Saving Habit of College Students.

UNDER GRADUATE STUDENTS

Table 3.8

Spending Avenue

Weighted Score

Rank

Entertainment

203

Fast Food

212

Health & Fitness

157

Mobile & Laptop Expenses

227

Studies & Tuition fees

273

Shopping

302

Transportation

285

Cosmetic & Beauty care

175

Figure 3.8

Spending Pattern of Under Graduate Students

350

300

250

200

150

100

50

0

19

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

When studying the under graduate students spending habits, students give first

preference to shopping. Most of them are ranked shopping as their top most spending

area. Transportation comes in the second position. They also incurred expenses on

studies and tuitions. Mobile and expenses comes in the fourth rank and fast food

comes in the fifth rank. They are not much interested in spending on entertainment.

UG students are beauty conscious as compared to PG students, they give seventh rank

to this area and health and fitness comes in the last position

SPENDING PATTERN OF STUDENTS

(GENDER WISE)

MALE STUDENTS

Table 3.9

Spending Avenue

Weighted Score

Rank

Entertainment

110

Fast Food

82

Health & Fitness

52

Mobile & Laptop Expenses

102

Studies & Tuition fees

73

Shopping

88

Transportation

96

Cosmetic & Beauty care

60

20

A Study on Spending and Saving Habit of College Students.

Figure 3.9

Spending Pattern of Male Students

120

100

80

60

40

20

0

INTERPRETATION:

When studying the spending pattern of male students entertainment rank. All most

all male students are spending more on entertainment. Gadgets expenses hold the

second position and transportation in the third rank. These three areas are denoted as

the most spending area in the case of male students. Shopping comes in the fourth

position and spending on fast food comes in the fifth position. As compared to female

students male students have more consumption of fast food. Males are less conscious

about beauty care and health and fitness.

21

A Study on Spending and Saving Habit of College Students.

FEMALE STUDENTS

Table 3.10

Spending Avenue

Weighted Score

Rank

Entertainment

255

Fast Food

210

Health & Fitness

194

Mobile & Laptop Expenses

273

Studies & Tuition fees

290

Shopping

278

Transportation

247

Cosmetic & Beauty care

228

Figure 3.10

Spending Pattern of Female Students

350

300

250

200

150

100

50

0

22

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

When studying the spending pattern of female students it is evident that the female

spend more on studies and tuition fees. Shopping hold the second rank in the spending

pattern of female youth. Mobile and laptop expenses is the another area where females

tempt to spend. The expenses on entertainment are lesser in females as compared to

males. Transportation and beauty care is another areas where females have adequate

amount of spending. Only a small number of female students spend in maintaining

health and fitness.

NUMBER OF STUDENT HAVING SAVINGS

(EDUCATION WISE)

Table 3.11

Savings?

UG

PG

Total

Yes

46

49

95

No

Figure 3.11

50

45

40

35

30

YES

25

NO

20

15

10

5

0

UG

PG

23

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

About 95% of students have savings. Also about 5% of students do not have

savings. Out of 50 students in UG, 46 of them have savings and 4 students do

not have savings. In the case of PG students, 49 students having savings and 1

dont save any amount.

STUDENTS HAVING SAVINGS

(GENDER WISE)

Table 3.12

Savings

Yes

No

Male

Female

17

78

(85%)

(97.5)

(15%)

(2.5%)

Total

95

Figure 3.12

100

90

80

70

60

50

40

30

20

10

0

Yes

No

Male

Female

24

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

From the above table it is clear that 85% of males save money and 97.5% of

females save money. It is also given that about 15% of females do not save any

amount and only 2.5% of females do not have any savings.

AMOUNT SAVES PER MONTH

(EDUCATION WISE)

Table 3.13

Class

UG

PG

Total

Percentage

Less than 500

29

38

67

69.56%

500 1000

12

12

24

26.08%

1000 1500

Nil

1.08%

More than 1500

Nil

3.26%

Figure 3.13

40

35

30

25

20

15

UG

10

PG

5

0

Less Than

500

500 - 1000

1000 - 1500

More than

1500

25

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

The above table and figure shows the amount of money save per month for UG

and PG students separately. It is understood that majority of students save less

than 500. In UG, 29 students save per month less than Rs 500 and in the case of

PG students 30 save less than 500. In total, 69.56% of students save less than

500. In the class of 500 1000, 12 PG Students and UG students come under

the class. Only 1 student saves in UG in the class of 1000 1500 and no one

save in PG in this class. There are 3 students in UG only save more than Rs

1500 per month.

AMOUNT SAVES PER MONTH

(GENDER WISE)

Table 3.14

Class

Male

Female

10

60

(58.82%)

(76.92%)

16

(29.41%)

(20.51%)

Nil

(0%)

(1.28%)

More than

1500

(11.76%)

(1.28%)

Less than 500

500 - 1000

1000 1500

26

Total

70

21

A Study on Spending and Saving Habit of College Students.

Figure 3.14

80

70

60

50

40

30

20

10

0

Male

Female

Female

Less than

500 - 1000

500

Male

1000 1500

More than

1500

INTERPRETATION:

Both the table and figure show the gender wise amount of savings per month. It

is clear that about 76.92% of female students save per month less than Rs 500

and 58.82% of males save in the same class. Only 29.41% of males and 20.51%

of female students save in the class of 500 1000. Only 1 female saves in the

class of 1000 1500. Only 2 males and 1 female save more than 1500 per

month.

27

A Study on Spending and Saving Habit of College Students.

SAVING AVENUES

(EDUCATION WISE)

Table 3.15

Saving Avenues

UG

PG

Total

Percentage

Bank Deposit

32

31

60

65.25%

3.26%

Chit funds

4.34%

Others

10

15

25

27.17%

Post office savings

bank

Figure 3.15

35

30

25

20

15

UG

10

PG

5

0

Savings

Bank A/C

Post Office

Savings

Chit Funds

28

Others

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

The above table and figure shows the saving avenues of UG and PG students.

Most of the students are channelizing into bank deposits (That is about 65.2%)

students having post office savings and chit funds are less in number compared

to bank deposit. About 27.17% of students invest their savings into other

avenues.

SAVING AVENUES

(GENDER WISE)

Table 3.16

Saving Avenues

Male

Female

56

(20%)

(70%)

Post office savings

bank

(5%)

(2.5%)

(10%)

(2.5%)

20

(25%)

(25%)

Bank Deposit

Chit funds

Others

29

Total

60

25

A Study on Spending and Saving Habit of College Students.

Figure 3.16

80

60

40

Male

Female

20

Female

Male

0

Bank Deposits

Post office savings

Chit funds

Others

INTERPRETATION:

The above table shows the way in which respondents save their surplus money.

Out of 20 males, 20% divert their savings into bank deposit. About 25% of

males save through other sources. Out of 80 females, 56 (70%) respondents

save their money in bank deposits and 25% of females in other sources. The

number of males and females having post office savings and chit funds are very

less when compared with other avenues of savings.

30

A Study on Spending and Saving Habit of College Students.

REGULARITY IN SAVINGS

(EDUCATION WISE)

Table 3.17

UG

PG

Total

Percentage

Save Regularly

10

16

26

26%

Not Save Regularly

40

34

74

74%

Figure 3.17

40

35

30

25

20

Yes

15

No

10

5

0

UG

PG

INTERPRETATION:

There is a higher irregularity in savings. About 74% of students do not save

regularly. Only 26% of students have regularity in their savings. In the case of

UG students 10 students save regularly and 40 students not save regularly. In

the of PG students 16 students save regularly and 34 of them not save regularly.

31

A Study on Spending and Saving Habit of College Students.

REGULARITY IN SAVINGS

(GENDER WISE)

Table 3.18

Save Regularly

Not Save Regularly

Male

Female

10

16

(50%)

(20%)

10

64

(50%)

(80%)

Total

26

74

Figure 3.18

70

60

50

40

Save Regularly

30

Not save regularly

20

10

0

Male

Female

INTERPRETATION:

The above table and figure shows regularity in savings of males and females.

About 50% of males save regularly and 50% not save regularly. In females,

20% save regularly and 80% not save regularly.

32

A Study on Spending and Saving Habit of College Students.

PURPOSE OF SAVINGS

(EDUCATIONAL WISE)

Figure 3.19

Purpose

UG

PG

Total

Percentage

As a habit

13

23

36

38%

For higher studies

14

17

18%

For future shopping

10

15

15.78%

Others

14

13

27

28.42%

Figure 3.19

25

20

15

10

UG

PG

5

0

As a habit

For Higher

Studies

For future

shopping

Others

INTERPRETATION:

The above table and figure shows the purpose of savings in UG and PG

students. About 38% of students save money as a habit. And 18% of students

save money for higher studies. And about 15.78% of students save money for

future shopping and 28.42% save for other purposes.13 students in UG and23

students in PG save money as a habit. 14 students in UG and 3 in PG save for

33

A Study on Spending and Saving Habit of College Students.

future higher studies. 5 students UG and 10 students in PG save money for

future shopping purposes. About 14 students in UG and 13 students in PG save

money for other purposes.

PURPOSE OF SAVINGS

(GENDER WISE)

Table 3.20

Purpose

Male

Female

28

(40%)

(37.33%)

For higher

13

studies

(20%)

(17.33%)

For future

13

shopping

(10%)

(17.33%)

21

(30%)

(28%)

As a habit

Others

Total

36

17

15

27

Figure 3.20

40

35

30

25

20

15

10

5

0

Male

Female

As a habit

For higher

For future

studies

shopping

34

Others

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

The above table and figure shows the purpose of savings among students. From

the table it is evident that 40% of male students and 37.33% of female students

save money as a habit. 20% of males and 17.33% of female students save for

future higher studies.10% of male students and 17.33% of female students are

saving for future shopping. About 30% of males and 28% of female students

save for other purposes.

SPENDING AND SAVING STATUS

(EDUCATIONAL WISE)

Table 3.21

UG

PG

Total

Percentage

Spending > Savings

26

29

55

57.89%

Spending = Savings

15

15.78%

Spending < Savings

12

13

25

26.31%

Figure 3.21

30

25

20

15

UG

10

PG

5

0

Spending >

Saving

Spending =

Saving

35

Spending <

Saving

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

The above table and figure shows saving and spending status of UG and PG

students. More than 50% of students spend more than they save. Small portion

students have an equilibrium status, that is saving is equal to spending. About

26.31% of students save more than they spend. 26 students in UG and 29

students in PG have spending greater than savings. 8 students in UG and 7

students in PG have an equilibrium status i.e., spending equal to saving.12

students in UG and 13 in PG have spending less than savings.

SPENDING AND SAVING STATUS

(GENDER WISE)

Table 3.22

Spending> Saving

Spending= Saving

Spending< Saving

Male

Female

49

(41.17%)

(62.82%)

11

(23.525)

(14.1%)

18

(35.29%)

(23.07%)

36

Total

55

15

25

A Study on Spending and Saving Habit of College Students.

Figure 3.22

FEMALE

MALE

23.07%

SPENDING<SAVING

35.29%

SPENDING=SAVING

14.10%

23.52%

62.82%

SPENDING>SAVING

41.17%

INTERPRETATION:

The above table and figure shows gender wise spending and saving status of

students. About 41.17% of male students and 62.82% female students have

spending more than savings. About 23.52% of male students and 14.10% of

female students have an equilibrium position that spending is equal to savings.

About 35.29% of male students and 23.07% of female students spend less than

their savings.

37

A Study on Spending and Saving Habit of College Students.

DURATION OF SAVINGS

(EDUCATION WISE)

Table 3.23

Class

UG

PG

Total

Percentage

Less than 1 year

13

13

26

27.36%

1 3 years

21

16

37

38.94%

3 5 years

8.42%

More than 5 years

17

24

25.26%

Figure 3.23

25

20

15

UG

PG

10

5

0

Less than 1

year

1-3 years

3-5 years

More than 5

years

INTERPRETATION:

The above table and figure shows the duration of savings of UG and PG

students. About 27.36% of students save for less than 1 year. About 38.94% of

students have been saving money for 1 3 years. Some of the students have

38

A Study on Spending and Saving Habit of College Students.

been saving since 3 5 years and about 25.26% of students have been saving

for more than 5 years. 13 students in UG and 13 students in PG have savings for

less than 1 year.21 UG students and 16 PG students have savings for 1 3

years. 5 students in UG and 3 students in PG have saving for 3 5 years. 7

students in UG and 17 students in PG have savings for more than 5 years.

DURATION OF SAVINGS

(GENDER WISE)

Table 3.24

Class

Less than 1 year

1 3 years

3 5 years

More than 5 years

Male

Female

21

(25%)

(28%)

29

(40%)

(38.67%)

(15%)

(6.67%)

20

(20%)

(26.66%)

39

Total

26

37

24

A Study on Spending and Saving Habit of College Students.

Figure 3.24

40

35

30

25

20

15

Male

10

Female

5

0

Less than 1

1 - 3 years

year

3 - 5 years

More than

5 years

INTERPRETATION:

The above table and figure shows gender wise duration of savings. About 25%

of males and 28% of females have been saving for less than 1 year. 40% of

male and 38.67% of female students have been saving since 1 3 years. About

15% of males and 6.67% of females have been saving for 3 5 years. About

20% of males and 26.66% of females have been savings for more than 5 years.

40

A Study on Spending and Saving Habit of College Students.

GENERAL OPENION ABOUT SAVINGS AMONG COLLEGE

STUDENTS

Table 3.25

Total

Percentage

Increasing

28

28%

Decreasing

37

37%

Dont know

35

35%

Figure 3.25

INCREASING

28%

DON'T KNOW

35%

DECREASING

37%

41

A Study on Spending and Saving Habit of College Students.

INTERPRETATION:

When analysing the general opinion about saving among college students 35%

students dont know about the importance of savings. 28% of students have

increasing opinion about savings. Most of students dont know about the

importance of savings.

42

A Study on Spending and Saving Habit of College Students.

CHAPTER 4

FINDINGS AND CONCLUSIONS

FINDINGS OF THE STUDY

Data were collected from 100 samples, based on convenience sampling and the

observation based on the analysis of the data, are presented:

1. Among UG and PG students, most of them have income from pocket money.

In gender wise classification, both males and females meet their expenses by

using pocket money.

2. Only a small percentage of students earn money through part time or weekend

jobs. A minor portion of students get scholarships and grants.

3. Majority of our respondents get less than rupees 500 per month. There is only a

minor portion of them get more than rupees 2000 per month.

4. When study the spending habit of UG students, we find that their major

spending segment is shopping. Shopping of branded lifestyle products and

accessories are taking first position in their spending.

5. When we consider PG students, both males and females prefer studies and

tuition as their highest spending area. More than half of our respondents are

females and they marked that their spending is mainly concentrated in the area

of studies and tuitions, but the male students prefer entertainment as their

highest spending area.

6. Majority of students in both UG and PG have savings. Most of them prefer

bank deposit as their interested saving avenue. In gender wise classification,

43

A Study on Spending and Saving Habit of College Students.

most of the male and female students have savings.

A minor portion of

students do not have savings.

7. Most of the students in UG and PG save less than 500 rupees per month. When

we consider gender wise, the study shows that male and female students have a

savings of less than 500 rupees per month.

8. Most of the students prefer savings bank deposits as their savings avenue. Both

male and female students are also interested in savings bank account.

9. Post office saving and chit funds have an equal role in the saving habit among

college students.

10. Only a small portion of students have regularity in their savings most of the

students save irregularly. When we consider male and female separately, about

half portion of male students have regularity in savings.

11. In the case of female students, only a minor portion of them have regularity in

their savings.

12. Most of the students in PG save their portion of income as a habit. But in the

case of UG students, they save money for the purpose of future studies. While

classifying gender wise purpose of savings both male and female students save

their money as a habit. Most female students in UG and PG are interested to

save money as a habit but some of them save for future studies.

13. Most of the students in UG and PG have similar spending and saving status.

That is every one save less than they spend. The gender wise analysis of

students shows that both male and female students spend more than they save.

14. The duration of savings of students in UG and PG are 1 3 years. About onefourth of students save for less than 1 year. Female and male students are also

44

A Study on Spending and Saving Habit of College Students.

interested in medium term savings. Only a minor portion of them save money

for long team.

15. The general opinion about saving among college students shows a decreasing

trend. Only a small portion of students have knowledge about th youth savings.

SCOPE FOR FUTURE STUDIES

The study and finding observed therein consider 100 students in two educational

categories. The sample size can be expanded and the study can be expanded to

different categories including higher secondary and high school level. Also a study

can be carried out for those students who have got employment because the spending

pattern may be drastically different for a youth whom earns money. It can be further

studied that whether spending habits change after getting job or employment or not.

Spending and savings habit of adults i.e. above 30 years of age is also an interesting

area for study. It may be significantly different from youth.

CONCLUSION

The study conducted on The spending and saving habit of college students was

undertaken to know the spending and saving habit of college students. It was found

that most of our respondents spend more than they save but their spending avenues are

different. Most of the students have savings and they know about the importance of

savings. Students commonly prefer saving bank account as their saving avenue and

post office savings and chit funds are very popular in female students. Students save

as a habit and a small portion save for their higher studies. From the study on

spending pattern of students, male students are spending higher amount in

entertainment, shopping and transportation. Female students mainly spend in the area

of studies and tuition fees expenses.

45

A Study on Spending and Saving Habit of College Students.

From this, we conclude that the students have savings but they spend more than they

save and the students are not aware about the importance of savings.

BIBLIOGRAPHY

BOOKS:

1. Peter S Rose, Money and Capital Markets, McGraw-Hill

Publication, 6th Edition

2. Dr. A P Philip, Capital Market & Investment Management- 4th

Edition, Sobha Publication Changanashery.

3. E Gordon, P K Gupta Banking & Insurance

4. S.N Maheswari, S K Maheswari, Banking Law and Practice.

Kalyani Publishers, New Delhi, 13th Edition, 2010

5. Neelam C. Gulati, Banking and Insurance, Excel Books, New

Delhi 1st Edition 2011.

6. Abhijeet Birari & Umesh Patil Spending & Saving Habits of Youth

in the City of Aurangabad The Standard International Journals

(The SIJ), May 2014

WEBSITES:

1. www.mgu.ac.in

2. www.aboutmoney.com

3. www.investopedia.com

4. www.sebi.org.in

5. www.businessdictionery.in

46

A Study on Spending and Saving Habit of College Students.

A STUDY ON SPENDING AND SAVING HABITS OF COLLEGE

STUDENTS

QUESTIONNAIRE

1, Name:

2, Age:

3, Gender: Male

Female

4, Educational Qualification: a) Graduation

b) Post Graduation

5, Source of Income:

a) Pocket Money

b) Scholarship/Grant

c) Job (part time/weekend)

d) Others

6, How much money will you get per month?

a) Less than 500

b) 500 - 1000

c) 1000 - 2000

d) More than 2000

7, Please rank the following according to your spending:

Entertainment

Fast Food

Health and Fitness

Mobile/Laptop Expenses

Studies/ Tuition Fees

Shopping

47

A Study on Spending and Saving Habit of College Students.

Transportation/Petrol

Cosmetics and Beauty care

8, Do you have savings: Yes

No

9, If yes, How much amount you save per month ?

a) Less than 500

b) 500 - 1000

c) 1000 - 1500

d) More than 1500

10, In which way you make savings?

a) Bank Deposit

b) Post office Savings

c) Chit funds

d) Others

11, Do you have regularity in savings? Yes

No

12, What is your purpose of savings?

a) As a habit

b) For higher studies

c) For future shopping

d) Others

13, What is your spending and savings status:

a) Spending greater than savings

b) Spending equal to savings

48

A Study on Spending and Saving Habit of College Students.

c) Spending less than Savings

14, How long have you been saving money for?

a) Less than 1 year

b) 1 3 years

c) 3 5 years

d) More than 5 years

15, What is your general opinion about savings?

a) Increasing

b) Dont Know

c) Decreasing

49

You might also like

- A Study On Saving and Spending Habit of Youth PDFDocument49 pagesA Study On Saving and Spending Habit of Youth PDFBindesh Agarwalla100% (1)

- Project On Spending and Saving of College StudentsDocument61 pagesProject On Spending and Saving of College StudentsKerala Techie Teens100% (1)

- FInancial Management of Senior High School Students in Relation To Fluctuating InflationDocument9 pagesFInancial Management of Senior High School Students in Relation To Fluctuating InflationRd Diaz100% (2)

- Practical Research A.Y. 19 20Document30 pagesPractical Research A.Y. 19 20Scrapbook ko100% (1)

- Personal-Budgeting Research ProperDocument46 pagesPersonal-Budgeting Research ProperJodie Sagdullas85% (110)

- Strategies in Budget Management of St. MDocument20 pagesStrategies in Budget Management of St. MElaiza Jayne Pongase100% (1)

- Project Work On Spending and Saving Habits of College Students.Document42 pagesProject Work On Spending and Saving Habits of College Students.Aakash Debnath50% (4)

- Research 2Document8 pagesResearch 2josaiah sanaNo ratings yet

- Descriptive Research On Personal Finance in Savings Behaviour and The Knowledge Level Possessed by Graduating College Students Chapter 1 4Document43 pagesDescriptive Research On Personal Finance in Savings Behaviour and The Knowledge Level Possessed by Graduating College Students Chapter 1 4charlotte calopezNo ratings yet

- A Descriptive Research On Allowance andDocument6 pagesA Descriptive Research On Allowance andsmart which100% (2)

- Definition of TermsDocument5 pagesDefinition of TermsAdonis Corowan100% (1)

- A Research On The Allowance and Budgeting of Grade 12 Students in ASIST Main CDocument23 pagesA Research On The Allowance and Budgeting of Grade 12 Students in ASIST Main CAB11A4-Condor, Joana Mie0% (1)

- Budgeting and Spending Behaviors of AccountancyDocument9 pagesBudgeting and Spending Behaviors of AccountancyLyan0% (1)

- Spending & Saving Habits of Youth in The City of AurangabadDocument8 pagesSpending & Saving Habits of Youth in The City of Aurangabadthesij100% (2)

- Budgeting pr2Document23 pagesBudgeting pr2Kenneth ParpanNo ratings yet

- Financial Goals and Saving Habits of Senior High StudentsDocument35 pagesFinancial Goals and Saving Habits of Senior High StudentsJude LeinNo ratings yet

- The Spending and Saving Habits of Junior High School StudentsDocument44 pagesThe Spending and Saving Habits of Junior High School StudentsKaye Monique100% (1)

- FINANCIAL LITERACY Research Paper 2019 (BEST PAPER)Document108 pagesFINANCIAL LITERACY Research Paper 2019 (BEST PAPER)Fiona Francheska Guerrero100% (1)

- The Problem and Its BackgroundDocument68 pagesThe Problem and Its BackgroundPaula Rodalyn MateoNo ratings yet

- Financial Behavior of Abm Students As Indication of Their Financial LiteracyDocument77 pagesFinancial Behavior of Abm Students As Indication of Their Financial LiteracyXiao Lai100% (2)

- Grade 12 ReseachDocument54 pagesGrade 12 Reseachjaiscey valenciaNo ratings yet

- Malaysian University Student Spending Habits 2014Document21 pagesMalaysian University Student Spending Habits 2014Najmi Sidik100% (1)

- Budgeting and Spending Behavior Chapter 1-3Document48 pagesBudgeting and Spending Behavior Chapter 1-3Ricardo TabladaNo ratings yet

- The Spending and Saving Behaviors of The Senior High School Students of PSU-BC: A Descriptive StudyDocument80 pagesThe Spending and Saving Behaviors of The Senior High School Students of PSU-BC: A Descriptive StudyAlloysius Macam75% (16)

- Personal Budgeting Practices of Grade 12 HUMSS Students of University of Cagayan ValleyDocument7 pagesPersonal Budgeting Practices of Grade 12 HUMSS Students of University of Cagayan ValleySherinne Jane Cariazo100% (1)

- Budgeting o AllowanceDocument10 pagesBudgeting o AllowanceNea May LiguanNo ratings yet

- Strategies On Budgeting Allowance of Grade 12 DhiaDocument5 pagesStrategies On Budgeting Allowance of Grade 12 DhiaAshley Loyola100% (2)

- Financial Literacy Impacts Saving HabitsDocument15 pagesFinancial Literacy Impacts Saving HabitsMa Aragil Valentine Jomoc100% (1)

- Spending Behavior of Management Students PDFDocument40 pagesSpending Behavior of Management Students PDFAngela Nicole Nobleta100% (1)

- Spending and Saving PR2Document6 pagesSpending and Saving PR2Jona Unabia100% (2)

- Financial Goals and Saving Habits of Senior High StudentsDocument61 pagesFinancial Goals and Saving Habits of Senior High StudentsJude LeinNo ratings yet

- RRL ForeignDocument4 pagesRRL Foreignゔ違でStrawberry milkNo ratings yet

- The Effects of Financial Literacy On Senior High School StudentsDocument40 pagesThe Effects of Financial Literacy On Senior High School Studentsbuladacoerick8No ratings yet

- Effectiveness of Personal Budgeting To Daily Expenses Among Grade 12 Students of Malinta National High SchoolDocument60 pagesEffectiveness of Personal Budgeting To Daily Expenses Among Grade 12 Students of Malinta National High SchoolWendel Bernabe100% (1)

- Students Budget Practices 1Document41 pagesStudents Budget Practices 1Dave Aggasid100% (1)

- A Comparative Study On Spending Behavior Between Grade 11 and Grade 12 Abm Students in University of CebuDocument26 pagesA Comparative Study On Spending Behavior Between Grade 11 and Grade 12 Abm Students in University of CebuMark Francis SolanteNo ratings yet

- Financial Literacy and Spending HabitsDocument4 pagesFinancial Literacy and Spending HabitsKaye Jay Enriquez100% (2)

- KweengDocument39 pagesKweengJulius Allen dawisNo ratings yet

- COMPILATIONDocument36 pagesCOMPILATIONRianne Onas100% (1)

- Chapter 2 FinalDocument8 pagesChapter 2 FinalKrisk TadeoNo ratings yet

- Financial Literacy and Spending Habits of Accountancy Students in Saint Francis Xavier College FinalDocument21 pagesFinancial Literacy and Spending Habits of Accountancy Students in Saint Francis Xavier College FinalAngelika Panilag100% (8)

- Relationship Between The Financial Literacy and Spending Habits of Grade 12 Iloilo National High School StudentsDocument8 pagesRelationship Between The Financial Literacy and Spending Habits of Grade 12 Iloilo National High School StudentsDjRalph DuhinaNo ratings yet

- Financial Literacy and Saving Habits Among Anahawan StudentsDocument15 pagesFinancial Literacy and Saving Habits Among Anahawan StudentsTitser FjaneNo ratings yet

- Review of Researched Literature About Saving MoneyDocument6 pagesReview of Researched Literature About Saving MoneyKing Solomon100% (2)

- Written Report in FM - Chapter 3Document21 pagesWritten Report in FM - Chapter 3Divina Grace Rodriguez - Librea100% (2)

- RRL- Allowance and Budgeting of Grade 12 ABM StudentsDocument1 pageRRL- Allowance and Budgeting of Grade 12 ABM StudentsCatherine B. DellicaNo ratings yet

- Financial Literacy Among Senior High StudentsDocument16 pagesFinancial Literacy Among Senior High StudentsPrincess Engreso100% (2)

- Understanding ABM Student SpendingDocument33 pagesUnderstanding ABM Student SpendingRhea Lyn LaloNo ratings yet

- Abanes The Factors Affecting The Budgeting Skills and Spending Behavior Among Senior High School Students of Thy Covenant Montessori School in S.Y. 2019 2020Document27 pagesAbanes The Factors Affecting The Budgeting Skills and Spending Behavior Among Senior High School Students of Thy Covenant Montessori School in S.Y. 2019 2020Bjarne Lex Francis AgbonNo ratings yet

- DoneChapter 1 G3 Research G12 Abm 2Document12 pagesDoneChapter 1 G3 Research G12 Abm 2roquesa burayNo ratings yet

- Theoretical FrameworkDocument7 pagesTheoretical Frameworkranny began100% (1)

- Budgeting of Allowance and Financial StabilityDocument12 pagesBudgeting of Allowance and Financial StabilityNea May LiguanNo ratings yet

- The Levelof Spending Habitsamong Accountancy Businessand Management Studentsof Tacurong National High School Basisfor Program InterventionDocument47 pagesThe Levelof Spending Habitsamong Accountancy Businessand Management Studentsof Tacurong National High School Basisfor Program InterventionErica Napigkit0% (1)

- Spending Behavior of BSBA Students in University of BatangasDocument14 pagesSpending Behavior of BSBA Students in University of Batangasjay-ar dimaculanganNo ratings yet

- The Impact of Grade 12 Abm Student GlycelrichelrosieDocument13 pagesThe Impact of Grade 12 Abm Student Glycelrichelrosieimccbed villasanNo ratings yet

- Review of Literature and Studies on Student Budgeting BehaviorDocument6 pagesReview of Literature and Studies on Student Budgeting BehaviorRobert60% (5)

- Philippine Christian University Union High School of Manila Senior High SchoolDocument24 pagesPhilippine Christian University Union High School of Manila Senior High SchoolDaniela Mae Pangilinan100% (1)

- Saving Habit in Unisza StudentDocument16 pagesSaving Habit in Unisza StudentRj Firdaus Ramli75% (4)

- PR1 FormatDocument23 pagesPR1 FormatJohn Noriel LambitNo ratings yet

- Concept PaperDocument5 pagesConcept PaperRhorrie RosalesNo ratings yet

- Chit FundDocument44 pagesChit FundSatish Reddy Karri (PGDM 17-19chn)0% (1)

- 022 The Kerala Chit Fund Rules 2012Document72 pages022 The Kerala Chit Fund Rules 2012chitty auditorNo ratings yet

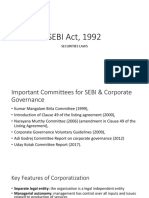

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarNo ratings yet

- Judgment On Chit Fund Act and 138 of The NI ActDocument28 pagesJudgment On Chit Fund Act and 138 of The NI ActRam Prakash100% (1)

- The Chits Funds Act,1982 ExplainedDocument40 pagesThe Chits Funds Act,1982 Explaineddesikudi9000No ratings yet

- Project On NBFCDocument67 pagesProject On NBFCAnu Pandey77% (44)

- Chit Funds Act, 1982Document30 pagesChit Funds Act, 1982Latest Laws TeamNo ratings yet

- SalimDocument51 pagesSalimMuhammed Salim vNo ratings yet

- Chit Funds Help Small Businesses Access FinanceDocument19 pagesChit Funds Help Small Businesses Access FinanceNisha UchilNo ratings yet

- Chit Fund CompanyDocument34 pagesChit Fund CompanyPARAS JAINNo ratings yet

- Org ProjectDocument78 pagesOrg Projectsvinduchoodan8614No ratings yet

- Troy LocoDocument26 pagesTroy LocoFeroj AhmedNo ratings yet

- CONTENTDocument51 pagesCONTENTMuhammed Salim v0% (1)

- Introduction to Easy Money - A Unique Financial SchemeDocument19 pagesIntroduction to Easy Money - A Unique Financial SchemerrvaraprasadNo ratings yet

- Kapil ChitsDocument14 pagesKapil ChitsAnonymous 22GBLsme1No ratings yet

- Chit Fund CompaniesDocument179 pagesChit Fund CompaniesMIKE4U4No ratings yet

- Chit Fund FormsDocument45 pagesChit Fund Formssaisankar ladiNo ratings yet

- Margadarshi Chit Fund CaseDocument21 pagesMargadarshi Chit Fund Casenewguyat77No ratings yet

- IFMR News Letter May 10Document2 pagesIFMR News Letter May 10Arjun M AyyapparajNo ratings yet

- Chit Fund Final Part - 2Document38 pagesChit Fund Final Part - 2shahsuhail100% (1)

- Chit FundsDocument10 pagesChit Fundscenajocker100% (1)

- Customer Attitudes Towards Investing in Chit FundsDocument82 pagesCustomer Attitudes Towards Investing in Chit FundsRavi Ajith50% (2)

- AIPPMDocument15 pagesAIPPMNaman ShahNo ratings yet

- Chit Fund Companies DBDocument267 pagesChit Fund Companies DBWipro EcoenergyNo ratings yet

- Black Book Chit FundDocument63 pagesBlack Book Chit FundLalit MakwanaNo ratings yet

- Meaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofDocument32 pagesMeaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofPunya KrishnaNo ratings yet

- Supreme Court Case on Kerala Chitties ActDocument15 pagesSupreme Court Case on Kerala Chitties ActAnant JoshiNo ratings yet

- Chit FundDocument89 pagesChit FundLalit Bonde50% (2)

- Project Report - Shriram Transport FinanceDocument40 pagesProject Report - Shriram Transport FinanceVikas Rathod100% (1)

- Chit FundsDocument6 pagesChit FundsNida0% (1)